- Who reports and pays for the NVOS?

- Innovation 1. New (almost) declaration form

- Innovation 2. The declaration will indicate the method for calculating advances

- Innovation 3. New coefficients for the formulas for calculating the payment amount

- Innovation 4. New coefficients for pay rates

- Innovation 5. Settlement of overpayment

- Innovation 6. New sheet with totals

- Innovation 7. Changes in the sheet where the fee amount is calculated

- Innovation 8. OKTMO of the object

Who reports and pays for the NVOS?

There are no changes here.

Just a reminder in case you're not sure if this applies to you. We described the conditions under which a company must report for the NVOS and the registration algorithm in the article “Reporting to the RPN for the NVOS: who should do what.” If these criteria are met, the company needs to submit reports and pay a fee for the NVOS (minus advance payments).

There are two exceptions:

- Legal entities and individual entrepreneurs who work exclusively at category IV facilities are exempt from reporting.

- Only SMEs are exempt from advance payments: they pay only the final amount.

Results

Advances on payments for NVOS must be paid by legal entities that are not classified as small or medium-sized businesses.

Such payments are made three times a year, upon completion of the 1st, 2nd and 3rd quarters, no later than the 20th day of the month following the end of the corresponding quarter. The amount of each advance is determined in one of three ways specified in Law No. 7-FZ. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Innovation 1. New (almost) declaration form

If you remember, there were some discrepancies in the reporting for 2021. Two days before the end of the reporting campaign, the form for the declaration of payment for environmental impact assessment was changed (new edition of Order of the Ministry of Natural Resources dated January 09, 2017 No. 3). Those who submitted a declaration in recent days did so using a new form. But many managed to report according to the old one. This means that this time they will see the new declaration for the first time.

The names of the columns in sections 1, 1.1, 1.2 and 2 have changed:

| Was | It became |

| Maximum permissible emissions (MPE) | Permissible emission standards, technological standards (NDV, TN) |

| Temporarily agreed emissions (TCE) | Temporarily permitted emissions (TPE) |

| Permissible discharge standards (VAT) | Permissible discharge standards, technological standards (VAT, TN) |

| Temporarily agreed discharges (TCD) | Temporarily permitted discharges (TDR) |

The columns were renamed because the norms for NVOS objects of different categories have changed. Previously, all facilities, regardless of category, had to have emission permits, discharge permits, and waste disposal limits. Now the norms depend on the category of objects:

- For objects of category I, it is necessary to obtain a comprehensive environmental permit (IEP).

- For objects of category II, it is necessary to submit an environmental impact statement (EDD).

- For objects of category lll, the permitted masses of emissions and discharges are established according to the report on industrial environmental control (PEC).

Submit an IEE declaration via Extern

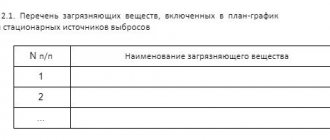

Section 3.1 of the declaration, which is filled out by enterprises with municipal solid waste disposal facilities, has changed. The number of columns has changed, new coefficients have appeared, similar to the coefficients in section 3.

In the calculation of fees for OKTMO, the names of some lines have changed and new lines have been added for fees for the placement of MSW.

Rates for air emissions from stationary sources

1. Nitrogen dioxide 138.82. Nitrogen oxide 93.53. Nitric acid 36.64. Ammonia 138.85. Ammonium nitrate (ammonium nitrate) 206. Barium and its salts (in terms of barium) 1108.17. Benz(a)pyrene 5472968.78 .Boric acid (orthoboric acid) 2759. Vanadium pentoxide 2736.810. Suspended particles PM1093.511. Suspended particles PM2.5182.412. Suspended substances 36.613. Hydrogen bromide (hydrobromide) 56.114. Arsenic hydrogen (arsine) 2736.815.V hydrogen phosphorous (phosphine) 5473.516. Hydrogen cyanide 547.417. Sulfur hexafluoride 0.318. Dialuminum trioxide (in terms of aluminum) 442.819. Dioxins (polychlorinated dibenzo-p-dioxins and dibenzofurans) in terms of 2,3,7,8- tetrahlordibenzo-1,4-dioxin1340000000020. Diectilet (in terms of mercury) 18244.121. Trichloride yield (in terms of iron) 1369.722. Solid fuel zools15,123. Mazeta TPP (in terms of vanadium) 221424. its compounds 14759.325. Sodium carbonate (disodium carbonate) 138.826. Terephthalic acid 5473.527. Cobalt and its compounds (cobalt oxide, cobalt salts in terms of cobalt) 442828. Nickel, nickel oxide (in terms of nickel) 5473.529. Nickel soluble salts (in terms of nickel) 27364.830. Magnesium oxide 45.431. Manganese and its compounds 5473.532. Copper, copper oxide, copper sulfate, copper chloride (in terms of copper) 5473.533. Methane 10834. Methyl mercaptan, ethyl mercaptan 54729, 735. Arsenic and its compounds, except arsenic hydrogen 1823.636. Ozone 182.437. Inorganic dust containing silicon dioxide in percentage: above 70 percent 109.570 - 20 percent 56.1 below 20 percent 36.638. Mercury and its compounds, except diethylmercury 18244.139 .Lead and its compounds, except tetraethyl lead (in terms of lead) 18244.140. Hydrogen sulfide 686.241. Carbon disulfide 1094.742. Sulfuric acid 45.443. Sulfur dioxide 45.444. Tellurium dioxide 1094745. Tetraethyl lead 136824.246. Carbon oxide1 ,647.Phosgene1823, 648. Phosphorus anhydride (diffosphorus pentaccis) 109,549. Gaseous fluorids (hydrofactoride, tetraftoride silicon) (recalculating to fluorine) 1094.750. Hardfront. Solid fluoride181.651.fluorous hydrogen, soluble fluorides547,452. Chalor181.653. -chlorous hydrogen 29,954. Chloroprene 2736.855. Chromium (Cr+6) 3647.256. Saturated hydrocarbons C1 – C5 (excluding methane) 10857. Saturated hydrocarbons C6 – C100.158. Saturated hydrocarbons C12 – C1910.859. Cyclohexane 3.260. Amylenes (mixture of isomers) 3.261.Butylene 6.762.1,3-Butadiene (divinyl) 6.763.Heptene 93.564.Propylene 1.665.Ethylene 1.666.Alpha-methylstyrene 138.867.Benzene 56.168.Dimethylbenzene (xylene) (mixture of meta-, ortho- and para-isomers) 29.969. Isopropylbenzene (cumene) 392.570. Methylbenzene (toluene) 9.971. Furniture solvent (AMP-3) (toluene control) 9.972.1,3,5-Trimethylbenzene (mesitylene) 56.173. Phenol 1823.674. Ethylbenzene 27575. Ethylenebenzene (styrene) 27 36, 876. Naphthalene 1823,677. Bromobenzene 182,478.1-Bromoheptane (heptyl bromide) 547,479.1-Bromodecane (decyl bromide) 547,480.1-Bromo-3-methylbutane (isoamyl bromide) 547,481.1-Bromo-2-methylpropane (isobutyl bromide)5 47,482.1-Bromopentane (amyl bromide )547,483.1-Bromopropane (propyl bromide)547,484.2-Bromopropane (isopropyl bromide)547,485.Dichloroethane10,886.Dichlorofluoromethane (freon 21)21,687.Difluorochloromethane (freon 22)0,588.1,2-Dichloropropane47,58 9. Methylene chloride 2.290. Tetrachlorethylene (perchlorethylene) 93.591.Tetrafluoroethylene13.492.Trichloromethane (chloroform)181.693.Trichlorethylene10.894.Tribromomethane (bromoform)45.495.Tetrachloromethane (carbon tetrachloride)9.996.Chlorobenzene56.197.Chloroethane (ethyl chloride)29 .998.Epichlorohydrin 29.999.Hydroxymethylbenzene (cresol, mixture of isomers : ortho-, meta-, para-) 275100. Amyl alcohol 547.4101. Butyl alcohol 56.1102. Isobutyl alcohol 56.1103. Isooctyl alcohol 36.6104. Isopropyl alcohol 9.9105. Methyl alcohol 13.4106. Propyl alcohol 20107. Ethyl alcohol y1.1108. Cyclohexanol 93.5109. Terephthalic acid dimethyl ether 547.4110. Dinyl (mixture of 25% diphenyl and 75% diphenyl oxide) 547.4111. Diethyl ether 16112. Methylal (dimethoxymethane) 36.6113. Ethylene glycol monoisobutyl ether (butyl cellosolve) 2011 4.Butyl acrylate (butyl ether of acrylic acids) 365.8115. Butyl acetate 56.1116. Vinyl acetate 36.6117. Methyl acrylate (methylprop-2-enoate) 442.8118. Methyl acetate 80.1119. Ethyl acetate 56.1120. Acrolein 181.6121. Butyraldehyde 365.8122. Acetaldehyde 547.4123. Formaldehyde 1823.6124 .Acetone 16.6125. Acetophenone (methyl phenyl ketone) 1823.6126. Methyl ethyl ketone 56.1127. Wood alcohol solvent grade A (acetone ether) (acetone control) 46.5128. Wood alcohol solvent grade E (ether acetone) (acetone control) 80.1129. Cyclohex anon138 ,8130. Maleic anhydride (vapor, aerosol) 106.8131. Acetic anhydride 181.6132. Phthalic anhydride 56.1133. Dimethylformamide 181.6134. Epsilon-caprolactam (hexahydro-2H-azepin-2-one) 93.5135. Acrylic acid (prop. -2-enoic acid) 138.8136. Valeric acid 547.4137. Caproic acid 1094.7138. Butyric acid 547.4139. Propionic acid 365.8140. Acetic acid 93.5141. Formic acid 45.4142. Isopropylbenzene hydroperoxide a (cumene hydroperoxide) 365.8143. Propylene oxide 69.4144. Ethylene oxide 181.6145. Dimethyl sulfide 69.4146. Aniline 181.6147. Dimethylamine 1094.7148. Triethylamine 40.1149. Nitrobenzene 686.2150. Acrylonitrile 181.6151. N, N1-Dimethylacetamide 934 ,5152.Toluene diisocyanate 275153.Gasoline (petroleum, low sulfur in in terms of carbon) 3.2154. Shale gasoline (in terms of carbon) 109.5155. Kerosene 6.7156. Mineral oil 45.4157. Turpentine 6.7158. Solvent naphtha 29.9159. White spirit 6.7Innovation 2. The declaration will indicate the method for calculating advances

From the first quarter of 2021, the user of natural resources can choose the calculation option for each type of environmental impact assessment, but must notify the RPN of which method he has chosen.

In the past, reports were notified by accompanying or separate letters. Starting with reporting for 2021, the method for calculating advances for the next year will need to be indicated in the declaration itself. The new sheet was introduced by order of the Ministry of Natural Resources of the Russian Federation dated December 10, 2020 No. 1043. It comes into force on January 15, 2021 and is valid until January 14, 2027 inclusive.

How to calculate advance payments for the tax assessment: 3 options

Before January 1, 2021, there was one algorithm for calculating advance payments for environmental impact assessments: the amounts for each type of negative impact for the past year were divided by 4 and transferred to the budget on time.

From January 1, 2021, three payment methods were introduced to choose from the payer (new edition of the Russian Government Decree dated March 3, 2017 No. 255):

- ¼ of the amount payable for the previous reporting period, as before.

- ¼ of the fee amount, but the payment base is determined based on the volume or mass of emissions and discharges of pollutants within the limits of standards (see Names of standards in the table above).

- First, we determine the payment base. As a basis, we take PEC data on the volume or mass of emissions (discharges), the volume or mass of disposed waste in the previous quarter of the current reporting period. Then we multiply the base by the payment rates with coefficients (Article 16.3 of the Federal Law of January 10, 2002 No. 7-FZ).

What distinguishes payments under NVOS from environmental payments?

In addition to payments under the NVOS, there is another payment of an environmental nature, which has the official name “environmental fee”. It is regulated by another regulatory act - the Law “On Industrial and Consumption Waste” dated June 24, 1998 No. 89-FZ.

It has many differences from pollution charges:

- the circle of payers represented by persons producing or importing products that require their disposal upon completion of use;

- tax base, defined as the volume of recycled goods, adjusted to the recycling standard;

- rate depending on the type of product being disposed of;

- the deadline established for payment and being the only one, coincides with the deadline for submitting collection reports and corresponds to the date of April 15 of the year following the reporting one.

The legislation does not provide for advance payment of environmental fees. Thus, there is no need to make advance environmental payments in 2021.

Read more about the environmental fee in the material “Who must pay the environmental fee in 2021 - 2021?”

Innovation 3. New coefficients for the formulas for calculating the payment amount

We calculate the tax payment for 2021 using formulas with new coefficients.

They were approved by Decree of the Government of the Russian Federation dated March 3, 2017 No. 255 (as amended on August 17, 2020). The same resolution provides calculation formulas (rules for calculating and collecting fees for the NVOS, hereinafter referred to as the Rules).

Payment for emissions and discharges within the limits of the standard (clause 17 of the Rules)

The formula for calculation is the same as in previous years. But there is one change. For organizations that operate centralized wastewater systems (CSS), a coefficient of 0.5 was introduced. CSW companies can use it if they discharge pollutants for which best available technologies for wastewater treatment have not been established. An exception is if the organization has launched a program to improve environmental efficiency or environmental protection measures.

Thus, in section 2 in column 15 for CSV organizations you need to enter 0.5. For all others this coefficient is equal to 1.

| Was | It became |

| Section 2, column 15 (Quo): coefficient 1 for all | Section 2, column 15 (Quo): for CSV organizations the coefficient is 0.5, for others - 1 |

Payment for waste disposal (except for MSW) within limits (clause 18 of the Rules)

We are talking about limits on waste disposal, about the standards specified in the DVOS or in the report on the generation, recycling, neutralization, and disposal of waste. The formula in section 3 has not changed.

Payment for placement of MSW in excess of established limits (clause 18 (1) of the Rules)

We are talking about limits on waste disposal, about the standards specified in the DVOS or reporting on the generation, recycling, neutralization, and disposal of waste.

From January 1, 2021, in section 3.1, a coefficient of 25 is applied to the rate of payment for the disposal of waste of the j-th hazard class in excess of limits. Previously, there was a coefficient of 5.

| Was | It became |

| In section 3.1, art. 13 (Ksl) coefficient 5 is applied to the fee rate | In section 3.1, art. 13 (Ksl) a coefficient of 25 is applied to the fee rate |

Payment within the limits of temporarily permitted emissions and discharges exceeding the standards (clause 19 of the Rules)

The coefficient for the payment rates for the emission or discharge of the i-th pollutant within the limits of temporarily permitted masses and volumes has changed: instead of coefficient 5, 25 is now applied (column 11, sections 1 and 2).

An exception is CSV organizations that have launched a program to improve environmental efficiency or environmental protection measures (except for discharges within the limits of technological standards). They apply factor 1 (column 11 of section 2 for CSV).

| Was | It became |

| Column 11 (Kvr) of sections 1 and 2 - all have a coefficient of 5 | Column 11 (Kvr) of section 1 and 1.1 - all have a coefficient of 25 Column 11 (Kvr) of section 2 - TsSV has a coefficient of 1, all others have a coefficient of 25 |

Payment for waste disposal (except for MSW) in excess of limits (clause 20 of the Rules)

We are talking about limits on waste disposal, about the standards specified in the DVOS or reporting on the generation, recycling, neutralization, and disposal of waste (with the exception of MSW).

From January 1, 2021, if the limit is exceeded, in Section 3 the coefficient of payment for disposal of waste of hazard class j is applied not to 5, as before, but to 25.

| Was | It became |

| Section 3, Art. 14 (Ksl) - coefficient 5 | Section 3, Art. 14 (Ksl) - coefficient 25 |

Payment for exceeding permitted emissions and discharges (clause 21 of the Rules)

We are talking about standards that depend on the category of objects.

- For category I objects, we look at the excess of emissions and discharges established by the IEP.

- For objects of category II we are talking about excess emissions and discharges from DVES.

- For category III objects, we mean the excess over emissions and discharges from industrial environmental control reports.

For objects of categories I and II, in columns 12 of sections 1 and 2, we use payment rates for emissions or discharges with a coefficient of 100 , and not 25, as before.

When CCB organizations conduct environmental efficiency programs or environmental protection activities, they, like others, use the coefficient 25 in column 12 of section 1, and in column 12 of section 2 they use the coefficient 1.

There are also those who use a coefficient of 25 in column 12 of sections 1 and 2. These are:

- persons who work at category III facilities and are required to pay fees;

- persons who work at facilities of categories I and II received a permit for emissions and discharges before January 1, 2021. The condition is valid until the permit expires, the company receives an IEP or submits a DVOS.

| Was | It became |

| All excesses of emissions and discharge standards were considered with a factor of 25 | For objects of categories I and II in columns 12 (Ksr/Kpr) of sections 1, 1.1 and 2, art. 5 section 1.2 - coefficient 100 |

| Column 6 of section 1.2 (Knmm) - coefficient 0.25 | |

| Column 12 of section 2 (Ksr/Kpr) TsSV: coefficient 1 | |

| For objects of categories III and II with permission before January 1, 2019 and subject to the conditions in column 12 (Ksr/Kpr) of sections 1 and 2 - coefficient 25 |

Payment for emissions and discharges in the absence of IEP, DVOS or a report on the results of the PEC (clause 21 (1) of the Rules)

We are talking about companies and individual entrepreneurs that operate at category I facilities and, from January 1, 2021, received or reissued a permit or limit on emissions and discharges. This also includes the situation when there are no such limits and permits.

Their coefficient was and remains 25, the payment base has changed. Now this is the actual volume or mass of emissions or discharges of pollutants in tons or cubic meters.

Calculate the fee for the tax assessment and send the declaration via Extern

As usual, the exception is CSV organizations. When they carry out programs to improve environmental efficiency or environmental protection measures, then in column 12 of section 2 they use a coefficient of 1.

Those who are required to pay a fee and work at category III facilities will apply a coefficient of 25 in column 12 from January 1, 2021.

Fee for disposal of recycled waste, except MSW (clause 22 of the Rules)

We are talking about the placement of waste that needs to be disposed of. The fee is charged if the company itself disposed of this waste at its production site according to technological regulations or transferred it for disposal no later than 11 months later. When calculating fees for such waste, a coefficient of 0 is applied in columns 18 and 21.

The payment base for waste disposal (except for MSW) of the j-th hazard class is considered as:

- Category I - the difference between the volume or weight of disposed waste and the volume or weight of established limits for their disposal;

- Category II - the difference between the volume or weight of disposed waste (except for MSW) and the volume or weight of waste in the DVOS;

- Category III - the difference between the volume or weight of disposed waste and the volume or weight of disposed waste, which is indicated in the report on the generation, disposal, neutralization, and disposal of waste.

If the company has not submitted a recycling report, the payment base is determined as the actual volume or weight of disposed waste.

Payment for emissions and discharges within the limits of technological standards (clause 17 of the Rules)

We are talking about emissions or discharges equal to technological standards. This also includes the case where a company has implemented BAT. In these situations, in column 10 of sections 1 and 2, we apply a coefficient of 0.

Data on which fee calculation is based

Calculation of fees for negative impact on the environment (or fees for pollution) depends on many factors:

- nature of the source of pollution;

- type of pollutant (or its hazard class);

- volumes of actual emissions;

- the fact that there are no means of measuring emissions;

- presence of excess pollution above established standards;

- the fact that the contaminated object or territory is under special protection;

- expenses incurred on measures to reduce negative impacts.

Based on the first 2 indicators, the rate used in the calculation is determined. By multiplying it by the volume of actual emissions (if it does not exceed the maximum permissible) the amount of payment for pollution is determined. The following odds are applied to the bet amount:

- increasing, if we are talking about the lack of means of measuring emissions, exceeding permissible pollution standards, or the location of an object (territory) under special protection;

- reducing, depending on the hazard class of the disposed waste, the method of its generation and disposal.

The maximum multiplying factor (120) may arise in a situation where there are no means to measure volumes. Exceeding the standards leads to the application of coefficients equal to 5 (if the excess occurs during the period of planned reduction of discharges) or 25. For an object (territory) under special protection, a coefficient of 2 applies.

The specific size of the reduction factor can be determined by a combination of factors influencing it and range from 0 to 0.67.

The presence of expenses for measures to reduce negative impacts allows you to reduce the amount of accrued fees.

Also, the amount of amounts payable at the end of the year is influenced by the fact that advances on pollution payments were transferred during the year.

Innovation 7. Changes in the sheet where the fee amount is calculated

If you reconcile your payments with Rosprirodnadzor, the agency may credit you with the overpayment for a future period.

Previously, the amount was simply entered into the declaration with an adjustment for the overpayment, and it was difficult for RPN employees to find out whether there was a reconciliation or whether the payer simply took and reduced his payment.

Now a column has appeared in the declaration in which you need to indicate the decision of Rosprirodnadzor to offset the overpayment:

Innovation 8. OKTMO of the object

In sections 3 and 3.1 of the declaration, a separate line has appeared in which it is necessary to indicate the OKTMO of the waste disposal facility.

This innovation will facilitate the work of inspectors who accept declarations on paper. The fee is calculated according to OKTMO. Previously, in printed form, this code was included in the calculation, but was not included in the headings of sections 3 and 3.1. Inspectors had to look at OKTMO for each landfill and check whether the amount was calculated correctly. Now the calculation has become more transparent.

Olga Zakharova, Contour expert on reporting to Rosprirodnadzor

"Environmental" statistics: form No. 2-TP (waste)

Who is obliged to take

Report No. 2-TP (waste) refers to forms of statistical observation.

In general, this report is submitted by organizations and individual entrepreneurs “carrying out activities in the field of industrial and consumer waste management.” Most companies that leave behind some kind of garbage fit this definition.

An exception is made for those who belong to small and medium-sized businesses. They have the right not to submit Form No. 2-TP (waste) if the following conditions are simultaneously met:

- only MSW is generated in quantities less than 0.1 tons;

- an agreement has been concluded with a regional operator;

- there are no waste management activities (processing, disposal, neutralization, disposal).

Should tenants submit Form No. 2-TP (waste)

Disputes arise regarding tenants belonging to small and medium-sized enterprises that generate MSW less than 0.1 tons and do not conduct waste management activities.

If such a tenant has entered into an agreement on his own behalf with a regional operator, then everything is clear - the tenant does not have to submit the specified report.

But a different situation often occurs. According to the documents, the lessor is responsible for garbage removal, and it is he who enters into an agreement with the operator. And the tenant simply transfers the waste to the ownership of the landlord. Should the tenant submit Form No. 2-TP?

There are two opposing points of view.

According to the first, it is necessary to submit report No. 2-TP, since the tenant does not have a direct agreement with the operator. As a result, one of the conditions giving the right to be exempt from the obligation to submit this form has not been met.

The second point of view (which we also adhere to) is as follows. Since the tenant is not the owner of the waste, then he does not need to report in Form No. 2-TP (waste). Moreover, this form is submitted by the owner of the garbage - the landlord (if he is not a small enterprise). Resubmitting the report would be pointless.

Also see: “New form No. 2‑TP (waste) has been approved.”

Fill out and submit a new 2‑TP form online for free