Free legal consultation by phone:

8

The process of applying for sick leave includes a large number of nuances. When workers return to work after illness, they often receive less than expected on payday. This is due to the insurance period and the principle of its calculation. In Russia, several years ago, new rules began to apply, according to which sick leave is issued. Therefore, HR specialists need to be careful when using articles of the Labor Code of the Russian Federation in order to correctly calculate the benefits due to employees who are leaving after illness.

Recently, payments are made not only by the employer, but also by the Social Insurance Fund. The amount of funds that will be accrued on the day of payment of wages is determined depending on how many days you were temporarily disabled and how long your insurance period is. For example, the employer is responsible for paying for the initial three sick days. It is worth understanding that the calculation takes into account only months of work during official employment. Also important is the fact that funds are repaid for calendar days, and not for working days - that is, for the entire time the employee was sick.

How does compensation for disability benefits depend on length of service?

When paying sick leave, the percentage by which the average earnings used to calculate disability benefits will depend on the length of service. The amount of sickness benefits and the procedure for their calculation are reflected in the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ.

The same regulatory act also describes other cases when a reduction in sickness benefits is applied by adjusting the average wage by a specified percentage. In these cases, the percentage of sick leave will not depend on length of service.

For example, this applies to caring for a sick child. If the child is being treated in a hospital, the general calculation rules apply. But if a child is being treated at home, then according to the general rules, only the first 10 days are paid, after which the percentage of sick pay depending on the length of service is not applied, and payment is made based on 50% of the average wage.

Before you figure out what the sick leave payment will be depending on your length of service, you should understand how to determine the duration of work used for calculation: what periods are included in it and what documents confirm this.

The Ministry of Health and Social Development described in detail the procedure for calculating the length of service for accruing sick leave in Order No. 91 dated 02/06/2007. According to this normative act, the length of service for social insurance purposes includes the following periods:

- activities under an agreement drawn up in accordance with the Labor Code of the Russian Federation;

- civil services;

- other employment, the payment of which was subject to social insurance;

- military service.

Read about the specifics of including military service in the insurance period in the publication “Is military service included in the insurance period (nuances)?” .

General or continuous

Considering the length of service in a certain place or for the entire period of life, a citizen must be guided by several rules:

- 12 months equals 1 year, and 30 days equals 1 calendar month;

- the length of service that will be considered when calculating sick leave payments is indicated in years and months;

- this period of time is calculated in calendar order starting from the very first record;

- the specific date when the sick leave was issued and after which the period of temporary incapacity began is taken into account.

Examples

Not in all cases it is necessary to contact the Pension Fund or other authorities in order to make accurate calculations. If the work book is at hand or you have a copy of it, you can do it yourself; you need to pay attention to each period of work.

Let's give a simple example: if the record contains the following dates: 05/18/2003 - 09/13/2001 (the length of service in this case will be 1 year, 4 months and 6 days) and 04/23/2015–11/1/2008 (6 years, 5 months and 23 days) .

Then these two figures need to be summed up, resulting in a length of service of 12 years, 9 months and 29 days. This indicator must be presented to your employer, who is obliged to make a 100% compensation payment.

When making your own calculations, it is important to note that the length of service includes:

- Military service;

- maternity leave;

- when a person was registered at the employment center;

- when he moved and it was related to the performance of an official assignment;

- when care for a disabled person took place, regardless of his age;

- if a person was in prison, but was later acquitted;

- if he was involved in work that qualifies as a socially useful activity.

Does military service count?

Yes, military service is necessarily taken into account as part of your seniority. It is believed that a person at this time is busy protecting the borders of his country, and this activity is in some cases more important than working in an enterprise of any type.

Calculation of insurance experience and documents confirming it

Sick leave pay is determined depending on the length of service, which is confirmed by a valid work book. If for some reason an individual provides 2 books, then one of them is invalid.

Read more about this in the article “Is it possible to have two work books at the same time?” .

But if for some reason the labor records do not reflect all the activities of an individual, the length of service can be confirmed:

- an employment contract drawn up in accordance with the norms of the Labor Code of the Russian Federation in force at the time of conclusion;

- a certificate from the employer issued by the employer;

- extracts from orders, personal accounts and payroll statements;

- military ID or other documents confirming military service;

- any other document confirming payments for compulsory social insurance from the income of an individual (this can be a certificate from financial authorities, archival institutions, the Social Insurance Fund or other organizations).

IMPORTANT! If the employer did not pay social insurance payments from his employee’s earnings, then he does not have the right to issue a certificate to confirm the insurance record.

All of the above documents must have the number, date, full name of the insured person and all data about his work. In the event of a discrepancy between the full name in the document confirming the length of service for accruing sick leave and the passport, the authenticity of the document is established either by providing evidence of the legality of the change in the last name or first name, or in court.

There are only two basic rules for calculating the insurance period:

- Every 30 days is considered one month, and every 12 months is considered a year;

- if there is no specific month in the supporting document, the start or end date of employment is considered to be July 1, and if there is no specific date in the month, the beginning or end of the period is set to the 15th.

Example

The certificate of military service indicates the period from 2011 to 2012. In this case, only 1 calendar year will be included in the insurance period - from July 1, 2011 to July 1, 2012.

How is work experience calculated?

In order to calculate your work experience, you must first confirm it. The main document is the work book, which contains all the necessary entries, dates of hiring and dismissal at will or for another reason.

If any period is not recorded in this document, it is necessary to obtain archival certificates or an employment contract and, by contacting the competent authorities, make the appropriate entries.

In some cases, doing this after the fact is problematic, therefore, when working in any government or commercial structure, it is necessary to ensure that timely notes are made in the work book. After an employee resigns, he has the right, without leaving the premises, to verify all the data in this document and, if errors are found, to report this to a representative of the HR department.

How is sick leave paid for less than 6 months of service?

Sick leave for less than 6 months of service is calculated based on the minimum wage, taking into account all the coefficients established for individual regions. This procedure is applicable to those employees who had no earnings for the two previous years or had some, but the basis for calculation turned out to be less than the minimum wage increased by 24.

The payment amount will be received as follows:

P = minimum wage × 24 months. / 730 × CD,

Where:

P - disability benefit;

Kd - number of calendar days of sick leave.

In this case, the minimum wage is assumed to be equal to the value that was in effect on the start date of the sick leave.

But there are cases when sick pay for less than 6 months of service will be calculated differently. This applies to situations where an employee in the billing period had an income higher than 24 times the minimum wage (for example, if he got a job in September 2021, and went on sick leave in January 2018. Moreover, his income from September to December was higher Minimum wage × 24). Then, to determine the amount of benefits, average earnings will be used (taking into account the rules for paying sick leave for less than 5 years of experience). But the total amount of benefits for a full calendar month should still not exceed the minimum wage.

For information on how the amount of the maximum minimum payment for sick leave is calculated, read the material “What is the minimum payment for sick leave in 2017-2018?”

Actions to determine length of service

Determining the length of service or insurance coverage is one of the important procedures for an employee. After all, this information will help to obtain a number of compensations, for example, payment of sick leave. The algorithm of actions in this case is as follows:

- Collect a number of documents that were written about in the previous section;

- Determine the period for making contributions;

- Find periods that coincide;

- Select one of the matching periods at the request of the employee himself.

The calculation is made according to the following plan: 30 days of the selected period are converted into 1 month, and 12 months into 1 year. The procedure is regulated by Decree of the Government of the Russian Federation of 2014 No. 1015.

For understanding, you can give a visual calculation.

Let us assume that Ivanov A. made insurance contributions in the following periods:

- March 1, 2015 - March 1, 2021 - that is, 2 years.

- April 7, 2007 - September 9, 2021 - that is, 6 months and 1 day.

Summarizing the insurance experience, it turns out that Ivanov A. worked for 2 years, 6 months and 1 day. Accordingly, the coefficient is equal to 0.6.

Download for viewing and printing:

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

How much will accrual for sick leave be for insurance coverage of up to 3, 4, 5 years?

There are no separate instructions on how much sick leave is paid for 3 or 4 years of experience. If the work experience of the sick individual is less than 5 years, but more than six months, the certificate of incapacity for work is calculated in the amount of 60% of the average wage for the previous 2 years.

The same percentage, regardless of length of service, will be assigned to those who fell ill within a month from the date of dismissal and no later than 6 months after recovery came to their former employer for sick pay. This norm is prescribed in Part 2 of Art. 7 of the law of December 29, 2006 No. 255-FZ.

But if, by a court decision, the dismissal is declared illegal, and the employee is reinstated at his previous place of work, the amount of the benefit will have to be recalculated by applying the required percentage of sick pay depending on the actual length of service of the employee. This position directly follows from the provisions of Art. 394 of the Labor Code of the Russian Federation, as well as from the explanations of the Ministry of Labor in letter dated July 14, 2004 No. 3186-YUL. In this case, the adjustment should be made within 10 calendar days from the date of entry into force of the court decision in order to comply with the deadlines for assigning benefits specified in Part 1 of Art. 15 of Law No. 255-FZ.

Sick leave in 2018

Each of us has at least once encountered, or will still encounter, the need to take sick leave.

According to labor law, sick leave is a certain basis for receiving assistance associated with temporary loss of ability to work due to health problems.

Sick leave in 2018

As you know, in 2021 an electronic sick leave certificate was introduced. That is, the employer fills out a sick leave certificate online, which removes unnecessary paperwork.

In 2021 , sick leave can also be filled out electronically. To fill out sick leave online, you will need to fill out a special electronic form in the system and, of course, have it certified with the electronic signatures of the employer and the person taking the sick leave.

How is compensation paid for sick leave if the insurance period is more than 8 years?

When an individual’s work experience exceeds eight years, the benefit amount is no longer reduced; 100% of the average wage is paid.

IMPORTANT! If at the time a person went on sick leave his length of service was, for example, 7 years and 11 months, and during the period of illness the length of service crossed the eight-year limit, then the benefit will still be 80% of the average wage. Even if an employee brings a continuation of sick leave issued after the date of reaching eight years of service, he cannot count on 100% payment. The length of service used for calculation is the one that was at the time of opening the first sick leave, since the period of incapacity for work certified by sick leave, taking into account all issued continuations, refers to one insured event. This position of social insurance is recorded in letter dated August 18, 2004 No. 02-18/11-5676.

Causes of disability

The sick leave certificate contains codes that describe the exact cause of temporary disability and are needed for doctors, accountants and employers to know the exact reason why a person was absent from work:

| Code | Decoding |

| 01 | Common illness (ARVI, influenza). |

| 02 | The employee was injured while outside the workplace. The injury can vary in severity. |

| 03 | If a person was forcibly isolated from society, including released from performing his work duties. Quarantine comes into force after contact with an infectious patient and can remain in effect throughout the entire incubation period of a particular disease. |

| 04 | An accident occurred at work that resulted in injury to an employee of any severity. People are sent on sick leave if the consequences of an accident result in temporary disability. |

| 05 | Pregnancy, childbirth. |

| 06 | If you need to do prosthetics (teeth or part of the body) with a mandatory stay in the hospital. |

| 07 | A disease associated with the performance of professional duties, as well as the period of its exacerbation. |

| 08 | Assigned if it is necessary to undergo additional treatment in a sanatorium-resort type institution. |

| 09 | Caring for a family member who is unable to care for himself during illness. |

| 10 | A serious condition in which it is impossible to perform one’s official duties, but not directly related to the disease (for example, severe poisoning with accompanying symptoms). |

| 11 | A disease classified as socially significant (hepatitis or tuberculosis). The list of such diseases is indicated in the decree of the Government of the Russian Federation and is included in a separate list. |

| 12 | Assigned if an employee is caring for a child who has not yet turned 7 years old and his illness is included in a separate list approved by the Government of the Russian Federation. |

| 13 | Caring for a minor child of any age with a disability. |

| 14 | Caring for a child of an employee who has complications after vaccination or requires treatment related to malignant tumors. |

| 15 | A code is assigned when care is needed for a child with HIV status. |

Results

Determining what percentage of sick leave is given based on length of service is not always easy. There are nuances that affect both the determination of the length of service and the application of coefficients for calculating benefits depending on its duration.

But if you figure out what percentage of sick leave - it will depend on length of service or on other factors - you need to use, then the algorithm for calculating sickness benefits will become clear.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Special cases

The calculation of interest on sick leave may occur differently, which corresponds to special cases. The following situations can be distinguished in this matter:

- Sick leave for pregnancy and childbirth. Here, payment is made in full, but the validity period of the document issued by the medical institution has been changed. So, if a woman is carrying one child and the pregnancy is not complicated, the period of incapacity for work is 140 days. In case of complications, the days increase to 156, and if the employee is expecting 2 or more children - 194 days. The amount of payments follows the previous example, with the exception of calculating the final benefit - the average daily earnings are multiplied by the number of days presented.

- For child care. Payment is made depending on the age of the child - it affects the number of paid days on sick leave. A parent can leave for a longer period, but a total of 90 days, 45 days and 30 days will be transferred for the year if there are children under 7 years old, under 15 years old and 18 years old, respectively.

- Part time. Benefits are calculated as usual.

Attention! The accountant takes these special cases into account in full - strictly in accordance with the law.

If there is employment at several enterprises, payments are made by both employers or only one. In this case, the fact of registration is taken into account. If an employee worked in two companies for the previous two years, he needs to submit sick leave to both organizations. If before receiving the employee was not registered at these enterprises, the document should be given to only one manager. In this case, the calculation will be carried out taking into account the previous salary.

Rules for providing compensation

Temporary disability benefits are assigned and paid by the employer at the citizen’s place of work.

If the insured person has several jobs, then benefits must be paid at each of them. A form for a certificate of incapacity for work is available.

If the employer’s activities are terminated at the time of application by a person entitled to sick leave benefits, then payments are made through the Social Insurance Fund.

Payment of benefits is made by the employer in the manner established for paying salaries to employees.

The insured person is obliged to provide the employer with an application and a sick leave certificate issued by a medical institution.

If the payment is assigned and paid by the Social Insurance Fund, then additionally data on the citizen’s income for the past 2 full years and documents confirming the employee’s insurance record (work book, contracts) must be provided.

If an employee quits or is fired and falls ill within 30 calendar days after dismissal, this period is also paid according to the general rules.

But the condition must be met that the employee has not yet managed to register with the Employment Center or get a new job.

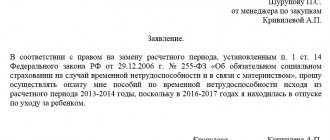

How to fill out an application correctly

The application form for a certificate of incapacity for work from the FSS was officially approved by Order of the FSS of the Russian Federation dated September 17, 2012 No. 335. It can be found and downloaded on the official website of the Social Insurance Fund.

In this case, the benefit amount will be received directly through the Social Insurance Fund without the participation of the employer to the employee’s bank account or through a branch of the Russian Post.

The application for benefits must be completed in block letters, either by hand or on a computer.

Only those sections for which the applicant has data must be completed. The remaining columns do not need to be filled in.

But in most cases, an application written in free form on an A4 sheet is submitted to the employer.

It is written according to the company template and mainly contains the following information. In the upper right corner, the details of the organization, position, surname and initials of the manager are written down.

Next, you must provide information about the applicant - last name, initials, position in the company, registered address. Below in the center of the sheet is written the word “Statement”.

Then, in free form, the employee must write a request for the appointment and payment of compensation for sick leave.

The method of receiving payment is indicated - to a bank account (indicating the necessary details) or in cash through the accounting department of the enterprise.

It is advisable to refer to Law No. 255-FZ, which obliges the employer to pay sick leave. Below is written the word “Attachment” and a list of documents attached to the application is listed. Next, the applicant must put a date and signature.

Is it possible to calculate online

More and more often, accountants use software products or online tools when making calculations.

An online calculator for calculating sick leave for employees is a tool designed to facilitate the calculation procedure.

Photo: sick leave calculation online

In this case, all the necessary data will be taken into account, and the benefit amount will be calculated in a few minutes. To calculate the amount of compensation online, you will need sick leave and the amount of the employee’s salary for the last 2 years preceding the period of illness.

If the employee’s length of service is less than 6 months, then the calculation will be made based on the minimum wage.

Once all the necessary information has been entered into the required fields, the calculator will automatically calculate the benefit amount.

This tool is a good help for the employee himself who wants to independently verify the correctness of the accrual of sick leave benefits.

On some Internet resources, when using a calculator, tips are also displayed with links to regulations that are used in calculations.

When working with a calculator, you should know or have the following information with you:

- The amount of wages for the previous full 2 years.

- In the regional coefficient field, you should indicate the indicator that is valid in the region of the employer’s activities. The default factor is 1.

- Experience should be calculated as the number of full years worked by a citizen.

- If the total insurance period is less than six months, then 0 is entered in the length of service field, and benefits are calculated according to the minimum wage.

- If an employee was on sick leave due to a work-related injury, then the amount of earnings for calculations is not limited.

- The amount of benefits for citizens who live in the regions of the Far North and entered into an agreement with the employer before 01/01/2007 is calculated as 100%, regardless of length of service.

Registration of sick leave in 2018

Sick leave is issued on a special form, which you can see in the photo below.

It’s worth saying right away that not every medical organization has the right to issue sick leave. Only accredited medical institutes have this right. For example, neither emergency doctors, nor medical personnel in blood transfusion centers, nor employees of emergency departments of clinics and hospitals HAVE THE RIGHT TO ISSUE SICK LEAVES.

Example of a sick leave form

What is needed to apply for sick leave?

For registration you only need a passport.

Deadlines for filing sick leave.

The sick leave certificate indicates exactly the date it was filled out, so that, at the request of the patient, this date can correspond to either the date of admission to the hospital or the end date of the sick leave. If you are admitted to the hospital after the end of the working day, be sure to ask your doctor to fill out a sick leave sheet with the date of the next day. Since you will not receive wages for the day you have already worked.

It is important that sick leave CANNOT BE ISSUED FOR PAST PERIODS.

Obtaining sick leave abroad?

If you get sick outside the country, for example, during a business trip, then you must obtain the appropriate supporting documents in the country where you are located. Upon your return, you can simply legalize them and submit them to a medical institution at your place of residence, where a special commission will receive it.

Sick leave during vacation time?

In 2021, everything will remain the same in this matter. That is, if you get sick while on vacation, having received sick leave, you will be able to extend your paid vacation for the entire period of sick leave.

Filling out sick leave 2018

Filling out sick leave by a doctor in 2021

Correctly filling out a sick leave form is very important. First of all, this is important for the doctor who prescribes sick leave and for the accountant of the enterprise where the patient works. But it doesn’t hurt the employees themselves to see a sample of filling out sick leave so that they know what to pay attention to in order to avoid correcting mistakes.

How to fill out sick leave correctly in 2021

Basic rules for filling out sick leave in 2021:

- Filled out in Russian

- Printed capital letters

- Black ink

- Starting from the very first cell in the graph

- You cannot go beyond the boundaries of cells

- The sick leave form can be filled out with a gel pen (BUT NOT a BALLPOINT pen), or printed on a computer.

- Medical corrections when filling out a sick leave certificate are not allowed.

- The diagnosis or reason for sick leave is not indicated. Instead, a special code is entered, where: 01 – illness, 02 – worker injury, 03 – quarantine. This is done to maintain anonymity and inviolability of medical confidentiality.

Our users often write about errors when filling out sick leave sheets, so, the team of the medical portal 47 medportal . ru , strongly advises you to use these rules and check that sick leave is filled out correctly.

Filling out sick leave by an employer in 2021

It is important for any employer to understand that if he accepts sick leave filled out with medical errors, then the Social Insurance Fund has the right to refuse compensation to such an employer.

Here are a few basic rules for filling out sick leave for 2018:

- The name of the institution can be indicated either in full or in abbreviated form. That is, if the name of the institution does not fit into 29 cells, then you simply interrupt the name, but in no case go beyond the cells.

- The employer must fill out the “Start date” column if the employment contract was terminated or cancelled.

- You can find a sick leave calculator on the Social Insurance Fund website at the following link (https://portal.fss.ru/fss/sicklist/guest).

Accrual of sick leave

In this final chapter, we would like to summarize the accrual of sick leave in 2018 . If we draw a line under the entire article, then the bottom line is the following:

- Sick leave accrual will be calculated based on a person’s earnings for 2021 and 2021

- The upper limit of the maximum possible earnings has been increased; in 2021 it is 1,473,000 rubles

- The minimum wage (SMW) has also been increased - from January 1 it is equal to 9,489 rubles, which will also significantly affect the accrual of sick leave

- The number of days by which the total two-year earnings will be divided = 730 days, and for maternity leave = 731 days for 2018.

We would like to thank you for reading our material “Sick leave in 2021”. If you have any questions or want to express your opinion, be sure to do so in the comments to the article. If you found the article interesting, share it on one of the social networks provided. networks.

Benefit calculation procedure

Not only the insurance period affects the amount of temporary disability payments. Let's look at how to correctly calculate sick leave and what rules apply in 2021. To calculate the amount of payment, you will need to determine the values of the following calculation indicators:

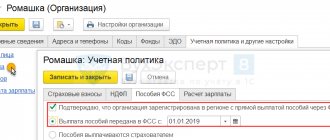

- Billing period. It is equal to two calendar years that precede the year of onset of the disease. For example, if an employee’s illness occurred in 2021, then the years 2021 and 2018 are included in the calculation. But there are exceptions for some employees, such as maternity workers. They are allowed to postpone periods to earlier dates. But provided that the entire billing period fell on maternity leave and parental leave.

- Insurance experience. The procedure for calculating the insurance period was determined earlier. It is necessary to add up all the working periods that are included in the length of service for calculating sick leave benefits. Compare the obtained result with the provided gradation. Let us remind you that if the accountant incorrectly determines the length of service or the percentage of average earnings for calculating benefits, then the excess will have to be paid at the expense of the individual entrepreneur, LLC or institution. The FSS will not reimburse erroneous overpayments.

- Time worked in the pay period. For two calendar years that a person has fully worked, 730 (365 + 365) days are due. But if the calculation period includes a leap year, then the indicator increases by one day - 731 (365 + 366). For example, for a maternity leave, the billing period may include two leap years - 732 days. From the time worked, exclude days of illness, vacations without pay, as well as all periods for which there were no deductions of insurance premiums.

- Earnings for calculating the average salary. Learn all types of remuneration that were accrued to the subordinate for the pay period. Include only those payments and rewards from which the employer paid VNiM insurance premiums. Exclude non-taxable guarantees and compensation from the calculation.

- Current VNIM limits. For each financial year, the Government of the Russian Federation sets the maximum value for the calculation and payment of insurance coverage for VNIM. For example, in 2021 the limit was equal to 755,000 rubles, in 2021 - 815,000 rubles, in 2021 - 865,000 rubles. Apply restrictions when calculating total income for calendar years.

- Minimum and maximum values of average earnings for calculating benefits. For example, the minimum disability payment is equal to the minimum wage, but taking into account the coefficient for the insurance period. The maximum is calculated based on the VNIM limit, time worked and a percentage of average earnings. The indicators are indexed annually. The indexation date for benefits is the first of February.

Having determined the values and indicators, you should follow simple instructions:

- divide the total income, taking into account the limits on VNiM insurance premiums, by the actual time worked;

- compare the result obtained with the minimum and maximum values of average earnings for the corresponding calendar year;

- determine the percentage of average daily earnings for calculating sick leave benefits, taking into account the employee’s insurance record;

- calculate the period of illness, include in the calculation all days without exception, including holidays and non-working days off;

- multiply the average earnings, taking into account the insurance period, by the number of sick days;

- according to the general rules, pay for the first three days at the expense of the employer, and pay for the rest of the illness at the expense of the Social Insurance Fund (but there are exceptions).

Do not forget to include information about sick leave in reporting on insurance premiums - RSV and 4-FSS.