Author: Maria Novikova

Adults have the right to a certificate of incapacity for work

child care.

He is prescribed on the basis of law No. FZ-255

. This act regulates the procedure for payments and accrual of funds for the period during which the employee was absent. The payment rules and procedure for issuing sick leave for caring for a sick child in 2021 have their own specifics. This article will answer all pressing questions.

How is sick leave paid for child care?

Sick leave for a child is paid from the first day at the expense of the Social Insurance Fund.

The number of paid days depends on several factors: the age of the child, the method of treatment - outpatient or inpatient - and the disease. Child under 7 years old, outpatient treatment . The Social Insurance Fund will pay for 60 days during the year. The period increases to 90 days if the child’s illness is listed in the Appendix to the Order of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 No. 84n. Within the framework of one insured event, an unlimited number of days will be paid.

Child under 7 years old, hospital . The state will pay for all days spent by the parent and child in the hospital.

Child 7-15 years old, outpatient treatment . For one insured event, they will pay for a maximum of 15 days, within a year - 45.

Child 7-15 years old, inpatient treatment . For each insured event, the Social Insurance Fund will pay sick leave for a maximum of 15 days.

Child over 15 years old . The rule for calculating sick leave applies here as when caring for a sick family member. For outpatient treatment, no more than 7 days will be paid for each case of illness. Within a year, the limit is 30 days.

Disabled child under 18 years of age . For outpatient treatment, a maximum of 120 days will be paid during the year. Within one case of treatment, outpatient or inpatient, the number of days is not limited.

A disabled child under 18 years of age with HIV or an illness associated with a post-vaccination complication . In such a situation, the FSS does not limit the number of paid days.

Important! The child's age is determined at the date of onset of the disease.

The days for payment are calculated by the employer, as stated in the Letter of the Federal Social Insurance Fund of the Russian Federation dated December 19, 2014 No. 17-03-14/06-18772.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

To whom will it be issued?

Sick leave does not have to be issued by one of the parents or legal guardian.

Any relative is able to care for a minor, even if they do not live together. The answer to the question whether sick leave for child care is paid by the Social Insurance Fund or the employer is this: unlike cases of illness of the employee himself, when the first three days of illness are paid by the employer, money for caring for a sick child comes from the Fund. The doctor will issue a certificate of incapacity for work only to a working family member who makes contributions to the Social Insurance Fund.

During the same period, only one relative has the right to care for the sick person, but if the illness is prolonged, then, if necessary, the forms are given in turn to different family members. For example, a mother goes to work and closes the certificate of incapacity for work, and the grandmother draws up the certificate instead.

According to paragraph 5 of Art. 13 of Federal Law No. 255 of December 29, 2006 (as amended on March 7, 2018), which establishes the procedure for paying benefits, in order to receive payment for the period of care for a sick family member, it is enough to present to the employer a certificate of incapacity for work that is correctly completed and issued at a medical institution. The employee is not required to confirm in any way the degree of his relationship with the child.

How to calculate sick leave

The amount of the benefit depends on the average daily earnings. It is calculated using the following formula:

Average earnings = Sum of payments for the previous 2 years / 730

In 2021, the calculation requires the amounts of payments in 2021 and 2021. The legislator has provided limits for the base for calculating insurance premiums: in 2021, when calculating average earnings, more than 865,000 rubles cannot be included in the calculation, in 2021 - 815,000 rubles. That is, in 2020 the maximum average daily earnings is:

(RUB 815,000 + RUB 865,000) / 730 days = 2,301 rub. 37 kopecks

The minimum benefit amount has also been established. It depends on the minimum wage on the day of onset of the disease:

RUB 12,130 * 24 months / 730 days = 398 rub. 79 kopecks

When determining benefits, remember to compare the employee's benefit to the minimum and maximum amounts.

Next, we calculate the amount of the benefit using the formula:

Benefit amount = Average earnings * % of length of service * Number of sick days

The percentage of experience can range from 60% to 100%. You can get 100% only if you have at least 8 years of work experience. 80% goes to employees with 5 to 8 years of experience. And 60% is the percentage for employees with less than 5 years of experience.

The number of days of illness is indicated on the sick leave certificate. The employer’s task is to control whether the number of child care days that are subject to payment has been exhausted. If the sick leave indicates more days than the employee has left, accrue only the due portion.

The calculation uses the insurance period - the period of work of the employee when insurance premiums were paid for him by all his employers. You can recognize him by looking at his work record.

Important! When caring for a child under 15 years of age for outpatient treatment after 10 days of illness, all subsequent days are paid at a rate of 50% of the average daily earnings.

Benefits are accrued based on a certificate of incapacity for work within 10 calendar days from the date of its transfer to the employer.

If the benefit recipient is employed by several employers

FZ-255 dated 12/29/06

provides three options for paying for children's sick leave if the caregiver works in several places (

clauses 2, 2.1, 2.2 of Article 13

):

- payment from all employers, if the applicant worked for them in the previous 2 years;

- payment from one of the employers of your choice, if the citizen has worked in other places for the previous 2 years;

- choosing one of the above options if the applicant has worked for the same and other employers for the previous 2 years.

When paying for sick leave from one employer, the recipient of the benefit provides information about income

from other employers (on

form 182n

), as well as a certificate that they did not pay benefits. As for the time, how much sick leave is paid for child care, the length of stay on the sick leave does not depend on earnings in previous years for all employers - the terms are determined by other factors.

How to fill out a sick leave certificate

The employer fills out only part of the form. Enter the employee’s data, length of service, average earnings, the period for which the benefit is calculated and its amount. The head and accountant of the company put their signatures.

In the line “Reason of disability”, enter the appropriate code:

- 09 - standard code for child care;

- 12 - caring for a seriously ill child under 7 years of age;

- 13 - caring for a disabled child;

- 14 — caring for a disabled child with a complication after vaccination;

- 15 — caring for a child with HIV.

Sample filling

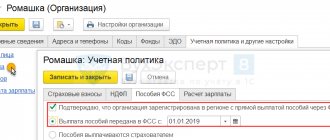

The benefit is accrued on the basis of a certificate of incapacity for work issued to the employee by a doctor, within 10 calendar days from the moment the certificate is presented to the employer. For more information about filling out a sick leave certificate, read the step-by-step guide to filling out a sick leave certificate. The column “Disease code” usually contains the number 09, in some cases - codes 12, 13, 14, 15 (more about this in the table above).

The employer fills out his part of the form, indicating the employee’s data, insurance experience, average earnings and the total amount of accrued benefits, and submits the sheet to the Social Insurance Fund. Benefits are paid on the next payday. The details of the calculation (why such an amount was accrued) are not given in the main form; they are additionally attached in free form when submitting the sheet to the Social Insurance Fund.

Here is a sample of the employer filling out his part of the form.

Sick leave for 2 children

The main difficulty when applying for sick leave for 2 children is controlling the paid limits. It must be maintained for each employee’s child separately. If children are sick at the same time, one sick leave certificate is issued, which serves as the basis for calculating benefits.

Easily read benefits in the Kontur.Accounting web service. The system includes accounting, tax, personnel records, payroll, and reporting. Most operations are automated. The first two weeks of working in the service are free for all newcomers

Design rules

In order for the sick leave to be accepted for execution and payment by the financial departments of the employer of the person who cared for the sick child, it is necessary to comply with the requirements for the preparation of such a leave. These include:

- the ability to issue a sick leave certificate only by a doctor working in a clinic, hospital or similar medical institution;

- sick leave issued by ambulance staff is not legal;

- The first day of the sick leave must indicate the day on which the doctor was contacted regarding the child’s illness (regardless of whether it is a call to the doctor’s home or a visit to a medical institution, including if we are talking about a visit made through the use of emergency medical services);

- the last day of sick leave is the day the child is discharged (if one sick leave is issued for two children, then the day the last child is discharged);

- first working day – the day specified in the column “Start working from...”.

Registration of a sick leave certificate is possible only if documents are provided for the person who will care for the child, as well as for the child himself:

- child's medical insurance;

- his birth certificate or passport (if the child’s age ranges from fourteen to fifteen years, and for a disabled child - up to eighteen years);

- passport or other document proving the identity of the person who will care for the child.

Sample document: blank sick leave form can be viewed at

.

If these requirements are met, the employer is obliged to accept this certificate of incapacity for payment.

Features of payment of compensation

When determining the amount of benefits due, accounting staff take into account the following factors:

- Official insurance experience of parents or close relatives of a sick child.

- The amount of salary received for two reporting years.

- The place of treatment and recovery is at home or in a hospital.

The first ten full days of the official sick leave period are paid based on the earned insurance period. The remaining care time is paid in the amount of no more than 50% of the average salary received. This rule applies to treatment in normal home conditions.

If the therapy was carried out in a hospital setting, the monetary compensation required by law will be paid in full. The basis here is the full insurance experience of the employee in whose name the sick leave is issued.

Reasons for non-payment of sick leave

When studying the issue of correct registration of official sick leave directly related to the medical care of children, it is necessary to familiarize yourself with the restrictions on payment. Parents or close relatives will not receive the required compensation if:

- The child, aged 15 years or older, was sent to a hospital for treatment or surgery.

- The child’s health problem developed during official paid leave.

- Relatives who want to take sick leave are on specialized administrative leave, and children get sick during this period.

- During the development of pathology in a child, the mother who is treating or caring for him is already on maternity leave.

If the parents' annual leave has completely ended and the child has not fully recovered, a certificate of incapacity for work will be issued without any objections.