What can and cannot be adjusted

There are a number of errors that are considered non-critical in payment orders, i.e. subject to editing (for example, an incorrectly entered BCC - budget classification code, TIN, KPP, name of the organization, etc.) and they are the ones that are corrected by submitting the appropriate application to the tax office.

At the same time, there are inaccuracies that cannot be corrected in the manner described above:

- incorrectly specified name of the receiving bank;

- Invalid federal treasury account number.

In cases where the sender of the payment made errors in such details, the function of paying the contribution or tax will not be considered completed, which means the money will have to be transferred again (including late fees, if any).

Will there be penalties and offset of overpayments against arrears?

When paying taxes, you should be more careful when indicating the purpose and details of the payment. Otherwise, a penalty will be charged on the amount of the debt. If the payer has provided a letter confirming payment, penalties can be avoided.

The penalty is charged regardless of the payer’s request in the following situations:

- An error was made when specifying the recipient's bank account. Tax authorities do not have the right to change this information, so the date of tax payment will be considered the date of the second transfer of funds. And you will have to pay a penalty for this period, if it was accrued.

- The inspector may change the details, but the original payment was sent late. All accrued fines must still be paid.

Important to remember!

If the payer has an overpayment of taxes, it can be counted against the arrears. But this procedure is not carried out automatically, so you need to send the appropriate application.

The Federal Tax Service has 10 days to consider such an application, so it must be sent in advance. At least 10 days before the tax payment deadline. Then the overpayment will be counted.

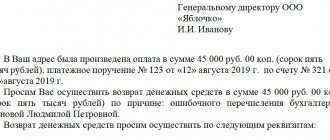

Features of drawing up an application

An application for clarification of payment to the tax service today does not have a unified uniform form, so employees of organizations and enterprises have the opportunity to write it in any form or, if the company has a developed and approved document template, based on its sample. The main thing is that office work standards are observed in terms of the structure of the document, and some mandatory information is also entered.

In the header you need to indicate:

- addressee: name and number of the tax service department to which the application is sent, its location, position, last name, first name and patronymic of the head of the territorial inspection;

- similarly, information about the applicant company is entered into the form;

- then in the middle of the line the name of the document is written, and just below it is assigned an outgoing number and the date of preparation is indicated.

In the main part of the application you should write:

- what kind of mistake was made, indicating a link to the payment order (its number and date);

- Next, you need to enter the correct information. If we are talking about some amounts, it is better to write them in numbers and words;

- Below it is advisable to provide a link to a provision of law that allows for the inclusion of updated data in previously submitted documents;

- if any additional papers are attached to the application, this must be reflected in the form as a separate item.

Who draws up the document

According to general rules, drawing up a letter to the tax office is the responsibility of the person making the payment. This means that the payer has certain powers.

Most often, this is the accountant of the organization, who is obliged to make all money transfers.

The letter can be written by either an ordinary accounting employee or a chief accountant. This depends on the number of staff at the enterprise.

Before sending a document, it must be signed not only by the originator, but by the head of the company.

What to pay attention to when filling out the form

Just like the text of the application, there are no special requirements for its execution, so it can be formed on a simple sheet of any convenient format (usually A4) or on the organization’s letterhead.

You can write the application by hand or type it on a computer.

The main thing is that the document contains a “living” signature of the head of the applicant company or a person authorized to act on his behalf (in this case, the use of facsimile autographs, i.e. printed by any method, is prohibited).

There is no strict need to certify the form with a seal - this should be done only if the use of stamp products is enshrined in the regulatory legal acts of the enterprise.

The application should be made in two copies , one of which is transferred to the tax office, and the second remains in the hands of the representative of the organization, but only after the tax specialist puts a mark on it accepting the document.

Is it possible to challenge a new payment assignment?

Typically, changing the “Purpose of payment” parameter occurs by mutual agreement and without any special consequences. But in some cases complications are possible. For example, if the tax inspectorate during an audit discovers such a correction and considers it a way to evade taxes, sanctions from the regulatory authority can be considered inevitable. It happens that friction regarding the purpose of payment arises between counterparties, especially in terms of payments on debts and interest. In most cases, in order to challenge the correction, the party protesting it will have to go to court, and no one will give guarantees of winning the case, since such stories always have many nuances.

An important condition necessary in order to avoid possible problems is that information about changes in the purpose of the payment must be transmitted to the banks through which the payment was made. To do this, you just need to write similar letters in a simple notification form.

What gives the right to clarify payment

The right to correct errors in a payment order is given by the tax code, or more precisely, paragraph 7 of article 45 of the Tax Code of the Russian Federation. However, it should be noted that not all information can be corrected on the basis of this legal norm.

What errors can be corrected?

The variety of fiscal taxes and fees often leads to the fact that the taxpayer makes typos in payment documents. If the error is not corrected, the payment may be lost, and the tax authorities will recognize the debt and apply penalties.

If an inaccuracy was identified before the payment document was executed by the bank or Federal Treasury authorities, the payment order can be recalled. But what to do if the payment order (PO) has already been posted and the funds have been debited from the current account in favor of the Federal Tax Service.

You can correct a payment order from 01/01/2019 due to any errors, but subject to three conditions:

- The statute of limitations has not expired, that is, three years have not yet passed since the transfers were made to the Federal Tax Service.

- The money was credited to the budget, that is, it went to the personal account of the Federal Treasury.

- When adjusting payment, no arrears are created for a specific tax liability.

In this case, you will have to prepare a sample: an application to the tax office to clarify the payment. However, not all errors can be corrected. Let's define the key conditions.

It is impossible to correct the PP for insurance contributions to the Federal Tax Service, as well as for contributions for injuries to the Social Insurance Fund, if:

- the money has not been received to the appropriate account of the Federal Treasury, that is, fields 13 and 17 (bank and beneficiary account) are filled in incorrectly in the payment order;

- an error was made in the KBK (the first three digits of the budget classification code are incorrectly indicated) in field 104;

- payment of the contribution to compulsory pension insurance was credited to the individual pension account of the employee (insured person), that is, the contributions already credited cannot be clarified (clause 9 of Article 45 of the Tax Code of the Russian Federation).

In other cases, the taxpayer can correct any errors and inaccuracies in the following fields of the PP:

| Field number | Name |

| 101 | Payer status |

| 60 | Payer's TIN |

| 102 | Payer checkpoint |

| 61 | Recipient's TIN |

| 103 | Recipient's checkpoint |

| 104 | KBK, but only if the first three digits are correct |

| 105 | OKTMO |

| 106 | Basis of payment |

| 107 | Payment period |

| 108 | Base document number |

| 109 | Document date |

| 24 | Purpose of payment |

What cannot be specified

Let's say right away that not all tax payments can be corrected. There are two cases where this will not work:

- The bank number of the recipient of the funds is indicated incorrectly;

- the transferred amount of pension contributions is taken into account in the individual account of the insured person (paragraph 2, clause 9, article 45 of the Tax Code of the Russian Federation).

In the first case, the payer’s bank will not process the payment at all, and the company will have to submit a new payment order with the correct details. In the second case, the fees will have to be paid again.

All other errors in the payment order (for example, indicating an incorrect BCC (Letter of the Ministry of Finance dated January 19, 2017 N 03-02-07/1/2145)) do not lead to the fact that the payer’s obligation to pay the tax/contribution is recognized as unfulfilled, and correct this The error can be made by clarifying the payment.

Can you clarify?

Both the payer himself and another person who transferred the tax on behalf of the payer (paragraph 2, clause 7, article 45 of the Tax Code of the Russian Federation) can make an amendment to the payment. How to clarify the payment to the tax office if the checkpoint is incorrect? Contact the Federal Tax Service with a corresponding application.

If the mistake made by the accountant did not affect the transfer of tax to the budget, the company can clarify the following details:

- Treasury account number;

- basis of payment;

- payment affiliation;

- taxable period;

- payer status;

- TIN, checkpoint of the payer;

- TIN, checkpoint of the recipient.

The current legislation contains a list of errors that can be corrected by clarifying the payment (clause 7 of Article 45 of the Tax Code of the Russian Federation, Procedure, approved by order of the Federal Tax Service dated December 29, 2016 No. ММВ-7-1/731). Please note that in 2021, it is possible to clarify the payment even if there is an error in the Treasury account number.

Starting from 01/01/2019, you can clarify such a payment by submitting an application to the Federal Tax Service. Previously, you had to pay the tax again and return the erroneous payment. How to clarify a payment to the tax office if OKTMO is incorrect? Also write an application to clarify the payment.

The tax inspectorate can find the mistake. In this case, the company will be asked to correct it by sending a message to clarify the details. Having studied the circumstances of the error, you need to prepare a statement describing the problem and asking for the payment to be taken into account.

Also, an error made in a payment order can be found by the accountant himself. How to clarify a payment to the tax office if the recipient is incorrect? Write an application in any form and attach documents confirming the transfer of tax payments to the budget. Having received the application, tax authorities will review the documents and make a decision to clarify the payment. They are given 10 working days for this. Based on the results of the decision, the tax will be recognized as paid, and the penalties accrued at that time will be written off.

The period will begin to be calculated from the date of receipt of the application from taxpayers or from the date of signing the act of joint reconciliation of calculations (paragraph 2, paragraph 4, paragraph 8, article 78, paragraph 6, article 6.1 of the Tax Code of the Russian Federation, order of the Federal Tax Service dated July 25, 2017 No. MMV- 7-22/579).

Now you know how to clarify a payment to the tax office if the period is incorrect or if other errors are made. We will also explain how to submit an application for clarification of payment due to an error in the KBK.

How to submit an application

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

Results

If the taxpayer made an error in the KBK or other fields of the payment order and the payment was received in the budget system of the Russian Federation, then the payment is considered executed. In this case, you should send an application to the Federal Tax Service to clarify the payment.

If critical errors were made: in the recipient's account number or the name of the recipient bank, the payment does not go to the budget. In this case, you need to re-transfer the tax amount to the correct details, pay penalties and write an application for a refund of the incorrectly paid tax to your current account.

Sources

- https://www.klerk.ru/buh/articles/485877/

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/obrazec_zayavleniya_ob_utochnenii_nalogovogo_platezha_oshibka_v_kbk/

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/beznalichnye/platezhnoe-poruchenie/pismp-ob-utochnenii-platezha-v-platezhke.html

- https://assistentus.ru/forma/pismo-ob-utochnenii-naznacheniya-platezha/

- https://assistentus.ru/forma/zayavlenie-ob-utochnenii-platezha-v-nalogovuyu/

- https://ppt.ru/forms/nalogi/utochnenie-plateja

- https://buhguru.com/effektivniy-buhgalter/utochnyaem-platezh-v-nalogovuyu-pri-nevernom-kbk.html

- https://buhguru.com/spravka-info/zayavlenie-ob-utochnenii-platezha-po-nalogu-v-2019-godu-tekst-i-obrazets.html

- https://ppt.ru/forms/platejka/pismo-ob-oshibke

- https://pravoznay.ru/zayavlenie-na-utochnenie-platezha-v-nalogovuyu.html