SZV-STAZH - report on the insurance experience of employees. It has been in use since March 2021. The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 3p dated March 5, 2017. It partially replaces RSV-1, which previously indicated the length of service of employees. This report has been canceled as of 2021.

SZV-STAZH is submitted by all policyholders. They are:

- IP (individual entrepreneurs);

- lawyers, notaries, detectives;

- persons engaged in private practice;

- Russian organizations and their divisions;

- foreign companies and their divisions.

Policyholders submit a report on employees with whom they have the following agreements:

- employment contracts;

- GPC agreements (civil law);

- agreements for the licensed use of works of literature, art, science, etc.;

- other types of labor agreements provided for by law.

SZV-STAZH contains information about each employee for whom contributions to the Pension Fund are paid.

Enterprises, individual entrepreneurs and other persons who do not use hired labor in their activities are exempt from submitting a report. They did not enter into employment agreements with employees that included payment of pension insurance contributions.

Even if the company has only one director on staff, this does not relieve the company from the obligation to submit a report within the deadlines established by law.

The SZV-STAZH form contains several sections (Resolution of the Board of the Pension Fund of the Russian Federation No. 507p). They indicate the following information:

- data of the policyholder (registration number in the Pension Fund of Russia, INN, KPP, name);

- reporting period (year);

- data on the insurance experience of employees (full name, SNILS, Taxpayer Identification Number, period of work, etc.).

- information about accrued and paid insurance premiums.

SZV-STAZH is submitted before March 1 of the year following the reporting year.

Penalties are provided for providing false information in the report. They are also applied to violators of deadlines for submitting SZV-STAZH.

What is the deadline for submitting a report upon liquidation of a company? How to fill it out?

What are these forms and when are they submitted during liquidation?

SZV-STAZH is an annual report on insured persons and the periods of their work activity, provided before March 1 of the following year. SZV-M is a monthly report on insured persons. Both reports are compiled for those working under an employment contract or civil servants' agreement.

The deadline for submitting reports to the Pension Fund when closing an enterprise is established in paragraph 3 of Art. 11 FZ-27 - within a month from the date of approval of the interim liquidation balance sheet, but no later than the day of filing documents to exclude the company from the register of legal entities. During the entire closure period, SZV-M is submitted by the 15th day of the month following the reporting month for citizens who continue to work during this period, and when we submit the last SZV-M report upon liquidation of the LLC, it is determined by the day of dismissal of employees. There is no need to prepare this report for dismissed employees.

In the same paragraph 3 of Art. 11 establishes that in case of reorganization, information is submitted to the PRF within a month after drawing up the transfer act or separation balance sheet. When changing the legal form, a transfer act is drawn up, therefore the SZV-M during reorganization in the form of transformation is drawn up within a month from the date of its approval.

When filling out the forms, it is worth taking into account the formalization of relations with the liquidator and members of the liquidation commission. If they receive remuneration under GPC agreements, their data must be reflected in the reports. The last SZV-M report is drawn up for the month in which the termination of the company’s activities is registered, but taking into account clause 3 of Art. 11 FZ-27, that is, before the date of submission of documents for exclusion from the Unified State Register of Legal Entities. If the relationship with the liquidator is not formalized (the founder himself acts in this role, the liquidator does not receive remuneration, etc.), his data should not be reflected in the SZV-M, and zero reports should not be submitted.

The question arises: is it necessary to hand over the SZV-M to the liquidator in 2020, if an agreement has not been concluded with him or such an obligation has not been established? The answer is similar: the data of such a liquidator is not included in SZV-STAZH, since there is no agreement, payment is not made, and there is no obligation to reflect the data.

Therefore, SZV-STAZH for a liquidator without payment in 2021 is not filled out; this conclusion is drawn from the norms of Federal Law-27, the reporting form.

Liquidation of an organization: general description of the procedure

The procedure for terminating the activities of an organization in connection with liquidation is regulated by Art. 62 of the Civil Code of the Russian Federation, according to which:

- The founders/participants of the organization make a decision on liquidation and formalize it in writing in the form of a protocol.

- The authorized representative of the organization notifies the Federal Tax Service of the planned liquidation within 3 working days from the date of adoption of the relevant decision. The notification is sent to the Federal Tax Service in writing.

- The founder (participants) appoint a liquidator (liquidation commission), concluding a civil law agreement with him. In the text of the agreement, the parties approve the procedure and timing of liquidation measures.

From the moment the above-mentioned agreement comes into force, all powers to manage the affairs of the organization are vested in the liquidator. It is the liquidator (or liquidation commission):

- compiles and submits tax, accounting, and statistical reports on the organization’s activities to regulatory authorities;

- represents the interests of the company in court;

- makes settlements with creditors;

- dismisses employees (if there are any in the company at the time of concluding the agreement with the liquidator);

- carries out other actions on behalf of the company.

How to report using the SZV-STAZH form

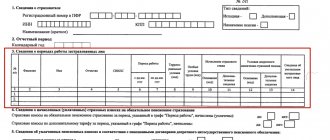

The form is filled out in the usual manner and includes the following information about the employees:

- last name, first name and patronymic if the latter is available;

- SNILS;

- time of work during the reporting period;

- information about the calculation of contributions.

It is important to correctly reflect periods of work:

- the actual dates of labor activity are indicated;

- if the employee did not work from the beginning of the reporting year (not from January 1), the date of actual hiring is indicated as the start date of the work period;

- the period of activity is indicated from January 1 of the reporting year to the day of liquidation, if the contract with the employee was in force at the time of drawing up the report, this is possible if the employee worked before the day of filing the final application for liquidation of the organization;

- periods of temporary disability are noted separately with the code “VRNETRUD”.

At the beginning of the form there is information about the organization, name, registration number, TIN, KPP, as well as information about the form (original, supplementary) and the reporting year.

Procedure for filling out the report

Fill out the form following the instructions below.

Step No. 1. Policyholder details.

We register information about the liquidated enterprise. We indicate the registration number assigned to the Pension Fund. We enter the TIN and KPP. Then we indicate the name of the insurance company.

Here: indicate the type of information provided - “initial”.

Step No. 2. Reporting period.

We indicate the calendar year for which the liquidation form is generated. For example, if a firm goes out of business in 2021, report “2019.”

Step No. 3. Information about the insured persons and periods of work.

We detail the information separately for each employee of the company. We indicate your full name and SNILS. Then we register all periods of work in the company. For each period, we enter the appropriate code, in accordance with the Appendix to the Resolution of the Board of the Pension Fund of the Russian Federation No. 507p.

What information should be included in the SZV-M report?

The first three points include data about the enterprise, the reporting period - month (a two-digit code is indicated by the month number), type of form (original, additional, canceling). Then follows a table indicating information about the employees: last name, first name, patronymic, SNILS and INN. The form is signed by the manager and stamped.

Another pressing question arises: what reports to submit to the Pension Fund of the Russian Federation when liquidating an LLC if there are no employees, although the existence of such is regularly questioned. In practice, such forms of business are not uncommon. SZV-STAZH and SZV-M with zero values (without data on employees) are submitted to the Pension Fund of the Russian Federation when such enterprises are closed.

If there is no agreement with the liquidator

Sometimes the director, who is also the sole founder, decides to liquidate his own company on his own. At the same time, he does not enter into an agreement with himself, and does not pay remuneration. What should I do?

In such a situation, during the period when the organization is in the process of liquidation, zero reports in the SZV-M form, or rather empty ones, do not need to be submitted (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581). After all, although the liquidated company is still registered with the Pension Fund as an insurer, it has no one to submit individual information to.

How to submit reports to the Pension Fund of Russia

There are several options for how to submit SZV-STAZH during liquidation:

- on paper by mail or in person (by courier);

- electronic.

If there are more than 25 employees, the company is required to report electronically.

Despite the adoption of restrictive measures due to coronavirus, reporting to the Pension Fund for the liquidation of an LLC in 2021 is submitted as usual. To be excluded from the Unified State Register of Legal Entities, confirmation of the provision of all information to the Pension Fund will be required; now the tax office is requesting information about the submission of all reports by the organization from the Pension Fund.

SZV-experience during reorganization

The most important thing when reorganizing or transforming enterprises in order to select a list of final reports is the fact of dismissal of employees. It is necessary to submit SZV-experience only for citizens who stop working under employment contracts.

The law on personalized accounting states that in the process of changes occurring with organizations, the administration must report on all dismissed employees; if citizens are registered with newly created business entities by transfer (without reduction), such employees will only have to report next year.

Submission of individual personalized accounting information to the Pension Fund of the Russian Federation is discussed in the video below:

Characteristics, purpose of the report

Monitoring the labor activity of individuals is one of the responsibilities of the Pension Fund of the Russian Federation. Continuous control helps protect citizens from violations of constitutional rights and eliminates the possibility of enterprises evading taxes. Starting from 2021, all legal entities are required to submit a report to the government agency on the length of service of employed citizens by submitting the SZV-STAZH form.

It was approved by regulatory legal act No. 3p dated January 11, 2017. The tabular sections accumulate the basic information necessary to determine pension payments to citizens. Commercial, state-owned enterprises, individual entrepreneurs, persons engaged in private practice (lawyers, law firms, notary offices, etc.) undertake to provide the Pension Fund of Russia with information on all citizens involved in labor within the specified time frame.

The employer is the policyholder and independently calculates and transfers contributions for the formation of pension savings. The reference statement is filled out on a blank sheet of paper, in block letters using a ballpoint pen or using electronic computer technology. Any ink can be used, excluding green and red. No blots, mistakes, or corrections should be allowed. If an error is recorded, you must fill out the report on a new sheet.

To fill out the reporting form, all documents are used that record data on periodic accruals and payments of wages and insurance contributions for individuals. It is important that all amounts are taken into account: salary, tariff allowances, bonuses, vacation, travel allowances. Data on length of service is recorded according to orders, work books, and adjustment documentation.

All pages of reporting on the length of service of workers are numbered in Arabic numerals on a special field, starting from the title page. If an indicator has several familiar places, then zeros are placed in front of the serial number. The employer draws up SZV-STAGE for all citizens engaged in labor activities, including GPC transactions, contracts of author's order, temporary disposal of intellectual rights.

One of the responsibilities of the founders is to provide information about employees to the Pension Fund of Russia

If the organization ceases operations, the obligation to submit the final form remains. The report is generated for employees whose employment agreements are terminated. If citizens are no longer employed, the employment center in the region of residence will report for them.

Filling example

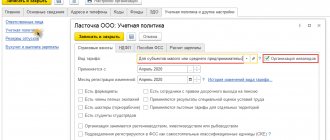

VESNA LLC will be liquidated in 2021. The date of approval of the liquidation balance sheet is 06/03/2019.

The company had two employees: director Ivanov I.I. and specialist Petrov P.S.

Employment contracts were concluded with both employees, which were terminated on 06/03/2019. In the period from January to the date of liquidation, the employees had periods of incapacity for work.

Sample of filling out SZV-STAZH during liquidation of an organization

SZV-STAGE for a part-time worker in 2021

The form for submission to the Pension Fund includes information about all insured persons who are in an employment relationship with the organization.

Employees working part-time must be shown in SZV-STAZH. SZV-STAZH must be taken for both internal and external part-time workers (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Data on part-time workers in the SZV-STAZH form is reflected as for regular employees. The period of work under normal conditions is reflected in section 3 of SZV-STAZH in the general manner, in one line.

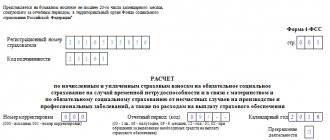

Procedure for compiling EFA-1

Simultaneously with the provision of the SZV-STAZH form, entrepreneurs pass the EDV-1 handicap. The procedure for filling out the document is prescribed in section 3 of Resolution No. 3p. By analogy with the first report, the compiler indicates the details of the policyholder: TIN, KPP, short name, number in the Pension Fund register. Next, the reporting period and type of reporting are noted.

Section three of the document serves to reflect the total number of insured persons for whom basic reporting is provided. In simple terms, EFA-1 is a register or accompanying form. Section four is completed only for reports with the “Special” type; in other cases it is skipped. The last table is intended to display information on special working conditions. The form is signed by the manager. As an example, you can also use a sample of filling out the EDV-1 form when liquidating an individual entrepreneur.

SZV-experience report: what is it and who takes it

This report was developed by pensioners back in January 2021, but began to be submitted for the first time in 2021. Until this time, data was submitted to the Pension Fund only in exceptional cases. For example, in 2021 you should have issued a copy of the SZV-STAZH upon dismissal of an employee, and sent the original to the Pension Fund.

Why was there a need to develop an additional type of report? The fact is that starting from 2021, a single calculation of contributions is submitted to the tax office, and the Pension Fund has stopped receiving data on the length of service of your employees. That's why new reporting appeared. By the way, the SZV-Stazh report is somewhat similar to the monthly SZV-M, to which you are already accustomed.

Based on the data from the SZV-M report, the Pension Fund receives information about the pensioners working for you, thus adjusting the indexation of their pensions.

What kind of information does this new SZV-STAZH form contain? To briefly answer the question posed, this is an addition to the SZV-M form, containing information about the length of service of a particular employee, as well as accrued (paid) insurance premiums.

Important! The number of insured persons presented in the SZV-STAZH form must completely coincide with the number of persons reflected in the SZV-M reports during 2021.

Who takes SZV-STAZH? This report is submitted by all companies that have employees:

- legal entities, including those with separate divisions;

- Individual entrepreneurs, lawyers, notaries.

Individual entrepreneurs, notaries and lawyers who do not have hired employees are exempt from submitting this form of information on insurance experience to the Pension Fund of the Russian Federation.

Penalty for failure to submit SZV-STAZH report

- Violation of reporting deadlines will result in a fine of 500 rubles. for each employee.

- If the report is submitted on time, but not all employees were included in it, penalties will also amount to 500 rubles. for each “missed” employee.

- If the report reveals inaccurate information or errors regarding the insured, but the report is submitted on time, a fine cannot be avoided. It will be 500 rubles. for each “erroneous” employee.

- For late submission of reports, company managers may be fined 300 - 500 rubles.

- Violation of the reporting format will result in a fine of 1,000 rubles. (when the report is submitted in paper form instead of the established electronic format).

And the most severe fine awaits a legal entity in the amount of 50 thousand rubles if:

- On the day of dismissal, the employee was not given a copy of the SZV-STAZH form.

- A report was not sent to the Pension Fund to issue a pension to the employee.