What is an advance report

In the very phrase “advance report” one hears a decoding of the meaning - a report on the advance payment issued. An advance is issued to the accountable person for the intended use of funds, confirmed by properly completed primary documents.

Reported funds are provided for the following purposes:

- Economic needs of the organization;

- Travel expenses;

- Entertainment expenses.

The advance report is filled out by the accountable person himself, checked, as a rule, by an accountant (or manager) and signed by the head of the organization. Based on the data of the approved advance report, the accountant writes off the accountable funds.

The accountable person may be:

- Employees of the organization;

- Freelance employees who have entered into civil legal relations with the company.

Correct completion of the report is very important, because... otherwise, the tax office may have questions about the validity of accepting the spent amounts for tax accounting.

The deadline for the employee to submit a report on accountable amounts is set at 3 working days, however, if this day falls on a weekend (sick day, business trip), then the date of the report will be considered the day the accountable person goes to work.

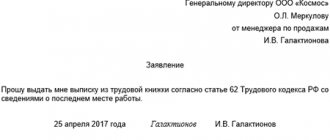

To provide advance funds, the accountant writes an application for the issuance of money, where he specifies the amount and period for which they are required, as well as information about the absence of debt on the previous report. The signature of the manager and the date on such an application are mandatory details.

If an employee has not reported on a previously issued advance, a new one cannot be issued to him. However, if the employee has not returned the balance of unspent amounts, this does not serve as a basis for non-issuance of the next accountable funds.

When the employee presents supporting documents for the advance report, the final payment is made: the accountable person either returns the unspent part of the money or reimburses the organization for the overexpenditure.

At the same time, it is necessary to explain to the accountable person that in addition to checks issued by the store, he must request invoices, delivery notes and other documents.

For the right to sign on acceptance of goods, a power of attorney is issued to the accountable person. Without receipts, you should not accept invoices and other primary documents, since it will not be possible to confirm expenses without them.

Results

A report for an advance received by an employee for expenses for the company's business is an important document for both accounting and tax accounting, since based on the documents attached to it and approved by the manager, the expenses incurred can be taken into account (or not taken into account) when forming tax base. Therefore, company employees must comply with the deadlines for submitting advance reports, which, from November 30, 2020, companies have the right to determine independently, and accounting employees must carefully approach the timely reflection of accountable amounts in accounting.

Sources:

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

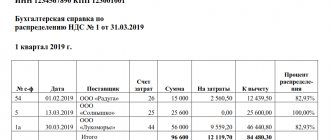

What taxes can be reduced

An advance report makes it possible to reduce the tax base for organizations using the simplified tax system (15%) and reduce the amount of VAT.

For the simplified tax system of 15%, this is explained by the fact that the taxpayer takes into account the expenses incurred, confirming them with receipts and primary documentation for the purchased goods (services).

When purchasing goods and services subject to VAT, the taxpayer has the right to reduce the amount of tax by the specified VAT on checks.

Representation expenses can reduce the tax base when calculating income tax. But not completely: the amount limit is 4% of labor costs in the corresponding tax period. In this case, it is necessary to have supporting documents: an order for the event, a report on the event, an estimate, etc.

Documented travel expenses are exempt from insurance premiums and are taken into account when calculating income tax. Also, daily allowance

in the amount of no more than 700.00 rubles for each day on a business trip in Russia and no more than 2,500.00 rubles for each day on a foreign business trip

are not subject to personal income tax

.

Personal income tax will have to be charged on the amount of excess expenses. It is important to note that food costs are included in the daily allowance and cannot be taken into account separately

.

If the employee has not provided supporting documents for the business trip, then the expenses cannot be taken into account when calculating income tax, and insurance premiums must also be charged on them. But according to the law, you can save on personal income tax and not charge it within the established limits of taxable expenses (700.00 and 2500.00 rubles).

If the employee has not reported on the advance (has not provided an advance report), the previously issued amounts are subject to salary taxes (insurance contributions and personal income tax).

Deadlines

A report containing the amounts spent must be submitted within three working days:

- after the end of the period for which the funds were received;

- from the date of return to work, when the employee returned from vacation or business trip.

Two examples of correct calculation can be considered.

Example 1:

Cash was issued to the company representative on Tuesday, May 15, 2018, for a period of five working days. The first working day ends on Wednesday, 05/16/2018, and the fifth on Monday, 05/22/2018.

It turns out that over the next three working days from Tuesday to Thursday, the period from May 23 to May 25), a report on the money spent must be received by the accounting department.

Example 2:

Cash has been provided to the employee for travel expenses that ends on Friday, May 19, 2021. On May 22, Monday, the employee starts work. He has three days (from May 23 to May 25) to submit the report to the accounting department.

Time limits

The accounting department checks the submitted documents, after which it submits it for approval to the director of the company. When it is finally approved, a final settlement is made with the employee for the period that is displayed in the order.

The submitted document must be checked and approved within the period approved by the director of the enterprise. This is stated in paragraph 6.3 of Directive 3210-U.

The final settlement is made either by the representative returning the unspent money in the form of a balance, or he is required to reimburse the amount of overspending that was taken from his own money.

How to accept checks from an accountant

When accepting checks from an accountable person, you must make sure that the expenses are made for the needs of the organization and not in the interests of the individual.

Documents confirming expenses are:

- Cash register receipt;

- Sales receipts/invoices;

- Receipts, strict reporting forms;

- Passenger tickets/boarding passes.

Since July 2021, a QR code has become a mandatory element of the new cash receipt. This detail makes it possible to check the legality of the organization and the purchase being made. In some cases, sellers are allowed to issue a strict reporting form. The tax office may find fault with the completed cash receipt (or BSO) and charge taxes on these amounts. Therefore, you need to review checks for the following points:

- Number, date of the check;

- Time, place of payment;

- Name of organization (full name of individual entrepreneur);

- Taxpayer INN;

- Applicable tax regime, tax rate;

- Sign of payment (payment from the buyer; refund to the buyer, etc.);

- Name of goods (services, works);

- Amount and form of payment (cash/non-cash);

- The position and surname of the person who made the settlement with the buyer;

- CCP registration number;

- Serial number of the fiscal drive model;

- Serial number of the fiscal receipt;

- Shift number;

- Fiscal message sign.

If the check was sent to the buyer by email, the check will contain the sender's email address and the buyer's email address (or subscriber number).

We spend expenses correctly

First of all, when preparing documents, you must enter the date and number of the advance report. It has been in ordinal terms since the beginning of the year. We register the accountable person and the amount of the advance report.

On the front side please indicate:

- the balance or overspending of the reporting person from the previous advance;

- the amount of the advance received by the accountable person (indicate cash issued and transferred to the card in different lines);

- the amount of funds spent equal to the amount in columns 7-8 of the advance report;

- the amount of the balance or overexpenditure taking into account the previous advance report;

- numbers of accounts (subaccounts) corresponding to column 9 of the reverse side of the advance report.

- in the line “Attachment of documents on sheets” - the number of documents and sheets on which these documents are drawn up;

- the amount of the report for approval (in words and figures).

All lines of the expense report must be completed. If the accountable person is an employee of the organization, then we indicate the structural unit in which he works, personnel number and position. If the advance report is filled out by another individual, then these lines remain empty.

Write down the purpose of the advance. In the names of the indicators, indicate information about previously issued funds: the balance of the amount, or overexpenditure (if any).

It is important to specify how money is issued: from the cash register, or to a bank card (employee, or corporate card of the organization). Below, write down the final balance, taking into account the previously issued advance and the amounts already spent. In the case of the example, the employee was given 40,000.00 rubles, of which he spent 33,355.27 rubles. He returned the balance in the amount of 6,644.73 rubles to the cashier in the same number with which he filled out the advance report. In the attachment, he provided documents on 2 sheets (the number of checks issued).

The receipt is confirmation that the documents of the accountable person have been accepted and he does not owe funds for the amount for which reasonable expenses were incurred. It indicates the number of documents, the total amount of expenses in figures and words, the date and the person who accepted the documents. In this case, it is the accountant who signs the tear-off part of the first page of the report and affixes the date. This part is detachable and issued to the accountable person.

On the reverse side of the expense report, in columns 1-5, the date and document number, type of document (check, copy of a check) and amount are indicated under the serial number. Lines 7-9 indicate the amounts of expenses accepted for accounting and the numbers of accounts (subaccounts) that are debited for these amounts. Usually this information is provided by an accountant or the head of the organization. If accounting is kept in 1C, then when setting up the program, it will enter the accounting accounts itself. The employee does not fill out these lines.

The accountable person puts his signature only on the reverse side of the expense report. The advance report is drawn up for the amount for which the documents are provided and only this amount will be displayed on the reverse side.

In the advance report, it is necessary to check the intended use of the funds spent, the presence of supporting documents (checks, copies of checks), the correctness of filling out the documents and the correctness of the calculation of the specified amount in the report. That is, you need to look at the receipts to see what exactly was purchased and calculate the amounts of the receipts.

A receipt without indicating goods and materials will only confirm expenses and will not allow goods to be delivered on receipt, so it is necessary to request primary documents from the seller confirming the purchase of goods.

Reporting documents on business trips abroad

Upon returning from a trip abroad, the employee must attach documents confirming his expenses to the report. a copy of the passport with customs control marks on border crossing must be attached to the report An employee may also have consumable documents for currency exchange, obtaining a visa, translation services, compulsory medical insurance, fees for the right to enter vehicles, consular fees, etc.

All reporting documents, including those for accommodation, must be translated into Russian line by line. The translation can be done in a specialized company or performed by a full-time employee who is responsible for translating documents.

When receiving an advance payment for a foreign business trip in rubles, an employee may need to exchange currency. A document that will confirm these expenses can be a certificate from the bank about the movement on the account (if paying with a ruble card) or a certificate of purchase of currency issued by an exchange office.