Who should submit the 4-OS report?

The report is submitted by all legal entities and individual entrepreneurs, provided that they have fixed assets for environmental purposes and their costs for environmental protection or environmental services amount to more than 100,000 rubles per year. If there are branches and divisions, you must report separately on the parent company and divisions.

To find out whether you must take 4-OS, use the official Rosstat service. It is enough to indicate OKPO, INN or OGRN, and the system will show all the statistical reports that you must submit this year.

If there was no observed event during the year, then reporting does not need to be submitted. There are no “zero” forms for this report.

Responsibility for failure to report

Lately submitted reports or false data, including in Form 4-OS, may be regarded as an offense. According to Article 13.19 of the Code of Administrative Offenses of the Russian Federation, fines are provided for it

- for officials – from 10 to 20 thousand rubles.

- for legal entities – from 20 to 70 thousand rubles.

A re-registered violation increases the amount:

- for officials – up to 30-50 thousand rubles;

- for legal entities – up to 100-150 thousand rubles.

In addition, it must be remembered that if errors in reporting are corrected or deadlines are missed, damage is caused to statistical bodies, for example, due to the need to redo the final report and re-conduct generalizing calculations. According to the law of the Russian Federation No. 2761-1 of May 13, 1992, such damage (if it is proven) will have to be compensated.

How to fill out form 4-OS

The latest form of the 4-OS report was approved by Rosstat Order No. 399 dated July 21, 2020. The form template itself, instructions for filling it out and attachments in the form of a list of environmental funds and types of environmental activities are fixed in Appendix No. 1. Form code for OKUD 0609030.

Remember that the following costs are not taken into account in Form 4-OS:

- on health protection and improvement of working conditions and safety;

- on the use of natural resources (for example, for water supply);

- to prevent and combat natural disasters and disasters;

- for the construction and repair of environmental protection facilities;

- to reduce the cost of raw materials and fuel used in activities;

- for the purchase of fixed assets for environmental purposes.

In addition, the form does not take into account mandatory taxes and payments, such as:

- mineral extraction tax;

- water tax;

- forest taxes;

- fees for the use of wildlife and water resources;

- environmental fee;

- other taxes and payments for the use of natural resources.

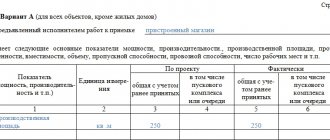

The form consists of a title page and a tabular section. It is filled in in thousands of rubles in whole numbers. All amounts are indicated without VAT. Let's look at each element in more detail.

Title page

The title is similar to the other statistical forms. You just need to indicate the reporting year, the name of the company or individual entrepreneur, postal address and OKPO code. After this, you can proceed to filling out the table.

Tabular part

The table has many columns, which are divided into two large groups. Columns 3 to 10 are the costs of environmental protection measures for personal needs, and columns 11 to 18 are the costs of providing services in the field of environmental protection.

To fill out the columns, use the data from primary documents: invoices for raw materials, bills of lading, TTN, etc.

Environmental protection costs will include:

- all costs for the maintenance and use of fixed assets for environmental protection in the form of fuel, raw materials and electricity;

- all costs for repairs of fixed assets;

- all costs for personnel involved in servicing funds;

- leasing payments for environmental funds;

- all costs for the collection, storage, burial and disposal of production and consumption waste on our own;

- all costs of organizing, on our own, control over harmful impacts on nature and monitoring activities, scientific and technical research, environmental management;

- costs of measures to preserve and restore the environment;

- salary of an ecologist;

- other costs to reduce negative impacts.

In this case, columns 3 and 11 do not include:

- costs for the purchase of environmental protection services from third-party companies (for example, payments for the reception and treatment of wastewater, waste removal and disposal, and so on) - indicate these amounts in columns 7 and 15;

- costs for major repairs of environmental facilities - enter these amounts in columns 8 and 16.

Next, fill in the information line by line. Line 01 is general, therefore, the figure in line 01 must be equal to the sum of lines 02-10. It is needed to account for current costs in general for all activities, which will be described in detail in lines 02-10 in accordance with fixed assets from Appendix No. 1 and types of environmental activities from Appendix No. 2.

In line 02, enter the costs associated with atmospheric air protection. This will include costs associated with:

- maintenance and use of air protection funds;

- control over emissions of pollutants into the air;

- organization of monitoring and control of air quality;

- modification of production processes;

- administrative and environmental management, information support and educational activities in the field of air protection;

- other measures to protect atmospheric air and prevent climate change.

Costs associated with the collection and treatment of wastewater fall into line 03. Consider the costs here:

- for the maintenance and use of fixed assets for the collection and treatment of wastewater;

- reduction of wastewater pollution in production;

- reusing cooling water and treating it before disposal;

- water quality control;

- management, information support and educational activities regarding water treatment.

In this case, line 3 does not include:

- costs for the maintenance and use of industrial and municipal water utilities;

- costs of maintaining and using urban and industrial sewer networks that are not connected to treatment facilities and discharge wastewater directly into water bodies.

Costs associated with waste management, such as recycling, composting or disposal costs, should be included in line 04. Consider the costs here:

- for the maintenance and operation of funds that protect nature from production and consumption waste;

- for activities for the collection, separation, storage and transportation of waste to special places created for storage, neutralization or disposal;

- to measure and control the amount and structure of waste;

- to analyze the physical and chemical composition of waste;

- for management and training in the field of waste management;

- for other events.

In this case, the equipment of vehicles involved in the transportation of waste with the GLONASS system is not taken into account in line 04.

In line 05, list the costs aimed at protecting and rehabilitating land, surface and groundwater. This includes expenses for:

- maintenance and operation of specialized fixed assets;

- elimination of landfills, landfills, sedimentation tanks, etc.;

- preventing the infiltration of pollutants into soils and water bodies;

- maintaining water protection zones;

- cleaning soils and water bodies from pollution and contamination;

- preventing erosion and other types of land destruction;

- land reclamation;

- measurements, control and laboratory research of lands and waters;

- land and water conservation management and education;

- other measures to protect and restore lands and waters.

Indicate costs for protecting the environment from noise, vibration and other physical impacts in line 06. This will include the following costs:

- for the maintenance and operation of fixed assets that ensure protection of the environment from physical impact, preventing and reducing noise, vibration and other impacts;

- measurement and control of physical impact;

- administration, management and training in the field of environmental protection from various impacts;

- other events.

Line 07 includes current costs that are needed to preserve biological diversity and protect natural areas. This includes:

- maintenance, protection and restoration of various animals, fungi, plants, and their habitats;

- support of natural areas;

- monitoring of biological diversity and environmental conditions;

- information support, education, management and administration in this area;

- other events.

The group does not need to include all costs related to green sections of roads, artificial monuments and landscapes, city gardens and parks. As well as current costs that relate to other statistical forms, for example, for forest protection (Form No. 12-LH).

In line 08, enter the current costs of ensuring radiation safety. The group includes:

- reducing exposure to radiation;

- radioactive waste management;

- radiation level control;

- information support, education, management and administration in this area;

- other events.

There is no need to include here the costs of eliminating or preventing emergencies, as well as processing waste with low radiation activity.

On line 09, show the costs of research and development aimed at reducing the negative impact on the OS.

Line 10 is intended to account for current costs in other areas in the field of OS protection. This includes all expenses that cannot be attributed to the previous groups. For example, environmental audit and consulting, development of an environmental education system, general administrative activities, etc.

Form 4-OS

Sample filling

Check the finished table using the control ratios to ensure that the calculations and logic in the filling are correct. If everything is correct, sign the report and send it to Rosstat.

Regulations for 2021

Environmental reporting for 2021 includes about 10 types of documents, generated depending on the type of activity of the enterprise. Information can be provided both in paper and electronic form. If the second option is preferred, the form is available on the Rosprirodnadzor website or on the government services portal.

The legal basis for 4 OS environmental reporting 2018 is Federal Order of the Ministry of Nature No. 30 of February 2010. The report is of a notification nature. It is mandatory for representatives of small and medium-sized businesses whose activities interact with natural resources. The information concerns waste from the activities of enterprises, their use, processing, disposal, disposal or disposal. The report must contain information about the volume of waste, a special code for the classifier, information about the degree of hazard and type.

The completed form is accompanied by copies of licenses, waste transfer agreements, as well as a copy of the license of the receiving enterprise if the business entity uses the services of other companies.

How to pass 4-OS through Kontur.Extern

The electronic method of submitting reports to Rosstat is simple and convenient. You don’t have to visit branches, hire couriers and redo incorrect reporting several times.

Extern allows you to report without leaving your computer and without additional agreements with government agencies. To do this, just register with the service and issue an electronic signature. New users have the opportunity to get a “test drive” of the service for three months.

To submit the form, go to the “Rosstat” section and select the method of generating the report: download a ready-made one or fill it out in the service interface. The system automatically inserts the data it knows about your company into the form, and after approving the report, it checks whether the control ratios have been met. An incorrect report will not be sent, but edits can be made in editing mode.

After agreeing with the system, sign the electronic signature report and send it to the statistics service. As soon as Rosstat receives and accepts the report, you will receive a notification.