In order to be sure that there are no debts to the budget for taxes, insurance premiums and other payments, the taxpayer needs to monitor the status of his settlements with the Federal Tax Service. After the transfer, tax payments may not be used for their intended purpose, and then an arrears will arise, and vice versa, amounts transferred in excess form an overpayment. One of the tools with which you can clarify the presence of debts and overpayments to the budget is a tax certificate on the status of settlements. What kind of document this is, how you can obtain it, and how to correctly read the information contained in it, we will tell you further.

How to order certificates

A certificate of settlement status is received both on paper and in electronic form. To request a paper document, you must contact the Federal Tax Service in person or send a request by mail. The tax authorities ask you to fill out the request in the recommended form (Appendix 8 to the Federal Tax Service Order No. 99n dated 07/02/2012) (you can request it at the end of the article).

To receive an electronic document, the request is sent using another form (Appendix 1 to the Order of the Federal Tax Service dated June 13, 2013 No. ММВ-7-6/ [email protected] ).

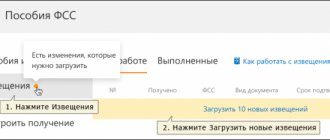

A statement of transactions is a fairly voluminous document, which for large organizations reaches several hundred sheets. This version is received only in electronic form by sending an application via TKS. The request form is the same as for reference. Here you select the required document and the period for which you want to receive information.

What is it for?

Form 39-1 is attached to the package of documents when they are collected for the following purposes:

- take part in tenders;

- when applying for a license;

- when submitting documents for lending from a bank;

- documents for receiving grants and subsidies;

- when applying for a visa.

Please note that this is not a complete list of cases when it is necessary to provide Form 39-1. The document is issued by the Federal Tax Service and is an extract that clearly demonstrates the stages and dates of debt formation. You can obtain it at the local branch of the Federal Tax Service freely upon request.

When and how the Federal Tax Service will provide information

Paper documents are received from the tax office in person or the Federal Tax Service sends them by mail to the company. The desired method of receipt must be indicated in the request. The electronic document is sent to the taxpayer via TKS.

The tax inspectorate is obliged to provide information on mutual settlements with the counterparty, both in paper and electronic forms, no later than 5 working days (clause 10, clause 1, article 32 of the Tax Code of the Russian Federation). But, as practice shows, the Federal Tax Service provides information in electronic form via telecommunication channels much faster. The response time, as a rule, does not exceed one or two days.

Certificates on taxes and duties: which one to choose

When talking about a tax certificate, we usually mean:

- certificate of fulfillment of the obligation to pay taxes;

- or a certificate about the status of settlements with the budget.

Both are issued by the tax office at the request of the taxpayer-organization. Certificates of absence of tax debts for individual entrepreneurs and ordinary “physicists” are also issued.

To obtain a certificate on paper, you must submit an application to the inspectorate. You can compose it in free form, or in the form recommended by the Federal Tax Service (it can be downloaded here), or on this form.

An example of a written request for a certificate is given in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

This application is the same for both certificates; you can select the one that is required by ticking it. Or you can order both at once. And by the way, this is the best thing to do. We'll explain why next.

In the application you need to indicate the date you need the certificate, as well as how you want to receive it: in person at the tax office or by mail. You can submit your application directly to the Federal Tax Service. Or you can scan it and send it through an EDF operator. In the information message to which you will attach the scan, be sure to indicate that you need a certificate on paper.

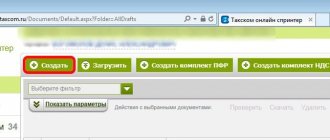

If a paper document with a blue seal from the Federal Tax Service is not important to you, get an electronic version (it will be certified by an electronic signature from the Federal Tax Service). In this case, you do not need to fill out an application, just send an electronic request through your operator.

If you have a personal account on the Federal Tax Service website, you can order a certificate there. You will receive a paper document with the necessary signatures and seal (you can choose the delivery method - in person or by mail). Tax authorities will also duplicate it electronically and upload it to the service.

Read more here.

Now see how to choose the right type of tax certificate.

Certificate on the status of settlements with the budget

The certificate form was approved by Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ [email protected] It is generated on the date that the taxpayer indicated in the request. It includes information on all taxes that the company is required to pay. It includes information not only directly about the tax payment, but also about the status of payments for penalties and fines.

The certificate consists of a tabular part containing information about the taxpayer, document number and date on which the information is provided, and a tabular part containing information about tax payments.

The tabular section contains 10 columns. For each tax payment the following is indicated:

- name (column 1);

- KBK (column 2);

- OKTMO (column 3);

- balance on taxes, fees, insurance premiums (column 4), penalties (6) and fines (8);

- amounts of tax payments, penalties and fines for which installment plans were provided (columns 5, 7, 9);

- balance on interest provided for by the Tax Code of the Russian Federation.

If the balance is shown with a “+” sign, this indicates the presence of an overpayment for the corresponding fiscal fee. If with a “–” sign, it indicates the presence of arrears.

Analyzing the certificate, we conclude that LLC “Company” has a VAT arrears in the amount of 50 rubles. for tax and 20 rubles. for a penalty. There is an overpayment for income tax, insurance premiums and personal income tax.

Extracting transactions for settlements with the budget

Unlike a certificate, an extract does not show the situation on a specific date, but the history of your relationship with the tax office for the period. For example, from the beginning of the year to today.

How debts/overpayments increased or decreased can be seen in column 13. A positive number is an overpayment, a negative number is a debt.

In column 13 you see the debt or overpayment for a specific payment - only tax, penalty or fine. At 14 - the total total for all payments. It’s better to focus on 13.

Now let’s figure out how these overpayments and debts are formed.

The data in column 10 goes to your “minus” - these are tax charges. And at 11, on the contrary, the “plus” is your payments. Line by line they form the total in the 13th column.

! If you have debt, the first thing to do is check to make sure all of your payments are shown on your statement. If you find that there are not enough payments, although everything was paid on time, take the tax payments and take them to the tax office to sort it out. If there are no errors, but you still owe the state, you will have to pay additional tax.

What does the statement look like?

If, having received a certificate of the status of settlements, you do not agree with the data of the Federal Tax Service, you think that the information on any payment is reflected incorrectly, then for a more detailed analysis you should order an extract of budget transactions. In it, information will be presented in detail for each accrual of tax payable and transfers made to the budget - as shown in the sample statement of transactions for settlements with the budget in the illustration.

LLC "Company", having discovered information about arrears of VAT, requested an extract of transactions for settlements with the budget.

From the extract it is clear that by the deadline of July 25, 20,050 rubles were due for payment, and the organization transferred 20,000 rubles. The arrears for penalties are the opening balance as of 01/01/2018. If it is necessary to clarify the occurrence of arrears on penalties, LLC "Company" has the opportunity to order an extract for previous tax periods (2017 and early years).

To decipher the entries in the statement, use our cheat sheet: deciphering the statement of budget settlement transactions shows the symbols and designations in it:

| Count | Symbols and Notations | Description |

| Balance of payments | Amounts with a “–” sign | Taxpayer's debt |

| Amounts with a “+” sign | Overpayment of tax, fee | |

| By payment type | Balanced balance separately by tax, penalty or fine | |

| According to the card “Calculations with the budget” | Balanced balance in total, including taxes, penalties and fines | |

| Operation | Accrued by calculation | Accruals according to reporting provided to the Federal Tax Service |

| Paid | Taxpayer payments | |

| Balance on... | Balanced balance. Displayed by the Federal Tax Service at the beginning and end of the year | |

| Document | Type: PP | Payment order |

| Type: RNalP | Tax return, report | |

| Number | Payment order number, special coding is provided for reporting: 2020Q01 - declaration for the 1st quarter of 2021. | |

| date | Date of submission of the declaration, date of the payment document | |

| Sum | Debit | Accruals payable to the budget |

| Credit | Tax reduction: payment, offset |

>

What does Form 39-1 contain?

The document form is a specially approved form. When filling out, follow the template. The complete list of information on the page has the following structure:

- in the upper right corner the name of the body authorized to issue this certificate is indicated;

- title and number of the document;

- date of generation of the information reflected in the certificate marked “as of _____”;

- subject's TIN;

- checkpoint;

- address.

The standard sample of Form 39-1 reflects the status of current accounts item by item. This is the following:

- type of budget fee/tax/contribution;

- KBK;

- OKATO code;

- the amount of overpaid taxes (including after deduction) or arrears, if any, is indicated in rubles;

- the next item indicates the amount of deferred taxes (including during the restructuring process). The exact amount and deferment date are entered in the field;

- overpayments or arrears of penalties. The amount is indicated in rubles;

- deferments and installment payments for penalties. Indicate the total amount and the date by which the penalty must be paid;

- tax debts or overpayments for sanctions and fines in rubles;

- debt or overpayment of funds allocated from the budget.

Form 39-1 (tax), as well as its sample filling, can be downloaded from the link below:

form form 39-1

Sample of filling out form 39-1 (tax)

Nuances of self-design

How to get form-39 in Moscow? Very often, collecting certificates is a problem because it takes a lot of time and effort. It is especially difficult during the work process to find time to solve all the troubles. Most often, those wishing to obtain this document encounter the following difficulties:

- long queues;

- constant shortage of documents;

- constant control over the registration process.

All this not only complicates life, but also causes a lot of problems that affect all areas of life. Therefore, it makes sense to enlist the support of an experienced company in these matters. A modern service will help you get help and solve major problems without your personal participation. Considering this option as one of the most optimal solutions, you will be able to receive a request about the status of settlements with the Pension Fund on time, which will allow you to resolve the issue in a minimum period of time. Such information on taxes and fees may be necessary in various legal matters, and therefore it makes sense to contact us. How? Order a tax certificate online or call the office in Moscow. For example, if you have already made your first attempts to collect documents, then this is the first reason to contact us.

Obtaining information from the tax office will speed up any processes involving the exchange and re-registration of documents. We don’t just help citizens do the work for which they don’t have enough time, but we speed up the process of all procedures. Legal support is of enormous importance, because we have knowledge in this matter, therefore we always respond to any difficulties in a timely manner. This service is very useful from a profitability point of view, because it is available to everyone in Moscow and the region. Now it makes no sense to doubt the validity period of information from the tax office; we have complete information about all laws and changes in them.

Internal review

Quite a few companies order certificates for internal use. For example, an accountant receives information to conduct an independent audit. In this case, requesting a unified document is inappropriate. Since it takes 5 working days to form.

If the information is needed for internal audit activities, then the accountant only needs to request a simple printout. This form contains information about current payments, debts, overpayments and other information. This document is generated immediately, that is, it can be received on the day of application to the Federal Tax Service.

Initiating a check

To obtain information of the established form, you need to contact the territorial office of the tax office.

Please submit your request in writing as a statement. Please note that there is no unified form of written appeal. We talked about how to request information to reconcile mutual settlements with the budget in a separate article, “How to reconcile with the tax office.”

Why you will need this document:

- Determine the presence of debts and overpayments for all fiscal payments that the organization is obliged to pay to the budget.

- Confirm the absence of debts to the state if customers or counterparties require it.

- Conduct a credit or refund of overpaid funds in favor of the Federal Tax Service.

- Eliminate the possibility of applying penalties for arrears and debts on fiscal payments.

Tax authorities recommend systematically carrying out such control measures. This approach will eliminate possible problems with the Federal Tax Service.

Why us?

The range of services of our law firm is extensive, because our capabilities are unique. By cooperating with us, obtaining a certificate from the Federal Tax Service on the status of settlements for taxes and penalties (Form 39) will not become a problem for you, but will be a regular legal issue on the way to the result. You can order a certificate from the Pension Fund of Russia, which will be received in accordance with all the rules. If the question concerned other difficulties, then from us you can get a tax certificate, the transcript of which will be issued on the basis of existing rules and recommendations. Each such certificate from the Federal Tax Service on the status of settlements with the budget is an official document that is required to resolve tax disputes of various types.

We value your timeWe are a reliable partnerProfessionals with extensive experienceLeaders in fulfilling orders of any complexityQuality guarantee for the services provided

In order to be sure that there are no debts to the budget for taxes, insurance premiums and other payments, the taxpayer needs to monitor the status of his settlements with the Federal Tax Service. After the transfer, tax payments may not be used for their intended purpose, and then an arrears will arise, and vice versa, amounts transferred in excess form an overpayment. One of the tools with which you can clarify the presence of debts and overpayments to the budget is a tax certificate on the status of settlements. What kind of document this is, how you can obtain it, and how to correctly read the information contained in it, we will tell you further.

Answers to popular questions

What to do if the tax was paid by payment order with the correct details, but was never received by the tax office?

It happens. You must write an application to the tax office to search for payment. If the payment is not in the card for transactions with the budget, and you have a payment slip in your hands with a bank mark with the correct details, then we write the application in any form. For example, like this:

If errors are made in the payment slip, you can provide the correct details through your personal account in the My Mail section -> Contact the tax authority -> Budget payments -> Application for clarification of payments -> Other payments. In the form that opens, indicate the details of the payment order: number, date and amount.

In the found payment order, you can enter new correct details and immediately generate and send an application for payment clarification.

Still have questions? Need help deciphering your statement? Write to WhatsApp or Telegram and get a consultation.

How to get it

To issue it, you must:

- Make a written statement in the form recommended by law (see sample below).

- Send a request to the inspectorate. Either the head of the organization or his authorized representative can do this (subject to the availability of an appropriate power of attorney certified by a notary). An alternative option is to send by mail a valuable letter with a list of the contents. Another way is to submit it electronically.

- Wait while the information is processed (up to 5 days).

- Get the result of the request. Its form depends on how the application was drawn up.

IMPORTANT!

It is important to indicate the date on which you need to receive information. Otherwise, the tax office relies on the date of registration of the request (for example, when the letter reaches the inspectorate).