Moscow region minimum wage (figures)

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). What is the size of the new minimum wage in the Moscow region from January 1, 2021?

The minimum wage in the Moscow region has been established since December 1, 2016 in the amount of 13,750 rubles (clause 1 of the Agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Union "Moscow Regional Association of Trade Union Organizations" and associations of employers of the Moscow region, concluded 11/30/2016 No. 118).

Since January 1, 2021, the minimum wage in the Moscow region has not changed or increased in any way. It remained in the amount of 13,750 rubles.

State employees of the Moscow region are guided by the federal minimum wage (from January 1, 2021 - 9,489 rubles).

Amount 13,750 rub. for the commercial sector, it is a guarantee that any employee, even without any qualifications, has the right to expect to receive a salary in this amount. In this case, it is assumed that the employee has worked for a full month and fulfilled the production plan.

What will the minimum wage affect?

The smallest base for calculating work remuneration affects the amount of compensation for sick leave, the period for child care and pregnancy, as well as maternity leave. The amount of compensation money and the conditions for receiving funds depend on the current base rate.

The amount of money for VNIM is calculated from the average pay per working day and length of service at the previous and current job. The minimum amount of payments for sick leave, maternity leave and child care for children under one and a half years old is calculated in proportion to the minimum wage in exceptional situations. Since the minimum wage for 2021 has increased, the amounts and terms of payments have increased.

Table 2. Impact of the minimum wage on benefits.

| Payment type | Influence |

| For temporary disability | The amount is calculated based on the minimum wage if the employee has less than two years of experience |

| Maternity | The amount of the benefit is calculated from the minimum wage if the employee has less than two years of experience |

| Child care up to one and a half years old | Calculated from the base tariff for calculating salary if the average profit for the employee’s labor exceeds the minimum wage |

How the minimum wage changed in the Moscow region until 2018

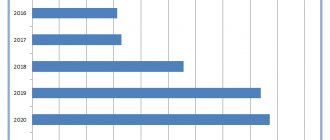

Minimum wage, according to Art. 133 of the Labor Code of the Russian Federation, should be no less than the subsistence level; this parameter was constantly increasing in order to somehow compensate for the increase in the cost of the consumer basket. We present a table that reflects the dynamics of increases in the minimum wage in the Moscow region by year (up to 2021).

Table: Minimum wage by year in the Moscow region

| date | Value, rub. |

| from 01/01/2018 | 13750 (base value) 9489 (for federally funded organizations) |

| from 01.07.2017 | 13750 (base value) 7800 (for organizations financed from the federal budget) |

| from 01.12.2016 | 13750 (base value) 7500 (for organizations financed from the federal budget) |

| from 01.07.2016 | 12500 (base value) 7500 (for organizations financed from the federal budget) |

| from 01/01/2016 | 12500 (base value) 6204 (for organizations funded from the federal budget) |

| from 01.11.2015 | 12500 (base value) 5965 (for organizations funded from the federal budget) |

| from 01/01/2015 | 12000 (base value) 5965 (for organizations funded from the federal budget) |

| from 05/01/2014 | 12000 (base value) 5554 (for organizations funded from the federal budget) |

| from 01/01/2014 | 11000 (base value) 5554 (for organizations funded from the federal budget) |

The table above shows the minimum wage values in the Moscow region for 2014, 2015, 2021, 2021 and 2021. These minimum wage values are applied in the cities: Aprelevka, Balashikha, Bronnitsy, Vidnoye, Volokolamsk, Voskresensk, Golitsyno, Dzerzhinsky, Dmitrov, Dolgoprudny, Domodedovo, Dubna, Yegoryevsk, Zheleznodorozhny, Zhukovsky, Ivanteevka, Istra, Kashira, Klimovsk, Klin, Kolomna, Korolev , Kotelniki, Krasnoarmeysk, Krasnogorsk, Krasnozavodsk, Lobnya, Losino-Petrovsky, Lukhovitsy, Lytkarino, Lyubertsy, Mozhaisk, Mytishchi, Naro-Fominsk, Noginsk, Odintsovo, Lakes, Orekhovo-Zuevo, Pavlovsky Posad, Podolsk, Pushkino, Pushchino, Ramenskoye, Reutov, Sergiev Posad, Serpukhov, Solnechnogorsk, Stupino, Troitsk, Fryazino, Khimki, Chernogolovka, Chekhov, Shatura, Shcherbinka, Shchelkovo, Elektrogorsk, Elektrostal, Yakhroma and other settlements of the Moscow region.

Moscow region and federal minimum wages from January 1, 2018

From January 1, 2021, the federal minimum wage is 9,489 rubles. See “Minimum wage from January 1, 2021.” However, the “minimum wage” of the Moscow region is higher than the federal one. After all, regions have the right to set their own minimum wage, but not less than the federal one (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

The minimum wage in the Moscow region directly depends on the cost of living for the working population living in this region. Therefore, this amount continues to apply from January 1, 2021:

| Region | Region code | Minimum wage (RUB) |

| Moscow region | 50 | 13 750* |

* The minimum wage includes additional payments, allowances, bonuses and other payments, except for payments in accordance with Articles 147, 151–154 of the Labor Code.

Minimum wage and living wage: what will change from May 1, 2021

It is necessary to distinguish between the concepts of minimum wage and subsistence minimum.

The minimum wage is the minimum wage that an employer is obliged to pay to its employee, provided that he has worked full time. When determining the minimum wage at an enterprise, all amounts paid are used, and not just the official salary.

The living wage is an indicator that is established by the Government of the country, taking into account the following indicators:

- Composition of the consumer basket;

- Statistical data on changes in prices for products, services, etc.;

- Statistical data on mandatory fees and payments;

- Price change index.

Thus, the minimum wage and the living wage are not the same concepts. The minimum wage serves as a lower limit when determining the size of wages, and the living wage generally provides an assessment of the quality of life.

Currently, there is a process of gradually increasing the minimum wage to the subsistence level. Previously, it was assumed that these two indicators would be equalized from 05/01/19. However, recent statements by the President of the country indicate that this will happen much earlier - from May 1, 2021. From now on it will be 11,163 rubles.

Attention! In the future, the minimum wage will be raised automatically every year to the level of the subsistence level for the 2nd quarter of the previous year. If this indicator decreases, then the minimum wage will remain at the previous level (i.e., it will not be lowered).

How to compare the federal and Moscow region minimum wages in 2021

Employers in the Moscow region (organizations and individual entrepreneurs) must set a salary no less than the Moscow region minimum wage (RUB 13,750) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If such a refusal was sent, then the salary in the Moscow region from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). If there was no refusal, then from January 1, 2018, rely on the minimum wage of the Moscow region - 13,750 rubles.

The minimum wage of the Moscow region, applied from January 1, 2021, already includes the tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow region minimum wage.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

Conclusion

The new agreement applies to all organizations, as well as individual entrepreneurs operating in the Moscow region. The exception is for organizations financed from the federal budget. Employers who have not yet concluded an agreement have been sent an offer to join. Companies also have the opportunity to submit motivated written refusals to the Ministry of Social Development of the Moscow Region. This must be done before April 6, otherwise the agreement will apply to them.

Possible fines for employers in the Moscow region

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

When the Moscow Region minimum wage does not need to be applied

Benefits

To calculate social benefits, use the federal minimum wage, not the regional one. Let us remind you that “minimum” social benefits are received by employees with earnings below the minimum wage or with short work experience (up to 6 months) (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Vacation pay

The federal, and not the regional, minimum wage should also be taken into account when calculating vacation pay. The average monthly earnings calculated for calculating vacation pay cannot be lower than the minimum wage (clause 18 of the Regulations, approved by Government Resolution No. 922 of December 24, 2007). Therefore, you need to compare the calculation result with this indicator. And if the comparison is not in favor of the employer, you will have to make an additional payment up to the federal minimum wage.

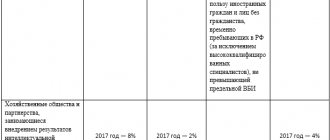

Insurance premiums for individual entrepreneurs “for themselves”

Insurance premiums for individual entrepreneurs “for themselves” for 2021 are also determined based on the federal minimum wage. In this case, you need to take the value set at the beginning of the year (RUB 7,500). However: from 2021, individual entrepreneurs’ contributions “for themselves” are no longer tied to the minimum wage. The Tax Code - in paragraph 1 of Article 430 - now spells out fixed amounts that all businessmen will have to pay throughout the year. And these fixed payments do not depend on the amount of income. And it doesn’t matter whether the businessman worked at a profit or at a loss. As a general rule, all individual entrepreneurs will have to pay such contributions to the Federal Tax Service budget. See “Insurance premiums for individual entrepreneurs from 2021“.

Read also

21.11.2017

What is a regional minimum wage

To establish a minimum wage in an entity, an appropriate regional agreement must be in effect. Most regions of the country did not take advantage of the opportunity to set their own indicator. But, for example, in the capital, the Moscow region and some other regions there is a regional agreement. Although from 2021 the federal minimum wage is correlated with the median salary, for now trilateral agreements between business and government in the constituent entities of the Russian Federation use the cost of living in the region as a reference point.

For example, in the capital it was agreed that the minimum wage in Moscow will be revised simultaneously with the cost of living. As soon as it increases (the law does not allow it to be reduced), the minimum salary immediately increases. In accordance with Moscow government decree No. 2207-PP dated December 15, 2021, capital workers receive from January 1, 2021 no less than 20,589 rubles.

After the adoption of a regional agreement, employers begin to implement it or write a reasoned refusal. 30 days are allocated for refusal from the date of official publication of the document. After this time, employers who have not explained the reasons for their inability to pay the regional minimum are automatically considered parties to the agreement.

You can always find the exact values of the minimum wage and other indicators in ConsultantPlus. Use these free access.