Not a single modern enterprise or organization can do without accounting. It is a system that allows you to collect and register data that is expressed in cash and reflects the debts or obligations of the enterprise to counterparties, the state of all property of the enterprise. The entire accounting system is a process of recording certain data in special registers called accounts, which include homogeneous financial and economic data.

One of them is accounting account 76. To understand what we are talking about and understand the important nuances, it is recommended to delve deeper into the topic. This material for dummies will tell you what an account 76 AB and BA is, an active or passive account 76, what its debits and credits show, what special accounts its correspondence occurs with.

The importance of accounting is difficult to overestimate

Account 76 in accounting

Account 76 - active-passive. Here information is collected on settlements with debtors and creditors that has not found a place on other accounts for settlements with counterparties.

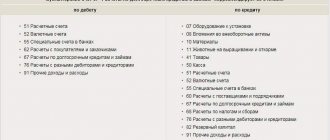

Find out more about account 76:

- what is it for?

- what subaccounts are opened for account 76;

- about account 76 in the balance sheet;

- about standard accounting entries for account 76.

Next, we will consider the features of using account 76.

Account characteristics

Account 76 in the chart of accounts is an active-passive account, which can have two balances at once, both debit and credit of the account. If an account has a debit balance, then the debit of the account reflects the increase in debt, and the credit of the account reflects its repayment.

In this case, the account behaves as an active one, and the initial balance plus the debit turnover and minus the credit turnover determine the final balance. In this case, it matters on which side the excess occurs: on debit - debit balance, on credit - credit balance.

If an account has a credit balance, then it behaves like a liability account. That is, the opening balance plus credit turnover minus debit turnover.

Attention! The final balance is determined by finding out which side of the account the excess is coming from. By debit - the final balance is reflected in the debit of the account, by credit - in the credit of the account.

Account 76: accounting for insurance settlements

Subaccount 76.1 traditionally reflects transactions related to settlements under commercial insurance contracts. At the same time, a company can enter into such agreements both for itself (usually for property insurance) and for the benefit of employees - for example, under voluntary health insurance agreements.

The following typical transactions for the subaccount in question can be distinguished:

- Dt 20 Kt 76.1 - the amount of payment under the insurance contract was accrued as part of production costs;

- Dt 76.1 Kt 51 - payment was made under the contract in favor of the insurance organization;

- Dt 51 Kt 76.1 - payment was received from the insurance company for the insured event;

- Dt 76.1 Kt 73 - payment for the insured event is accrued to the employee;

- Dt 76.1 Kt 91 - insurance compensation accrued for property damage;

- Dt 99 Kt 76.1 - loss of property not compensated by insurance compensation is included in losses.

Within subaccount 76.1, various analytical subaccounts can be opened to account for individual insurers and contracts with them.

What is it used for?

Account 76 is used to maintain claims against contracting and supply partners, as well as the amounts of fines filed and recognized. With its help, settlements are made with other counterparties who act as creditors and debtors and do not belong to special accounts 60 - 75.

Important! Accounting on account 76 is carried out when cases occur that are not described in the certificates for accounts 60 to 75. These may include settlements, as a rule, issued or received for claims and insurance amounts. Moreover, this account records deductions for judicial and other administrative papers.

A specific example of accounting for an insurance transaction can help you understand the specifics of the work. Let's say that in August 2021, Alpha LLC signed an agreement with Beta, which is an insurance company. The subject of the agreement was insurance of the production premises of one of the workshops in case of fire. The amount of insurance compensation in case of fire is 800 thousand rubles.

In October 2021, a fire broke out in the workshop due to a malfunction in the equipment. After eliminating the fire itself and carrying out subsequent repairs to the production premises, Alpha LLC incurred the following expenses:

- For materials and tools for repairs - 560 thousand rubles, including VAT (60 thousand rubles);

- To pay for the work of the working personnel who were busy eliminating the consequences of the fire and its spread, as well as repairing the workshop - 200 thousand rubles.

Account 76 reflects accounts receivable and payable.

The insurance company paid the amount in full for the insurance case. Alpha LLC then reflected all of the above transactions with the transactions described below:

- Debit 51 Credit 76.01. There was a transfer of money from the insurance company, which was received under an insurance contract to compensate for damage from the fire in the amount of 800 thousand rubles;

- Debit 10 Credit 60. Accounting for the amount of material assets and tools to eliminate the consequences of a fire and repair the production premises in the amount of 560 - 60 = 500 thousand rubles;

- Debit 19 Credit 60. Reflection of the amount of VAT for the purchase of materials. Only 60 thousand rubles;

- Debit 60 Credit 51. Transfer of funds for purchased materials and tools to the supplier. Amount - 560 thousand rubles;

- Debit 20 Credit 10. Reflection of the transfer of materials to workers to eliminate the consequences of a fire in the production premises in the amount of 500 thousand rubles;

- Debit 20 Credit 70 or 69. Reflection of expenses for paying employees for eliminating the consequences of a fire in the workshop in the amount of 200 thousand rubles;

- Debit 76.01 Credit 20. Accounting for the costs of eliminating the consequences of a fire in the production premises at the expense of the insurance compensation received from Beta. Total 500 + 200 = 700 thousand rubles;

- Debit 76.01 Credit 19. VAT expenses were also written off against insurance compensation from Beta. The amount of compensation is 50 thousand rubles;

- Debit 76.01 Credit 91.02. Reflection of the amount of income received as the difference between the compensation received and total expenses. Total 800 - 700 = 100 thousand rubles.

It’s easy to close special account 76 using “Debt Adjustment” in 1C

Account 76: accounting for claims settlements

Subaccount 76.2 reflects transactions on claims that arise mainly when the counterparty fails to fulfill contractual obligations. The claim may be resolved out of court or through arbitration.

Typical accounting entries:

- Dt 76.2 Kt 60 - reflects the amount of the claim against the supplier;

- Dt 76.2 Kt 10 (41) - short delivery detected after acceptance;

- Dt 76.2 Kt 91.1 - reflects the amount of the penalty from the supplier who did not fulfill the terms of the contract;

- Dt 51 (50, 52) Kt 76.2 - money within the framework of the claim was credited to the account;

- Dt 91.2 Kt 76.2 - receivables that could not be collected from the counterparty are written off as other expenses.

Additional analytical accounts to subaccount 76.2 can be opened to account for individual counterparties and claims.

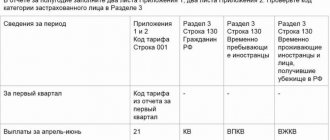

VAT check cheat sheet

Enter the invoice number and date in the spaces provided.

Place a tick in the box to the left of the line “Invoice for advance payment” . In this case, the “Corr. account and customs declaration number" will disappear from the screen.

“Buyer” details through the “Counterparties” : to open it, click the selection button to the right of the column.

the remaining details in the “Header” .

Go to the “Table part” (double-click on it or press “Enter” ).

In the “Amount” , indicate the advance amount.

Click the “OK” and post the document - to the question “Post the document?” answer "Yes" .

After posting invoices for all advances, the following transactions will be generated in the Transaction Journal:

D76.AV /Element of the directory “Counterparties”/ /Document “Invoice issued” / K68.2 / Transfer element “Types of payments to the budget - “Tax: Accrued/paid” / “Amount”.

...where “Amount” is the amount of advances.

Since when entering the initial balances for account 68.2 we have already entered the balance as of the start date of work in the program, it is necessary to make reversing entries in the “Operations Journal” for all entered advances:

D68.2 / Transfer element “Types of payments to the budget - “Tax: Accrued/paid” / K00 “Amount”.

...where “Amount” is the amount of advances.

Account 76: dividend payments

Subaccount 76.3 is used to account for the income of a business entity from investing in the capital of third-party legal entities, which periodically make interest payments to investors in relation to their shares.

In this case, the investor will reflect the following entries in accounting:

- Dt 76.3 Kt 91.1 - dividends are accrued as a type of other income;

- Dt 51 (50, 52) Kt 76.3 - receipt of dividend payment to the current account.

Additional analytical accounts for the subaccount in question are opened for each source of payments.

If interest is charged on the balance

Each company tries to choose the most favorable conditions for opening a current account. One of the advantages is that the bank accrues interest on the balance at a certain frequency established by the agreement (often once a month).

In this case, upon receipt of money from the bank to the current account, the amount of the transferred interest will need to be recorded in accounting. For this purpose, you can use the account. 76.09 “Other settlements with various debtors and creditors.”

The assignment of interest to the balance will be reflected in the following entry and included in non-operating income:

Dt 76.09 Kt 91.01

Use 76 sch. in the working chart of accounts makes sense when we are talking about irregular transactions that are not directly related to the main activity. The law does not establish a requirement for the mandatory closure of this account at the end of the billing period. In relation to the account. 76 recording the results and reducing the balance to zero is carried out as the activity is completed.

Account 76: accounting of deposited amounts

Subaccount 76.4 is used to account for deposited amounts - wages that were accrued but not paid to the employee from the cash desk (for example, due to his failure to appear at the accounting department on time).

Accountant upon expiration of the established period:

- reflects the fact of depositing wages that the employee did not collect Dt 70 KT 76.4;

- transfers the deposited amount to the bank from the cash desk Dt 51 Kt 50.

As soon as the employee applies for a salary, the accountant:

- transfers money from the account to the cash desk to pay salaries Dt 50 Kt 51;

- issues wages from the cash register Dt 76.4 Kt 50.

If the employee never applies for the deposited salary (the statute of limitations expires, which in general is 3 years from the date of its accrual), the organization includes its amount in other income Dt 76.4 Kt 91.1.

Account 76: accounting for settlements with subsidiaries (dependent) companies

Organizations that have subsidiaries can make a variety of settlements with them. However, do not forget: a subsidiary and a dependent company are not the same thing.

Simply put, subsidiaries include those economic entities where the main enterprise has more than 50% of the shares (authorized capital), and dependent ones are those in which the main enterprise owns 20% or more of the shares (authorized capital).

Let's consider the entries used when accounting for settlements of an enterprise with subsidiaries and dependent companies (for this, a subaccount 76.5 can be opened to account 76):

- Dt 08 (10, 41...) Kt 76.5 - the enterprise acquired fixed assets, materials, goods from a subsidiary;

- Dt 76.5 Kt 90, 91.1 - the enterprise sold property to a subsidiary;

- Dt 91.2 Kt 76.5 - the enterprise included the losses of the subsidiary, which it is obliged to repay, into other expenses;

- Dt 76.5 Kt 51 - the enterprise transferred funds to repay the losses of the subsidiary.

A significant part of business transactions between the main enterprise and a subsidiary (dependent) company is reflected by correspondence using not only account 76, but also account 58.

Example 1

Payment of a share in the authorized capital of a subsidiary by transfer of property.

To begin with, the main enterprise, on account 76, registers the formation of a payable debt corresponding to the amount of debt for a contribution to the authorized capital of a third-party organization: Dt 58 Kt 76.5.

Repayment of this debt can be made by different types of property:

- If these are funds, their transfer in favor of a subsidiary is shown by posting Dt 76.5 Kt 51.

- If this is an item of fixed assets (FPE) that was in operation, then the postings will be as follows: Dt 58 Kt 76.5 - reflects the cost of the transferred property, previously agreed upon by the parties;

- Dt 02 Kt 01 - reflects the write-off of accrued depreciation from the moment of commissioning of an asset until the moment of its disposal;

- Dt 76.5 Kt 01 - reflects the write-off of the residual value of the fixed asset.

If the residual value of the fixed assets is lower than that agreed upon by the parties in order to repay the debt on the contribution to the authorized capital, then the enterprise records other income: Dt 76.5 Kt 91.1. If higher - other consumption: Dt 91.2 Kt 76.5.

- If intangible assets (intangible assets) are transferred to the authorized capital, then the correspondence is applied: Dt 58 Kt 76.5 - accounts payable are reflected in the agreed value of the transferred intangible assets;

- Dt 05 Kt 04 - reflects the write-off of depreciation on assets accrued at the time of their alienation;

- Dt 76.5 Kt 04 - reflects the write-off of the residual value of intangible assets.

If the residual value of the intangible asset is less than the agreed value, other income is recorded: Dt 76.5 Kt 91.1. And if more - other expenses: Dt 91.2 Kt 76.5.

- If materials are transferred to the authorized capital, then the correspondence will be as follows: Dt 58 Kt 76.5 - accounts payable have arisen in the amount of the agreed cost of materials;

- Dt 76.5 Kt 10 - reflects the write-off of the actual cost of materials.

If the actual cost turns out to be lower than the agreed value, other income is recorded: Dt 76.5 Kt 91.1 If more, other expenses: Dt 91.2 Kt 76.5.

Example 2

The company acquired shares, but has not yet paid for them.

The fact of transfer of ownership of shares to an enterprise, if it has not paid for them by the time of such transfer, is reflected by posting Dt 58 Kt 76.5.

Example 3

The enterprise has made an advance payment for shares to which it will become entitled later:

- Dt 76.5 Kt 51 - reflects the amount paid for the shares;

- Dt 58 Kt 76.5 - the right to the shares transferred to the enterprise, the shares were registered.

Example 4

The company resells previously purchased shares to the public:

- Dt 76.5 Kt 91.1 - other income received from the sale of shares;

- Dt 91.2 Kt 58 - the cost of shares sold is written off;

- Dt 51 Kt 76.5 - payment received for shares sold.

VAT on deposit: controversial situations

The main difficulties for taxpayers arise when determining the moment at which the deposit should be included in the tax base. There are 2 points of view on this issue:

- The regulatory authorities believe that the deposit should be included in the tax base in the period in which it was received by the taxpayer. In support of their position, they cite the provisions of subsection. 2 p. 1 art. 167 of the Tax Code of the Russian Federation, which states that the amount of prepayment increases the tax base at the time of receipt. The reasoning is given in letters of the Ministry of Finance of Russia dated 04/10/2017 No. 03-07-14/21013, dated 02/02/2011 No. 03-07-11/25 and the Federal Tax Service of Russia dated 01/17/2008 No. 03-1-03/60. See also “The deposit is included in the VAT base upon receipt .

- An alternative point of view, according to which the deposit at the time of receipt is not yet a payment, states that it should be included in the VAT tax base only at the moment when the execution of the agreement begins. There are court decisions to support this position, but they are few (resolution of the Federal Antimonopoly Service of the Ural District dated December 1, 2005 No. F09-5394/05-S2).

ConsultantPlus experts explained how to take into account VAT on an advance paid in foreign currency (in rubles under a contract in cu). Get trial access to the K+ system and upgrade to the Ready Solution for free.

Based on the above, it is advisable to include the deposit in the tax base immediately after its receipt. In this way, it will be possible to avoid disputes with regulatory authorities.

See also the material “Is it necessary to calculate VAT on funds received as a security (guarantee) payment, pledge, deposit?”

Account 76: application by non-profit organizations (HOA)

An HOA is a typical example of a non-profit organization. They function due to:

- targeted financing - from the budget or from homeowners;

- permitted business activities.

Account 76 is used by the HOA to reflect exactly those transactions that are related to targeted financing. Common postings (we will agree to use subaccount 76.6 for the purposes under consideration) include the following:

- Dt 76.6 Kt 86 - The HOA records the debt upon receipt of targeted funding (in practice, it makes an accrual for payments that citizens must pay);

- Dt 51 Kt 76.6 - the debt is repaid upon receipt of funds to the HOA account.

Account 76: application by partnerships

The main purpose of creating partnerships is to make a profit as a result of joint business by several organizations. If there is profit, then it is distributed in proportion to the size of the contributions of each of the partners. Losses are distributed in a similar way. In both cases the score 76 is used.

Each of the partnership organizations that has the right to income records the following entries in the accounting registers:

- If there is profit: Dt 76.3 Kt 91.1 - profit from joint activities is reflected;

- Dt 51 Kt 76.3 - reflects the receipt of money on account of profit from joint activities.

- Dt 91.2 Kt 76.3 - loss from joint activities is reflected;

Is the deposit an advance payment for VAT?

According to paragraph 1 of Art. 380 of the Civil Code of the Russian Federation, a deposit is an amount of money given to a party to an agreement on account of future payments and serving as evidence of the conclusion of an agreement. This amount also serves as security for the execution of the contract. The deposit agreement must be concluded exclusively in writing.

Since the deposit performs a payment function and is paid at the preliminary stage, its receipt should be considered an advance. That is, VAT must be calculated and entered into the budget on the amount of the deposit (subclause 2, clause 1, article 167 of the Tax Code of the Russian Federation).

This provision is fully applicable to services when organizations enter into a preliminary contract and, within its framework, a deposit is transferred, which is subsequently included in the total cost. This amount should also be considered an advance. Confirmation of this thesis can be found in the letters of the Ministry of Finance of Russia dated 02.02.2011 No. 03-07-11/25, the Federal Tax Service of Russia dated 17.01.2008 No. 03-1-03/60 and the resolution of the Federal Antimonopoly Service of the Volga District dated 04.09.2009 No. A55-7887/ 2008.

Account 76: application in commission agreements

Account 76 is also used to reflect transactions under a commission agreement. Let us recall that a commission agent is an economic entity that provides intermediary services under an agreement with the principal.

For commission transactions, we agree to consider the following subaccounts:

- 76.80 - for settlements with the commission agent;

- 76.81 - for settlements with the principal;

- 76.82 - for settlements with the buyer.

These subaccounts are used within the following standard correspondence:

- In the accounting of the commission agent who participates in the calculations: Dt 76.82 Kt 76.81 - the buyer has an obligation to redeem the goods received by the commission agent from the principal;

- Dt 51 Kt 76.82 - money was received in the commission agent’s bank account for goods sold;

- Dt 76.81 Kt 90.1 - commission accrued;

- DT 76.81 CT 51 - payment for the goods is transferred to the principal minus the commission.

If the commission agent does not participate in the settlements, then the proceeds from the sale go to the principal himself.

- In the principal's accounting: Dt 44 Kt 76.80 - commission agent's services are included in sales expenses;

- Dt 19 Kt 76.80 - reflected VAT on intermediary services;

- Dt 76.80 Kt 62 - based on the commission agent’s report, the intermediary’s services were credited against the payments due for the goods sold.

Characteristics of subaccounts 76.11, 76.12, 76.13, 76.5

Account 76.11 “Calculations for target fees for housing and communal services” is used to calculate payments for the use of utility services.

Account 76.12 “Settlements for unclear amounts” is used to carry out operations in cases where it is not possible to find documents for transferring amounts to the appropriate accounts. If the recipients of funds for debts are not identified, the amounts are written off from account 76.12 in favor of the organization.

Account 76.13 “Settlements with government agencies” is used to carry out operations to pay fines and debts to the state administration.

In the course of a company's activities in the production and sale of products or services, account 76 is widely used in accounting.

Postings using subaccounts 76.11, 76.12 and 76.13

| Dt | CT | Characteristics of an accounting transaction |

| 76.03 | 76.11 | accrued amount of payments for utilities |

| 76.11 | 51 or 55 | funds were transferred to utility service providers |

| 51 or 55 | 76.12 | Unidentified amounts were credited to the current account/special bank account |

| 76.12 | 91.01 | writing off outstanding debts to the organization's income |

| 91.02 | 76.13 | a fine was imposed on the company |

| 76.13 | 51, 50 or 79.02 | the amount of the fine is transferred to the relevant government agency |

| 97.03 | 76.13 | expenses for issuing a license are reflected |

| 76.13 | 51 | the debt for the issued license has been repaid from the bank account |

Account 76.5 in accounting is used for settlements with other suppliers and contractors. Do not forget that the main account for settlements with suppliers is 60, a subaccount 76.5 exists to pay for additional services not included in it. Here the amounts of the cost of packaging, the work of transport companies, and VAT for importing products can be recorded.

Account 76: application in leasing

Account 76 is also used to reflect leasing transactions. Let’s agree that for this we use three subaccounts: 76.9 - “Debt on leasing payments”, 76.10 - “Rental obligations”, 76.11 - “Debt on repurchase of property”.

If the property is on the balance sheet of the lessor:

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 20 Kt 76.9 - the lease payment is reflected in the accounting;

- Dt 19 Kt 76.9 - VAT is taken into account in the lease payment.

If the property is listed on the lessee's balance sheet:

- Dt 08 Kt 76.10 - the leasing object is accepted for accounting;

- Dt 19 Kt 76.10 - presented VAT by the lessor;

- Dt 76.9 Kt 51 - lease payment transferred;

- Dt 76.10 Kt 76.9 - monthly lease payment is taken into account;

- Dt 76.10 Kt 76.11 - the debt on the redemption value of the leased property is reflected;

- Dt 76.11 Kt 51 - the redemption value of the leased object is listed.

Application of account 76: VAT

Account 76 is also used in VAT-related transactions. Let's look at a few examples.

Example 5

Reflection of VAT on advances received.

For the upcoming delivery of goods, the company received an advance payment of 120,000 rubles from the buyer. , from which she charged VAT: 120,000 * 20 / 120 = 20,000 rubles. Then the goods were shipped, and VAT was deducted.

In the supplier company’s postings, these operations look like this:

- Dt 51 Kt 62 - advance payment received from the buyer;

- Dt 76.AV Kt 68 - VAT is charged on the advance payment.

- Dt 62 Kt 90 - goods shipped to the buyer;

- Dt 90 Kt 68 - VAT is charged on sales;

- Dt 68 Kt 76.AV - VAT is deducted after shipment and prepayment is offset.

Example 6

Reflection of VAT on advances issued.

To account for the upcoming receipt of materials, the company transferred an advance to the supplier in the amount of 60,000 rubles, adding VAT: 60,000 * 20 / 60 = 10,000 rubles. Later the materials were received and capitalized.

Let's write down the wiring:

- Dt 60 Kt 51 - advance payment transferred to the supplier;

- Dt 68 Kt 76.AV - VAT is charged on the advance;

- Dt 10 Kt 60 - materials from the supplier have been capitalized;

- Dt 19 Kt 60 - VAT on delivery is allocated;

- Dt 76.AV Kt 68 - VAT on advance has been restored;

- Dt 68 Kt 19 - VAT is claimed for deduction.

Example 7

Reflection of VAT on advance payment from the buyer-tax agent.

The tax agent company bought scrap metal from the seller for 100,000 rubles, having previously paid an advance payment of half the amount - 50,000 rubles.

In the buyer’s accounting entries there will be 76 accounts, and more than one:

- Dt 60 Kt 51 - advance payment to the seller of 50,000 rubles;

- Dt 76.NA Kt 68 - VAT is charged on an advance of 10,000 rubles. ((50,000 + 50,000 * 20%) * 20 / 120);

- Dt 68 Kt 76.AV - deduction of VAT on an advance payment of 10,000 rubles.

- Dt 41 Kt 60 - scrap in the amount of 100,000 rubles was accepted for accounting.

- Dt 76.NA Kt 68 - VAT charged on the shipment of scrap 20,000 rubles. ((100,000 + 100,000 * 20%) * 20/120);

- Dt 68 Kt 76.NA - deduction of VAT calculated when transferring the advance - 10,000 rubles;

- Dt 68 Kt 76.NA - deduction of VAT on purchased scrap 20,000 rubles;

- Dt 76.AV Kt 68 - VAT, previously accepted for deduction on the advance payment of 10,000 rubles, has been restored.

Account 76 does not appear in the scrap seller's accounting.

Should advance VAT be calculated if the advance payment and shipment were in the same period?

In business practice, situations often arise in which an advance payment is received by the supplier in the same tax period when the shipment is made. The taxpayer has a doubt: in the given circumstances, is it worth calculating VAT on advance payments - after all, almost immediately you will have to make a calculation on the rest of the payment amount?

There are two opposing positions on this issue.

- The position of officials is that VAT must first be calculated on the advance payment, and then on the proceeds from sales. Both amounts of tax, in their opinion, should be reflected in the declaration for the past tax period. In the same report, VAT on the advance payment should be indicated as part of tax deductions. Confirmation of this point of view can be found in letters of the Ministry of Finance of Russia dated October 12, 2011 No. 03-07-14/99, Federal Tax Service of Russia dated July 20, 2011 No. ED-4-3/11684, 03.10.2011 No. KE-4-3/3790 and 02/15/2011 No. KE-3-3/ [email protected] , Federal Tax Service of Russia for Moscow dated 02.06.2005 No. 19-11/39279 and 31.01.2005 No. 19-11/5754. In some cases, even arbitration courts take the side of the regulatory authorities (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated June 28, 2012 No. A32-13441/2010).

- However, the overwhelming majority of courts take the opposite point of view and in their decisions indicate that the payment cannot be considered an advance payment, since it came in the same tax period in which the goods were shipped. Confirmation of this position can be found in the ruling of the Supreme Arbitration Court of the Russian Federation dated September 19, 2008 No. 11691/08, resolutions of the Federal Antimonopoly Service of the North Caucasus District dated May 25, 2012 No. A32-16839/2011, FAS Volga District dated September 7, 2011 No. A57-14658/2010 (retained in force by the determination of the Supreme Arbitration Court of the Russian Federation dated January 16, 2012 No. VAS-17397/11) and the Federal Antimonopoly Service of the Far Eastern District dated December 22, 2011 No. F03-6321/2011). If you follow this logic, then there is no need to calculate VAT on advance amounts. See also “Prepayment and shipment in one period - it is not necessary to calculate VAT on the advance payment .

At the same time, the accountant has the opportunity not to issue an invoice for the advance payment if the time interval between the advance payment and shipment does not exceed 5 calendar days. Confirmation of this thesis is contained in letters of the Ministry of Finance of Russia dated 10/12/2011 No. 03-07-14/99 and 03/06/2009 No. 03-07-15/39 (clause 1). That is, the taxpayer has the opportunity not to calculate VAT on the advance payment if the five-day condition is met.

But here, too, the Federal Tax Service of Russia in letters dated March 10, 2011 No. KE-4-3/3790 and February 15, 2011 No. KE-3-3/ [email protected] explains that advance invoices should be issued even in those circumstances when which are shipped within 5 days after receiving the advance payment.

As a result, practice shows that it would be more rational to calculate tax on advance payments, even if the shipment was made in the same tax period. In this case, the tax base will not increase, and the taxpayer will be able to avoid unnecessary disputes with regulatory authorities.

Only those amounts that arrived on the day of shipment, but even before its implementation (letter of the Ministry of Finance of Russia dated March 30, 2009 No. 03-07-09/14) may not be considered an advance payment. And this is only on the basis that it is not possible to establish the order of operations based on primary documents.

Application of account 76: shared construction agreements

Another area of application of account 76 is legal relations in the field of shared construction contracts. Let's look at the entries in the developer's accounting, compiled using escrow accounts - according to the new payment scheme between the investor and the developer, mandatory for use after 07/01/2019:

- Dt 009 subaccount “Funds of shareholders in escrow accounts” - the shareholder transferred funds to the escrow account;

- Dt 51 Kt 67 - the bank issued a targeted loan for the construction of a real estate property;

- Dt 91.2 Kt 67 - interest was accrued for using the loan;

- Dt 20 Kt 60 - the cost of work carried out by the contractor is included in construction costs;

- Dt 43 Kt 20 - reflects the book value of the property;

- Dt 76 “Settlements with shareholders” Kt 43 - the apartment was transferred to the investor after the property was put into operation;

- Dt 76 “Settlements with equity holders” Kt 90 - revenue from the sale of housing is recorded;

- Dt 67 Kt 76 “Settlements with shareholders” - funds from shareholders credited to the escrow account are used to repay the loan and interest;

- Dt 51 Kt 76 “Settlements with shareholders” - the balance of funds of shareholders was received from escrow accounts after repayment of the loan and interest;

- KT 009 “Funds of equity holders in escrow accounts” - completion of settlements through an escrow account.

Let's sum it up

- Account 76 of the accounting system collects information on settlements with counterparties that has not found a place on other settlement accounts.

- The list of transactions for account 76 discussed above is far from exhaustive. It can be used to reflect any transactions with debtors and creditors - if they methodologically cannot be reflected in accounting accounts 60-75.

- If necessary, it is possible to open any sub-accounts for account 76 in addition to those given in the general Chart of Accounts.

If you find an error, please select a piece of text and press Ctrl+Enter.

What's happened

Accounting account 76 is a special account that is used to accumulate data on transactions of receivables and payables of an organization that were not mentioned in the explanations to accounting accounts 60 - 75:

- Personal and property insurance;

- Claims for amounts withheld from the salaries of company employees in favor of other legal entities by court order, etc.;

- Insurance and social security plan.

Formation of SALT according to the VAT balance comparison table