All individual entrepreneurs are required to keep a Book of Income and Expenses, abbreviated as KUDiR, with a few exceptions. We will talk about the specifics of the document for different tax regimes in the article.

First, about the exception. The exception is for individual entrepreneurs who use UTII. They may not fill out the Book, provided that they work only for UTII. However, when combining UTII with other tax regimes, the individual entrepreneur is obliged to ensure separate accounting of property and transactions, that is, fill out the KUDiR for each tax regime.

The Ministry of Finance of the Russian Federation together with the tax service have developed 4 KUDiR forms:

- for individual entrepreneurs on OSNO;

- for individual entrepreneurs on the simplified tax system;

- for individual entrepreneurs on PSN;

- for individual entrepreneurs on the Unified Agricultural Tax.

The book of income and expenses for individual entrepreneurs is a tax register that forms the basis for calculating taxes in connection with the use of special regimes.

KUDiR for individual entrepreneurs on OSNO

The procedure for filling out the Book for individual entrepreneurs under the general taxation regime was approved by joint Order of the Ministry of Finance No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/02.

We have prepared a sample document for the OSNO “Book of Expenses and Income of Individual Entrepreneurs”; you can download it for free at the end of the article.

The book of income and expenses for individual entrepreneurs on OSNO consists of a sheet with information about the individual entrepreneur, a sheet with contents and 6 sections:

- Accounting for income and expenses.

- Calculation of depreciation of fixed assets.

- Calculation of depreciation for small business enterprises not written off as of 01/01/2002.

- Calculation of depreciation of intangible assets.

- Calculation of accrued and paid wages.

- Determination of the tax base.

Several tables have been developed for each of them; they must be filled out for each type of activity separately.

The sheet “Information about the individual entrepreneur” indicates the registration data of the individual entrepreneur, his bank accounts, license numbers, cash register numbers, types of business activities, place of business, telephone numbers.

The “Contents” sheet lists all completed tables with page numbers.

6.1 reflects the summary data on the basis of which the declaration is filled out.

Book of accounting of income and expenses, sample of filling out section 6.1

KUDiR for individual entrepreneurs on the simplified tax system

The document for the simplified tax system is much simpler, and it is filled out not only by individual entrepreneurs, but also by organizations that use the simplified taxation system.

The book of income and expenses for the simplified tax system 2021 consists of a title page and 4 sections:

- Income and expenses.

- Accounting for the costs of acquiring fixed assets and intangible assets taken into account when determining the tax base.

- Calculation of the amount of loss that reduces the tax base under the simplified tax system.

- Expenses that reduce the amount of the calculated simplified tax system.

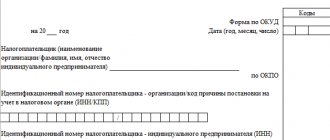

The title page indicates: name of the individual entrepreneur, INN, object of taxation, bank account details, tax period, OKPO code.

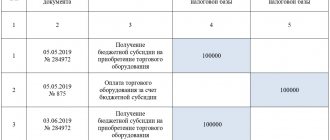

In section 1, the amounts of income are recorded in chronological order as payments are received from clients.

Sample of filling out KUDiR 2021 “income minus expenses” (hereinafter referred to as “D minus R”):

This is what section 1 of KUDiR 2021 of the simplified tax system looks like, you can find excel at the end of the article.

The last, 5th, column is filled out only for the simplified tax system with the taxable object “D minus R”.

The figures reflected in the first section of KUDiR are summed up quarterly on an accrual basis, and based on the data obtained, the taxable base for the simplified tax system is determined.

Sections 2 and 3 are filled out only with the simplified tax system “D minus R”.

Section 4 is filled out only for the object of taxation “Income”, it shows paid insurance premiums and other things determined by clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

The amounts specified in section 4 reduce the amount of the accrued simplified tax system in full for individual entrepreneurs without employees and by no more than 50% if the individual entrepreneur makes payments of remuneration to individuals.

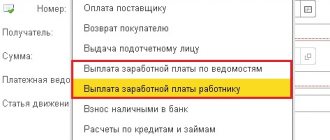

Program for maintaining a book of income and expenses under the simplified tax system

Fortunately, the advent of online services has made the lives of entrepreneurs and accountants much easier. Now, in order to fill out KUDiR quickly and without errors, you don’t need to struggle with Excel or other editors. However, if it’s more convenient for you, you can do it on our website. However, the human factor can always interfere and the likelihood of errors increases greatly. To prevent this from happening, we friendly recommend that you use special programs.

Why is it worth teaching KUDiR in an online program:

- Automatic update of report forms. You are always confident that the book will be compiled in the form required by current legislation, which means there will be no problems with the tax authorities in the event of an audit.

- Loading business transactions in 1 click. Literally like that! You simply upload a statement from your online bank to the program and that’s it. Moreover, you can integrate the online service with your bank and data on account turnover will be sent there automatically. At the moment, integration has been implemented with the following banks: Sberbank, ALFA-BANK, Modulbank, Tochka, Tinkoff, AVANTGARD.

- Accurate calculation of final indicators. Excel, of course, also helps make calculations easier, but it is still possible to make a mistake. In an online program this is practically impossible.

- Ease of working with data . After the bank statement is loaded into the complex, you can easily delete unnecessary items of expenses or income by clicking the mouse, just like adding something manually. In this case, the program will immediately recalculate all the results and generate a KUDiR for you in the finished final version.

- Access from anywhere in the world 24/7. You do not need to download the program to your computer or other gadget or update it. All data is available through an electronic account using a login and password at any time of the day and from any place where there is Internet.

Income book for individual entrepreneurs on PSN

Entries are made in the Patent Income Book (PSN) on the day payment is received and only for income from activities on the patent.

For each patent, a separate Book is opened for the validity period of the patent during the calendar year.

Expenses for activities on the PSN are not recorded in the document.

As usual, we give you the opportunity to use a sample: KUDiR for 2021 - free for PSN below.

Fine for absence of KUDiR

Inspectors of the Federal Tax Service have the right to check the correctness of maintenance and reliability of the submitted declarations during planned activities. In case of refusal to maintain KUDiR or violations in its registration, the entrepreneur will be held accountable in the form of penalties.

Article 120 of the Tax Code provides for fines for the lack of a book of income and expenses and other gross violations:

- for the first tax period - 10,000 rubles;

- more than the first tax period - 30,000 rubles;

- if there is an understatement of tax on insurance premiums, then 20% of unpaid taxes is at least 40,000 rubles.

General requirements of KUDiR for all tax regimes

Every year a new document is opened.

At the end of the year, it is printed, stapled, the pages are numbered, the total number of pages is certified by the signature of the individual entrepreneur.

All information is recorded in chronological order based on primary documents and only after payment (cash method).

For transactions with settlements through a cash register, it is allowed to fill out the Book at the end of the working day using the Z-report.

KUDiR and primary documents on the basis of which records are made must be stored for 4 years.

If there is no activity, a “zero” KUDiR is printed and stitched.

For individual entrepreneurs on OSNO

For individual entrepreneurs on the simplified tax system

For individual entrepreneurs on PSN

Electronic documents

KUDiR is a book of income and expenses that must be kept by: individual entrepreneurs on the simplified tax system, OSN, PSN, unified agricultural tax (i.e., everything except UTII), as well as organizations on the simplified tax system.

KUDiR can be carried out independently, i.e.

manually on paper. However, with a large number of income transactions, in order to save time and avoid errors when filling out the KUDiR, it is better to use our service “ Filling out the book of income and expenses online .” The service will help you create a book both automatically with downloading statements from your bank(s), and manually, and the service also allows you to use both filling options. When using automatic or semi-automatic generation, you need to receive a bank statement in 1C format, WIN encoding. The service allows you to download several statements from several banks, the main thing is that they are for the reporting period for which you are generating KUDiR. After filling out all the forms, you will receive a finished book in Excel format. All you have to do is check it, print it, number it, lace it up and certify it with your signature and seal. BE SURE TO CHECK THE BOOK YOU RECEIVE!!! Check payments with the word REFUND and its derivatives. If you have chosen a mixed filling mode, be sure to carefully review the received file to ensure that the same payments are added. Please note that the “income” column should not include funds:

- — from the Social Insurance Fund for payment of benefits;

- — on loans and borrowings;

- — as payment for the authorized capital;

- — pledge and deposit (with the exception of subsequent offset);

- — under an agency or commission agreement (you should only indicate your income);

- — return of the security deposit from participation in trades and auctions;

- — amounts from the return of low-quality goods or advance payment;

- — under an assignment agreement (you should only indicate your income);

- — dividends, if part of the share belongs to the company;

- — interest on deposits (only for individual entrepreneurs.

SUBMISSION AND CERTIFICATION OF KUDIR

You do not need to submit KUDiR to the tax office yourself, only upon request. However, a stitched and numbered KUDiR must be available for previous reporting periods, even in the absence of activity, profit or expenses, in this case a “zero” KUDiR is made. The fine for its absence for individual entrepreneurs is 200 rubles , for organizations - 10,000 rubles. On February 20, 2021, in the first reading, the State Duma adopted a bill abolishing KUDiR for simplified workers at the “Revenue” facility from July 1, 2021. This relaxation applies only to persons who make payments to buyers of goods (works, services) using cash register equipment.

The Federal Tax Service has reviewed the online request and reports the following.

The legislation on taxes and fees does not contain a prohibition on an individual entrepreneur using his personal bank card to receive payment for services rendered, followed by cashing out funds at an ATM and depositing these funds into his current account opened for business activities.

The question of the legality of using an account opened for an individual entrepreneur for business activities, as an individual who is not an individual entrepreneur, is not within the competence of the tax authorities. On this issue, a copy of the Internet appeal in accordance with Article 8 of Federal Law dated 02.05.2006 N 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation” was sent for consideration and preparation of a response to the Central Bank of the Russian Federation.

According to paragraph 1.1 of Article 86 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), the obligation to report to the tax authority information about the opening or closure of an account, deposit (deposit), about changes in account details, contribution (deposit) of an individual entrepreneur, as well as an individual who is not an individual entrepreneur, lies on the bank.

A similar obligation for an individual entrepreneur, as well as an individual who is not an individual entrepreneur, is not provided for by the legislation on taxes and fees.

Consequently, banks provide account identifying information, including in cases where an individual entrepreneur has an account opened as an individual who is not an individual entrepreneur.

Paragraph 2 of Article 86 of the Code stipulates that banks are required to issue to the tax authorities certificates about the existence of accounts, deposits (deposits) in the bank and (or) about cash balances (precious metals) in accounts, deposits (deposits), statements of transactions on accounts, on deposits of individual entrepreneurs and individuals who are not individual entrepreneurs, as well as certificates of electronic money balances and electronic money transfers in accordance with the legislation of the Russian Federation in electronic form within three days from the date of receipt of a reasoned request from the tax authority in cases provided for in paragraph 2 of Article 86 of the Code.

That is, the tax authority has the right to request from the bank information about the accounts of an individual entrepreneur, including in cases where an individual entrepreneur has an account opened as an individual who is not an individual entrepreneur.

Based on the above, there is no obligation for an individual entrepreneur to inform the tax authority about his use of an account opened for him as an individual who is not an individual entrepreneur for business activities.

At the same time, on the basis of subparagraph 4 of paragraph 1 of Article 31 of the Code, tax authorities have the right to summon taxpayers, fee payers or tax agents on the basis of a written notification to the tax authorities to give explanations in connection with the payment (withholding and transfer) of taxes and fees or in connection with with a tax audit, as well as in other cases related to their implementation of legislation on taxes and fees.

Acting State Advisor of the Russian Federation, 2nd class D.V. Egorov

Format and rules for maintaining KUDiR

It is worth considering the communication requirements for maintaining KUDiR:

- A new book of income and expenses of the simplified tax system is maintained from the beginning of each year; manual filling or electronic filling is allowed.

- When filled out on a computer, the document is printed at the end of the year.

- Each copy of the book is numbered and bound, the number of pages is indicated on the last sheet, after which a seal and signature are affixed.

- It is necessary to adhere to chronological order in the records, taking into account the cumulative total.

- To fill out, the cash method is used - only the actual movement of funds in the current account or cash register is taken into account. If products have been shipped but payment has not yet been received, income is not recognized as such. The same principle should be followed when managing expenses.

- Rubles and kopecks are used to indicate amounts.

- To correct errors in a handwritten copy, you must cross out the corresponding entry and write the correct version next to it. The correction is certified by the position, full name and signature of the official, after which the date of the correction is indicated.

How to apply for KUDiR

In 2021, it is not enough to download and maintain KUDiR for free in electronic form: by the end of the tax period it must be printed and bound. Former supplicants may have questions about this: what are the requirements, how to certify and seal? First, about the firmware:

- We fold the sheets in the correct order and make holes where they are stitched. To do this, you can use a needle, or you can use a hole punch if the file is thick. There are no general regulated requirements for this.

- We thread the threads and make a knot on the back of the document. You can also use tape for this.

For KUDiR on a patent there are no special requirements for registration and storage. Now let's look at the sealing process. There are two ways. Here you can see what the KUDiR looks like, which should be stored at the enterprise.

- Take a sheet of paper and glue it: the narrow side should be on the back side of the document, and the wide side should be on the front. On the front side we write the following information: number of pages (in words and numbers), date, name of the certifier. You can also use a seal if available. Moreover, the signature and seal must extend beyond the sealing sheet.

- We make a hole through all the pages of the book of income and expenses. You can do it as in the example, through the upper right corner, or you can just do it from the side. We thread the thread or ribbon. We make a knot on the back side of the document, and fix the end on the front side with a piece of paper with the information already listed above. The signature and seal (if any), again, must go beyond the limits.

Other blog posts

Nomenclature for individual entrepreneurs in the check from 2021: nuances and latest news

January 28, 2021 Read more

Transition from UTII to PSN from 2021: one of the best alternatives to “imputation”

January 28, 2021 Read more

Transition from UTII to OSNO: general system or special regime?

January 28, 2021 Read more