The act of decommissioning a vehicle (OS-4A) is a standard form, when filled out, the disposal of the institution’s vehicle is carried out. This article will present the rules for filling out the document, a template of the act and a sample drafting.

Basic moments

A report is drawn up when it is determined that the transport has become unusable and poses a certain threat during further operation. The document is drawn up by the commission after examining the transport. Based on the results of the survey, a decommissioning act for the vehicle is drawn up in the OS-4a form.

The document is drawn up in 2 copies, certified by the commission members approved by order of the head of the institution and signed by the management of the enterprise.

One copy is sent to the accounting department, the other is given to the person who reports to the transport or to the chairman of the commission. Based on the act, the responsible person delivers the suitable elements and the scrap metal remaining after write-off to the warehouse.

- When filling out the form, in the 1st section, data on transport is filled in, displaying the revaluation and the cost of restoration as a result of repairs performed (if any). For vehicles that have not undergone revaluation, data on the initial cost at the time the vehicle is registered in the accounting department is entered.

- In the 2nd section “Accrual of depreciation (wear and tear)…” the amount of calculated depreciation from the time the vehicle was put into operation is displayed.

- The 3rd section is intended for entering information about the technical characteristics of transport.

- In the 4th section “Data on registration ...”, data on the cost of parts and assemblies suitable for further use after disassembling the vehicle and entering the warehouse is filled in.

- The costs of disassembling a car are displayed in the 5th section “Cost data...”

- At the end of the document, the amount to be written off is entered and a signature is placed. accountant.

Information about the results of liquidation is entered into the inventory card (journal) for accounting for fixed assets (form No. OS-6)

Where is the vehicle write-off act used?

An act for writing off a car is drawn up when:

- A vehicle breakdown that cannot be repaired.

- Any type of excessive wear.

- In the event of a defect in vehicle components that cannot be restored.

At the same time, to assess the level of deterioration and unsuitability of the vehicle for further use, the vehicle is inspected by a special commission with the participation of highly qualified specialists.

The head of the automobile enterprise issues an order to remove the vehicle from the institution’s balance sheet, based on the OS-4a liquidation act signed by the commission members. The document is filled out in 2 copies, with one copy being submitted to the accounting department and the other to the chairman of the commission. The results of the liquidation of the vehicle are noted in the OS inventory record card in accordance with the OS-6 form.

( Video : “Filling out a vehicle write-off report”)

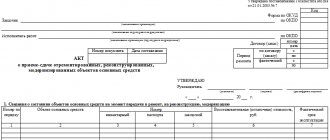

Sample of filling out form OS-4a

In the header of the act of writing off motor vehicles (f. 0306004), fill in the name of the organization, OKPO code, date of write-off of fixed assets from accounting, account, subaccount, analytical accounting code. Next comes the manager’s signature, document number and date of preparation.

The main part of the OS-4a form contains 5 tables. Before you start filling them out, describe the vehicle in detail: make, model, numbers (factory, registration, etc.). The information is certified by the signature of the financially responsible person.

Table 1 consists of 7 columns and contains information about the technical condition of the car at the time of write-off. Table 2 contains information about the cost: the initial cost of the car, the amount of accrued depreciation, the residual value.

Table 3 “Brief characteristics of the fixed asset object” consists of 11 columns and contains information about the registration certificate number, engine number, vehicle load capacity and its weight. Below the table there are lines for a detailed description of other characteristics of the machine, the conclusion of the commission, and the list of attached documents. The chairman and members of the commission must sign.

Table 4 “Information on the acceptance for accounting of dismantled main parts and assemblies” consists of 9 columns and contains the characteristics of the parts.

Table 5 “Information on the costs associated with writing off vehicles from accounting” consists of information on the costs incurred for dismantling and writing them off, and what came from their write-off.

Below the tables it is necessary to summarize: what are the results of the write-off, the proceeds from sales. The chief accountant of the enterprise signs the act.

If you are filling out an act for the first time, spend a little time and familiarize yourself with a sample of filling out an act for writing off vehicles. Having previously studied the sample for filling out the OS-4a form, you will quickly fill out the form and avoid making mistakes.

Where is the vehicle write-off act used?

- A vehicle breakdown that cannot be repaired.

- Any type of wear.

- The vehicle is defective beyond repair.

At the same time, in order to assess the degree of wear and tear and unsuitability of the transport for further use, an assessment is carried out by a special authority. The manager of the company writes an order to write off an object (you can find this example here). The commission fills out Act OS-4a in 2 copies, where the first is given to the accountant, and the second remains with the chairman of the expert commission (appointed by the head of the organization). The results of writing off the car are reflected in the inventory card for recording fixed assets in the form: OS-6, OS-6a or OS-6b. Inventory card can be found in this article: “Inventory card OS-6“.

Basic rules for drawing up an act on write-off of auto funds

This document does not have a unified template that is mandatory for use, so each enterprise has the right to independently develop its own template for the act or write it in free form. The main requirement is that it must contain information about the company on whose balance sheet the vehicle being written off is listed, as well as detailed information about the write-off object. In addition, the document must have the signatures of all members of the commission and the approving autograph of the head of the enterprise. In the future, the fact of write-off must be reflected in the inventory documentation.

It is customary to create a write-off act in one copy, which is transferred to the organization’s accounting department.

Instructions for filling out a defect report

- At the beginning of the document, the date and number of the order for approval of the form of the defective act adopted in this particular organization are indicated.

- Then information about the enterprise is entered: its name indicating the organizational and legal form, as well as the structural unit or department in which the machinery and equipment is inspected to identify defects.

- Next, enter the last name, first name, and patronymic of the head of the organization, with whose sanction the inventory of property is being carried out, and also put the date of inspection and a seal (it is not necessary to put a seal, since from 2021 legal entities, as well as individual entrepreneurs, may in principle not use it).

- Below enter the name of the document, as well as its number according to internal document flow. Then, again, the date of compilation of the document is indicated and the address where the object being checked is located is entered.

- The next step is to enter the date and number of the order that served as the basis for the work of the expert commission, as well as its composition. Employees included in the commission must be indicated with the full name of their position, last name, first name and patronymic.

- Next, fill in detailed information about the equipment that was tested: enter its name, series, number, etc., as well as the date of production and commissioning.

Below is information about the identified malfunctions, their units of measurement and quantity are entered. Wording reflecting the essence of the breakdowns must be carefully thought out; they must be as clear and correct as possible. - Then options for eliminating them are proposed, as well as, if this is not possible, then the corresponding reasons.

- In the last section of the defective act, members of the expert commission must confirm the data entered into the document by placing their signatures opposite the indicated positions with the obligatory decoding.

The main purpose of the defective act

A defect report is usually drawn up upon inspection of equipment (or other material assets), when defects or breakdown of an asset are detected. Inspection can be carried out during acceptance of equipment (materials), during inventory and in other cases.

A defect report is a special accounting document that records all defects, deficiencies, equipment breakdowns, etc. identified during an inspection of an asset. The report refers to the primary documentation and is drawn up on the basis of the conclusion of a commission of experts. The commission is appointed by the management of the organization that owns the asset, which inspects and checks the property. Typically, the commission includes employees of the enterprise, technical experts, representatives of interested organizations - counterparties of the owner of the assets being inspected.

During a technical inspection or testing the performance of equipment, a commission of experts may identify defects or breakdown of an asset. In this case, the decision to repair or write off the asset is made by the members of this authorized commission, based on the general conclusions based on the results of the inspection and the expert opinion, which is entered into the report.

A defect report may be the basis for a decision to write off fixed assets, carry out repair work, and even legal proceedings in the event of unresolved serious contradictions between interested organizations.

If the act is drawn up incorrectly, this may cause a refusal to recognize tax costs for repairs or write-off of assets, a refusal to satisfy a lawsuit, or when resolving a dispute between interested business entities in court. Which will lead to additional losses and financial costs.

In general, the act is a two-page form containing several sections that must be filled out:

- title part;

- tabular part;

- conclusion;

- signatures of members of the expert commission.

The defective act is considered a fairly important document, since it has a direct impact on the organization’s budget and contains legally establishing aspects. Therefore, filling out the act requires compliance with current legislative norms and standards. However, some modification of the unified form of the act itself is allowed, but this does not cancel the indication of all mandatory details and data in it, otherwise it will not have any legal force and will lose its meaning.

Who draws up an act for writing off car funds?

This document is prepared by a specialist from the accounting department. This is due to the fact that any write-off of fixed assets of an enterprise is subject to accounting and tax accounting. However, in order to first certify the reasons for writing off a vehicle, a special commission is created in the organization. The order for its formation is issued by the head. It must include a specialized specialist (mechanic, driver, etc.), as well as employees of other structural divisions.

After the commission concludes that it is impossible to further use the vehicle, a write-off report is drawn up.

As a rule, in large enterprises all actions of the commission are subject to a specific, strictly established algorithm.

Rules for drawing up a defective act

Let us note that in order to inspect the equipment, a special authorized commission is assembled, consisting of representatives of all interested organizations, these can be: supplier, transporter, contractor - installer, repairman, as well as, of course, technical experts and representatives of the organization that currently owns the equipment (mathematically responsible person, shop manager). The act is approved by the director of the owner organization and endorsed by the chief accountant.

In order to avoid unnecessary financial losses for the enterprise, members of the expert group usually follow the procedures and requirements for drawing up a defect report, conduct a thorough inspection of the equipment and record all identified defects in the report.

Inspection activities and signing of reports must be carried out in the presence of all authorized persons. There should be no corrections or errors in the acts. Additional expert opinions, technical documentation, etc. may be attached to the act. Signatures of all authorized members of the commission are placed only when the inspection process is completed and no one has any claims or disagreements regarding the conclusion.

All persons signing the act must agree with the general conclusion, and if there are persons who disagree with the conclusion of the act, they must reflect their opinion in the act and also sign it. Those who disagree can also appeal the commission's decision in a legally established court.

Note that, although there are legislative opportunities to use arbitrary acceptance certificates, standard forms are usually used, since they clearly indicate the main key points of equipment inspection. Correctly and accurately filling out all the necessary positions of standard documents will allow you to avoid many controversial and conflict situations.

The report must indicate all the nuances of the results of the equipment inspection. The summary table indicates how many items with a defect were detected and describes the exact nature of the identified faults and defects. Defects are examined for their possible elimination; in the final part of the report, general conclusions are formulated about the possible elimination of defects/malfunctions or write-off of equipment, indicating why the identified defects cannot be eliminated.

The defect report refers to primary documents that, first of all, characterize the technical condition of equipment or other valuables, therefore the valuation is not indicated in this act, although sometimes in the conclusion the commission notes the total amount of write-off of valuables.

After drawing up the act, on its basis, the commission members make a decision on the write-off of valuables or on carrying out restoration work, list them, and indicate the total estimated cost of the required work. The equipment is then written off or repaired.

What is needed to dispose of a car at the traffic police

A package of documents for recycling a car by an individual, which is approved by the Order of the Ministry of Internal Affairs of Russia “On the Procedure for Registration of Vehicles” No. 1001 dated November 24, 2008:

- Passport of a citizen of the Russian Federation.

- Technical certificate.

- Certificate confirming the registration of the car.

- Statement of desire to dispose of the vehicle.

- Registration plates (if available).

- General power of attorney and a notarized copy of the power of attorney (in case of application by a proxy).

If any of the above or even everything is lost, then it’s okay, come with what is available from the list above.

What does it take to scrap a car? Procedure:

1To dispose of a vehicle completely (with components), you need to collect all the above documents. After which the traffic police inspector will issue the appropriate certificate.

2When writing off a vehicle without recycling the units, you need to carry out a number of additional actions:

- Check all the numbers on the units, but if the car is not capable of moving on its own, you should call an expert to your home, who will inspect the car and issue an opinion.

- Make payment for the remaining numbered unit during machine recycling.

- Give the collected documents to the inspector, who will issue a reference document about the released unit.

The state duty that must be paid for removing a car from state registration during disposal is 200 rubles,” this is for issuing a certificate for released license plate units, which is provided for in Art. 333.33 Tax Code.

Thus, after deregistration of the car, the relevant information will be transferred to the tax office within 10 days for recalculation of the transport tax.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Act for write-off of technical equipment”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Application of the unified form of defective act OS-16

A defect report is usually used upon acceptance, acceptance for installation, commissioning or testing of purchased equipment if defects or shortcomings are identified that are significant and may, for example, affect its suitability for use or require additional repair of the equipment. The form of the act is a unified form OS-16, but is not a strictly established model and can be changed.

Depending on the situation and whose fault the breakdown occurred, representatives of the supplier, transporter, installation contractor or other interested parties, as well as external technical experts, may be involved in drawing up a defect report. Depending on the situation, the required number of copies is also drawn up and signed, one for each party.

Let us further consider, in addition, two more modifications of the standard form of the defect report, which are also often used to reflect identified equipment defects. One of these forms is intended for discarding equipment, and the other is for equipment that is expected to be repaired in the future. The “repair” form of the defect report is also used to draw up the conclusion of the technical assessment commission for residential or non-residential premises.

general information

To write off unusable cars, a separate form has been developed, since this type of fixed assets has many special characteristics, unlike others for which the OS-4 form is suitable. Form OS-4a was introduced into use by Decree of the State Statistics Committee No. 7 of January 21, 2003.

For information! This form is unified and mandatory until the end of 2012. Since 2013, it has become recommended, so today companies can use forms created independently with the information they need. However, the basic details of the document must be indicated.

To fill out the form and carry out the procedure, a special commission is created by order of the management; its composition should include from 2 to 4 people. The manager can appoint such employees as heads of departments, chief engineers, and mechanics.

The objectives of the vehicle write-off act are as follows:

- confirmation of the fact that the vehicle is unusable and written off;

- recording the amounts that go towards dismantling, write-off and those received from write-off;

- Based on this document, the accounting department makes the appropriate entries in the company's accounting records.

The document is required in two copies: the first - for the financially responsible person, the second - for the accounting department.

The document is signed by the chairman, members of the commission, chief accountant and head of the company (he is the last to approve the act).

Related documents

- Act on write-off of low-value and high-wear items. Form No. MB-8

- Certificate of write-off of technical equipment

- Certificate of write-off of technical equipment

- Act on liquidation of fixed assets (in relation to standard form No. os-4)

- Certificate of acceptance and transfer of fixed assets. Form No. os-1

- Cash audit report (instruction of the Central Bank of the Russian Federation dated 10/04/93 No. 18 (as amended on 02/26/96)

- Act of markdown of goods

- Act-receipt for the performance of warranty and paid work on the repair of telephone sets. Form No. tf-2-22 (letter of the Ministry of Finance of the Russian Federation dated February 22, 1994 No. 16-36)

- Act-request for replacement (additional supply) of materials. Form No. m-10

- Analytical data on accounting for the costs of procuring and purchasing materials for journal order No. 6

- Analytical data on accounting for deviations in the cost of materials for journal order No. 6

- Certificate of assessment of the value of buildings and structures approved. Ministry of Agriculture of the Russian Federation on January 22, 1992 (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm)

- Certificate of assessment of the cost of machinery, equipment and transport (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Certificate of assessment of the cost of unfinished capital construction (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act on the assessment of the value of working capital (appendix to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act of transfer (sale) of collective farm (state farm) property to the rural (settlement) council of people's deputies (appendix to the regulations on the commission for land privatization and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- An acceptance certificate

- Balance sheet of an insurance organization (quarterly). Form No. 1-insurer (Order of Rosstrakhnadzor dated April 16, 1996 No. 02-02/12)

- Balance sheet of the enterprise (Form No. 1 for capital) (approved by Letter of the Ministry of Finance of the Russian Federation dated October 13, 1993 No. 114 for annual reporting for 1993)

- Balance sheet of an insurance organization - form No. 1 - insurer. (approved by the Russian Federal Service for Supervision of Insurance Activities in agreement with the Ministry of Finance of the Russian Federation for quarterly reporting in 1993)

How to correctly draw up an act of write-off of fixed assets

Since sooner or later an enterprise has to make a write-off, every accountant must be able to correctly formalize this procedure. This allows the company to always display the real situation with the property on the company’s balance sheet.

Various objects are subject to write-off:

- faulty transport;

- dilapidated buildings;

- outdated equipment;

- other property.

The main reason for write-off is the unsuitability of the property. The main condition is that it cannot be repaired or restored. This is determined by a specially created commission. However, if we are talking about technically complex property, it is unlikely that it will be possible to do without an expert opinion. For example, the air conditioner broke down. Company employees visually see only non-working equipment. An opinion on its malfunction can only be given by a specialist provided by the relevant company.

( Video : “Write-off of fixed assets - accounting”)

Even if the faulty equipment can be repaired, the service company must provide a full estimate to fix the problem. This will allow you to determine the economic benefit of the repair. If repair is not practical, the equipment is subject to write-off. Thus, it is the expert’s opinion that allows you to determine whether faulty OS can be written off.