A certificate of absence of tax arrears is a document confirming the taxpayer’s fulfillment of the obligation to pay taxes, issued by the tax authorities. A company may need it when attracting a bank loan, concluding a leasing agreement, participating in a tender, or the customer may simply ask for it to confirm the reliability of the counterparty. In our article we will tell you how to obtain and what details a certificate of absence of tax arrears should contain; a sample will help to present everything clearly.

Why do you need a form?

Confirming the absence of tax debts may be required in different situations. For example, current cases when KND form 1120101 is required:

- Registration of borrowed capital in a credit institution. For example, if an organization applies to a bank for a loan, it will have to confirm that the taxpayer does not have any late payments or debts on fiscal payments.

- Participation in state or municipal procurement. The procurement participant is obliged to confirm his integrity and solvency. One of the evaluation criteria is the absence of debts on taxes and fees.

- Participation in competitions and government grants also requires the provision of reporting documentation confirming the absence of debt to the budget, including taxes.

- The founder or owner of the organization has the right to request information about the absence of tax delinquencies. Information is necessary when planning and distributing the budget for the corresponding year.

- Information is required for analysis and management decision-making. The certificate will be useful to accounting employees when preparing reports and financial documentation.

The form may also be useful when carrying out control activities. For example, during an on-site inspection by the Tax Inspectorate and other inspectors.

OPTION 1: Certificate KND 1120101- “Takskom”

Step one:

- Log in using your electronic signature key to the Online Sprinter system.

- On the Online Sprinter main screen, click the “Create” button.

Step Two:

- On the document creation screen, set the marker to the “Request ION” position

- Select document form – 1166101 – Request for information src=»https://zakupki-gov-ru.com/wp-content/uploads/2019/08/2-1024×286.jpg» class=»aligncenter» width= "1024″ height="286″[/img]

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (TIN, KPP, Address of location in the Russian Federation, etc.)

- In the “request code” input field, select: Certificate of fulfillment by the taxpayer (payer of fees, tax agent) of the obligation to pay taxes, fees, penalties, fines, interest. The required response format should be specified as “XML”.

- Input field “Date” – Indicates the date of relevance of the certificate, if the date is not specified, then the relevance will be on the date of generation of the request to the Federal Tax Service

- Then send the request for generation using the appropriate “Submit” button.

Step four:

- Wait for the results of document processing by the tax authority (the operation may take quite a long time, up to several days)

- Download the file archive containing the document in the KND form 1120101.

This file is an electronically signed Certificate of fulfillment by the taxpayer of the obligation to pay taxes and can be uploaded to the interface of the application for participation in the ETZP Russian Railways auction,

Who issues

A certificate of taxes and duties is issued only by a representative of the Federal Tax Service. Other representatives of government agencies are not authorized to issue such documents.

You should request the form at the territorial office of the Federal Tax Service at the place of registration of the taxpayer. If an organization has separate divisions and branches, then information will have to be requested from all Federal Tax Service Inspectors at the location of the branch network.

IMPORTANT!

You can only get a certificate of absence of tax debts from the Federal Tax Service!

OPTION 2: Certificate KND 1120101- “Contour”

Step one:

- Log in to the Kontur Extern website.

If you do not have Kontur Extern, you can use the free “Test Drive” version: 3 months.

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

Step Two:

- On the “Request Reconciliation” tab, select the required document.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (Inspection Code, Date)

- After filling out all the fields, click the “Proceed to Send” button.

Step four:

- Wait for the results of document processing by the tax authority. Processing usually occurs within a day, but may take longer.

- Go to the “Documents”, “ION Requests” section and download the finished document.

This certificate confirming the taxpayer’s fulfillment of the obligation to pay taxes is required to participate in the Russian Railways ETZP auction.

What form is used?

The form was approved in Appendix No. 1 to the Order of the Federal Tax Service dated July 21, 2014 No. ММВ-7-8/ [email protected] The structure of the document is simple and does not contain special fields. The form gives a clear answer: whether the taxpayer has an outstanding debt or not. If there are overdue tax payments, the Federal Tax Service inspector will indicate the code of the territorial office in which the penalty or arrears are listed.

For example, an organization liquidated a branch. Made calculations with the budget and paid all fiscal tranches. But based on the results of a desk audit, the inspectorate accrued a tax arrears of 5 rubles. No notifications were received to the company's head office. The received certificate confirming the presence and absence of tax debt will reveal information about the debt. The form will indicate that there is a tax debt. And in the application, the inspector will indicate the code of the Federal Tax Service, in which the delay is listed.

What data is reflected in the certificate?

The help consists of 3 blocks of information:

- Output data (document name, number, on what date the information is provided).

- Taxpayer information (TIN, KPP, name, address).

- Table with calculated data. The table consists of 10 points.

1. Name of tax, fee, insurance premiums

,

2. Budget classification code - KBK,

3. OKATO

– if the data is generated on a date before December 31, 2013,

OKTMO

– if the data is generated as of the date from 01/01/2014,

4, 6, 8. Calculation status

.

The balance of settlements (positive “+”, negative “-”) with the budget system of the Russian Federation is indicated for all taxes, fees, insurance premiums, penalties, fines, excluding amounts of funds written off from the current account, but not credited to the budget system of the Russian Federation Federations for which there is a court decision that has entered into force recognizing the obligation to pay these funds as fulfilled, as well as amounts for which a deferment (installment plan) has been granted, an investment tax credit, restructuring is being carried out, and amounts suspended for collection. A separate line indicates the amounts of funds written off from the current account of the organization (individual entrepreneur), but not credited to the budget system of the Russian Federation, for which there is a court decision that has entered into force recognizing the obligation to pay these funds as fulfilled (if the specified funds are available) .

5, 7, 9. The amount of deferment.

The amounts of taxes, fees, insurance premiums, penalties, fines for which an organization (individual entrepreneur) has been granted a deferment (installment plan), an investment tax credit, restructuring is being carried out, as well as amounts suspended for collection are indicated.

10. Status of interest payments.

The status of settlements with the budget system of the Russian Federation for interest provided for by the Code and regulatory legal acts on debt restructuring is reflected. A separate line indicates the amounts of interest suspended for collection.

What do you need to receive

An official certificate of tax debt is issued only upon special request. It can be sent in several ways:

- in person by filling out an application to the Federal Tax Service;

- through an authorized representative (an official power of attorney is required);

- by sending an application by registered mail;

- by submitting an electronic request through the taxpayer’s personal account;

- by sending a forgiveness through the single portal “State Services”;

- by contacting the multifunctional center (if there is no Federal Tax Service Inspectorate in the locality).

When applying in person, you must present a passport of a citizen of the Russian Federation, as well as documents confirming your authority to represent the interests of the organization. For example, if the head of the company contacted the Federal Tax Service, then a passport is sufficient. And if the registration is carried out by a deputy or another person, then a power of attorney is required.

Certificate of absence of debt on taxes and fees: how to obtain it in the regions of the Russian Federation

- Adygea (republic) Adygeisk

- Maykop

- village Takhtamukai

- Tula village

- Krasnogvardeyskoe village

- Giaginskaya village

- Gorno-Altaisk

- Aleysk

- Belogorsk

- Arkhangelsk

- Astrakhan

- Agidel

- Alekseevka

- Bryansk

- Gusinoozersk

- Alexandrov

- Volgograd

- Babaevo

- Bobrov

- Buynaksk

- Birobidzhan

- Balei

- Vichuga

- Karabulak

- Angarsk

- Baksan

- Bagrationovsk

- Gorodovikovsk

- Balabanovo

- Elizovo

- Ust-Dzheguta

- Belomorsk

- Anzhero-Sudzhensk

- White Kholunitsa

- Vorkuta

- Buoy

- Abinsk

- Achinsk

- Dalmatovo

- Dmitriev-Lgovsky

- Boksitogorsk

- Mud

- Magadan

- Volzhsk

- Ardatov

- Moscow

- Balashikha

- Apatity

- Naryan-Mar

- Arzamas

- Borovichi

- Barabinsk

- Isilkul

- Abdulino

- Bolkhov

- Belinsky

- Alexandrovsk

- Arsenyev

- Velikie Luki

- Azov

- Kasimov

- Zhigulevsk

- Kolpino

- Arkadak

- Aldan

- Alexandrovsk-Sakhalinsky

- Alapaevsk

- Alagir

- Velizh

- Grateful

- Zherdevka

- Agryz

- Andreapol

- Asino

- Aleksin

- Ak-Dovurak

- Ishim

- Votkinsk

- Barysh

- Amursk

- Abakan

- Beloyarsky

- Asha

- Argun

- Alatyr

- Anadyr

- Labytnangi

- Gavrilov-Yam

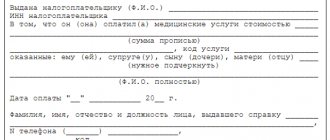

Features of receiving in paper form

You can obtain a completed sample of KND certificate 1120101 about tax debts at any branch of the Federal Tax Service. To do this, you will have to fill out an application in the form approved in Appendix No. 8 to the Administrative Regulations, approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

In your application, please provide the following information:

- In the header of the document: Full name. the head and the name of the Federal Tax Service to which you are submitting the request.

- We indicate what type of information is required for registration. Place a tick in the required field.

- Enter the date or period for which information is required. If the data is not specified, the inspectorate will prepare information as of the date the request is received.

- Applicant details. It is necessary to identify the taxpayer for whom information is needed. We indicate the full name of the organization, address, tax identification number and checkpoint.

- We prescribe the method for receiving the answer.

- We put the seal and signature of the manager.

The response from the Federal Tax Service will be ready within 10 working days from the date of receipt of the official request.

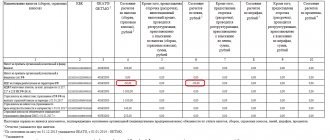

Is the received certificate filled out correctly?

Let's look at an example of what a completed certificate KND 1120101 should look like: a sample is presented below.

1. A serial number must be assigned.

2. The name, INN and KPP, and address of the taxpayer are indicated. When generating information for a company that has separate divisions, the checkpoint may not be specified.

3. The date must correspond to the date specified in the request

4. The most important record is the record of the presence or absence of debt

5. The name of the inspection that issued the form must be given

6. At the bottom of the paper document there must be the signature and seal of the head of the Federal Tax Service, and on the electronic document - the digital signature details.

Below is a completed document, which is assigned a code according to KND 1120101: certificate (sample).

KND 1120101 (form)

Application (request form)

Features of receiving in electronic form

You can submit your request via the Internet. For example, using specialized accounting programs, fill out a request and send it via secure communication channels. Or prepare an application through the taxpayer’s personal account or the State Services portal. The request is generated in a similar manner.

IMPORTANT!

When sending an application electronically, the Federal Tax Service will also prepare a response in electronic form. To receive a paper certificate (with a blue stamp), you will have to contact the inspectorate in person.

View statement

Within 2 business days, the tax office must process your request and send a response.

To view it, expand the “ Extract received ” sticker and open the “Extract” document.

The result can also be viewed in the query:

- If taxes have been paid, the certificate will contain the entry “doesn't have unfulfilled obligation to pay."

- If the organization has a debt, the certificate will contain the entry “It has unfulfilled obligation to pay."

How to check the accuracy of the certificate

In fact, the certificate reflects the presence or absence of tax debt. The taxpayer may not be aware of the existence of a debt or penalty. The applicant can only check his details to see if the inspection made any mistakes in them.

If, according to the company’s accounting data, there are no fiscal debts, and the Federal Tax Service indicated in the certificate that there is a debt, then it is necessary to act:

- Request the Federal Tax Service for an amendment to your budget calculations.

- Reconcile accounting data and inspection information.

- Identify discrepancies and determine their causes.

- If the arrears are the fault of the company, repay the amounts in the general manner.

- Make adjustments to your accounting. For example, reflect underaccrued penalties and fines in an accounting statement.

- Prepare adjusting statements as necessary.

If the debt is unjustified and an error is suspected in the Federal Tax Service data, then you must contact the inspectorate. Prepare payment documents, tax registers and other documentation confirming the absence of debt. Provide evidence to the inspector. Upon request, a review will be initiated.

This is what a correctly completed sample certificate of no tax debt looks like:

Purposes of writing

Legal entities may need a certificate of absence of tax debt in the following cases:

- when collecting a package of documents for participation in tenders and government procurement;

- upon liquidation or reorganization of a legal entity;

- when changing the legal address of the company;

- if the company collects documents for the bank to obtain a loan/credit;

- if the organization changes its chief accountant;

- if the certificate is required for concluding a major agreement/contract and is required by the counterparty.

A certificate of proper fulfillment of tax obligations is a kind of guarantor for a legal entity and evidence of its reliability and financial solvency for the transaction.

How to get a certificate about the status of settlements with the Federal Tax Service?

Organizations and individuals will be able to order a certificate of tax calculations from the Federal Tax Service. To do this, they need to submit a corresponding request to the department. The certificate will be prepared within 5 days from the date of its submission.

A certificate of tax calculations, penalties and fines can also be requested electronically through the official website of the tax service. The sequence of actions will be as follows:

- go to “Personal Account” on the Federal Tax Service website;

- open the menu “Request for documents”, then “Request for information service”;

- in the window that opens, check the box next to the required document and indicate the method of receipt.