Kosgu 310 or 340 system unit in 2021

In the specification for the contract, the Contractor indicates: No. Product Unit.

Quantity Price, rub. Cost, rub.1 Photocells (receiver-transmitter) pair 1 1,330.00 1,330.002 Drive with built-in control unit and built-in receiver pcs. Doubts often arise when choosing between 225 and 310 KOSGU (between repair and modernization (reconstruction, retrofitting), as well as between 225 and 226 KOSGU. Why such difficulties arise and how an accountant can “get away with it”, let’s look at the example of work situations.

Accounting for Monitors and System Units in the Budget in 2021

Having considered the issue, we came to the following conclusion: 1. The current legislation in the field of budget accounting does not oblige to take into account monitors and system units exclusively as part of a personal computer (workstation). Therefore, a government agency may decide to account for these material assets as independent objects of fixed assets, justifying its decision. 2. Due to the absence of a code for system units in OKOF OK 013-2021 (SNS 2021), these material assets can be assigned to code 330.28.23.23 “Other office machines” as other machines related to computer equipment. The monitor can be assigned either code 320.26.2 “Computers, peripheral equipment”, or code 320.26.30.23 “Other telephone devices, devices and equipment for transmitting and receiving speech, images or other data, including communication equipment for working in wired or wireless networks communications (for example, local and global networks).”

Rationale for the conclusion: 1. The classification of property into fixed assets is carried out when the criteria listed in paragraphs are met. 7, 8 GHS “Fixed assets”, pp. 38, 39 Instructions No. 157n. One of the main criteria for classifying an object as a fixed asset is its useful life: it must be more than 12 months, but the cost of the property does not matter when classifying it as a fixed asset or inventory. Moreover, according to clause 10 of the GHS “Fixed assets”, the object must be intended to perform certain independent functions. In addition, in accordance with the provisions of the GHS “Fixed Assets”, non-financial assets cannot be classified as fixed assets if they must be accounted for as part of inventories in accordance with the requirements of clause 99 of Instruction No. 157n (see also section 3 “ Methodological recommendations communicated by letter of the Ministry of Finance of Russia dated December 15, 2021 N 02-07-07/84237). An important innovation is that now material value can be taken into account as part of fixed assets, provided that the subject of accounting is predicted to receive economic benefits or useful potential from its use and the initial cost of the material value, as an accounting object, can be reliably assessed (clause. 8 GHS “Fixed assets”). At the same time, in accordance with the provisions of paragraph 5 of clause 10 of the GHS “Fixed Assets,” a unit of accounting for fixed assets may be recognized as part of an item of property if: - in relation to this part, you can independently determine the period of receipt of future economic benefits and useful potential; - this is a part of the property that has a useful life that is different from the remaining parts (a method of obtaining future economic benefits or useful potential); — the cost of part of the property is a significant amount of the total value of the property. Moreover, such a unit of accounting for fixed assets is determined regardless of the possible physical isolation of part of the property. It should be noted here that accounting for monitors and system units as separate inventory objects has always been a topic of controversy and discussion. Moreover, specialists from the financial department have previously given explanations for quite a long time about the need to record them together as single inventory items. Such recommendations were also given for organizations in the non-profit sector (see, in particular, letters from the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia dated October 29, 2021 N 03-03-01-04/1/89, dated June 2, 2021 N 03-03- 06/2/110). At the same time, the courts, when considering such disputes, previously took both the side of institutions (for example, the resolution of the Eighth Arbitration Court of Appeal dated December 7, 2021 N 08AP-8357/11) and the side of regulatory authorities (for example, the resolution of the Federal Antimonopoly Service of the East Siberian District dated March 19, 2021 N F02-601/12 in case N A74-919/2021). Recent judicial practice (for example, the ruling of the Volga-Vyatka District Court of December 26, 2021 N F01-6014/17 in case N A29-1287/2021), supported by the Supreme Court of the Russian Federation (determination of the Supreme Court of the Russian Federation dated April 26, 2021 N 301-KG18 -3857), indicates the possible accounting of monitors and system units both as separate fixed assets and as single inventory objects. Based on the analysis of regulations, the court comes to the conclusion that each of the disputed objects (system units and monitors) operated by the institution as part of workplaces does not lose its functional purpose outside the complex: they are suitable for installation in various configurations and are easily replaceable; will not become unusable when disconnected from the complex and can be used as part of another complex; the monitor and the system unit are not a single whole, are not mounted on the same foundation and do not have common control; replacement and relocation of system units and monitors is possible without any damage to their purpose and can be carried out based on the determined feasibility of production activities. Accordingly, system units and monitors can be taken into account not only exclusively as a single object of fixed assets - a personal computer, but also as independent fixed assets as separate structurally separate items intended to perform certain independent functions. Thus, regulations in the field of budget accounting do not oblige monitors and system units to be taken into account exclusively as part of the personal computer they form. Accounting for system units and monitors as separate fixed assets is possible and should be determined by the decision of the institution’s specialized commission. Uniform norms and criteria for making relevant decisions by the relevant commission, in order to eliminate possible doubts, should be established by the accounting policy of the institution. So, for example, if an institution purchases components to assemble them into one computer, then in this case it would be advisable to account for them as a single inventory item. If the specific use of computer components and technical characteristics require their separate accounting, then the current legislation does not limit the institution in this right. At the same time, any decision of the relevant commission must be justified and reasoned, and the approach to accounting for fixed assets that are used in the same way must be uniform. 2. Note that in the All-Russian Classifier OK 013-2021 (SNS 2021), adopted and put into effect by order of Rosstandart dated December 12, 2021 N 2021-st (hereinafter referred to as OKOF OK 013-2021 (SNS 2021)), there are separate codes for system There are no blocks or monitors. Therefore, if a government agency decides to account for these material assets as separate objects of fixed assets, then to determine OKOF codes it is necessary to refer to the direct and reverse transitional keys between the editions of OK 013-94 and OK 013-2021 (SNA 2021), approved by order Rosstandart dated April 21, 2021 N 458. Workstations (personal computers) in accordance with the old OKOF belonged to the group “Electronic computing equipment” (code 14 3020210). The provisions of OK 013-94 made it possible to identify the component parts of computers as separate objects of fixed assets, in particular: - a monitor could be classified as code 14 3020350 (information display devices); - the system unit could be classified as code 14 3020260 (processors, operating devices). However, the forward and reverse transition keys indicate that processors and operating devices (code 14 3020260) are no longer fixed assets for OKOF OK 013-2021 (SNS 2021), but information display devices (code 14 3020350) in OKOF OK 013-2021 (SNA 2021) belong to the subgroup “Computers, peripheral equipment” (code 320.26.2). At the same time, OKOF does not regulate the procedure for classifying objects as fixed assets, so it would be a wrong decision to be guided by its provisions when classifying property as fixed assets. If the relevant commission decides to account for monitors and system units separately, then the forward and reverse transition keys indicate that electronic computing technology (code 14 3020210) in OKOF OK 013-2021 (SNA 2021) is compared with code 330.28.23.23 “Machines” office others." Therefore, due to the absence of a code for system units in the new OKOF, these material assets can be attributed to code 330.28.23.23. According to the transition keys for monitors, code 320.26.2 “Computers, peripheral equipment” is proposed, but it is a grouping. A more detailed code, close in semantic meaning to monitors, may be code 320.26.30.23 “Other telephone devices, devices and equipment for transmitting and receiving speech, images or other data, including communication equipment for working in wired or wireless communication networks (for example, local and global networks)". This or that choice of code for a government institution should be fixed as part of the formation of accounting policies.

We recommend reading: Deprivation of benefits to labor veterans

Accounting for system units and monitors

When replacing components at the site where the computer is constantly used, do not draw up an acceptance certificate for repaired, reconstructed and modernized fixed assets (f. 0504103). But if you hand over the computer to the repair service of an institution or a contractor, draw up such a report.

The fact is that drawing up an act (f. 0504103) is mandatory to reflect the fact of acceptance (transfer) of the fixed asset from the customer to the contractor (Methodological instructions, approved by order of the Ministry of Finance dated March 30, 2021 No. 52n). That is, if you handed over the computer for repair to a contractor or to an institution’s repair service.

Accounting for computer equipment in a budgetary institution

Today it turned out that “funds were allocated only for 310.” Having found out what this is all about (since I am very far from accounting), I realized that I cannot purchase 90% of what was planned, because: 1. Components are MZ (Article 340) 2. Monitor - this is also MZ. 3. The projector is the MZ. .

Answer

: The monitor can be accounted for as an independent inventory item (according to the accounting policy), that is, as an independent fixed asset, and, accordingly, its acquisition must be reflected under article KOSGU 310.

Rebus Company

The number of PACs is determined by the number of classrooms at the rate of 1 PAC per 1 audience for the exam. One PACK includes: Name Qty USB Web camera Logitech 2 pcs.

— PC Intel Core i3, 2.93 GHz, 2 Gb RAM, 500 Gb HDD; - power cable; — monitor; - keyboard; - mouse; — UPS 1 pc.

It is worth noting that paragraph 45 of Instruction No. 157n does not mention all unified functioning systems that can be installed in a building, therefore it is advisable to define the general procedure for organizing the accounting of such systems in the accounting policy.

Replacing an old system unit with a new one in a public sector institution in accordance with the FSB

An inventory item may be recognized as a part of a property in relation to which the period of receipt of future economic benefits and useful potential can be determined. But the following conditions must be met:

If the accounting policy does not establish a procedure for accounting for the replacement of components of an OS object that have a significant cost, but writes off the cost of a broken system unit as an expense or, conversely, increases the cost of a computer by the cost of a new system unit without reducing the residual value of the failed part, then you can get a remark from the inspectors. Indeed, in such cases, the book value of the computer may be either underestimated or overestimated.

We recommend reading: How much is the minimum sick leave for pregnancy and childbirth in Novosibirsk 2021

Document storage

Storing a document only in electronic form is unacceptable and is a violation.

The form must be printed after filling it out and signed by the persons responsible for the material safety of the asset, as well as by the designated employee for filling out and maintaining inventory cards. Usually the only copy of the document is kept by the accounting staff. Even after the property is retired from use, the safety of inventory cards for them should be ensured for a period of five years.

Accounting for monitors and system units as separate inventory objects

Only those items that the computer can operate without and that meet the criteria for a fixed asset can be taken into account as separate fixed asset objects. For example, a printer - OKOF code 330.28.23.23 “Other office machines.” After all, the computer will work without it. As well as those components that the institution plans to operate as part of various sets of computer equipment. For example, if you plan to connect the monitor to different computers.

Institution - State Autonomous City of Moscow Information Technology Center. Is it possible to account for monitors and system units (SU) as separate inventory items of fixed assets. In practice, monitors or SBs are often changed due to production needs. Some workplaces have 1 SB and two monitors. There is no need to write them off; they are used at other workplaces.

Which depreciation group does a computer in the Russian Federation belong to in 2021?

If any structurally articulated object has several components (in particular parts) - OS, with different periods of use, each component is taken into account as a separate inventory object.

According to the Instructions, the definition of useful life period means the period during which it is possible to use, during the work of the organization, an object of non-financial assets for the purposes for which it was purchased, formed or received.

Purpose of the document

When an enterprise owns a significant amount of durable property, that is, the useful life of which is more than one year, then it is advisable to debug the process of accounting for the receipt of each such unit, reflect all movements within the location of the organization, control and ensure conditions for proper storage. For this purpose, individual inventory cards are issued for owned and leased objects.

Examples of application of articles 310 KOSGU and 340 KOSGU in 2021-2021

The costs of purchasing a switch are included in expense item KOSGU 310. The useful life of the switch is more than 12 months. In accordance with OKOF, the switch is included in the group “Communication equipment that performs the function of switching systems (OKOF code – 320.26.30.11.110).

A cartridge is a spare part for a printer, copier, or scanner, that is, a consumable item. Therefore, in accounting it must be reflected as part of inventory under article KOSGU 340. But services for replacing the cartridge are under expense item KOSGU 225.

Document header

The card includes several parts: a header and tables with information. So, at the very beginning of the document the following information is indicated:

organization-owner of the property (its full name, and in the right columns - the corresponding OKPO and OKOF codes), division- the name of the document itself, the date of preparation and its number

- about the property: its exact name, model, brand; manufacturing organization (manufacturer); place of use; all existing and assigned numbers (from the technical passport, inventory, factory); belonging to one or another depreciation group; dates – registration and disposal

If there are several structural divisions in the organization, then the card must indicate their coded meaning in the document columns intended for this.

How to write off a monitor

Correctly selected lighting is an integral factor in occupational health and safety. Rational lighting is created by achieving certain regulated parameters - optimal illumination, minimal glare, correct direction of light. All this influences the choice of types and quantities of lighting fixtures used in an institution.

But replacing individual computer elements with new ones due to obsolescence cannot be considered as computer repair and is its modernization. Therefore, for example, replacing an obsolete monitor with a new one is an upgrade.

Budget accounting of fixed assets in 2021-2021 (nuances)

To account for fixed assets, a synthetic account 010100000 “Fixed Assets” is provided. The budget accounting account number consists of 26 digits, and only 18–26 digits are used in the accounting of the institution. Depending on the group and type of fixed assets, as well as the essence of their movement, the code in the 22–26 digits changes in the account number.

In accordance with paragraph 21 of Order No. 157n, the concept of “budget accounting of fixed assets” applies only to certain government organizations. For example, government institutions, government agencies, extra-budgetary funds. In addition to the unified chart of accounts, a special chart of accounts must be used in budget accounting (Order of the Ministry of Finance of Russia dated December 6, 2021 No. 162n).

We recommend reading: Mortgage rate reduction at Sberbank for a family with children born in 2021

Details tables

Next, the card consists of partition tables and contains information about the object accepted for accounting:

- at the time of receipt or transfer (to be completed if the product has already been used previously) - section 1

- on the date of commencement of use in accounting: cost excluding VAT (if a payer of this tax); the planned number of months of use until disposal - are entered in the 2nd section

- on revaluation (may increase or decrease) – section 3

- on movement within the organization, change of responsible persons (indicating the number and date of orders, signatures, residual value) - section 4

If there are several owners, then below is provided background information on the ratio of ownership shares of each of them (as a percentage).

Which KVR and KOSGU to use for government procurement

Subsidies (grants in the form of subsidies) for financial support of expenses, the procedure (rules) for the provision of which do not establish requirements for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision

Subsidies (grants in the form of subsidies) for financial support of costs in connection with the production (sale of goods), performance of work, provision of services, the procedure (rules) for the provision of which establishes a requirement for subsequent confirmation of their use in accordance with the conditions and (or) purposes of the provision

Purchase of a System Unit in Kosgu 2021 for Budgetary Institutions

Doubts often arise when choosing between 225 and 310 KOSGU (between repair and modernization (reconstruction, retrofitting), as well as between 225 and 226 KOSGU. Why such difficulties arise and how an accountant can “get away with it”, let’s look at the example of work situations.

Since KVR is a larger grouping than KOSGU, to simplify the application of the corresponding codes, the Ministry of Finance has approved a correspondence table. A comparison of CVR codes and KOSGU codes for 2021 for budgetary institutions and public sector organizations is presented in a table. The document contains the latest changes that should apply in 2021.

KOSGU presents an option for grouping operations that are carried out by government agencies in accordance with their economic essence.

Sections of the reverse side of the OS-6 form

On the reverse side of the OS-6 form, sections must be completed (see Table 1).

| Section number | Description |

| № 5 | Information about the operations carried out that affected the initial cost (date and number of the order; type of action - additional equipment, modernization, partial disposal, reconstruction; amount of expenses incurred) |

| № 6 | Expenses for repairs, for maintaining the used facility in working condition (information is entered from the OS-3 form) |

| № 7 | Special distinctive components of the instrument of labor, additional significant attachments, as well as the content of special materials (precious or semi-precious items) in its configuration |

Columns 8-14 of the final table of the card reflect information on the presence of special structural elements as a whole, their quantity and distinctive quality.

Video about correcting errors in the form:

At the bottom is a signature with a transcript and an indication of the position of the person responsible for maintaining, the accuracy of the information displayed on the card and moving OS objects (changing primary data) within the company.

Computer in budget accounting

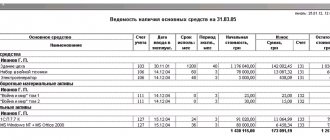

The federal government agency has a large fleet of computer equipment. Some personal computers are accounted for in budget accounting registers as a single fixed asset object. In addition, system units and monitors are taken into account on the institution’s balance sheet as separate independent objects of fixed assets.

A similar position is confirmed by the Letter of the Ministry of Finance of Russia dated October 21, 2021 No. 02-14-10a/ 2902. From recent documents, you can use the Letter of the Treasury of the Russian Federation dated June 27, 2021 No. 42-7.1-15/2.2-265 “On the application of the budget classification of the Russian Federation in reflection of cash expenses for the modernization of fixed assets.”

HOW TO CORRECTLY ACCOUNT SYSTEM UNITS AND MONITORS

In accordance with paragraphs 10 and 11 of Order No. 91n of the Ministry of Finance of Russia dated October 13, 2021 “On approval of guidelines for accounting of fixed assets,” if one object has several parts that have different useful lives, each such part is accounted for as an independent object. According to the technical characteristics (including obsolescence factors), when purchasing electronic equipment (system unit, monitor, keyboard, mice), the institution took them into account as independent objects and assigned a separate inventory number to the monitor and system unit.

In this case, only part of the document is provided for familiarization and avoidance of plagiarism of our work. To gain access to the full and free resources of the portal, you just need to register and log in. It is convenient to work in extended mode with access to paid portal resources, according to the price list.

Tell me, on which subaccount should I put mice, flash drives, and keyboards? on or

Of course, it is more profitable to take these objects into account separately. The fact is that the rules of accounting and tax accounting allow you to immediately write off as expenses objects with an initial cost of no more than 40 thousand rubles (clause 18 of PBU 6/01 “Accounting for fixed assets”, subclause 3 of clause 1 of Article 254 of the Tax Code of the Russian Federation) .

The Tax Code does not clearly formulate the requirements for accounting for fixed assets. But from the Classification of fixed assets included in depreciation groups, we can conclude that the computer should be accounted for as one object. But you can avoid unnecessary disputes. To do this, it is necessary to consolidate in the accounting policy, based on the requirements of rational accounting and the specifics of the work, a decision on the minimum set of basic elements and peripheral devices that you need. You may decide that the necessary complex for you is a system unit, an operating system, a monitor and a keyboard. Or, for ease of accounting, select monitors separately.

Replacing a monitor in a budget or autonomous institution

In fact, with the usual replacement of, for example, a monitor, the functional purpose, quality use and economic characteristics of the computer practically do not change, which does not fully correspond to the concept of modernization defined by the financial department. In any case, the qualification of operations performed by the institution (modernization, repairs) must be carried out by the institution independently.

The operation of replacing a broken and inoperative monitor should be considered as a repair of computer equipment, the costs of which do not increase its original cost. Accordingly, the cost of spare parts used in the repair process is written off to the institution’s expense accounts (accounts 0 109 60 000, 0 109 70 000, 0 109 80 000, 0 109 90 000, 0 401 20 000) using code 272 “Consumption of inventories” » KOSGU. If repair work is carried out by a third-party organization, then the costs of paying for its services are also taken into account in expense accounts, but according to code 225 “Works, services for property maintenance” of KOSGU. Similar rules apply to other parts of computer technology (for example, network cards, CD or DVD drives, motherboards, etc.).

KVR and KOSGU in 2021 for budgetary institutions

Also, in the practice of procurement for several CWR, issues arise with the correct reflection of codes, which is determined by the use of classification. For this case, 34-36 digits of the procurement identification code are formed in a special way: 34-36 digits are set to “0” if these expenses are subject to reflection across several CWR.

Since 2021, KOSGU is not used by recipients of funds when forming plans for income and expenses, but is used in accounting and reporting. In 2021, it is required to apply it to public sector institutions and organizations when drawing up a working chart of accounts, maintaining records and reporting. The procedure for approving the chart of accounts for budget accounting is enshrined in Order of the Ministry of Finance No. 162n (as amended on March 31, 2021).

Inventory card form

It is allowed not to have individual inventory cards for objects of the library collection and property whose value does not exceed three thousand rubles. The forms of acts for writing off fixed assets for budgetary institutions are regulated by Order of the Ministry of Finance No. 52n (dated March 30, 2015). If eliminated:

- vehicle, then form 0504105 is used

- printed publications – 0504144

- soft (or household) equipment – 0504143

- other property (not a vehicle) – 0504104

This document is approved directly by the head of the institution. As a rule, additional approval is required from higher authorities controlling the activities.

Only after receiving a properly executed protocol and write-off act does the accountant have the right to begin entering information into the inventory card and removing fixed assets from the balance sheet.

Thus, there is no legal obligation at the legislative level to use a card for asset accounting for commercial enterprises. But maintaining this document will significantly simplify the procedure for rational ownership of property and promptly monitor the need to update existing long-term labor tools. The most complete information is provided in the OS-6 form, which the organization has the right to modify and use at its own discretion, subject to the requirement that the form contains all mandatory details. For state-supported institutions, there are specific features in accounting for fixed assets and its documentation.

Top

Write your question in the form below