From January 1, new KBK budget classification codes for 2021 will begin to be applied. The changes affected mainly insurance premiums, which companies transfer to extra-budgetary funds for their employees. In addition, changes have been made regarding self-employed persons. Read more about the changes in our article.

The main changes to the current order of the Ministry of Finance on budget classification codes No. 65 dated 07/01/2013 were introduced in the summer by another order of the ministry No. 90n dated 06/08/2015. In addition, another document should appear in the very near future that will clarify the amendments already made. All these changes under the KBK 2021 are related to insurance contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund for both organizations and self-employed individuals.

Introductory information

The budget classification code (BCC) is part of the group of details that allow you to determine the ownership of the payment.

Therefore, when transferring insurance premiums to extra-budgetary funds, it is important to fill out the payment order correctly, indicating the correct 20-digit code in the “104” field. If you make a mistake, the payment may be attributed to unknown receipts. In this case, you will need to clarify the payment and, possibly, go through a reconciliation with the funds (see “Instructions for filling out payment orders when paying taxes, penalties, fines, as well as contributions to extra-budgetary funds.”) Starting from January 2021, when filling out payment orders for transfer of insurance premiums must be applied to the KBK approved by the commented order of the Ministry of Finance. In addition, the codes for paying penalties and interest on contributions will change.

Pension contributions from payments to employees

Basic payments

Insurance contributions to the Pension Fund budget for payments to employees within the limit (for 2015 it is 711,000 rubles) are charged at a rate of 22%, and for payments above the limit - at a rate of 10%. Such tariffs are established for most insurers by Article 58.2 of the Federal Law of July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ). To transfer contributions from payments within the limit and from payments accrued in excess of the maximum base value, the same BCC is used today.

From 2021, two codes will need to be used. One is for paying pension contributions from payments within the limit, the second is for paying pension contributions from payments exceeding the limit (see “Starting from 2021, the BCC for payment of insurance contributions to the Pension Fund will change”). Please note that the commented order does not specify which BCC to use to transfer contributions for December 2015 in 2021. In our opinion, in this case there is no reason to use new codes. Official clarification on this matter will likely appear towards the end of this year.

Let us also recall that pension contributions accrued for periods from January 1, 2014 are transferred to the Pension Fund of the Russian Federation in a single payment, without dividing into the insurance and funded parts of the pension. When filling out the payment form, you must indicate the BCC for contributions credited to the insurance pension. This is stated in Article 22.2 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” (hereinafter referred to as Law No. 167-FZ). Starting from 2021, if the maximum base for calculating pension contributions is exceeded, you will need to issue two payments, while you still need to use the KBK to transfer contributions to the insurance pension (see Table 1).

From the editor

Please note: at the end of 2015, the Ministry of Finance abandoned the idea of distributing contributions to the Pension Fund for employees into two payments. According to the order of the Ministry of Finance of Russia dated December 1, 2015 No. 190n, in 2021, insurance contributions for compulsory pension insurance (both within the limit and above it), as well as in 2015, will need to be transferred to the same code (392 1 0200 160). See “The Ministry of Finance refused to introduce separate BCCs for paying contributions to the Pension Fund for payments within the limit and above the limit.” Thus, Table 1 of this article has lost its relevance.

Table 1. BCC for payment of pension contributions

| Payment type | 2015 | 2016 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of insurance pensions for employees (at a rate of 22%) | 392 1 0200 160 | 392 1 02 02010 06 1100 160 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of insurance pensions for employees (at a rate of 10%) | 392 1 0200 160 | 392 1 02 02010 06 1200 160 |

Please note that payers of insurance premiums who apply reduced rates established by Articles and 58.1 of Law No. 212-FZ do not charge contributions to the Pension Fund for payments exceeding the maximum base value. This follows from paragraph 1 of part 1.1 of Article 58.2 of Law No. 212-FZ. Thus, in 2021, beneficiaries must use the KBK to pay pension contributions, which is provided for transferring contributions from payments within the limit (that is, code 392 1 0200 160).

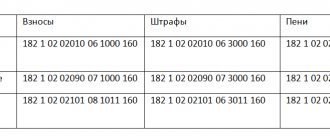

Penalties and interest

If insurance premiums are paid later than established by law, you will have to pay a fine (Part 1, Article 25 of Law No. 212-FZ). Also, payers of insurance premiums may be faced with the need to pay interest, for example, when receiving a deferment (installment plan) for paying premiums (Part 6, Article 18.1 of Law No. 212-FZ). Whether a payment belongs to penalties or interest is determined by the code of the subtype of income (14-17th categories of the KBK). Today, the values of 14-17 categories of the BCC for the payment of penalties and interest on taxes and insurance premiums differ (see “The BCC for the payment of interest and penalties on taxes has changed” and table 2).

Table 2. Comparison of 14-17 categories of the BCC for taxes and contributions (2015)

| Payment type | 14-17 categories of the KBK for taxes | 14-17 categories of the KBK for insurance premiums |

| Basic payment of tax or insurance premium | 1000 | 1000 |

| Penalty | 2100 | 2000 |

| Interest | 2200 | 2000 |

| Fines | 3000 | 3000 |

As can be seen from the table, in order to list penalties and interest on tax payments, different codes of the subtype of income are indicated (different values of 14-17 KBK categories), and to list penalties and interest on insurance premiums, the same code is used. The commented order changes this situation. From 2021, payments for penalties and interest on insurance contributions to the Pension Fund will need to be distributed (see Table 3).

Table 3. BCC for payment of penalties and interest on pension contributions

| Payment type | 2015 | 2016 |

| Penalties and interest on insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance pension | 392 1 0200 160 | 392 1 02 02010 06 2100 160 - fine 392 1 02 02010 06 2200 160 - percent |

| Penalties and interest on insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of a funded pension | 392 1 0200 160 | 392 1 02 02020 06 2100 160 - fine 392 1 02 02020 06 2200 160 - percent |

| Penalties and interest on contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 02 02080 06 2100 160 - fine 392 1 02 02080 06 2200 160 - percent |

| Penalties and interest on contributions paid by coal industry organizations to the Pension Fund for payment of pension supplements | 392 1 0200 160 | 392 1 02 02120 06 2100 160 - fine 392 1 02 02120 06 2200 160 - percent |

| Penalties and interest on insurance premiums at an additional tariff for employees engaged in the types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund for the payment of an insurance pension | 392 1 0200 160 | 392 1 02 02131 06 2100 160 - fine 392 1 02 02131 06 2200 160 - percent |

| Penalties and interest on insurance premiums at an additional tariff for employees engaged in the types of work specified in paragraphs. 2-18 hours 1 tbsp. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund for the payment of an insurance pension | 392 1 0200 160 | 392 1 02 02132 06 2100 160 - fine 392 1 02 02132 06 2200 160 - percent |

| Penalties and interest on insurance premiums credited to the Pension Fund for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) | 392 1 0200 160 | 392 1 02 02031 06 2100 160 - fine 392 1 02 02031 06 2200 160 - percent |

| Penalties and interest on insurance contributions credited to the Pension Fund for the payment of funded pensions (for billing periods from 2002 to 2009 inclusive) | 392 1 0200 160 | 392 1 02 02032 06 2100 160 - fine 392 1 02 02032 06 2200 160 - percent |

Failed changes

In the summer of 2015, the Russian Ministry of Finance amended Order No. 150n dated December 16, 2014, which defines budget classification codes, including for the payment of insurance premiums.

It was assumed that from January 1, 2021, quite a lot of new CBCs will appear for employers, entrepreneurs and other categories of the self-employed population.

However, by the end of last year, information appeared that the new BCCs for employers would not come into force. Argument: it is not possible in practice to implement the payment of contributions to different KBK from payments within the limit of 711,000 rubles. and above him.

In addition, uncertainty arose in the issue of comparing the amounts paid in this way with the existing RSV-1 form of the Pension Fund and the technologies of the Pension Fund.

It was also important that the need to pay to different BCCs would inevitably lead to an increase in labor costs and paperwork for policyholders - premium payers.

Therefore, the information that appeared in December about changes to the order of the Russian Ministry of Finance pleased both payers and employees of the Pension Fund of the Russian Federation.

Insurance contributions to the Social Insurance Fund from payments in favor of employees

To transfer insurance contributions from payments to employees to the Social Insurance Fund, the following BCCs are used: - 393 1 0200 160 - for payment of contributions for compulsory social insurance in case of temporary disability and in connection with maternity; - 393 1 0200 160 - for payment of contributions for compulsory social insurance against industrial accidents and occupational diseases. The commented order left these codes unchanged. But payments for penalties and interest on contributions to the Social Insurance Fund from 2021 will need to be distributed among different BCCs (see Table 4).

Table 4. BCC for payment of penalties and interest on contributions to the Social Insurance Fund

| Payment type | 2015 | 2016 |

| Penalties and interest on contributions to compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 | 393 1 02 02090 07 2100 160 - fine 393 1 02 02090 07 2200 160 - percent |

| Penalties and interest on contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 393 1 02 02050 07 2100 160 - fine 393 1 02 02050 07 2200 160 - percent |

What to do if the payment is transferred using the wrong BCC

If the payment is nevertheless transferred to an incorrect BCC, the payer should submit an application to the Fund to clarify the payment.

Based on this application, the Fund will decide to clarify the payment on the day of actual payment of the contribution. And as a result, the obligation to pay contributions will be recognized as fulfilled on the day the payment is presented to the bank. And penalties, if they were accrued, must be recalculated. Reason - clauses 8 and 11 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund”, letter of the Ministry of Finance of Russia dated July 17, 2013 No. 03- 02-7/2/27977 and dated 03/29/2012 No. 03-02-08/31.

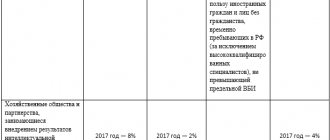

Insurance premiums in fixed amounts

Article 14 of Law No. 212-FZ contains the concept of “insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund in fixed amounts.” These contributions refer to payments that are paid “for themselves” by individual entrepreneurs, lawyers, notaries and other persons engaged in private practice. From 2021, to transfer fixed payments it will be necessary to use the codes provided for by the commented order.

Let us remind you that since 2014, a differentiated amount of insurance premiums has been in effect, which entrepreneurs transfer “for themselves” to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund. If the income of an individual entrepreneur in the billing period does not exceed 300,000 rubles, then contributions must be paid in a fixed amount (in 2015 to the Pension Fund of the Russian Federation - 18,610.80 rubles, to the Federal Compulsory Medical Insurance Fund - 3,650.64 rubles). Those entrepreneurs whose annual income exceeds 300,000 rubles must additionally pay to the Pension Fund 1% of the amount of income exceeding the specified amount, but not more than the established maximum amount of insurance premiums (see “Insurance premiums for individual entrepreneurs without employees: how much will you need to pay in funds “for yourself” in 2015).

Pension contributions

Entrepreneurs transfer mandatory pension contributions “for themselves” in a single payment order, using the KBK for the contribution credited to the insurance part of the pension (Article 22.2 of Law No. 167-FZ). To pay fixed contributions to the Pension Fund, including contributions in the amount of 1% of income exceeding 300,000 rubles, the same BCC is used today. From 2021, it will be necessary to indicate two different codes - for contributions from income up to 300,000 rubles, and for contributions from income exceeding the specified limit (see table 5). Let us remind you that pension contributions accrued on income over 300,000 rubles must be paid no later than April 1 of the following year. To date, the question of which BCC to use to pay the additional fixed contribution for 2015 by April 1, 2021 remains open (nothing is said about this in the commented order). In our opinion, it is necessary to apply the currently valid BCC.

Table 5. BCC for payment of pension contributions in a fixed amount

| Payment type | 2015 | 2016 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of an insurance pension (calculated on income less than 300,000 rubles) | 392 1 0200 160 | 392 1 02 02140 06 1100 160 |

| Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of an insurance pension (calculated from income over 300,000 rubles) | 392 1 0200 160 | 392 1 02 02140 06 1200 160 |

As for penalties and interest on fixed contributions to the Pension Fund, from 2021 they will need to be transferred to different BCCs. The commented order also clarifies which BCCs to indicate when paying penalties and interest on pension contributions for past periods (see Table 6).

Table 6. BCC for payment of penalties and interest on pension contributions in a fixed amount (contributions based on the cost of the insurance year)

| Payment type | 2015 | 2016 |

| Penalties and interest on insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of the insurance pension | 392 1 0200 160 | 392 1 02 02140 06 2100 160 - fine 392 1 02 02140 06 2200 160 - percent |

| Penalties and interest on insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of a funded pension | 392 1 0200 160 | 392 1 02 02150 06 2100 160 - fine 392 1 02 02150 06 2200 160 - percent |

| Penalties and interest on insurance premiums for compulsory health insurance based on the cost of the insurance year, credited to the Pension Fund for the payment of the insurance pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 | 392 1 02 02100 06 2100 160 - fine 392 1 02 02100 06 2200 160 - percent |

| Penalties and interest on insurance premiums for compulsory pension insurance based on the cost of the insurance year, credited to the Pension Fund for the payment of a funded pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 | 392 1 02 02110 06 2100 160 - fine 392 1 02 02110 06 2200 160 - percent |