Employer reporting

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of September 24, 2018

6 personal income tax for 9 months of 2021 - you will see a sample of filling out the report in this publication. Instructions and examples on specific situations regarding rolling salaries are also provided. We will answer the questions: what is the deadline for submitting 6-NDFL for the 3rd quarter of 2021? Which form should I use? How to fill it out correctly? What to consider when paying vacation pay, sick leave or carryover salary? Will I be fined for late submission of a report? A comprehensive answer to these and other questions is in this publication.

What does Form 6-NDFL show?

6 Personal income tax is a relatively new report, mandatory for all employers, applied from the 1st quarter of 2021.

It includes information about:

- employee remuneration (income);

- accrued, withheld and transferred personal income tax;

- terms of assignment, withholding and transfer of tax.

The document form and the algorithm for its execution were approved by order of the Federal Tax Service on October 14, 2015 No. ММВ-7-11/ [email protected] To calculate for 9 months, you should take the form as amended. Order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/ [email protected]

You can download the current 6-NDFL form here .

Who submits 6-personal income tax and where for 9 months of 2021

The form is submitted to the Federal Tax Service at the place of registration of tax agents paying income under employment and civil law contracts to individuals. Personal income tax agents are considered organizations and individual entrepreneurs, as well as private notaries, lawyers and other self-employed persons who pay income to “physicists”.

6-NDFL includes all accrued income, regardless of whether they are paid or not. If you did not calculate or issue salaries to your employees, there is no need to create a calculation. However, it is advisable to notify the tax authorities that you are not submitting the report due to the lack of data to fill it out.

Branches are also required to submit Form 6 personal income tax to the tax office at the place of registration. At the same time, the checkpoint and OKTMO corresponding to the territorial location of this separation are indicated on the title page of the form. An exception is large taxpayers who have the right to submit the form at the place of registration of the parent organization. However, tax authorities do not consider this position to be legitimate and want to see a report to the Federal Tax Service at the place of registration of the unit (letter of the Ministry of Finance of the Russian Federation dated December 19, 2016 No. BS-4-11 / [email protected] ).

Also see “Deadline for submitting 6-NDFL for the 3rd quarter of 2021“.

Responsibility for violation of deadlines

Failure to submit a declaration on time or in error is one of the grounds for administrative liability. Both the management of the enterprise and the person directly responsible for submitting documents are involved in the execution of the punishment, as a rule, this is an accountant.

There is only one way to avoid a fine: if the organization independently identified a calculation error during delivery and redirected the corrected version as soon as possible.

The amount of the fine is distributed as follows, according to Art. 15.6 Code of Administrative Offenses of the Russian Federation:

| Citizen or employee of an organization | 100-300 rubles |

| Supervisor | 300-500 rubles |

If during the audit it turned out that personal income tax payments were transferred to the Federal Tax Service account not on time or not in full, then, according to Art. 123 of the Tax Code of the Russian Federation, the management of the organization expects sanctions in the amount of 20% of the amount of tax not received into the account.

Thus, declaration 6 of personal income tax is one of the mandatory elements of enterprises making payments to their employees. Late submission of documentation entails administrative liability both for the management of the organization and for the accountant obligated to submit this report.

Procedure for processing 6-NDFL for 9 months of 2021

The form is filled out based on tax registers for personal income tax. General filling requirements include:

- entering information into each individual cell from left to right;

- mandatory completion of sum and detail indicators; if any data is missing, 0 is entered;

- if during the registration process there are blank acquaintances left, a dash is placed in them;

- The pages are numbered consecutively.

In calculations submitted on paper, it is prohibited:

- making corrections using a bar-corrector;

- two-sided printing.

The form can be filled out in blue, purple or black ink.

Sample 6-NDFL can be downloaded here .

Title page

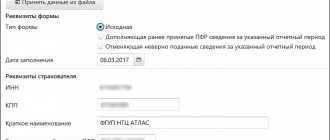

The title page of form 6-NDFL is filled out by both the tax agent and the tax authority employee in specially designated cells. It contains:

- TIN of the organization's checkpoint (or only TIN for entrepreneurs or self-employed people) in accordance with the tax registration certificate.

- In the line “Adjustment number” indicate the serial number of the clarification. For the primary report, the value 000 is fixed.

- In the “Representation period” field, enter the code designation of the reporting period:

What it is

6 Personal income tax is a quarterly reporting form, which is submitted, as a rule, on the last day of the month following the previous reporting period.

If the due date falls on a holiday or weekend, it is postponed to the next working day. The general annual declaration must be submitted before April 1.

The report is produced by the inspectorate at the place where business or banking activities are carried out. Organizations that have branches or representative offices must submit 6 personal income taxes separately for all employees of each division.

Individual entrepreneurs operating on the UTII or patent system, in turn, submit reports to the inspectorate, where they are recognized as payers of these tax fees.

Section 1

Sec.

1 of Form 6-NDFL includes general information about income, as well as accrued and withheld tax from January to September 2018. The section is filled out separately for each tax rate, with the exception of lines 060-090. The total indicators for these lines are recorded only on the first page of the section. 1. This section contains:

| Line | Index |

| 010 | Tax rate |

| 020 | Amount of employee income |

| 025 | Amount of calculated dividends |

| 030 | The amount of standard, property and social deductions |

| 040 | Amount of calculated personal income tax |

| 045 | Amount of accrued tax on dividends |

| 050 | Amount of advances paid for a foreign worker |

| 060 | Total number of employees to whom income was accrued |

| 070 | Amount of personal income tax withheld |

| 080 | Amount of unwithheld personal income tax |

| 090 | Return of withheld personal income tax to the taxpayer (for example, if an employee’s salary was recalculated and the amount of withheld tax exceeded the calculated one) |

Let's look at an example of filling out section. 1 form 6-NDFL for 9 months of 2018.

Alliance LLC for 9 months of 2021 accrued income to its employees in the amount of 6,832,350 rubles. The amount of deductions amounted to 210,000 rubles. The amount of calculated personal income tax is RUB 860,906. The amount of unwithheld tax is RUB 102,700.

Control ratios for verification

Income tax accounting is a rather complex and time-consuming procedure. It is necessary to make calculations for each employee, take into account the types of payments, the use of deductions, etc. Therefore, when filling out the final form 6-NDFL, there is a high probability of making mistakes in the calculations.

To check yourself, it will be useful to use the control ratios that the tax authorities themselves use (letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 N BS-4-11/).

- Line 020 of section 1 (accrued income) cannot be less than line 030 (amount of deductions). If this condition is not met, you should check the correct application of deductions.

- The value of line 040 (accrued tax) should be obtained by calculation from other lines of the section:

Page 040 = (page 020 – page 030) / 100 x page 010

There may be an error here, because... Personal income tax is calculated separately for each employee and rounded to the nearest whole ruble. To determine the permissible deviation, you need to multiply the value of line 060 (the number of income recipients) by the number of lines 100 (the number of payments).

- The value of line 040 must be greater than line 050 (fixed payment for foreigners). If this is not the case, then personal income tax calculations on the income of foreign workers are carried out with errors.

Section 2

This section is prepared for 3 reporting months, i.e. when preparing calculations for 9 months, information for July, August, and September is transferred here.

In Sect. 2 the following information is recorded:

| Line | Intelligence |

| 100 | Date of receipt of income, the amount of which is reflected on page 130 |

| 110 | Date of personal income tax withholding from the amount recorded on page 130 |

| 120 | Deadline for transferring taxes to the budget |

| 130 | The amount of personal income tax income actually received on the day specified in page 100 |

| 140 | The amount of personal income tax withheld on the date reflected on page 100 |

If for at least one type of income received on the date specified on page 100, the day of tax withholding or transfer is different, a separate block on pages 100-140 is formed for this income.

Next, we will consider the procedure for filling out section. 2, continuing the previous example.

Algorithm for preparing a report when paying bonuses, vacation pay and sick leave

accrued to 30 employees:

| Month | July | August | September |

| Salary | 750 000 | 710 000 | 780 000 |

| Monthly bonus | 15 000 | 10 000 | |

| Leave compensation upon dismissal | 17 000 | ||

| Vacation pay | 32 000 | ||

| Hospital benefits | 12 000 | ||

| Remuneration under the GPC agreement | 20 000 |

Leave compensation upon dismissal was paid to the employee on September 10, 2018, vacation pay on August 20, 2018, and sick leave benefits on July 16, 2018.

On August 15, remuneration was paid to the individual who carried out the installation of equipment under a civil contract in the amount of 20,000 rubles. (Personal income tax - 2,600 rubles). The advance payment date is the 20th of each month, the salary date is the 5th of the month following the month of income accrual.

How to correctly reflect carryover payments

Studying the above example of filling out form 6-NDFL, you may wonder whether the accountant of Alliance LLC made a mistake by reflecting the salary for June in the document for 9 months and not recording the data for September. How to correctly display the rolling salary on the form? The answer to this question was given by the Federal Tax Service in its letter dated February 25, 2016 No. BS-4-11/3058: in section. 2, only indicators are recorded on those incomes on which tax was calculated, withheld and transferred during the last 3 months for which the report is generated.

That is, in the example conditions, income for September is considered received, but the deadline for tax withholding and transfer will occur only in October (on the day of salary payment), i.e. already in the 4th quarter of 2018. Therefore, this information should be recorded in the report for 2021 (Letter of the Federal Tax Service dated January 25, 2017 No. BS-4-11/1249). At the same time, on page 020 section. 1 reflects the generalized amount of employee income from January to September.

Salary for June 2021 is displayed in the same way. Since the tax was withheld and transferred to the budget already in July 2018, information about the June earnings of employees is recorded in the report for 9 months.

Hot questions about filling out form 6-NDFL

Since the calculation of 6-NDFL appeared only in 2021, tax authorities often provide explanations and recommendations on the procedure for drawing up a document in a given case.

Let's look at some of them:

- How to reflect daily or other non-taxable income in form 6-NDFL?

Daily allowances in the amount of the limits established in the Tax Code (700 rubles / day - in Russia and 2,500 rubles / day - for foreign business trips) are not reflected in the calculation of 6-NDFL, since they are not taxed. And non-taxable amounts are not included in form 6-NDFL (see question 4 of the Federal Tax Service letter dated 06/01/2016 No. BS-4-11 / [email protected] ). Over-limit daily allowances (as well as other payments in excess of the norms established in the Tax Code, for example, the cost of gifts exceeding 4 thousand rubles) are recognized as income of the taxpayer, and tax is withheld from them on the salary payment day closest to the date of approval of the advance report.

- Should I submit an updated calculation for the 1st quarter and half of the year if an error was discovered in August for February 2021, which led to an understatement of the taxable base?

Conclusion

Formally, providing zero 6-personal income tax is not mandatory. If an economic entity does not have the data to fill out the form, then it is not a tax agent, which means it should not submit this report at all. However, to avoid problems with tax authorities, you should send a letter to the Federal Tax Service with information about this. Often tax agents submit a zero report instead of a letter. The deadlines for sending a letter or submitting a zero form 6-NDFL are the same as for a “regular” report.

Read also

27.07.2016

What are the deadlines for submitting a report to the Federal Tax Service and the penalties for late submission of Form 6 Personal Income Tax

Form 6-NDFL is generated once a quarter and sent to the Federal Tax Service no later than the last day of the month following the reporting period. That is, based on the results of 9 months, the form should be submitted to the tax authorities by October 31, 2018.

If the tax agent is late for any reason and the payment reaches the tax authorities later than the deadline, the Federal Tax Service will issue sanctions for each month of delay (full or partial) in the amount of 1 thousand rubles. (clause 1.2 of article 126 of the Tax Code of the Russian Federation), and will also block the current account if the delay exceeds 10 days (clause 3.2 of article 76 of the Tax Code of the Russian Federation).

Submission rules

The declaration can be submitted in several forms, the choice of which depends solely on the type of enterprise.

Let's look at the main points:

- If the company employs a maximum of 25 people, the declaration can be submitted on paper directly to the tax department or by post.

- If the number of employees exceeds 25, then reporting is made in electronic form, in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation.