With the taxable object “Income” you need to fill out:

- title page;

- section 2.1.1;

- section 1.1.

Section 3 is for non-profit organizations, and section 2.1.2 is for trade tax payers.

The remaining sections are needed for the simplified tax system “Income minus expenses”.

In section 2.1.1 on line 102 the sign “1” is added.

Lines 110–113 indicate income for the first quarter, half year, 9 months and year on an accrual basis from the beginning of the year, and lines 130–133 indicate advance payments and tax calculated from them for the year.

Lines 140–143 reflect the amounts of contributions and benefits that reduce tax.

In section 1.1, only 5 lines are filled in. Line 010 contains OKTMO - you can find it on the website of the Federal Tax Service of the Russian Federation.

Lines 020, 040, 070 indicate advance payments payable for the first quarter, half a year and 9 months. Line 100 shows the tax payable for the year.

If the simplified tax system is used with the object of taxation “Income”, you must pay a “simplified” tax on the entire amount of income (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). In this case, the expenses incurred are not taken into account when calculating the tax base, and the taxpayer is not required to confirm them with documents (letters of the Ministry of Finance of the Russian Federation dated June 16, 2010 No. 03-11-11/169, dated October 20, 2009 No. 03-11-09/353).

An organization or individual entrepreneur has the right to reduce the amount of the calculated “simplified” tax (advance payments) by the costs of payment (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation):

- insurance contributions for compulsory pension insurance;

- insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- insurance premiums for compulsory health insurance;

- insurance contributions for compulsory social insurance against accidents at work and occupational diseases;

- temporary disability benefits.

Example. Filling out a declaration under the simplified tax system with the object “Income” for 2021

| Period | Cumulative income, rub. | Calculated advance payments and tax for the year, rub. (gr. 2 x 6 percent) | The amount of paid contributions and benefits by which advance payments and tax for the year can be reduced, rub. Tax deduction (NV) (gr. 4 < gr. 3 x 50 percent) |

| 1 | 2 | 3 | 4 |

| I quarter | 870 000 | 52 200 | 26 100 |

| Half year | 1 305 000 | 78 300 | 39 150 |

| 9 months | 1 400 000 | 84 000 | 42 000 |

| Year | 1 800 000 | 108 000 | 54 000 |

In 2021, the organization's address did not change and no trading fee was paid.

To determine the advance payment payable at the end of the reporting period, there is a formula:

AP = APrasch - NV - APisch,

where APrasch is an advance payment attributable to the tax base determined from the beginning of the year to the end of the reporting period for which the calculation is made;

NV - tax deduction in the amount of contributions paid for compulsory social insurance and temporary disability benefits paid to employees;

APisch - the amount of advance payments calculated (to be paid) based on the results of previous reporting periods (in the current tax period).

Therefore, advance payments and tax due for 2021 will be as follows.

For the first quarter - 26,100 rubles (52,200 rubles - 26,100 rubles).

For the six months - 13,050 rubles (78,300 rubles - 39,150 rubles - 26,100 rubles).

For 9 months - 2,850 rubles (84,000 rubles - 42,000 rubles - 26,100 rubles - 13,050 rubles).

For the year - 12,000 rubles (108,000 rubles - 54,000 rubles - 26,100 rubles - 13,050 rubles - 2,850 rubles).

Sections 1.1 and 2.1.1 of the simplified taxation system declaration are filled out as follows.

Form and deadlines for submitting the simplified tax system “income” declaration – 2021

The current form of simplified taxation system declaration was adopted on February 26, 2016 (order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/99) and has not changed since then. Not all sheets are included in the declaration, but only those that relate to the selected type of taxation. In the declaration under the simplified tax system “income” for 2021, it is mandatory to fill out the “Title Page” and sections 1.1, 2.1.1. “Simplers” who paid the trade fee also complete Section 2.1.2. If there are targeted revenues, section 3 is formed. Blank sheets do not need to be submitted.

The “simplified” tax must be reported once a year. The declaration is submitted even if there is a complete absence of income from the “simplified tax” in the reporting period - then only the title page is filled out, and the indicators in sections 1.1 and 2.1.1 will be “zero”.

Declaration form for the simplified tax system “income”, an example of filling can be downloaded below.

The deadline for submitting a simplified taxation system return to the Federal Tax Service is the same for any taxable object, but depends on who submits the reports: for organizations, the last day for submitting a declaration for the past year is March 31 (for 2021 you need to report no later than 04/01/2019, since March 31 is Sunday), for individual entrepreneurs - April 30 (for 2021 - until 04/30/2019 inclusive).

When to submit a simplified declaration

your simplified declaration at the end of the year. The deadline for organizations is no later than March 31 of the following year, for entrepreneurs no later than April 30.

The reporting deadline, which falls on a weekend, is moved to the nearest Monday (Clause 7, Article 6.1 of the Tax Code). Organizations report for 2021 no later than March 31, 2021.

Organizations and individual entrepreneurs that have lost the right to simplification before the end of the year report early. The simplified declaration must be submitted no later than the 25th day of the month following the quarter in which the conditions for applying the simplified tax were violated.

If during the year an organization or individual entrepreneur re-profiles its activities and “winds down” the simplified business, send two documents to the inspectorate. Within 15 working days from the date when the simplifier ceased to conduct business, submit a notice of termination of activity to the simplified tax system. No later than the 25th day of the month following the one in which you stopped operating under the simplified system, submit a tax return to the simplified tax system. This procedure is provided for in Article 346.23 of the Tax Code.

If an organization is liquidated and an individual entrepreneur loses its status, inspectors do not need notification of termination of activities on the simplified tax system. Organizations submit the declaration together with the liquidation balance sheet, and entrepreneurs - no later than April 30 of the following year (letter of the Federal Tax Service dated April 29, 2015 No. SA-4-7/7515).

Delay in a simplified tax return is an offense for which tax and administrative liability is provided (Article 106 of the Tax Code, Articles 2.1 and 15.5 of the Administrative Code).

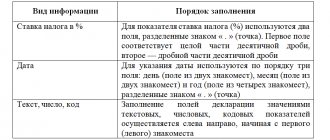

Declaration of the simplified tax system “income” 2021 – rules for filling out

Instructions for preparing a simplified taxation system (STS) declaration can be found in the same order No. ММВ-7-3/99 (Appendix No. 3). Starting from the title, all sheets of the report are numbered consecutively. When filling out a declaration, you cannot:

- correct errors using a proofreader (or other similar means);

- fasten sheets with a stapler;

- print the declaration on both sides of the sheet.

When “manually” filling out the simplified tax system “income” declaration, indicators (numeric, text) are entered into the appropriate fields from left to right (starting from the first cell of the field), and if software is used, the numbers are aligned to the right. The absence of an indicator is indicated by a dash.

Monetary figures are rounded (to the nearest ruble). The text is entered in capital block letters.

These are the general requirements for preparing a report. We will look at filling out the simplified tax system “income” declaration 2021 in more detail using an example.

Types of tax returns

In the practical activities of an entrepreneur, it may be necessary to prepare four types of tax returns:

- Main. Compiled by any individual entrepreneur for each reporting period. This is the document that is usually discussed when collaborating with a competent outsourcing company.

- Refined. It is submitted if it is necessary to make adjustments to the main declaration when employees of the Federal Tax Service or the individual entrepreneur himself discover errors or inaccuracies in a previously provided document.

- Zero. Issued in a situation where the activities of an individual entrepreneur are temporarily not carried out.

- Final. The need to prepare this type of tax return arises when an individual entrepreneur is closed.

“Simplified”: how to fill out a declaration under the simplified tax system “income”

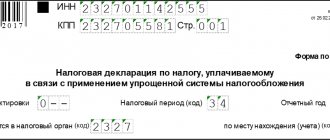

"Title page"

At the top of the title (and each page of the report) indicate the TIN, KPP of the company (individual entrepreneurs indicate only the TIN). The following fields are filled in as follows:

- The “adjustment number” for the primary declaration is “0—”, and if an updated form is submitted – “1—”, “2—”, etc. according to the order in which the adjustments are submitted;

- “Tax period” - here the code for annual reporting is “34”;

- “Reporting year” - 2018;

- “Submitted to the tax authority” - indicate the code of your Federal Tax Service;

- “At location (registration)” - code in accordance with Appendix No. 2 to the Filling Out Procedure. Companies reporting at their location indicate “210”, individual entrepreneurs (at place of residence) - “120”;

- Organizations indicate their full name (as in the charter), individual entrepreneurs - full name;

- OKVED is indicated according to the OKVED2 Classifier;

- If the company was reorganized (or was liquidated), the code is indicated in accordance with Appendix No. 3 to the Procedure for filling out the TIN and KPP of the reorganized entity.

Next, enter the phone number of the “simplified” person, the total number of pages of the declaration and its attachments. The signature of the taxpayer (or his representative), the date of completion and a stamp (if any) are affixed.

An example of filling out the simplified tax system “income” declaration for 2021 (sections 1.1, 2.1.1)

Let's consider filling out the main sections of the simplified taxation system (STS) declaration. To do this, take the following data:

Mirage LLC applied the simplified tax system “income” in 2021. The company paid advances on the simplified tax (tax rate 6%) quarterly. What will it be like to fill out the simplified taxation system declaration for 2021 (“income”) if there are the following indicators according to KUDiR data:

| Amount of income (cumulative total), rub. | Amount of calculated “simplified” tax (6%), rub. | Amount of insurance premiums paid, rub. | |

| 1 sq. 2018 | 479 600 | 28 776 | 21 000 |

| half year 2018 | 1 940 000 | 116 400 | 42 000 |

| 9 months 2018 | 2 400 550 | 144 033 | 63 000 |

| year 2018 | 3 115 700 | 186 942 | 84 000 |

First, in the simplified taxation system “income” declaration, fill out section 2.1.1 “Tax calculation”.

In line 102 we indicate sign “1” (sign “2” indicates individual entrepreneurs without employees).

Lines 110-113 - amounts of taxable income (increasingly from the beginning of the year).

The tax rate of 6% is reflected on lines 120-123.

Next comes the direct calculation of advances (quarter, half-year, 9 months) and annual tax: the amount of income is multiplied by a rate of 6% (from lines 110-113). The result is reflected in fields 130-133.

The given sample declaration of the simplified tax system “income” includes the amount of insurance premiums (lines 140-143). According to clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation, the calculated “simplified” tax (and advances on it) can be reduced by the amount of insurance premiums transferred to the Federal Tax Service in the reporting period. Such a reduction for employers cannot exceed 50% of the calculated tax amount (individual entrepreneurs without employees can reduce the tax up to 100% through contributions “for themselves”). In our case, we can apply the following deductions:

- In the 1st quarter, contributions were paid in the amount of 21,000 rubles, but the advance payment can only be reduced by 14,388 rubles. (28,776 x 50%). It is this amount that we will reflect in line 140 of the declaration under the simplified tax system “income”.

- For six months, the entire amount of insurance premiums (paid) does not exceed 50% of the advance amount. On line 141, the amount of contributions taken into account is 42,000.

- In the same way (by the entire amount of contributions paid), the advance payment for 9 months and the tax for the year will be reduced:

- for 9 months - enter 63,000 in line 142;

- contributions for 2021 in the amount of 84,000 are indicated on line 143.

Please note: if a “simplified” person conducted an activity in the reporting year that required payment of a trade tax (today it is valid only in Moscow), he can also reduce the simplified tax system by the amount of the fee paid (by filling out section 2.1.2). In this case, the indicators of lines 110-143 (section 2.1.2 for types of activities subject to the fee) are included in similar lines of section 2.1.1.

The last stage is the reflection of the tax amounts “payable” in section 1.1.

Field 010 - OKTMO code (8 or 11 characters). If in the reporting year the location of the company (place of residence of the individual entrepreneur) has changed, then the corresponding OKTMO must be indicated in lines 030, 060, 090. If the place of registration has not changed, the code in line 010 is sufficient, and for the rest we put dashes.

Next, in our example of filling out a declaration under the simplified tax system “income”, we enter the amounts payable:

- line 020 - in the 1st quarter, from the tax amount (line 130), we subtract the insurance premiums paid (line 140) and get the advance amount of 14,388 rubles. (28,776 – 14,388);

- on line 040, the advance for the half-year will be 60,012 rubles: from line 131, subtract line 141, as well as the amount of the advance for the 1st quarter (116,400 - 42,000 - 14,388);

- advance payment for 9 months in line 070 is equal to 6,633 rubles: line 132 minus line 142 and lines 020 and 040 (14,4033 – 63,000 – 14,388 – 60,012);

- additional tax payment for the year (line 100): from line 133 we subtract contributions on line 143 and advances (lines 020, 040, 070); the tax will be 21,909 rubles. (186,942 – 84,000 – 14,388 – 600 12 – 66 33).

Declaration of the simplified tax system “income” 2021: sample filling

Advantages of outsourcing accounting services

Cooperation with our outsourcing company guarantees clients the receipt of high-quality accounting services on the most favorable terms. The key advantages of this organization of work are:

- attracting competent and professional accountants, whose full workload and decent payment are simply not possible for individual entrepreneurs;

- accurate compliance with tax legislation requirements;

- guarantee of confidentiality of information received from the client during the preparation of the declaration;

- financial responsibility of the outsourcing company for the quality of the final result;

- no need to pay insurance premiums for the accountant and organize his workplace.

An important additional advantage of contacting our company is an individual approach to pricing. The company’s specialists will promptly prepare a personal commercial proposal based on the information received from a potential client.

Section 1.2: tax payable for the object “income minus expenses”

Based on the indicators from section 2.2, complete section 1.2. It is intended for final advance payments and tax due or reduced.

On line 010, indicate OKTMO. If the organization or entrepreneur has not changed its location (residence), there is no need to re-enter the OKTMO code on lines 030, 060, 090.

On line 020, reflect the advance payment accrued for payment for the first quarter.

On line 040 - advance payment accrued for payment for the first half of the year (minus the advance payment for the first quarter). If the difference between advance payments for the half-year and the first quarter is negative, reflect the difference on line 050 - the advance payment for the half-year will be reduced.

Similarly, indicate advance payments for nine months: on line 070 - advance payment payable for nine months, on line 080 - advance payment to be reduced based on the results of nine months.

On line 100, indicate the additional tax for the year. If the difference between the tax calculated for the year and accrued advance payments is negative, indicate it on line 110 as tax to be reduced.

On line 120, indicate the minimum tax payable for the year. An organization is required to pay a minimum tax if its amount is greater than the tax calculated for the year according to the general rules. That is, if the inequality holds:

| Minimum tax (indicator of line 213 of section 2.2 × 1%) | > | Tax for the year (indicator of line 273 of section 2.2) |

Determine the minimum tax payable taking into account accrued advance payments. If the amount of the minimum tax exceeds advance payments, then calculate the indicator in line 120 of section 1.2 as follows:

| line 120 of section 1.2 | = | line 280 of section 2.2 | – | line 020 of section 1.2 + line 040 of section 1.2 – line 050 of section 1.2 + line 070 of section 1.2 – line 080 of section 1.2 |

If the minimum tax is less than the accrued advance payments, put a dash in line 120 of section 1.2. That is, in this case the inequality must be satisfied:

| section 2.2 line 280 | < | line 020 of section 1.2 + line 040 of section 1.2 – line 050 of section 1.2 + line 070 of section 1.2 – line 080 of section 1.2 |

This follows from Section V of the Procedure, approved by Order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/99.

How to submit a declaration to the Federal Tax Service

All returns with the exception of one - VAT - can be submitted to the tax office both electronically and on paper.

Acceptance and registration of business tax reports can take place in several ways; let’s look at the nuances when submitting a declaration:

- The declaration can be submitted in person to the Federal Tax Service at the place of registration of the individual entrepreneur or, in some cases, of doing business; it depends on the tax regime. For example, for a single imputed tax, reporting must be provided at the place where this activity is carried out, since UTII is a regional tax that is paid to the municipal budget.

- If a businessman does not have the opportunity or time to personally go to the inspection office, he has the right to send the form through the legal representative of the businessman. In this case, it is necessary to draw up a document for the authorized person, having first notarized it. In any case, the declaration must be endorsed by the personal signature of the individual entrepreneur.

- In the first and second cases, everything is clear regarding the deadline for submitting and accepting the declaration: the date of submission of the report is considered the moment the form is received by the inspector.

- The third way to submit tax reports on paper is remotely - sending a package of documents by Russian Post. It is necessary to take into account that when sending, an inventory of the attachment must be drawn up, otherwise the report may not be accepted. Notification of acceptance of the declaration (or refusal) in this case will be sent to the entrepreneur by registered mail. In this case, the date of submission of the declaration is considered to be the date confirmed by the postmark.

- There is another online way to submit a tax return - through the website of the Federal Tax Service of the Russian Federation, using the service “Presentation of tax and accounting reports in electronic form.” This is a pilot project for tax authorities. To work in it you need to: have an electronic signature key, register yourself in the “Subscriber Identifier” system on the portal, install the necessary software. At first glance, this may seem like a long and complicated process, but consider how much time you can save later. There is one problem with this service - it is not yet possible to send a VAT return using it. The rest of the reporting is available in full. The document is considered sent to the Federal Tax Service on the date of dispatch. Notification of acceptance (or return for adjustment) is sent to the individual entrepreneur’s email.

- The best option for generating a declaration is to send a package of electronic documents certified by an enhanced qualified electronic signature (ECES). This can be done through an electronic document management (EDF) operator. This is the most convenient and efficient way to generate reports. You can find out which companies have the right to such activities, as well as clarify where the nearest certification center is located, on the page of the portal of the Federal Tax Service of the Russian Federation “Organizations - operators of electronic document management”. In this case, the declaration is considered accepted at the time of its sending. The individual entrepreneur receives all comments and clarifications in his personal mailbox.

There are 2 cases when private entrepreneurs are required to submit tax reports only using EDI:

- staff of more than one hundred people;

- declaration and all reporting documents for value added tax (VAT).

An electronic document is not only operational reporting to the Federal Tax Service, here you can exchange documents with counterparties, interact with government services, etc.

It is necessary to note several undeniable advantages of submitting tax reports via electronic communication channels:

- There is no need to come to the inspection, reports are generated and transmitted from anywhere in the world (as long as there is Internet) and at any time of the day or night, which significantly saves a businessman’s time.

- There is no need to print out the package of documents.

- One of the most important advantages is minimizing possible errors. Reporting is generated in the required format, all fields are controlled by the system, incorrect data simply will not pass internal verification.

- The system contains only current templates. The entrepreneur does not waste time searching for forms or changing outdated forms. All versions are updated automatically.

- Guarantees of timely delivery of documents and information on their passage.

- Protection of reporting from adjustments by unauthorized persons.

- Full information about individual entrepreneurs’ settlements with the state budget, receiving online certificates, statements, reconciliation reports, etc.

Why the deadlines for submitting reports and receiving feedback from the tax office on the acceptance (return) of declarations were considered in such detail will become clear if we clarify what sanctions threaten for late declaration.

Section 2.2: tax calculation for the object “income minus expenses”

In section 2.2, the tax base is calculated for the object “income minus expenses”.

On lines 210–213, indicate income for each reporting period: quarter, half-year, nine months, year. Indicate the data on an accrual basis.

If you stopped operating on a simplified basis in the middle of the year, also indicate income for the last reporting period on line 213. For example, if an organization stopped operating on a simplified basis in March, indicate income for the first quarter on line 210. The same amount is duplicated on line 213, and lines 211–212 are filled in with dashes.

Attention! The local Federal Tax Service may not accept a declaration under the simplified tax system if the organization has put dashes in lines 211–212 of section 2.2. If an organization has ceased operating on a simplified basis since the beginning of the second quarter, inspectors suggest entering the same income in lines 210–213. But such a demand is unlawful. Firstly, it is not related to the calculation of tax and does not affect the tax base (paragraph 2, paragraph 7, article 80 of the Tax Code). Secondly, control ratios allow you not to fill out lines 211–212 (letter of the Federal Tax Service dated May 30, 2016 No. SD-4-3/9567).

On lines 220–223, indicate expenses for each reporting period on an accrual basis. If the activity has ceased, duplicate the expenses for the last reporting period on line 223.

Entrepreneurs indicate in lines 220–223 contributions for both their own insurance and employee insurance.

On line 230, indicate the loss (part of the loss) for previous tax periods, which will reduce the base of the reporting year.

On lines 240–243, indicate the tax base for each reporting period, which is defined as the difference between income and expenses. When calculating the tax base for the year, subtract the loss indicated on line 230 from income.

If the difference between income and expenses is negative, indicate the loss on lines 250–253.

On lines 260–263, indicate the tax rate for each reporting period and year. The general rate is 15 percent, while in different regions it can vary from 0 to 15 percent.

On lines 270–273, reflect the calculated advance payments. Calculate the advance payment for this line as the product of the tax base (lines 240–243) and the tax rate (lines 260–263).

On line 280, indicate the minimum tax, that is, income for the year (line 213), multiplied by 1 percent. It must be paid if the actual tax is less than the minimum or a loss is incurred.

Submitting a document and methods

The declaration under the simplified tax system can be submitted in person to the Federal Tax Service. It must first be printed out in two copies, signed and sealed.

There is no need to staple the document, just staple it with a stapler. One copy must be given to the inspector, the second with a mark from the Federal Tax Service must be kept. It will serve as confirmation that the taxpayer has reported within the established time frame.

Of the documents from the individual entrepreneur, you will only need a passport proving his identity, from a representative of the legal entity - documents confirming his authority . But you can additionally capture the TIN and OGRNIP (OGRN). Notarization of the report is not required for personal submission.

It is advisable to take a flash drive with an electronic version of the report. It can be pre-prepared in the free Legal Entity Taxpayer software.

For those who cannot personally come to the Federal Tax Service to report, today the following methods are provided for remote submission of a declaration under the simplified tax system :

- Through a representative (with a notarized power of attorney for representation of interests).

- By valuable letter via Russian Post.

- Via the Internet (with a document signed using an electronic signature).

When sending by mail, you need to fill out two lists of attachments, on one of them the postal specialist must put a stamp with the date of sending. This date will be considered the date of submission of the report.