The length of service for sick leave is the duration of the employee’s working activity, which must be taken into account when calculating temporary disability benefits.

What is sick leave

To pay for days missed due to illness, you must issue a sick leave certificate. It is issued to a citizen when seeking medical help if an illness prevents him from performing his work duties. A certificate of incapacity for work is also issued to a relative when caring for a sick family member: a child or an adult.

The procedure for paying for days of incapacity for work is established by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

What types of experience exist?

An ignorant person may think that there is only one type of work experience - general. This is wrong. In fact, experience is divided into several types:

- Actually the total work experience. Here it is necessary to count all periods of a person’s work, including under contract agreements and employment contracts. It is calculated based on the contracts in hand and entries in the work book;

- Special experience. Here we consider work that was carried out in special conditions (for example, in hazardous industries, in the north, etc.);

- Continuous experience. The main distinguishing feature of this type of work experience is the total period of work in one or several organizations without interruption. However, since 2007 it is not taken into account when calculating payments for temporary disability;

- Insurance experience. It is this type of experience that is taken to calculate sick leave. It includes all periods of work with mandatory insurance transfers, as well as civil service and military service.

What is work experience and what does it look like?

Many citizens working officially in any organization have encountered the following concepts:

- seniority;

- insurance experience.

They are often confused with each other, at a time when these concepts have fundamentally different meanings . Further in the table we will look at what their difference is.

These two concepts have significant differences, which you definitely need to know about if you want to understand the topic

Table 1. Difference in the concepts of labor and insurance experience

| Concept | Description |

| Seniority | Work experience is understood as the entire period of a citizen’s working life, during which he worked on the basis of any organization, or, for example, performed work under contractual agreements. In addition, it can also be attributed to pension terminology, since this length of service is also used when calculating the amount of material support for pensioners who began working before 2002, that is, until the next pension reform carried out in our country came into force. country |

| Insurance experience | The insurance period is the period of work of a person during which the employer made insurance contributions for him to the Social Insurance Fund and the Pension Fund. |

However, there are cases in which a citizen does not work, but he is still accrued the insurance period we are interested in. We list them further in the list.

So, this is possible provided that the citizen has become incapacitated for work due to the following circumstances:

- he fell ill or was injured during production , as a result of which he temporarily lost the ability to work;

- a woman became pregnant and retired before giving birth to a baby, with the onset of a certain week of pregnancy (BIR);

- a woman does not go to work due to the fact that she is caring for her newborn offspring (by law she has the right to stay at home until he is one and a half years old);

- the employee is forced to go on temporary leave due to the need to provide all possible assistance to a sick family member , a relative with an officially recognized disability, or an old relative (80 years or older);

- the person is serving in military education due to receiving conscription;

- a person undergoes civil service , and so on.

There are still many situations in which a person does not work, but he continues to accrue seniority

You can learn more about situations in which a person does not work, but continues to accumulate experience, by reading Law No. 4461-I of February 12, 1993 .

All cases indicated above in the list, as well as those that you will read additionally in the mentioned legislative act, belong to the category of non-insurance experience. In other words, during this period of time the employer did not make any additional payments to the Social Insurance Fund and the Pension Fund of the Russian Federation for you.

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army and compulsory military service cannot be excluded.

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example, the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following total: 8 years + 1 year 2 months + 1 month 5 days = 9 years 3 months and 5 days.

There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

Important! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

How is sick leave paid?

To calculate and pay sick leave benefits, we will give a specific example. Let’s say that employee Ivanov fell ill on March 1, 2017 and on the same day went to a medical institution, whose doctors confirmed the illness and opened a sheet for temporary disability. On March 10, 2021, this sheet was closed, that is, Ivanov was ill for ten days. The total amount of insurance premiums for the last 2 years is 200 thousand rubles. Let's divide this amount by 730 and get an average daily income of 274 rubles. It is more than the minimum, and therefore it is taken into account. The employer pays contributions for Ivanov for six years, and therefore the employee will receive compensation of 80% of the average daily earnings: 274 * 80% * 10 days. = 2192 rub.

Amount of payments depending on length of service

By law, the final amount of sick pay directly depends on the employee’s insurance coverage. That is, if:

- If the length of service is less than 5 years, then the employee receives 60% of the income for one working day missed due to illness;

- experience from 5 to 8 years, then the amount already reaches 80%;

- 8 years of experience or more - a person can count on 100% payment.

In situations where the length of service is less than six months, payments come from the state budget. The amount for the certificate of incapacity for work is calculated based on the minimum wage (minimum wage) for one month (according to the calendar).

The average daily minimum wage can be calculated using the following formula:

Minimum wage × 24 months / 730 days

Important! If an illness or injury occurs to an employee at the workplace while he is performing his job duties, then sick leave payments will be made to him in the amount of 100%.

Nuance! When calculating payment for sick leave, do not forget that payment for one month cannot be higher than four monthly insurance payments.

How to determine average daily earnings

Determine the average earnings to pay for disability using the formula:

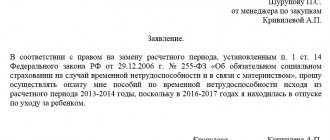

The calculation period for temporary disability benefits is two calendar years preceding the year in which the employee fell ill. That is, if an employee fell ill on January 15, 2019, then earnings received in 2021 and 2021 should be included in the calculation.

The calculation includes all payments to the employee from which insurance premiums for compulsory insurance in case of temporary disability and in connection with maternity were calculated. Payments from the previous place of work are also taken into account if the employee has recently started work. Earnings data is taken into account on the basis of a certificate issued by the previous employer and issued in accordance with Order of the Ministry of Labor No. 182n dated April 30, 2013.

Rules for calculating insurance experience

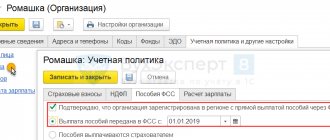

The method for calculating sick leave was introduced by Federal Law No. 255-FZ. Before this law, benefits were calculated based on the total length of service, observing the condition of its continuity. Since 2007, the calculation of this length of service and related issues have been regulated by the Rules approved by the Ministry of Health and Social Development (Order No. 91).

Insurance period is the period of time during which the worker was insured.

And to be insured against accidents, illnesses and other forms of disability means regularly paying contributions to the accounts of the Federal Social Insurance Fund of the Russian Federation.

As a rule, these payments are made not by the employee himself, but by his employer.

The insurance period up to the day of the onset of incapacity is calculated.

With this calculation, the calendar system is taken as the basis: 12 months - a year, 30 days - a month. When counting days, 30 of them are translated as a unit of month, and 12 of months - as a unit of year (Rules, Section III).

As the FSS explains (response dated 10/30/12), such a transfer is provided only for unfinished years or months. In case the employee has worked the calendar time (year, month) in full, then a transfer is not needed.

EXAMPLE: Boborykin V.Z.’s insurance experience is as follows:

- LLC "Raketa" - from 02/11/2003 to 10/26/2006.

- CJSC "Gardener" - from 01/14/2009 to 01/14/2017.

Boborykin V.Z. was given sick leave on November 15, 2016.

Boborykin’s length of service will include 3 years and 8 months of work at Raketa LLC. and 17 days and at ZAO Sadovod, which amounted to exactly 8 years.

All the numbers here - both the number of months and the number of days - are incomplete, so translation is not needed. Consequently, the entire insurance period is 11 years 8 months. and 17 days

Based on Federal Law No. 255-FZ (Article 17), if the calculated insurance period up to 01/01/07 is less than continuous, it is equal to continuous service.

Part-time workers: procedure for paying sick leave

Part-timers are a headache for many accountants. Young specialists in accounting departments do not always know how to pay sick leave for this category of workers. This is not surprising: there are some subtleties here too.

For example, if a person is officially employed at several enterprises at once, when receiving sick leave at the clinic, he should notify the attending physician or registrar about this. In this case, he is entitled to as many sick leaves as the number of companies he works for. However, it is important to make a note about which of their positions is the main one, since this is where he can count on additional material support.

Important! If an employee officially works in different places for more than one year, then each employer is obliged to pay for his sick leave.

How long can sick leave last?

Sometimes extremely unpleasant situations for the employer occur when an employee immediately goes from one sick leave to another. A reasonable question arises: how many people can be on sick leave without violating the Labor Code of the Russian Federation? By law, this period is strictly regulated and is limited to 12 months. However, it should be noted that the attending physician can issue a certificate of incapacity for work only for half a month, a dentist for 10 days, and if the employee is on sick leave for more than 15 days, then its extension is possible only by the decision of a specially convened medical commission.

Important! If an employee’s illness or injury occurs while he is at work and performing work tasks, then the duration of sick leave in this case is not limited by law in any way. Such certificates of incapacity for work are paid 100% by the Social Insurance Fund.

As can be seen from the above information, calculating length of service for paying sick leave has its own nuances. To correctly calculate sick leave, only the employee’s insurance record should be taken into account, since it is he who determines the final amount of payment for temporary disability.

Controversial issues regarding the calculation of length of service

The correctness of determining the percentage of sick leave payment depends on the length of service. To avoid mistakes, check the employee’s work periods. Exclude the following from your experience:

- Leave without pay.

- Downtime due to the fault of the employee.

- Removal from service due to the fault of the employee.

An error in one day’s length of service can cost an organization not only overpayment of benefits, but also a hefty fine from the Social Insurance Fund. If disputes or doubts arise, it is better to work with Social Insurance lawyers. Foundation specialists can advise and answer questions online or by phone.

Documents confirming insurance experience

Only the work book is the basis of all calculations, proof of the reality of working periods. But it may be missing some records, there may be inaccuracies and errors, so for additional confirmation the following must be presented:

- employment contracts (written), drawn up in accordance with the Labor Code, corresponding in time;

- certificates prepared by employers or the necessary government agencies;

- extracts from orders and orders;

- statements and personal accounts related to the employee.

What if the book is not registered for the employee at all? Then the working periods are stated in the employment contract. All this is documented in writing in accordance with the Labor Code and must be timely.

The Rules (section II) provide a list of employee documents. Using them, it is possible to attest to the reliability of experience for different situations.

Example: The head of the company demanded that the new employee bring a certificate and a copy of documents for payment of insurance at the previous place of work. Here the employer’s actions are unlawful: in the Rules (Section II) such documents are not named in the list of documents.

What to do if the dates in the documents are not specifically indicated

The rules dictate:

- if there is no number, then conditionally accept the 15th number;

- if a month is missing, count as July 1.

Periods of insurance coverage for sick leave

Federal Law No. 255-FZ established the following periods for the insurance period:

- all work carried out under an employment contract;

- services in government agencies, municipal institutions;

- other work, if the conditions for paying insurance are met. For example, periods:

- working as an entrepreneur in his own enterprise;

- holding an honorary (but unpaid) position - being a local deputy or priest;

- service in the military and law enforcement agencies;

- when the employee was unemployed and receiving benefits;

- being on maternity leave;

- caring for the elderly and disabled;

- living with a spouse, a contract serviceman, where there was no opportunity to work;

- of a different nature provided for by law.

For the following periods of work, an employee is not entitled to sick leave when he:

- got a job without drawing up an employment contract.

- being an entrepreneur, he evaded enrollment in insurance.

- took a vacation at my own expense.

What periods are considered non-insurance?

As a general rule, sickness benefits are paid for all calendar days (including weekends and non-working holidays) that are indicated on the sick leave. But there may be exceptions.

Thus, an employee of an organization is an insured person, but if he is presented with a certificate of incapacity for work, some periods may not be included in the insurance period.

These are the moments:

- removal from work, for example, in case of evasion

- mandatory medical examination;

- arrest;

- participation in court medical examination;

- just me;

- exemption from work, for example when on leave at your own expense or on study leave.

But you need to keep in mind that in case of illness during annual leave, sick leave is paid.

In addition, sick leave is not paid to persons who intentionally caused harm to their health, as well as in the event of a suicide attempt (intention must be established by the court).

You cannot count on receiving benefits even if the incapacity for work occurred in connection with the commission of an intentional crime by the insured employee.

What documents are needed to confirm your experience?

The main document indicating length of service is the work book. If it is lost or not all data is included in it, confirmation can be an employment contract, extracts from salary documents, copies of orders of the organization or certificates issued by the organization or enterprise where the citizen works.

If you are on maternity leave, supporting documents will be the child’s birth certificate, certificates from the place of work granting such leave to the child and other documentation confirming this fact. If you perform military service, you must provide documents from the place of service.

In addition to the working period during which the contributions were paid, the insurance period for determining the amount of sick leave includes:

- period of pregnancy and childbirth;

- military service;

- socially useful activities;

- caring for a sick relative or disabled person.

How the amount of sick leave depends on length of service in 2021 (table)

Our table provides information on how the amount of benefits depends on length of service. The higher it is, the greater the benefit.

| Cause of disability | Employee length of service | Percentage of sick pay depending on length of service (% 2018) |

| Illness of the employee himself | 8 years or more | 100% |

| from 5 to 8 years | 80% | |

| up to 5 years* | 60% | |

| Occupational disease or accident at work | Any | 100% |

| Care for a sick child (under 15 years of age) on an outpatient basis | 8 years or more | 100% for the first 10 days and 50% for subsequent days of incapacity |

| from 5 to 8 years | 80% for the first 10 days and 50% for subsequent days of incapacity | |

| up to 5 years* | 60% for the first 10 days and 50% for subsequent days of incapacity | |

| Care for a sick child (under 15 years of age) in a hospital and care for an adult family member (including a child over 15 years of age) on an outpatient basis | 8 years or more | 100% |

| from 5 to 8 years | 80% | |

| up to 5 years* | 60% |

* The amount of benefits for employees who have worked for less than 6 months is limited to the minimum wage calculated for a full calendar month (taking into account the regional coefficient, if applicable in a given area). This is stated in paragraph 6 of Article 7 of Law No. 255-FZ.

If an employee takes sick leave within 30 days after dismissal, the employer is also required to pay him benefits.

When calculating, the following main points should be taken into account:

- labor activity was carried out with the payment of insurance;

- length of service is listed by month;

- The average salary is calculated for the previous 2 years.

Example: An employee who has been working in a company since 06/08/2015 fell ill and took sick leave from 04/22/2016. Before that, from 02/01/2010 - 06/04/2014, he worked in another company. There is a record of this in the work book. Calculation: in 2011-2014, in the same place, he worked for 4 years, 4 months. and 4 days

They worked at the new enterprise for 10 months. and 14 days.

Total - 4 years, 14 months. and 18 days. 14 months equals 1 year plus 3 months. After transfer, the insurance period is 4 years, 3 months. and 18 days. An employee has the right to claim a benefit of 60% of the average salary.

Calculation example

To calculate benefits, you need to calculate the insurance period of worker Yuri Panin. The sick leave was discharged on August 10, 2016.

Work book entries:

- from 12/05/2011 to 07/19/2013 Panin worked at Kvant JSC;

- from 07/22/2013 to 08/24/2015 – at Zarya JSC;

- from 08/26/2015 to 08/30/2015 – at JSC Mechta;

- from 08/31/2015 to this day - Vector LLC.

The insurance period must be calculated on the day preceding the day of illness (accident), i.e. August 09:

- from 05.12.2011 to 19.07.2013 – 1 year 7 months. 15 days;

- from 07/22/2013 to 08/24/2015 – 2 years 1 month. 3 days;

- from 08/26/2015 to 08/30/2015 – 0 year 0 month. 5 days;

- from 09/31/2015 to 08/09/2016 – 0 year 11 months. 10 days

We get: 3 years 19 months. 33 days and translate.

In total: 4 years 8 months. 3 days

Yuri Panin's insurance experience is only 4 years and 8 months. 4 days He can count on benefits of 60% of the average salary.

So, the analysis of the question of how to calculate the insurance period for sick leave has been completed.

At first glance, this calculation seems complicated, but in reality there is no difficulty in it. Calculations are much easier and benefits increase if all documents are properly drawn up and submitted on time.

Procedure for calculating temporary disability benefits

To calculate benefits, use the formula:

Payment for the employee's sick leave is made for all days of illness. The maximum duration of the disease is 12 months. Calendar days are paid, including weekends and holidays.

At the same time, how much sick leave is paid for care for a calendar year depends on the patient’s age:

- for an adult or a child over 15 years old - no more than 30 days and no more than 7 days in one case;

- for a child from 7 to 15 - no more than 45 days and no more than 15 days in one case;

- if the child is under 7 years old - no more than 60 days (in exceptional cases - 90);

- for a disabled child - no more than 120 calendar days.

Payment of sick leave in 2021 as a percentage of length of service, taking into account changes

Everyone knows that benefits in case of temporary disability are assigned and paid to employees only on the basis of a sick leave certificate issued by a medical institution. Now sick leave can also be electronic.

You must understand that if a person works under a civil law contract (GPC), then he will not be paid sick leave during this period. A GPC agreement is not an employment contract, and the employee under it is not socially insured.

Payment for not all periods of incapacity depends on the length of insurance coverage. For example, sick leave for pregnancy and childbirth (maternity leave), as well as sick leave due to an accident at work or an occupational disease, is calculated based on 100% of average earnings.

In other situations, the percentage of payment for sick leave depends on the length of insurance coverage and is:

- 60% of average daily earnings with work experience from 6 months to 5 years;

- 80% of average daily earnings with 5 to 8 years of experience;

- 100% of average daily earnings with 8 years of experience or more.

What if the employee has less than six months of insurance coverage? Then, according to the law, the benefit is paid to him in an amount not exceeding the minimum wage for a full calendar month, and in regions and localities in which regional coefficients for wages are applied in accordance with the established procedure, in an amount not exceeding the minimum wage taking into account these coefficients (with On January 1, 2021, the minimum wage in Russia is 9,489 rubles).

A sick leave certificate can also be issued to an employee to care for a sick child or other family member. This procedure is provided for by order of the Ministry of Health and Social Development of the Russian Federation No. 624n dated June 29, 2011. The legislation allows it to be issued not only to the mother, but also to the father, grandmother, grandfather or other family member.

If an employee was on sick leave due to the fact that he was caring for a sick member of his family, then payment for sick leave will depend not only on the length of service, but also on who was cared for (Parts 3, 4, Article 7 of the Law of 29.12 .2006 N 255-FZ).

| Which family member needed care? | What percentage of sick leave accrual depending on length of service is used in calculating benefits? |

| For a child (up to 15 years old) during treatment on an outpatient basis | The first 10 calendar days are paid based on the “percentage” of sick leave, determined by the employee’s length of service (see above). The remaining days are based on 50 percent of average earnings. |

| A child (up to 15 years old) in a hospital or an adult during outpatient treatment | 60, 80 or 100 percent depending on length of service as a general rule. |

Every employee should take their documents seriously, especially the work book and its records. Be demanding in terms of paperwork during employment and dismissal. Don’t be lazy and make copies and extracts in a timely manner. Find out from the accounting department whether his insurance premiums have been paid on time.

Algorithm: how to calculate correctly?

The procedure for calculating the insurance period is described in the Decree of the Government of the Russian Federation dated October 2, 2014; it must be calculated in calendar order.

How to find out and correctly calculate the employee’s insurance length for filling out the BC? To calculate, you must follow the algorithm:

- The work book or other supporting documents are checked for the presence of records of employment and dismissals, and at the same time the correctness of completion is checked.

- The duration in days of each period in which the citizen paid contributions to the insurance fund is calculated: the first day is the date of employment, the last is the date of dismissal (both dates inclusive).

- Next, you need to add up all the periods calculated in days and get the insurance period in days, but for further benefit calculations it is needed in years, so we make the calculation:

Insurance length of service = All periods worked in days / 365 days.

Examples of calculations using a work book

The following is a sample of how to correctly calculate the length of service for a BL.

- The employee worked at the company for 20 years from 03/20/1999 to 02/26/2019, on February 27 he opens sick leave for 10 days. He was insured under the compulsory insurance system on 01/01/2007 - until this date, continuous work experience is calculated: 8 calendar years have passed from 03/20/1999 to 01/01/2007.

12 years, 1 month and 25 days passed from the date of insurance to the end of employment.Insurance experience = 8 years + 12 years, 1 month and 25 days = 20 years, 1 month and 25 days. Over 8 years, sick leave is paid at 100% of the average wage. With an average daily earnings of 1,800 rubles, the payment will be calculated: 1,800 rubles * 10 days = 18,000 rubles.

- The employee has been working at the company since 01/01/2009 and on 05/15/2010 he opens a sick leave for 10 days.

Before the current job, the employee was employed in another organization: from 05/02/2004 to 12/31/2006. Until 2007, continuous experience = 3 years is also considered. In his current job, the employee has earned work experience equal to 1 year, 4 months and 14 days. Insurance experience = 3 years + 1 year 4 months and 14 days = 4 years 4 months and 14 days. Up to 5 years of experience gives 60% of sick pay from average earnings. With an average daily earnings of 1200 rubles, the payment will be calculated: 1200 rubles * 0.6 * 10 days = 7200 rubles payable.

The payment itself is made for the first 3 calendar days from the date of issuance of sick leave from the employer’s funds, and for subsequent periods - from the Social Insurance Fund.