At the end of each quarter, employers submit a calculation of insurance premiums to the tax authority (KND 1151111). In 2021, you need to report using a new form, approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] [email protected] dated October 15, 2020. Let's figure it out , what has changed and how you now need to fill out this document.

Free accounting services from 1C

Who submits the RSV for 2021

Employers making payments must submit the DAM for 2021:

- employees working under employment contracts (regardless of the duration of the contract);

- persons with whom GPC agreements have been concluded;

- authors of works under copyright contracts;

- “physicists” under agreements on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, license agreements on granting the right to use the results of intellectual activity.

The following employers submit RSV:

- organizations;

- separate sections of Russian organizations that independently pay income to their employees and pay contributions to the budget from it;

- separate units of foreign organizations operating in Russia;

- IP;

- heads of peasant farms;

- an individual without individual entrepreneur status.

Zero RSV is given by:

- the only founders who simultaneously work as general directors (Letter of the Ministry of Finance dated June 18, 2018 No. 03-15-05/41578);

- organizations or individual entrepreneurs, if during the reporting period they did not have activities and payments to employees (Letter of the Federal Tax Service dated 04/03/2017 No. BS-4-11/6174);

- heads of peasant farms in the absence of employees and activities (Letter of the Federal Tax Service dated December 25, 2017 No. GD-4-11 / [email protected] ).

Individual entrepreneurs, lawyers, private notaries who do not have employees do not submit insurance premium calculations.

What is the purpose of calculating insurance premiums?

Based on the calculated amounts for employee insurance, these funds are transferred to the employee’s appropriate insurance account. The report indicates how much money the employer must contribute to each employee's retirement account, as well as medical contributions to the city budget. Insurance premiums are calculated from the amount of accrued wages, which is reflected in the payroll (form T-51). An accountant handles these calculations.

New RSV form: what has changed and when to use

The RSV for 2021 must be completed on an updated form. Changes were made by Federal Tax Service Order No. ED-7-11/ [email protected] to Federal Tax Service Order No. ММВ-7-11/ [email protected] , approving the current calculation form.

What has changed in the updated RSV:

- a field appeared on the title page to indicate the average number of employees (Article 80 of the Tax Code of the Russian Federation).

The appearance of the “Average number of employees” field in the updated DAM form is due to the cancellation of the separate reporting form “Information on the average number of employees for the previous calendar year” from 01/01/2021. There is no need to submit a separate report with information on the number of employees for 2021 (Federal Tax Service Order No. ED-7-11 dated October 15, 2020 / [email protected] ).

- The form includes a new Appendix 5.1 “Calculation of compliance with the conditions for the application of a reduced rate of insurance premiums by payers specified in subparagraph 3 (subparagraph 18) of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to Section 1, which is associated with the introduction of reduced premium rates for IT companies. This application applies starting with reporting for the 1st quarter of 2021;

- Appendix No. 5 of the Procedure for filling out the DAM has been supplemented with new tariff codes for the payer of insurance premiums (20, 21 and 22):

| 20 | Payers of insurance premiums recognized as small or medium-sized businesses in accordance with Federal Law No. 209-FZ dated July 24, 2007 |

| 21 | Payers of insurance premiums applying reduced insurance premium rates in accordance with Federal Law No. 172-FZ dated 06/08/2020 |

| 22 | Payers of insurance premiums carrying out activities in the design and development of electronic component base products and electronic (radio-electronic) products |

- Appendix No. 7 “Category codes of the insured person” includes the MS, KV and EKB codes:

| MS | Individuals for whom insurance premiums are calculated by payers recognized as small or medium-sized businesses in accordance with the Federal Law dated 07/24/2007 No. 209-FZ |

| HF | Individuals from whose payments and rewards insurance premiums are calculated by payers in accordance with Federal Law No. 172-FZ dated June 8, 2020 |

| EKB | Individuals from whose payments and remunerations insurance premiums are calculated by organizations engaged in the design and development of electronic component base products and electronic (radio-electronic) products |

- other amendments.

New RSV form for 2021

Location code

The field for this code is located on the title page to the right of the Federal Tax Service code. It is indicated depending on the territorial location of the enterprise and its legal status. The values can be as follows:

EXAMPLE

Let's assume that Guru LLC is located in Russia - in Tomsk. Then in the field in question they put the number 214, and the Federal Tax Service code is 7017:

Letters from the Federal Tax Service to help fill out the RSV in 2021

When filling out the DAM in 2021, the following explanations from the Federal Tax Service will help:

| Letter from the Federal Tax Service | How it will help |

| Letter dated 06/09/2020 No. BS-4-11/ [email protected] | Explains the procedure for filling out appendices 1 and 2 to Section 1 of the DAM by companies from industries affected by coronavirus that apply reduced insurance premium rates |

| Letter dated 04/02/2020 No. BS-4-11/ [email protected] | Clarifies how to fill out the DAM in a situation where, on the date of submission of the updated calculation, personal data (SNILS, last name, first name, patronymic) have changed |

| Explain the procedure for using tariff codes and category codes of the insured person when filling out calculations for insurance premiums by SMP subjects (before making appropriate changes to Appendices No. 5 and 7 to the Procedure for filling out DAM) |

| They explain how to fill out the DAM when several insurance premium rates are applied in the reporting period, including how many annexes to Section 1 of the DAM need to be filled out by payers of contributions ─ SMP subjects |

| Letter dated August 12, 2020 No. SD-4-3/ [email protected] | Explains the right of insurance premium payers to apply reduced tariffs under Law No. 102-FZ dated April 1, 2020, subject to the inclusion of information about them in the register of SMEs, regardless of the type of activity they carry out |

Budget classification code

The corresponding 20-digit number is placed on some pages of Sections I and II. It allows you to correctly distribute cash receipts from contributions depending on their purposes:

- pension insurance (compulsory and at an additional rate);

- medical insurance (CHI);

- social security;

- additional social security;

- illness and motherhood.

EXAMPLE

prepares calculations for insurance premiums for the first 6 months of 2019. Which BCCs need to be reflected in the first section for compulsory pension and health insurance are shown below:

When filling out a single calculation, use the new BCCs in force in 2021. Since the Federal Tax Service is now in charge of controlling insurance premiums, some changes have occurred.

Requirements for filling out the DAM for 2021

They are indicated in the Procedure for filling out this report, approved. By Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] ):

- Calculation pages are numbered in continuous order, starting with the title page.

- Information in the RSV is entered in capital block letters from left to right.

- When filling out the calculation manually, use black, purple or blue ink.

- When filling out the RSV, the Courier New font with a height of 16-18 is installed on the computer.

- Correcting errors using putty and other corrective means is unacceptable.

- If you are creating the RSV on paper, print each sheet on a separate page.

- The printed report is not held together, not even with paper clips. It is recommended to submit it for verification in a separate file.

- In fields where there are no quantitative or total indicators, indicate “0”; in the remaining empty lines and cells, enter a dash. But if the report is filled out using a program, dashes may not be placed in empty cells.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

How to submit the RSV - on paper or electronically?

There are several ways to submit the DAM for 2021 (clause 10 of Article 431 of the Tax Code of the Russian Federation):

- On paper - if the number of employees is no more than 10 people.

If during the reporting period you paid income to a maximum of 10 employees, the calculation can be submitted both on paper and electronically.

- In electronic form - if the number of employees is 11 people. and more.

If from January to December 2021 income was paid to more than 10 employees, the DAM is submitted exclusively in the form of an electronic document signed with an electronic signature. It is sent to the Federal Tax Service via telecommunication channels (TCC) through electronic document management operators.

RSV composition for 2021

The RSV, which is due at the end of 2021, consists of 3 sections and appendices to them. But you don't need to fill them all out. Required to be included in the calculation:

- title page;

- Section 1 “Summary of the obligations of the payer of insurance premiums”;

- subsection 1.1 of Appendix No. 1 to Section 1 “Calculation of contributions for compulsory pension insurance”;

- subsection 1.2 of Appendix No. 1 to Section 1 “Calculation of contributions for compulsory health insurance”;

- Appendix No. 2 to Section 1 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to Section 1”;

- Section 3 “Personalized information about insured persons.”

The procedure for filling out the DAM sheets is as follows: title page, Section 3 (for each employee), appendices to Section 1, Section 1. The remaining DAM sheets are filled out if necessary:

| RSV section or application | Who fills it out and in what case? |

| Section 2 and Appendix 1 to Section 2 | Included in the DAM by heads of peasant farms |

| Included in the DAM when payers apply the appropriate insurance premium rates |

| Appendices 3 and 4 to Section 1 | Included in the DAM when payers incur expenses for the payment of insurance coverage for compulsory social insurance in case of VNiM |

The updated calculation includes a new Appendix 5.1 “Calculation of compliance with the conditions for the application of a reduced tariff of insurance premiums by payers specified in subparagraph 3 (subparagraph 18) of paragraph 1 of Article 427 of the Tax Code of the Russian Federation” to Section 1. Starting from the reporting period for the first quarter of 2021, it is filled out by companies carrying out activities in the field of information technology, activities in the design and development of electronic component base products and electronic (radio-electronic) products and applying reduced insurance premium rates.

It is also established that Appendix 5 to Section 1 is filled out by IT organizations that apply the reduced tariffs established by paragraphs. 1.1 of paragraph 2 of Article 427 of the Tax Code of the Russian Federation, and applies to the billing period of 2020.

How to fill out the RSV if you apply several tariffs

SME employers can apply two tariffs simultaneously: the generally established one for payments within the minimum wage and a reduced 15% for payments in excess of this amount (subclauses 2, 5, 7, clause 2 of Article 427 of the Tax Code of the Russian Federation).

When applying several tariffs simultaneously, the DAM must include (Letter of the Federal Tax Service dated July 27, 2020 No. BS-4-11/12050):

- subsections of Appendix 1 and Appendix 2 to Section 1 by payer tariff code “01”, “20”;

- subsections of Appendix 1 and Appendix 2 to Section 1 for other tariff codes in connection with the application of reduced contribution rates in accordance with Art. 427 Tax Code of the Russian Federation.

The procedure for applying the codes is explained in the Letter of the Federal Tax Service dated 04/07/2020 No. BS-4-11/ [email protected] :

- in field 001 “Payer's tariff code” of Appendix 1 (in relation to contributions to compulsory health insurance and compulsory medical insurance) and in Appendix 2 (for contributions to compulsory health insurance) of Section 1 the tariff code “20” is reflected;

- in column 130 of subsection 3.2.1, to indicate the code of the category of an individual for whom payments above the minimum wage are calculated at reduced rates, the following letter codes are used:

| Individual category code | Decoding |

| MS | Persons insured in the field of compulsory health insurance |

| VJMS | Foreign citizens and stateless persons temporarily residing in the Russian Federation, as well as persons who have been granted temporary asylum, insured in the field of compulsory health insurance |

| IPMS | Foreign citizens and stateless persons, except highly qualified specialists, insured in the field of compulsory health insurance) temporarily staying in the territory of the Russian Federation |

Designation of tariff codes:

- code “01” ─ basic tariff;

- code “20” ─ tariff 15%.

There are also other reduced tariffs applied to payments to certain categories of employees.

If you apply several tariffs at the same time, in the DAM include as many appendices 1 (or individual subsections of appendix 1) and appendices 2 to section 1 as tariffs were applied during the period.

What codes to use for document types?

The single calculation also includes a code that informs about the type of document identifying the insured. The designation used also depends on the presence of Russian citizenship and the status of the employee. Full information is presented below (Appendix No. 6 to the order of the Federal Tax Service No. ММВ-7-11/551):

These codes indicate:

- in information about an individual without individual entrepreneur status;

- in personal data about the insured (page 140 of Section 3).

EXAMPLE

In the personalized accounting information, the company reflected information about employee N.V. Maneev on the basis of a temporary identity card issued to a citizen of the Russian Federation. In such a situation, in line 140 you must specify code “14”:

Filling out the title page

The procedure for filling out the title page of the RSV

| Line | What do they indicate? |

| TIN | TIN in accordance with the tax registration certificate. Since the TIN of legal entities is 2 digits shorter than the TIN of entrepreneurs, put dashes in the remaining cells |

| checkpoint |

|

| Correction number | If you are submitting the calculation for the first time in 2021, put “0 – -”. If you are making an adjustment, put “1- -”, “2- – ”, etc. (depending on what adjustment to the account you are submitting) |

| Settlement (reporting) period (code) | Code of the period for which the report is submitted. For the DAM for the year we enter the code “34”. If the calculation is submitted at the end of the year, but in connection with reorganization (liquidation), when deregistering an individual entrepreneur or the head of a peasant farm - code “86”. The codes for the remaining periods are indicated in Appendix No. 3 to the Filling Out Procedure (they are presented in the table below) |

| Calendar year | The year of the period for which you submit the calculation is 2020 |

| Submitted to the tax authority (code) | Code of the Federal Tax Service to which you submit the payment |

| By location (code) |

These codes are given in Appendix No. 4 to the Filling Procedure |

| “Name of organization, OP...” |

|

| Average number of employees (persons) | The average headcount is indicated, determined in the manner established by the federal executive body authorized in the field of statistics. |

| OKVED2 code | The employer's main activity code is filled in according to the All-Russian Classifier of Types of Economic Activities (OKVED2). |

| Form of reorganization (liquidation) (code)/Deprivation of powers (closing) of a separate division (code)” | The code for reorganization (liquidation), deprivation of powers (closing) of a separate division is indicated in accordance with Appendix No. 2 to the Procedure for filling out the DAM. The indicator “Deprivation of authority (closing) of a separate division (code)” is filled in by payers if it is necessary to submit an updated DAM for a separate division, which was previously vested with the authority to accrue payments and rewards in favor of individuals, and by the time the updated DAM was submitted, deprivation of authority had occurred. |

| “TIN/KPP of a reorganized organization” and “TIN/KPP of a deprived of authority (closed) separate division” | The fields are filled in in accordance with clauses 3.3 and 3.4 of the Procedure for filling out the DAM. |

| Contact phone number | Enter in the following format: “8 space code space number.” For example: "8 917 2002010" |

| The calculation has been completed | The total number of sheets that make up the RSV. Blank pages are not included in the calculation. |

| With supporting documents attached | Fill out only if any documents are attached to the DAM: for example, a power of attorney for a representative. In other cases, dashes are placed in this line |

| Reliability and completeness... |

|

| Full name |

|

| Title of the document... | The name and details of the document on the basis of which the representative acts. For example: “Power of Attorney No. 1 dated January 18, 2021” |

A power of attorney to sign accounting and statistical reporting does not give the authorized person the right to sign the DAM. Calculation of contributions relates to tax reporting, and as a separate type of reporting must be registered in a power of attorney (Letter of the Federal Tax Service dated November 18, 2019 No. BS-4-11 / [email protected] ).

Code of the tax authority to which the report was submitted

Depending on the territorial location, tax inspectorates are assigned an individual number. You can find it out on the official website of the Federal Tax Service of Russia, from accounting reference books, or take the first four digits of the TIN.

The table shows values for some regions:

| Region of Russia | IFTS/MIFNS code |

| Moscow | 77— |

| Moscow region | 50— |

| Saint Petersburg | 78— |

| Tyumen region | 72— |

| Novosibirsk region | 54— |

| Amur region | 28— |

Where: “–” is the serial number of the tax authority in the region.

Filling out Section 3

To be completed in relation to all employees who received payments under employment and civil law contracts in the reporting period of 2021.

Procedure for filling out Section 3 of the DAM

| Line | What do they indicate? |

| 010 | Sign of cancellation of information about the insured person (indicate “1” when canceling previously submitted information about this insured person, as well as when adjusting data on lines 020-060). When filling out the RSV for the first time, this field is not filled in |

| 020-070 | Employee information: TIN, SNILS, full name, date of birth |

| 080 | Code of the country of which the employee is a citizen. For the Russian Federation - code “643”. The list of codes for other countries is given in the All-Russian Classifier of Countries of the World (OKSM). If the employee does not have citizenship, indicate the code of the country that issued him the identity document |

| 090 |

|

| 100 | Identity document code:

* See below for a complete list of codes |

| 110 | Employee's passport details. The number sign is not placed (the number is separated from the series by a space) |

| 120 | Numbers of three months of the last quarter: 1, 2, 3 |

| 130 | Insured person category code. It can be clarified in Appendix No. 7 to the Filling Out Procedure (for example, “NR” denotes persons who are covered by compulsory pension insurance, including those who are employed in a workplace with special (difficult and harmful) working conditions, for whom insurance premiums are paid according to the main tariff) |

| 140 | Monthly payment amount to employee |

| 150 | The base for contributions to compulsory pension insurance is within the limit (RUB 1,292,000 in 2020) |

| 160 | Amount of payments under the GPC agreement (if any) |

| 170 | The amount of contributions from a base not exceeding the limit of RUB 1,292,000. (for OPS) |

Block 3.2.2 is filled out only if in the reporting period of 2021 payments were made that were subject to contributions to compulsory pension insurance at an additional tariff.

If the details “TIN of an individual” in Section 3 are left blank (crossed out), tax authorities must accept such a DAM (Letter of the Federal Tax Service dated 06/04/2020 No. BS-3-11 / [email protected] ). A similar situation may arise if the employee does not have a TIN or the employer is not sure of the correctness of the available information. Let us also remind you that you can clarify the employee’s TIN using the online service on the Federal Tax Service website.

Activity code

On the title page, after the name of the organization, you must indicate the code of economic activity - according to OKVED2. It contains information about the name of the company’s field of activity and a description of the grouping of its specific activities. You can view its value:

- in the all-Russian classifier;

- certificate of registration of an economic entity.

EXAMPLE

The scope of activity of Guru LLC is the production of armored and reinforced safes, as well as fire-resistant doors. According to the 2nd edition of the Classifier, the type of activity in question is assigned code 25.99.21. It is indicated in the corresponding field of the title page:

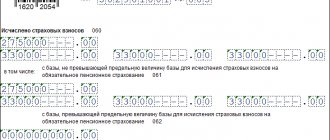

We fill out subsection 1.1 of Appendix No. 1

Rules for filling out subsection 1.1 of Appendix No. 1 of the RSV

| Line | What do they indicate? |

| 001 | Contribution payer tariff code. You can find it in Appendix No. 5 to the Filling Out Procedure. |

| 010 | From left to right - the total number of insured employees, regardless of whether they received income in the reporting period:

|

| 020 | From left to right - the number of employees who were paid income subject to compulsory pension contributions:

|

| 021 | If during the reporting quarter the employee's income exceeded the maximum base for contributions, show their number in the columns of this line. In 2021, the maximum base for contributions to compulsory pension insurance is RUB 1,292,000. |

| 030 | The amount of payments to employees subject to contributions to compulsory pension insurance:

This line does not include payments that are not subject to insurance premiums: dividends, material benefits, payments under lease agreements or upon the sale of property (Letter of the Federal Tax Service dated 08.08.2017 No. GD-4-11 / [email protected] , Letter of the Ministry of Health and Social Development dated 19.05 .2010 No. 1239-19). |

| 040 | If any payments during the year were not subject to contributions to compulsory pension insurance, they are reflected in the columns of this line in the same order as we reflected contributions on page 030 |

| 045 | This line shows the amounts:

|

| 050 | Contribution base for the year and October-December 2021. It is calculated using the formula: page 030 - page 040 - page 045 |

| 051 | Contribution base exceeding the maximum limit |

| 060 | The amount of calculated insurance premiums, calculated according to the formula: line 050 x tariff. Page 060 = page 061 + page 062 |

| 061 | The amount of insurance premiums calculated for 2021 from a base not exceeding the limit of RUB 1,292,000. Calculated using the formula: (050 - 051) x tariff |

| 062 | The amount of contributions calculated from a base exceeding the limit. Calculated using the formula: line 051 x per tariff |

What codes to use for reporting and billing periods?

A single calculation must be submitted after the 1st quarter, 6, 9 and 12 months. The deadline is no later than the 30th day of the month following such reporting period. The combination of numbers informing tax authorities about the reporting period is defined in Appendix No. 3 of the procedure for filling out a single calculation:

As you can see, the billing period is a year. It corresponds to code 34.

EXAMPLE

submits reports on contributions for the first quarter of 2021. When drawing up the first sheet in the field for reporting and billing periods, she notes the number 21:

We fill out Appendix No. 2 to Section 1

In this application, contributions for VNiM are calculated. Contributions for injuries are not reflected in it, since they are included in the calculation of 4-FSS.

Procedure for filling out Appendix No. 2 to Section 1

| Field, line | What do they indicate? |

| Field 001 | Applicable tariff code (according to Appendix No. 5 to the Procedure for filling out the DAM) |

| Field 002 | “1” - if benefits are paid to employees by the Social Insurance Fund, bypassing the employer (direct payments). “2” - if the VNIM benefit is paid by the employer with the offset of funds from the Social Insurance Fund (offset system) |

| Page 010 | The total number of insured persons for 2021 and separately for each month of the 4th quarter. Individuals with whom GPC agreements have been concluded are not taken into account in this line. Contractors under the GPA are reflected here only if contributions to VNiM are paid from their income, and this is stated in the contract |

| Page 015 | The total number of individuals for whom insurance premiums are calculated from payments and other remuneration (on an accrual basis from the beginning of the billing period, as well as for the first, second and third month of the last three months of the billing (reporting) period, respectively) |

| Page 020 | The amount of payments to employees for 2021, and for each month of the 4th quarter separately. The data is entered in the same order as when filling out page 030, subsections 1.1 and 1.2 of Appendix No. 1 |

| Page 030 | Payments not subject to contribution: state benefits, compensation, one-time financial assistance and other payments listed in Art. 422 of the Tax Code of the Russian Federation. It also reflects the amounts of expenses associated with the extraction of income under copyright contracts, contracts for the alienation of the exclusive right to works of science, literature, art, publishing license agreements, etc. |

| Page 040 | Payments exceeding the maximum base for contributions to the Social Insurance Fund in 2020 - 912,000 rubles. |

| Page 050 | Basis for calculating contributions (line 020 - line 030 - line 040) |

| Page 055 | The basis for calculating insurance premiums for compulsory social insurance of VNiM in relation to the amounts of payments and other remuneration accrued in favor of foreigners and stateless persons temporarily staying in the Russian Federation (except for citizens of the EAEU member states (on an accrual basis from the beginning of the billing period, as well as for the first , second and third months of the last 3 months of the billing (reporting) period, respectively) |

| Page 060 | The amount of calculated contributions for the year and each month of the 4th quarter separately. The value for this line is calculated using the formula: line 050 x insurance premium rate |

| Page 070 | This line is filled in only if the offset payment system is used (code “2” is indicated on page 001). It reflects payments for VNIM. Please note: the employer pays for the first 3 days of illness from his own funds, and there is no need to include them in this line (Part 2 of Article 3 of Law No. 255-FZ of December 29, 2006) |

| Page 080 | The amount of expenses reimbursed by the Social Insurance Fund. It, like line 070, is filled out by employers using the credit system |

| Page 090 | The amount of contributions payable to the budget or the amount of excess expenses over calculated contributions. The value of this line is calculated using the formula: page 060 - page 070 + page 080. In the “Characteristic” line, indicate:

|

We fill out Appendix No. 3 to Section 1

This application is optional and must be completed only if benefits were paid during the reporting period:

- for temporary disability;

- for pregnancy and childbirth;

- for child care;

- for early pregnancy registration;

- at the birth of a child;

- for caring for a disabled child (payment for additional days off);

- for burial.

For each payment indicate:

- the number of cases that are the basis for the payment or their recipients;

- number of paid days of incapacity (number of payments or benefits);

- the amount of expenses incurred (including from the federal budget).

On page 100 indicate the total amount of expenses (sum of lines 010-090).

On page 110, for reference, they reflect the amount of accrued but unpaid benefits (with the exception of the amounts of benefits accrued for the last month of the reporting period, in respect of which the deadline for payment of benefits established by law has not been missed).

The insurer attributes the amounts received from the Social Insurance Fund in the report for the period when the fund reimbursed the costs of paying sick leave benefits. The period in which the days of incapacity for work are paid to the employee does not matter (Letter of the Federal Tax Service dated November 19, 2019 No. BS-4-11 / [email protected] ).

Filling out Section 1

Section 1 includes summary data for each type of insurance premium paid to the Federal Tax Service and is completed last.

Procedure for filling out Section 1 of the RSV form

| Line | What do they indicate? |

| OKTMO | OKTMO code by which insurance premiums were paid |

| 020 | KBK, to which contributions to the OPS are credited. When filling out the RSV for 2021, use KBK 18210202010061010160 |

| 030 | The total amount of accrued insurance premiums for compulsory health insurance since the beginning of the year |

| 031-033 | The amount of accrued insurance premiums for last 3 months:

|

| 040 | KBC for insurance premiums for compulsory medical insurance. When filling out the RSV for 2021, enter the code 18210202101081013160 |

| 050 | The amount of compulsory medical insurance contributions accrued since the beginning of the year for all employees |

| 051-053 | Monthly amount of contributions for the last quarter - similar to contributions to compulsory pension insurance |

| 060-073 | This block is filled out if during the reporting period contributions to compulsory pension insurance were accrued at an additional tariff. If contributions were accrued to different BCCs, fill out as many sheets of Section 1 (pages 060-073) as were used by the BCC |

| 080-093 | This block is filled out if additional social security contributions were accrued during the reporting period. If they were paid to different BCCs, fill out Section 1 according to the number of BCCs |

| 100 | KBC for contributions in case of VNiM - 18210202090071010160 |

| 110 | The amount of insurance contributions for compulsory social insurance in case of VNIM, subject to payment to the budget for the billing (reporting) period |

| 111-113 | Amount of contributions payable monthly (for October-December) |

| 120 | If the amount of benefits issued exceeds the amount of accrued contributions, the difference is reflected in this line |

| 121-123 | Excess amount broken down by month: for October, November, December |

In Section 1, fill out either block pp. 110-113 (indicating the amount of contributions payable) or block pp. 120-123 (indicating the amount of excess of benefits issued over accrued contributions). These blocks cannot be filled at the same time.

Sample of filling out the RSV for 2021

Fines for DAM 2021

The type of liability and the amount of the fine depends on the offense:

| Violation | Punishment | Base |

| Late delivery of RSV |

| Art. 119 Tax Code of the Russian Federation |

| Additionally, officials of the employer may be held liable and will be fined from 300 to 500 rubles. | Art. 15.5 Code of Administrative Offenses of the Russian Federation | |

| Tax authorities will not be able to block a current account for missing the deadline for submitting the DAM. | Letter of the Federal Tax Service dated May 10, 2017 No. AS-4-15/8659 | |

| Submission of the DAM on paper with the obligation to submit in electronic form | Fine 200 rubles. per document | Art. 119.1 Tax Code of the Russian Federation |

| The report was submitted with gross errors that resulted in an underestimation of the contribution base | Fine - 20% of the amount of unpaid insurance premiums, but not less than 40,000 rubles. | Art. 120 Tax Code of the Russian Federation |

It is quite possible to reduce the size of the fine (including the minimum) if there are mitigating circumstances. For example, if you are late with the submission of the DAM by only 1 day (Letter of the Ministry of Finance dated June 18, 2015 No. 03-02-08/35141). The list of mitigating circumstances is given in Art. 112 of the Tax Code of the Russian Federation, but is aimed at “physicists” (personal and family problems, difficult financial situation, etc.). This list is open, so prepare your arguments in advance to convince controllers to reduce the fine.

If the arguments do not work, you can go to court (see, for example, Resolution of the Arbitration Court of the West Siberian District dated 03/21/2018 No. F04-644/2018), although it will not be possible to reduce the fine to zero (Determination of the Supreme Court dated 02/05/2019 No. 309- KG18-14683).

Control ratios according to the RSV

The main KS for the DAM are given in the Letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11/ [email protected] In 2021, the Federal Tax Service repeatedly updated and supplemented them (Letter of the Federal Tax Service dated 05/29/2020 No. BS-4-11/ [email protected] , dated June 10, 2020 No. BS-4-11/9607, dated June 23, 2020 No. BS-4-11/ [email protected] ).

The updated KS allow you to compare the monthly amounts of payments received by employees within the framework of labor relations, not only with the regional minimum wage, but also with the average salary in the region for a given sector of the economy for the previous billing period. This helps tax officials identify “shadow” wages.

Compared to the previous ones, the updated control ratios have changed slightly. Their list has been shortened and a check for new RSV lines has been added:

- page 045 subsection 1.1. and 1.2 of Appendix No. 1 to Section 1;

- page 015 of Appendix No. 2 to Section 1.

After clarifying the control ratios 1.197-1.199, it was possible to check the use by employers from the SME category of reduced insurance premium rates in relation to payments to employees who at the end of the month exceed the minimum wage.

If violations are detected in the control ratios, tax inspectors are obliged to send the contribution payer a request to provide explanations or make appropriate corrections within 5 working days. If such explanations are not provided or the information indicated in them indicates violations of the Tax Code of the Russian Federation, controllers are required to draw up an inspection report (Article 100 of the Tax Code of the Russian Federation).

Let's sum it up

- The calculation of insurance premiums (DAM) for 2021 must be submitted to the Federal Tax Service on an updated form no later than 02/01/2021.

- It is possible to submit a calculation on paper only if the number of employees to whom the income was paid did not exceed 10 people. For 11 or more employees, the DAM is issued exclusively in electronic form.

- Mandatory for completion by all employers: title page, Section 1, subsections 1.1 and 1.2 of Appendix No. 1 to Section 1, Appendix No. 2 to Section 1 and Section 3.

If you find an error, please select a piece of text and press Ctrl+Enter.

Working conditions class code

The indicator under consideration affects the amount of insurance premiums. Additional rates are provided for employees who work in difficult or hazardous conditions. When making a single calculation, in the “Working conditions class code” box of Subsection 1.3.2, enter the number 1 if the hazard subclass is 4. And codes 2, 3, 4 and 5 correspond to subclasses 3.4, 3.3, 3.2 and 3.1.

EXAMPLE

compiles a calculation of insurance premiums for the first half of 2021. When entering data about K.V. Kuznetsov, who works as an electric welder, must enter the number 4 in the “Class of working conditions” field in Subsection 1.3.2.