Concept and structure of assets and liabilities

Assets are the resources of an enterprise that it uses for its activities. They can represent both material objects and various rights of claim, intellectual property, etc.

What assets have in common is that a company owns them and can use them to obtain economic benefit.

Liabilities are the sources through which an enterprise acquires assets. This could be owner funds, accumulated profits, various forms of accounts payable.

Actually, all liabilities can be considered accounts payable in the broad sense of the word. After all, both the owners’ investments and retained earnings can be returned under certain conditions (for example, upon payment of dividends, liquidation or withdrawal of one of the founders from the company’s capital).

Grouping of assets and liabilities is carried out by liquidity, sources of formation and timing. Let's consider the composition of assets and liabilities of the balance sheet in the traditional version recommended by the Ministry of Finance for financial statements (order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n).

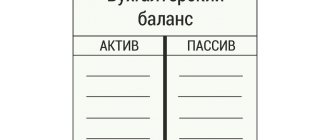

The assets and liabilities of the balance sheet (the table below) contains the main groups of company resources and their sources:

| Assets | Liabilities |

Fixed assets:

Current assets:

| Capital and reserves:

Long term duties:

Short-term liabilities:

|

Active part of the balance

The active part of the balance sheet reflects property assets and liabilities owned by the company and used by it for business purposes. activities. They can bring benefits to the company. The active part is divided into two sections:

- Current assets - information about their availability and composition is constantly changing, their value in the financial result is taken into account one-time.

- Non-current assets - this section reflects property assets that the company has been using for a long period of time; their value in the financial result is recorded in parts.

The relationship between assets and liabilities of the balance sheet

The connection between the two parts of the balance can be explained not only on the basis of economic theory, but also from the point of view of the laws of physics. Resources (assets) cannot appear “out of nothing,” so any of them must correspond to one or another source. In practice, an exact match, when a specific asset is equal to a liability, as a rule, does not exist. One group of assets can be formed at the expense of several categories of liabilities or vice versa.

For example, a fixed asset can be acquired partly through the contribution of the founders, and partly through a bank loan. Or the fixed assets and materials were purchased on deferred payment terms, i.e. two groups of assets were obtained at the expense of one category of liabilities - accounts payable.

But in general, equality of assets and liabilities of the balance sheet must be observed. Those. all assets must be covered by their sources - liabilities. If the balance sheet does not match the asset with the liability, then this indicates errors in accounting. The reasons why the assets and liabilities of the balance sheet do not converge can be very different:

- Late reflection of certain transactions on accounts.

- Incorrect closing of the reporting period (for example, incomplete write-off of production costs).

- Retained earnings (loss) for the period were not transferred to the appropriate liability section.

Example

The company received an advance payment from the buyer in the amount of 100 thousand rubles to its bank account. If the amount of money received in the reporting period is reflected only in the asset (item “Cash”), then a situation will arise in which the asset and liability do not converge. In order to correct the situation, you need to add the received amount (100 thousand rubles) to the liability (item “Accounts payable”).

Please wait until the system is updated to resend the report.

Also, a corresponding update of the automatic tax reporting verification systems operating in the Federal Tax Service may be a panacea. Considering the many errors recorded in the system, errors 0400400010, technical support of the Federal Tax Service may release an update that will solve the error in the difference in calculating the balance amount. But there is no exact data on the release of such an update yet.

Wait for the appropriate system update

This may be useful: Error generating a certificate in the taxpayer’s personal account - what to do?

Above, we looked at why error code 0400400010 occurs, which means: “The control ratio of the NBO form indicator is violated.” Since this problem is caused by the peculiarities of calculating the summed values, we recommend either writing an explanatory note on your numbers, or recalculating your balance as the Federal Tax Service itself considers. After this, the error will be resolved.

Analysis of assets and liabilities of the balance sheet

Analysis of balance sheet data is carried out in absolute and relative terms.

When studying absolute figures, balance sheet figures are compared with corresponding data for previous periods. The structure of assets and liabilities and its changes in dynamics are analyzed.

Relative indicators represent various financial ratios - indicators of profitability, liquidity, financial stability, turnover, etc. Some of them are calculated based only on balance sheet data, others require information from other forms of reporting. For example, profitability and turnover also require financial performance report data.

Relative indicators are considered in dynamics and compared with standard values. Their analysis allows us to draw a conclusion about the financial position of the enterprise and the efficiency of its work.

Checking if the balance is out of balance

It happens that the asset does not match the liability on the balance sheet. To understand where the error was made, you need to check:

- Accuracy and timeliness of entering transactions into registers.

- Indication of all transactions performed and recording of all necessary documents.

- Inventory results. Inventory is a mandatory process that must be carried out at the end of each year, in full compliance with current legislation. All actions taken must be reflected in the appropriate documentation. It is possible that the mistake was made in them.

- Reformation of the balance sheet is the last stage in the formation of accounts. balance. It is carried out upon completion of all transactions for the current year. Most accountants make mistakes on this point.

If an error has been found, it must be included in the balance, then it will converge without any problems.

Balance sheet in 1C

Accounting has become fast and convenient thanks to the 1C program. Forms of financial statements are regulated by government agencies on the basis of regulations. The balance sheet in 1C is formed taking into account all changes, since using the built-in parameters for updating the configuration, the form of regulated reporting is promptly updated.

The printed form of the balance sheet in 1C is compiled according to Form No. 1, approved by Order of the Ministry of Finance of the Russian Federation No. 66n “On Forms of Accounting Reports of Organizations” dated 07/02/10, as amended on 04/06/15. The report form has the form of a table consisting of two parts:

- Asset – property of the organization;

- Liabilities are the things by which property is formed.

Photo No. 1. Printable balance sheet form in 1c accounting 8 edition 2:

Balance sheet.

All information about the organization is formed in the header of the printed form of the document:

- Full name;

- TIN;

- Kind of activity;

- Type of ownership;

- Currency and units of measurement of indicators;

- Legal address.

This data is taken into the printed form of the document automatically from the section containing information about the company.

The document displays the date of compilation, the name of the indicators, their line code, the value of the indicator in monetary terms at the beginning and end of the reporting period.

In order for the balance to converge in the 1C program, it is necessary to first carry out all the documents and operations on the basis of which it is formed.

Photo No. 2. Screen balance form in 1C:

Screen form

Photo No. 2 shows that the document cells are painted in several colors:

- White means the cell cannot be manually edited;

- In yellow, users can enter the required information;

- In light green fields, indicators can also be changed, and they are generated automatically by the program, based on data from yellow and white cells;

- Indicators in green cells also appear automatically. They change if the data in the light green cells is edited.

In the electronic form of the report, you can manually change the settings of light green cells to the following parameters:

- Only automatic filling, no manual adjustment;

- Automatic filling with adjustment;

- No auto-fill.

Photo No. 3. Balance sheet section in 1C 8:

By right-clicking on any balance sheet indicator in 1C 8, a section will appear as shown above. The “Decipher” button will make it possible to track the algorithm for calculating the indicator and see from which standard report the amount is added to the report. The “Add and remove line” buttons will perform the corresponding actions in the balance sheet form.

Step-by-step formation of a balance sheet in 1C 8.2

It’s easy to create a balance sheet in 1C Accounting 8 edition 2, to do this you need to follow these steps:

- Open the program, in the working field that appears in the top menu, click on the “Reports” button, select the 1C-Reporting item, sub-item “Regulated reports”;

Photo No. 4. Regulated reports:

Regulated reports

2. By left-clicking on the sub-item “Regulated reports”, a window will open as shown below. Here you need to select an organization, in this example – Trading House “Complex LLC” and the reporting period, in the example 1st quarter of 2021. Then click on the “Create” button - the “Types of reports” window will open;

Photo No. 5. Menu “Types of reports”:

Types of reports

3. In the “Types of reports” window that opens, in the “All” tab, in the “By categories” section, select the “Accounting statements” item, to do this, click on “+”. A list of financial statements will appear on the screen. In this list, find the item “Accounting statements since 2011” and click on the “Select” button;

Photo No. 6. Accounting statements since 2011:

4. In the “Accounting Statements” window, you need to specify the organization for which the balance sheet will be generated in 1C 8 2, specify the period of compilation, and indicate a commercial or non-profit organization. The printed form of the document is formed taking into account the latest changes in legislation - current information is reflected in the line “Form edition”. When all parameters are specified, click the “Create” button;

Photo No. 7. Specified parameters for financial statements:

5. An empty balance sheet in 1C will appear on the screen. It is filled in with data when you click on the “Fill” - “Current Report” button. The total in the asset cell must agree with the total in the liability cell. Otherwise, the balance in 1s will be drawn up incorrectly;

Photo No. 8. Filling out an empty balance with data:

6. The document is generated, filled out, the indicators match. Now they print it, click on the “Print” button, it is located in the first top line above the document screen form. The “Select printed form” window that opens gives you the right to select the printed form of the document, depending on which regulatory authority the reporting will be submitted to. In 1C, the balance is printed immediately or a printed form of the form is viewed on the screen;

Photo No. 9. Balance print:

Balance print

7. The balance is saved in 1C 8 by clicking on the “Write” button; in the picture above it is highlighted with an orange background.

The program provides a calendar for an accountant. He tells you what report and within what time frame must be submitted to the regulatory authorities. Information in 1C is generated according to the due date of delivery. To open it, click on the “Main” menu - in the “Tasks” section, select the “Task List” item, as in the picture below.

Photo No. 10. Accountant’s calendar: