Accounting for material assets

Inventories are assets used as raw materials in the production of products, performance of work, provision of services, for resale, as well as for the needs of the organization.

It is also acceptable to use the term “inventory assets”. Accounting for inventories in accounting is regulated by Guidelines for accounting of inventories (approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n) and PBU 5/01 “Accounting for inventories” (approved by Order of the Ministry of Finance of Russia dated June 9, 2001 No. 44n).

If the need arises and there are sufficient grounds, the organization can write off inventory items. Reasons for writing off material assets (clause 90-132 of Order of the Ministry of Finance of the Russian Federation No. 119n):

- release of materials into production;

- sale of materials by the organization to individuals and legal entities;

- write-off of materials that have become unusable after expiration of storage periods;

- write-off of obsolete equipment;

- write-off when shortages, theft or damage are identified, including due to accidents, fires, and natural disasters.

Documentation of these operations is carried out through accounting documents, including the act of writing off the inventories. An organization can develop the form independently or use a unified one approved for public sector organizations (No. 0504230 according to Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n).

How to write off inventories using forms No. 0504230 and No. 230

Unified form No. 0504230 (act of write-off of inventories), put into circulation by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, can be used to formalize business transactions within the framework of each of the three above-mentioned procedures for writing off inventories.

In particular, it allows:

1. Register the write-off of materials for production by reflecting (in accordance with the requirements of clause 98 of Order No. 119n) the names, quantities, accounting price, amount, as well as the number (or code) of material inventories.

2. Formalize the write-off of inventories due to their disposal through reflection (clause 126 of order No. 119n):

- names of inventories, their distinctive properties, quantity of inventories, reasons for writing off inventories, information about penalties from the guilty parties;

- information about the actual cost, storage period, date of receipt of inventories (in fields that can be additionally included in the structure of the form).

3. Complete the write-off of materials for which special accounting is maintained through reflection (clause 107 of order No. 119n):

- data on inventory movements (spending - including according to standards, overruns, savings;

- Inventory balances as of the beginning and end of the reporting period (in the fields that can be supplemented with this form if necessary).

Note! From January 2021, inventories are accounted for according to new rules in accordance with FAS 5/2019.

Find out how an organization can switch to inventory accounting in accordance with FAS 5/2019 in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

An alternative to using form No. 0504230 may be to use another unified form - No. 230, approved by order of the Ministry of Finance of the Russian Federation dated December 30, 1999 No. 107n. It has lost force, but the form it introduced into business circulation continues to be used:

- to generate acts on the write-off of materials for production;

- to register the write-off of inventories accounted for in a special way or written off due to disposal - subject to the inclusion of additional fields in the form.

Rules for writing off inventory items

Inventory assets mean the following property of the organization:

- raw materials - items, things that are used in production for the manufacture of any product;

- work in progress - goods, products, the production of which has not been completed, which have not received consumer properties in accordance with their purpose, that is, those that are in the production stage;

- finished products - goods that can be sold without additional costs, having gone through all stages of production established in the relevant regulatory documents: regulations, technical instructions;

- inventories - unused property of an organization transferred for storage to warehouses.

Both the person responsible for the safety of valuables and keeping records of them, as well as the chief accountant or the head of the enterprise, can propose recycling. In order to carry out write-offs, a special commission is created in the organization, which can act on both a temporary and permanent basis. The composition of such a commission must include persons who are financially responsible for specific assets of the company, specialists in specific equipment, and the chief accountant. The powers of the commission include, inter alia, drawing up a write-off act, a sample of which is presented below.

Write-off procedure

The procedure consists of 8 stages:

- A commission is created. The head of the organization can also join the commission if he so desires. An order is issued on the creation of the commission. It provides a list of the persons who make up the commission, and also contains an indication of the need to compile a list of valuables to be written off.

- The commission examines the values themselves, establishes the reasons for write-off: breakdown, damage, natural loss, identifies those responsible and further actions in relation to written-off material assets.

- The commission examines and analyzes documents confirming the state and composition of values: work reports, lists, expense reports, calculations, etc.

- The commission fixes the volume that needs to be written off, approves the list and sums up the amount and book value.

- All this data is reflected in a document signed by all members of the commission.

- The act is submitted to the manager for approval.

- Accounting makes the necessary entries and notes in accounting, financial and reporting documents.

- The commission exercises control over the destruction of written-off property, if necessary.

If a guilty person is identified, he may also be involved in the work of the commission. In this case, a note is made in the act on the procedure for reimbursing the organization’s expenses.

The accounting department records valuables at the actual cost of their acquisition, while indirect taxes paid to the supplier are not reflected in the final amount. The write-off method must be established in the accounting policy (at the cost of each unit, according to average cost indicators).

The write-off method approved in local regulatory documents cannot be changed during the write-off process. Sometimes the act is drawn up in the presence of third-party organizations, for example, with the participation of sanitary or fire inspectors.

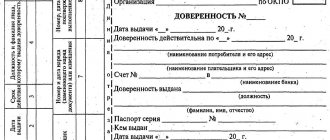

Order template

The template is not unified, so an organization can develop its own template, including additional details and provisions in accordance with current legislation.

Although the company itself has the right to develop forms of orders and other documents, we must not forget that they must be approved in the internal accounting policies of the organization and comply with it. This document approves the forms of primary documentation at the enterprise for accounting purposes.

Form of the act

Based on the Guidelines, organizations themselves develop forms and samples of primary documents. The albums of unified forms of primary accounting documentation do not provide for the form of an act on write-off of inventory items. Consequently, each organization can independently develop and approve an act on the write-off of material assets. However, you can use OKUD forms 0504230 and 0504143, which are used by state and municipal institutions.

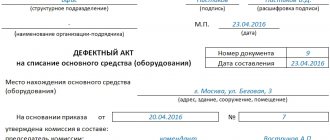

Form OKUD 0504143, sample act of writing off material assets that have become unusable

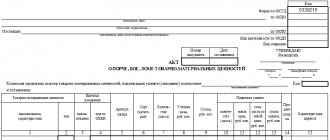

Form 0504230, act of write-off of material assets

IMPORTANT!

The form, compiled independently, must meet the requirements of the primary accounting document.

Primary accounting documents must include the mandatory details established by the Federal Law “On Accounting”:

- Name;

- date of compilation;

- name of company;

- content of a business transaction;

- meter of business transactions in physical and monetary terms;

- the name of the officials responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons and their transcripts.

The organization has the right to independently add details to the write-off document that reflect its specifics. A form that meets the specified requirements is approved by the accounting policy of the organization.

The act is signed by members of the commission headed by the chairman. It necessarily includes an accounting employee and a financially responsible person.

Filling out the act

Let's look at an example of filling it out step by step.

Step 1. Fill in the information of the manager and the date of approval of the document.

Step 2. Place and date of compilation. The date of drawing up the act will be considered the date of write-off of inventories and recognition of expenses. The organization has the right to draw up an act once at the end of the month and include in it the vacation of inventories for the entire month. It must be prepared in a timely manner, otherwise there is a risk of non-recognition of expenses.

Step 3. We indicate the number and date of the order to appoint the commission, as well as the reason. When moving internally, an organization can issue materials to its departments without specifying the destination. In this case, the materials themselves are considered subordinate to the department that received them, and their value is assigned to expenses when they are actually spent on manufacturing products or performing work according to the materials consumption report.

Step 4. Fill out the table, which should indicate the name of the materials, price and reason for writing off the materials; in the write-off act, it is necessary to indicate the full name of the inventories, including brand, grade, batch, article, etc. to justify the accounting of expenses and the possibility of their identification in accounting. To do this, it is advisable to add data by date of receipt. Erroneous write-off of another brand or grade of materials leads to misgrading or refusal to accept expenses. It is not necessary to indicate the cost, as it may differ in accounting and tax accounting. But if the cost matches, then the act will additionally confirm the amount of expenses.

Step 5. Total by quantity and amount of write-off.

Step 6. The document must be signed by members of the entire commission responsible for the release and receipt of materials, persons who authorized such release and ensure internal control in the organization.

Components

The act of writing off inventories has two pages in the form. The first must contain the signature of the head of the institution. The second is the “autographs” of all members of the commission convened regarding the writing off of materials. A table that starts on the first sheet and ends on the second can be longer. Also on the first page, in the upper right corner, there is a separate space for the director’s signature with the date of signing. Directly below it is a miniature table containing the codes. In the document form available for download on this page, the form code for OKUD is immediately marked - 0504230. When filling out, all that remains is to enter the date of write-off of inventories, the code for OKPO and KPP.

No matter how many pages there are in a specific act on the write-off of inventories, it must contain a header, a main tabular part and a conclusion.

At the top of the act it is always written:

- Document number and date of its adoption.

- Name of the institution.

- His Taxpayer Identification Number.

- Name of the structural unit (if any).

- Financially responsible person (position, full name).

- Position, surname and initials of the chairman and members of the commission in whose presence the document was completed.

- Link to the number and date of the order (or instruction) on convening the commission by the head of the institution.

After a long introductory part there is a table, which should contain specific and reliable information about:

- The name of the material that is subject to write-off (was consumed) with its code.

- Units of measurement of the material mentioned.

- Consumption standards.

- How much was actually spent: quantity, price and amount (only in numbers).

- Reasons for write-off.

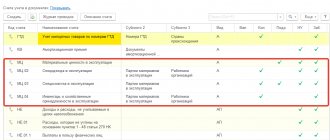

The last two columns are devoted to accounting entries: debit and credit. They are filled out only after the act is received by the accounting department.

Important! Data about different materials should be in different rows of the table.

A separately prescribed nuance is the total write-off amount. It is written out in a separate fragment of the table. In addition, it is written immediately after it in numbers and in words. It is the basis for further accounting operations.

At the end, five lines are left to formulate the commission’s conclusion. The chairman and members of the commission put their signatures confirming that a check at the warehouse was carried out and revealed the actual consumption of the specified materials in the specified quantity.

The form also contains a note from the accounting department stating that the act was reflected in the transaction journal for a specific date. The fact of the act must be evidenced by the seal and signature of the chief accountant with a transcript.

Specifics of write-off for production

The need to write-off from warehouse to production arises for enterprises that are engaged in production activities. Such an act must reflect the following information:

- Date of completion;

- information about the sender of the document (name of the structural unit and its type of activity);

- information about the recipients (also the name of the specific structural unit and the type of its activity);

- why the property is written off, the purpose of this action (for example, for the production of accessories);

- the name of the property being written off, allowing it to be identified indicating the item number;

- unit of measurement of materials being written off;

- the amount of materials written off, that is, released into production;

- price.

Sample act for writing off materials for production

The company can either develop a form for this act independently or decide to use standardized forms. In the latter case, the following standardized forms can be used to confirm the transfer of materials to production:

- limit intake card in form M-8 in the event that materials are transferred systematically and the organization has approved standards and plans for their consumption. Also, under such circumstances, you can use a materials accounting card in form M-17;

- invoice in form M-11 if the materials are transferred to a division of the company that is not geographically separate.

What could be the reason

There must always be a basis for the formation of an act, because In some way it is necessary to argue that inventories are being written off.

If, for example, these are building materials that are used for routine repairs, to confirm the write-off act, an order must be issued on behalf of the chief director to carry out repair and finishing work in any premises.

If the act is issued after an inventory has been carried out, then the basis for the paper should be its results, or rather, the documents that were obtained as a result of the inventory. The following may also be grounds:

- demand-invoice;

- limit-fence card;

- invoice for release to the side;

- statement of issue of supplies, etc.

Write-off with disposal

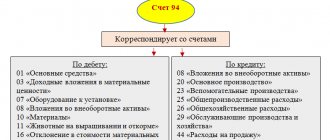

After drawing up an act confirming that material assets are recognized as written off, the accountant needs to make the following entries:

- Dt 94 Kt 10. In this posting, the accountant reflects the book value of written-off inventory items, the data is taken directly from the act;

- Dt 20 Kt 94. It reflects the cost of shortage, loss or damage of materials within the limits of their maximum loss. Such information can also be provided in the act, or it should be requested separately and documented in a special accounting certificate. If the natural loss limit is exceeded, you cannot post from the Dt 20 account; you must additionally create subaccounts.

These are the main transactions; in some cases you will need to specify other accounts. For example, in the event of damage to property as a result of a natural disaster, a posting is made Dt 99 Kt 100. When generating data on accounts and registering transactions for the movement of inventory items, data from the act is used.

Storage and liability

Members of the commission are responsible for the correctness of the inspection of inventory items, the validity of recognizing the need for write-off (based on damage to property due to wear and tear or damage, loss or loss, etc.). The commission is also responsible for the correct preparation of documentation: not only the act, but also other forms. Company employees cannot write off inventories or other property of the organization without properly established grounds. Otherwise, the person financially responsible for the safety of property may be held liable within the limits established by his agreement on individual financial responsibility.

The write-off act is drawn up in two copies and stored both in the accounting department (in the archives of the organization) and with the financially responsible person. The minimum shelf life is 5 years.

Correct and timely drawing up of the act will save the organization and financially responsible persons from problems during inspections.

Sample order for write-off

Download a free form for the write-off of material assets

act for write-off of materials in excel

Results

The write-off of inventories in most cases is recorded in a special act, the form of which is unified.

You can familiarize yourself with other features of writing off inventories in the articles:

- “The procedure for accounting and writing off fuel and lubricants on waybills in 2020–2021”;

- “The procedure for writing off materials in accounting (nuances).”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.