The staffing table is an internal regulatory act of an organization that significantly simplifies the maintenance of personnel records. It records the entire working structure of the organization, the composition and number of employees, and the monthly payroll.

In accordance with the Labor Code, it is not at all necessary to have a staffing table. If desired, the employer has the right to work without him, including the names of positions and salary amounts in employment contracts and orders for hiring employees. Such documents will be full-fledged internal regulations, and no inspectors will have questions about this.

But not everything is so simple with this document: from the content of Article 15 of the Labor Code of the Russian Federation and part two of Article 57 of the Labor Code of the Russian Federation, it follows that if the terms of the employment contract determine that the employee’s labor function is to perform work in a certain position, such a position must correspond to the ShR. Or if some positions, or rather the employees occupying them, are entitled to benefits.

Therefore, there must be a schedule in the organization. An employee taking office in the absence of his position on staff is considered a violation of labor legislation, for which administrative liability is imposed under Art. 5.27 Code of Administrative Offenses of the Russian Federation. Individual entrepreneurs and micro-enterprises can do without SR. They have the right to use standard employment contracts, which include all the conditions.

The current regulations do not provide for a unified form of staffing, and the organization develops and approves this document independently.

Do companies have to have a staffing table?

Let us present two opposing points of view on this issue that exist today. The first asserts that enterprises must compile and have a SR. It is in it that the employee’s labor function and the amount of his salary are indicated, along with the employment contract. Art. 15 (explains the concept of labor relations) and Art. 57 of the Labor Code of the Russian Federation (determines the content and essence of the employment contract) define the labor function as “work according to the position in accordance with the staffing table.”

Adherents of the second point of view believe that the decision on whether an economic entity needs SR is made by the manager himself. This opinion is justified as follows:

- Fast. Goskomstat of Russia No. 1 dated January 5, 2004 established only recommended for use: unified T-3.

- Instructions for filling out work books (approved by the Post. Ministry of Labor of Russia No. 69 of October 10, 2003) indicated that records about the name of the position, profession, specialty, etc. are made “ as a rule , in accordance with the organization’s SR.”

Consequently, it is not indicated anywhere that SR is mandatory for use.

Attention! The FSS, the Pension Fund of the Russian Federation, and the Federal Tax Service agree with the first point of view.

The FSS document is needed to verify the correctness of the calculation of insurance premiums, the Pension Fund of the Russian Federation - to clarify information about the length of service. Tax authorities may request SR during on-site audits.

The main tasks of staffing in the company

ShR can be useful for an economic entity by performing the following tasks:

- It describes the structure of the company, departments, divisions. By looking into it, you can immediately get an idea of the system of divisions of the company.

- It contains information about the total number of employees in the entire company, in each division, and about how many staff units there are for each position.

- Provides information about what wage system was adopted by the personnel of each department, workshop, etc.

- Sets the amounts of allowances for staff.

- Using this paper, you can easily track the number of vacant positions.

Thus, one should not diminish the importance of such a document as the HR, the organization and its personnel department, if there is one.

Validity

The company can choose the validity period of the staffing schedule independently. In most cases it is drawn up for 1 year. If the organization is small, with a small number of employees and is not actively developing, then the staffing table can function for several years. In large organizations whose staff is growing rapidly, the document is filled out annually.

If new positions appear throughout the year, the number of staff positions, vacancy names, and salaries change, then amendments and additions can be made to the document. This is done by issuing a special order (we will discuss it below) and introducing changes to the ShR.

Display of vacant positions

To exclude staff units, an order is created in which they indicate:

- the date on which this change comes into effect;

- titles of positions that are excluded;

- number of staff positions that are excluded.

Vacant positions are not filled, so they can be removed without approval from anyone.

Order to exclude vacant positions, sample

Is it necessary to use the T-3 form?

The staffing table in form T-3 was fixed by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1. All unified forms have ceased to be mandatory for use in work since January 2013. From this moment on, company managers received the right to work with independently created forms. It has become possible to supplement existing unified forms with new details.

In most cases, business entities use the T-3 form, since it is familiar to many accountants, experienced personnel officers, and employees of inspection departments and contains all the necessary data. And what's the point of reinventing the wheel?

Important! Management decides which forms the business entity will use, unified or developed independently. The choice must be recorded in the company’s accounting policies using a separate order to make appropriate changes there.

How to correctly fill out the T-3 form for a personnel employee

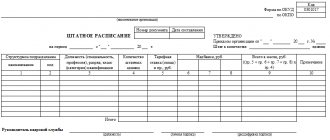

The staffing form consists of two parts: introductory and main (tabular). Let's look at how to fill out each of them.

Introductory part

The first thing to do is indicate the name of the company. It must match the one written on the registration certificate. If the “name” contains Latin letters or words, then this should be indicated. If the registration document contains a short and full name, then any of them can be entered into the ShR.

Next they write the OKPO code, the document number and the date of its preparation. Then you should indicate the period of operation. Usually only the approval date is written, because the end date is not always known, since the schedule may be subject to change by creating a new document during the operation of the company.

Main part

This part contains a table. Let's look at how to correctly fill out each column out of 10.

Column 1. Here you need to enter the name of the structural unit. These include workshops, departments, and branches. It is more convenient to indicate divisions in a document in a hierarchical order. For example, first of all, indicate the administration, legal department, accounting, personnel department, that is, those departments that deal with general management. Next are the departments that carry out the main tasks of the enterprise, for example, production, sales department, etc. Units performing auxiliary or service tasks are listed last. For example, these are warehouses, the supply department.

Column 2. You need to enter the code of the structural unit. The number is assigned by the employer. This is usually done like this: the main department is assigned the code “01”, the departments that are part of it are assigned the codes “01.01”, “01.02”, etc. In this way, you can designate the place of a department in the overall hierarchical system of a company or enterprise.

Column 3. This contains information about the citizen’s position, rank, and qualifications. If you can choose a job title in accordance with OKPDTR (stands for the All-Russian Classifier of Worker Occupations, Employee Positions and Tariff Classes), then it is better to choose it. Since it has been operating since 1994, many professions and positions are outdated, and new ones have not been introduced.

It is imperative to select a name from this directory if the employee is entitled to any guarantees: benefits, compensation, etc. Otherwise they will not be provided.

Column 4. Here for each position you need to note the number of staff units. If the company practices part-time work, then the number is indicated in the form of decimal fractions: 0.25, 0.5, 0.75, 1.25, etc. Let's look at an example: the company has 2 designers, one full-time, the second part-time; in this case, in the ShR they write - 1.5 staff units.

In addition, vacant positions can be added to the HR. If it is planned to expand the staff, then they can be entered into the document in advance so as not to make adjustments to it in the future.

Column 5. In this field you need to indicate the tariff rate for each position, that is, the monthly salary.

Columns 6-8. This includes data on existing allowances in the organization. These may include bonuses, additional payments, incentive and incentive payments. In some cases, they can be set by the employer himself, and in some they have already been introduced by the Labor Code of the Russian Federation: various allowances for the number of years worked, for harmfulness, etc. The amount of allowances can be fixed or expressed as a percentage of the salary.

Column 9. In this column you need to note the total amount, which is calculated by adding columns five to eight for each of the personnel in specific positions.

Column 10. It indicates comments, if any. Here you can enter details of orders for personnel, etc.

The “Total” line at the end of the table should contain the total number of staffing units of the business entity and the monthly salary fund (total amount in the ninth column).

At the end, the head of the personnel department (may have a different name) and the chief accountant of the enterprise or company put their signatures. The seal is placed at the request of the management.

Still have questions about filling out the document? We will answer on the FORUM!

What determines the number of staff in a cafe or restaurant?

When drawing up the staffing schedule for a cafe or restaurant, you need to focus on the number of seats in the hall . This will determine how many personnel need to be hired.

It is worth considering the specifics of the kitchen. Will it be fast food, where they cook from semi-finished products? Or maybe this is a sushi bar? Or will the restaurant be a family restaurant with home cooking and a huge menu?

- On average, there are 12 kitchen staff per 100 seats, working in two shifts of 6 people each. These are two cold shop cooks, two hot shop cooks, two preparation cooks, two distribution cooks, two soup cooks, if they are on the menu. To assist the chef and organize the work of the cooks, a cook-foreman is required, also one person per shift.

- For the hall there are 16 waiters (also working in two shifts of 8 people each), two administrators, two bartenders.

- It is also necessary to take into account managers, suppliers, accounting, technical workers and office workers - that’s about 10 more people. The chef is a manager.

- If a restaurant or cafe plans to deliver food to your home, then drivers or couriers will also be required. This is from two to four employees. As a result, a restaurant with one hundred seats will require approximately 50 staff.

How to approve the company's staffing table

The HR is put into operation by the employer with the help of an order approving the staffing table. Management can approve HR department employees, accountants, and legal department employees as responsible for developing and filling out the form. The manager himself may be responsible, especially if the enterprise does not have a large staff of employees. If work on the ShR is entrusted to a specific person, then he must be designated in the order. In addition, you can specify this task in the employment contract with him.

Remember! The dates for document approval, implementation and creation may vary. It is not forbidden to approve the staffing table even after it has been completed, but it can be put into operation much later than it has been compiled and approved.

The text of the order must contain the following information:

- name of the business entity;

- name and number of the order;

- place and date of creation of the document;

- dates of approval of the schedule, its introduction into work (here you should also note the number of staff positions and enter data on the monthly salary fund);

- Full names and positions of those persons entrusted with the preparation of the SR;

- indication of the annex to the order - the ShR itself and its details;

- signatures and positions of the manager and persons responsible for drawing up the document.

For your information! It is more convenient to introduce the staffing table from the 1st day of the month, since staff salaries are calculated monthly.

Procedure for making changes

Any change in staffing always occurs on the basis of an order. Such amendments are related to:

- with the exclusion of vacancies due to organizational changes in the company’s work;

- introducing new staffing positions if business expansion is necessary;

- reduction of staffing units associated with a reduction in numbers or staff;

- changes in salaries;

- renaming departments, names of structural units, etc.

Changes are allowed to be made to the current ShR form or simply to approve a new document based on the old sample. In both cases, paperwork and related documents will be required. In addition, legal requirements must be strictly observed. For example, when reducing the number of employees, it is necessary to issue an order to exclude certain positions from the staffing table and to introduce a new schedule, observing the requirements of Article 180 of the Labor Code of the Russian Federation. This article defines the employer's obligation to notify about layoffs at least two months in advance. The date of entry into force of the updated SR with occupied positions is no earlier than two months after the issuance of the order to make changes (for example, the date of issue of the order to make changes is 11/15/2020, and changes must be put into effect no earlier than 01/16/2021). If changes concern vacancies, this deadline may not be met.

Similarly, when changing salaries, it is necessary to comply with the requirements of Article 74 of the Labor Code of the Russian Federation, according to which a change in the terms of an employment contract at the initiative of the employer is allowed only if it is a consequence of a change in organizational or technological working conditions. All employees whose salaries are to change must also be notified of this no later than two months in advance.

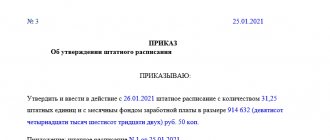

We will draw up a sample order for approval of the staffing table

LLC "Aphrodite"

Order No. 34-OD

Sarapul

December 30, 2021

On approval of the staffing table

I ORDER:

1. Approve staffing schedule No. 3-ShR dated December 30, 2021 in the amount of 35 staff units and a monthly wage fund in the amount of 1,238,000 (one million two hundred thirty-eight thousand) rubles. 2. Introduce document No. 3-ШР dated December 30, 2021 into operation from January 1, 2021. 3. Control over the implementation of this order is entrusted to the HR manager Nikolaeva E.A.

Appendix: ShR No. 3-ShR dated December 30, 2021.

General Director: Simonov / R.O. Simonov

I have read the order:

HR Manager: Nikolaeva / E.A. Nikolaev

Choosing a remuneration system

Once the number of personnel and work schedule have been decided, it is necessary to choose the correct remuneration system. There is no need to overload the calculation with numerous and complex indicators.

The main thing is simplicity and clarity for employees. The more difficult it is for an employee to calculate his salary, the less trust he has in his employer. Typically, employees of restaurants and cafes are paid a salary and a bonus, which depends on revenue and the individual contribution that the employee made to achieve certain financial indicators.

Extract from the staffing table

An employee may request such a document to submit it to the Social Insurance Fund, Federal Tax Service Inspectorate, Pension Fund and other institutions. In some organizations, the receipt of such an extract must be preceded by writing an application for its issuance. The manager does not have the right to refuse to issue this document to his employee, since the employee has the right to receive from the employer all information that concerns him personally.

The extract is prepared by an employee of the personnel service, certified by the employer, the head of the personnel service and the employee who compiled the document. The employee who requested the extract also signs.

The paper is not a copy of the SR; it contains only those data that are relevant to the employee who ordered it.

The document must contain only the following information:

- The name of the paper and the date of its preparation.

- Company name.

- A table with the following data: structural unit in which the employee is registered, his position, number of pieces. units, salary, allowances, monthly wage fund for this position, notes.

- Validity period of the statement.

- Signatures of the above employees.

Important! The fact that the employee was issued an extract must be noted in the journal of documents issued by the personnel department, as well as in the employee’s personal file.

Who develops and approves

Resolution of the State Statistics Committee of the Russian Federation No. 1 dated January 05, 2004 approved the unified form T-3, the staffing table is drawn up according to this form. But the employer has the right to change the format taking into account the needs of the organization. The content remains unchanged:

- structural units;

- positions;

- number of units in the state;

- salary levels;

- the size of the monthly wage fund.

Any official who has such authority (manager, accountant, human resources specialist) has the right to develop a SR. But, as a rule, this is done by HR specialists. In some cases, before the SR, the structure of the organization is drawn up - a diagram of divisions, their relationships and subordination. It is necessary to determine the labor costs for each available position in order to understand what staff is needed for the normal functioning of the organization. It is advisable to do this when creating a legal entity, but it can be done at any time later.

When developing the ShR, the following normative and legal acts are taken into account:

- enterprise structure (if any);

- accounting policy;

- professional standards;

- calculations of monthly official salaries;

- other legal and regulatory technical documents.

The developed document is approved by order signed by the head of the organization or other authorized person. The official seal is not placed on this document, even if the organization uses it. The details of the relevant order are indicated at the top, the document is certified by the signature of the manager.