We hope that everyone already knows about the Decree of the Government of the Russian Federation of April 24, 2021. No. 576, according to which enterprises and individual entrepreneurs that meet the requirements of the Resolution are provided with free grants allocated from the country’s federal budget.

Now let’s look at how the subsidy is reflected in the 1C software product: Enterprise Accounting 8th edition. 3.0 using the example of different taxation systems.

How to keep records when receiving a subsidy

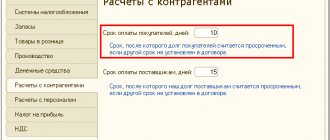

According to clause 1 of Article 346.17 of the Tax Code of the Russian Federation, subsidies for the first two years in “simplified terms” are reflected in income in proportion to the expenses actually incurred through subsidies.

If at the end of the second year the amount of the subsidy exceeds the amount of recognized expenses, then the difference in full is reflected in the income of this tax period.

This procedure for recognizing income is used by taxpayers who use “Income minus expenses” as an object, as well as for the object “Revenue”, provided that they keep records of payment amounts.

Thus, these incomes should appear in KUDiR (column 4) in the amount of expenses incurred from them (column 5). The amounts will be the same. This will be the accounting of subsidies.

Those taxpayers who use “Income minus expenses” make expenses for the first two years and immediately display KUDiR income. If you have not spent the entire subsidy in two years and have a balance, then in the third year you include the subsidy as income, regardless of the expense.

Regulatory regulation

Subsidies received from the federal budget in connection with the spread of COVID-19 (Resolutions of the Government of the Russian Federation dated April 24, 2020 N 576, dated May 12, 2020 N 658) by taxpayers included as of March 1, 2020 in the register of SMEs from affected industries are reflected in the following order:

- the amounts of subsidies are not taken into account in income for profit tax purposes (clause 60, clause 1, article 251 of the Tax Code of the Russian Federation);

- VAT is deductible on expenses incurred due to such subsidies (clause 2.1, clause 6, clause 3, Article 170 of the Tax Code of the Russian Federation);

- expenses incurred through subsidies specified in paragraphs. 60 clause 1 art. 251 of the Tax Code of the Russian Federation are not recognized for profit tax purposes (clause 48.26 of Article 270 of the Tax Code of the Russian Federation).

Read more How to get help for small businesses from the state due to coronavirus

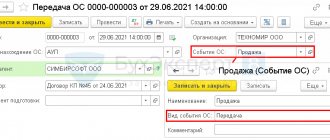

How to receive a subsidy in 1C 8.3

Step 1. Received a subsidy for the purchase of materials

There may be different options with methodology; according to the chart of accounts, you can provide your own methodology. For example:

- A subsidy was received on the current account: posting Dt 51 Kt 76.09. Executed by the document “Receipt for settlement”, type of operation “Other receipts”;

- Subsidy calculation: posting Dt 76.09 Kt 86.01. Documented in the document “Operation entered manually.” At the same time, as much as was received was accrued according to the CT account 86.01.

Step 2. Purchased materials

Receipt of materials: posting Dt 10.01 Kt 60.01. It is drawn up with the document “Receipt (act, invoice)”. At the same time, an entry is made in the “STS Expenses” register.

Step 3. Transferred funds to the supplier

Money was transferred to the supplier for materials: posting Dt 60.01 Kt 51. Documented in the document “Write-off from the current account” with the type of transaction “Payment to the supplier”. And at this moment, after the transfer, there is an expense to KUDiR in the amount of the cost of purchased materials and input VAT.

Step 4. Income is recognized in the amount of expenses incurred

When an expense appears, it is necessary to simultaneously record income in the Income and Expense Book. Recognize income in accounting by posting Dt 86.01 Kt 91.01 with the document “Operation entered manually” and make an entry in KUDiR manually:

In other words, as much is reflected in the expense, you manually include this document in income. And so it was exactly for the first two years. This will be “keeping records of subsidy amounts,” that is, income is equal to expenses.

On the PROFBUKH8 website you can find other free articles and video tutorials on the 1C Accounting 8.3 configuration.

The features of the simplified taxation system, the capabilities of the 1C 8.3 program when applying the simplified tax system and how to avoid errors in accounting under the simplified tax system are discussed in our master class, where you can understand and understand how the legal requirements for the simplified tax system should be reflected in the 1C 8.3 Accounting program .

Give your rating to this article: (

4 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Who can receive a subsidy for coronavirus prevention activities?

Subsidies are provided to small and medium-sized businesses (SMEs), as well as socially oriented non-profit organizations operating in sectors of the economy that require support for coronavirus prevention measures in 2021.

The subsidy is provided one-time and free of charge. Organizations and individual entrepreneurs (IEs) can use the subsidy for any expenses related to coronavirus prevention measures.

Subsidy for coronavirus prevention and disinfection: how to get it and where to spend it

There is no control over the direction of spending the subsidy; no reports on the expenditure of funds are provided.

Operations with targeted capital subsidies

Budgetary (autonomous) institutions reflect transactions with these subsidies in the following order*(2):

1. Debit KDB1 5,205 62,561 Credit KDB1 5,401 40,162 - accrual of deferred income for targeted capital subsidies in the amount of the Agreement. 2. Debit KBK2 5,201 11,510 (increase in account 17, analytics code 150, KOSGU 162) Credit KDB1 5,205 62,661 - reflects the receipt of a capital subsidy. 3. Debit KDB1 5,401 40,162 Credit KDB1 5,401 10,162 - recognition of income in the form of a targeted capital subsidy as current year income based on information about the achievement of the conditions for the provision of a subsidy (Notice, Report, other document provided for by the Agreement). 4. Debit KDB1 5,401 40,162 Credit KDB1 5,205 62,661 - decrease in deferred income for targeted capital subsidies based on the amended Agreement and (or) additional Agreement. 5. Formation at the end of the year of settlements for capital subsidies on the basis of the Notice, Report on the fulfillment of the terms of the Agreement (transactions are reflected on the last day of the reporting year, unless otherwise provided by the founder): 5.1. Debit KDB1 5 401 40 162 Credit KBK3 5 303 05 731 - closing settlements in the amount of unused balances of targeted capital subsidies subject to return to the budget in the next year. 5.2. Debit KDB1 5,401 40,162 Credit KDB1 5,205 62,661 - closing settlements in the amount of unused financial support for the subsidy, if it was not transferred to the institution. 5.3. Debit KDB1 5,401 40,162 Credit KDB4 5,303 05,731 - formation of settlements for the unused balance in the presence of obligations assumed at the expense of it and unfulfilled (the need to confirm the need for these funds). When confirming the need, the following entry is reflected: Debit KDB4 5,303 05,831 Credit KDB1 5,401 40,162 5.4. If settlements with the founder under the subsidy are “closed” completely, but the institution still has accounts payable accepted at the expense of the subsidy funds (accepted and unfulfilled monetary obligations), then there is no need to record additional entries. The balance of funds in the personal account in the next year will be used to repay the accepted monetary obligation. 5.5. If, due to a targeted capital subsidy, an advance was paid that was not confirmed by the counterparty’s documents for the reporting year, then the difference between the indicators Dt 5,205,62,000 and Kt 5,401,40,162 is equal to this advance. If a decision is made to return (not confirming the intended nature of the accepted monetary obligations), the operation specified in clause 5.1 is reflected in the next financial year. 6. Debit KBK3 5 303 05 831 Credit KBK2 5 201 11 510 (increase in account 18, analytics code 610, KOSGU 610) - return of the unused balance of the targeted capital subsidy of previous years.

More on the topic: Coronavirus: the reason for the cancellation of business trips and events in budgetary institutions

How to indicate receipt of a subsidy for an enterprise and individual entrepreneur on OSNO?

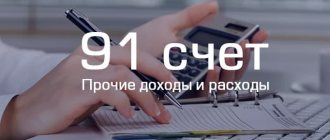

In accordance with the Regulations on accounting. According to accounting 13/2000, budget money allocated in the prescribed manner to finance expenses incurred by the company in previous reporting periods is allocated to increase the financial result of the organization. This means that receipt of funds from the state to pay salaries must be reflected as 91.01 “Other income”. Article 251 of the current tax legislation of Russia “Income not taken into account when determining the tax base” states that such income includes subsidies allocated from the federal budget due to the unfavorable situation caused by the spread of a dangerous virus. Then for account 91.01 you will need to create an expense item that would include the subsidy among other income in the accounting book. accounting and did not show it in the tax office. Let's go to the "Directories" category and click "Other income and expenses." In the tab that opens, click “Create” and enter the name “Subsidy from the federal budget.” In the “Type of article” field, you must select “Compensation for losses receivable (payable)” and clear the “Accepted for tax accounting” flag.

Then we will enter the document “Receipt to the current account” in the “Bank and cash desk” - “Bank statements” tab. In the completed document “Type of operation” you need to select “Other receipt”. In the “Settlement account” tab, indicate 91.01, as well as the previously created subaccount “Subsidy from the federal budget.”

The posted document will make the following entries:

The money received can be spent on costs associated with paying salaries or other urgent needs. For example, pay debts for utilities, rent and other important expenses. To reflect these expenses, you will need to enter a new expense item in the “References” - “Cost Items” category. In this case, “Type of expense”, based on Article 217 of the tax legislation, should refer to the item “Not taken into account for tax purposes.”

If you decide to send a subsidy to pay employees salaries, you will need to go to the “Salaries and Personnel” tab, then click “Salary Settings” and click “Salary Accounting Methods”. In the provided tab, you will need to make a new reflection on the expense account with the subconto “Costs made through subsidies.”

After you save the reflection, go back to the salary settings and go to the “Accruals” link. Here it is necessary to introduce a new charge, which is subject to insurance premiums and income tax. However, the “Method of Reflection” will be related to the money allocated by the government.

Next, let's calculate the salary. To do this, in the “Salaries and Personnel” tab, click “All accruals”, select “Create” and select “Salary accruals” from the list that opens. We indicate the period (namely the month) in which the funds will be credited and click on the “Fill” button. Then you need to click on the accrued amount that will be paid through the subsidy.

Next, you need to adjust the reflection of the previously issued accrual, dividing the amount into money received from the state and the company’s usual expenses for paying salaries.

When making an accrual, the amount of federal funds spent will be indicated in the accounting record. accounting and will not contribute to the growth of taxable profits.

Return of subsidies

An important feature of the use of subsidy funds is the company’s obligation to spend them strictly for their intended purpose, strictly observing the agreed terms of provision. The legislation does not provide for any alternative options; if it is impossible to implement projects for which a budget subsidy was received, the funds received will have to be returned. The return of the subsidy is carried out depending on the method of recording the funds received and the moment the obligation to return the funds arises.

If the subsidy is returned in the year of its receipt, then the company only needs to reverse the entries that accompanied its receipt (except for D/t 51 K/t 76) and use. At the time of actual transfer of the returned subsidy, a reverse accounting entry is made - D/t 76 K/t 51.

Refunds of subsidies received in previous years are processed as follows:

| Operations | D/t | K/t |

| By capital investment | ||

| The debt to repay the subsidy is reflected | 86 | 76 |

| Subsidy funds were restored in the amount of accrued depreciation | 91/2 | 86 |

| The subsidy amount has been restored | 98/2 | 86 |

| At current costs | ||

| Debt to repay previously provided subsidies | 86 | 76 |

| The amount of the subsidy was restored to the amount of actual expenses incurred. | 91/2 | 86 |

Operations with targeted subsidies of a current nature

Budgetary (autonomous) institutions reflect transactions with these subsidies as follows*(2):

1. Debit KDB1 5,205 52,561 Credit KDB1 5,401 40,152 - accrual of future income for targeted subsidies in the amount of the Agreement. 2. Debit KBK2 5,201 11,510 (increase in account 17, analytics code 150, KOSGU 152) Credit KDB1 5,205 52,661 - reflects the receipt of a current subsidy. 3. Debit KDB1 5,401 40,152 Credit KDB1 5,401 10,152 - recognition of income in the form of a targeted subsidy as current year income based on information about the achievement of the conditions for the provision of a subsidy (Notice, Report, other document provided for by the Agreement). 4. Debit KDB1 5,401 40,152 Credit KDB1 5,205 52,661 - decrease in deferred income for targeted subsidies based on the amended Agreement and (or) additional Agreement. 5. Formation of subsidy payments at the end of the year on the basis of the Notice, Report on the fulfillment of the terms of the Agreement (transactions are reflected on the last day of the reporting year, unless otherwise provided by the founder): 5.1. Debit KDB1 5 401 40 152 Credit KBK3 5 303 05 731 - closing settlements in the amount of unused balances of targeted subsidies of a current nature, subject to return to the budget in the next year. 5.2. Debit KDB1 5,401 40,152 Credit KDB1 5,205 52,661 - closing settlements in the amount of unused financial support for the subsidy, if it was not transferred to the institution. 5.3. Debit KDB1 5,401 40,152 Credit KDB4 5,303 05,731 - formation of settlements for the unused balance in the presence of obligations assumed at the expense of it and unfulfilled (the need to confirm the need for these funds). When confirming the need, the following entry is reflected: Debit KDB4 5,303 05,831 Credit KDB1 5,401 40,152. 5.4. If settlements with the founder under the subsidy are “closed” completely, but the institution still has accounts payable accepted at the expense of the subsidy funds (accepted and unfulfilled monetary obligations), then there is no need to record additional entries. The balance of funds in the personal account in the next year will be used to repay the accepted monetary obligation. 5.5. If, at the expense of a targeted subsidy, an advance was paid that was not confirmed by the counterparty’s documents for the reporting year, then the difference between the indicators Dt 5,205,52,000 and Kt 5,401,40,152 is equal to this advance. If a decision is made to return (not confirming the intended nature of the accepted monetary obligations), the operation specified in clause 5.1 is reflected in the next financial year. 6. Debit KBK3 5 303 05 831 Credit KBK2 5 201 11 510 (increase in account 18, analytics code 610, KOSGU 610) - return of the unused balance of the targeted subsidy of a current nature from previous years.