Every organization, be it an individual entrepreneur or a legal entity, registered on the territory of the Russian Federation and receiving profit from its activities is obliged to pay to the state treasury for its existence. Payments are quite varied for each type of activity. In the article, we will look at who must pay one of the types of payments - the environmental fee in 2021 and how it differs from a similar payment - for a negative impact on the environment, as well as what fines are provided for non-payment of the environmental fee.

Who should pay for negative environmental impacts?

Legal entities and individual entrepreneurs operating on the territory of the Russian Federation, the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation must pay for the negative impact on the environment:

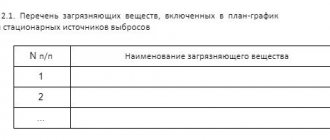

emissions of pollutants into the atmospheric air from stationary sources (hereinafter referred to as emissions of pollutants);

discharges of pollutants into water bodies (hereinafter referred to as discharges of pollutants);

storage, burial of production and consumption waste (waste disposal).

Part 1 of Article 16 of the Federal Law “On Environmental Protection”

Exception: Objects of negative impact on the environment of category 4 (Part 1 of Article 16.1 of the Federal Law “On Environmental Protection”).

Moreover, if a legal entity or individual entrepreneur simultaneously has objects of category IV and objects belonging to other categories defined by law (I, II, III), payment for the negative impact on the environment is calculated and paid for all objects, including objects of IV categories.

<Letter> of Rosprirodnadzor dated January 11, 2019 N AA-06-02-31/370 “On payment for environmental assessment”*

If you generate waste from the MSW group, then in this case your enterprise is not a payer of fees for negative impact on the environment. In this case, the payer is the regional MSW management operator, MSW management operators carrying out disposal activities (Article 16.1 of the Federal Law “On Environmental Protection”).

Who is required to pay the environmental fee in 2019?

The obligation to pay the environmental fee lies with manufacturers of certain types of products that are subject to recycling in the prescribed manner. This category of payers includes legal entities and individual entrepreneurs engaged in the production of products specified in the list (Order of the Government of the Russian Federation dated December 28, 2021 No. 2970-r). This list is established for goods produced in 2021 and 2021 (in 2021, a different list was in effect). Products include cardboard and paper packaging, appliances, fabrics and clothing, rubber products and many other diverse products. Regardless of the legal form of the entity, payment is paid only on the basis of information about the manufacture of any goods named in the order.

The environmental fee is paid if the products are not disposed of by the manufacturer itself in the manner prescribed by Government Decree No. 1542 dated December 8, 2015. That is, the goods are produced and sold.

Thus, before starting the production of a particular product, you should carefully familiarize yourself not only with the costs dictated by the tax authorities, but also with payments of other types, including environmental fees for packaging and recyclable goods.

How is the fee for negative environmental impact calculated?

Payment for negative impact on the environment is calculated based on the actual amount of emitted pollutants, discharged pollutants, disposed waste (Article 16.2 of the Federal Law “On Environmental Protection”) for the reporting period.

- Emissions of pollutants are taken into account for each operated source during the reporting period, according to the emissions logbook.

- Discharges of pollutants - according to the wastewater quality logbook. I would like to draw your attention to the fact that if the discharge occurs into centralized wastewater systems, then the payment is made by the organization receiving the wastewater from your enterprise. And you are already paying this organization its expenses.

- Placed waste - according to the waste logbook. Payment is not made for waste accumulated at the enterprise, for waste transferred for recycling or neutralization.

When calculating the negative impact fee, you must take into account the available permitting documentation:

- within the limits of emissions, discharges and above;

- within the limits of temporarily permitted emissions, discharges and above;

- within the limits for the disposal of production and consumption waste and above.

Method of submitting the declaration

The declaration can be submitted to Rosprirodnadzor both on paper (if the payment for the last year was no more than 25,000 rubles) and in electronic form.

An electronic signature is required to submit the declaration online. If the declaration is submitted on paper, then this can be done: in person, through a representative or by mail. When sending a declaration by mail, the letter is drawn up with a list of the attachments and a notification of receipt.

When submitting a declaration on paper, you will also have to attach its electronic version on a flash drive or disk.

You can draw up a declaration using the “Reporting Formation” service on the Rosprirodnadzor website.

When submitting a declaration online, there is no need to duplicate the paper version.

Excessive environmental pollution

Above-limit environmental pollution is a familiar term in everyday life, meaning exceeding standards and limits.

Permits for the emission of pollutants into the atmospheric air, limits for the emissions of pollutants, permits for the discharge of pollutants into the environment, limits for the discharge of pollutants, waste generation standards and limits for their disposal (hereinafter referred to as permits and documents) obtained by legal entities and individual entrepreneurs carrying out economic and (or) other activities at facilities that have a negative impact on the environment and are classified, in accordance with the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection,” as objects of categories I and II, up to January 1, 2021, are valid until the day of expiration of such permits and documents or until the day of receipt of a comprehensive environmental permit or submission of an environmental impact statement during the validity period of such permits and documents.

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

In essence, this provision of the law, after receiving a comprehensive environmental permit or declaration of environmental impact for ENVOS categories 1, 2, these documents are permits.

At facilities of categories I and II, until comprehensive environmental permits are obtained and an environmental impact declaration is submitted, temporarily permitted emissions/discharges are recognized as limits on emissions/discharges

Article 11 of the Federal Law of July 21, 2014 N 219-FZ “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation”

Explanations for ENVOS category 3 - what I found:

With regard to emissions of pollutants, with the exception of radioactive ones, for objects of category III in accordance with Article 22 of the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection”, it is necessary to calculate the standards of permissible emissions for highly toxic substances, substances that are carcinogenic, mutagenic properties (substances of hazard class I, II). If it is impossible to comply with the standards for permissible emissions of such substances, an environmental protection action plan is developed and temporarily permitted emissions are established (Article 23.1 of Law No. 7-FZ).

Letter of the Ministry of Natural Resources of Russia dated September 20, 2019 N 12-47/22755 “On the implementation of industrial environmental control in the field of atmospheric air protection”

When calculating fees for the negative impact on the environment by legal entities and individual entrepreneurs carrying out economic and (or) other activities at category III facilities , the volume or mass of emissions of pollutants, discharges of pollutants, indicated in the report on the organization and on the results of the implementation of industrial environmental control are recognized as being carried out within the limits of permissible emissions standards, permissible discharge standards, with the exception of radioactive substances, highly toxic substances, substances with carcinogenic, mutagenic properties (substances of hazard class I, II).

Federal Law of July 21, 2014 N 219-FZ 19) “On Amendments to the Federal Law “On Environmental Protection” and Certain Legislative Acts of the Russian Federation” (as amended and supplemented, entered into force on January 1, 2020)

It turns out that for category 3 ENVOS the following rule applies:

- The amount of emissions and discharges of pollutants shown in the PEC report (with the exception of substances of hazard classes 1 and 2) is recognized as an amount within the limits of the standards.

- For substances of hazard classes 1 and 2, ENVOS of category 3 have calculations of standards; therefore, for these substances, excesses of standards are established based on these calculations.

Reporting on the generation, recycling, neutralization, and disposal of waste

This environmental reporting must be submitted to organizations that operate NVOS category III facilities. Documentation is submitted in accordance with Art. 18 of the Federal Law of June 24, 1998 N 89-FZ “On production and consumption waste ”.

The document must:

- List the FKKO and the names of the waste generated at the enterprise;

- Indicate their number;

- List the methods of waste management (disposal, disposal, etc.);

- Enter information about the companies to which you transferred this waste for disposal, disposal, use or disposal.

Facts of waste transfer must have documentary evidence: contracts with licensed companies for waste transfer, certificates of completed work.

The deadline for submitting environmental reports is annually before January 15 for the previous calendar year to the Rosprirodnadzor department. The reporting form has not yet been established by law.

Payment for negative impact on the environment - terms

The fee for negative impact on the environment, calculated based on the results of the reporting period, taking into account the adjustment of its amount, is paid no later than March 1 of the year following the reporting period.

Art. 16.4 Federal Law “On Environmental Protection”

Wherein:

- Quarterly advance payments are made no later than the 20th day of the month following the reporting quarter.

- For the 4th quarter, advance payments are not made - the already adjusted annual fee minus 3 quarters is paid.

- Small and medium-sized businesses do not make quarterly advance payments.

Persons obligated to pay a fee have the right to choose one of the following methods for determining the amount of the quarterly advance payment for each type of negative environmental impact for which a fee is charged:

1) in the amount of one-fourth of the amount of the fee for negative environmental impact payable for the previous year - the simplest option ;

2) in the amount of one-fourth of the amount of payment for negative impact on the environment, in the calculation of which the payment base is determined based on the volume or mass of emissions of pollutants, discharges of pollutants within the limits of permissible emission standards, permissible discharge standards, temporarily permitted emissions, temporarily permitted discharges, limits on disposal of production and consumption waste;

3) in the amount determined by multiplying the payment base, which is determined on the basis of industrial environmental control data on the volume or weight of emissions of pollutants, discharges of pollutants, or the volume or weight of industrial and consumption waste disposed in the previous quarter of the current reporting period, by corresponding rates of payment for negative impact on the environment using the coefficients established by Article 16.3 of this Federal Law.

The deadline for submitting a declaration on payment for negative environmental impact is no later than March 10 of the year.

Answers to common questions

Question 1: Do I need to pay for environmental protection if all our garbage is only office waste?

Answer: First, you should make sure that the organization does not operate objects of I-III hazard categories. If there are no such objects, then there are no grounds for registration with Rosprirodnadzor, which means there is no need to pay for pollution.

Question 2: Do enterprises that discharge substances into the central sewer system have to pay a fee?

Answer: Until recently, such organizations were exempt from the obligation to make payments for pollution. But from July 1, 2015, such organizations are required to pay a fee.

Emissions inventory report

All companies with emission sources must leave a report on the results of their inventory. This requirement is defined in Art. 32 Order of the Ministry of Natural Resources of Russia dated August 7, 2021 No. 352. This reporting is compiled and approved directly by the organization providing NVOS. Recommendations for drawing up an emission inventory report are given in Appendix No. 4 to Order No. 352.

When submitting reports, please note that Article 193 of the Civil Code of the Russian Federation stipulates that if the last day of the deadline for submitting documents falls on a non-working day, then the filing deadline is postponed to the next working day.

So, we have prepared for you information about all the changes in environmental reporting in 2021. As a result of the “regulatory guillotine,” new laws, guidelines and clarifications have appeared, and many of the regulations to which we are accustomed are no longer in effect. Therefore, our team will always help you keep abreast of innovations and generate environmental reporting to Rosprirodnadzor of St. Petersburg, taking into account current legal requirements in a short time.

Form 2-TP air

The 2-TP air report form at the beginning of the current year remains unchanged. It is subject to Rosstat Order No. 661 dated November 8, 2018. It is necessary to submit a report if the organization operates stationary sources of air pollution and as a result of their activities:

- Emissions are made in the amount of 5–10 tons per year in the presence of pollutants of hazard classes I and II;

- The annual emissions exceed 10 tons.

Even if you have recently installed high-tech equipment, you will still have to submit a report; there are no exceptions. The number of reports depends on the number of branches in the company. If there are several NVOS objects of an organization in one subject of the Russian Federation, one report is submitted for all objects in this region.

Please note that for each NEI object you will still need to fill out the table separately.

To calculate the volume of emissions, you need to take the current permit as a basis and add up the indicators. If such a permit is missing or has expired, then the report is completed based on the actual amount of emissions.

The statistical observation is sent using the “Personal Account of the Nature User” to the territorial body of Rosprirodnadzor no later than January 22.

Report on Form 4-OS

Such a report is submitted by organizations that pay for wastewater treatment, carry out environmental protection measures or operate wastewater treatment plants. This reporting is necessary for statistics, although it is mandatory for companies meeting the above criteria.

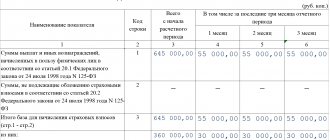

Form 4-OS is information about the company’s expenses for environmental protection measures for the previous calendar year. The list may include, for example: the salary of an environmentalist, costs for waste removal and management, costs for production control measures. Companies receive certain benefits for submitting statistical data.

An exception for filing is organizations whose environmental costs were less than 100 thousand rubles. in year.

Environmental reporting is required to be submitted electronically. Form N 4-OS is sent by the company to the territorial body of Rosstat of St. Petersburg by January 25.

The number of reports depends on the availability of branches and is filled out for each branch separately, and you will also need to submit a general report for the legal entity. An exception is branches that are located in the same area of the city with continuous production activities. In this case, one document will be required.