Why are fee payer rate codes needed?

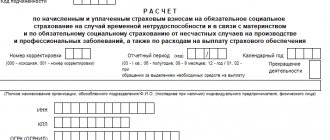

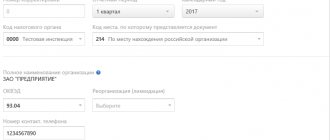

The codes in question are recorded in the employer reporting form on the payment of insurance premiums - KND 1151111, approved by order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11 / [email protected] In it, tariff codes are recorded in Appendices 1 and 2 to Section 1 in the column “Tariff code 001”.

In both cases, the codes are taken from Appendix 5 to the Procedure for filling out the specified form, approved by Order No. ММВ-7-11/551. These codes are used in accordance with paragraphs. 5.4 and 10.1 Procedure for filling out the KND form 1151111.

You can download the KND form 1151111 in this article.

The codes specified in Appendix 5 to the Procedure for using the KND form 1151111 are presented in the table below.

Persons associated with IT (information technology)

The code for all persons who operate in this area is written as follows: ODIT.

The code for those employed in the IT field is ODIT.

Those who belong to this category can also engage in implementation activities, but only in the IT field. In the previous paragraph we were talking about entire societies, but in this case we are talking about specific people. Such persons develop and implement various computer programs, databases, and other special information technologies. In addition, they are also engaged in adaptation and modification of their own or other people’s developments, their installation, testing and further maintenance. Their products can be presented in electronic form or in the form of physical media (if, for example, the program is recorded on a regular CD). In 2021, these persons, as before, will pay contributions to the Pension Fund at a reduced rate, as specified in the same Federal Law No. 212-F3, and specifically in its Article 57. It is also interesting that they have been considered as such since the beginning of 2014 of the year. In 2021, this category of persons will not change, like everyone else.

What insurance premium rates are in effect in 2020?

According to Appendix 5 to the Procedure for using the KND form 1151111 in the DAM, the following tariff codes can be used:

| 01 | Payers of insurance premiums applying the basic tariff of insurance premiums |

| 06 | Payers of insurance premiums operating in the field of information technology |

| 07 | Payers of insurance premiums who make payments and other remuneration to crew members of ships registered in the Russian International Register of Ships for the performance of labor duties of a ship crew member |

| 10 | Payers of insurance premiums are non-profit organizations (with the exception of state (municipal) institutions) that apply the simplified tax system and carry out, in accordance with the constituent documents, activities in the field of social services for the population, scientific research and development, education, healthcare, culture and art (activities of theaters, libraries, museums and archives) and mass sports (except professional) |

| 11 | Payers of insurance premiums are charitable organizations using the simplified tax system |

| 13 | Payers of insurance premiums are residents of Skolkovo |

| 14 | Payers of insurance premiums who received the status of participant in the free economic zone in Crimea and Sevastopol |

| 15 | Payers of insurance premiums who have received the status of a resident of a priority development area |

| 16 | Payers of insurance premiums who have received resident status of the free port of Vladivostok |

| 17 | Payers of insurance premiums are organizations included in the unified register of SEZ residents in the Kaliningrad region |

| 18 | Payers of insurance premiums are Russian organizations engaged in the production and sale of animated audiovisual products produced by them, regardless of the type of contract and (or) provision of services (performance of work) for the creation of animated audiovisual products |

| 19 | Payers of insurance premiums who have received the status of a participant in a special administrative region in the territories of the Kaliningrad Region and Primorsky Territory, making payments and other rewards to crew members of ships registered in the Russian Open Register of Ships for the performance of labor duties of a ship crew member |

There are also two new payer tariff codes 20 and 21 in RSV 2021. We will talk about them below.

As you can see, in 2021 all payers of contributions at regular rates use code 01. The remaining codes are intended for policyholders who have various preferences.

What general and preferential rates of insurance premiums are currently established and what are the nuances of their application, you can find out from the Ready-made solution from ConsultantPlus:

If you do not already have access to this legal system, a full access trial is available for free.

However, at present, the Procedure for filling out the calculation does not contain all the tariff codes that need to be used when filling out the DAM, starting from the first half of 2021. Due to the coronavirus and the changes made in connection with it, the Federal Tax Service introduced two new codes: 20 and 21. We will describe below what these codes are, who they are intended for and what are the features of their use in the DAM.

And you can find out about the changes in the procedure for calculating insurance premiums brought by the coronavirus in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Essence of the question

Despite numerous changes in terms of insurance coverage for working citizens, reports will still have to be submitted to the Pension Fund.

Although the list of forms has been significantly reduced, you will now have to submit information monthly. Violations of current surrender rules result in large fines. State employees and non-profit organizations do not have privileges in this matter and are required to report on the same basis as all Russian enterprises and organizations.

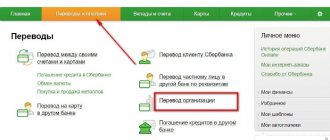

To generate reports to the Pension Fund, you will have to use specialized programs. Some public sector employees have the right to submit reports on paper. But even when filling it out, you will have to take into account numerous rules and factors. A program developed by representatives of the Pension Fund of the Russian Federation will help you avoid mistakes - this is Spu_orb.

The software allows you not only to quickly and easily generate reports, but also to carry out special checks that eliminate errors and warnings in reports. The software will have to indicate what the main category of the IP payer is (the explanation for 2020 is presented below).

Payer tariff codes 20 and 21 in RSV 2021

New insurance premium rates in 2021 were introduced as measures to support small and medium-sized businesses and some other insurers due to the coronavirus epidemic.

Firstly, from April 1, 2020, SMEs and socially-oriented non-profit organizations received the right to use reduced insurance premium rates in the amount of 15% of salaries above the minimum wage (RUB 12,130). We talked about how this tariff is applied here.

Secondly, some SMEs, NGOs and religious organizations are allowed to apply zero insurance premium rates to payments for April-June.

To ensure that these payers can correctly fill out the reports, the Federal Tax Service introduced tariff code 20 into the RSV for contributions at a rate of 15% and tariff code 21 for contributions at zero rates.

If you belong to the category of policyholders entitled to the specified benefits on contributions, when filling out the DAM for 9 months of 2021, keep in mind the following. Since you have been applying preferential rates since April 2021, and for January-March you calculated contributions as usual, you will need to fill out:

- two each of Appendix 1 and Appendix 2 to Section 1 - with tariff codes 01 and 20 - if you apply only reduced contributions;

Example. Calculation of contributions for 9 months of 2021 with reduced tariffs from ConsultantPlus Calculation sections are presented, the filling of which has features when applying reduced tariffs... You can view a sample of filling in K+, having received free trial access to the system.

- three specified applications each - with tariff codes 01 and 20, as well as with tariff code 21 - if you are subject to zeroing of contributions for the 2nd quarter.

This is provided for in clauses 5.4 and 10.1 of the Procedure for filling out the DAM and is reflected in the control ratios in the calculation.

See also: “How to fill out the DAM for the 3rd quarter of 2021 for affected industries.”

Business societies

In this case, the code is XO.

In fact, payments there are made by the same individuals, but here we are talking about entire societies, and the responsibilities of individuals. persons only includes control over the activities of the company and its supervision. There, too, management can be carried out by an ordinary individual entrepreneur. But this person will have to pay to the Pension Fund both as an individual entrepreneur and as a business entity. The purpose of such organizations is to introduce a variety of research results and scientific activities. Most often this concerns innovative technologies, specifically computers, models, drawings, so-called know-how and everything connected with it. Another feature of the company is that the rights to all inventions belong to the founders, that is, the heads of the companies. But various scientific institutions, higher schools, universities and the like may be listed as participants. It is interesting that business entities pay to the Pension Fund at a reduced rate, following Federal Law No. 212-F3.

Results

The payer's tariff codes are recorded in a special reporting form for insurance payments KND 115111. Their list is established in Appendix No. 5 to the Procedure for filling out this form and was supplemented by the Federal Tax Service in connection with the coronavirus epidemic.

Sources:

- tax code

- Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Phys. persons and employees

Their code: FL.

This includes various individual entrepreneurs, lawyers, notaries who work for themselves.

In principle, everyone who works in private practice and at the same time complies with all the instructions of Russian legislation can be classified in this category. Of course, such individual entrepreneurs must have all the relevant documents that can serve as confirmation that they actually made their insurance payments to the Pension Fund. In fact, the list of such persons is quite extensive. In fact, somewhere around 15-20% of all people from whom money goes to the Pension Fund can be contributed to it.

As for another category, it unites persons who work for hire. Their code is: HP

, which stands for “hired employees.” These are the people for whom the boss makes insurance premiums. In fact, in this situation, it is the employer who fulfills the obligations of the policyholder.

Organizations and individual entrepreneurs that use a simplified taxation system

Their code is PNED.

The type of activity of such organizations or individual entrepreneurs can be very different. This can be the production of food, mineral water, clothing production, as well as shoe production, various chemical production, production of plastic or metal products, machines and components for them, furniture, electrical equipment and much more. Also very popular types of activities that may imply a simplified taxation system are often the production of sports goods, recycling. raw materials, providing communications and transport, providing a variety of personal services, repairing apartments, household appliances, showing or renting films, maintaining libraries, ensuring the integrity of museums and architectural monuments, and so on. Various government agencies also use this system. These can be botanical gardens, theaters, the same museums, zoos, nature reserves, historical sites and everything connected with it. In general, the circle of such persons is so vast that it would take several days to describe it.

Skolkovo participants

As you know, in Russia there is an innovative one. Only the best scientists of the Russian Federation and some foreign “bright minds” are gathered there. These could even be stateless persons who are somehow involved in the developments of this center. All of them will also make contributions to the Pension Fund in 2016 in a special manner, which is clearly stated in the Law number 244-F4, published back in 2010.

They will do this according to the VZhTS code.

Participants of the Skolkovo project have the code VZHSC

Of course, they also benefit from a reduced rate for these contributions.

Moreover, this category includes not only the scientists themselves who work in the laboratories of this innovation center, but absolutely everyone who participates in the life of the center. These could be specialists involved in the commercialization processes of Skolkovo developments, assistants, management personnel and even cleaners. Only for this they need to have a document with them that would confirm the participation of a particular citizen in the development of the innovation center. Without such a document, they will not see any reduced tariffs. For temporarily residing participants in this project, the designation does not change, that is, the same thing - VZhTS.