You need to report on insurance premiums in 2021 to the Federal Tax Service, and not to extra-budgetary funds. Tax authorities have developed a new calculation form that replaces the previous 4-FSS and RSV-1 calculations; it must be applied starting with reporting for the 1st quarter of 2021. The form and instructions for filling out the calculation were approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. In addition, new BCCs are now used to pay insurance premiums.

Read more about the new form, as well as the procedure for filling it out with an example, in this article.

Who needs to submit the annual calculation for 2017

All policyholders must submit calculations of insurance premiums for the 4th quarter of 2021 to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs (IP).

Calculation of insurance premiums for the 4th quarter of 2021 must be completed and submitted to all policyholders who have insured persons, namely:

- employees under employment contracts;

- performers - individuals under civil contracts (for example, contracts for construction or provision of services);

- the general director, who is the sole founder.

The calculation must be sent to the Federal Tax Service, regardless of whether the activity was carried out during the reporting period (from January to December 2017) or not. If in 2021 an organization or individual entrepreneur had employees, but did not conduct business at all, did not make payments to individuals and had no movements on current accounts, then this does not cancel their obligation to submit accounts for the 4th quarter of 2021. In such a situation, you need to submit a zero calculation to the Federal Tax Service (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940).

The reporting period for calculating insurance premiums is the first quarter, half a year, nine months. The billing period is a calendar year - Article 423 of the Tax Code of the Russian Federation. Thus, it is more correct to call the calculation for the 4th quarter of 2021 an annual calculation for insurance premiums for 2021, and not a quarterly one. Moreover, many accountants know that many calculation indicators are formed on an accrual basis from the beginning of 2021, and not from the quarter. Therefore, at the end of the year, it is the annual DAM that is surrendered.

Deadlines for submitting annual calculations

Calculations for insurance premiums must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting (settlement) period. If the last date of submission falls on a weekend, then the calculation can be submitted on the next working day (clause 7 of Article 431, clause 7 of Article 6.1 of the Tax Code of the Russian Federation). The billing period in our case is 2021 (from January 1 to December 31). Therefore, the calculation (DAM) for 2021 must be submitted to the Federal Tax Service no later than December 31 (Monday). Also see “Deadline for submitting calculations for insurance premiums for 2021.”

How does the new form differ from existing calculations?

The main difference of the new form of calculation is that it is drawn up in the same way as a tax return. This means that it includes only those indicators that relate to the accruals of the reporting (calculation) period. As for the amount of transferred contributions, as well as the balance of debt at the beginning and end of the period, they are not indicated in the new form.

But the current forms RSV-1, RSV-2, RV-3 and 4-FSS contain fields where you need to enter the amounts of not only accrued, but also paid contributions. This makes it possible to determine what debt the policyholder owed to the fund (or the fund to the policyholder) as of the last date of the period.

Annual calculation form: new or old?

Fill out the calculation of insurance premiums according to the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. The form can be downloaded from this link. Use the new calculation form only for reporting for the 1st quarter of 2018. For more details, see “Calculation form for insurance premiums for the 4th quarter of 2021.”

The composition of the current calculation form is as follows:

- title page;

- sheet for individuals who do not have the status of an individual entrepreneur;

- section No. 1 (includes 10 applications);

- section No. 2 (with one application);

- Section No. 3 – contains personal information about insured persons for whom the employer makes contributions.

Organizations and individual entrepreneurs making payments to individuals must include in the calculation of insurance premiums for the 4th quarter of 2021 (clauses 2.2, 2.4 of the Procedure for filling out the calculation of insurance premiums):

| title page |

| section 1 |

| subsections 1.1 and 1.2 of Appendix 1 to section 1 |

| appendix 2 to section 1 |

| section 3 |

In this composition, the annual calculation for 2021 should be received by the Federal Tax Service, regardless of the activities carried out in the reporting period (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940). In addition, if there are certain grounds, payers of insurance premiums must also include other sections and appendices. Let us explain the composition of the calculation in the table:

| Calculation element | Who fills it out |

| Title page | Filled out by all organizations and individual entrepreneurs |

| Sheet “Information about an individual who is not an individual entrepreneur” | Formed by individuals who are not individual entrepreneurs if they did not indicate their TIN in the calculation |

| Section 1, subsections 1.1 and 1.2 of appendices 1 and 2 to section 1, section 3 | Fill out all organizations and individual entrepreneurs that paid income to individuals from January 1 to December 31, 2021 |

| Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 | Organizations and individual entrepreneurs transferring insurance premiums at additional rates |

| Appendices 5 – 8 to section 1 | Organizations and individual entrepreneurs applying reduced tariffs (for example, conducting preferential activities on the simplified tax system) |

| Appendix 9 to section 1 | Organizations and individual entrepreneurs that, from January 1 to December 31, 2021, paid income to foreign employees or stateless employees temporarily staying in the Russian Federation |

| Appendix 10 to section 1 | Organizations and individual entrepreneurs that paid income to students working in student teams from January 1 to December 31, 2017 |

| Appendices 3 and 4 to section 1 | Organizations and individual entrepreneurs that paid hospital benefits, child benefits, etc. from January 1 to December 31, 2021 (that is, related to compensation from the Social Insurance Fund or payments from the federal budget) |

| Section 2 and Appendix 1 to Section 2 | Heads of peasant farms |

How to fill out the annual calculation: sequence

Start filling out the calculation for the 4th quarter of 2021 with the cover page. Then create section 3 for each employee you had in the 4th quarter. After this, fill out the Appendices to Section 1. And last but not least, Section 1 itself. In it you will summarize the data

Introductory information

The appearance of the new form is due to the fact that starting next year, the calculation and payment of contributions (except for contributions for injuries) will be supervised by the Federal Tax Service (see “Starting 2021, insurance premiums will come under the control of tax authorities: what changes await policyholders”).

In this regard, instead of calculations using forms RSV-1, RSV-2, RV-3 and 4-FSS, which are currently submitted to the funds, the policyholder will have to submit one calculation using the new form. It will be accepted by the Federal Tax Service, that is, the tax office. Please note: reporting to funds will not be completely eliminated next year. Policyholders will have to submit to the Pension Fund a monthly form SZV-M and a new annual report on experience (its form has not yet been approved).

Submit reports online to the Federal Tax Service, Pension Fund and Social Insurance Fund for free

It is necessary to submit to the social insurance fund a calculation of contributions “for injuries” according to the updated form 4-FSS (approved by order of the FSS of Russia dated September 26, 2016 No. 381; “The Social Insurance Fund approved the new form of calculation 4-FSS”).

How to submit a payment

There are two ways to transfer the calculation of insurance premiums for the 4th quarter of 2021 to the territorial tax service:

| On paper | Electronically |

| Allowed to be used by enterprises and businessmen whose number of employees does not exceed 25 people (inclusive). | A method for submitting a report, which is mandatory for organizations and individual entrepreneurs with a staff of 25 or more people. |

A mistake was made: what to do

When preparing reports, there remains a risk of entering data incorrectly. What the policyholder should do in such a situation depends on the consequences:

- A mistake made has reduced the amount of the payment - it is necessary to submit a “clarification” to the Federal Tax Service, which includes incorrectly filled out pages and section 3. Other sheets are attached only if it is necessary to make additions.

- Incorrect information did not change the results of calculations - submission of an updated calculation is carried out at the request of the policyholder.

By complying with the registration requirements and correctly performing computational steps, the enterprise will be able to correctly calculate insurance premiums in 2021. Instructions for filling out and useful recommendations prepared for you will help you avoid accounting errors. Below, as an example, you can calculate the calculations for the 1st quarter of 2021 in Excel format.

Read also

01.02.2017

Samples and examples of filling out the annual calculation for 2021

Most policyholders will fill out insurance premium calculations for the 4th quarter of 2021 electronically using special accounting software services (for example, 1C). In this case, the calculation is generated automatically based on the data that the accountant enters into the program. However, in our opinion, it is advisable to understand some principles of calculation formation in order to avoid mistakes. We will comment on the features of filling out the most common sections, and also provide examples and samples.

Title page

On the title page of the calculation of insurance premiums for the 4th quarter of 2017, you must, in particular, indicate the following indicators:

Reporting period

In the “Calculation (reporting) period (code)” field, indicate the code of the billing (reporting) period from Appendix No. 3 to the Procedure for filling out the calculation of insurance premiums. There are four possible values in total

- 21 – for the first quarter;

- 31 – for half a year;

- 33 – in nine months;

- 34 – per year.

Therefore, in the annual calculation of insurance premiums for 2017, the reporting period code will be “34”.

Federal Tax Service code

In the field “Submitted to the tax authority (code)” - indicate the code of the tax authority to which the calculation of insurance premiums is submitted. You can find out the value for a specific region on the Federal Tax Service website using the official service.

https://service.nalog.ru/addrno.do

Performance venue code

As this code, show a digital value indicating the ownership of the Federal Tax Service to which the DAM is submitted for the 4th quarter of 2021. Approved codes are presented in the table:

| Code | Where is the payment submitted? |

| 112 | At the place of residence of an individual who is not an entrepreneur |

| 120 | At the place of residence of the individual entrepreneur |

| 121 | At the place of residence of the lawyer who established the law office |

| 122 | At the place of residence of the notary engaged in private practice |

| 124 | At the place of residence of the member (head) of the peasant (farm) enterprise |

| 214 | At the location of the Russian organization |

| 217 | At the place of registration of the legal successor of the Russian organization |

| 222 | At the place of registration of the Russian organization at the location of the separate division |

| 335 | At the location of a separate division of a foreign organization in Russia |

| 350 | At the place of registration of the international organization in Russia |

Name

Indicate the name of the organization or full name of the individual entrepreneur on the title page in accordance with the documents, without abbreviations. There is one free cell between words.

OKVED codes

In the field “Code of the type of economic activity according to the OKVED2 classifier”, indicate the code according to the All-Russian Classifier of Types of Economic Activities.

Previously, the OKVED classifier was in effect (OK 029-2007 (NACE Rev. 1.1)). However, starting in January 2021, it was replaced by the OEVED2 classifier (OK 029-2014 (NACE Rev. 2)). Use it when filling out the calculation of insurance premiums for the 4th quarter of 2021. Here is an example of how to fill out the title page as part of the calculation of insurance premiums (DAM) for the 4th quarter of 2021:

The sheet “Information about an individual who is not an individual entrepreneur” is filled out by citizens who submit payments for hired workers, if he did not indicate his TIN in the calculation. On this sheet, the employer indicates his personal data.

Section 3: Personalized employee data

Section 3 “Personalized information about insured persons” as part of the calculation of insurance premiums for the 4th quarter of 2021 must be filled out for all insured persons for October, November and December 2017, including in whose favor payments were accrued for January - December 2017 within the framework of labor relations and civil contracts. Subsection 3.1 of Section 3 shows the personal data of the insured person - the recipient of the income: Full name, Taxpayer Identification Number, SNILS, etc.

In subsection 3.2 of Section 3, provide information on the amounts of payments calculated in favor of the individual, as well as information on accrued insurance contributions for compulsory pension insurance. Here is an example of filling out section 3.

Payments to an employee - a citizen of the Russian Federation and accrued contributions to compulsory pension insurance for the 4th quarter of 2021.

| Index | October | november | December | 4th quarter |

| All payments | 28 000 | 28 181,45 | 28 000 | 84 181,45 |

| Non-taxable payments | – | 4 602,90 | – | 4 602,90 |

| Contribution base | 28 000 | 23 578,55 | 28 000 | 79 578,55 |

| Contributions to OPS | 6 160 | 5 187,28 | 6 160 | 17 507,28 |

Under these conditions, section 3 of the calculation of insurance premiums for the 4th quarter of 2021 will look like this:

Please note that for persons who did not receive payments for the last three months of the reporting period (October, November and December), subsection 3.2 of section 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums).

But what about employees who quit in the previous reporting period? That is, during the period from January to September (inclusive)?

Include dismissed employees in the total number of insured persons (column 1 of line 010 of subsection 1.1 of appendix 1 to section 1). Show employees who quit in the previous quarter in subsection 3.1 of the calculation of insurance premiums. You have not accrued payments to such employees in the last three months, so do not fill out subsection 3.2 for them.

Copies of section 3 of the calculation must be given to employees. The period is five calendar days from the date when the person applied for such information. Give each person a copy of Section 3, which contains information only about them. If you submit calculations in electronic formats, you will need to print paper copies. Give the extract from Section 3 to the person also on the day of dismissal or termination of the civil contract. The extract must be prepared for the entire period of work starting from January 2021.

Check SNILS

Some Federal Tax Service Inspectors, before submitting calculations for insurance premiums for the 4th quarter of 2021, sent out information messages about changes in the technology for receiving reports. Such messages note that settlements will not be considered accepted if information about individuals does not match the data in the Federal Tax Service databases. Problems may arise, for example, with SNILS, date and place of birth. Here is the text of such an information message:

Dear taxpayers (tax agents)!

Please note that the algorithm for accepting calculations for insurance premiums has been changed (in accordance with the order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ “On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance contributions in electronic form").

In case of unsuccessful identification of insured individuals reflected in section 3 “Personalized information about insured persons”, a refusal to accept the Calculation will be generated.

Previously, when a single violation was detected - unsuccessful identification of insured individuals from section 3, a Notification of clarification was automatically generated (in this case, the calculation was considered accepted).

In order to avoid refusal to accept Calculations for insurance premiums due to a discrepancy between the information on the persons indicated in the calculation and the information available with the tax authority, we recommend that you verify the personal data of individuals indicated in the calculation (full name, date of birth, place of birth, Taxpayer Identification Number, passport details , SNILS) for the purpose of presenting outdated data in the calculation. Also, similar data must be verified with the information contained in the information resources of the Pension Fund of the Russian Federation for unambiguous identification of the SNILS of the insured individual.

Basic information on the DAM

Starting from 2021, the administration of insurance premiums has been transferred to the Federal Tax Service. The Federal Tax Service, by its order No. ММВ-7-11/551, introduced the RSV reporting form (KND 115111) for insurance premiums with its own deadlines, penalties and responsibilities. This form is intended to replace the previously existing RSV-1 (information about length of service is still transferred to the Pension Fund of the Russian Federation with the form SZV-STAZH).

Calculation of insurance premiums is submitted to the tax office by all policyholders, that is, organizations and entrepreneurs who make payments to individuals. The calculation period for filling out the DAM is the calendar year. The following table shows the reporting periods for this calculation, as well as the deadlines for its submission.

Table 1. Deadlines for filing the DAM in 2021

| Reporting/billing period | expiration date |

| 2017 (calculation period) | January 30, 2018 |

| I quarter 2018 | April 30, 2018 |

| half year 2018 | July 30, 2018 |

| 9 months 2018 | October 30, 2018 |

| 2018 (calculation period) | January 30, 2019 |

Policyholders with an average number of insured persons over the past year of 25 people or more are required to report electronically. The rule also applies to new organizations with a specified number of employees. If the number of insured persons is less than 25 people, then the policyholder can report both electronically and in paper form.

Appendix No. 3 to section 1: benefits costs

In Appendix 3 to Section 1 as part of the annual DAM for 2021, record information on expenses for the purposes of compulsory social insurance (if such information is not available, then the Appendix is not filled out, since it is not mandatory).

In this application, show only benefits from the Social Insurance Fund accrued in 2021. The date of payment of the benefit and the period for which it was accrued do not matter. For example, reflect a benefit accrued at the end of December and paid in January in the calculation for the year. Reflect sick leave benefits, which are open in December and closed in January, only in calculations for the 1st quarter of 2021.

Benefits at the expense of the employer for the first three days of illness of the employee should not appear in Appendix 3. Enter all data into this application on an accrual basis from the beginning of 2021 (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

As for the filling example, the lines of Appendix 3 to Section 1 should be formed as follows:

| In column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation). |

| In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation): – in lines 010 – 031 and 070 – the number of days for which the benefit was accrued at the expense of the Social Insurance Fund; – in lines 060 – 062 – the number of monthly child care benefits. For example, if you paid benefits to two employees throughout the year, enter 24 in line 060; – in lines 040, 050 and 090 – the number of benefits. |

Here is a sample of the reflection of benefits as part of the calculation for the 4th quarter of 2021. In 2021 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for October, November, December, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles;

- total benefits accrued - 44,439.90 rubles. (RUB 22,902.90 + RUB 21,537.00).

Contributions to pensions and medicine: subsections 1.1 – 1.2 of Appendix 1 to section. 1

Appendix 1 to section 1 of the calculation includes 4 blocks:

| № | Block |

| 1 | subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” |

| 2 | subsection 1.2 “Calculation of insurance premiums for compulsory health insurance” |

| 3 | subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation” |

| 4 | subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations” |

In line 001 “Payer tariff code” of Appendix 1 to section 1, indicate the applicable tariff code. See “Insurance premium rate codes in 2021: table with explanation.”

In the annual calculation for the 4th quarter of 2021, you need to include as many appendices 1 to section 1 (or individual subsections of this appendix) as tariffs were applied during 2021 (from January to December inclusive). Let us explain the features of filling out the required subsections.

Subsection 1.1: pension contributions

Subsection 1.1 is a mandatory block. It contains the calculation of the taxable base for pension contributions and the amount of insurance contributions for pension insurance. Let us explain the indicators of the lines of this section:

- line 010 – total number of insured persons;

- line 020 – the number of individuals from whose payments you calculated insurance premiums in the reporting period (from January to December 2017);

- line 021 – the number of individuals from line 020 whose payments exceeded the maximum base value for calculating pension contributions (See “Limit value of the base for pension contributions in 2021”);

- line 030 – amounts of accrued payments and rewards in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not included here;

- in line 040 reflect: the amount of payments not subject to pension contributions (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is reflected within the limits determined by paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

- on line 061 - from a base that does not exceed the limit (RUB 876,000);

Record the data in subsection 1.1 as follows: provide data from the beginning of 2021, as well as for the last three months of the reporting period (October, November and December 2021).

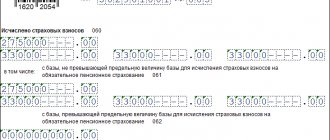

Example: An organization using the general regime charges contributions at basic rates. It employs 10 people.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions: – to OPS | 249 634 | 65 264,76 | 64 292,04 | 70 733,74 | 449 924,54 |

| – on compulsory medical insurance | 57 869,70 | 15 129,56 | 14 904,06 | 16 397,37 | 104 300,69 |

Subsection 1.2: medical contributions

Subsection 1.2 is a mandatory section. It contains the calculation of the taxable base for health insurance premiums and the amount of insurance premiums for health insurance. Here is the principle of forming strings:

- line 010 – total number of insured persons for 12 months of 2017.

- line 020 - the number of individuals from whose payments you calculated insurance premiums;

- line 030 – amounts of payments in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not shown on line 030;

- on line 040 – amounts of payments: not subject to insurance contributions for compulsory health insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation.

Subsection 1.3 – fill out if you pay insurance premiums for compulsory pension insurance at an additional rate. And subsection 1.4 - if from January 1 to December 31, 2021, you transferred insurance contributions for additional social security for members of flight crews of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.

Section 2: heads of peasant farms

Section 2 of the calculation of insurance premiums for the 1st quarter of 2021 should be prepared only for the heads of peasant (farm) farms. This section is a set of indicators about the amounts of insurance premiums payable to the budget for them. Here's what information you need to enter in this section:

| Section 2: heads of peasant (farm) households | |

| Section 2 lines | Filling |

| 010 | OKTMO code (in which territory insurance premiums are paid). |

| 020 and 030 | BCC for insurance premiums for pension insurance and the amount of pension contributions payable in 2021. |

| 040 and 050 | BCC for medical contributions and the amount of contributions payable in 2017. |

Appendix 1: calculation of the amounts of contributions for the head and members of the peasant farm

In Appendix 1 to Section 2 of the calculation of insurance premiums for the 1st quarter of 2021, show information personally for each member of the peasant farm, namely:

- in lines from 010 to 030 - full name;

- in line 040 – TIN;

- in line 050 – SNILS;

- in line 060 – year of birth;

- in line 070 – the date of joining the peasant farm in 2021 (if the joining took place from January to March inclusive);

- in line 080 - the date of exit from the peasant farm in 2021 (if the exit took place from January to March inclusive).

- in line 090 - the amount of insurance premiums payable to the budget for each member of the peasant farm based on the results of the 1st quarter of 2021.

Contributions for disability and maternity: Appendix No. 2 to Section 1

Appendix 2 to Section 1 calculates the amount of contributions for temporary disability and in connection with maternity. The data is shown in the following context: total from the beginning of 2021 to December 31, as well as for October, November and December 2021. In field 001 of Appendix No. 2, you must indicate the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity:

- “1” – direct payments of insurance coverage (if there is a FSS pilot project in the region, See “Participants in the FSS pilot project”);

- “2” – offset system of insurance payments (when the employer pays benefits and then receives the necessary compensation (or offset) from the Social Insurance Fund).

If there is no FSS pilot project in your region, then you have the right to reduce mandatory social contributions for benefits. Show the total amounts in line 090 of Appendix 2 to Section 1. These figures will always be positive, even if the benefits exceeded insurance contributions to the Social Insurance Fund.

Negative amounts of accrued contributions as part of the calculation of insurance premiums for the 4th quarter of 2021 should not be recorded. After all, officials from the Pension Fund of the Russian Federation will not be able to distribute the amounts with a minus to the individual personal accounts of employees.

Sometimes benefits costs exceed accrued medical premiums. Some accountants record this difference in line 090 of Appendix No. 2 to Section 1 of the calculation with a minus sign. However, this is wrong. In such a situation, specify the line 090 attribute:

- “1” if the amount in line 090 is greater than or equal to 0;

- "2" if the amount is less than 0.

If you send to the Federal Tax Service a calculation of insurance premiums for the 4th quarter of 2021 with negative values, then you will need to submit an updated report (letters from the Federal Tax Service dated August 23, 2021 No. BS-4-11/16751, dated August 24, 2021 No. BS- 4-11/16793).

Some accountants do not pay attention to such filling rules. And they show negative contribution amounts with code 1. This error should be corrected:

| In line 090 of Appendix 2 to Section 1, enter the positive values of the amounts with code 2. Check that lines 110-123 of Section 1 also contain positive numbers. |

Let’s assume that there are 10 people in the organization; the organization accrues and pays benefits to them itself. The amounts of payments, contributions to VNiM and benefits accrued from the Social Insurance Fund for all employees for 2017 are shown in the table.

| Index | 9 months | October | november | December | year |

| Payments | 1 153 000 | 303 837 | 304 018,45 | 328 696 | 2 089 551,45 |

| Non-taxable payments | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

| Contribution base | 1 134 700 | 296 658 | 292 236,55 | 321 517 | 2 045 111,55 |

| Contributions to VNiM | 32 906,30 | 8 603,08 | 8 474,86 | 9 323,99 | 59 308,23 |

| Benefits from the Social Insurance Fund | 18 300 | 7 179 | 11 781,90 | 7 179 | 44 439,90 |

Line indicator 090 of Appendix 2 to section. 1 is formed like this:

- in column 2 – 14,868.33 rubles. (RUB 59,308.23 – RUB 44,439.90);

- in column 4 – 262.03 rubles. (RUB 26,401.93 – RUB 26,139.90);

- in column 6 – 1,424.08 rubles. (RUB 8,603.08 – RUB 7,179);

- in column 8 – -3,307.04 rub. (RUB 8,474.86 – RUB 11,781.90);

- in column 10 – RUB 2,144.99. (RUB 9,323.99 – RUB 7,179).

Section 1: Summary Data

In section 1 of the annual calculation for 2021, reflect the general indicators for the amounts of insurance premiums payable. The part of the document in question consists of lines from 010 to 123, which indicate OKTMO, the amount of pension and medical contributions, contributions for temporary disability insurance and some other deductions. Also in this section you will need to indicate the BCC by type of insurance premiums and the amount of insurance premiums for each BCC that are accrued for payment for 2021.

Pension contributions

On line 020, indicate the KBK for contributions to compulsory pension insurance. On lines 030–033 - show the amount of insurance contributions for compulsory pension insurance, which must be paid to the above BCC:

- on line 030 – for the reporting period on an accrual basis (from January to December inclusive);

- on lines 031-033 – for the last three months of the billing (reporting) period (October, November and December).

Medical fees

On line 040, indicate the BCC for contributions to compulsory health insurance. On lines 050–053 – distribute the amounts of insurance premiums for compulsory health insurance that must be paid:

- on line 050 - for the reporting period (2017) on an accrual basis (that is, from January to December);

- on lines 051 – 053 for the last three months of the reporting period (October, November and December).

Pension contributions at additional rates

On line 060, indicate the BCC for pension contributions at additional tariffs. On lines 070 – 073 – amounts of pension contributions at additional tariffs:

- on line 070 – for 2021 (from January 1 to December 31);

- on lines 071 – 073 for the last three months of the reporting period (October, November and December).

If there were no payments for additional tariffs, then enter zeros.

Additional social security contributions

On line 080, indicate the BCC for contributions to additional social security. On lines 090–093 – the amount of contributions for additional social security:

- on line 090 – for 2021 (for 12 months) on an accrual basis (from January to December inclusive);

- on lines 091 – 093 for the last three months of the reporting period (October, November and December).

Social insurance contributions

On line 100, indicate the BCC for contributions to compulsory social insurance in case of temporary disability and in connection with maternity. On lines 110 – 113 – the amount of contributions for compulsory social insurance:

- on line 110 - for the entire year 2021 on an accrual basis (from January to December inclusive);

- on lines 111 – 113 for the last three months of the billing (reporting) period (that is, for October, November and December).

On lines 120–123, indicate the amount of excess social insurance expenses incurred:

- on line 120 – for 12 months of 2021

- on lines 121–123 – October, November and December 2021.

If there were no excess expenses, then enter zeros in this block.

Additional contributions to the Federal Tax Service: nuances

You are required to pay additional contributions to the Pension Fund of the Russian Federation, administered by the Federal Tax Service in the manner discussed above, in accordance with Art. 428 Tax Code of the Russian Federation:

1. Employers hiring employees in places with hazardous working conditions (for types of work defined by law) - at a rate of 9%.

2. Employers hiring employees for places with difficult working conditions (also for certain types of work) - at a rate of 6%.

3. Employers under clause 1 or 2, hiring employees for places with harmful or hazardous working conditions - at rates depending on the class (subclass) of danger or harmfulness assigned based on the results of a special assessment.

Thus, the highest rate is set for class 4 (hazardous working conditions) - 8%, the lowest - for subclass 3.1 (harmful conditions) - 2%.

If a company is obliged to pay additional contributions under clause 3, then it does not pay those provided for in clauses 1 or 2.

Another type of contribution to the Pension Fund is payments for additional social security. In accordance with Art. 429 of the Tax Code of the Russian Federation, these contributions are paid:

- firms that are employers of airplane and helicopter crews - at a rate of 14%.

- firms that are employers in the coal industry - at a rate of 6.7%.

At the same time, the lists of economic entities that are required to apply the designated social security tariffs are established by law.

Checking the calculation using control ratios

If you have compiled a calculation of insurance premiums for the 4th quarter of 2017 and are submitting it to the Federal Tax Service, then keep in mind that controllers will check it for compliance with control ratios. At the same time, updated ratios are applied from the reporting for the 4th quarter of 2021. The controls and formulas established for the acceptance of settlements were communicated to taxpayers in the letter of the Federal Tax Service of Russia dated December 13, 2021 No. GD-4-11/25417. Also see New Benchmark Ratios Effective 2021.

In this case, you can first check the generated file with the annual calculation for compliance with the specified control ratios. As reported on the official website of the tax department, a new functionality has been added to the “Legal Taxpayer” program that allows you to identify errors in the calculation of insurance premiums (https://www.nalog.ru/rn77/program/5961229/). The adjustment is related to the corresponding innovations of the Tax Code (paragraph 2, paragraph 7, article 431 of the Tax Code of the Russian Federation as amended by paragraph 78, article 2 of the Federal Law of November 27, 2021 No. 335-FZ).

Tax officials noted that from January 1, 2021, when accepting a calculation (updated calculation) for insurance premiums, the tax authority will monitor not only the discrepancy in information about the calculated amounts of insurance premiums for compulsory health insurance, but also the discrepancy in the following parameters:

- amounts of payments and other remuneration in favor of individuals;

- bases for calculating insurance premiums for compulsory health insurance within the established limit;

- bases for calculating insurance premiums for compulsory health insurance at an additional rate;

- amounts of insurance premiums for compulsory health insurance at an additional rate.

The calculation of insurance premiums is checked for compliance with the indicators from the 6-NDFL report. For example: The amount of accrued income subject to personal income tax, minus dividends (line 020 indicator minus the amount on line 025 of the calculation in Form 6-NDFL), must be greater than or equal to the amount of income on line 030 “Amount of payments and other remuneration calculated in favor of individuals » subsection 1.1 of Appendix 1 of the single calculation for the corresponding period.

Possible liability

For late submission of calculations for insurance premiums for the 4th quarter of 2021, the Federal Tax Service may fine an organization or individual entrepreneur 5 percent of the amount of contributions that is subject to payment (additional payment) based on the calculation. Such a fine will be charged for each month (full or partial) of delay in submitting the calculation. However, the total amount of penalties cannot be more than 30 percent of the amount of contributions and less than 1,000 rubles. For example, if you paid the settlement fees in full on time, then the fine for late submission of the calculation will be 1000 rubles. If only part of the contributions is transferred on time, then the fine will be calculated from the difference between the amount of contributions indicated in the calculation and the amount actually paid (Article 119 of the Tax Code of the Russian Federation).

From January 1, 2021, DAM will not be accepted for the following reasons: errors in the amount of payments and other remunerations, errors in the base for calculating “pension” contributions within the limit, errors in the base for calculating “pension” contributions for additional tariffs, as well as errors in the amount of the “pension” contributions themselves (“regular” and at additional tariffs). The condition for data discrepancy now looks like this: a discrepancy between the amounts of the same indicators for all individuals and the same indicators for the payer as a whole. As for inaccurate personal data, they will also remain on the list of reasons for non-acceptance of payment of contributions. In 2021, tax authorities, as before, must notify the policyholder of unsubmitted calculations. The notification period remains the same: no later than the day following the day of receipt of the calculation in electronic form (or 10 days following the day of receipt of the calculation in paper form). The policyholder must correct the violations and submit a new calculation within 5 days from the date of sending the notice in electronic form (or within 10 days from the date of sending the “paper” notice). If these deadlines are met, the date of submission will be considered the day the initial calculation is submitted.

It is worth noting that the Ministry of Finance of the Russian Federation in its letter dated 04/21/2017 No. 03-02-07/2/24123 indicated that the calculation of insurance premiums not submitted to the Federal Tax Service on time is not a basis for suspending transactions on the accounts of the insurance premium payer. That is, you don’t have to worry about blocking your account for late payment for the 4th quarter of 2021.

Read also

20.11.2017

Reduced contributions to the Federal Tax Service: grounds for application and rates

Only employer firms can pay insurance contributions to the Federal Tax Service using various benefits. For individual entrepreneurs without employees, there is no opportunity to reduce the payment for the corresponding benefit, unless otherwise expressly provided by law (later in the article we will look at examples of such privileges).

Employers can transfer insurance payments to the Federal Tax Service (depending on their status, organizational and legal form and other grounds):

- using reduced rates for contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund in 2017–2019 and other periods;

- in the Pension Fund of the Russian Federation - at a reduced rate, and in the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund - at a zero rate;

- don't pay any fees at all.

Let's consider what criteria determine the possibility of using these benefits by employer firms.