Starting from 2021, control over the calculation and payment of insurance premiums is largely carried out by the Federal Tax Service. The Social Insurance Fund also has the right to administer part of the payments calculated from employee salaries. In what cases can contributions be additionally accrued and how to reflect the amounts based on the inspection report in accounting?

Question: What actions should the tax authority take to re-qualify the GPC agreement into an employment contract for the purposes of additional assessment of insurance premiums? View answer

In what cases is it necessary to recalculate insurance premiums for previous periods?

Typically, updated data is submitted to regulatory authorities if the amount is more or less than the specified standards due to errors made when drawing up the document. Here are some examples of reasons for submitting updated information:

- During the preliminary calculation, there is no information that the employee’s profession is hazardous, which requires the application of additional tariffs. Because of this, there was an underpayment of insurance premiums.

- The right to apply preferential tariffs has been lost by the unit. The accounting department received the information with some delay. As a result, after recalculation the amount will increase.

- The premium from the calculation base is not included during the initial setup of computer programs.

- An employee was transferred from one department to another, and both have different tariffs and payment ratios.

- Incorrect completion of the third section, late transfer of personal data.

It is also useful to read: Is sick leave subject to insurance contributions?

Filling out the production calendar for 2015

According to Article 112 of the Labor Code of the Russian Federation, the Government of the Russian Federation postpones weekends that fall on “January” holidays (January 1-8) to any working days in the corresponding year. Other weekends that fall on non-working holidays may also be postponed. Otherwise, they will be “automatically” transferred to the working days following the holidays.

Thus, in 2015, 4 weekends fall on non-working holidays, two of which are “January” (January 3 and 4), and the rest are “spring” (March 8 and May 9). In this regard, the Government adopted Resolution No. 860 dated August 27, 2014, according to which the following days off will be postponed in 2015:

- January 3 to Friday January 9

- January 4th to Monday May 4th

In the new version 2.5.84, the production calendar for 2015 is automatically filled in in accordance with the specified resolution. If before the update the production calendar was not filled out, then when switching to version 2.5.84, the calendar for 2015 is filled out in accordance with the Resolution, i.e. with the postponement of two January days off, including the weekends that coincided with March 8 and May 9

If before the transition to the new version, the transfer of weekend days was carried out manually, for example, all weekends were transferred to the next working days, then after the update you will need to check and cancel, if necessary, the incorrectly transferred manually days. In order to cancel the transfer of such days, we need to right-click on the “erroneous” day and then select “Cancel transfer of a weekend day”

We recommend that after updating (including after adjustments, if any have been made), compare the calendar with other calendars.

How to make a conversion in 1C ZUP

Let's consider one of the practical examples for clarity. There are conditions that can be described as follows.

Example:

The employee works as a storekeeper, her standard salary is 10 thousand rubles. The warehouse itself is classified as a division for which a preferential rate for insurance premiums is applied under the name “Residents of a technology-innovative special economic zone.” First, we submitted the calculations for the first half of 2021, then we found out that since February 2021, the right to preferential treatment has been lost.

The clarification must be submitted within the deadlines.

Payments for insurance premiums must be submitted by the 30th day of the month following the end of the quarter. An update submitted earlier than this date will mean that the calculation was submitted on the date of update, that is, on time (clause 2 of Article 81 of the Tax Code of the Russian Federation). Corrections after the reporting date may result in interest and fines if the amount of contributions has increased. To avoid being fined, you must transfer the arrears and penalties before submitting the updated calculation. As in the case of taxes, this should be done before the inspectors themselves discover the error or before an on-site audit is scheduled for the given period.

If corrections are required in section 3 of the calculation, which affects personalized accounting, the prescribed deadlines must be observed. After all, such errors make the calculation unrepresented (as discussed above).

After receiving a calculation with errors, controllers will send a notification. You have 5 days to make changes. It must be counted from the date the notification was sent electronically. If it was on paper, then the period for clarification will be 10 days (clause 7 of Article 431 of the Tax Code of the Russian Federation). The days are, as usual, working days.

Compliance with these deadlines eliminates sanctions for late submission of calculations. The reporting date will be the day the original version was submitted. Otherwise, a fine of 1,000 rubles will follow. up to 30% of the amount of contributions according to the calculation data (clause 1 of Article 119 of the Tax Code of the Russian Federation) and blocking of the account became possible.

Read more about the deadlines for submitting mandatory clarifications and their consequences here.

NOTE! The fine for an overdue ERSV is paid in three installments .

Specific recommendations

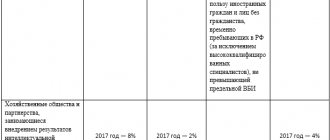

Previously, tariff code 05 was used when calculating insurance premiums using programs. For 2021, at this tariff, 13% is allocated to the Pension Fund. The Social Insurance Fund needs 2.9%, the Federal Compulsory Medical Insurance Fund – 5.1%. Previously, the calculation of contributions for the specified employee was based on the information given above.

The amount of insurance deductions for the month was, taking into account the tariff:

- 290 rubles to the Social Insurance Fund.

- 510 rubles for FFOMS.

- 1,300 rubles for the Pension Fund.

The calculation for the 1st quarter of 2021 reflects exactly these amounts. When this information was discovered, the need arose to draw up an updated Calculation. This means that insurance premiums are recalculated at new rates.

The “Preferential rate of insurance premiums” field in the “Divisions” card is completely cleared. Then choose the standard tariff established for the organization. Usually information about it is located in the “Organizations” card. The Tab that interests users is called “Accounting Policy and Other Settings”, then follow the link to the Accounting Policy and look at the type of tariff.

According to the previously established tariff, the previously specified company must transfer:

- FFOMS 5.1%.

- 2.9% for Social Insurance Fund.

- 22% for the Pension Fund.

The tariff code should change, in addition, the Pension Fund received less than 9%.

The procedure for accounting for income must be reviewed in order to make adjustments in accordance with all the rules. To do this, use a document called “Recalculation of insurance premiums” from the “Taxes and Contributions” menu. All employee incomes are specified manually on the “Income Information” tab.

Insurance premiums are recalculated automatically on the corresponding tab.

With a monthly salary of 10 thousand rubles, after recalculation, the amount of contributions became as follows:

- 290 and 510 rubles, respectively, for the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

- 2,200 rubles for the Pension Fund.

Calculations with clarifications are being prepared for the 1st quarter. During the corrected periods, new documents are created using the 1C program. The cover page must contain information regarding the revision number. An example is when changes affect all employees of the Section, therefore adjustments are required for everyone.

In the adjusted calculation, the third Sections are formed for each employee. If only one of them is needed, then the information is adjusted accordingly.

The remaining sections are completely filled with new data, regardless of the current situation.

Reasons for additional contributions

Additional assessment of contributions, as a rule, is a consequence of underestimating the base in calculations.

In practice, errors most often occur for the following reasons:

- Incorrect application of settlement rates. Thus, the current rate for compulsory health insurance is 22%, for compulsory medical insurance – 5.1%, for compulsory social insurance – 2.9%, and contributions “for injuries” depend on the type of activity of the company. Their value can range from 0.2 to 8.5%.

- Incorrect use of base limits for calculating insurance premiums for the current year. A similar situation may arise if the company is large, the wages of employees are quite high and at some point may exceed the limits established by government regulation in relation to one employee. In such cases, for pension contributions the basic tariff is set at 10%, and for contributions to the Social Insurance Fund, accrual occurs only within the limit (Article 425 of the Tax Code of the Russian Federation). Errors affect the OPS and OSS databases.

- Errors in including payments in the contribution base. In a general sense, this is the employee's income subject to contributions. The list of income is given in Art. 420 of the Tax Code of the Russian Federation, and in Art. 422 contains a similar list of amounts not included in the base. For example, financial assistance only in the amount of up to 4,000 rubles is not subject to contributions; compensation for unused vacation upon dismissal may be mistakenly not included in the base, etc.

The reason for additional accrual may also be calculation errors, incorrect transfer of data from previous periods, or even deliberate evasion of payment of contributions.

Based on the act, the company is obliged to calculate an additional amount to the funds, reflect it in accounting and make payment or resolve the issue in court.

Updated calculation and right of representation

If the Policyholder has discovered errors due to which the amount differs from the standards, then he has the right to provide updated information. In such situations, there are no additional legal requirements for completed documents. All recalculations are carried out in the next period . But the organization has the right to clarify the documents even six months in advance.

Attention! You should not make hasty conclusions and take actions before the end of the reporting period. After all, it also happens that later different results overlap each other, so there is no need to change anything radically.

Write a return request or don’t write

Overpayments can be reduced by 1% for 2021, 2021 and subsequent years. This is perhaps the simplest option: you don’t need to submit any applications, you’ll just pay less next time. But to offset the overpayment against penalties or 1% fines, you will have to submit an application. It will not work at all to direct the overpayment to other contributions, for example, to health insurance.

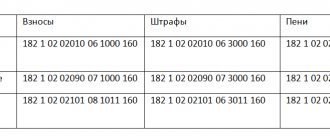

You can also return , for this you must submit an application, here is its form. In the application, indicate your data, Federal Tax Service code, payer status - 3, Article 78 of the Tax Code, according to which you are asking to return or offset the overpayment. Indicate the amount of overpayment, BCC of pension contributions. Enter the code of the tax period for which you paid the excess amount - GD.00.2017, GD.00.2018 or GD.00.2019. If you want to return or offset an overpayment for several periods, write several applications. On the second page of the refund application, indicate the bank details of the account where the tax authorities should transfer the amount. The Federal Tax Service will return the overpayment within a month.

Both for offset and for the return of contributions that were not recalculated, it is worth sending or attaching to the application a letter requesting this. Let me remind you that for periods before 2021, inspectors will not do this automatically. The letter might look like this:

That is: to offset the overpayment against the same contributions to the tax office, you send only a letter, for a refund - a refund application + letter. All this will need to be done on paper or through the taxpayer’s personal account.

If inspectors refuse to recalculate contributions and return the difference, file a complaint with the Federal Tax Service. In the complaint, explain where the overpayment came from and show the new calculation of contributions. Refer to the letter from the Federal Tax Service and the ruling of the Constitutional Court. File a complaint through your Federal Tax Service.

What else needs to be considered

Sometimes there is no obligation to submit an Update, but the policyholder has no other option to provide important information to regulatory authorities.

For example , when a negative amount is formed. Such a report cannot be submitted to the tax authorities; new papers must be generated.

Or if an employee works in a hazardous workplace. But then he was transferred to regular work, and the information arrived with a delay. Then the accruals cannot compensate for the amount. Reports also need to be developed.

What about the recount in Elbe?

The logic for calculating contributions in Elbe will change only for 2021. I’ll explain why we didn’t change the logic over the past years. Although the practice of recalculation and refunds is positive, there are still tax authorities who calculate contributions in the old way and there are still entrepreneurs who do not want to argue with them. By changing the calculation, we risk exposing such entrepreneurs to penalties and fines. We hope that in 2021 this issue will no longer be so shaky and we will change the calculation with peace of mind. In the meantime, we will be glad if you share in the comments how things are going with the accruals and returns of this unfortunate 1% for you.

Composition of the updated calculation

The updated calculation includes those sections and appendices to them that were presented earlier, except for section 3, taking into account the changes made; other sections and appendices may also be included if changes have been made to them. Section 3 “Personalized information about insured persons” is included only in relation to those individuals for whom changes have occurred (clause 1.2 of the Procedure).

Let's go back to the example above. In this case, when filling out the updated calculation, the indicators of section 1 of the previously submitted calculation for the half-year are adjusted. It includes section 3 containing information regarding the person to whom the recalculation was made, with the correct indicators (reduced amounts) in subsection 3.2 - with an adjustment number different from “0”, but with the same serial number (line 040) as in the initial calculation.

Kontur.Extern will help you submit your reports on time and without errors

To learn more

How to check

If you have doubts about the correctness of filling out the DAM, it is recommended to reconcile the calculations with the budget . This is the most reliable method that will give a 100% guarantee that there will be no errors.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

The document contains fields that reflect the debts owed by the policyholder and the Fund at the beginning and end of the reporting period. Thus, the mentioned calculation certificate reflects the real state of settlements with the Social Insurance Fund.

In conclusion, let us mention that when checking, inspectors are not guided by the contents of line 090 of Appendix 2 to Section 1. The document from which they receive data on mutual settlements is the Budget Payment Card . Reconciliation of the policyholder is carried out precisely on the basis of this card, and not at all according to data from the DAM.

Procedure for payment of benefits

According to the rules in force today, sick leave and maternity benefits are paid in one of two ways:

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Everything said below applies only to payers of insurance funds from point No. 1.

At the end of the month, the policyholder determines the amounts:

- accrued insurance premiums;

- benefits paid.

If more contributions are accrued than benefits paid, the difference is transferred to the Social Insurance Fund. If on the contrary, that is, the difference between contributions and benefits turns out to be a minus sign, then it is counted against future payments or returned from the Fund to the policyholder.

Exceptions to this procedure are provided only for benefits for the first 3 days of sick leave.