A calculation of the fee for negative impact is submitted annually to Rosprirodnadzor; in 2021, the declaration is drawn up in an updated form. This document reflects information about the negative impact on nature, broken down by type of harm caused. Negative influence manifests itself through:

- harmful emissions into air masses;

- removal and storage of industrial waste, its burial;

- discharges of wastewater that change the chemical composition of water resources (Article of the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ).

The deadline for submitting the calculation of the negative impact fee is no later than March 10 of the year that follows the annual reporting range. Both legal entities and individual entrepreneurs can act as payers of such a fee. The criteria for recognition as a payer are the implementation of activities, the side effect of which is pollution of the surrounding space, within the territory of the Russian Federation.

Tenants do not need to submit an environmental calculation if their property lease agreements indicate that payments to the budget for polluting factors are made by the lessor. Persons whose activities are based on objects belonging to the 4th, least “harmful” category are exempt from environmental payments. The conditions for classifying objects into categories 1-4 are given in paragraph 6 of Government Decree No. 1029 dated September 28, 2015.

Who is the payer of the tax collection fee?

According to Art. 16.1 of Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection” all organizations and individual entrepreneurs that have the following impact on the environment:

- emit pollutants into the air through stationary sources;

- or release pollutants into water bodies;

- or are engaged in the storage and disposal (disposal) of waste,

are required to pay for negative impacts on the environment.

Please note the following points:

- Only emissions from stationary sources are taken into account; mobile sources of emissions have not been taken into account for a long time.

- If an organization only generates waste and has a contract for waste removal, then ownership of this waste does not transfer anywhere. Those. the organization must pay the NVOS for its own waste placed at the landfill. The exception is the payment for solid waste if there is an appropriate agreement with the regional operator.

- The obligation to pay the NVOS arises regardless of whether the organization is the owner of the production facility or leases it.

Who reports on fees for negative environmental impact?

Submission of the report to the authorized bodies is mandatory for all individual entrepreneurs and owners of organizations that have formed a legal entity. This list includes persons whose activities lead to environmental pollution (emissions into the air, rivers and lakes, etc.).

There are no exceptions to this situation for anyone. Every owner of an individual entrepreneur or LLC is required to submit reports if they carry out activities that have a negative impact on the environment.

Moreover, the application of any tax regime is in no way connected with the deposit of funds. This point is regulated by Article 23 of Federal Law No. 96 of May 4, 1999.

Many business owners ask questions about whether they need to submit a declaration if they independently remove waste waste by concluding an agreement with a specialized company.

This situation, namely an agreement on waste removal with a third-party company, does not exempt the owner of the enterprise from paying money for the waste collection.

The company hired by the businessman removes garbage waste only to the designated territory, for which the customer pays. Consequently, no one pays for environmental pollution. Therefore, payment is mandatory for all companies. Every business owner whose activities cause environmental pollution must submit a declaration.

How to calculate the amount of the tax assessment?

Calculation of the amount of payment for negative environmental impact depends on the following factors:

- nature of the source of pollution;

- type of pollutant (or its hazard class);

- volumes of actual emissions;

- the fact that there are no means of measuring emissions;

- presence of excess pollution above established standards;

- the fact that the contaminated object or territory is under special protection;

- expenses incurred on measures to reduce negative impacts.

Based on the first 2 indicators, the rate used in the calculation is determined. By multiplying it by the volume of actual emissions (if it does not exceed the maximum permissible) the amount of payment for pollution is determined. The following odds are applied to the bet amount:

- increasing, if we are talking about the lack of means of measuring emissions, exceeding permissible pollution standards, or the location of an object (territory) under special protection;

- reducing, depending on the hazard class of the disposed waste, the method of its generation and disposal.

To calculate the amount of payment for the environmental impact assessment, the following methodology is used (approved by Decree of the Government of the Russian Federation dated 03.03.2017 N 255 “On the calculation and collection of fees for negative impacts on the environment.”

The amount of payment for the NVOS can be calculated in the Natural Resources User Module.

The declaration is submitted to Rosprirodnadzor

A document called a declaration of payment for NWOS should be sent to the territorial office of Rosprirodnadzor at the location of the objects of negative impact or waste disposal.

If sources of pollution are present in different regions of Russia, then for each individual facility it is necessary to draw up its own declaration and submit it to the authorized body.

If several objects are located in one subject of the country, then a general declaration for all sources is filled out and submitted.

Rates applied for calculation for 2021

Decree of the Government of the Russian Federation No. 913 dated September 13, 2016 approves the rate for calculating the fee for the NVOS.

| Sources of environmental pollution | Criteria for setting a bid |

| Stationary sources of pollution producing emissions into the atmosphere | For each pollutant |

| Discharges into water bodies | For each pollutant |

| Disposal of production and consumption waste | Waste hazard class |

Please note that Regulation 913 provides rates for 2016, 2021 and 2021. At the same time, by Decree of the Government of the Russian Federation dated June 29, 2018 No. 758, the rates of payment for the negative impact on the environment when disposing of solid municipal waste of hazard class IV for 2021 are indexed.

If you are using the Environmental User Module, be sure to update the program version to take into account the latest changes in legislation.

Punishment (fine)

In the event that your company does not provide / does not provide in a timely manner / does not provide information in the declaration that does not correspond to reality, the company as a legal entity will be held accountable.

Holding a legal entity liable does not exempt the official from liability.

Article 8.5 of the Code of Administrative Offenses of the Russian Federation: Concealment, deliberate distortion or untimely communication of complete and reliable information contained in the environmental impact declaration shall entail the imposition of an administrative fine on citizens in the amount of five hundred to one thousand rubles; for officials - from three thousand to six thousand rubles; for legal entities - from twenty thousand to eighty thousand rubles.

When and how to pay?

Payment is made annually before March 1 of the year following the reporting year (Clause 3, Article 16.4 of Law No. 7-FZ of January 10, 2002). The amount of payment is determined as the amount of the annual fee minus advances paid and expenses for measures to reduce the negative impact.

Who pays advances and how?

According to paragraph 3 of Art. 16.4 of Federal Law No. 7-FZ of January 10, 2002 “On Environmental Protection” small businesses do not pay advances; other enterprises and organizations pay advances quarterly during the reporting year no later than the 20th day of the month following the next quarter. The advance amount is calculated as ¼ of the total amount of the negative impact fee for the previous year.

Such accrual of advance payments often leads to significant overpayments to the budget. Therefore, back in 2021, a draft Government Resolution was published, which proposed two other options for calculating the advance payment:

- Pay an advance in the amount of 1/4 of the fee amount calculated on the basis of established standards for permissible emissions, discharges of pollutants, temporarily agreed upon emissions, temporarily agreed upon discharges and limits on the disposal of production and consumption waste.

- Pay an advance in an amount equal to the amount of payment calculated for the actual negative impact on the environment in the past quarter based on industrial environmental control data.

Payment for negative environmental impact is carried out according to the following BCC:

| Payment name | KBC in 2018-2019 |

| Payment for emissions of pollutants into the atmospheric air by stationary facilities, with the exception of those generated during flaring and (or) dispersion of associated petroleum gas | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Fee for disposal of industrial waste | 048 1 1200 120 |

| Fee for disposal of municipal solid waste | 048 1 1200 120 |

| Payment for emissions of pollutants generated during flaring and (or) dispersion of associated petroleum gas | 048 1 1200 120 |

Deadline for submitting a declaration on the impact on the environment

The primary deadlines for submitting the declaration are not established by law. It all depends on the expiration of the permitting documents:

-permits for emissions of pollutants,

-permits for discharge of pollutants.

The specified documentation received before 01/01/2019 is valid in accordance with letter dated 12/29/2018 N AA-10-02-36/29629, which is presented at the very end of this article.

Upon expiration of the established validity period of the above documentation, it becomes necessary to provide a declaration. In essence, it turns out that the submitted declaration and the declared types of impact on the environment and the amount of pollutants entering the environment as a result of the impact are the permitting document for objects of the 2nd category.

In this case, the declaration must be submitted once every 7 years, provided:

constancy of ongoing technological processes, qualitative and quantitative characteristics of emissions, discharges of pollutants and stationary sources.

Along with the declaration the following are provided:

— calculations of permissible emission standards,

— calculations of permissible discharge standards,

which will be appendices to the declaration and which are not subject to approval by third-party structures (simply approved by the enterprise).

Calculation of permissible discharge standards:

VAT is not subject to revision during the period for which a comprehensive environmental permit is issued, in the application for which they were contained, or for which an environmental impact declaration is submitted, to which they were annexed, as well as the period for which they are approved in cases provided for in Part 1.1 of Article 11 of Federal Law N 219-FZ, except for the occurrence of circumstances for calculating new VAT specified in paragraph 13 of this Methodology.

The validity period of VAT calculations does not exceed 7 years from the date of receipt of the comprehensive environmental permit in the application for which they were contained (except for the cases provided for in paragraph 13 of Article 31.1 of Federal Law No. 7-FZ), or this period is calculated from the moment the impact declaration is submitted on the environment to which they were an attachment.

In the cases provided for in Part 1.1 of Article 11 of Federal Law N 219-FZ, VAT is approved for 5 years in accordance with paragraph 1 of Decree of the Government of the Russian Federation of July 23, 2007 N 469 “On the procedure for approving standards for permissible discharges of substances and microorganisms into water bodies for water users".

paragraph 11 of the order of the Ministry of Natural Resources of Russia dated December 29, 2020 No. 1118

If your enterprise has undergone a change in technology, resulting in the formation of new sources of pollutant emissions, new names of pollutants, then it becomes necessary to submit a declaration without waiting for the expiration of the 7-year period. At the same time, you must update information about the ENVOS.

NVOS Declaration

In addition to paying for the NVOS, it is necessary to annually draw up a corresponding declaration (see Order No. 3 of 01/09/2017) and submit it no later than March 10 of the year following the reporting year.

Order No. 3 of the Ministry of Natural Resources of Russia dated January 09, 2017 presents in detail the rules for filling out the declaration, and also contains the necessary coefficients and methods for checking the correctness of data entry for each section of the declaration. In addition, the calculation procedure for each type of polluting object is described in detail in Decree of the Government of the Russian Federation dated March 3, 2017 No. 255.

The declaration can be filled out using the Nature User Module. Once again we attach the corresponding instructions (it was also above) and additional files.

Requirements for the declaration and its control by the Fee Administrator for 2020

Order of the Ministry of Natural Resources of the Russian Federation dated December 10, 2020 No. 1043 introduced the obligation to attach the following documents to the payment declaration, the attachment of which was not previously required:

- Copies of waste disposal agreements;

- Waste movement records for the reporting period.

During the verification of the declaration, Rosprirodnadzor authorities have the right to request documents recording emissions, discharges of pollutants, production and consumption waste generated during the implementation of industrial environmental control, confirming the determination of the payment base for the reporting period.

How to submit a calculation for environmental tax

As a general rule, reports to Rosprirodnadzor on environmental collection are submitted electronically. Only if the payer has confirmation that he does not have access to the Internet (for example, the payer is located in a hard-to-reach area), reports can be submitted on paper.

In this case, it is necessary to attach a medium with an electronic copy of the report to the paper report.

To generate the report itself - in our case, calculation of the environmental fee for 2021 - there are several ways:

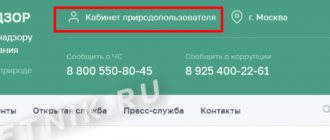

- You can use the program from the Rosprirodnadzor website “Nature User Module” and create a calculation in it (https://rpn.gov.ru/node/5523/). Then, if you have an electronic signature, you can immediately submit the report through the website.

- Submit the report through an electronic document management (EDF) operator. This option may have some advantages over delivery through the Rosprirodnadzor website. As practice shows, the channels for receiving Rosprirodnadzor reports do not always work properly and the report may get stuck on the receiving gateway. When sending through an EDF operator, this problem does not arise. In addition, the EDF operator’s system will record the time of sending upon sending, which can be very useful if you send the report on the last day (as this often happens).

An example of filling out an environmental fee declaration in the Rosprirodnadzor program

As an example of generating calculations for environmental fees in electronic form, let’s look at how this is organized in the “Nature User Module” program, which can be downloaded for free on the Rosprirodnadzor website.

1. You need to start working with the module in the same way as with other similar programs - by entering data about your company. This is done on the Registry tab.

NOTE! One program can be used for several payers, entering them into the register one by one. Then in the field on the left you will see a list of all enterprises entered into the register, and navigation will also be possible.

2. After entering information about the enterprise, you can begin creating reports. To do this, go to the “Reports” tab and select the desired report. In our case, “Calculation for environmental fee” is the RES icon.

3. The “Title” tab will be filled in automatically with the data entered in the register. Next, in the report form, you need to go to the “Calculation of environmental fee” tab.

4. Entering data into the calculation is available in 2 ways:

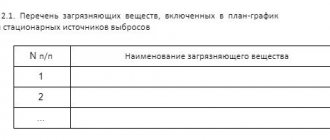

- Manually. Then, on the “Calculation of eco-fee” tab, a table is filled in where all types of manufactured (imported) goods subject to disposal are entered (from the drop-down list, according to the lists approved by the Government of the Russian Federation). In addition to the goods themselves, their quantity is also indicated.

- Automatically. This option is preferable if you have already used the program to submit a report on the total number of finished products for the same period (in our case, 2021). Then, by going to the “Calculation” tab, you can immediately click the “Calculate” button in the upper left corner (see Figure 2). The program will automatically transfer data from the report on the number of products to be recycled into the calculation of the eco-fee for them and perform the calculation of the eco-fee.

5. To upload the completed report, on the “Title” tab, check the “Report closed” checkbox. Then, by clicking the “Upload” icon on the top toolbar, you can upload a report file in xml (xms) format.

Regional environmental reports for 2021

Reporting has been established for SMEs operating in the field of waste management and subject to regional supervision. It is provided in paper form from February 8 to March 8 in accordance with the order of the Ministry of Ecology of the Nizhny Novgorod Region dated February 3, 2021 No. 53 directly to the regional department or to its interdistrict departments.

Legal entities and individual entrepreneurs whose work generates waste (including MSW) are required to submit information to the regional waste cadastre. The deadline for sending the report is March 1. Regulatory framework:

- Order of the Ministry of Ecology of the Nizhny Novgorod Region dated December 15, 2011 No. 990;

- Resolution of the regional government of July 25, 2008 No. 306.