“Form 23-FSS RF” is a special unified standard document that is filled out in cases where an enterprise or organization wants to return overpaid funds to extra-budgetary funds (Pension Fund, Social Insurance Fund, etc.). Such situations are not uncommon; as a rule, this occurs as a result of the “human factor”: accounting errors, incorrect calculations, or simply inattention, as well as failures in accounting programs.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Which form to use

Since 2021, the order of the Social Insurance Fund dated November 17, 2016 No. 457 has been in force, which approved several forms of documents necessary for offset or return of overpaid (excessively collected) insurance premiums for injuries.

Also see "".

The Form 23-FSS form of interest to us for the return of these contributions is given in Appendix No. 3. It takes only 2 sheets and looks like this:

Please note that it is better to download form 23-FSS, since this application form does not have an official electronic format. Although the law provides for the possibility of submitting it in the form of an electronic document.

From our website, via a direct link, download form 23-FSS of the Russian Federation for free.

Deadlines for the return of overpaid funds

According to the law, the possibility of returning money paid in excess is strictly limited to a period of three years. Applications received after this will not be accepted.

If the application arrived in a timely manner and the facts indicated in it are true, then the return of funds must occur within a month after its receipt by the employees of the extra-budgetary fund with which the incident happened. At the same time, if the fund violates its obligations and is overdue for the return of funds, then by writing a corresponding statement, for each day of delay, you can demand interest in the amount of 1/300 of the refinancing rate (if representatives of the organization refuse to pay voluntarily, you can safely go to court ).

An important clarification: if the fact of overpaid contributions was revealed during reconciliation, then the period for their return is counted from the date of signing the reconciliation act.

Return mechanism

You can submit a completed form 23-FSS of the Russian Federation to the fund for a refund of overpayment of insurance premiums for injuries only within 3 years from the date of excessive transfer of the corresponding amounts. This is stated in paragraph 13 of Art. 26.12 of the Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”, hereinafter referred to as Law No. 125-FZ.

EXAMPLE

That is, for example, in April 2021, you can return the overpayment of contributions from a maximum of April 2015, but not earlier. It does not matter when the overpayment occurred, since these contributions are still supervised only by the Social Insurance Fund.

From the date of receipt of a refund application from the policyholder, the law gives FSS specialists 10 days to respond.

By law, the territorial office of the Social Insurance Fund must inform the policyholder in writing or electronically within 10 days:

- about each identified fact of overpayment (clause 3 of article 26.12 of Law No. 125-FZ);

- amount of overpayment.

By the way, the territorial branch of the fund may offer the policyholder to make a mutual reconciliation of calculations (clause 4 of article 26.12 of Law No. 125-FZ). We strongly advise you to agree to it. In addition, nothing prevents the enterprise from taking the initiative to conduct a reconciliation regarding overpayment of contributions for injuries.

The results of the reconciliation are documented in the act. It will show whether there has been an overpayment, as well as the amount that can be refunded.

Should I return the entire amount?

Sometimes the overpayment is quite significant, but the payer does not feel a great need for a full refund.

A completely reasonable question arises: is it possible to partially return the paid amount or distribute it in some non-trivial way. The answer is simple: yes, the law in no way limits the right of the payer to dispose of overpaid funds as he pleases.

For example, you can demand the return of only a certain percentage of the amount, and use the rest to pay off arrears, fines and penalties, you can set aside part of it for future payments, etc.

Filling example

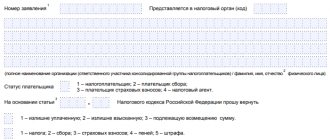

Filling out form 23-FSS of the Russian Federation does not cause any particular difficulties. Moreover, the FSS has not approved a separate procedure for completing this return application form.

Please note that at the very beginning of the application form you must correctly indicate the registration number in the Social Insurance Fund and the code of subordination. They are assigned to each policyholder when registering for injury.

Also see “Registration numbers in the Pension Fund of the Russian Federation and the Social Insurance Fund in payment orders for the payment of insurance premiums.”

If the overpayment was only for contributions, put dashes in the lines “Penalties” and “Fines”.

The following link shows a sample of filling out Form 23-FSS in 2021.

Also see “Form and sample for filling out Form 22-FSS of the Russian Federation in 2021.”

Read also

21.04.2018

How is an overpayment detected?

As a rule, the accountant is the first to know about an overpayment. But sometimes it turns out:

- during reconciliation with funds;

- employees of the FSS or Pension Fund.

In the latter case, a corresponding notification is received about the fact of overpayment. It is sent to the company’s address within 10 days after the overpayment is detected. The message can also be transmitted personally against signature to the head of the company or his representative.

If an overpayment is discovered by an accountant, then in order to return the overpaid funds it will be necessary to perform a reconciliation with the Social Insurance Fund or the Pension Fund of the Russian Federation. Based on the results obtained, an act is drawn up using form 21-FSS of the Russian Federation or 21-PFR.

Policyholder code in the Social Insurance Fund in 2021

When an organization has the right to reimburse money from the Social Insurance Fund

It is not always necessary to apply for restoration of expenses through an extra-budgetary fund. To determine the amount to be reimbursed, an organization needs to compare two indicators:

- the amount of accrued insurance premiums for VNIM;

- the amount of expenses incurred to pay for sick leave, benefits and maternity leave at the expense of Social Insurance.

If the costs of paying social benefits exceed the accrual of contributions for VNIM, then reimburse the difference to the Social Insurance Fund. If there is no excess, the employer has the right to reduce the next VNIM payment by the amount of sick leave.

IMPORTANT!

When calculating the amount to be reimbursed, do not take into account the amount of benefits that the employer pays at his own expense (for the first three days of the employee’s illness).

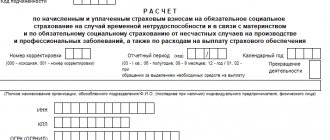

How to submit a contribution report to the tax service

Before submitting documents for compensation, you must provide a tax report on contributions. The filling out procedure is regulated by Appendix No. 2 to the Order of the Tax Service dated October tenth two thousand and sixteen No. MMB-7-11/551. This document consists of a title page and three sections. The calculation is filled out strictly in black, blue or purple ink. Letters must be capitalized only. If the document is filled out electronically, use Courier New font, size 16-18. Then the completed sheet must be printed.

Payments must be submitted by the thirtieth day of the month following the reporting month. For example, for nine months of 2021, the document must be received by the tax service no later than October 30, 2021.

If the company has more than twenty-five employees, the report should be submitted strictly electronically. For small companies, you can fill out a paper version of the document.

Report form

There are two ways to submit a report to the tax office:

- the head of the organization or his authorized representative personally visits the Federal Tax Service;

- A registered letter with a list of attachments is sent to the address of the tax service.

Tax authorities transmit to the Social Insurance Fund information about how many contributions have been accrued and paid for social security within the following time frames:

- no later than 5 days from the date of submission of the electronic report;

- no later than 10 days from the date of submission of the report on paper.

Delivery methods

The sender, at his discretion, may choose one of the following methods of delivering the application and necessary certificates to the insurer:

- Electronic means of communication.

This method has its advantages and disadvantages. This is definitely the fastest and easiest way, but you need to make sure that the email is received by the recipient. You can send an application this way if the sender has a registered electronic signature.

- Personal meeting with an FSS employee and submitting an application to him.

A more reliable method, but for this you will have to spend time and appoint an employee who will do this.

- Through a representative.

- By registered mail via Russian Post.

Then the sender will have a guarantee that the addressee will receive it personally.

Who should compile

The application is drawn up by the employer himself. This happens regardless of whether he is an individual entrepreneur or a legal entity. It is submitted to the FSS along with other documents.

First, they are checked by the fund, then transferred to the tax office for a more thorough check. For this reason, you must not make mistakes in documents or indicate false information in forms. As a result, a decision is made to refuse or to issue the requested amount to the organization.

Documents attached to the application for insurance payment to the Social Insurance Fund

How to evict a person from an apartment - https://uristboss.ru/pravo-sobstvennosti/kak-vyselit-cheloveka-iz-kvartiry/.

Eviction from municipal housing - https://uristboss.ru/pravo-sobstvennosti/vyselenie-iz-municipalnogo-zhiliya/.

How to register land under the dacha amnesty - https://uristboss.ru/pravo-sobstvennosti/kak-oformit-zemlyu-po-dachnoj-amnistii/.

The following are the papers that the insured person must provide to the territorial department of the fund along with a completed application form for receiving insurance payments:

- a conclusion on the degree of disability of a citizen, issued by the institution that carried out the medical examination;

- a certificate of the average monthly earnings of the injured person;

- a document certifying the existence of an employment relationship with the employer (for example, an employment contract, a copy of the work record book);

- report of an accident during work;

- applicant's passport;

- power of attorney (if the applicant acts through a representative).

A certificate of the average income of a citizen is usually issued by the accounting department at the place of his employment. However, in its absence, the insured person can send an application to the Social Insurance Fund to receive the necessary data from the Pension Fund of Russia.

The documents listed above are sent to the fund department in the form of originals or notarized copies.

Types of insurance payments

Insurance payments assigned to a citizen in the event of loss of ability to work due to an occupational illness or accident during work are of two types:

- one-time;

- monthly.

The amount of payments depends on the average earnings of the insured person, which is calculated based on his total income for a certain period of time. To calculate the amount of insurance payment, it is necessary to multiply the average income of a citizen by the degree of loss of ability to work.

The last component of the algorithm is determined by a specially created commission after conducting a medical and social examination (otherwise MSA). In addition, when calculating the amount of payments, salary bonuses and regional coefficients are taken into account.

In the event of the death of an insured citizen, a one-time payment of 1 million rubles is received by his close relatives. In this case, the amount is divided between each family member in equal shares.

According to Article 11 of Federal Law No. 125 of July 24, 1998, monthly payments are subject to adjustment taking into account the level of inflation in the country.

In addition, the legislation establishes maximum amounts of compensation in favor of employees who have lost their professional performance. In 2021, the maximum payment amount reaches 72,290 rubles 40 kopecks, and in 2021 – 75,182 rubles.