Personal income tax reporting

Personal income tax reporting in the form of certificate 2-NDFL is submitted in the following order:

- At the end of the calendar year, if the individual taxpayer has not had tax withheld, the tax agent must submit a 2-NDFL certificate with feature 2 to the tax authority by March 1 of the following year.

- At the end of the calendar year, before April 1 of the following year, certificates are submitted for employees whose personal income tax was withheld (item 1 in the certificate).

For more details, see the material “Filling out the taxpayer’s attribute in the 2-NDFL certificate .

- If the number of employees is up to 25 people, 2-NDFL certificates can be transferred to the tax authorities in paper form; if there are a larger number of employees, the information is transmitted via telecommunication channels (TCS) in electronic form.

- Simultaneously with the 2-NDFL certificate, a register of information on personal income tax is submitted in 2 copies.

Attention! As of reporting for 2021, the certificate form for tax authorities is different from the form issued to employees. How to fill out both forms correctly, see here.

From January 1, 2021, quarterly (with cumulative total) and annual personal income tax reporting in Form 6-NDFL was introduced for tax agents. The report on Form 6-NDFL at the end of the quarter must be submitted no later than the last day of the month following the quarter, and at the end of the year - no later than April 1 of the following year. The report shows not only the accrued and withheld amounts of personal income tax for the organization as a whole, but also the income received, the date of its payment, the deadlines within which the withheld tax must be withheld and paid. This will allow tax authorities to quickly monitor the correctness of personal income tax calculations.

You can learn more about the features of filling out the report in the section “Calculation of 6-NDFL” .

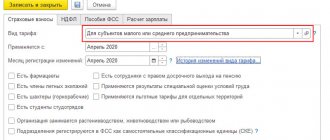

Simplified taxation system

The simplified tax system is one of the special modes that makes the work of a business and the life of an accountant easier. With the simplified system, you do not need to pay and report three taxes: profit, VAT and property tax. This has to be done only in exceptional cases.

All simplified employers must report on insurance premiums and employee income, as well as transfer information about them to the funds. We will consider these reports further.

A specific report for simplification is a declaration according to the simplified tax system.

Who is renting? Organizations and entrepreneurs are simplified, even if they do not operate or have taken a tax holiday.

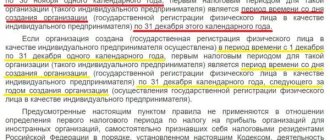

Deadlines for delivery . For organizations and individual entrepreneurs, the deadlines are different. Organizations report for 2021 by March 31, 2021. Entrepreneurs - until April 30, 2021.

Form and delivery format . The declaration form has not changed for a long time; it was approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] You can report on paper or electronically. For the paper form, the same limitation is established - the average number of employees is no more than 100 people.

Responsibility for violation of the deadline for submitting personal income tax reports

For violation of the deadline for submitting the 2-NDFL certificate, the organization will be fined in the amount of 200 rubles. for each certificate (clause 1 of article 126 of the Tax Code of the Russian Federation).

For violation of the deadline for submitting the 6-NDFL report, liability is provided in the form of a fine in the amount of 1,000 rubles. for each full or partial month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). Tax authorities can also block transactions on the account. If they find incorrect information in the submitted report, a fine of 500 rubles will be issued. for each incorrectly executed document (Clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

↑ Procedure for completing the Declaration 2014

The issue of taxes in our country will never cease to be relevant. If only because some citizens pay them regularly, others evade taxes, and still others are ready to fill out a declaration, but do not know how to do it correctly. In this article we will look at the main aspects of 3-NDFL for 2014 (personal income tax) and the procedure for filing a declaration. We hope that the information received will help you reduce any problems with the Tax Inspectorate to zero, teach you how to fill out the declaration correctly and always submit it on time.

Results

Tax agents are required to submit Form 6-NDFL quarterly no later than the last day of the month following the reporting quarter.

At the end of the year, the report is submitted no later than April 1 of the reporting year. At the end of the year, tax agents are also required to submit a 2-NDFL certificate. With sign 2, if the tax could not be withheld, no later than March 1, with sign 1, if the tax was withheld, before April 1. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New personalized accounting

New consolidated reporting to the Pension Fund is provided in accordance with Resolution of the Pension Fund Board of January 16, 2014 No. 2p.

Changes:

- Since 2014, a new form RSV-1 has been introduced, but there will be no separate SZV forms! Individual information will now be an appendix to the RSV-1 form.

- The distribution of insurance premiums between the insurance and savings parts will be carried out by the Pension Fund itself.

- The distribution of insurance premiums among insured persons will be carried out by the Pension Fund itself in proportion to the accrued contributions.

- One form will be submitted per person, which allows for the possibility of specifying several insurance premium rate codes. GPC agreements will now be a separate column in the information about the amount of payments section, and not a separate form.

- To indicate periods of inter-shift rest, transfer to light work, periods of study, transfers at the initiative of the employer, etc. The classifier of additional information codes for calculating length of service is being significantly expanded.

- New sections related to early non-state provision are appearing.

- Payments under the additional tariff will need to be further distributed by class of working conditions, depending on the results of a special assessment of working conditions.

- There will still be two BCCs, but the BCC of the funded part of the pension will be used only if the organization accrues additional contributions for the period 2010-2013. For the period starting from 2014, you will have to pay the insurance part to the KBK.

Accountant Calendar 2021

| Deadlines for submitting reports to the tax office (IFTS) in 2021 | ||

| Reporting type | For what period is it represented? | Deadline for submission to the Federal Tax Service |

| Certificates 2-NDFL | For 2021 | No later than 03/01/2021 |

| Calculation of 6-NDFL | For 2021 | No later than 03/01/2021 |

| For the first quarter of 2021 | No later than 04/30/2021 | |

| For the first half of 2021 | No later than 08/02/2021 | |

| For 9 months of 2021 | No later than 01.11.2021 | |

| For 2021 | No later than 03/01/2022 | |

| Calculation of insurance premiums** | For 2021 | No later than 02/01/2021 |

| For the first quarter of 2021 | No later than 04/30/2021 | |

| For the first half of 2021 | No later than 07/30/2021 | |

| For 9 months of 2021 | No later than 01.11.2021 | |

| For 2021 | No later than 01/31/2022 | |

| ** As of reporting for 2021, information on the average number of employees is included in the DAM | ||

| Income tax return (for quarterly reporting) | For 2021 | No later than March 29, 2021 |

| For the first quarter of 2021 | No later than 04/28/2021 | |

| For the first half of 2021 | No later than 07/28/2021 | |

| For 9 months of 2021 | No later than October 28, 2021 | |

| For 2021 | No later than March 28, 2022 | |

| Income tax return (for monthly reporting) | For 2021 | No later than March 29, 2021 |

| For January 2021 | No later than 03/01/2021 | |

| For January – February 2021 | No later than March 29, 2021 | |

| For January – March 2021 | No later than 04/28/2021 | |

| For January – April 2021 | No later than 05/28/2021 | |

| For January – May 2021 | No later than 06/28/2021 | |

| For January – June 2021 | No later than 07/28/2021 | |

| For January – July 2021 | No later than 08/30/2021 | |

| For January – August 2021 | No later than September 28, 2021 | |

| For January – September 2021 | No later than October 28, 2021 | |

| For January – October 2021 | No later than November 29, 2021 | |

| For January – November 2021 | No later than 12/28/2021 | |

| For 2021 | No later than March 28, 2022 | |

| VAT declaration | For the fourth quarter of 2021 | No later than 01/25/2021 |

| For the first quarter of 2021 | No later than 04/26/2021 | |

| For the second quarter of 2021 | No later than 07/26/2021 | |

| For the third quarter of 2021 | No later than October 25, 2021 | |

| For the fourth quarter of 2021 | No later than 01/25/2022 | |

| Journal of received and issued invoices | For the fourth quarter of 2021 | No later than 01/20/2021 |

| For the first quarter of 2021 | No later than 04/20/2021 | |

| For the second quarter of 2021 | No later than July 20, 2021 | |

| For the third quarter of 2021 | No later than October 20, 2021 | |

| For the fourth quarter of 2021 | No later than 01/20/2022 | |

| Tax declaration under the simplified tax system | For 2021 (represented by organizations) | No later than 03/31/2021 |

| For 2021 (represented by individual entrepreneurs) | No later than 04/30/2021 | |

| For 2021 (represented by organizations) | No later than 03/31/2022 | |

| For 2021 (represented by individual entrepreneurs) | No later than 05/03/2022 | |

| Declaration on UTII | For the fourth quarter of 2021 | No later than 01/20/2021 |

| Declaration on Unified Agricultural Tax | For 2021 | No later than 03/31/2021 |

| For 2021 | No later than 03/31/2022 | |

| Declaration on property tax of organizations | For 2021 | No later than 30.03.2021 |

| For 2021 | No later than 30.03.2022 | |

| Single simplified declaration | For 2021 | No later than 01/20/2021 |

| For the first quarter of 2021 | No later than 04/20/2021 | |

| For the first half of 2021 | No later than July 20, 2021 | |

| For 9 months of 2021 | No later than October 20, 2021 | |

| For 2021 | No later than 01/20/2022 | |

| Declaration in form 3-NDFL (submit only individual entrepreneurs) | For 2021 | No later than 04/30/2021 |

| For 2021 | No later than 05/03/2022 | |

| Deadlines for submitting reports to the Pension Fund in 2021 | ||

| Reporting type | For what period is it represented? | Deadline for submission to the Pension Fund |

| Information about insured persons in the Pension Fund (SZV-M) | For December 2021 | No later than 01/15/2021 |

| For January 2021 | No later than 02/15/2021 | |

| For February 2021 | No later than 03/15/2021 | |

| For March 2021 | No later than 04/15/2021 | |

| For April 2021 | No later than 05/17/2021 | |

| For May 2021 | No later than 06/15/2021 | |

| For June 2021 | No later than 07/15/2021 | |

| For July 2021 | No later than 08/16/2021 | |

| For August 2021 | No later than September 15, 2021 | |

| For September 2021 | No later than 10/15/2021 | |

| For October 2021 | No later than 11/15/2021 | |

| For November 2021 | No later than 12/15/2021 | |

| For December 2021 | No later than 01/17/2022 | |

| Information about the insurance experience of the insured persons (SZV-STAZH) | For 2021 | No later than 03/01/2021 |

| For 2021 | No later than 03/01/2022 | |

| Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EFV-1) | For 2021 | No later than 03/01/2021 |

| For 2021 | No later than 03/01/2022 | |

| Deadline for submitting reports to the Social Insurance Fund in 2021 | ||

| Reporting type | For what period is it represented? | Deadline for submission to the FSS |

| Calculation of 4-FSS on paper | For 2021 | No later than 01/20/2021 |

| For the first quarter of 2021 | No later than 04/20/2021 | |

| For the first half of 2021 | No later than July 20, 2021 | |

| For 9 months of 2021 | No later than October 20, 2021 | |

| For 2021 | No later than 01/20/2022 | |

| Calculation of 4-FSS in electronic form | For 2021 | No later than 01/25/2021 |

| For the first quarter of 2021 | No later than 04/26/2021 | |

| For the first half of 2021 | No later than 07/26/2021 | |

| For 9 months of 2021 | No later than October 25, 2021 | |

| For 2021 | No later than 01/25/2022 | |

| Confirmation of main activity | For 2021 | No later than 04/15/2021 |

| For 2021 | No later than 04/15/2022 | |

↑ What are the functionality of the “Declaration 2015” program?

Using the “Declaration 2015” program, anyone can fill out the necessary tax return forms for income tax (forms 3-NDFL and 4-NDFL).

(submitted for the reporting period 2013, as well as for the reporting period 2014).

Among the program's features it is worth noting:

- Entering information from taxpayer documents

- Arithmetic control of all data

- Calculation of the final indicators of the declaration

- Checking the correctness of calculation of all benefits and tax deductions, tax base and tax amount

- Generating a detailed XML file with all Declaration data

- Formation of forms with barcode and Declaration data

↑ How to fill out a tax return for 2014?

To correctly fill out the declaration, it is recommended to use special computer software, the 2015 Declaration Program. It is freely available on the official website of the Federal Tax Service of Russia, and you can also download it on our website.

RELATED LINKS:

|

The Special Program Declaration 2015 will allow you to automatically generate and fill out a tax return in form 3-NDFL. When filling in the data, the program will automatically check whether it was entered correctly. This will reduce the likelihood of errors occurring. The software is intended for individuals who are required to submit a 3-NDFL declaration.

By the way, all users of the “Taxpayer Personal Account for Individuals” service have the opportunity to fill out a tax document directly online by visiting the website of the Federal Tax Service of Russia. The developed software for filling out a tax return will allow you to quickly transfer all personal information about the taxpayer to the declaration. It has a fairly simple and intuitive interface. To avoid mistakes, the program developers have created hints. They will be very helpful to those who will fill out the declaration for the first time.