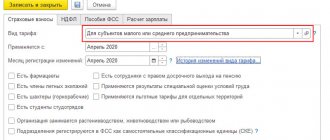

6-NDFL is a new form of personal income tax calculation for employers, which has been in effect since 2021 and remains relevant in 2021. Form 6-NDFL was approved by order of the Federal Tax Service of Russia No. ММВ-7-11/450 dated 10/14/2015. By Order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/ [email protected] ) changes were made to Form 6-NDFL that are relevant in 2021.

The calculation contains information: for all individuals who received income from a tax agent, about accrued (paid) amounts of income and data on tax deductions provided, including information about calculated and withheld personal income tax for the reporting period.

If you don’t have the time or desire to do accounting yourself, we recommend using this popular service. High quality services and competitive prices are guaranteed.

In our publication today, we will look at what the new 6-NDFL form for 2021 is, the procedure for filling it out, and the deadline for submission. At the bottom of the page the reader can 6-NDFL 2020.

New in 6-NDFL from 2021

The last time we will fill out the current Form 6-NDFL is based on the results of 2021. Starting with reporting for the 1st quarter of 2021, forms 2-NDFL and 6-NDFL are combined into one report. Its form was approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected]

The updated 6-NDFL includes:

- title page, Section 1 “Data on the obligations of the tax agent”;

- Section 2 “Calculation of calculated, withheld and transferred personal income tax amounts”;

- Appendix No. 1 “Certificate of income and tax amounts of an individual” (to be completed only at the end of the year).

From 2021, the procedure for clarifying information reflected in 6-NDFL will change. If you need to make changes to sections 1 or 2 of the calculation, the updated document must be submitted without attachments (without certificates of income and tax amounts of an individual). If you need to correct the information in the certificates, you will have to submit the calculation in full.

From 2021, due to the introduction of a progressive income tax rate in 6-NDFL, it will be necessary to fill out sections 1 and 2 separately for each tax rate if the tax agent paid income taxed at different rates (Letter of the Federal Tax Service dated December 1, 2020 No. BS-4- 11/ [email protected] ).

Why do you need to calculate 6-NDFL?

Individual entrepreneurs and organizations paying remuneration to their employees are required to calculate, withhold and pay income tax (NDFL) to the budget. Until 2021, to monitor the timeliness and correctness of calculation, withholding and payment of personal income tax, tax authorities used information from two reports: 2-NDFL and 6-NDFL.

They differ:

- Frequency of presentation.

6-NDFL is submitted quarterly, and 2-NDFL - once a year.

- Lack of personification.

6-NDFL provides information in general for all employees; it does not contain data separately for each employee.

From 2021, the 2-NDFL certificate as a separate document will cease to exist. The last time the certificates must be submitted to the tax authorities is based on the results of 2021. Tax authorities will learn the necessary information about the income of individuals and the amount of income tax from Appendix No. 1 to the updated calculation of 6-NDFL.

Checking the report

Before sending the calculation to the Federal Tax Service, be sure to check the control ratios and check the formal correctness of completion. In the letters of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] , dated March 13, 2017 No. BS-4-11/4371, dated March 20, 2019 No. BS-4-11/ [email protected] all are presented control ratios, with the help of which the inspector checks 6-NDFL. The first thing the inspector will pay attention to is the date the report was submitted. It must meet the deadline.

List of internal and inter-document control relationships:

- The amount of accrued income (field 020) is not less than the amount of deductions (030).

- The value from line 040 is equal to (020 – 030) × 010 / 100. A deviation from the calculated value is allowed in the amount of 1 ruble for each employee when taking into account each payment of income subject to personal income tax.

- The value from field 040 is not less than the value from 050.

- The total amount of tax transferred to the Federal Tax Service is not less than the difference between the personal income tax actually withheld (line 070) and the tax returned to the taxpayer (090).

- The date of transfer of the tax payment to the budget system must correspond to the value from line 120.

The annual form is checked using control ratios and by comparison with the data shown in the annual declaration forms 2-NDFL (KND 1151078) and “Profit” (1151006). For annual reporting, test ratios:

- The figure in line 020 (the amount of accrued income) is equal to the amount for all 2-NDFL certificates and the value from 020 of Appendix No. 2 of the profit report.

- Line 025 (amount of dividend income) is equal to the sum of lines from certificates 2-NDFL for 1010 and 1010 of Appendix No. 2 of the “Profit” declaration.

- Line 040 (calculated tax) is equal to the sum of the same indicator for all 2-NDFL certificates and line 030 of Appendix No. 2 of the profit reporting.

- Line 080 is equal to the total final unwithheld tax from each 2-NDFL certificate and line 034 of Appendix No. 2 of the profit reporting.

- Line 060 (the number of persons who received income) coincides with the number of 2-NDFL certificates and appendices No. 2 to the annual profit statements sent for control to the territorial bodies of the Federal Tax Service.

All parameters for monitoring reporting were approved by letter of the Federal Tax Service of Russia dated March 20, 2019 No. BS-4-11/ [email protected]

When, where and how is 6-NDFL submitted?

If your company has changed its address during the year, by the end of the year you need to submit two 6-NDFL reports with different OKTMO codes to the tax office at the new place of registration:

- In the first calculation, which reflects the income of employees before the change of address, enter the OKTMO that was used previously.

- In the second calculation, which reflects the income from which personal income tax was withheld after a change of address, you need to indicate the new OKTMO.

In this case, in both calculations it is necessary to indicate the company’s new checkpoint (Letters of the Federal Tax Service dated December 27, 2016 No. BS-4-11/25114, dated September 28, 2020 No. BS-4-11 / [email protected] ). Which calculation should reflect the income of individuals must be determined by the date of tax withholding.

Calculation form 6-NDFL

For 2021 you need to report on the same form. It was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

6-NDFL consists of the following sections:

- Title page.

Includes basic information about the employer, the period for which the calculation is submitted and the Federal Tax Service to which it is sent.

- Section 1.

Filled out with a cumulative total from the beginning of the year, includes information about all employee income for the reporting (tax) period.

- Section 2.

Deadline

For the first half of 2021, you must report no later than July 31, 2021.

You can see detailed instructions and a sample filling in the article “

6-NDFL for the 2nd quarter of 2021: how to fill out the report .”

Read also

25.11.2016

Methods for submitting 6-NDFL

You can submit a report to the Federal Tax Service:

- On paper.

You can submit it yourself, through a representative, or by sending it by registered mail with a list of attachments.

Be careful: a paper report can be submitted in 2021 only if the number of employees does not exceed 10 people. (Letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11 / [email protected] ).

If there are more employees, you will have to report electronically. You may be fined for submitting a report on paper when you are required to submit it in electronic format.

- In electronic form.

Normative base

Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/

Decree of the Government of the Russian Federation dated April 02, 2020 No. 409 “On measures to ensure sustainable economic development” (together with the “Rules for granting deferrals (installment plans) for the payment of taxes, advance payments for taxes and insurance premiums")

Letter of the Federal Tax Service of Russia dated May 13, 2020 No. BS-4-11/

Letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/

Letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11/7928

Letter of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11/4901

Letter of the Federal Tax Service of Russia dated March 27, 2017 No. BS-4-11/

Where is 6-NDFL submitted?

6-NDFL is submitted to the Federal Tax Service:

- organizations - at the place of their registration;

- Individual entrepreneur - at the place of registration (except for special UTII and PSN regimes);

- separate subdivisions (SS) - at the place of registration of each separate unit;

In 2021, companies with OPs are given the right to choose a tax office for filing reports if the parent organization and OPs are located in different municipalities. To do this, you need to notify all the Federal Tax Service Inspectors with which the parent company and the OP are registered about this decision. The notification form was approved by Order of the Federal Tax Service dated December 6, 2019 No. ММВ-7-11/ [email protected] It must be submitted no later than the 1st day of the tax period for which you will report according to the new procedure.

- the largest taxpayers and their OP - at the place of registration of the “head”;

- Individual entrepreneur on UTII and PSN - at the place of registration as a payer of imputation or patent.

What is it about

Personal income tax (NDFL) is paid by both Russian citizens and foreigners who permanently reside in the Russian Federation. Today, the scale of personal income tax rates varies from 9 to 35% and depends on a number of factors.

Calculation of 6-personal income tax began in the first quarter of 2021. Its main difference from 2-NDFL certificates (which are compiled for each employee) is that the 6-NDFL report is generated by institution - for the entire amount of the transferred payment. The form of the form is approved in Appendix No. 1 to the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/.

Order No. ММВ-7-11/ indicates how to fill out 6-NDFL and who submits the report. This form is filled out by all tax agents - legal entities and individual entrepreneurs who make payments to individuals and contribute personal income tax to the budget. The calculation is submitted to the tax office at the place of registration or location and at the location of each of its separate divisions.

The delivery format directly depends on the number of staff. If the number of individuals who received remuneration in the tax period does not exceed 10 people, then KND form 1151099 can be submitted on paper (in person or by a valuable letter with a list of attachments). In all other cases, the calculation is submitted only electronically via the Internet, through EDF operators or the service on the Tax Service website (clause 2 of Article 230 of the Tax Code of the Russian Federation, clause 5.1 of the Federal Tax Service order No. ММВ-7-11/ dated October 14, 2015).

The calculation is submitted to the tax authority quarterly, no later than the last day of the month following the corresponding period (clause 2 of Article 230 of the Tax Code of the Russian Federation). For a year - no later than March 1 of the following year. Here are the deadlines for submitting 6-NDFL reports in 2020:

- For 2021 - until 03/02/2020.

- For the first quarter of 2021 - until July 30, 2020 (the dates have shifted due to the pandemic).

- For the second quarter of 2021 (half-year) - until 07/31/2020.

- For the third quarter (9 months) - until 02.11.2020.

- For 2021 - until 03/01/2021.

Requirements for filling out 6-NDFL for 2021

Requirements for drawing up and filling out the 6-NDFL report are given in Order No. ММВ-7-11/ [email protected] :

- We enter information from left to right, starting from the first familiarity. We put a dash in empty cells.

- We always fill in the details and total indicators, but if there is no value for the total indicators, we put “0”.

- Page numbering is continuous and starts from the title page.

- When filling out the report, you cannot use correction tools.

- Each page must be printed on a separate sheet; duplex printing is not permitted.

- We fasten the sheets so as not to damage the paper, so you cannot use a stapler.

- When filling out the report by hand, we use only black, blue or purple ink.

- When filling out on the computer, set the Courier New font to a height of 16-18 points.

- We fill out the report separately for each OKTMO.

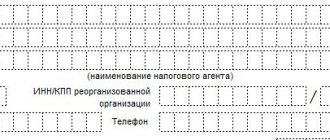

Fill out the title page 6-NDFL

On the title page please include:

- TIN and checkpoint.

We indicate them according to the tax registration certificate. Individual entrepreneurs do not have a checkpoint; they do not indicate it in the report.

- Correction number.

If 6-NDFL is submitted for the first time during the reporting period, the value “000” is indicated, indicating the initial calculation. If a clarification is submitted, indicate its number: 001, 002, etc.

- Presentation period.

For the annual report, enter code 34. If you are submitting the report during liquidation or reorganization, enter the value “90.” Codes for other periods, including during liquidation (reorganization), are given in Appendix No. 1 to the Filling Out Procedure, approved. Order No. ММВ-7-11/ [email protected] .

- Taxable period.

The year during which the report is submitted is entered. When submitting 6-NDFL for the periods of 2021 (including at the end of the year), we indicate “2020”.

- Submitted to the tax authority.

We put the code of the Federal Tax Service to which the report is submitted.

- At the location of the account.

We take the value for filling this line from Appendix No. 2 to the Procedure. For example, individual entrepreneurs (who do not use PSN or UTII) indicate the code “120”; organizations, if they are not the largest taxpayers, enter code “214”, etc.

- Tax agent.

Organizations indicate here their short name, which is reflected in the charter. If there is no short one, write the full one. Individual tax agents indicate their full names without abbreviations.

- OKTMO code.

Since 6-NDFL is compiled separately for each OKTMO and KPP code, you need to generate the number of calculations that corresponds to the number of your OKTMO/KPP.

- Contact phone number.

Here, please enter a current telephone number so that the inspection inspector, if necessary, can contact you and clarify any questions he may have.

- Reliability and completeness of information...

If the tax agent submits the report personally, enter “1”, if his representative – “2”. The lines below indicate the full name of the representative or the name of the representative organization.

Filling out Section 1

In this section we transfer information about all income, including allowances, bonuses and cumulative payments from the beginning of the year ─ for the period from January to December. It also needs to reflect data on other income paid to “physicists”, for example, dividends. Section 1 is completed separately for each tax rate applied.

- Line 020.

How to make a calculation

Current instructions for filling out using the example of Clubtk.ru LLC.

We start filling out 6-NDFL from the title page

We fill in the organization data: name, INN, KPP, full name. signatory and date of provision.

Year and tax period code:

- 34 - year;

- 21 - I quarter;

- 31 - half a year;

- 33 - 9 months.

Code of the tax office to which reports are submitted and code of the place of submission:

- 214 - at the place of registration of the organization (which is not the largest);

- 220 - at the place of registration of a separate subdivision;

- 120 - at the place of residence of the individual entrepreneur.

Filling example:

Filling out section 1

Let’s say that in the third quarter of 2020, the company accrued and paid income to two employees. Employees worked in July - September without vacations or sick leave. We will prepare a payroll statement for July 2021.

| Tab. No. | FULL NAME. | Salary | Number of days | Accrued | Deductions | Taxable income | Personal income tax |

| 1 | Ivanov I.I. | 10 000,00 | 22 | 10 000,00 | 10 000,00 | 1 300,00 | |

| 2 | Petrov P.P. | 9 000,00 | 22 | 9 000,00 | 1 400,00 | 7 600,00 | 988,00 |

| Total: | 19 000,00 | 19 000,00 | 1 400,00 | 17 600,00 | 2 288,00 |

We will draw up a cumulative statement for three months of the third quarter of 2020.

| Tab. No. | FULL NAME. | Salary accrued | Deductions | Taxable income | Personal income tax |

| 1 | Ivanov I.I. | 30 000,00 | 30 000,00 | 3 900,00 | |

| 2 | Petrov P.P. | 27 000,00 | 4 200,00 | 22 800,00 | 2 964,00 |

| Total: | 57 000,00 | 4 200,00 | 52 800,00 | 6 864,00 |

We transfer the calculated summary data for the organization into the report - an example of filling out 6-NDFL, section 1:

Let's move on to filling out section 2

It reflects data on the payment of personal income tax for the reporting period. When you fill out the nine-month report, enter information for the third quarter. The form does not reflect information on the amounts that should be transferred to the budget in the next quarter. For example, there is no need to show in the report for the third quarter personal income tax on salaries for September paid in October; this data will go into the report for the year.

Let us establish that in the third quarter the company paid tax to the budget for June, July and August 2021 in the amount of 6,864 rubles, and only the amount for September (2,288 rubles), due for transfer in October 2020, remained outstanding. Let’s say the company’s salary payment deadline is set on the 3rd day following the billing month. Personal income tax must be paid no later than the first working day following the day the income was paid. If employee salaries are paid after the end of the reporting period, their payment is not reflected.

Filling example:

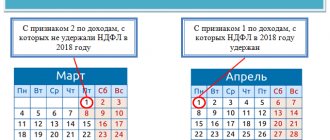

How to reflect wages paid in December 2021 in 6-NDFL

The December salary paid at the end of December is reflected in 6-NDFL in the following order (clause 2 of Article 223, clauses 4 and 6 of Article 226 of the Tax Code of the Russian Federation, clauses 3.1, 3.3, 4.1, 4.2 of the Procedure for filling out the 6-NDFL calculation, Letter of the Federal Tax Service dated November 1, 2017 No. GD-4-11/ [email protected] ):

- In 6-NDFL for 2021, in December of which the salary was paid, the salary amounts and the personal income tax amounts calculated and withheld from this salary are included in the indicators of lines 020, 040, 070 of section 1. This operation is not reflected in section 2.

- In 6-NDFL for the 1st quarter of 2021 - in section 1 of the new form (in the previous form it was section 2) the date of income actually received (December 31, 2020), the date of tax withholding and the deadline for transferring the tax (the first working day of January 2021), salary amounts for December and the corresponding amounts of personal income tax withheld.

Personal income tax accrued from the December salary, which was not withheld in December, is not reflected in line 80 of the 6-NDFL calculation (Letters of the Federal Tax Service dated November 29, 2016 No. BS-4-11 / [email protected] , dated May 24, 2016 No. BS-4 -11/9194).

How to check data and write a report

We offer a detailed guide on how to fill out the form correctly, how to take personal income tax into account in the 6-NDFL report, and how to check the reporting in practice.

| What we check | Where can I read about it? | Where to reflect in the calculation (column, line) | What to pay attention to |

| Section 1 is formed on a cumulative basis from the beginning of the year. 1 part. Information on each applicable tax rate. | |||

| Rates | Tax rates are established in Art. 224 Tax Code of the Russian Federation. The amount depends on the type of income paid and taxpayer status. Tax rates in 2021: 13%, 15%, 30% and 35%. | Box 010 in 6-NDFL | For each applied rate, a separate section 1 of the calculation is filled out. In this case, lines 060-090 are not filled in separately. |

| Taxable income | Income that is not subject to taxation (exempt from taxation) is listed in Art. 217 Tax Code of the Russian Federation. | Page 020 | Only taxable income is reflected. Indicated as a cumulative total from the beginning of the year. |

| Reflection of dividends | The total tax on dividends is determined taking into account the provisions of Art. 214 Tax Code of the Russian Federation. | Page 025 | Dividends are distinguished separately from taxable payments. |

| Standard tax deductions | The Tax Code of the Russian Federation provides for the following deductions:

| Page 030 Page 020 > page 030 | All deductions provided are reflected in total. |

| Payment amount | Estimated indicator. Tax amount = (taxable payments - deductions) × tax rate. Section 1 lines: 040 = (020 — 030) × 010. | Page 040 | Please note that only whole tax numbers are included in the sample for filling out the calculation of the amounts of payments on the income of individuals 6-NDFL. Since the income tax is calculated in full rubles, without kopecks. |

| Dividend tax amount | Estimated indicator. Tax = dividends × tax rate. Section 1 lines: 045 = 025 × 010. | Page 045 | |

| Tax on foreign citizens (work activity based on a patent) | In accordance with paragraph 2 of Art. 227.1 of the Tax Code of the Russian Federation, personal income tax is paid in the form of fixed advance payments. | Page 050 | The data is provided by the “patent” employee. This is determined by the instructions for filling out form 6-NDFL, clause 3 of Art. 227.1 of the Tax Code of the Russian Federation, orders of the Ministry of Economic Development on the establishment of deflator coefficients for the current year, decisions of regional authorities |

| Part 2. Step-by-step instructions for filling out the 6-NDFL declaration in 2020. Generalized information on all bets. | |||

| Number of individuals | How one person is counted:

| Page 060 | All individuals who received payments and rewards are taken into account, including under civil contracts, dividends, gifts, etc. |

| Payment amount | Personal income tax is withheld at the time of actual payment (paragraph 1, paragraph 4, article 226 of the Tax Code of the Russian Federation). The tax on the income paid is the withheld personal income tax. When paying an advance, tax is not withheld, since income is recognized as received only on the last day of the month for which such salary was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). | Page 070 | There may be a discrepancy between lines 070 and 040 in the amount of personal income tax on wages for the last month of the quarter, if wages for this month are paid in the next month. |

| The amount of the fee that cannot be presented for deduction | If it is impossible to withhold the calculated amount from the taxpayer, the tax agent reports this to the Federal Tax Service (clause 5 of Article 226 of the Tax Code of the Russian Federation). | Page 080 (for all tax rates) | Information for individuals in form 2-NDFL must be submitted no later than March 1 of the tax period following the current one. |

| Amount of fee submitted for refund | Tax returned by a tax agent to an individual (Article 231 of the Tax Code of the Russian Federation). | Page 090 | |

| Section 2 contains data for the last quarter, that is, not on an accrual basis. | |||

| Dates of receipt of income | Features of determining the date of actual receipt of income are defined in Art. 223 Tax Code of the Russian Federation. | Page 100 | Dates are arranged in chronological order. The number of rows is equal to the number of corresponding dates in the quarter. |

| Tax withholding dates | Dates of personal income tax withholding (clause 4 of article 226 and clause 7 of article 226.1 of the Tax Code of the Russian Federation). | Page 110 | |

| Tax payment deadline | The deadline for transferring payment is no later than the day following the day of payment of remuneration. The exception is income in the form of temporary disability benefits (including child care benefits) and in the form of vacations. In this case, the payment amounts are transferred no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). A different period is also defined for JSC dividends (clause 9 of Article 226.1 of the Tax Code of the Russian Federation). | Page 120 | Payment deadline, in accordance with the Tax Code of the Russian Federation, relating to the corresponding lines 100 and 110 of section 2. |

| Amount of income received | The amount of income paid as of the date specified in line 100 of section 2. | Page 130 | Add up all amounts with one date of receipt of income. |

| Amount of tax withheld | The amount of tax withheld as of the date specified in line 110 of section 2. | Page 140 | Add up all amounts with the same tax withholding date. |

Tax authorities check the report using control ratios from the letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/. The standard compares indicators within the 6-NDFL calculation and with the 2-NDFL form, notification of foreign citizens about a patent and income tax return.

The table shows the reconciliation within the 6-NDFL calculation:

| Interconnection of indicators | Formulation of the violation |

| Page 020 ≥ page 030 | If 020 < 030, then the amount of tax deductions is overestimated. |

| (page 020 – page 030) / 100 × page 010 = page 040 | If the result is < or > page 040, then the amount of uncalculated tax is overestimated or underestimated. At the same time, taking into account paragraph 6 of Art. 52 of the Tax Code of the Russian Federation, an error is allowed in both directions, determined as follows: line 060 × 1 rub. × quantity page 100. |

| Page 040 ≥ page 050 | If 040 < 050, then the amount of the fixed advance payment is overestimated. |

Do I need to submit a zero 6-NDFL report in 2020?

If you did not have duties as a tax agent during the reporting period, and you did not pay income to individuals either under employment or civil law contracts, there is no need to submit Form 6-NDFL, even “zero” form.

But if you have a desire to submit a zero 6-NDFL, the Federal Tax Service is obliged to accept it.

To avoid additional questions from tax authorities, you can provide an explanatory letter to the Federal Tax Service instead of zero. It should indicate that in the reporting period the organization (or individual entrepreneur) was not a tax agent, did not pay income to individuals, and did not have valid agreements with individuals. As a rule, this happens in the absence of financial and economic activities. You can indicate this in the letter. The letter is certified in the same way as a zero calculation of 6-NDFL would be certified.

Is it necessary to provide a zero calculation?

No, don't. This basis is provided by Letter of the Federal Tax Service of the Russian Federation dated March 23, 2016 N BS-4-11/4958. Individual entrepreneurs and organizations are required to submit 6-NDFL only if they are recognized as tax agents. And they are recognized as such if they paid income to employees (in accordance with Article 226 of the Tax Code of the Russian Federation). That is, there may be 3 situations when the zero calculation does not need to be submitted:

1) There are no workers on staff at all;

2) The employees are on the payroll, but no payments were made to them during the reporting period.

3) No activity.

This position is confirmed by the words of a tax official who was asked a similar question on the forum (click to enlarge the picture):

Is it necessary to submit an explanatory note to the Federal Tax Service () - why is 6-NDFL not submitted? NO, not necessary. But to be on the safe side, no one forbids you to do this (in any form), for example like this:

Income that does not need to be reflected in 6-NDFL

6-NDFL is filled out on the basis of accounting data for income accrued and paid to individuals. However, not all income should be reflected in this report:

| Type of income | To include or not in 6-NDFL | Rationale | Standard |

| Cash prize given to an employee as part of a promotion | No | From cash prizes that the organization awarded to an individual as part of an advertising campaign and which amount to 4,000 rubles. per year, no personal income tax required | clause 28 art. 217 of the Tax Code of the Russian Federation, question 1 from Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11/14329 |

| Monthly allowance for caring for a child up to 1.5 years old, payment for days off for caring for a disabled child | No | These types of benefits are included in the list of income completely exempt from personal income tax. | clause 1, 8 art. 217 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated December 11, 2018 No. BS-3-11/9358, dated April 11, 2019 No. BS-4-11/6839 |

| Alimony | No | Alimony is not the income of the recipient from which personal income tax is required to be paid. | clause 5 art. 217 Tax Code of the Russian Federation, clause 7 Letter of the Federal Tax Service dated November 1, 2017 No. GD-4-11/22216 |

| Financial assistance for the birth of a child, paid in installments | No | Personal income tax is not calculated on this payment if two conditions are met:

| clause 7 Letters of the Federal Tax Service dated November 1, 2017 No. GD-4-11/22216, letters of the Ministry of Finance dated August 27, 2012 No. 03-04-05/6-1006, dated October 31, 2013 No. 03-04-06/46587, dated August 22 .2013 No. 03-04-06/34374 |

| Maternity benefit | No | The benefit is included in the list of incomes completely exempt from personal income tax. | clause 1 art. 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 09.16.2014 No. 03-04-09/46390, paragraph 7 Letter of the Federal Tax Service dated 01.11.2017 No. GD-4-11/22216, question 4 from Letter of the Federal Tax Service dated 01.08.2016 No. BS-4 -11/13984 |

| Over-limit daily allowance | Yes | Excess daily allowance is taxable income. Daily allowances within the norms are not included in 6-NDFL, since they are not subject to personal income tax | subp. 6 clause 1 art. 223, paragraphs 3, 4 and 6 of Art. 226 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated April 11, 2019 No. BS-4-11/6839 |

Fines for 6-NDFL

For violations committed during the registration and submission of 6-NDFL, fines may follow:

- For late submission of the calculation.

The fine will be 1,000 rubles. for each full or partial month from the day established for the submission of the calculation to the day on which it was submitted (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). The employee responsible for submitting 6-NDFL may be fined from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

For late reporting, tax authorities have the right to block the company’s accounts if the payment is not received by the inspectorate within 10 working days after the end of the legally established deadline for submission (clause 6 of article 6.1, clause 3.2 of article 76 of the Tax Code of the Russian Federation).

- For inaccurate information and mistakes made.

The fine for such a violation is 500 rubles. (clause 1 of article 126.1 of the Tax Code of the Russian Federation). You can be fined for errors in the taxpayer’s personal data or total indicators (clause 3 of the Federal Tax Service Letter No. GD-4-11/14515 dated 08/09/2016).

If errors or inaccuracies do not lead to a reduction in personal income tax subject to transfer to the budget, or a violation of the rights of citizens, tax authorities can reduce the amount of the fine (clause 1, clause 1, clause 4, article 112 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service dated 08/09/2016 No. GD -4-11/14515).

- For submitting a paper 6-NDFL instead of an electronic one.

If your company is required to submit a calculation in electronic form, but you submitted it to the tax office on paper, the fine will be 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Useful information from ConsultantPlus

See a ready-made solution on how to fill out form 6-NDFL (it's free).

Let's sum it up

- Calculation of 6-NDFL for 2021 must be submitted no later than 03/01/2021.

- For the report for 2021, we use the previous form 6-NDFL, approved by Federal Tax Service Order No. MMV-7-11 dated October 14, 2015/ [email protected] Using the updated form, for the first time we will report for the 1st quarter of 2021 (Federal Tax Order No. ED dated October 15, 2020 -7-11/ [email protected] ).

- If in 2021 you did not have duties as a tax agent (income was not accrued or paid to individuals), you do not have to submit the zero 6-NDFL. But it is better to inform the tax authorities about this with an explanatory letter within the same time frame as the 6-NDFL.

If you find an error, please select a piece of text and press Ctrl+Enter.

This might also be useful:

- New RSV form 2021

- Form and rules for filling out form 4-FSS

- Application for leave at your own expense

- Payment of 1% on income over 300,000 rubles

- Property tax for organizations and individuals

- Trade fee in Moscow in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!