- Annual information on insurance experience - upon liquidation, a report is submitted to the Pension Fund about each employee for the period from the beginning of the calendar year to the day the report is submitted (clause 2 of Article 11 of Law No. 27-FZ dated 01.04.1996). Policyholders will submit this information for the first time, starting with reporting for 2021. But, ceasing activities earlier than the end of the reporting year, for example, from May 1, 2021, information about the length of service will need to be submitted for the period from January 1, 2021 to the date of submission information on all insured persons working during this period.

- Information in the SZV-M form is submitted for the period from the beginning of the reporting month to the day of submission. For example, if an organization ceases its activities in March and submits reports to the Pension Fund on March 6, then it is necessary to provide SZV-M for February by the due date and a March liquidation report to the Pension Fund for the period from the 1st to the 6th for all persons working at that time. In the case when the process of liquidation of an organization is carried out by a liquidation commission, with the members of which civil contracts for the provision of services have been concluded, then the SZV-M form includes information on “liquidators” (clause 2.2 of Article 11 of Law No. 27 dated 01.04.1996 -FZ).

- Registers in form DSV-3 for additional contributions to funded pension. They are represented only by those insurers who, since the beginning of the year, have transferred additional savings contributions from their funds or withheld them from the employee’s salary at his request (Article 9 of Law No. 56-FZ of April 30, 2088).

When to submit reports

As a general rule, information should be sent electronically. The report receives legal force after it is certified with an electronic enhanced signature.

You can also submit the report on paper. But this right is established only for small enterprises with fewer than 25 employees.

Documentation is submitted every quarter:

- Electronic documents must be submitted no later than the 25th.

- When documents are sent in paper form, this should be done before the 20th.

Important! Enterprises that employ disabled people or provide additional payment for time spent caring for disabled children provide additional documentation.

Number of employees

In the “Average number of employees” field, indicate the average number of employees excluding women on maternity leave and employees on maternity leave for up to 1.5 years.

In the “of which women” field, separately indicate how many insured women there are in the organization. Do not include women who are on maternity leave in this indicator.

This follows from paragraph 5.14 of the Procedure, approved by order of the FSS of Russia dated February 26, 2015 No. 59.

Compilation algorithm

There are certain rules for how to fill out the title page and other sections. If you follow these rules, the company will be able to easily submit the documentation.

How to prepare a report in 2021

- The report is prepared in two ways: in computer form.

- on a piece of paper with a pen and blue or black ink.

The remaining tables may not be submitted if data is missing. If corrections have been made, their accuracy should be certified by the signature of an authorized person and a seal (if any).

3 basic rules for designing a title page:

- On the title page write:

- registration number;

- subordination code;

- where the company is registered.

- Enter code 000 when the calculation is made for the first time.

- Use codes “03”, “06”, and “09” to designate reporting periods.

There are also different rules when designing tables.

Sample of filling out 4-FSS. Page 1

Sample of filling out 4-FSS. Page 2

Sample of filling out 4-FSS. Page 3

Sample of filling out 4-FSS. Page 4

Sample of filling out 4-FSS

Submitting a report upon liquidation of an enterprise

When an enterprise is liquidated or the activities of an individual entrepreneur are terminated, a report in Form 4-FSS is also submitted.

In this case, on the title of the report you must indicate the letter “L” in the corresponding column (“Cessation of activities”).

Important! If the business is being liquidated/closed, the report must be submitted before the application for liquidation is submitted.

The calculation will be made for the period from the beginning of the year until the day the report is submitted.

TIN and checkpoint

Indicate the TIN and KPP of the organization. You can view such data in the registration notice issued by the Federal Tax Service of Russia upon registration. For a separate subdivision, indicate the checkpoint at the location of such subdivision. Unlike the RSV-1 form, in the “TIN” field, leave empty cells not behind the number, but in front of it and fill them with zeros (clause 5.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated February 26, 2015 No. 59).

If the policyholder is an individual, then look at the TIN in the certificate of registration of the individual at his place of residence. In this case, put a dash in the “checkpoint” field.

Reporting to the Social Insurance Fund upon liquidation of an LLC or individual entrepreneur

In the event of liquidation of an LLC or individual entrepreneur, it is necessary to submit a 4-FSS calculation to the territorial social insurance authority at the place of registration of the payer. The form is filled out on the basis of the payer’s accounting information on insurance premiums for the period from January 1 of the current year (or from the date of registration, if the payer is registered in the current year) to the day the statement is submitted.

IMPORTANT! The statement is submitted to the FSS before the day of filing the application for liquidation with the Federal Tax Service. For example, if the liquidation application is planned to be submitted to the tax office on October 12, 2016, then you must report to the Social Insurance Fund by October 11, 2016. Payment of contributions must be made within 15 days after submitting the statement (Article 15 of the Law “On insurance contributions to the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ).

The calculation is sent electronically via telecommunication channels if the average number of employees exceeds 25 people. If the company has 25 employees or less, the statement can be submitted on paper.

For information on how to submit electronic reports, read the article “How to submit electronic reports to the Social Insurance Fund (nuances)?”

What else needs to be done

Submitting documents to the Federal Tax Service and funds to complete the activity is not enough. After submitting declarations when closing an individual entrepreneur, complete the liquidation procedure.

Report layoffs to the employment service

No later than two months before dismissal, send a notice to the labor exchange.

Pay off debts on taxes and contributions

If debts are not repaid before liquidation, they will be collected from you as from an ordinary individual.

Deregister the cash register (if available)

Submit a request to deregister an online cash register from the Federal Tax Service through your personal account.

Notify about the liquidation of individual entrepreneurs

Provide termination notices to counterparties prior to closure. Request reconciliation reports to identify existing debts.

Close an account

After making a record of the liquidation of the individual entrepreneur, contact the bank to close the current account.

Responsibility for violation of payment deadlines

In case of untimely submission of the calculation, the organization will face punishment in the form of penalties calculated in the amount of 5% of the amount of contributions for the last 3 months of the reporting period, but not more than 30% and not less than 1 thousand rubles, according to:

- Art. 46 of Law No. 212-FZ;

- Art. 19 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ.

This is due to the fact that the calculation contains 2 sections: “Compulsory social insurance” and “Accident insurance”.

Registration address

Please enter your registration address. For organizations this is the legal address, for entrepreneurs - the address of residence.

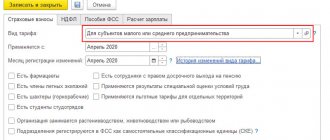

In the field “Code of the payer of insurance premiums (policyholder)” in the first three cells the code that determines the category of the policyholder is indicated. It can be determined using Appendix No. 1 to the Procedure approved by Order No. 59 of the FSS of Russia dated February 26, 2015. Fill out the next two cells in accordance with Appendix No. 2 to the above procedure. And fill out the last two cells of the field “Code of the payer of insurance premiums (policyholder)” in accordance with Appendix No. 3 to the Procedure approved by order of the FSS of Russia dated February 26, 2015 No. 59. This procedure is provided for in clause 5.13 of the Procedure approved by order of the FSS of Russia dated February 26, 2015 February 2015 No. 59.

For example, a commercial organization that applies a general taxation system and pays contributions at the basic tariff, in the field “Code of the payer of insurance premiums (policyholder)” you need to indicate “071/00/00” (letter of the Federal Insurance Service of Russia dated April 1, 2011 No. 14- 03-11/04-2866).

For a complete list of payer category codes, see the table.

Situation: what payer code should be indicated in the 4-FSS calculation when combining the simplified system and the patent system?

The code depends on the type of activity of the entrepreneur.

In general, an entrepreneur who combines the simplified procedure and the patent system must indicate the payer code “171/01/00”.

But if an entrepreneur has acquired a patent for activities such as leasing real estate, retail trade or catering services, then when combining modes he must indicate the payer code “071/01/00”.

Such explanations are contained on some regional websites of the FSS of Russia. For example, in the information of the Altai regional branch of the FSS of Russia dated April 1, 2014.

Situation: what payer code should I indicate in the 4-FSS calculation? During the reporting period, the organization became a participant in the SEZ in Crimea.

Enter code 181.

On the date of submission of the calculation, the organization had already received the status of a participant in the FEZ in Crimea. And such companies put a special code on the title page - 181.

In this case, the report must show the total indicators of insurance premiums accrued at different rates.

Sample of filling out the 4-FSS statement during liquidation

The calculation form is filled out in accordance with the rules specified in the FSS order No. 59 dated February 26, 2015 and differs from the standard 4-FSS design in the title page, in which the letter L is placed in the “Cessation of activities” column.

You can familiarize yourself with the calculation form in the material “How to fill out the new form 4-FSS in 2015-2016 (form)?”

A sample of filling out form 4-FSS can also be downloaded on our website.

Where to submit the payment

If the organization does not have separate divisions, then submit the calculation to the territorial branch of the FSS of Russia at its location (Part 9, Article 15 of the Law of July 24, 2009 No. 212-FZ). That is, at the place of registration of the organization.

If the organization has separate divisions, then Form 4-FSS must be submitted in the following order.

Submit the calculation to the territorial branch of the Federal Social Insurance Fund of Russia at the location of the separate division, only if such a division has its own balance sheet, current (personal) account and independently pays salaries to employees. In this case, in the 4-FSS form, indicate the address and checkpoint of the separate unit.

When the above conditions or at least one of them are not met, include all indicators for such a division in the calculation for the head office of the organization and submit it to its location. Do the same if the separate division is located abroad.

This follows from the provisions of parts 11, 14 of Article 15 of the Law of July 24, 2009 No. 212-FZ and paragraph 5.9 of the Procedure approved by Order of the FSS of Russia of February 26, 2015 No. 59.

Report to the Pension Fund upon liquidation

Related publications

For various reasons, an organization or an employer-entrepreneur may decide to terminate its activities. Before the policyholder is deregistered from extra-budgetary funds, he must report for the last time on insurance premiums and accounts, including to the Pension Fund. In what order and in what time frame this happens, we will consider in our article.

Example of filling out for the first quarter

Let’s assume that the limited liability company “Guru” (LLC “Guru”) is registered in Moscow. It includes 3 employees (together with the manager), with whom employment contracts have been signed. Moreover, one of the employees has a group II disability. All employees are citizens of the Russian Federation. During the 1st quarter of 2021, their number did not change.

For the 1st quarter of 2021, employees of Guru LLC received payments subject to injury contributions:

| Period | Taxable payments accrued to employees (rub. kopecks) | ||

| excluding payments in favor of a working disabled person | payments to a disabled person | Total, including payments to disabled people | |

| January | 65 000,00 | 32 000,00 | 97 000,00 |

| February | 65 000,00 | 32 000,00 | 97 000,00 |

| March | 65 000,00 | 32 000,00 | 97 000,00 |

| Total for the first quarter of 2021 | 195 000,00 | 96 000,00 | 291 000,00 |

The company did not accrue any other payments for the first quarter of 2021.

LLC applies a general tariff for contributions without discounts and surcharges in the amount of 0.50%.

In relation to payments to a disabled employee, the organization applies a tariff of 0.30% (60% of 0.50%).

For the first quarter of 2021, the company accrued the following amounts of contributions for injuries:

| Period | Accrued contributions for injuries (RUB kopecks) |

| January | 421,00 ((65 000,00 × 0,50% ) + (32 000,00 × 0,30%)) |

| February | 421,00 |

| March | 421,00 |

| Total for the first quarter of 2021 | 1263,00 |

At the beginning of the first quarter of 2021, Guru LLC has no debt to the territorial Social Insurance Fund and vice versa.

At the end of the first quarter of 2021, the organization incurred a debt in the amount of 421.00 rubles. These are March 2021 contributions due in April 2021.

A special assessment of working conditions was carried out in 2021. Based on its results, no workplaces with harmful and/or dangerous working conditions were found.

Let us also agree that in the first quarter of 2021 there were no industrial accidents at the company.

Please note that when calculating 4-FSS for the first quarter of 2021, Guru LLC must attach a certificate of disability of the employee (on 1 sheet).

The following link shows the completed sample 4-FSS for the 1st quarter of 2018. It includes a title page, tables 1, 2 and 5 of the calculation. There are no indicators to fill out the remaining tables, so we ignore them and do not include them in the final report.

Also see “Gateway for receiving FSS reports”.

Read also

29.02.2020

Liquidation report to the Pension Fund of Russia - what information to submit

Within one month after the approval of the liquidation balance sheet of the organization or the decision to terminate the activities of the individual entrepreneur, but before the day on which the application for liquidation is submitted, the following “pension” reports must be provided:

- Annual information on insurance experience - upon liquidation, a report is submitted to the Pension Fund about each employee for the period from the beginning of the calendar year to the day the report is submitted (clause 2 of Article 11 of Law No. 27-FZ dated 01.04.1996). Policyholders will submit this information for the first time, starting with reporting for 2021. But, ceasing activities earlier than the end of the reporting year, for example, from May 1, 2021, information about the length of service will need to be submitted for the period from January 1, 2021 to the date of submission information on all insured persons working during this period.

- Information in the SZV-M form is submitted for the period from the beginning of the reporting month to the day of submission. For example, if an organization ceases its activities in March and submits reports to the Pension Fund on March 6, then it is necessary to provide SZV-M for February by the due date and a March liquidation report to the Pension Fund for the period from the 1st to the 6th for all persons working at that time. In the case when the process of liquidation of an organization is carried out by a liquidation commission, with the members of which civil contracts for the provision of services have been concluded, then the SZV-M form includes information on “liquidators” (clause 2.2 of Article 11 of Law No. 27 dated 01.04.1996 -FZ).

- Registers in form DSV-3 for additional contributions to funded pension. They are represented only by those insurers who, since the beginning of the year, have transferred additional savings contributions from their funds or withheld them from the employee’s salary at his request (Article 9 of Law No. 56-FZ of April 30, 2088).

Signatures in calculation

If the calculation is signed by the legal representative (manager) of the organization, on the title page in the cells provided for signature, indicate “1” and the surname, first name and patronymic of the representative in full, signature and put the date of signing. In the field M.P. put a stamp (if available). If there is no seal of the organization, this cannot be a basis for refusing to accept payment. This was stated in the information of the FSS of Russia dated June 10, 2015.

If the calculation is signed by an authorized representative - an individual, on the title page in the cells provided for signature, indicate “2”, the surname, first name and patronymic of the representative in full, the date of signing, as well as the type of document confirming the authority of the representative (for example, a power of attorney).

If the calculation is signed by an authorized representative - a specialized organization, on the title page in the cells provided for signature, indicate “2”, the name of the specialized organization, the last name, first name and patronymic of its head (authorized employee) in full.

If the settlement is submitted by the legal successor, put “3” in the “I confirm the accuracy and completeness of the information” field.

This follows from the provisions of paragraph 5.16 of the Procedure, approved by order of the FSS of Russia dated February 26, 2015 No. 59.

Indicate the last name, first name and patronymic (if any) of the manager or individual and the date of the calculation. Signature and date must be on each page of the calculation.

If the calculation is submitted by a representative (legal successor), then indicate the document that confirms his authority.

RSV-1: liquidation report to the Pension Fund in 2021

In 2021, according to the RSV-1 form, policyholders only need to report to the Pension Fund on the results of 2021. Those who cease operations in 2021 must submit a new unified calculation of insurance premiums (approved by order of the Federal Tax Service No. ММВ-7-11/551 dated 10.10.2016). This form is submitted not to the Pension Fund, but to your tax office (Clause 1, Article 11 of Law No. 27-FZ; Clause 15, Article 431 of the Tax Code of the Russian Federation). In case of liquidation, a report on PFR contributions must be submitted not only by all organizations, but also by individual entrepreneurs who made payments to employees and other individuals in the year of termination of their activities.

The deadline for filing a liquidation settlement is established by clause 15 of Art. 431 of the Tax Code of the Russian Federation: for organizations - before an interim liquidation balance sheet is drawn up, and for individual entrepreneurs - before the day of filing an application for termination of activities. The period for which the Calculation must be prepared is from January 1, 2021 to the day of its submission to the Federal Tax Service, inclusive.

The balance of debt on insurance premiums, according to the presented single Calculation, must be transferred to the budget within 15 calendar days after its submission. Please note that for payment of arrears on “pension” and other insurance contributions that arose before 01/01/2017, different BCCs are used than for arrears on contributions accrued during the period from 01/01/2017.

Our Key Advantages

offers accounting support for liquidation on mutually beneficial terms. We calculate the cost of services on a personal basis, taking into account the organizational and legal form, the volume and completeness of accounting documentation, and the presence of debts of the enterprise. Our staff includes specialists with over 10 years of experience who guarantee the liquidation of legal entities in a short time.

The main advantages of cooperation with us:

- 10 years of experience in accounting support of liquidations;

- work with organizations of all forms of ownership - LLC, individual entrepreneur, non-profit organization, any tax regimes - OSNO, simplified tax system, UTII and others;

- free consultations with specialists;

- representation of clients' interests in regulatory authorities.

Responsibility for untimely submission of the liquidation report to the Pension Fund of Russia

When submitting the last reports to the Pension Fund before liquidation, you should not violate the deadlines established for this. If liquidation reports are not submitted to the Pension Fund on time, the fund has the right to apply fines that apply in the usual manner. Thus, if information in the form SZV-M, an annual report on work experience or registers of additional contributions is not submitted on time or is submitted but not completely, the policyholder is subject to a fine of 500 rubles for each insured individual. It is also necessary to comply with the electronic form of submission when this is expressly stated in the law. A paper form of reports submitted to the Pension Fund during liquidation, instead of an electronic one, will cost the violator a fine of 1,000 rubles (Article 17 of Law No. 27-FZ).

Also, do not miss the deadline for submitting a Unified calculation of insurance premiums to the Federal Tax Service. Lateness in this case threatens with a fine of 5 to 30 percent of the amount of unpaid contributions for each month of delay, but at least 1,000 rubles (Article 119 of the Tax Code of the Russian Federation). Failure to comply with the electronic form of the liquidation calculation, when this is mandatory, will cost the payer of contributions a fine of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

OGRN

Indicate the OGRN number in accordance with the state registration certificate. You can also view this code in the notification of registration with Rosstat. Just as when filling out the “TIN” field, leave empty cells in front and fill them with zeros.

Write your contact phone number in full, including the city code. This can be either a landline or a mobile number. The telephone number should not contain parentheses or dashes (clause 5.11 of the Procedure approved by Order of the FSS of Russia dated February 26, 2015 No. 59).

Purpose of the interim report

With the help of an interim report to the Social Insurance Fund, the employer has the opportunity to return to the current account the amounts paid to employees through social insurance.

An interim report is prepared when such payments are made in the first or second month of the reporting period. It makes sense to submit a report for reimbursement when, according to preliminary calculations by the policyholder at the end of the quarter, the total amount of contributions payable will be lower than the total amount of benefits paid.

If the payment of benefits from social insurance occurred in the third month of the reporting period, an interim report is not prepared. All expenses can be paid based on the quarterly report.

Section I

In Section I, reflect data related to calculations of contributions to compulsory social insurance in case of temporary disability and in connection with maternity.

The “OKVED Code” field is filled in only by those organizations that have the right to apply reduced insurance premium rates in accordance with paragraphs 8 and 11 of part 1 of Article 58 of the Law of July 24, 2009 No. 212-FZ. Indicate in this field the main code of the type of economic activity. Determine it using the OKVED classifier.

In Table 1, provide information on accrued and paid insurance premiums, as well as on the status of the organization’s settlements with the Federal Social Insurance Fund of Russia at the beginning and end of the reporting period.

On line 1, reflect the amount of debt on insurance premiums that the policyholder had at the beginning of the billing period. The amount should be equal to the indicator in line 19 of a similar calculation table for the previous year.

On line 2, indicate the amounts of insurance premiums accrued for payment. In this case, in the line “At the beginning of the reporting period,” indicate the amount of accrued insurance premiums for the quarters preceding the reporting period. For example, in the calculation for the first quarter, you need to put a dash on this line. And in the calculation for the half-year - the amount of contributions accrued for the first quarter. In column 3 of line 2, indicate the total amount of insurance premiums accrued for the reporting period. For example, in calculations for the first quarter, this will be the amount of accrued contributions for the first quarter (the indicator will be equal to the amount indicated in the line “For the last three months of the reporting period”). And in the calculation for the half-year, in column 3 of line 2, you need to indicate the total amount of insurance premiums accrued for the half-year (the indicator will be equal to the sum of the indicators indicated in the lines “At the beginning of the reporting period” and “For the last three months of the reporting period”).

On line 3, reflect the amount of contributions accrued on the basis of reports of on-site and desk inspections.

Line 4 should be filled out if the organization has discovered underpayments for previous years. And in line 5, indicate the amounts of expenses that the FSS branch of Russia did not accept for offset in previous years according to reports of on-site and desk inspections.

On line 6, show the amounts that the organization received from the Russian Social Insurance Fund for reimbursement of expenses (for sick leave, maternity benefits, etc.).

In line 7, reflect the overpaid contributions that the Russian FSS branch returned to the organization.

On line 8, reflect the total indicator. You will get it by adding rows 1 to 7 of this table.

Fill out line 9 only if the FSS of Russia has a debt to you.

On line 15, indicate expenses for the purposes of compulsory social insurance that have been incurred since the beginning of the billing period, broken down by month. This indicator must correspond to the indicator in line 15 of Table 2 of Form 4-FSS (clause 7.13 of the Procedure approved by Order of the FSS of Russia dated February 26, 2015 No. 59).

The amounts of insurance premiums that were transferred to the Social Insurance Fund of Russia should be reflected on line 16.

On line 17, you must indicate the debt on insurance premiums that has been written off by the fund, as well as the debt that is not subject to collection by a court decision. That is, the arrears that the FSS of Russia does not have the right to collect due to the expiration of the statute of limitations.

On line 18, reflect the total amount, determine it by adding lines 12, 15, 16 and 17.

On line 19, indicate the debt to the Social Insurance Fund of Russia at the end of the reporting (calculation) period.

Situation: how to reflect insurance premiums in form 4-FSS? During the reporting period, the organization acquired the status of a participant in the FEZ in Crimea.

Reflect the total indicators of insurance premiums accrued at different rates.

FEZ participants in Crimea have the right to apply a reduced tariff from the 1st day of the month following the month in which such status was obtained (Article 58.4 of the Law of July 24, 2009 No. 212-FZ). Therefore, until the month in which the company received the status of a FEZ participant (inclusive), you must pay contributions at the general rate. And from next month - at a rate of 1.5 percent.

The current form 4-FSS is not suitable for separately reflecting insurance premiums accrued at different rates. And since the calculation indicators are formed on an accrual basis from the beginning of the year, add up the accrued contributions at different tariffs. To do this, it is necessary to ensure separate accounting of payments and insurance premiums:

- for the period prior to obtaining the status of a FEZ participant;

- from the next month after receiving this status.

Be prepared for the fact that during a desk audit, fund employees will require documents confirming the correctness of the calculation. For example, they may request:

- certificate of inclusion in the register of FEZ participants - to check from what period the organization has the right to apply a reduced tariff;

- payroll records and calculations of insurance premiums broken down by periods before and after obtaining FEZ status.

There are no official letters on this matter yet, but in oral explanations, specialists from the Russian Ministry of Labor and the Federal Social Insurance Fund of Russia give precisely such recommendations.

Example: how to reflect insurance premiums in form 4-FSS. The company received the status of a participant in the FEZ in Crimea

The organization applies a general taxation system.

In February 2021, the company received the status of a participant in the FEZ in Crimea. From March 1, it has the right to charge insurance premiums to the Social Insurance Fund of Russia at a reduced rate.

Thus, when calculating contributions for January and February, the company applies a general tariff of 2.9 percent. Starting from March 1, the tariff is 1.5 percent (Article 58.4 of the Law of July 24, 2009 No. 212-FZ).

The data for calculating insurance premiums for the first quarter and half of the year is as follows:

| Month | Total amount of accrued payments, rub. | Non-taxable payments, rub. | Taxable base, rub. | Insurance premium rate, % | Amount of insurance premiums, rub. |

| January | 700 000 | 20 000 | 730 000 | 2,9 | 21 170 |

| February | 810 000 | 12 000 | 798 000 | 2,9 | 23 142 |

| March | 850 000 | 35 000 | 815 000 | 1,5 | 12 225 |

| Total for the first quarter | 2 360 000 | 67 000 | 2 343 000 | 56 537 | |

| April | 650 000 | – | 650 000 | 1,5 | 9750 |

| May | 590 000 | – | 590 000 | 1,5 | 8850 |

| June | 710 000 | – | 710 000 | 1,5 | 10 650 |

| Total for the second quarter | 1 950 000 | 67 000 | 1 950 000 | 29 250 | |

| Total for the half year | 4 310 000 | 67 000 | 4 293 000 | 85 787 |

Since on the date of submitting the calculation for the first quarter, the organization had already received the status of a participant in the FEZ in Crimea, on the title page of Form 4-FSS, the accountant indicated the policyholder code - 181/00/00. The accountant indicated the same code in calculations for subsequent periods.

In the calculations, the accountant indicated insurance premiums on an accrual basis. That is, he summed up the contributions accrued at different rates.

The accountant reflected the amounts of accrued insurance premiums in the 4-FSS calculation as follows:

For the first quarter:

For half a year:

Reimbursement of Social Insurance Fund expenses from 2021

Since 2021, contributions for temporary disability and maternity (VNiM) have come under the control of the Federal Tax Service, while the FSS retains only contributions from accidents and occupational diseases (NSiPZ). Due to the change of administrative bodies, these contributions are reflected in different reports:

- VNiM - as part of a new unified calculation of contributions to the tax service;

- NSiPZ - according to form 4-FSS to the social insurance fund.

From January 1, 2021, the following will be submitted to the Social Insurance Fund:

- application for compensation in any form;

- a calculation certificate containing information on accrued, reimbursed, and paid contributions to VNiM;

- copies of documents confirming expenses.

These forms were developed by the FSS and are given in the Letter of the FSS of the Russian Federation dated December 7, 2016 N 02-09-11/04-03-27029. There are no formats for these documents, so the forms are submitted on paper. Form 4-FSS does not need to be submitted, since since 2021 it does not contain information on sick leave.

Please note: regarding contributions for temporary disability and maternity (VNiM), interim reports are not required to be submitted to the social insurance fund.

If you need to submit for the period 2021 and earlier, then you can make such a report in Kontur.Exter as follows: when filling out the details of the 4-FSS form, you need to clear the “Reporting period” field and fill in the “Subsidy application number” field with the required number. Next, the report is printed and submitted independently to the Fund.

Who should report

All organizations and entrepreneurs that pay citizens remuneration subject to contributions for compulsory social insurance must submit calculations in form 4-FSS (clause 1, part 1, article 5, clause 2, part 9, article 15 of the Law of July 24, 2009 No. 212-FZ).

Situation: is it necessary to submit Form 4-FSS if an organization (entrepreneur) accrues payments to employees only under civil contracts?

Organizations submit calculations using Form 4-FSS in any case. Entrepreneurs must submit calculations only if they calculate contributions from payments under civil contracts.

All insurers must submit calculations in form 4-FSS (clause 1, part 1, article 5, clause 2, part 9, article 15 of the Law of July 24, 2009 No. 212-FZ). Therefore, in order to answer the question of whether it is necessary to submit a calculation or not, you need to figure out when an organization or entrepreneur is recognized as an insurer?

Organizations

Organizations are insurers in any case - they are registered with the Federal Social Insurance Fund of Russia, regardless of the nature of the contracts concluded with employees (subclause 1, part 1, article 2.3 of the Law of December 29, 2006 No. 255-FZ). Therefore, organizations must submit calculations using Form 4-FSS. Even if in the reporting (calculation) period they did not pay employees income subject to social insurance contributions or insurance against accidents and occupational diseases.

Entrepreneurs

Entrepreneurs become policyholders when they enter into a contract with an employee:

- employment contract;

- a civil law agreement, which states that payments under this agreement will accrue contributions for insurance against accidents and occupational diseases.

This follows from the provisions of subparagraph 3 of part 1 of Article 2.3 of the Law of December 29, 2006 No. 255-FZ, part 1 of Article 5, part 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ.

Thus, in the situation under consideration, an entrepreneur must submit Form 4-FSS only if the concluded civil law contracts contain a condition on the calculation of insurance premiums. If there is no such condition, the entrepreneur is not required to submit calculations in Form 4-FSS.

Contributions in case of temporary disability and in connection with maternity

Payments under civil law contracts are not subject to contributions in case of temporary disability and in connection with maternity (subparagraph 2, part 3, article 9 of the Law of July 24, 2009 No. 212-FZ). However, according to line 1 of table 3 of section I of the calculation, such payments must be indicated as part of total payments.

This is explained by the fact that line 1 of Table 3 reflects all payments accrued in accordance with Article 7 of Law No. 212-FZ dated July 24, 2009 (clause 10.1 of the Procedure approved by order of the Federal Social Insurance Fund of Russia dated February 26, 2015 No. 59) . And this article says that payments under civil contracts for the performance of work (rendering services) and under copyright contracts are subject to insurance premiums.

This means that the amount of payments under such agreements must be reflected in line 1 of Table 3 of Section I of Form 4-FSS. Payments under civil contracts, the subject of which is the transfer of property into ownership or use, are not subject to contributions (Part 3, Article 7 of Law No. 212-FZ of July 24, 2009). Therefore, they do not need to be included in the calculation.

On line 2 of Table 3, we indicate the amount of payments that are not subject to contributions under Article 9 of Law No. 212-FZ of July 24, 2009 (clause 10.2 of the Procedure approved by Order of the Federal Social Insurance Fund of Russia dated February 26, 2015 No. 59). These include payments under civil contracts, which we just talked about. Thus, filling out lines 1 and 2 of Table 3 does not lead to an increase in the calculation base and does not entail the calculation of contributions for insurance in case of temporary disability and in connection with maternity.

Contributions for insurance against accidents and occupational diseases

Contributions for insurance against accidents and occupational diseases for payments under civil contracts must be accrued only if such an obligation is provided for in the contract (paragraph 4 of article 5, part 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ ).

Payments under civil contracts, which are subject to contributions for insurance against accidents and occupational diseases, are indicated as part of the total payments in Table 6 of Section II of the calculation (clauses 24.1 and 24.2 of the Procedure approved by Order of the Federal Social Insurance Fund of Russia dated February 26, 2015 No. 59) .

If there is no provision in a civil contract that remunerations under it are subject to contributions for injuries, there is no need to reflect such remunerations in Table 6. After all, the table reflects:

- payments for which insurance premiums are calculated (columns 3 and 4);

- payments for which insurance premiums are not charged under Article 20.2 of the Law of July 24, 1998 No. 125-FZ (benefits, compensation, etc.).

This is stated in paragraphs 24.1–24.3 of the Procedure approved by order of the FSS of Russia dated February 26, 2015 No. 59.

Non-taxable remuneration under civil law contracts does not apply to either one or the other.

For clarity, we present all of the above in tabular form:

| What contracts have been concluded | Organization | Entrepreneur |

| Labor and civil law contracts were concluded | Required to submit payment. Reflect the payments in Table 3 of the calculation as part of the total payments. If payments are subject to injury contributions, also reflect them in Table 6 as part of total payments | Must submit payment. Reflect the payments in Table 3 of the calculation as part of the total payments. If payments are subject to injury contributions, also reflect them in Table 6 as part of total payments |

| Only civil contracts have been concluded (the contracts provide for the obligation to pay contributions for insurance against accidents and occupational diseases) | Required to submit payment. Indicate payments in tables 3 and 6 of the calculation as part of total payments | Must submit payment. Indicate payments in tables 3 and 6 of the calculation as part of total payments |

| Only civil contracts have been concluded (the contracts do not contain provisions on the payment of contributions for insurance against accidents and occupational diseases) | Required to submit payment. Reflect payments only in table 3 of the calculation | No need to submit a calculation |

In what cases is an interim report submitted?

The report is drawn up only if the amount of contributions from accidents and occupational diseases (A&O) is less than the amount of benefits paid to employees for this period.

In this case, the report is filled out when the indicated payments were made in the first or second month of the reporting quarter. If payments are made in the third month, then the expenses incurred are reflected in the quarterly 4-FSS and interim reporting is not submitted.

Important! An interim FSS report is submitted to the fund if the region in which the employer is registered is not included in the FSS pilot project. Participants in the pilot project submit the required list of documents to the Social Insurance Fund, and payments to the employee are made directly from the fund, while the insurer transfers contributions from the National Social Insurance Fund in full.

When to submit it

Regarding the submission of 4-FSS for the 1st quarter of 2021, the deadlines vary depending on the method of submitting this report. If in electronic form, then until April 25, 2021 inclusive. It will be a regular working day - Wednesday. If on paper, then the deadline for submitting 4-FSS for the 1st quarter of 2021 is slightly less - until April 20, 2021 inclusive (this is Friday).

However, paragraph 1 of Art. 24 of the Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law No. 125-FZ) allows you to choose the method of submitting 4-FSS only to payers with a staff of insured persons of 25 people or less. The rest submit 4-FSS calculations only electronically.

WARNING

For failure to comply with the 4-FSS report submission form, the fund may be fined 200 rubles (Clause 2, Article 26.30 of Law No. 125-FZ).

The requirements for the electronic format of the 4-FSS report are set out in the fund’s order No. 83 dated March 9, 2021. They must be taken into account by the developers of the software with which this calculation is filled out.

Also see “Deadlines for submitting 4-FSS in 2021: table.”

How to fill out an interim report

The report is prepared in accordance with Form 4-FSS. In terms of filling out the interim report, it does not differ from the standard quarterly report.

There are several features that should be taken into account when filling out interim reporting to the Social Insurance Fund:

- There is no fixed date for submitting the report. It is compiled as needed.

- On the title page of the report, in the “Reporting period” field, you need to fill in the second pair of cells (after the fraction). The cells contain the serial number of the interim reporting. If the company is renting it out for the first time, you need to enter code 01.

- The report (in tables with monthly data) reflects data for the first or first and second months of the quarter. The report itself is submitted from January to the month in which benefits were paid.

- Along with the report, you must submit an application and supporting documents (sick leave, child’s birth certificate, etc.).

Just 1C. Just a program for people.

in the “Reporting period (code)” field, the period for which the Calculation is being submitted and the number of requests from the policyholder for the allocation of the necessary funds for the payment of insurance compensation are entered.

3. After filling out the Calculation form, sequential numbering of the completed pages is entered in the “page” field.

When presenting the Calculation for the first quarter, half a year, nine months and a year, only the first two cells of the “Reporting period (code)” field are filled in. When applying for the allocation of the necessary funds for the payment of insurance coverage, only the last two cells are filled in the “Reporting period (code)” field. Reporting periods are the first quarter, half a year and nine months of the calendar year, which are designated respectively as “03”, “06”, “09”.

The billing period is the calendar year, which is designated by the number “12”. The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is indicated as 01, 02, etc.; 5.

We recommend reading: How to apply for land for a third child in Yekaterinburg

in the “Calendar year” field, enter the calendar year for the billing period of which the Calculation (adjusted calculation) is being submitted; 6.