What nuances affect the reflection of goods and services in accounting?

In the business activities of any company, the need regularly or periodically arises to purchase goods and (or) services from third-party sellers (performers, suppliers). If material assets are purchased in a retail chain, from the seller’s point of view they are all goods. However, when posting a purchase to the company (buyer) accounts, it is necessary to correctly classify it as:

- goods for resale (account 41 “Goods”);

- fixed assets (accounts 08 “Investments in non-current assets”, 01 “Fixed assets”);

- MPZ (accounts 10 “Materials”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”).

From 2021, the new standard FSBU 5/2019 “Inventories” is mandatory for use. PBU 5/01 is no longer in force.

ConsultantPlus experts explained in detail how to account for goods according to the rules of FSBU 5/2019. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

The situation with the purchase of services is also ambiguous. The determining factor here is the purpose of their acquisition. For example:

In each case, the transactions for the purchase of goods and services will be different.

Find out what a service is and what types of services exist from this material.

Available methods for receiving goods

To account for commodity transactions, 41 accounts called “Goods” are used, the debit of which is the receipt of commodity assets, and the credit is their disposal, that is, write-off:

Receipt of goods to the warehouse can be carried out according to three price categories:

- By purchase price

If goods are received at the warehouse at the purchase price, then the costs associated with their purchase are taken into account. Also, this value can be increased by the amount of transport and procurement costs that occurred upon their receipt. Interestingly, the amount of these costs can be written off separately for sales.

- Registration prices

The peculiarity of this method is the use of a trade margin, which is immediately included in the capitalized goods. For this purpose, a separate accounting account is used - 42 “Trade margin”.

Thus, the posting of goods at sales value occurs in two stages:

- Initial accounting of goods at purchase price;

- The trade margin is “increased” by the amount of the purchase price.

Please note that the amount of the trade margin should be written off in proportion to the goods shipped. Write-off occurs using “reversal”. If such a product is used for one’s own needs, then the trade markup is written off to the account where the product is written off.

- Sales price

The receipt of goods is carried out at predetermined accounting prices. To display the difference between the book value and the purchase price, two additional accounts are used - 15 and 16.

Please note that only the first two methods are applicable for wholesale trade enterprises. There are no such restrictions for retail businesses.

Basic accounting entries for the purchase of goods and services (example)

An example will help us understand the transactions for the receipt of goods and services.

Manufacturing Company LLC purchased the following goods from its supplier (a large retail chain):

To deliver the concrete pump, the company used transport services. Taking into account the range of movement and the large size of the cargo, its cost was estimated at 45,490 rubles. (without VAT).

The accountant of Production Company LLC took into account the planned uses of purchased assets (column 6) and made the following accounting entries for the receipt of goods and services:

We will tell you in this publication whether a seller can issue one UTD for goods and services.

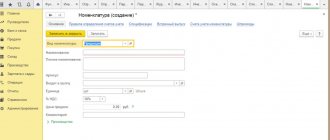

Sequence of accounting operations for retail trade transactions in 1C

In 1C: Accounting, the names of operations correspond to accounting practice, so that the process itself is intuitive for experienced accountants. In addition, the accounting system is end-to-end, so that specialists changing workplaces can quickly understand the postings.

Receipt of goods and services

So, the receipt of goods is recorded in the “Receipt of goods and services” program tab. What you will need to register:

- primary document – a shipment document from the supplier, usually an invoice with a number. In a separate case, this may be an act of acceptance and transfer of work;

- The application contains a note that allows you to track the availability of primary documents, since paper or electronic copies are often transferred. The mark “original received” is placed if a document has been received with a “wet” stamp;

- the number and date are generated by the program upon receipt and the current acceptance date;

- there is another interesting note for accountants working for a number of employers “in the cloud”. You can put a name in the “Organization” field and the program itself will distribute the data to different trading organizations.

This is also useful in cases where several entrepreneurs operate within the same retail network, accepting and shipping specific goods. This allows you to optimize tax payments, but at the same time it is necessary to ensure end-to-end business accounting. Companies must be registered in the system, then you can select by name from the drop-down menu;

- In the “Warehouse” field, the type of warehouse is indicated. These can be standard “virtual” positions, such as “Wholesale warehouse” or “Main warehouse”, or their own storage locations;

- In the “Counterparty” field we reflect the supplier. If it is not on the list, you must first create a new enterprise and reflect it in the “Counterparties” database;

- There is usually only one agreement with “Counterparties” and it is registered when creating a supplier; the document is entered automatically in the “Agreement” field;

- “Invoice”, if issued and available in the database;

- “Settlements” – you need to select the type of settlements with the supplier;

- “Consignor” and “Consignee”: these columns are filled in if the goods were sent and received not directly, but through companies providing delivery. This can be an in-house department; this is often necessary to ensure the safety of products during delivery when external contractors are involved;

- Value added tax in the “VAT” column is calculated automatically based on the data in the counterparty’s card.

After filling in the data, the product is added by clicking the “Add” button. If the product is standard, then the program saves the nomenclature. In this case, you only need to add the name and quantity of the products received, reflected in the invoice. Don't forget to check with the actual item received!

Additional notes, such as country of origin and customs declaration, are filled in as necessary. The invoice provided by the supplier is also reflected in the posting - the number and date are recorded. This information can be filled in at the bottom of the document.

After these operations are completed, the goods are capitalized.

Pricing

The next stage of registering a product and preparing it for sale is setting a price. This is done using the document “Setting item prices”. It can be found in the "Warehouse" menu. The data is entered manually by a specialist, but prices can be set automatically for all products in the previous document. This option is suitable for enterprises using a fixed trade margin.

When entering data manually, you need to directly enter the cost of the product and the price type. The application allows you to make different types of prices, for example, in different currencies or prices for different categories of buyers. If such an option is not available in the program, this problem can be solved by creating several documents with different types of prices. Thus, the goods will be transferred to the retail warehouse not as a whole lot, but in parts with different trade margins.

It is possible to register free goods, then in this case the o. However, the parameter will only be applied to those items that have not been priced. Registration of a zero price for paid products is unacceptable.

During the process, price changes in % are allowed. This can be done by selecting the “Change” button opposite the price.

After assigning a price, the goods must be formally moved to a retail warehouse; its functions can be performed by a sales area.

Moving goods to a retail warehouse

The “Movement” document is responsible for this operation with previously posted goods. In fact, it involves registering goods on different accounting accounts using double entry. 1C: The accounting department makes the entries independently, reflecting the required amounts in the debit and credit of the accounts used by the enterprise to record its activities.

As mentioned above, you can move not the entire batch, but in parts, and at different prices. For multiple transactions, you can perform automatic movement using the “Create on basis” function button. In this case, all data is entered by the program, but you need to indicate the type and type of warehouse, as well as the quantity of goods being moved.

The software application targets different users and different businesses. Therefore, goods from one batch can be moved to different retail warehouse storage facilities.

Please note that you cannot move more than is available in the wholesale warehouse. If you enter incorrect data, an error message will be displayed.

Sales area and retail warehouse

Once the product is moved to the retail warehouse, it can be sold. Sales can be conducted from a warehouse or “Trading floor” if there is a specialized storage location and accounting is required. The difference between sales in this case will be the generation of a report on daily revenue and sales called “Retail Sales Report”. It is created for each individual warehouse that works with the “Trading Floor”.

In this case, you need to enter the following data:

- warehouse type or number, select from the list;

- income item - indicate “Cash inflow from retail revenue”;

- cash register account – indicates the cash register account;

- Sometimes you need to indicate the accounting account and the income account if this is not done by subaccount. This refers to accounting accounts for which double-entry entries are made.

Before sales, it is customary to do an inventory in the corresponding tab in the “Warehouse” menu – “Inventory of goods”. This feature allows you to reflect warehouse balances and fill out the “Trading Hall” automatically. In this case, all available items in the warehouse with the actual quantity are displayed on the screen. All that remains is to check the physical conformity of the goods and prepare for its sale in accounting. If an item is sold, it should appear in the Variance column.

After an inventory check, you can automatically export items using “Create based on...”. In this case, a “Sales Report” appears, which will be posted when revenue is deposited or received.

When should goods be taken into account off balance sheet?

There are situations when there are valuables of other persons on the company’s territory. For example, when accepting a product, a defect is detected - until the supplier picks up the product, the buyer is obliged to ensure its safety (Clause 1, Article 514 of the Civil Code of the Russian Federation). Or the company provides goods storage services. In such cases, material value not related to the company's own property is subject to off-balance sheet accounting.

The postings for posting goods to the balance sheet will be as follows:

Whether it is possible to deduct VAT on goods included in the balance sheet, find out in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

What needs to be taken into account in off-balance sheet accounts and how the company will be punished if off-balance sheet accounting is not organized, learn from this material.

Concept and features of retail trade

The main criterion that determines retail trade is that the product is sold to the end consumer. It is understood that the buyer will use the product exclusively for personal purposes. The buyer can be individuals, enterprises and organizations.

There are basic conditions for recognizing a trade transaction as retail:

- the selling company is a retailer;

- goods sold in the course of trading activities are intended exclusively for personal use by the buyer (household, family use);

- issuing an invoice or issuing an invoice to the buyer is not required;

- the fact of sale is formalized by a check, which the selling company transfers to the buyer.

It should be noted that written registration of a retail trade transaction is not required by the contract. This rule is observed when the terms of the transaction are simultaneously executed and completed. According to the law, a written agreement is required if:

- a sample of the product is sold;

- the transaction is completed remotely;

- The periodical is sold in separate volumes.

Most retail transactions are carried out in cash. The fact of purchase and sale is documented by a sales receipt, which must be issued by the selling organization.

Results

The main posting upon receipt of goods: Dt 41 “Goods” Kt 60 “Settlements with suppliers and contractors”.

If the value acquired as a commodity will be used in the company’s activities, then it must be reflected in the debit of account 10 “Materials” or in the accounts of non-current assets. The procedure for recording the purchased service depends on its purpose and can be reflected as a debit to cost accounts or included in the initial cost of the asset. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is the purchase of services reflected in the enterprise?

Along with the purchase of goods, each enterprise constantly purchases services. These acquisitions do not have clearly defined material properties. They represent the actions necessary for the full functioning of all departments of the enterprise.

For example:

- Notary Services,

- office service,

- employee training,

- legal and audit services,

- and etc.

Example of receipt of services from a supplier in accounting

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.02 | Transfer of payment for services provided | Prepayment amount | Bank statement or payment order | |

| 44.01, 20.01, , , | 60.01 | Reflection of services | Cost of services excluding VAT | Certificate of completion |

| 19.03 | 60.01 | Allocation of VAT from the cost of services | VAT amount | Invoice, act of completed work, Purchase Book |

| 68.02 | 19.03 | Transfer of VAT amount for refund | VAT amount | Invoice, work completion certificate, Purchase Book |

| 60.01 | 60.02 | Offset of prepayment | Prepayment amount | Accounting information |

Accounting for financial results and subaccounts for retail trade

Absolutely every commercial structure is created for the purpose of making a profit. At the end of each month, the accounting department displays financial results and conducts “Month Closing”. For these purposes, account 90 with subaccounts is used. It is not reflected in the balance sheet and should not have a balance at the end of the month, but subaccounts are closed at the end of the year. Let's look at what subaccounts the 90th account has:

| Subaccount | Decoding |

| 1 | Revenue |

| 2 | Cost price |

| 3 | VAT |

| 4 | Excise taxes |

| 9 | Profit/loss |

90.1 – proceeds from the sale of inventory items are collected in this account during the month. This subaccount is credit only and is formed by the following transactions:

Dt 51 (50) Kt 90.1 – revenue received;

Dt 62 Kt 90.1 – goods and materials sold to a specific buyer.

90.2 – this account reflects the fact of writing off the cost of inventory items. All expenses incurred for the month are also covered. The account is debit and is formed by the following entries:

Dt 90.2 Kt 41 – the cost of inventory and materials is written off (based on sales);

Dt 90.2 Kt 44 – costs written off (at the end of the month).

90.3 – collects sold VAT, which must be transferred to the budget. In this case, the fact of payment does not affect the need to transfer VAT. That is, if the sale has taken place, but the buyer has not yet paid the money for the goods and materials, VAT must still be transferred by the 20th of the next month. This accounting method is called the “realization method.” Upon the fact of sale, you should issue an invoice, register it in the sales book and record it with the following entry:

Dt 90.3 Kt 68.2 VAT

However, in retail trade, the “Cash method” is most often used, since payment occurs at the time of transfer of inventory items. We have it in more detail below.

90.4 -Excise duties. This sub-account is dealt with by accountants whose companies sell highly profitable products: tobacco, oil, alcohol, etc. Wiring:

Dt 90.4 Kt 68 - excise duty

90.9 - Profit Loss. This subaccount is used to display financial results. It determines the difference between income and expenses incurred, that is, the profit or loss of the organization. Account balance 90.9 is closed monthly to account 99 by posting

Dt 90.9 Kt 99 – profit is reflected;

Dt 99 Kt 90.9 – loss received.

If we remember the initial example, then the Turnover Balance Sheet (SAS) for account 90 looked like this:

| check | rpm | Balance | ||

| Debit | Credit | Debit | Credit | |

| 90.1 | 4 348,50 | 4 348,50 | ||

| 90.2 | 2 834,75 | 2 834,75 | ||

| 90.3 | 663,33 | 663,33 | ||

| 90.9 | 3 498,08 | 4 348,50 | 850,42 | |

As a result of this operation, a profit was received in the amount of 850.42 rubles. That is, at the end of the month, the entire amount accumulated on account 90.3 must be written off to account 99. In this example the wiring is:

Dt 90.9 Kt 99 – 850.42 rub.

Principles of accounting for goods

Goods accounting is based on the following principles :

- conclusion of an agreement. In the absence of this clause, it will be impossible to hold the financially responsible person or any other person liable;

— selection of a method of accounting for goods that is more convenient in the operating conditions of a particular organization;

— write-off, disposal, and capitalization of goods must be carried out according to a single assessment;

— filling out reports on the availability and movement of goods by financially responsible persons must be carried out in a timely manner;

— carrying out inventories of actual balances of goods and comparing them with accounting data is carried out by the organization to ensure the safety of valuables;

— control over the actions of financially responsible persons through cross-reconciliation of documents. For example, all write-offs from department store warehouses must coincide with the posting of these valuables in sections.

Definition of goods and their types

A product is an object of civil rights or a product of an enterprise’s activity (including a service, work or financial service) intended for sale, exchange or putting into circulation.

According to the Tax Code, a commodity is any property intended for sale. In a broad sense, a product is a tangible or intangible property sold on the market. A commodity in the narrow sense is understood as a product of labor.

For example, a product of mental and physical labor, the result of a service, that is, everything that has a consumer value and its owner can exchange it for another product or money.

All products can be divided into 2 large groups:

- Material-material, having physical properties;

- Intangible – services, consultations. Intangible goods are specific and very diverse:

Purpose of accounting for goods in trade

Due to the fact that “ the purpose of accounting for transactions for the sale of goods is to provide users with information about the results of the activities of trading organizations for decision-making, the detailing of accounts should be carried out, maximally reflecting the information system for managing the sales of goods.” Considering sales management as a methodology of market activity that determines the strategy and tactics of organizations in a competitive environment, A.O. Lebedkin and I.V. Eremina, they think it is necessary to Fr.

The activities of trade organizations, according to Yu.A. Kotlovoy “requires differentiation of accounting data for internal and external users (primarily for reporting) and increasing the efficiency of managing product sales.” This can be achieved by improving the analytical accounting system. With the help of synthetic accounts, it becomes possible to isolate from the entire income of a trading organization the income from the sale of goods and in the context of each product separately, which allows for an in-depth analysis of sales, and to decide the feasibility of purchasing and selling a particular product.

Commission trading: transactions with the commission agent

As part of the retail trade, commission trade is also carried out, which is characterized by the acceptance of goods on commission from the consignor for the purpose of further sale. Accounting for consignment retail trade uses off-balance sheet accounts.

| D/t | K/t | Household operation |

| Reception of goods from the consignor | ||

| 004 | The goods are accepted at the agreed price | |

| Sales of goods | ||

| 004 | The goods have been shipped to the buyer | |

| 62 | 76-"Committee" | The sales price of the goods including VAT is reflected (negotiable price) |

| 50,51 | 62 | Payment from the buyer |

| Accrual of commissions | ||

| 76-"Committee" | 90/1 | Reward accrued |

| 90/3 | 68 | VAT on the remuneration amount |

| 76-"Committee" | 51 | The proceeds, reduced by the amount of remuneration, are transferred to the principal |

| Displaying the result | ||

| 26 | 02,10,69, 71,76 | Commission agent's expenses |

| 90/2 | 26 | Commission agent's expenses written off |

| 90/9 | 99 | Profit |

| 99 | 90/9 | Losses |

What about VAT?

As we know, for each sale the seller is obliged to issue an invoice within 5 days (clause 3 of Article 168 of the Tax Code of the Russian Federation) and register it in the sales book. But what about retail stores? Do I need to issue an invoice to every customer? Of course not. According to point 7. Art. 168 of the Tax Code of the Russian Federation, the seller’s obligation to provide the buyer with an invoice is considered fulfilled if he has issued a cash document or BSO. This rule applies only for cash payments. At the same time, the total amount of the Z-report of the cash register tape is entered into the sales book. The recording is made at a frequency convenient for the company: every day, every 3 days, week, decade, at the end of the month or quarter.

If the buyer pays by bank transfer, the seller is obliged to issue and register an invoice in the sales book. After all, in paragraph 7 of Art. 168 of the Tax Code of the Russian Federation speaks only about transactions with cash.

Losses, damage, defects: accounting in trade

Postings in trade for writing off damaged or missing inventory items directly reflect their value and its subsequent write-off as losses of the enterprise or recovery from responsible persons who committed the losses:

| D/t | K/t | Operation |

| 94 | 41 | Damage to goods reflected |

| 44 | 94 | Losses were written off within the limits of natural loss norms |

| 73,76 | 94 | Article of damaged goods and materials for compensation from the guilty parties |

| 91/2 | 94 | Loss from damage is written off if the culprit is not identified, or as a result of irresistible force majeure circumstances |

In the same way, they write off defects in trade. The transactions presented in the table reflect the option when the company does not send the defective product to the supplier.