Hello! My name is Dasha and I have been registering legal entities for several years; at Profdelo I am the registration manager.

I personally handle all client registration matters from accepting orders to handing over completed documents to clients. My main specialization is LLC liquidation.

People often come to us who tried to liquidate themselves, but for some reason did not complete the process, or did not even start, but were refused. I will tell you the 11 most common mistakes that owners make when liquidating companies.

The first and most important mistake is an irresponsible head of the liquidation commission or liquidator

When choosing a person for this position, remember that he must always be in the “access zone” throughout the entire liquidation period. Since it is he who will be the applicant and the responsible person instead of the general director. This choice should be approached with special responsibility. By choosing an unscrupulous head of the liquidation commission (hereinafter referred to as the liquidator), you run a high risk of “freezing the liquidation process”, and you will have to change the liquidator, which means additional money and time delays.

In our practice, there was a company in which an unscrupulous liquidator simply disappeared the word “hedgehog in the fog”, as a result of which we had to look for a new liquidator and re-register the appointment. This entailed a colossal loss of time and, accordingly, additional expenses that cost a pretty penny.

Also, many believe that the person responsible for the liquidation of the company is necessarily the general director or one of the participants of the company. In fact, any other person, even one who has nothing to do with the company, can be appointed as the person responsible for liquidation.

Tax claims not recognized by the liquidator are collected in court

In the Resolution of the Federal Antimonopoly Service No. A23-1737/08A-14-83 dated January 28, 2009, the court indicated that the tax service cannot require the inclusion of its stated requirements if the liquidation commission does not agree with them. In this case, the tax service, along with other creditors, must act in the manner established by clause 4 of Art. 64 Civil Code of the Russian Federation. This rule of law directly provides for a way to protect the interests of a creditor who has been denied satisfaction of his claim (filing a claim in court), as well as a way to satisfy his claims if they are justified (at the expense of the remaining property of the liquidated legal entity).[7]

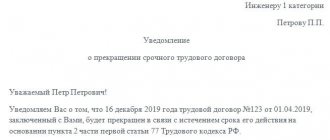

The second and very common is late submission of notification.

At the first stage of liquidation, when the corresponding decision is made, it is important to remember that a notice of liquidation must be submitted to the registration authority within three working days from the date of the decision on liquidation.

If you delay the three-day deadline for submitting a notice of the start of the liquidation procedure, the tax authority will impose a fine of 5,000 rubles. for late submission of notification.

A simple example that will clearly show how easy it is to not have time to submit a notification: the decision to liquidate was made on November 1, 2016, for some reason the notary got to the notary on November 3, 2016, and the notification to the registration authority was submitted on November 5, 2016 although the deadline for submission was November 4, 2016.

Liquidation of a legal entity: what is important for an accountant to know

18.09.19

The article was published in the newspaper “First Page” No. 8 (113), September 2021.

For an accountant, the liquidation process always raises a number of questions: firstly, it is not something that one has to deal with so often; secondly, many accounting procedures are not sufficiently regulated from a regulatory point of view.

In this article, we will consider the main issues of liquidation of commercial organizations (the most common are, of course, LLC and JSC), which are of interest to an accountant: the features of accounting at each stage, the procedure for preparing financial statements, ways to reduce tax risks and the risk of ordering an on-site tax audit.

In accordance with the Civil Code of the Russian Federation (Civil Code of the Russian Federation), legal entities can be liquidated voluntarily and compulsorily (by court decision). Bankruptcy can be distinguished as a separate type of termination of activity, because it differs in many ways from ordinary liquidation procedures and is regulated by Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy).”

What is liquidation from a legal point of view? In accordance with Art. 61 of the Civil Code of the Russian Federation, the liquidation of a legal entity is the termination of its existence with exclusion from the register of legal entities without the transfer of rights and obligations through succession to other organizations.

The reasons for voluntary liquidation are not limited by law and can be very different: contradictions between the founders, achievement of the goals set for the organization, insufficient efficiency of the company.

It's no secret that many companies resort to voluntary liquidation, considering it an effective tool to reduce the risks of an on-site tax audit in the future. After all, passing an on-site audit by the tax inspectorate without additional tax charges under the conditions of modern tax legislation is almost impossible even for the most properly operating company.

The tax authorities, of course, are also aware of this practice, so the voluntary liquidation procedure is under their close attention, which creates additional difficulties for the accountant. In any case, there is no need to justify your decision to liquidate with documents (although in practice the tax authorities ask such questions during the liquidation process).

It is important to note that the law provides for cases when an organization is required to file documents for liquidation.

Based on the provisions of civil law, companies (JSC and LLC) in the event of a critical decrease in net assets must themselves announce their liquidation (clause 4 of Articles 90 and 99 of the Civil Code of the Russian Federation).

In addition, counterparties, shareholders or tax authorities can independently apply to the court with a demand to liquidate the company in such a situation. Some experts consider this norm to be outdated, and judicial practice, which is based on the Resolution of the Constitutional Court of the Russian Federation dated July 18, 2003 No. 14-P, often speaks in favor of organizations that have been able to prove that the organization can operate stably and pay off creditors even with negative net assets for several years.

In any case, accountants can take note that at the end of the year, along with a number of other procedures, it is necessary to calculate the value of the company's net assets and bring this information to management.

In addition to reducing the size of net assets, forced liquidation by a court decision can occur at the initiative of government agencies in cases where violations were identified during the registration of the organization: the organization operates without the permits provided for by law or in violation of the law (in particular, it is not located at its legal address), as well as in a number of other cases (clause 3 of article 61 of the Civil Code of the Russian Federation).

Another separate type of termination of an organization’s activities can be called exclusion from the Unified State Register of Legal Entities at the initiative of the tax authorities. It does not require a court decision.

The tax authority is the only authority (other than the court) that has the power to force the liquidation of companies.

For this purpose, a special procedure is provided for exclusion from the Unified State Register of Legal Entities if there are signs of actual termination of activity.

This is perhaps the rare case when no special actions are required from the accountant.

Let's consider the main stages of liquidation of an organization, knowing which an accountant will be able to plan his work.

Third - incorrect filling out of the application for publication in the "Bulletin"

If you mistakenly indicate the wrong data when filling out an application and send it for verification and further publication, then the message with false information will be invalid. This will lead to the need to fill out the application again, a publication fee and, of course, a loss of time.

After the first stage of liquidation has been successfully completed, it is necessary to submit an application for publication in the journal “Bulletin of State Registration”.

At this stage, you need to pay close attention to filling out the application. To avoid making mistakes, pay attention to the fields you are filling out, for example, pay attention to the “decision made” field - in it you need to indicate verbatim which supreme body made the decision on liquidation, exactly as in your protocol or the decision of the participants.

Main stages of liquidation of an organization

1. Decision on liquidation and notification to the tax authority

Liquidation of an organization begins either with a decision on liquidation at a general meeting of participants, or with a court decision. But after the court’s decision, in any case, a general meeting of participants must be organized, at which a liquidation commission or liquidator (hereinafter referred to as the liquidation commission) is appointed, to whom all the powers of the head of the organization are transferred.

In the future, regardless of the reasons for liquidation, the basic procedures will be the same.

After approval by the liquidation commission, a notice of liquidation of the legal entity is submitted to the registration (tax) authority, accompanied by a decision on liquidation in form No. P15001. Information about the head of the liquidation commission (liquidator) is entered into this form, and on its basis, an entry about the liquidation procedure appears in the Unified State Register of Legal Entities.

2. Publication of information about liquidation in the State Registration Bulletin and notification of creditors

Immediately after filing an application with the tax authority or after some time (the timing is not regulated here), the liquidation commission publishes information about the beginning of the liquidation process in the journal “Bulletin of State Registration” (clause 1 of Article 63 of the Civil Code of the Russian Federation), so that creditors can present their requirements for the organization. It also informs about the procedure and deadline for submitting such demands, which cannot exceed two months from the date of publication.

In addition to the message in the Bulletin, the liquidation commission must personally notify in writing all creditors known to it to whom the organization has a debt (clause 1 of Article 63 of the Civil Code of the Russian Federation).

3. Inventory

During liquidation, an organization must carry out an inventory (Article 11 of Law No. 402-FZ “On Accounting”). Some experts recommend carrying out an inventory before drawing up the liquidation balance sheet, apparently focusing on clause 1.5 of the Methodological Guidelines for Inventorying Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49.

In my opinion, it is more advisable to conduct an inventory at the very beginning of the liquidation procedure in order to provide the liquidation commission with up-to-date information in advance about the composition of the organization’s creditors, whom it must notify, and the composition of the assets that will be needed to satisfy their claims.

During the inventory, I recommend reconciling calculations with the budget in order to identify and return overpayments or pay off debts. The presence of debt in the form of a few kopecks, for example for penalties, may serve as a refusal to make a final decision on liquidation.

4. Dismissal of employees, notification of the employment service

In connection with the liquidation on the basis of clause 1 of Art. 81, art. 178 and 180 of the Labor Code of the Russian Federation, all employees are subject to dismissal. They must be notified of this by signature two months before dismissal, and also send a notice to the employment service. The dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

Since the work of an accountant in a liquidated organization will be required until the organization is excluded from the Unified State Register of Legal Entities, I recommend concluding a civil law agreement with the accountant for the provision of accounting services and, if possible, paying for his services in advance.

5. Accounting, tax accounting and reporting

In paragraph 3 of Art. 6 of Law No. 402FZ states that accounting is maintained continuously until the date of termination of the organization’s activities as a result of liquidation. Also in paragraph 4 of Art. 3 of the Tax Code of the Russian Federation (Tax Code of the Russian Federation) provides that an organization’s obligations to pay taxes terminate in connection with liquidation after all settlements with the budget have been made.

6. On-site tax audit

Most of all, accountants are afraid of the liquidation procedure because after the announcement of the start of liquidation of the organization, the tax authority must decide on an on-site tax audit with all the possible negative consequences arising from it.

An on-site tax audit carried out in connection with the liquidation of a taxpayer’s organization can be carried out regardless of the time and subject of the previous audit. That is, even if you were checked six months ago, in the event of liquidation they may come to you again (Clause 11 of Article 89 of the Tax Code of the Russian Federation).

I would like to note right away that the duty of the tax authority to conduct tax audits during the liquidation of organizations is not established by tax legislation (Resolution of the AS of the Ural District dated July 7, 2015 No. A6043521/2014). That is, this is a right, not an obligation of the tax authority.

In practice, as a rule, liquidated organizations with zero reporting or organizations with insignificant turnover are not of interest to the tax authorities for the purposes of an on-site tax audit. What turnover is considered significant depends on the region of the Russian Federation and the city; there are no clear criteria here. For example, in the Altai Territory, which is one of the “poor” subsidized regions, the “risk zone” includes annual revenue of 50 million rubles for enterprises on the general taxation system.

In accordance with clause 2.1 of the Methodological Instructions approved by Order of the Federal Tax Service of Russia No. SAE-3-09 / [email protected] dated April 25, 2006, the structural unit of the tax authority responsible for registration and accounting of taxpayers, no later than the working day following the day of payment records of liquidation in the Unified State Register of Legal Entities, sends to the relevant departments of this tax authority (department for working with taxpayers, department of desk audits, department of on-site tax audits, etc.) a memo indicating information about the adoption of a decision on liquidation for the implementation of control measures in relation to the liquidated organization in accordance with the procedure established by the internal departmental act.

Thus, several departments of the tax inspectorate, independently of each other, begin an audit in relation to the liquidated organization.

In our work in the city of Barnaul, Altai Territory, at the beginning of the liquidation procedure by the tax authorities in relation to liquidated organizations, we observe the receipt of a variety of informational letters, requests and demands, which ask for:

- explain the reasons for liquidation;

- explain the existence or provide a breakdown of accounts payable (after all, during liquidation in case of non-repayment, it must be recognized as non-operating income);

- provide explanations about the composition or planned sale of inventories and fixed assets (tax authorities must make sure that before the moment of liquidation this property will be sold and all taxes will be paid on this sale);

- provide explanations on foreign exchange transactions if the tax authorities have data on incoming advances or loans in foreign currency (in this case, export contracts are monitored for repayment of debt in foreign currency by foreign buyers).

Most often, these requests come in the form of information letters, rather than demands, to which the taxpayer has the right not to respond. But since we understand that, based on a cumulative analysis of data, various departments of the tax authority will make a decision on an on-site tax audit, we recommend that these letters not be ignored. We recommend that you provide the tax authorities with all the necessary explanations, if necessary, with the attachment of balance sheets and primary documents, as well as formulate written obligations that all accounting and tax reporting will be submitted on time and all necessary tax payments and insurance premiums will be paid.

If the liquidation of an organization is planned in advance, then at the end of the reporting year preceding the liquidation, before drawing up the annual financial statements, it is advisable for the chief accountant to carry out preparatory work, including an analysis of upcoming tax payments related to the possible sale of assets and receivables during the liquidation process; check the presence of amounts of outstanding accounts payable, the presence of large amounts in the accounts and loans issued to the founders. In particular, you can write off the shortage of inventories identified during the inventory, check the timing of the write-off of materials (industrial and household, fuels and lubricants), analyze and, if possible, repay the existing accounts payable as much as possible (in particular, carry out reconciliations with counterparties and arrange offsets of counterclaims). And also pay dividends to the founders and pay off any debts to the budget.

Before the moment of liquidation, it is necessary to inform the management/founders that the transfer to them of assets remaining after settlements with creditors will be subject to VAT for the liquidated organization and personal income tax for the founders in excess of the amounts of their initial contributions to the authorized capital. If property is transferred (real estate, vehicles, remaining materials or goods), then the value of such property for tax purposes will be determined by market value.

If you take care of all these issues in advance and if the liquidated organization was a bona fide taxpayer during the period of its activities, then an on-site tax audit can in many cases be avoided. Sometimes, in order not to schedule an on-site audit, the tax authority sends a request for which it is necessary to provide virtually the entire volume of accounting documentation (including primary documents) for the last two to three years.

This amount of documentation required can be a shock to an accountant. In this case, I recommend that you begin to interact with the inspection inspector and try to agree on the provision of a reasonable amount of documents necessary to exclude an on-site inspection.

In any case, upon receipt of such a request, you can notify the tax authority about the impossibility of providing this volume of documents on time with the obligatory indication of the period by which you are ready to provide these documents.

In general, it can be noted: the larger the company, the higher the risk of an on-site tax audit.

7. Interim liquidation balance sheet

After the expiration of the period allotted for the presentation of claims by creditors, the liquidation commission draws up an interim liquidation balance sheet (Clause 2 of Article 63 of the Civil Code of the Russian Federation). It must contain information about the composition of the property, a list of claims presented by creditors, as well as a list of claims satisfied by a court decision that has entered into legal force (clause 2 of Article 63 of the Civil Code of the Russian Federation). The interim liquidation balance sheet includes only those claims for which there are no disputes between the organization and the creditor regarding the debt. Disputed accounts payable are not included in it (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 8, 2014 No. 18558/13, clause 2.2 of the Letter of the Federal Tax Service of Russia dated March 30, 2017 No. GD-4-14 / [email protected] ).

There is no special form for the liquidation interim balance sheet, so you can use the form of the balance sheet approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, with a special reporting period code - 94. The interim liquidation balance sheet is approved not by the liquidation commission, but by the founders (clause 2 of Art. 63 Civil Code of the Russian Federation).

Some experts believe that during liquidation, changes should be made to the organization's accounting policy, since it is initially formed on the basis of the assumption of continuity of activity and the absence of intentions to liquidate (clause 5 of PBU 1/2008). The procedure for changing accounting policies is not regulated; therefore, in this activity, an accountant can rely only on the current accounting regulations and his professional judgment.

The main point is the reclassification of long-term assets and liabilities into short-term ones (after all, the organization will most likely cease to exist before the expiration of 12 months), while the accountant can open new synthetic accounts, for example, to account for assets subject to sale during liquidation, and (or ) to account for assets to be distributed among the founders. This “amateur activity” will ultimately make it possible to create an interim balance sheet that provides users with complete and reliable information about the financial position of the organization and the ability to satisfy the claims of creditors.

If the property turns out to be insufficient, the organization will be obliged to apply to the arbitration court for bankruptcy (Clause 4 of Article 63 of the Civil Code of the Russian Federation). If there is enough property, then a notification in form No. P15001 is submitted to the tax authority, but the balance itself is not provided to the tax authority.

Notification of interim balance cannot be submitted earlier:

- the period established for the submission of claims by creditors;

- the entry into force of a court decision on claims containing claims against the liquidated company;

- completion of the on-site tax audit and registration of its results (clause 4 of Article 20 of Law No. 129-FZ).

8. Payments to creditors

Payment of sums of money to creditors of a liquidated legal entity is made in the order of priority established by Art. 64 of the Civil Code of the Russian Federation, in accordance with the interim liquidation balance sheet starting from the date of its approval (clause 5 of Article 63 of the Civil Code of the Russian Federation). The claims of creditors of each priority are satisfied after full satisfaction of the claims of the creditors of the previous priority, with the exception of claims for obligations secured by a pledge of the property of the liquidated company (Clause 2 of Article 64 of the Civil Code of the Russian Federation).

9. Reporting to funds

In accordance with paragraph 1 of Art. 9 and paragraph 3 of Art. 11 of the Law “On individual (personalized) accounting in the compulsory pension insurance system” dated April 1, 1996 No. 27-FZ, within one month from the date of approval of the interim liquidation balance sheet, but no later than the day the liquidation balance sheet is submitted, the following must be submitted to the Pension Fund of the Russian Federation:

- information about employees in form ADV-1 “Questionnaire of the insured person” together with a list of documents in form ADV-6-1;

- information about the insurance experience of the insured persons in the form SZV-STAZH together with information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records in the form EDV-1;

- information about insured persons in the SZV-M form.

Within the same period, you must submit to the territorial body of the Social Insurance Fund a calculation of accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as expenses for the payment of insurance coverage in Form 4-FSS.

10. Tax reporting

Within one month from the date of approval of the interim liquidation balance sheet, but no later than the day the liquidation balance sheet is submitted to the tax office, you must submit a calculation of insurance premiums.

The Tax Code of the Russian Federation states that if an organization was liquidated before the end of the calendar year, the last tax period for it is the period from the beginning of this year until the day the liquidation was completed (clause 3 of Article 55 of the Tax Code of the Russian Federation). However, this rule does not apply to those taxes for which the tax period is established as a calendar month or quarter.

In this case, upon liquidation of an organization, changes in individual tax periods are made in agreement with the tax authority at the place of registration of the taxpayer (clause 4 of Article 55 of the Tax Code of the Russian Federation). There are no other special tax reporting requirements.

Thus, tax returns with an annual tax period (for taxes on profits and property of organizations, transport and land taxes, unified agricultural tax, simplified tax system) must be submitted for the period from the beginning of the year until the day of liquidation. For the same period, calculations are submitted in form 6-NDFL and certificates of income of individuals in form 2-NDFL.

And the period for which you need to submit declarations with a monthly and quarterly tax period (VAT, excise taxes, water tax, mineral extraction tax, UTII) must be agreed with the tax office. Since the declarations are submitted by the taxpayer (clause 1 of Article 80 of the Tax Code of the Russian Federation), and the liquidation of a company entails the termination of its activities without transfer in the order of universal succession of its rights and obligations to other persons (clause 1 of Article 61 of the Civil Code of the Russian Federation), declarations must be submitted before day of liquidation of the company. The Federal Tax Service of Russia confirms this (Letter dated 08/03/2006 No. 026-10/ [email protected] ).

11. Liquidation balance and settlements with founders

Having fully paid off with creditors, the liquidation commission draws up a liquidation balance sheet, which is approved by the founders of the company (Clause 5 of Article 63 of the Civil Code of the Russian Federation). It is drawn up in the same form as the interim liquidation balance sheet. The purpose of the liquidation balance sheet is to reflect the property remaining after satisfying the creditors' claims and subject to transfer to the founders of the company (Clause 8 of Article 63 of the Civil Code of the Russian Federation).

The general procedure for distributing the property of a liquidated company among its participants is defined in paragraph 7 of Art. 63 Civil Code of the Russian Federation, art. 58 of Law No. 14-FZ, Art. 23 of Law No. 208-FZ. It follows from these norms that the property of the liquidated company remaining after the completion of settlements with creditors is distributed by the liquidation commission among the company's participants.

Thus, the decision on the distribution of the property of a liquidated LLC or JSC remaining after completion of settlements with creditors is made by the liquidation commission.

However, the legislation does not specify what document should be used to formalize the corresponding decision on the distribution of the remaining property. Based on established judicial practice, such documents may be:

- act on the distribution of property (for example, the Decision of the Arbitration Court of the Penza Region dated February 28, 2007 in case No. A49-6884/2006181/12);

- decision of the liquidation commission on the distribution of property (Determination of the Supreme Arbitration Court of the Russian Federation dated July 7, 2011 No. VAS8018/11);

- protocol on the distribution of the remaining property between the participants (Appeal ruling of the Supreme Court of the Republic of Tatarstan dated 08/06/2012 in case No. 33-6976).

The transfer of property should be carried out with the execution of a transfer and acceptance certificate, which indicates to whom and what is transferred. It is also recommended to indicate in the act the (market) value of the transferred property agreed upon by the parties to avoid further disputes on taxation issues. The act is signed by all participants of the organization and the liquidation commission. It is necessary to draw up a deed to confirm the fact of transfer of property.

After completing all settlements with creditors and the budget, it is recommended to close bank accounts.

For state registration of liquidation of a company, the tax authority must submit:

- application for state registration in form No. P16001;

- liquidation balance sheet;

- document confirming payment of the state duty (its amount is 800 rubles - subparagraph 3, paragraph 1, article 333.33 of the Tax Code of the Russian Federation).

Within five working days from the date of submission of documents, tax authorities must carry out state registration of the liquidation of the company and make an entry about this in the Unified State Register of Legal Entities (clause 1, article 8, clause 6, article 22 of Law No. 129-FZ). At this point, the liquidation is considered completed, and the company is considered to have ceased to exist (Clause 9, Article 63 of the Civil Code of the Russian Federation).

During the liquidation process, the accountant plays an important role and a lot of work. Some authors even recommend including an accountant on the liquidation committee, which I also consider justified.

In conclusion, I note that personnel documents and other documents whose storage period has not expired must be submitted to the state or municipal archive.

They are transferred to the archive in an orderly state on the basis of an agreement concluded by the liquidation commission with the archive (Clause 10, Article 23 of the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation”, Letter of the Federal Archives of December 11, 2014 No. 2/ 2342-A).

| Sorokina Olga Nikolaevna, Tax optimization expert, director of accounting and legal (Barnaul). |

Back

Forward

Sixth - incorrectly drawn up interim and liquidation balance sheets

If there are discrepancies in the dates or OKPO, OKOPF, OKFS codes in your approved interim liquidation balance sheet (PLB) or final liquidation balance sheet (LF), the tax authority will issue a refusal, in such a situation you will lose time and incur material losses to re-certify the form.

At the stage of filling out the interim liquidation balance sheet, you should pay attention to filling out the PLB form itself. The dates for drawing up the balance sheet must be identical to the date of the decision to approve the interim liquidation balance sheet, and all codes must also match.

A little about the liquidation balance sheet itself. As in the previous stage, it is worth paying attention to the correct registration and compliance with the date setting, as well as the reliability of the entered codes OKPO, OKOPF, OKFS. The most important thing: by this moment, the company’s balance sheet should no longer reflect any assets and liabilities, except for the authorized capital and funds due to be paid by the participant. If other assets or liabilities are reflected in the balance sheet, then such a company will not be liquidated .

Is it possible to indisputably collect mandatory payments from a liquidated organization?

Does the tax authority have the right to collect debts from a liquidated organization indisputably, and if not, then at what point in the liquidation procedure is it deprived of this right?

In the Ruling of the Supreme Arbitration Court of the Russian Federation dated 06/09/2014 No. VAS-6279/14, the court assessed the bank’s actions regarding direct debit of funds as contrary to the provisions of Art. 64 of the Civil Code of the Russian Federation on the procedure and priority for satisfying the claims of creditors of a liquidated legal entity, which entails the nullity of the corresponding transactions. But this is about banks - what about tax authorities? For example, in the FAS VSO Resolution No. A19-1757/2013 of September 26, 2013, the court considered that while the taxpayer is in the process of liquidation, the tax authority does not have the right to forcefully collect taxes, penalties and fines in the manner established by the provisions of Art. 46, 47 Tax Code of the Russian Federation.

The Ministry of Finance has also repeatedly spoken out on this issue. In Letter dated July 29, 2008 No. 03‑02‑07/1-319, the Ministry of Finance notes ,

that from the date of approval of the interim liquidation balance sheet, the tax authority does not have the right to collect taxes, fees, relevant penalties and fines in the manner prescribed by Art. 46 of the Tax Code of the Russian Federation, as evidenced by the practice of arbitration courts (resolutions of the Federal Antimonopoly Service of the North-West District dated November 25, 2004 No. A05-6517/04-13, FAS PO dated February 27, 2007 No. A55-7518/06, dated December 18, 2007 No. A55-6435/ 2007).

At the same time, the Ministry of Finance noted that the Tax Code of the Russian Federation does not provide for the obligation of tax authorities to revoke collection orders and cancel the decision to suspend transactions on the taxpayer’s accounts in the event of a decision to liquidate it.

In a later letter - dated August 24, 2011 No. 03-02-07/1-303 - in response to a request from the bank servicing the liquidated organization, the Ministry of Finance explained that if there are documents on the legal entity’s decision on voluntary liquidation and (or) When the liquidation commission approves the interim liquidation balance sheet, the bank cannot comply with the decisions of the tax authorities on the collection of taxes.

Taking into account the clarified position of the Ministry of Finance, as well as judicial practice, it can be argued that the period is calculated from the moment the decision on liquidation is made, and not from the moment the interim liquidation balance sheet is approved. The aforementioned Resolution of the FAS SZO No. A05-6517/04-13, which, by the way, was referred to by the Ministry of Finance in Letter No. 03‑02‑07/1-319, states directly: the issuance of a contested decision by the Tax Inspectorate on the collection of taxes and penalties from funds institutions in bank accounts and issuing collection orders to the bank on the basis of this decision after the decision to liquidate the institution should be considered unlawful

.

Since liquidation actions are subject to state registration, the period, accordingly, is calculated not from the moment of the action, but from the moment of its registration. This, in particular, is indicated in the Resolution of the Federal Antimonopoly Service of the North-West District dated 01.10.2012 No. A26-11436/2011: during the period the Company is in the stage of liquidation (that is, after making a decision on liquidation and making a corresponding entry in the Unified State Register of Legal Entities), the Inspectorate, by virtue of Art. 49 of the Tax Code of the Russian Federation and 64 of the Civil Code of the Russian Federation there was no right to indisputably collect taxes and penalties, since this would entail a violation of the order and priority of satisfying the claims of other creditors of the taxpayer... the special procedure for fulfilling the obligation to pay taxes and fees (fines, penalties) upon liquidation of an organization does not depend on the date drawing up a liquidation balance sheet. To apply this procedure, as the courts correctly indicated, it is sufficient to have a decision to liquidate the organization and make a corresponding entry in the Unified State Register of Legal Entities

.[8]

These rules also apply to mandatory contributions to social funds. Thus, the FAS Resolution VSO dated August 15, 2013 No. A19-917/2013 states that based on the fact that this issue is not regulated by Law No. 212-FZ [9], the general rules of law contained in the Civil Code of the Russian Federation are subject to application. That is, while the insured organization is in the process of liquidation, the fund does not have the right to carry out actions to indisputably collect insurance premiums, penalties and fines, since such actions entail a violation of the order and priority of satisfying the claims of other creditors of the taxpayer (Resolution of the Federal Antimonopoly Service VSO dated March 14, 2013 No. A19-14698/2012). A similar approach was expressed by the court in the Resolution of the FAS UO dated March 21, 2012 No. A76-12541/2011.

Seventh - non-payment of taxes or failure to submit reports

Failure to comply with the requirements of government bodies to pay taxes, fines, penalties, contributions, or failure to submit reports entails serious consequences. A company with debts is not liquidated until all debts are repaid. If you do not comply with these requirements, then you will not be able to obtain certificates, which are recommended to be attached to the package of documents for the last stage of liquidation - approval of the liquidation balance sheet.

I do not recommend submitting documents to the registration authority without these certificates, in order to avoid refusal by the registration authority. Before submitting documents for the last stage - the liquidation balance sheet - it is important to obtain certificates from the tax authority about the absence of debt, as well as a certificate from the pension fund about the fulfillment of duties for personalized accounting.

To obtain the necessary certificates, you must pay all taxes, penalties, fines, and fees.

Submit all reports requested by government agencies.

The order of repayment of tax and other obligatory payments

In order to establish the procedure for satisfying tax payments during the voluntary liquidation of legal entities, it is necessary to collectively analyze the norms of the Tax Code of the Russian Federation, the Civil Code of the Russian Federation, and the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)” (hereinafter referred to as the Bankruptcy Law) .

In accordance with paragraph 3 of Art. 49 of the Tax Code of the Russian Federation, the order of execution by a liquidated organization of obligations to pay taxes and fees among settlements with other creditors of such an organization is determined by the civil legislation of the Russian Federation, that is, the Tax Code of the Russian Federation refers to Art. 64 Civil Code of the Russian Federation [1].

From the analysis of the norms of Art. 64 of the Civil Code of the Russian Federation it follows that all payments, including mandatory ones, are divided into regular payments and current expenses. The latter refers to the expenses necessary to carry out the liquidation. According to paragraphs 1 and 2 of Art. 5 of the Bankruptcy Law, current payments are considered to be those that arose after the date of acceptance of the application for declaring the debtor bankrupt and are not subject to inclusion in the register of creditors' claims. In relation to voluntary liquidation, current expenses include those that arose after the preparation of the interim liquidation balance sheet and, accordingly, were not included in the interim liquidation balance sheet. Current tax payments may arise, for example, based on the results of an audit, which the tax authorities have the right to order on the basis of clause 11 of Art. 89 of the Tax Code of the Russian Federation, or as a result of the sale of property to pay off obligations to creditors in pursuance of clause 4 of Art. 63 Civil Code of the Russian Federation.

According to paragraph 1 of Art. 64 of the Civil Code of the Russian Federation, current expenses have priority over regular payments. Within current expenses, current tax payments are paid in the order prescribed by the Bankruptcy Law, that is, in the last, fourth place. In this case, since Art. 64 of the Civil Code of the Russian Federation does not establish the order of repayment of current expenses; an analogy of the law is applied (clause 1 of Article 6 of the Civil Code of the Russian Federation) based on the norms of Art. 134 of the Bankruptcy Law. The admissibility of such practice with reference to clauses 24, 25 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 6, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 of 07/01/1996 “On some issues related to the application of part one of the Civil Code of the Russian Federation”, in particular, is indicated in the Resolution of the FAS UO dated September 30, 2010 No. Ф09-7990/10-С4.

Regular payments are the claims of creditors that are included in the interim liquidation balance sheet. Debt on regular obligatory payments to the budget and to extra-budgetary funds by virtue of clause 1 of Art. 64 of the Civil Code of the Russian Federation is repaid in the third place.

So, the next mandatory payments are repaid in third place among the next payments. Current expenses are paid in priority order in relation to all regular payments. Within the group of current expenses, mandatory current payments are repaid in fourth place.

Eighth - fear of on-site tax audit

Many people assume that on-site inspections are assigned to every first company that enters into liquidation proceedings.

My experience shows that this is a wrong assumption. Of course, inspectors order such random checks, but under certain conditions. The most common conditions for its appointment may be:

- The company was active and had high turnover.

- There are arrears in paying taxes, fines, penalties, and reporting.

- The tax returns submitted for the current and previous quarters are radically different (the amount of tax in the last quarter was higher, and in the current quarter it is significantly less).

If you have no problems with running a business, then you will absolutely easily pass the inspection, or it will not be assigned at all.

The procedure for offset and refund of excessively collected taxes, fees, penalties and fines

The regulation of relations in the event of an overpayment of taxes and fees from a liquidated organization is prescribed in paragraph 4 of Article 49, 78-79 of the Tax Code of the Russian Federation. According to its provisions, the overpayment is offset against existing tax obligations, as well as arrears of penalties and fines.

The remaining amount of overpayment after tax offset is returned to the company within one month after submitting the relevant application.

When a tax refund is issued, interest is calculated starting from the day following the day of collection and continues to accrue until the day the settlement is actually made.

Author of the article

Ninth - hope for exclusion from the Unified State Register of Legal Entities by decision of the registration authority

Some entrepreneurs mistakenly believe that if they “abandon” the company, then there is a chance that the registration authority itself will decide to exclude it from the Unified State Register of Legal Entities. Sometimes such a wrong decision leads to a neglected state of the company from which it is then very difficult to “get out”.

There are certain signs according to which reg. the authority may make the following decision:

- there are no movements on the current account or in the cash register for 12 months.

- reports are not submitted to government agencies for 12 months.

If you have had at least one movement on your bank account or submitted at least one declaration, even “zero”, within 12 months, your company is no longer taken into account as inactive.

What is a declaration under the simplified tax system for individual entrepreneurs during liquidation

Submitting a tax return under the simplified tax system when closing an individual entrepreneur is a mandatory step. It is a reporting document on the work of the individual entrepreneur over the last year.

Zero declaration when closing an individual entrepreneur on the simplified tax system

If the individual entrepreneur actually ceased operations before the start of the reporting year, then you will still have to report. In this case, the declaration under the simplified tax system indicates zero indicators in the relevant sections.

At the same time, it is impossible to reduce the calculated tax of 0 rubles on insurance premiums that were paid by the individual entrepreneur for himself.

Tenth - disposal of documents after completion of the liquidation procedure

The final and important mistake that can be made even after the procedure is completed and you can calmly move on without looking back. If any questions arise from government authorities, if you do not have documents, you will find yourself in an unpleasant position. You will have to explain why all the documents were destroyed, and their absence may lead to problems or even fines.

By law, when the official liquidation has ended, you are obliged to transfer all your existing documents (constituent documents, statements) to the archive, where they must be stored for another three full years from the date of making an entry in the Unified State Register of Legal Entities about the termination of the company's activities.

Also, after liquidation, do not forget to draw up an act of destruction of the seal and, accordingly, destroy the seal itself.

What to submit when closing an individual entrepreneur on the simplified tax system

When closing, an individual entrepreneur on the simplified tax system must submit reports for himself and his employees. Let's consider what kind of reports should be prepared.

Even before you submit an application to terminate your business activity, you need to provide the SZV-M and SZV-STAZH reports to the Pension Fund. If you have entered into employment or civil contracts with individuals (except for self-employed and other individual entrepreneurs), then deregistration will be denied without these reports. They will have to be submitted for all periods in which you had hired employees.

Other “salary” reports can be submitted after the closure of the individual entrepreneur. These include forms RSV, 6-NDFL, 2-NDFL and 4-FSS. Individual entrepreneurs on the simplified tax system without employees are not required to submit them.

The declaration according to the simplified tax system is submitted by all individual entrepreneurs. The procedure for filling it out differs between the simplified tax system “Income” and the simplified tax system “income minus expenses”. Below we will analyze these differences.

Eleventh – “no company - no responsibility!”

Most entrepreneurs are inclined to believe that after an entry about the liquidation of the company has been made in the Unified State Register of Legal Entities, responsibility from the participants is automatically removed.

In fact, even after official liquidation, all participants bear subsidiary liability for another three years. This is worth remembering.

When the whole path has been completed, you can calmly begin new achievements and deeds, without thinking about the emergence of problems with the society that was recently liquidated.

When to submit a declaration when closing an individual entrepreneur

After the closure of the individual entrepreneur, reporting under the simplified tax system must be submitted by April 30 of the following year.

There is a common misconception that it is rented out the next month after the individual entrepreneur is deregistered, until the 25th. This rule applies only to cases when an individual entrepreneur submits a notification in Form No. 26.2-8. At the same time, you stop the activity for which you applied the simplified tax system, but continue to receive business income under other tax regimes.

When physical the person is deregistered as an individual entrepreneur, he submits another form, so this period does not apply to him. But it’s better not to delay time - when the individual entrepreneur has already closed, you may forget to make a declaration.

We recommend reading: Transition of an individual entrepreneur from the simplified tax system of 15% to 6% and vice versa: how and when to submit an application.

Sample of filling out a simplified taxation system declaration upon liquidation of an individual entrepreneur

As we have already noted, upon termination of the activities of an individual entrepreneur, a tax return under the simplified tax system is filled out in the usual manner.

If an individual entrepreneur has not been working since the beginning of the year, then he may not fill out information for the first quarter if there was no income in it. But if you submit a report in the middle of the year, you need to provide information for all 4 quarters - only the figures for the last two will be the same.

Sample declaration according to the simplified tax system “Income minus expenses” when submitted in the third quarter: