Form P24001 (application on form P24001) is intended for making changes to the Unified State Register of Individual Entrepreneurs (types of activity, passport data, change of place of residence) by an individual entrepreneur. The form is filled out when information about the individual entrepreneur changes or in case of errors made in the application earlier. We also submit R24001 if you need to add new types of activities or delete old OKVED codes under which the individual entrepreneur no longer conducts activities...

Why notify about changing, adding or deleting codes?

The registers of the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs indicate information about the types of economic activities engaged in by legal entities and individual entrepreneurs. A change of OKVED must be registered. Working with unregistered code is subject to a fine in the amount (Article 14.25 of the Code of Administrative Offenses of the Russian Federation):

- 5,000 rubles - if the change was announced untimely;

- from 5,000 to 10,000 rubles - if they did not declare a change in OKVED.

If you decide to add, change codes or replace the main type of economic activity, submit an application to change the OKVED for individual entrepreneurs in 2021 and do this within three days after the changes are made.

Apply online and in person

An application to change OKVED codes must be submitted no later than 3 days from the date of the start of a new activity. You can do this in the following ways:

- Approach in person or send a representative to the registering Federal Tax Service

(not to be confused with the regional one). If you fill out form P24001 through our service, your Federal Tax Service will be determined automatically. - Approach in person or send a representative to the MFC

. Whether your MFC provides such a service, check in advance. - Send your application by registered mail

. Don't forget to have your signature on Sheet F certified by a notary. - Submit Form P24001 online using a digital signature

.

After 5 days, you receive a new USRIP sheet. If there are errors or omissions, you will be sent a refusal and will need to submit the application again after it has been corrected.

Eliminate errors - fill out form P24001 automatically

In our free service, you just need to enter your data by following the prompts. Next, the program itself will fill out the form according to all the requirements of the Federal Tax Service. It's reliable and takes no more than 15 minutes.

Fill out an application

Fill out an application

How to add or remove code

The general rules for organizations and individual entrepreneurs are:

- Choose new codes.

- Decide on the shift and the main OKVED that brings the maximum income.

- Fill out an application for opening OKVED for individual entrepreneurs using form P24001 and for LLCs using form P14001.

- The printed application form must be filled out in capital letters. Font Courier New, 18. If filling out by hand, write in capital letters. Use black pen only.

- Abbreviations are allowed for the names of locations - streets, avenues. The list of available abbreviations is presented in Appendix No. 2 of the instructions for filling out the application.

- You cannot print the form on both sides of the same sheet.

- The second section of sheet G is filled out by a specialist from the Federal Tax Service.

Instructions from ConsultantPlus will help you fill out the application correctly.

Get instructions for filling it out

Get free access for 2 days to all ConsultantPlus materials

OKVED code structure

The classifier code consists of two to six digital characters and its structure can be presented as follows:

- XX - class

- ХХ.Х - subclass

- XX.XX - group

- XX.XX.X - subgroup

- XX.XX.XX – type

In applications for registration of an LLC or individual entrepreneur, it is necessary to indicate a minimum of 4 characters of the code; codes with two and three characters in applications are not acceptable.

Size - 4 MB.

What application should an individual entrepreneur fill out?

Entrepreneurs fill out form P24001. They enter information into the title page, sheets E and G. To add codes, information is entered into sheet E on page 1, to exclude - sheet E on page 2. To change the main one, the old OKVED is indicated in sheet E on page 2, and the new one on page 1. Section 1 of sheet G contains information about the applicant; sections 2 and 3 are not filled out.

Filling example:

How to prepare documents to change the types of activities of an individual entrepreneur according to OKVED online

If you do not have the time and desire to independently understand the intricacies and nuances of filling out the P24001 application, use the online service for preparing documents for state registration. Using this service, you will prepare a package of documents within 10 minutes. The cost of the set is 1490 rubles. All documents are checked by qualified lawyers and comply with current legislation. Thanks to the service, possible errors are eliminated that could lead to refusal of state registration if filled out independently.

4.4 / 5 ( 28 votes)

What application should an LLC fill out?

Legal entities use form P14001. Organizations fill out the title page and sheets H and R. The number of pages depends on the volume of changes being made. By analogy with an individual entrepreneur, to add a type of economic activity, fill out sheet H on page 1, to exclude - page 2, and to change the main one, indicate the old code on page 2, and the new one on page 1. Sheet P is intended to reflect information about the applicant.

Completed:

In what cases is it necessary to make changes to the types of activities of an individual entrepreneur?

If an individual entrepreneur decides to change the type of activity, add a new code, or remove some, the corresponding change must be made to the Unified State Register of Entrepreneurs.

For example, previously there was a flower stall registered to an individual entrepreneur, and this individual entrepreneur decided to simultaneously engage in flower delivery. In this case, it is necessary to add to the existing ones:

- 47.76 Retail trade of flowers and other plants, seeds, fertilizers, pets and pet food in specialized stores;

- 46.19 Activities of agents in wholesale trade of a universal assortment of goods;

- 46.22 Wholesale trade of flowers and plants;

- 46.90 Non-specialized wholesale trade;

- 47.19 Other retail trade in non-specialized stores;

- 47.59.4 Retail trade in wood, cork and wicker products in specialized stores;

- 47.76.1 Retail sale of flowers and other plants, seeds and fertilizers in specialized stores.

add this activity:

- 53.20.31 Activities for courier delivery by various modes of transport.

Or, if delivery will be carried out for large needs (decoration of holidays, events), on your own, then this one:

- 49.41 Activities of road freight transport.

It is generally possible that instead of a flower stall, the individual entrepreneur decided to open a stall with pies. Here we will have to almost completely change the types of activities for catering.

Where to submit

Inspectorate of the Federal Tax Service

The entrepreneur submits an application for a change in types of economic activity to the territorial inspectorate with which he registered the individual entrepreneur. You must have your passport with you. The entrepreneur signs form P24001 in the presence of the inspector.

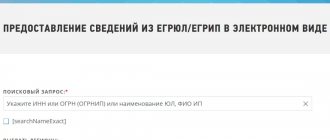

Another option for entrepreneurs is through a personal account in the special Federal Tax Service service for individual entrepreneurs. In LC, online submission of form P24001 is available for changing types of activity, but you will need an enhanced qualified digital signature.

Legal entities must have form P14001 certified by a notary. The necessary documentation is submitted to the tax office at the place of registration of the organization. Package of documents:

- when making changes to the charter - P13001, the decision of the founder or the protocol of the company's participants on changes to the charter, 2 copies of the new charter, a receipt for payment of the state duty;

- without entering information into the charter - P14001, a decision of the founders or a protocol of participants on changing types of activities.

MFC

Both entrepreneurs and legal entities have the right to submit documents to change types of economic activity to the nearest MFC “My Documents”. The same documents are provided to the MFC as to the Federal Tax Service. The entrepreneur signs the form P24001 in the presence of an MFC specialist.

IMPORTANT!

If the application is not submitted personally by an individual entrepreneur or the head of an LLC, then a power of attorney for the representative, certified by a notary, will be required.

Public services

Submitting an application through the State Services portal is available for both individual entrepreneurs and legal entities. The function is available in the ".

Choose non-electronic services, decide on the required service and fill out an electronic application. The documents will have to be submitted in person to the selected department, MFC, or by mail in a letter with a list of attachments and delivery notification.

Filling out an application on form P13014 when changing OKVED

At the end of 2021, tax authorities changed the forms of documents submitted for registration actions, including when changing any information, for example, the list of types of activities according to OKVED.

Previously, OKVEDs were changed using the P14001 form, but from November 25, 2021, you need to use the new P13014 form.

In this article we will look at a sample of filling out form P13014 when changing the list of activities according to OKVED.

Fill out the first page like this:

We fill out the OGRN and TIN of the company + select the reason for submitting the application.

Please note that the company name does not need to be filled in anywhere!

Since, in accordance with current legislation, the LLC Charter no longer must necessarily contain a specific list of activities carried out by the organization, we will make changes that are not related to changes in the charter.

Accordingly, we choose the reason for submitting application 2 - a change in information about a legal entity contained in the Unified State Register of Legal Entities .

This completes the completion of the first page of application P13014.

Then we immediately proceed to filling out Sheet K of the application in form P13014, which is actually intended to change the list of activities of the organization according to OKVED (All-Russian Classifier of Activities).

We remind you that currently it is necessary to indicate the types of activities from the OKVED-2 classifier!

Each activity code must consist of at least 4 digits!

Please note that Sheet K has 2 main sections:

- Information to be entered into the Unified State Register of Legal Entities;

- Information subject to exclusion from the Unified State Register of Legal Entities.

If the main type of activity changes, then in the section “Information to be entered into the Unified State Register of Legal Entities” we indicate the Code of the new main type of activity.

If you do not need to change the main type of activity, then the Code field for the new main type of activity blank and indicate only the list of additional types of activity to be added.

Attention!

If you decide to change the main type of activity, then do not forget to exclude the old main type of activity in the section “Information to be excluded from the Unified State Register of Legal Entities”! To do this, you need to enter the old main type of activity in the Code field of the new main type of activity in the section “Information to be excluded from the Unified State Register of Legal Entities”.

If you decide at the same time to exclude some additional types of activities, then also fill out the fields intended for excluding additional types of activities in the section “Information to be excluded from the Unified State Register of Legal Entities.”

In our example, we made 71.11 the main activity, which was previously an additional activity, and transferred the previous main activity 71.12 to additional.

Please note that we excluded both types of activities from the sections in which they were previously listed.

If your task is to only add or only exclude types of activities, then you only need to fill out one of the sections Information to be entered into the Unified State Register of Legal Entities or Information to be excluded from the Unified State Register of Legal Entities.

We do not fill out the section in which there are no changes!

There is no need to submit blank application forms to the tax office!

After we have dealt with the types of activities to be added/deleted, we proceed to filling out sheet H of application P13014 - information about the applicant.

The applicant for this type of registration must be the head of the organization (general director), who is a person acting on behalf of the organization without a power of attorney; accordingly, in the first section of sheet H of form P13014, select 1 - person acting on behalf of a legal entity without a power of attorney .

In the information about the applicant, we fill in the full name, tax identification number, date and place of birth + other passport details of the general director.

At the same time, there is no need to fill in the director’s residence address anywhere!

On the second page of Sheet H, all you have to do is fill out the email address to which the tax office will send you electronic documents on the registration of a new list of activities (Record Sheet of the Unified State Register of Legal Entities, which will reflect all records of both inclusion in the list of new types of activities and on the exclusion of unnecessary qualifiers) and the telephone number of the applicant (director).

Attention!

The phone number must be specified without parentheses!

In addition, if you want to receive a Record Sheet on paper, please enter the number 1 in the appropriate field.

What documents need to be attached to form P13014 when changing OKVED?

No documents are required to be attached to form P13014 when changing OKVED!

If you need help preparing documents, write or call us.