In accordance with Rosstat Order No. 404 dated July 15, 2019, the forms for 17 statistical reports on labor and wages, including Form 3-F, were updated. The full title of this report is “Information on overdue wages.” Overdue debt refers to actual accrued amounts that have not been paid to the organization’s personnel. The debt is formed the next day after the due date for salary payment, and if it is not repaid by the end of the month, information about it is displayed in the F-3 form.

The document contains data on debt for the last month and for previous reporting periods. Organizations must provide information on employed and dismissed employees. If a legal entity includes several divisions, reporting must be submitted separately for each of them.

Form 3-F for Rosstat

In 2021, a new form of Form 3-F “Information on overdue wages” was put into effect by order of Rosstat dated July 24, 2020 No. 412. It also contains the rules for filling it out and submitting it.

Information is submitted in Form 3-F to the territorial body of Rosstat, depending on the location of the organization. Only legal entities are required to provide reporting. That is, individual entrepreneurs do not have to fill out this statistical form. In addition, small businesses are exempt from submitting these reports.

Form 3-F in 2021 is submitted by an organization only if there is an overdue debt in payment of wages to employees. If there are no overdue wages, then the company does not have the obligation to submit a 3-F statistical report.

Statistical reporting is completed and submitted by an official whom the head of the enterprise appoints responsible for this activity.

Find out for free what the consequences of delay or non-payment of wages are from the ConsultantPlus review.

Who rents

This report is not sent to statistics by all organizations, but only by legal entities that had wage arrears as of the reporting date (1st day of each month). Here's who is submitting 3-F on overdue wages in 2021:

- Branches and representative offices of foreign companies operating in the Russian Federation.

- Separate divisions of Russian organizations. The 3-F report is filled out for each separate division.

- Bankrupt companies subject to bankruptcy proceedings.

- Temporarily not operating - enterprises in which the production of goods, works and services took place during the reporting period.

- Management bodies of education, health care, culture of the constituent entities of the Russian Federation. Such reporting institutions provide a report on Form 3-F for each registered activity.

If there are no salary arrears, then the report is not submitted to Rosstat. Individual entrepreneurs and small businesses do not submit information in Form 3-F to Rosstat.

All other enterprises with salary debts submit a report on their main activity. Form 3-F is submitted to Rosstat by organizations with OKVED 2 that belong to certain groups:

| OKVED code 2 | Name of main activities |

| 01 | Crop and livestock farming, hunting and provision of related services in these areas |

| 02.20 | Logging |

| 03 | Fishing and fish farming |

| Section B | Mining |

| Section C | Manufacturing industries |

| Section D | Providing electricity, gas and steam, air conditioning |

| Section E | Water supply, sanitation, organization of waste collection and disposal, pollution elimination activities |

| Section F | Construction |

| 49 | Activities of land and pipeline transport |

| 50 | Water transport activities |

| 51 | Air and space transport activities |

| 52 | Warehousing and auxiliary transport activities |

| 59.1 | Production of films, videos and television programs |

| 60 | Activities in the field of television and radio broadcasting |

| 68.32 | Real estate management on a fee or contract basis |

| 72 | Research and development |

| Section P | Education |

| Section Q | Activities in the field of health and social services |

| 90 | Creative activities, activities in the field of art and entertainment |

| 91 | Activities of libraries, archives, museums and other cultural facilities |

| 92 | Recreation and entertainment activities |

What is the procedure for submitting a statistical report 3-F

Reporting is submitted to the territorial body of Rosstat at the location of the organization. If a legal entity has separate divisions in its structure: branches, representative offices and others, then it is obliged to submit a report:

- at the location of the parent organization - without data on separate divisions;

- at the location of each unit - information on each individual unit is included in each separate report.

Foreign companies that have branches and representative offices on the territory of the Russian Federation are included in those who submit 3-F on overdue arrears under the salary when overdue arrears in wages arise.

Temporarily idle organizations and bankrupt organizations are not exempt from submitting Form 3-F. They are obliged to provide it on a general basis.

Report submission methods

The Federal Statistics Service provides companies with free software for generating reports in Form 3-F. You can submit your completed application in three ways:

- Personally. The respondent submits the 3-F form independently. After receiving the form, the Rosstat employee issues a receipt indicating the full name. the employee who received it, as well as the date of receipt of the questionnaire.

- Russian Post. The completed Form 3-F is sent by registered mail with a description of the envelope contents attached. Date the report was sent – the date the letter was sent.

- E-mail, or via telecommunication channels (TCS). When reporting using this method, you need to generate a file in .XML format, which protects information from theft. The file can only be decrypted using the Rosstat program.

Sending a form via TKS requires knowledge of following the algorithm when saving the file. Errors in formatting are comparable to false information, which is punishable by a fine according to the Code of Administrative Offenses of the Russian Federation.

Rosstat also offers another way to electronically send reporting and statistical documentation - through the electronic document management system on the official website of the Federal Statistics Service in your personal account.

Instructions:

- Log in to your personal account.

- Find form 3-F and fill out the information.

- Sign the document with an electronic digital signature (EDS).

- Upload the 3-F salary file in .xml format into the system.

- Send.

Upon receipt, employees will notify the company of receipt of the report within 5 business days. If errors are made when filling out the form, Rosstat will not accept the information and the document will have to be corrected within the specified period. In a positive case, employees also notify the respondent that they have received the report.

What is the responsibility for failure to submit a statistical form?

Responsibility for failure to provide statistical reporting is established by Article 13.19 of the Code of Administrative Offenses of the Russian Federation. It recognizes as a violation:

- failure to submit a report;

- submission of reports untimely;

- provision of false statistical data.

The fines are quite significant:

| Person fined | Fine amount | |

| Primary violation | Repeated violation | |

| Officials | From 10,000 to 20,000 rubles | From 20,000 to 50,000 rubles |

| Organizations | From 20,000 to 70,000 rubles | From 100,000 to 150,000 rubles |

What is the deadline for submitting statistical form 3-F?

Form 3-F statistics for 2021 is monthly. The statistical reporting form must be submitted to Rosstat the next day after the reporting date. Thus, the due date is the first day of the month following the reporting month (for example, for January reports are submitted before February 1, for April - on the first working day after the May holidays).

You can submit a report on arrears of wages:

- on paper: the report is signed by the manager, if available, a stamp is affixed to it;

- in electronic form: the report is signed with an electronic digital signature and sent to Rosstat through a telecommunications operator.

Which form to use

From the report as of February 1, 2021, Form 3-F in 2019 was approved by Rosstat Order No. 485 dated August 6, 2018 (Appendix No. 6).

According to OKUD, this form is No. 3-F – 0606013.

However, from the report as of February 1, 2021, a new form No. 3-F was approved for statistics. This is Rosstat order No. 404 dated July 15, 2019 (Appendix No. 12).

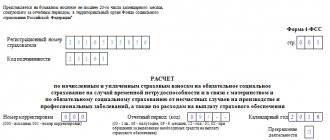

The main content of the 3-F form looks like this:

Also see “Reporting to Rosstat from 2021 and 2021: new forms.”

Procedure for filling out the report

The form consists of two sheets:

- Title page.

- The tabular part in which the data is reflected.

On the title page when filling out Form 3-F the following is indicated:

- the period for which reporting is provided;

- name and postal address of the reporting organization;

- OKPO must be indicated in the tabular part of the title page.

The main part of the report consists of 11 lines. Instructions for form F-3 are given in the table:

| Line number | Filling procedure |

| 01 | The entire amount of overdue wages and other payments (vacation pay) not repaid as of the reporting date is reflected. This amount includes not only debts incurred during the reporting month, but also carryover balances from previous periods. The report includes debts to all employees: full-time employees, part-time employees, employees hired under the GPA, dismissed. |

| 02 | Overdue debt is shown only for the last (reporting) calendar month. For example, the report as of October 1, 2020 reflects overdue debt that arose from September 1 to September 30, 2021. |

| 03, 04, 05, 06 | Overdue debt is shown only for the last (reporting) calendar month. For example, the report for October 1, 2020 reflects overdue debt that arose from September 1 to September 30, 2021. |

| 07 | The payroll for the last calendar month is reflected. It corresponds exactly to the indicator indicated in the statistical form P-4. |

| 08 | The number of employees (paid and unpaid) to whom the organization has overdue wages as of the reporting date. |

| 09, 10 | Debts for previous periods are separated from the total amount of overdue debt. |

| 11 | From the total amount, debts are allocated to persons dismissed from the organization in 2021 and earlier. |

Form F-3, sample filling

New form P-2 statistics: instructions for filling

Since 2021, a new form P-2 “Information on investments in non-financial assets” has been in effect.

The form was updated back in 2021, but began to be used with reporting for the first quarter of 2021. In 2021, officials updated a number of statistical surveillance forms. The report form P-2 “Information on investments in non-financial assets” has also changed. The new form was approved by order of Rosstat dated July 27, 2018. No. 462, but it is used starting with reporting for the first quarter of 2021. Thus, organizations in 2021 submit Form P-2 using two forms:

- For 2021 you need to report on the old form,

- For the first quarter of 2021 - already on the new one.

Download the form P-2 quarterly statistics for 2019 for free, and below we will tell you how to fill it out.

Form P-2 quarterly 2021: who submits

All organizations submit quarterly reports, regardless of type of activity and form of ownership. An exception is small business entities (clause 1 of the instructions, approved by order of Rosstat dated July 27, 2018 No. 462). Companies submit a report to the territorial body of Rosstat.

If an organization has separate divisions, it will have to submit at least two reports:

- Send the separation indicators to Rosstat at the location of the unit,

- For the parent organization, draw up a report without taking into account the department’s indicators. Send the form to Rosstat at the location of the parent company.

Companies that do not actually operate also report. In the report they are required to indicate periods when activities were not carried out. Enterprises that are in bankruptcy also report until they are liquidated.

Be careful: Rosstat now requires submitting zero reports in the absence of indicators. Failure to submit will result in a fine of up to 150,000 rubles. What should an accountant do?

How to submit the P-2 quarterly form to statistics in 2021

Submit the report quarterly by the 20th day of the month following the reporting period. For example, the report for the first quarter of 2021 must be submitted by April 20. An exception is the year-end report, the deadline for its submission is February 8 of the year following the reporting year.

Please note: the ability to reschedule deadlines that fall on a weekend is provided for financial reporting purposes only. It was recorded in the order of Rosstat dated March 31, 2014. No. 220.

This possibility is not provided for forms of statistical observation. If the deadline for submitting the statistical form falls on a weekend, it is safer to submit it on the previous working day.

For example, July 20, the deadline for sending P-2 for the first half of 2021, falls on a Saturday. It is safer to submit your report before July 19th.

You can submit a report in one of the following ways:

- Personally visit the territorial office of Rosstat,

- Send by mail,

- Deliver by courier by proxy,

- Submit via electronic channels.

Form P-2: 2019

Form P-2 “Investments in non-financial assets” changed in 2019. The new form was approved by order of Rosstat dated July 27, 2018. No. 462. But the new form is used only for reporting for the first quarter of 2021. The companies sent the indicators for 2021 to Rosstat on the old form.

Filling out form P-2: step-by-step instructions

Instructions for filling out the P-2 statistical form by order of Rosstat dated July 27, 2018. No. 462. You can download complete instructions for filling out form P-2. We will tell you the basic rules for filling it out and provide a sample.

Consider the following features of filling out P-2:

- Form P-2 is submitted quarterly, but the indicators in it are filled in with an accrual total from the beginning of the year,

- The form can be filled out by hand or on a computer,

- All total data is entered in thousands of rubles excluding VAT,

- Expenses incurred in foreign currency are translated into Russian rubles.

Step 1. Fill out the cover sheet

On the title page, indicate the reporting period as a cumulative total from the beginning of the year. Since the report is submitted quarterly, the reporting periods will be:

- First quarter,

- First half of the year

- Nine month,

- Year.

Next, indicate the full name of the organization, and the short name next to it in brackets. Below, indicate the address of the organization, including the name of the subject of the Russian Federation and postal code. In the code part, indicate your OKPO.

Step 2. Complete the section “Investments in non-financial assets”

In the first section, indicate the amounts invested in non-financial assets.

All indicators are presented on an accrual basis and for the reporting quarter in comparison with the same periods of the previous year: Column What to indicate

| 1 | Indicators since the beginning of the reporting year |

| 2 | Indicators for the reporting quarter |

| 3 | Indicators for the same period last year |

| 4 | Indicators for the same quarter last year |

On the first line, enter the total amount invested. The remaining lines provide the transcript:

- By investment objects (lines 2 – 16),

- By type of activity (lines 17 – 19).

Additionally, separately indicate investments in non-productive assets:

- On line 20, enter the total amount

- Enter the costs of acquiring land and environmental management facilities in line 21,

- On line 22, indicate investments in improving the company's business reputation and business relations.

Below the table, in two lines (23 and 24), indicate the costs of purchasing used items.

Step 3. Fill out the “Sources of Investment” section

In the second section, decipher from what sources the company made expenses. Enter the amounts in two columns:

- Column 1 – sources of investment in fixed capital,

- Column 2 – sources of investment in non-productive assets.

Here two relationships must be fulfilled:

- Line 01, column 1 = (line 31 + line 32) according to column 1,

- Line 20, column 1 = (line 31 + line 32) according to column 2.

Indicate the amounts of your own and borrowed funds. For borrowed funds, decipher the sources of attraction.

Step 4: Sign and submit the report

The report is signed by the head of the company. We have listed the delivery methods above. You can download a fully completed sample of the new P-2 form, current in 2021:

Source: https://www.RNK.ru/article/216651-forma-p-2-statistika-ob-investitsiyah-v-nefinansovye-aktivy

Test relations

To control the correct completion of statistical form 3-F, Rosstat has established control ratios that are mandatory for how to fill out form 3-F “Information on overdue wages.” If at least one control ratio is not met, Rosstat will refuse to accept the report. The following ratios must be observed:

- page 02 gr. 3 ≤ page 01 gr. 3;

- page 03 gr. 3 ≤ page 01 gr. 3;

- page 03 gr. 3 = sum of lines 04, 05, 06 gr. 3;

- page 03 gr. 4 = sum of lines 04, 05, 06 gr. 4;

- each of the lines from 03 to 06 gr. 4 ≤ each of the lines from 03 to 06 gr. 3;

- page 07 gr. 3 > 0;

- page 07 gr. 3 ≥ page 02 gr. 3;

- if page 01 gr. 3 > 0, then pages 07 and 08 gr. 3 > 0;

- each of the lines 09, 10, 11 gr. 3 ≤ page 01 gr. 3;

- page 11 gr. 3 ≤ sum of lines 09 and 10 gr. 3;

- sum of lines 09 and 10 gr. 3 ≤ lines 01 gr. 3;

- lines 01, 02, 07, 08, 09, 10, 11 gr. 4 = 0.

Sample

Pay attention to the example of filling out form 3-inform based on the results of 2020 (section 1, which is filled out by all companies submitting this report).

| Section 1. General information | ||

| Does your organization use the following equipment and digital technologies? | ||

| (indicate the appropriate code for each line) | ||

| Indicator name | Line no. | Response code (1 - yes; 2 - no) |

| 1 | 2 | 3 |

| Personal computers | 101 | 1 |

| Servers | 102 | 1 |

| Local area networks | 103 | 2 |

| Fixed (wired and wireless) Internet | 104 | 1 |

| Mobile Internet | 105 | 1 |

| Extranet (a network that uses Internet protocol to securely exchange enterprise information with business partners; may take the form of an addition to a corporate network or a private portion of its website) | 106 | 2 |

| Intranet (distributed corporate computer network based on Internet technologies and designed to provide employees with access to corporate information electronic resources) | 107 | 2 |

| Availability of a website on the Internet | 108 | 1 |

| Third party open source operating systems (such as Linux) | 109 | 2 |

| Electronic data exchange between internal and external information systems using exchange formats (EDIFACT, EANCOM, ANSI X12; XML-based standards, for example, ebXML, RosettaNet, UBL, papiNET; proprietary standards agreed upon by your and other organizations; other) (filled out by organizations indicating code 1 in at least one of pages 102-107 gr. 3) | 110 | 1 |

| of them for sending or receiving data to state authorities, local government (for example, tax returns, statistical reports, and so on) | 111 | 1 |

| Availability of a page on social networks (for example, VKontakte, Odnoklassniki, Facebook, LinkedIn and others) | 112 | 1 |

| Geographic information systems | 113 | 2 |

| Digital platforms | 114 | 2 |

| Technologies for collecting, processing and analyzing big data | 115 | 1 |

| Artificial intelligence technologies (allowing one to imitate human cognitive functions (including self-learning and searching for solutions without a predetermined algorithm) and obtain results when performing specific tasks that are comparable, at a minimum, to the results of human intellectual activity) | 116 | 2 |

| Cloud services (distributed data processing technologies in which computer resources and power are provided to the user as an Internet service) | 117 | 1 |

| Internet of Things (interconnected devices or systems that can be remotely controlled via the Internet) | 118 | 2 |

| Radio frequency identification (RFID) technologies, which allow data stored in RFID tags to be read or written using radio signals | 119 | 2 |

| Industrial robots/automated lines | 120 | 2 |

| Additive technologies (allow the production of products of complex geometric shapes and profiles (three-dimensional printing, laser sintering of powders, stereolithography, etc.) through the layer-by-layer creation of three-dimensional objects based on their digital models) | 121 | 2 |

| Digital twin (a digital model of a product or process that includes design requirements and technical models describing its geometry, materials, components, assembly and behavior; technical and operational data unique to each specific physical asset) | 122 | 2 |

(complete sample)