An advance report is a document that is drawn up to account for funds issued to employees to perform a specific job assignment (business trips, purchases of fuel and lubricants for the organization’s transport, etc.). Its preparation is necessary to confirm the amounts spent by accountable persons.

The report is generated manually or using software, for example, the 1C application solution. The document is submitted by the accountable person to the accounting department within 3 days from the date of spending the funds or returning from a business trip.

Issuance of accountable amounts

The general procedure for issuing funds for reporting is established in clause 6.3 of Procedure No. 3210-U. Therefore, an organization can issue accountable funds in the following ways:

- cash from the cash register;

- by cashless transfer to a bank card (see Letter of the Ministry of Finance of the Russian Federation dated August 25, 2014 No. 03-11-11/42288).

Cash can be issued to employees with whom an employment contract or a civil law contract has been concluded (see Letter of the Central Bank of the Russian Federation dated October 2, 2014 No. 29-R-R-6/7859).

IMPORTANT!

Immediately before issuing funds to an employee of the enterprise's accounting department, it is necessary to check whether the employee has any debt on previously issued advances. If there is no such information (the employee has not reported on previously issued funds), he does not have the right to receive other accountable amounts (paragraph 3, clause 6.3 of Order No. 3210-U).

What if there are no supporting documents

If a company employee knows that he needs to document his expenses, he will definitely make transactions with organizations that provide the relevant documents. However, the accountable person may simply lose them. What to do in this case?

The law suggests that if an employee is unable to provide supporting documents about the funds spent, the company has the right to demand a refund from him. Thanks to this, the organization will protect itself from fines.

However, the situation can be looked at from the other side. In the event that the accountable person actually delivered the purchased goods or paid for services, the price of which can be verified, then the company reimburses the expenses of its employee. Although there are some nuances here. Firstly, the employer must be willing to accommodate an employee who has lost supporting documents. Secondly, 13% of the accountable amount is withheld from the employee. Since it is impossible to prove the waste of funds, the law considers them the income of the taxpayer, which must be taxed.

Just a few years ago, the ambiguity of judicial practice in this matter made it possible to avoid paying taxes on hidden income. Today, legislation has closed this loophole. Now, if a person cannot prove where he spent the advance funds, this is considered his income, from which personal income tax is withheld.

Advance report

The 2021 advance report form remains unchanged. Do not forget that supporting documents must be attached to the advance report.

The law does not contain requirements for the mandatory use of unified forms of primary accounting documents. At the same time, each fact of economic life is subject to registration with a primary accounting document, which is determined by clause 1 of Art. 9 of Law No. 402-FZ. Organizations have the right to choose:

- independently develop report forms;

- use the unified form No. AO-1 (approved by Resolution of the State Statistics Committee of Russia dated 01.08.2001 No. 55).

An advance report in form No. AO-1 in Excel spreadsheet format is available for free at the end of the article, and an example of filling is shown in the figure below.

IMPORTANT!

All used primary documents must be approved in the accounting policy (Law No. 402-FZ, clause 4 of PBU 1/2008 “Accounting Policy of the Organization”).

After receiving the funds, the accountable person is obliged, within a period not exceeding three working days after the expiration date for which the funds were issued for the report, or from the date of return to work, to submit an advance report with attached supporting documents (clause 6.3 of Instruction No. 3210- U) to the accounting department. If the advance report is not drawn up in a timely manner, then this is a violation of cash discipline (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Accounting entries

The entries that the accountant must make after processing the expense report depend on the purpose of receiving money into the account.

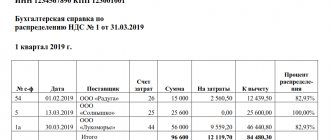

| Debit | Credit | Contents of operation |

| Postings for purchasing materials | ||

| 08, 10, 41 | 71 | Accepted for accounting of purchased materials |

| 60, 76 | 71 | Prepayment for materials has been made to the supplier |

| Postings following a business trip | ||

| 20 | 71 | Expenses for a business trip during which work was carried out under a contract with the customer were written off |

| 44 | 71 | Expenses are written off if the business trip was related to advertising or selling the company’s products |

| 08 | 71 | Expenses for purchasing new equipment were written off |

| 28 | 71 | Expenses were written off if the purpose of the business trip was to return defects to the supplier |

| Allocation of VAT (necessary if the business entity uses the general regime) | ||

| 19 | 71 | Accepted for VAT accounting on business trips |

| 68 | 19 | VAT offset completed |

| Return of the balance of accountable amounts | ||

| 50 | 71 | Refund of unused balance in cash. The cashier issues a cash receipt order. |

| 51 | 71 | The unused amount is returned to the current account |

| 70 | 71 | The amount is refunded from the salary |

Tags: Cash documents Online cash registers

Filling procedure

Let's look at how to fill out an advance report (see sample for 2020 below). For example, the unified form AO-1 “Advance report” is suitable.

The reporting person enters data in the following fields.

Filling out the front side of form No. AO-1:

- name of the organization that issued funds on account;

- Date of preparation;

- structural subdivision;

- details of the accountable person: full name, position, tab. number;

- purpose of the advance, for example: travel expenses, household expenses. needs, etc.;

- at the bottom you should indicate the number of attached supporting documents.

Filling out the reverse side of form No. AO-1:

- all details of the supporting document(s) confirming the expenses incurred;

- the amount of expenses incurred is reflected in the column “Amount of expenses according to the report.”

An employee of the financial or accounting service checks the fields filled in by the accountable person and additionally fills in the following fields:

- number;

- information about funds issued, broken down by amount: previous advances (balance or overexpenditure); issued from the cash desk for current expenses (for reference indicating currencies);

- “spent” - the approved amount should be indicated;

- “remaining/overexpenditure”—the amount of remaining funds is calculated;

- “accounting entry” - must contain entries that will be posted upon approval of the report.

After checking the correctness of filling out the document, accuracy, as well as the intended use of the issued funds, the form is sent for approval to the head of the organization.

After approval of the expense report, on its reverse side the amounts are indicated in the column “Amount of expense accepted for accounting” indicating the accounting accounts to which the expenses of the accountable person will be attributed. The advance report and the entries on it must correspond to the entries made in the accounting registers. Next, final settlements are made with the accountable person.

The detached part of the advance report is returned to the employee. This counterfoil is proof of reporting on accountable funds.

Sample filling AO-1

What can be taken into account

In a company, officials who accept advance reports of accountable employees of the company must know what documents can be accepted for accounting.

The list of forms confirming consumption includes:

- A sales receipt accompanied by a cash receipt issued using an online cash register. A sales receipt can be sent without a receipt if the business entity that issued it is exempt from the use of cash registers. In this case, the sales receipt must contain all the required details by which the seller can be identified.

- Receipt for the PCO with online cash register receipts attached to it. At the same time, this package of documents must include an invoice or an act for work (services). In these documents, the buyer must be the legal entity or individual entrepreneur who issued the amounts for accounting, and not the employee himself.

- Receipts, work orders and other numbered forms related to BSO and are supporting documents of expenses incurred by the employee.

- Tickets and insurance policies issued by transport companies, issued in cases of transportation of goods and passengers.

The regulations may establish additional requirements for such documents. For example, if a document on a foreign business trip is drawn up in a foreign language, you need to translate the part that relates to the expenditure of funds into Russian.

Important: special attention should be paid to documents that were drawn up on weekends, when the employee was supposed to rest and not perform his work duties.

Supporting documents

Supporting documents can be divided into two groups:

- financial - confirm the fact of payment of funds and the expenditure of accountable amounts for their intended purpose;

- shipping documents - confirm the fact of receipt of material assets.

All supporting documents must contain the required details: name of the counterparty, date, content of the fact of economic life, quantity, cost, as well as full name, position and signature of the person who compiled the report.

Let's consider the features of filling out various types of supporting documents.

What to do with debtors?

It would seem that the lifting of the ban on receiving advance payments to non-reporting employees makes life easier for companies. When you need to issue several amounts at short intervals (for example, the next day) to the same employee, who objectively did not have time to spend the money and report on it, this relaxation from the Central Bank will come in handy.

But the amounts of accountable funds, the issuance and reporting of which were carried out too freely, arouse unnecessary interest on the part of tax authorities. Therefore, to maintain financial discipline, we recommend establishing a list of persons and debt limits under which it is allowed to receive a new advance.

Cash receipt and strict reporting form

A cash receipt or a strict reporting form (hereinafter referred to as the SSR) confirms the actual payment (that is, the fact that the accountable person spent the money received). The forms must contain the mandatory details provided for in Art. 4.7 54-FZ.

Taking into account the specifics of their activities or the characteristics of their location, counterparties make calculations without using cash registers (clauses 2, 3, 5–7 of Article 2 of Law No. 54-FZ).

The required BSO details are:

- Name;

- series;

- BSO numbering;

- date of payment and date of registration of the BSO;

- name of the service provider indicating the tax identification number and address;

- name and cost of services;

- position, personal signature and full name. supplier employee;

- stamp (if available);

- imprint of the printing house that produced the form.

IMPORTANT!

The BSO must contain information about the printing house (name, address, TIN); The series and number of the form must be printed in a special line.

General provisions for conducting cash transactions

Accountable amounts are issued for travel expenses, payment for services and goods for the needs of the enterprise, and other needs necessary to ensure the activities of the organization. It is advisable to determine the procedure for making settlements with accountable persons in the local regulatory act of the organization or individual entrepreneur. The document defines the circle of accountable persons, the goals and timing of the issuance of money. Reduces questions from accountable persons, cashiers and regulatory authorities.

The procedure for receiving funds in the hands of employees is regulated by new rules for issuing accountable amounts adopted in 2021 and consists of the following stages:

- Permission (order or application).

- Receipt of money by an individual.

- Report on amounts spent.

- Return of unspent money or repayment of debt.

Sales receipt and invoices

The sales receipt does not have a unified form. Accordingly, each organization has the right to develop forms independently. This also applies to invoices. You only need to check the form for the presence of the required details.

It should be noted that these documents are shipping documents and do not contain confirmation of payment; accordingly, they do not reduce the amount of accountable amounts, except in cases where the acquisition of goods and materials is carried out from UTII payers who do not use cash registers. In this case, confirmation of costs will be a sales receipt (see Letter of the Ministry of Finance of Russia dated January 19, 2010 No. 03-03-06/4/2, dated November 11, 2009 No. 03-01-15/10-499, dated November 6, 2009 No. 03-01-15/10-492, dated 01.09.2009 No. 03-01-15/9-436).

Accountable Tools and Report

Another relaxation of the legislation, which came into force on August 19, 2017, affected the transfer of money if there is a debt owed to an employee. There is no longer any need to track the availability of a full report for previous accountable amounts, and issuing a new amount is allowed at any time. Previously, until the employee fully repaid the previous debt, it was impossible to issue a report. Now it is possible to write an application for accountable money and, if the decision is positive, receive it.

IMPORTANT!

Please note that a large amount of accumulated imprest amounts attracts the attention of regulatory authorities. These amounts qualify as borrowed (interest-free) funds.

Let us recall that income from the amount of savings on interest when receiving borrowed funds in terms of exceeding the amounts specified in clause 2 of Art. 212 of the Tax Code of the Russian Federation, are subject to personal income tax at a rate of 35%.

Invoices and UPD

An invoice is a tax document, which in this case provides the opportunity to accept VAT as a deduction from the budget. Please note that invoices to individuals purchasing goods (work, services) for cash are issued only if they have a power of attorney to receive this form (clause 7 of Article 168 of the Tax Code).

The universal transfer document is both a tax and shipping document. According to the UPD, you can simultaneously accept inventory items and take VAT into account for deduction from the budget.

An invoice and UPD are not documents confirming payment of material assets, and accordingly, they do not reduce the amount of accountable amounts.

IMPORTANT!

New invoice and UPD forms have been introduced in 2021!

Nuances

You can issue amounts of more than 100 thousand rubles for a report - this limit does not apply to settlements with employees. But the amount for any of the submitted documents should not exceed this limit.

If an employee goes on a business trip abroad, then you can give him accountable amounts in foreign currency. Her company independently exchanges it at the bank. In this case, this amount is indicated at the rate that was established on the date of issue.

Since 2015, it has been allowed to issue reports to contractors. He is also required to provide an advance report after spending the funds. However, in this case, the “Personnel number” column is not filled in, and “contractor” is indicated in the “Position” column.

The accountable amount can be transferred to the employee’s card. To do this, he must submit an application, and the transaction details (date and payment order number) are indicated in the “Advance Received” column.

New invoice and UPD formats have been approved Supporting documents for individual transactions

The procedure for documenting travel and hospitality expenses requires special consideration. Below we note the key points for these cost groups.

Travel expenses

After the amendments adopted by Government Decree No. 749 “On the specifics of sending employees on business trips” (hereinafter referred to as Decree No. 749) come into force, the forms of a travel certificate, official assignment and report on work performed on a business trip are not required to be filled out. Organizations have the right to stipulate in local regulations the need to fill out these forms.

If the organization decides not to use travel certificates, then to confirm the daily allowance it is necessary to attach a free-form accounting certificate to the advance report for the business trip. The form of the certificate should be approved as part of the accounting policy.

The legislation does not limit the amount of payments in the form of daily allowances to employees of the organization. The amount of daily allowance payment should be approved by order or indicated in the regulations on travel expenses. Daily allowances are exempt from payment of insurance premiums in an amount not exceeding 700 rubles for each day of being on a business trip in the Russian Federation, and no more than 2,500 rubles for each day of being on a business trip abroad (clause 2 of Article 422 of the Tax Code). In the same amount, daily allowances are not included in the employee’s income when calculating personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation).

We should not forget that when traveling to an area where the employee has the opportunity to return home every day, or when sending an employee on a one-day trip, daily allowances are not paid (clause 11 of Resolution No. 749).

E-ticket

The advance report for business trip 2021 must be completed taking into account the opinion of the Ministry of Finance set out in letter No. 03-03-06/1/35214 dated 06/06/2017. This letter clarifies that if an airline ticket is purchased electronically, the electronic ticket receipt and boarding pass are the documentary evidence for income tax purposes.

In this case, the boarding pass must confirm the fact of air transportation services to the accountable person. As a rule, this requisite is an inspection stamp.

If there is no inspection stamp on the printed electronic boarding pass, the taxpayer must confirm the fact that the accountable person has provided air transportation services in another way.

Accounting for services provided by carriers

Very often, a luxury travel ticket includes the cost of services (meals, basic necessities and hygiene items, including bedding, printed materials, etc.).

The Ministry of Finance in letter No. 03-03-РЗ/37488 dated June 16, 2017 explained how the cost of additional services is taken into account.

The cost of additional services when traveling in luxury cars is not subject to personal income tax (clause 3 of Article 217 of the Tax Code).

For the purposes of taxing the profits of organizations, the cost of additional services is taken into account entirely as part of other expenses (clause 12, clause 1, article 264 of the Tax Code).

But regarding VAT, the opinion is the opposite: if the amount of additional fees and services is formed taking into account the cost of food services, the amount of VAT is not deductible (clause 7 of Article 171 of the Tax Code of the Russian Federation).

Entertainment expenses

None of the current regulations contains instructions on the volume and procedure for processing entertainment expenses. Based on this, the organization must independently develop and approve in its accounting policies or a special regulatory act a list of supporting documents that confirm the validity and business purposes of entertainment expenses made by accountable persons.

To correctly reflect the costs of receiving and servicing Russian and foreign delegations, we recommend drawing up the following documents (see Letters of the Ministry of Finance No. 03-03-06/4/26 dated 03.22.2010 and No. 03-03-06/1/807 dated 11.13.2007 ):

- an order appointing a commission to verify the legality of writing off entertainment expenses;

- general estimate for receiving a delegation signed by the head of the organization indicating the person responsible for receiving the delegation and a list of expenses (detailed);

- a document indicating: the purpose of the delegation’s arrival (for example, an invitation), the meeting program, the composition of the delegation indicating the positions of both the invited party and the organization;

- a certificate of spent souvenirs or samples of finished products indicating what, to whom and how much was awarded;

- calculation of the buffet service performed: indicating the type of products, price, quantity and total amount, signed by the person in charge and the person who served the table.

Documents confirming the purchase of products, souvenirs and other inventory items must be attached to the reports.

IMPORTANT!

Representation expenses include expenses in an amount not exceeding 4% of the taxpayer’s expenses for wages for the reporting (tax) period. The following expenses are not recognized as entertainment expenses:

- expenses for organizing entertainment;

- vacation-related expenses.

The date of recognition of entertainment expenses issued through an accountable person is the date of approval of the advance report by the head of the organization.

In what case does it apply?

Existing rules establish that cash paid to an employee on account for established purposes can only be used in the direction specified in the order. The document confirming the payment of money to the employee is a cash receipt order containing the manager's authorization visa.

The legislation also establishes the period of time during which the employee must report on expenses incurred. In this case, the supporting document is the advance report.

Attention: the main purpose of this document is to confirm the validity of the employee’s expenditure of company funds, as well as compliance with the reporting deadlines. This document writes off previously issued funds from the individual’s account.

The role of the expense report increases when confirming the expenses of an employee sent on a business trip. Currently, the list of documents required to complete a business trip has been significantly reduced. All others can be filled out at the discretion of the company itself.

Only one document remained among the mandatory forms that must be filled out upon returning from a business trip. The procedure for conducting cash transactions establishes the mandatory compilation of this form.

Attention: only entrepreneurs who are subject to a simplified procedure for conducting cash transactions are exempt from this requirement.

Since settlements through accountants refer to cash payments, it is also necessary to remember that there is a limit on settlements between organizations, which is equal to 100,000 rubles at a time under one agreement. If the amount exceeds this amount, then non-cash payments must be used.