Unfortunately, each of us is familiar with the situation when you feel that you are getting sick... Weakness, headache, chills are just a small list of unpleasant symptoms. The next day, as a rule, health worsens, and the person can no longer work fully at his workplace. The employee becomes temporarily unable to work, and the doctor prescribes bed rest to the patient. Unfortunately, not only a banal ARVI can cause a sick leave, and in some cases this document does not indicate the employee’s illness at all.

So, sick leave. What it is? To whom is it entitled by law? How are working disabled citizens paid for sick leave benefits?

Changes for 2021

Before starting calculations, you need to familiarize yourself with the changes and the new calculation formula.

- Minimum wage

The minimum wage is established in accordance with Art. 133 Labor Code of the Russian Federation.

That is, the employer does not have the right to pay less than the required minimum, the amount of which as of January 2021 is 9,489 rubles. The minimum wage was increased by 20%.

Important: The exact amount depends on the region. For example, in Moscow the minimum wage is 18,742 rubles.

In what cases are payments less than the minimum wage allowed:

- In addition to salary, there are compensation or incentive payments. If an employee receives a salary, taking into account all additional payments, that exceeds the minimum wage, this is not a violation of the law. That is, the salary may be less than acceptable, but in this case there should be additional payments.

- Part-time work. In accordance with Art. 285 of the Labor Code of the Russian Federation, payment for part-time work must be proportional to the hours worked and the terms of the employment contract.

- Underemployment. In accordance with Art. 93 of the Labor Code of the Russian Federation, part-time work is allowed if there are supporting documents: illness or disability of a close relative, pregnancy, etc.

- Billing period. The year 2021 and 2021 are taken, that is, 730 days, in the case of maternity leave - 731.

- Employee income. For 2 years it should be less than 1,473,000 rubles.

back to menu ↑

The procedure for calculating average earnings to pay for sick time

In order for the employee to receive the compensation due to him, the accountant must correctly calculate the payment for temporary disability. The basic rules for calculating and paying sick leave in 2021 are as follows.

Step 1. The accountant calculates the average earnings for the billing period, then calculates the average daily earnings and the amount of the disability benefit itself. It is necessary to calculate the average salary in accordance with Government Decree No. 922 of December 24, 2007.

Step 2. Average earnings are calculated as follows: wages are determined for the two-year period preceding the accrual. When calculating average earnings, all income that the employee received from official employers and from which insurance premiums were paid is taken into account. The resulting amount is divided by 730.

Accountable income includes (Article 421 of the Tax Code of the Russian Federation):

- income that an employee receives by agreement with the employer - wages, rewards and fees, allowances, bonuses, compensation and incentive payments;

- long service payments;

- payment for an academic degree, badge and certificate of honor;

- for working night shifts, weekends and holidays;

- payment for expanding service areas, for combining job responsibilities;

- remuneration for piece work according to orders;

- salary in kind;

- payments to state and municipal employees;

- allowances to tariff rates and established salaries;

- regional coefficients and northern allowances;

- additional payments for work in difficult climatic conditions, in hazardous industries, etc.;

- allowances for working with documents and information containing state secrets.

Step 3. The formula for calculating average earnings for sick leave is as follows:

SZ = income for the previous 2 years / 730 days.

If one of the calculation years is a leap year, then the total income for 2 years is divided by 731 days. To calculate maternity leave, we take 731 days.

When calculating average earnings, payments that are not subject to FSS insurance contributions are not taken into account. Chapter 34 of the Tax Code of the Russian Federation states that when calculating average earnings, the following amounts are not taken into account (Article 422 of the Tax Code of the Russian Federation):

- Maternity leave.

- A benefit paid during parental leave.

- For other sick leave.

- Travel allowances (daily allowances) paid for business trips both within the Russian Federation and abroad.

- Vacation pay during business trips.

- Financial assistance in the amount of up to 4000 rubles. per employee for a certain billing period.

- One-time financial assistance that is paid in connection with natural disasters or emergency situations, the death of employee family members, the birth of a child, or the establishment of guardianship.

- Year-end bonuses. The final bonus for the year is included in the calculation of average earnings in direct proportion to the number of months worked.

- Compensation payments upon dismissal of an employee. The exception is compensation for unused vacation, amounts of payments in the form of severance pay and average monthly earnings for the period of employment.

- Compensation for costs of professional retraining.

- Payment for employee training for basic and additional professional programs.

- Payments to individuals under GPC agreements.

- Public utilities.

- Compensations related to the employment of laid-off employees and the employee’s relocation to another area. The exception is benefits paid in connection with difficult, harmful working conditions.

Step 4. If the average earnings for each previous period exceed the limit (815,000 rubles in 2021 and 865,000 rubles in 2021), then the limit value is taken for calculation. For 2021, the maximum value of the insurance base for calculating benefits for temporary disability and maternity will be 912,000 rubles. The updated limit value of the base for calculating insurance contributions for compulsory pension insurance from 01/01/2020 is RUB 1,292,000.

There are no excluded periods for calculating average earnings for temporary disability certificates.

Step 5. The resulting calculated result of average earnings is compared with the current minimum wage at the time the minimum wage is calculated. From 01/01/2020, the official minimum wage will be 12,130 rubles. (until the end of 2021 - 11,163 rubles).

How to calculate length of service for sick leave.

Length of service is the period during which the employer made contributions for the employee.

In order to confirm your experience, you must present documents.

Sample certificate of average earnings:

The table below will tell you how to make a confirmation in your situation.

| Period. | Confirmation. |

| State service and municipal. | An entry in the work book, or a certificate from a previous place of work. |

| Periods when the employee was insured by the Social Insurance Fund | Payments, where fees are indicated. |

| Military and other similar service. | Military ID or other similar document. |

| Period. | Confirmation. |

| State service and municipal. | An entry in the work book, or a certificate from a previous place of work. |

| Periods when the employee was insured by the Social Insurance Fund | Payments, where fees are indicated. |

| Military and other similar service. | Military ID or other similar document. |

Next you need to perform the following calculation:

- Months and years. A month is taken into account - 30 days, even if in fact there were fewer days. It is necessary to calculate the full months and years of work.

- The remaining days are being transferred. When calculating that 1 month = 30 days, we calculate the balance and convert it to full months. The remaining days are thrown away.

- Months into years. Convert months of experience into years if there are more than 12.

The end result is the amount of experience.

Example:

It is necessary to calculate sick leave payment as of January 19, 2018.

The employee’s work book contains the following periods:

- 01.2015 – 01.31.2016 – Teplostroy OJSC

- 02.2017 until the day of calculation of length of service – LLC “Dizas”

We carry out calculations:

- Full years included in the experience - 1 year, at Teplostroy OJSC.

- Full calendar months – 11 (1.02-31.12.2017)

- The remainder we get is 35 days, of which 30 are transferred to a month, and 5 are thrown away.

- The remainder is 2 years (1 year + 11 months + 1 month).

back to menu ↑

What should I do if I quit my job and immediately got sick?

Incredibly, even former employees are entitled to paid sick leave! If you come down with a cold, injury, whatever, within 30 days of leaving your job, you are entitled to sick pay. And the reason for dismissal does not matter. Even if you lost your job due to staff reduction, having received all the compensation due, you should still be paid sick leave. And it is not at all necessary that you close it within these 30 days. True, the amount of compensation here is fixed: 60% of your average daily earnings, but not less than the minimum wage (in terms of the period of illness).

Relationship between length of service and benefit amount

Depending on the length of insurance, the percentage of payments of average daily earnings on sick leave is determined.

The percentage depends not only on length of service, but also on the cause of disability.

The most common situation is caring for a minor.

In the table below, you can see the relationship between length of service and benefits.

| Cause. | Experience. | Percent. |

| Caring for a minor. | >8 years 5-8 years | 100% 80% 60% |

| Occupational disease or accident during work. | Any. | 100% |

| Illness, caring for a sick family member. | >8 years 5-8 years | 100% 80% 60% |

| Cause. | Experience. | Percent. |

| Caring for a minor. | >8 years 5-8 years <5 years | 100% 80% 60% |

| Occupational disease or accident during work. | Any. | 100% |

| Illness, caring for a sick family member. | >8 years 5-8 years <5 years | 100% 80% 60% |

Any employee who quits can apply for paid sick leave if no more than 30 days have passed since the dismissal.

back to menu ↑

Calculation period for benefits

The calculation period for benefits for determining average daily earnings is two calendar years before the year in which the insured event occurred. Those. if the insured event occurred in 2019, it is necessary to calculate the average daily earnings for 2021 and 2018.

But there are cases when during these years the employee had no income. For example, an employee was on maternity leave.

Federal Law No. 255, Part 1, Article 14, establishes that employees have the right to change the pay period subject to two conditions:

- in the year being replaced, the employee was on parental leave or maternity leave;

- Changing the years of the calculation period will lead to an increase in the benefit amount.

To do this, the employee must write and submit an application for changing the years of the billing period for sick pay. Moreover, if the Social Insurance Fund allowed to include any years in this period, the Ministry of Labor, by its letter No. 17-1/OOG-1105 dated August 3, 2015, determined that only the years closest to the insured event, and not any, can be taken for replacement.

Calculation example

Example No. 1

Vasilyeva O.V. there is a certificate of incapacity for work. Her minor son became seriously ill and she was forced to take sick leave from April 2 to April 20. Her experience is 8 years, and her income in 2021 is 710 thousand rubles, and in 2021 – 745,500 thousand rubles.

- Calculation period.

2016-2017, number of days of incapacity for work: 18 days.

- We get the average daily earnings.

Average daily earnings: (710,000+745,500)/730 = 1933 rubles

- We determine the percentage based on length of service.

Based on the data in the table above, for 8 years of experience – 100%

- We calculate the benefit.

1933 rubles multiplied by 18 days and by 100% = 34.794 rubles

- We deduct a tax of 13%

Tax amount: 34.794 * 13% = 4.523

Amount of sick leave, excluding tax: 30,271 rubles.

Example No. 2

Employee Ivanov has been working here for 6 years; he had never worked anywhere before. While he was unloading orders, a mount fell on him and injured his back. The doctor said that recovery would take at least a month (30 days).

Income in 2021 – 500,000, and in 2021 – 746,500 thousand rubles.

- Calculation period.

2016-17, 30 days of sick leave.

- We receive daily earnings.

(500.000+746.500)/730 = 1707,53

- We determine the percentage based on length of service.

Since an employee has an industrial injury, based on the data in the table, 100% is calculated, regardless of length of service.

- We calculate the benefit.

1707,53*30*100% = 51.225

- We deduct the tax.

Tax amount: 51.225*13% = 6.659 rubles

Sick leave amount, excluding tax: 44,566

Example No. 3

The general manager Alekseeva E.A. Grandmother became seriously ill. During treatment after surgery, she requires constant care. You must take sick leave for 10 days. Her experience is 4.5 years, and her total income (for 2021 and 2017) is 1,420,000 rubles.

- Calculation period.

2016-17, 10 days of incapacity for work.

- We receive daily earnings.

1,420,000/730 = 1,945 rubles.

- We determine the percentage based on length of service.

According to the data from the table, the percentage based on experience will be 60%.

- We calculate the benefit.

1.945*10*60% = 11.670 rubles

- We deduct the tax.

Tax amount: 11.670*13% = 1.517 rubles

Total benefit amount excluding tax: 11.670 – 1.517 = 10.153

Sample of filling out the form.

back to menu ↑

Everything is very difficult! Can I have an example of the calculation?

Let's say you caught a cold and were sick for 12 days. You have 10 years of insurance experience, income for 2021 amounted to 854,000 rubles, for 2019 - 739,000 rubles.

For 2021, only 815,000 of your earnings will be taken into account: the rest exceeds the contribution limit to the Social Insurance Fund. For 2021 - the entire amount, because the limit here is greater than your actual income.

Your accounted profit is higher than the minimum wage, which means we don’t take it into account. More than 8 years of insurance experience means 100% of the average daily earnings are paid.

According to the formula, you are supposed to:

(815,000 rubles + 739,000 rubles) ∶ 730 days × 100% = 2,128.77 rubles per day

Total sick leave will be:

2,128.77 rubles per day × 12 days = 26,193.24 rubles

Another option: you were sick for 8 days. You have 3 years of insurance experience, in 2018 you received 120,000 rubles, in 2019 - 124,000 rubles.

(120,000 rubles + 124,000 rubles) ∶ 730 days × 60% = 200.55 rubles per day

But this is less than the minimum wage calculation. This means that you will be paid at a rate of 398.79 rubles per day and the total will be 3,190.32 rubles.

Note that some regions have their own coefficients for the minimum wage. And if, for example, the minimum wage applies to a coefficient of 50%, then they will pay one and a half times more (100% of the minimum wage, like everyone else, and another 50% on top).

How is sick leave paid?

There are only 2 dates when employees are credited with money - advance and salary.

According to the payment rules, sick leave benefits are accrued on the earliest date.

If your employer violated payment deadlines or you were not paid for sick leave, you can go to court by presenting the following evidence:

- A copy of the sick leave certificate.

- A copy of the employment contract.

- An extract from the bank card account where funds for wages are received.

- A payslip with the accrued amount.

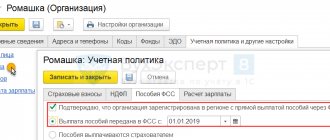

Payment for electronic sick leave depends on the region of residence and can be paid directly by the Social Insurance Fund or the employer.

back to menu ↑

From 2022, sick leave benefits will be transferred to direct payments from the Social Insurance Fund

The government will change the procedure for paying benefits for temporary disability and pregnancy and childbirth from 2022.

All sick leave payments will be made by the Federal Social Insurance Fund of Russia, and not by employers. Prime Minister Mikhail Mishustin announced this at a government meeting. Now the Social Insurance Fund is already paying sick leave benefits directly as part of a pilot project in 77 constituent entities of the Russian Federation (as of November 2020). Without the participation of employers they pay:

- temporary disability benefits;

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- temporary disability benefits due to an accident at work or an occupational disease;

- compensation for sanatorium treatment in addition to annual paid leave and travel to the place of treatment for those injured at work.

As Mikhail Mishustin explained:

From 2022, we will extend this practice throughout the country. Moreover, we will switch to a proactive format of work: benefits for temporary disability, pregnancy and childbirth will be issued automatically on the basis of an electronic certificate of incapacity for work, there will be no need to write any applications.

Data on sick leave will be sent to the Social Insurance Fund automatically. Employers and employees will not have to take any additional actions. According to the Prime Minister:

This procedure for assigning payments will reduce the amount of paperwork for employers and speed up the transfer of funds. There will simply be no need to write any statements. And in general, obtaining information for the appointment of such benefits will take place electronically. This will help save a person time, energy, and - as often happened when preparing documents - nerves.

Organizations will no longer withdraw funds from circulation to pay for sick leave and then expect reimbursement from the Social Insurance Fund.

Maternity leave: features of payments and calculation of sick leave

In the Russian Federation, pregnant women are given leave, which is equal to 140 days.

To determine when it is necessary to go on maternity leave, you need to contact the antenatal clinic, where they will indicate the expected date of birth.

The leave begins 70 days before the expected birth and ends the same number of days after.

If a pregnant woman is planning to give birth to 2 or more children, then the vacation begins 84 days before the birth and then 110 days of rest. The total is 194 days.

Childbirth with complications or caesarean section will give an additional 84 days of leave, instead of 70.

back to menu ↑

How to obtain a certificate of incapacity for work and apply for sick leave?

After the doctor determines the approximate time frame, he needs several days to draw up a work ability sheet (it may be ready in 2 days, in private clinics it may be earlier).

When a woman comes to receive a certificate of incapacity for work, she must have her passport and SNILS with her.

Next, the doctor writes out a sick leave certificate and sends it to the employer.

The woman writes an application to the employer for leave, to which she attaches the received document.

Example.

The approximate due date is November 7. Subtracting 70 days, it turns out that on August 30, Thursday, the woman begins her vacation. Let's assume that the birth occurred exactly on time and without complications. We add another 70 days to the 7th day and we get that on January 16, Wednesday, the woman must go to work.

back to menu ↑

Vacation benefits.

- For early production – 613 rubles.

- After birth – 16,350 rubles.

back to menu ↑

Birth benefits: documents

To apply for benefits, you must bring the following documents to the employer:

- Divorce certificate if the marriage was dissolved.

- A certificate from the husband’s place of work, which will confirm that he did not receive benefits.

- Child's birth certificate. If there are several children, the benefit is given to each one.

- Application for granting benefits.

back to menu ↑

What determines the increased benefit amount?

- Job. If a pregnant woman has worked for 6 months or more, then the benefit amount is 100% of average earnings.

- There is insurance experience. If you have insurance coverage from previous places of work, the amount of payments will be at least 34 thousand rubles.

- Student. If the expectant mother is a full-time student, the benefit will be equal to a scholarship.

back to menu ↑

Which mothers receive benefits?

- University students.

- Officially employed.

- Unemployed due to the liquidation of the company over the past year.

back to menu ↑

Calculation example.

Katya earned 980,000 rubles in 2016-17.

- We get the average daily earnings.

Divide 980,000 by 730 days = 1342 rubles.

- We calculate the benefit.

We multiply 1342 rubles by 140 days = 190.630 rubles.

back to menu ↑

Sick leave for child care

According to the law of the Russian Federation, any citizen can take sick leave if he takes care of a sick child. However, it is not necessary to be a legal parent in order to issue a certificate of incapacity for work. It is enough to be a close relative.

Sick leave, which is issued due to child care, has its own limitations on payment and the duration of its validity. This is an official document that is issued to an official with the condition that he must either work or be registered with the Federal Social Insurance Fund of the Russian Federation.

However, there is an exception: such a document can be issued by the mother of a child who is on maternity leave or has a sick child under 3 years old. But since 2014, this mother must work at least part-time or be engaged in light labor.

A sick leave certificate is not issued for chronic diseases, only for acute illness in a child or for treatment that requires the intervention of the treating staff. If there are more than two children who require immediate care from a parent or loved one, then two sick leave certificates are issued. If one of the children has recovered, the document is extended until the other children have fully recovered.

The benefit amount is paid based on a correctly completed sick leave certificate within 10 days. The principle of paying for the first 3 days by the employer does not work. The entire amount is deposited into the Social Insurance Fund of the Russian Federation. Also, the payment and duration depend on the age of the sick child. Children under 7 years of age allow their parent to remain on sick leave for the entire duration of treatment – that’s 60 calendar days. Children from 7 to 15 years old require attention 45 calendar days a year. Children over 15 years old – only 30 calendar days.

Also, sick leave in case of illness of a child depends on the employee’s length of service. If the child was treated in a hospital, then the entire amount of payments must be calculated relative to the length of the experience. When treating at home based on length of service, the first 10 days of sick leave are paid, then 50% of the average wage is taken into account. Experience up to six months (6 months) is paid per month at least 370.8 rubles. in a day. With an experience of at least six months (more than 6 months), 60% of the employee’s average earnings are taken into account. Experience from 5 to 8 years – only 80% of earnings are taken into account. From 8 years, the entire amount (100%) of the average salary of a working employee is paid.

The above percentages of payment for sick leave have been established by federal law of the Russian Federation since the beginning of 2019.

Example of sick leave payment for child care

An employee of Iskra LLC N.V. Ivanova’s 8-year-old son fell ill. The child’s treatment took place at home, and it lasted only 10 days - from March 15, 2019 to March 26, 2019. Earlier, in January 2019, the child was already sick, and N.V. Ivanova issued a certificate of incapacity for work for 10 days. N.V. Ivanova’s work experience is 14 full calendar years. In 2017 she earned 780,000 rubles, in 2018 - 797,000 rubles. Earnings exceed the established limit for calculating sick leave, therefore, to calculate benefits, the SDZ limit for 2019 is used - 2150 rubles. 68 kopecks Since N.V. Ivanova’s child is over 7 years old, she has access to only 45 days of sick leave per year to care for her child. The calculation looks like this:

2150.68 * 100% * 10 = 21,506 rubles. 80 kop.

There are exceptions of this kind: if a child is seriously ill, then the duration of sick leave is extended for the period that is necessary.

Electronic certificate of incapacity for work: filling out procedure

For accountants, electronic documents are the easiest to use because they cannot be lost.

Filling procedure:

- Organization and position. It is necessary to enter the above data in the cells.

- Form of organization. You must check the box next to the type of work - part-time or permanent.

- Registration number and organization code.

- An identification number. If you take sick leave due to pregnancy or you do not have a tax identification number. In other cases, we skip the point.

- SNILS number.

- Periods of insurance and its absence. It is necessary to enter data on the period of contributions to the Social Insurance Fund.

- Average earnings.

- Benefit amount.

- The amount given by the employer in person.

- Accrual conditions.

Sick leave payment terms

After the employee provides documentation of disability, the employer has 10 days to calculate benefits.

The benefit is issued on the nearest date of payment of salary or advance payment.

If a pilot project is launched in the region, the number of days increases. The minimum waiting period is 15 days.

back to menu ↑

Employer's obligation to pay

Every employer is responsible to employees for sick leave payments. When calculating the amount of temporary disability benefits, accounting must be guided by the norms that were adopted in the previous reporting period - this is 255-FZ; sick leave is calculated and paid strictly according to the rules of this law. Apply the provisions of Government Decree No. 375 of June 15, 2007 and Order of the Ministry of Social Development No. 624n of June 29, 2011, which determines the procedure for making such payments. Order No. 624n establishes a strict reporting form for a temporary disability sheet.

According to Part 1 of Art. 13 255-FZ the employer calculates and assigns temporary disability benefits. Then the territorial Social Insurance Fund reimburses the organization for the payment made, subtracting the first three days of the employee’s illness from the benefit amount. The procedure itself is as follows: upon completion of treatment, an employee who was absent from work due to illness is issued a certificate of temporary incapacity for work of the established form. Before starting work, the employee submits sick leave to the accounting department, and then the accountant checks that the form is filled out correctly.

The employer counts the amount of money, draws up and pays sick leave benefits. After the employee receives the funds, the accountant sends an application to the Social Insurance Fund to receive compensation for the benefits paid. Organizations must reimburse the transferred funds not in full, but with the exception of the first three days of illness, which, according to the rules, are paid at the expense of the employer.

IMPORTANT!

In many regions of the Russian Federation, there is a pilot project under which the Social Insurance Fund makes payments from the fourth to the last day of treatment. In 2021, more and more regions joined the pilot project. Starting from 2021, the Ministry of Labor will oblige all constituent entities of the Russian Federation to work on a pilot project.

The territorial body of the Social Insurance Fund pays full benefits for pregnancy and childbirth and for caring for a disabled family member (Order of the Ministry of Health and Social Development No. 1021n). The basis for such payments is a correctly completed sick leave certificate.

Fake sick leave: consequences

No matter how serious the condition, it is better to call a doctor or visit a clinic.

If your documents start being checked, which is quite natural, then you may have serious problems.

The following situations often occur: accountants notice inaccuracies in a document, and in order to correct them, they contact the clinic where the document was issued.

If the document is official, the problem is resolved; otherwise, it is sent to the FSS, then to the prosecutor’s office, where a criminal case is initiated.

Part 3 of Article 327 of the Criminal Code of the Russian Federation states that the use of false documents is punishable by criminal liability.

If there are circumstances mitigating the sentence, you can get off with a fine. An employer has every right to fire someone for absenteeism.

In some cases, it is possible to reach an agreement and an administrative leave is issued.

In cases where it is problematic to get sick leave, try to talk openly with the employer and solve the problem without buying fake documents.

back to menu ↑

What if I’m not sick, but just sitting in quarantine?

Illustration: Olga Selepina / Lifehacker

In this case, sick leave is opened to representatives of the following categories:

- People who came to Russia from countries where cases of the new coronavirus infection have been registered.

- FSS insured who live with people from point 1.

The benefit is calculated according to general rules. For persons from the first category, an application and photos of documents confirming a trip abroad are required. You can apply for sick leave online on the FSS website. Muscovites can also do this on Mos.ru.

Sick leave is also issued over the phone. You need to call the clinic you are assigned to or the hotline in your region. If you test positive for COVID‑19, you will automatically be given sick leave for 14 days - even if you feel excellent.

In addition, if your child attended a kindergarten that was closed for quarantine, you can apply for sick leave to care for your baby while he is at home. The calculation of the amount here is the same as for caring for sick children. But the quarantine period is not included in those 60 days, beyond which benefits are no longer paid.

FAQ

- If I did not enter into an employment contract, but worked for several years, can this time be included in my work experience?

Any employment must be formalized. In this case, you worked illegally - you received income, but did not pay taxes.

You will not be able to prove your length of service at a particular place of work if you were not officially registered there.

- If my experience is 3.4 years, then how long did I work - 3 or 4 years? How to calculate the length of service in this case?

When calculating length of service, no one rounds your length of service up or down - months and years are calculated, as a result of which interest is calculated.

If you worked for 3 years and 4 months, then your experience will be >5 years => you will be credited with 60%

- What services can I use to calculate sick leave?

There are several calculators, here is one of them. You can also do the calculations yourself using the following formulas:

(income for 2021 + income for 2017) / 730 days = average daily earnings.

Average daily earnings * number of days of incapacity * percentage of length of service = sick leave benefits

Sickness benefit * 13% personal income tax = tax amount.

Sick pay – tax = amount the employee receives.

- Does an employer have the right to refuse sick leave to an employee?

When working under a contract, you must be provided with a benefits package, which includes sick leave. In case of violation, you have every right to go to court.

- In what cases can I be fired while on sick leave?

If an employee’s sick leave lasts more than 4 months, then the employer has the right to ask him to write a statement of his own free will, or to fire him, citing the requirements of the work contract.

- The employer refuses to acknowledge the accident at work, what to do?

If you receive an injury, which also includes sprains and fractures, you must immediately record them at the emergency room, that is, obtain a special document. If the employer refuses to give sick leave or admit guilt, you have the right to sue him.

- The employer thinks I can work, what should I do?

Many employers believe that if a person does not faint, then he is very efficient. To prove otherwise, you need to visit a doctor who will make a diagnosis and provide a document about it.

- How to extend sick leave?

If you need more time to recover, then you also go to the doctor and get his opinion. It is important to document all facts so as not to get absenteeism.

- I'm pregnant, when can I go on maternity leave, according to the law?

At the antenatal clinic, the doctor will calculate in more detail the expected date of birth and vacation. In most cases, it turns out to be 140 days, 70 before birth and the same amount after.

- I work without an officially concluded contract. Am I entitled to receive maternity benefits? I have never worked anywhere before. Maybe there is an opportunity to prove that I worked for a specific employer?

It's not a matter of proof, but of the legality of actions. The employer is obliged to pay taxes and provide a full package of services. By hiring, but not drawing up a contract, the employer and employee are breaking the law. No benefits will be paid.

- If I worked until 2015, then took a break and went to work in 2021 with the same employer. When calculating sick leave, will they be able to calculate my length of service for 2015 and earlier?

If at this moment the employment was official and the employer paid contributions, then the length of service will be taken into account.

- I have a slight fever, is it worth taking sick leave?

Many workers, faced with a slight illness, cannot decide whether to go on sick leave or treat themselves. It all depends on your intuition and immunity - someone can lower their temperature in a day or two, while others sit on antibiotics for a week. If you have already had situations where a slight ailment developed into a serious illness, then you should take a sick leave for a few days and recover.

- Can an employer force you to take sick leave?

The employer can give advice or try to negotiate. If you are sick and your boss sees that it’s hard, then you should take sick leave. Remember that you work in a team and it is easy to infect others. However, no employer has the right to send you on sick leave under an order.

- Is it possible to take work home instead of taking sick leave?

In some situations, when it is unprofitable on both sides to take sick leave, the employer, if possible, agrees on temporary work from home - all reports are sent by email.

back to menu ↑

Registration of a hospital document

A sick leave certificate is an official document indicating a valid reason for absence from work. The document is drawn up on a special form that has certain degrees of protection.

According to Order No. 347n dated April 26, 2011, a certificate of incapacity for work is issued to a sick citizen at the medical institution where he applied for help. Registration takes place on the basis of a compulsory medical insurance policy and a passport. A temporary disability certificate can be issued at the onset of the disease or after recovery (at discharge). The rules for filling out the document are described in detail in the Order of the Ministry of Health of the Russian Federation:

- Information is entered by the health worker into specially designated cells in legible handwriting and only with a pen, preferably black.

- A medical institution issues a duplicate of a sick leave certificate if errors or blots are detected in the document, which, due to corrections, loses its legal force.

- Diseases must be filled in in the form of special codes.

- All remaining blank fields in the “Exemption from work” column must be crossed out with a horizontal line.

Important! If an employee is registered in several organizations, then a document on temporary disability is issued for each of them. A mark is placed on it: this is the main place of work or part-time.

From July 1, 2021, with the written consent of the patient, a certificate of incapacity for work can be generated in the form of an electronic document

How to apply for sick leave

The form of the certificate of incapacity for work was approved by Order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n. The sick leave confirms that the employee was absent from work for a valid reason (paragraph 2, paragraph 17 of the letter of the Federal Social Insurance Fund of the Russian Federation dated October 28, 2011 No. 14-03-18/15-12956). On its basis, the employee is paid benefits for temporary disability and pregnancy and childbirth (Articles 183, 255 of the Labor Code of the Russian Federation, Part 5, Article 13 of Federal Law No. 255-FZ of December 29, 2006 (hereinafter referred to as Law No. 255-FZ) ).

Please note: not all medical organizations can issue sick leave. The medical organization must have a license for medical activities, including the performance of work (services) for the examination of temporary disability (clause 2 of the Procedure for issuing certificates of incapacity for work, clause 3 of the Regulations approved by Decree of the Government of the Russian Federation of April 16, 2012 No. 291).

This is also important to know:

Gray salary: judicial practice, is there any point in suing, employer’s responsibility

Cases in which a sick leave certificate is issued:

- illness (injury) of a citizen;

- further treatment of an employee in a sanatorium-resort institution;

- prosthetics in a hospital;

- illness of a family member who needs care;

- pregnancy and upcoming birth;

- quarantine.

Filling out a sick leave certificate

Let us note several important points that should be taken into account when filling out a sick leave certificate:

- The doctor fills out certain sections, they are indicated in clauses 56 - 63 of the Issuance Procedure and certifies with the seal of the medical institution;

- The doctor has the right not to fill out the line “place of work - name of organization” (especially if the patient cannot correctly name the name of the organization). The employer can enter the name of the organization himself using a black gel, capillary or fountain pen and block letters. You cannot fill out the certificate of incapacity for work with a ballpoint pen or use ink of a different color.

- If the doctor makes a mistake when filling out the form, he must issue a duplicate certificate of incapacity for work (paragraph 5, clause 56 of the Issuance Procedure);

- There are no requirements for the form of seal of a medical organization. The imprint of the seals of medical organizations may contain the text “for sick leave certificates”, “for sick leave certificates” (paragraph 2 of clause 2 of the letter of the Federal Social Insurance Fund of the Russian Federation dated October 28, 2011 No. 14-03-18/15-12956).

- For its part, the employer should pay attention to whether the doctor of the medical organization filled out the form correctly. This is important, since the Federal Social Insurance Fund of the Russian Federation will not reimburse expenses if the employer accepts a certificate of incapacity for work filled out in violation of the Issuance Procedure;

- The employer must fill out the sections specified in clauses 64 - 66 of the Issuance Procedure;

- Please note that the presence of technical deficiencies in filling out the certificate of incapacity for work (for example, stamps on the information field, putting spaces between the doctor’s initials) is not a basis for its re-issuance and refusal to assign and pay benefits, if all entries are read (paragraph 5 clause 17 of the letter of the FSS of the Russian Federation dated October 28, 2011 No. 14-03-18/15-12956).