Provisions of the Tax Code of the Russian Federation on deadlines

The procedure and deadlines for paying insurance premiums are established by Chapter 34 of the Tax Code of the Russian Federation. If in 2021 the deadline for paying insurance premiums falls on a weekend or non-working holiday, then the contributions must be transferred on the next working day. Such an indication is in paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation. You can find out which day falls on a weekend or holiday in Articles 111 and 112 of the Labor Code of the Russian Federation. If holidays coincide with weekends, as a rule, they are moved to other dates. The Government of the Russian Federation adopted a Resolution on the transfer of days off in 2021 (Resolution of the Government of the Russian Federation dated October 14, 2017 No. 1250). The following weekends will be postponed in 2021:

- Saturday 6 January to Friday 9 March;

- Sunday 7 January to Wednesday 2 May.

Also in 2021, the Government decided to make three working Saturdays:

- April 28. At the same time, Monday April 30 will become a non-working day, and we will rest from April 29 to May 2 inclusive;

- the 9th of June. Due to this, the June holidays will last three days: from June 10 to June 12 inclusive;

- December 29th. Such a postponement will lead to the fact that the New Year holidays 2019 will begin on December 30, 2018.

Results

For contributions accrued to extra-budgetary funds, the same calculation and payment rules apply in 2021 as in 2021.

However, the magnitude of a number of components of the calculations changes. Moreover, these changes apply both to payments accrued by employers (the maximum value of the taxable bases is changing, the value of some rates, regarded as lower, is increasing), and to amounts calculated by self-employed persons (the minimum wage used in calculations has increased). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When insurance premiums are considered paid

Insurance premiums in 2021 are considered paid on the day when an LLC or individual entrepreneur receives a payment order to pay insurance premiums. Such an order for the payment of insurance premiums can be submitted either by the payer of insurance premiums or by any other person: an organization, an individual entrepreneur or a person who is not engaged in business (clause 1 of Article 45 of the Tax Code of the Russian Federation). Of course, there must be enough money in the current account of the organization or other person for the payment, and the order itself must be filled out correctly. In 2021, transfer insurance premiums to the budget without rounding: in rubles and kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

The procedure for paying insurance premiums for separate units depends on what powers they are vested with. The division transfers insurance premiums to its tax office if it independently calculates payments to employees. Notify the tax office of the head office within one month that the organization has vested a branch, representative office or other division with such powers. If payments and remunerations to employees of the unit are calculated by the head office, then it transfers contributions for them to the inspectorate at its location (subclause 7, clause 3.4, article 23, subclause 11, article 431 of the Tax Code of the Russian Federation).

Enterprise income: what to take into account

A businessman must pay 1% on income exceeding three hundred thousand rubles. But what is considered income? It depends on the tax regime that the company applies:

- ECXH - only operating and non-operating income of a business. Expenses are not taken into account.

- OCHO income without business deductions.

- The simplified tax system is only sales and non-sale income of a business. Expenses are not taken into account. Take the figures for calculation in the “Book of Expenses and Income”, section “Income”.

- PSN is the estimated income, which is established by regional regulations.

- UTII - imputed income. When calculating this amount, the coefficients K1 and K2, the physical indicator, as well as the basic profitability of the business are taken into account.

- Combining modes - add up all the amounts of income obtained from all modes.

On a note! When calculating the pension contribution, all income is taken into account. There is no need to deduct the company's expenses from this amount. It is only necessary to deduct expenses when applying the OCHO tax regime (common system).

Table with payment deadlines for 2018

In 2021, insurance premiums for compulsory medical insurance, compulsory medical insurance and VNIM from payments to employees, as well as individual entrepreneurs’ contributions for themselves, are transferred to the Federal Tax Service, and contributions “for injuries” - to the Social Insurance Fund.

Contributions to the Federal Tax Service

Employers-insurers (organizations and individual entrepreneurs) will have to transfer insurance premiums no later than the 15th day of the month following the month of accrual of contributions (clause 3 of Article 431 of the Tax Code of the Russian Federation). Taking into account the postponement of weekends and holidays, the deadlines for paying insurance premiums to the Federal Tax Service from payments to employees (or other individuals) in 2018, the table with the deadlines for paying insurance premiums looks like this:

| Insurance premiums to the Federal Tax Service in 2018 | |

| Period | Payment deadline |

| December 2017 | No later than 01/15/2018 |

| January 2018 | No later than 02/15/2018 |

| February 2018 | No later than March 15, 2018 |

| March 2018 | No later than 04/16/2018 |

| April 2018 | No later than 05/15/2018 |

| May 2018 | No later than June 15, 2018 |

| June 2018 | No later than July 16, 2018 |

| July 2018 | No later than 08/15/2018 |

| August 2018 | No later than September 17, 2018 |

| September 2018 | No later than 10/15/2018 |

| October 2018 | No later than 11/15/2018 |

| November 2018 | No later than 12/17/2018 |

Insurance premiums for individual entrepreneurs “for themselves”

Individual entrepreneurs who have hired employees will pay insurance premiums for pension (social, medical) insurance not only for their employees, but also for themselves in 2021 (Article 419 of the Tax Code of the Russian Federation).

Individual entrepreneurs are required to pay contributions for themselves in 2021 (Article 430 of the Tax Code of the Russian Federation):

- for pension insurance;

- for health insurance.

Entrepreneurs are not required to pay social insurance contributions. However, this is possible on a voluntary basis (Part 6, Article 4.5 of the Law of December 29, 2006 No. 255-FZ). For more information, see “Insurance premiums for individual entrepreneurs in 2021.”

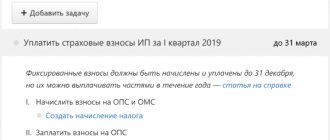

In 2021, entrepreneurs pay the annual amount of contributions for their own compulsory pension (medical) and voluntary social insurance at their own discretion - either in a lump sum or in several payments throughout the year (for example, monthly, quarterly, semi-annually). The main thing is that contributions are transferred in full before December 31 of the current year.

At the same time, a different deadline has been established for pension contributions accrued from income over 300,000 rubles. The entrepreneur can pay them next year, but no later than July 1. However, in 2018 this day falls on a Sunday, so it is moved to July 2. Here are the deadlines for paying insurance premiums in 2021 (you must pay premiums for 2021 within these deadlines).

| Insurance premiums for individual entrepreneurs “for themselves” in 2018 | |

| Period | Payment deadline |

| For 2021 | No later than 01/09/2018 |

| For 2021 (additional payment of contributions to compulsory health insurance if the amount of income for 2017 exceeds 300,000 rubles) | No later than 07/02/2018 |

Also see “Insurance premiums for individual entrepreneurs for 2021”.

Insurance contributions to the Social Insurance Fund

In 2021, insurance contributions to the Social Insurance Fund (for accident insurance) are subject to payments and other remunerations within the framework (clause 1 of Article 20.1 of Law No. 125-FZ):

- labor relations;

- civil contracts for the performance of work and (or) provision of services, as well as copyright contracts - if the payment of fees is provided for by these contracts.

Payments that are not subject to accident insurance contributions are specified in Art. 20.2 of Law No. 125-FZ.

The table below shows the deadlines for paying insurance premiums to the Social Insurance Fund in 2021:

| Insurance contributions to the Social Insurance Fund in 2018 | |

| Period | Payment deadline |

| December 2017 | No later than 01/15/2018 |

| January 2018 | No later than 02/15/2018 |

| February 2018 | No later than March 15, 2018 |

| March 2018 | No later than 04/16/2018 |

| April 2018 | No later than 05/15/2018 |

| May 2018 | No later than June 15, 2018 |

| June 2018 | No later than July 16, 2018 |

| July 2018 | No later than 08/15/2018 |

| August 2018 | No later than September 17, 2018 |

| September 2018 | No later than 10/15/2018 |

| October 2018 | No later than 11/15/2018 |

| November 2018 | No later than 12/17/2018 |

Privileges

Reduced insurance rates apply to several categories of entrepreneurs:

- Individual entrepreneurs using a simplified tax regime and engaged in real estate management, production, construction, etc.

- Carrying out activities under a patent. The exception is enterprises that operate in the field of catering, retail trade and rental property.

- Pharmaceutical enterprises operating on imputation.

The individual entrepreneurs listed above pay only pension contributions in the amount of 20%.

Such entrepreneurs are not required to transfer medical insurance and payments for injuries.

Also, preferential treatment applies to enterprises that operate in a special economic zone:

- "SEZ Yantar", located in the Kaliningrad region;

- "SEZ Zelenograd";

- “Istok”, an enterprise located in the Moscow region;

- “Stupino Square” from the Moscow region, etc.

Responsibility for violation of deadlines

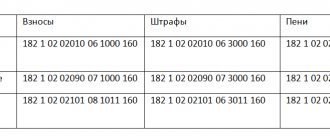

If insurance premiums were transferred later than the established deadlines, the tax inspectorate will charge the organization a penalty (Article 75 of the Tax Code of the Russian Federation). It is also possible to be held liable for various types of liability.

Tax liability

The Federal Tax Service has the right to fine an organization or individual entrepreneur for failure to pay insurance premiums. However, they can do this only for complete or partial non-payment of the contribution based on the results of the tax (calculation) period. No fines are assessed for the amount of unpaid advance payments (Clause 3, Article 58 of the Tax Code of the Russian Federation).

The fine will be 20 percent of the amount of arrears. If inspectors prove that non-payment was intentional, the fine will increase to 40 percent. This follows from Article 122 of the Tax Code of the Russian Federation.

If an organization does not remit the tax, acting as a tax agent, it will also be fined 20 percent of the amount (Article 123 of the Tax Code of the Russian Federation).

Administrative responsibility

It is possible that insurance premiums will not be paid on time in 2021 due to a gross violation of accounting rules: when insurance premiums were calculated incorrectly and the amount was distorted by at least 10 percent. Then the court may additionally hold the head of the organization or chief accountant administratively liable. The fine in this case will be from 2000 to 3000 rubles. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In practice, tax liability in relation to an organization can be applied simultaneously with administrative liability to its officials. That is, for the same violation, the organization is fined under Article 122 or 123 of the Tax Code of the Russian Federation, and the director or chief accountant is fined under Article 15.11 of the Code of Administrative Offenses of the Russian Federation.

Criminal liability

If the Federal Tax Service proves that failure to pay insurance premiums in 2021 was the result of a crime, the court may sentence the perpetrators to criminal liability under Articles 198, 199, 199.1, 199.3 and 199.4 of the Criminal Code of the Russian Federation.

Read also

15.01.2021

Tax base

Employers must determine the accrual base for each employee on a monthly accrual basis from the beginning of the pay period.

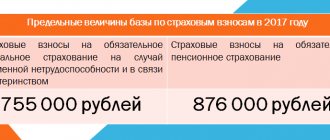

The maximum value of the insurance premium base is determined by Decree of the Government of the Russian Federation dated November 29, 2016 No. 1255:

- compulsory pension insurance - 1,021,000 rubles;

- social insurance in case of temporary disability and in connection with maternity - 815,000 rubles;

- for other types of compulsory insurance, the maximum values have not been determined.

The database should include remuneration for full-time employees, as well as other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, determined by the norms of Article 420 of the Tax Code of the Russian Federation and Article 421 of the Tax Code of the Russian Federation, as well as Law No. 125-FZ. Thus, other remunerations in favor of individuals include:

- payment under civil contracts, the subject of which is the performance of work or the provision of services;

- payment under copyright contracts in favor of the authors of the works themselves;

- payments under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, licensing agreements.

Employers calculate the amounts due for payment during the calendar year (settlement period) based on the results of each calendar month in the manner specified in Article 431 of the Tax Code of the Russian Federation. Consequently, the deadline for paying insurance premiums in 2021 comes monthly for employers.

Features of payment by individual entrepreneurs

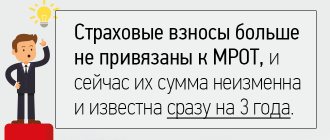

Attention! From January 1, 2021, the rules for paying contributions for individual entrepreneurs have changed. They are no longer tied to the minimum wage, but are taken in a fixed amount of money.

For these contributions, the payment deadline is December 31, 2021. If the date happens to be a weekend, the deadline will move to the first working day of January 2021.

The main thing is to have time to pay the entire amount of insurance premiums before December 31, 2021.

There are special deadlines for payment for individual entrepreneurs. Individual entrepreneurs who pay contributions for themselves can transfer them to the budget once a quarter or even once a year, at their choice. For them, there is only one deadline for paying insurance premiums in 2021 - December 31. Since this date fell on a weekend, payments must be made before the first working date of 2021.

| Type of contribution | Payment deadline |

| Compulsory medical insurance contribution for yourself | No later than 01/09/2019 |

| Contribution to OPS for yourself | |

| Contribution to OPS for yourself (1% contribution) | No later than 07/01/2019 |

Please note that from 2021 the deadline for paying 1% contributions has been moved from 1 April to 1 July.

If the deadline for payment of individual entrepreneur's contributions is violated, penalties will be charged (Article 75 of the Tax Code of the Russian Federation).

You can check the correctness of the calculation of penalties made by tax authorities using the Calculator on our website.