Lines 010–060 Income and expenses. Profit

On lines 010–050, indicate income and expenses on the basis of which the profit received or loss incurred is calculated. Do not record earmarked receipts and other non-taxable income here, as well as expenses associated with these incomes.

On line 010, indicate income from sales. Transfer this amount from line 040 of Appendix 1 to sheet 02. Do not include in it the income reflected in sheets 05 and 06.

To line 020, transfer the amount of non-operating income from line 100 of Appendix 1 to sheet 02.

To line 030, transfer the amount of expenses associated with production and sales from line 130 of Appendix 2 to sheet 02. Do not include in this amount the expenses reflected in sheets 05 and 06.

Transfer the amount of non-operating expenses and losses to line 040:

- from line 200 of Appendix 2 to sheet 02;

- from line 300 of Appendix 2 to sheet 02.

To line 050, transfer the amount of losses from line 360 of Appendix 3 to sheet 02. Do not include losses reflected in sheets 05 and 06 in this amount.

Calculate the total profit (loss) for line 060:

| page 060 | = | page 010 | + | page 020 | – | page 030 | – | page 040 | + | page 050 |

If the result is negative, that is, the organization suffered a loss, enter the amount with a minus on line 060.

Lines 100–130 Tax base

For line 100, calculate the tax base using the formula:

| page 100 | = | page 060 | – | page 070 | – | page 080 | – | page 090 | – | Page 400 appendix 2 to sheet 02 | + | page 100 sheets 05 | + | page 530 sheet 06 |

Indicate negative results with a minus sign.

On line 110, indicate losses from previous years. For more information about this, see How to take into account losses of previous years for income taxes.

On line 120, calculate the tax base for calculating tax using the formula:

| page 120 | = | page 100 | – | page 110 |

If there is a negative amount on line 100, enter zero on line 120.

Fill in line 130 if the organization applies regional benefits in the form of a reduced income tax rate. In this case, indicate separately on the line the tax base in respect of which the reduced tax rate is applied.

If the organization is engaged only in preferential activities, line 130 will be equal to line 120.

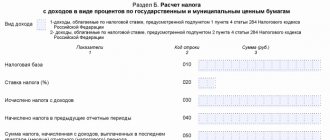

Lines 140–170 Tax rates

On line 140, indicate the income tax rate.

If the declaration is submitted by an organization with separate divisions, put dashes on line 140 and indicate only the federal income tax rate on line 150.

On line 150, indicate:

- federal income tax rate. For example, for a standard rate of 2 percent, enter “2–.0–”;

- or a special income tax rate, if the organization applies exactly that. This is explained by the fact that the tax calculated at special rates is completely transferred to the federal budget (clause 6 of Article 284 of the Tax Code of the Russian Federation).

On line 160, indicate the regional income tax rate. For example, for a standard rate of 18 percent, enter "18.0-."

If the organization applies regional benefits in the form of a reduced income tax rate, indicate the reduced regional tax rate on line 170.

Possible violations and fines

In addition to punishment for incorrect filing of returns, tax authorities fine for late submission of quarterly or monthly reports. In this case, organizations face a fine under Art. 126 of the Tax Code of the Russian Federation (200 rubles) and sanctions are possible under Art. 15.5 and 15.6 Code of Administrative Offenses of the Russian Federation (up to 500 rubles or a warning

for officials). As for the annual report, failure to submit it or submitting it late will result in punishment under Art. 119 of the Tax Code of the Russian Federation (up to 30% of the unpaid tax amount, and if there is no debt - min. 1000 rubles).

Lines 180–200 Tax amount

On line 190, calculate the income tax paid to the federal budget using the formula:

| page 190 | = | page 120 | × | page 150 | : | 100 |

On line 200, calculate the income tax paid to the regional budget using the formula:

| page 200 | = | (page 120 – page 130) | × | page 160 | : | 100 | + | page 130 | × | page 170 | : | 100 |

If the organization has separate divisions, form the line 200 indicator taking into account the tax amounts for the divisions indicated on lines 070 of Appendix 5 to Sheet 02.

On line 180, calculate the total amount of income tax using the formula:

| page 180 | = | page 190 | + | page 200 |

Example

The taxable profit of the Organization based on the results of the first half of the year amounted to 2,800,000 rubles. The declaration for the first quarter of the current period indicates advance payments payable in the second quarter - 200,000 rubles, including:

- to the federal budget - 30,000 rubles;

- to the regional budget - 170,000 rubles.

For the first half of the year, a trading fee in the amount of 60,000 rubles was accrued and transferred to the budget.

It is necessary to calculate the tax payable for the first half of the year and monthly advance payments for the third quarter.

Lines 210–230 Advance payments

On lines 210–230, indicate the amounts of advance payments:

- on line 220 - to the federal budget;

- on line 230 - to the budget of the constituent entity of the Russian Federation.

When filling out the lines, follow clause 5.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Lines 210–230 of sheet 02 of the income tax return reflect accrued advance payments. The indicators of these lines do not depend either on the amount of actual profit (loss) at the end of the reporting period, or on the amounts of advance payments for income tax actually transferred to the budget. However, they are affected by how the organization pays income tax: monthly or quarterly.

Organizations that pay tax monthly based on the profit of the previous quarter indicate in these lines:

- the amount of advance payments on the declaration for the previous reporting period (if it is included in the current tax period);

- the amount of advance payments to be transferred no later than the 28th day of each month of the last quarter of the reporting period (IV quarter of last year (if the declaration is submitted for the 1st quarter of the current year)).

Situation: how to fill out lines 210–230 in the half-year income tax return? Starting from the second quarter, the organization switched from monthly advance payments to quarterly ones.

In lines 210–230, enter the data from lines 180–200 of the declaration for the first quarter.

In lines 210–230, organizations that transfer advance payments to the budget quarterly indicate the amount of advance payments for the previous quarter. And these are the amounts that were in lines 180–200 in the previous declaration. The exception is the declaration for the first quarter, in which these lines are not filled out. This is provided for in clause 5.8 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Let us explain why from the declaration for the first quarter it is necessary to take data from lines 180–200, and not lines 290–310 of sheet 02 and subsection 1.2, where accrued monthly advances are usually reflected.

The fact is that based on the results of the first quarter, it is already possible to draw a conclusion: from the second quarter, an organization has the right to switch from monthly payments to quarterly payments or not. To do this, you need to estimate the volume of revenue for the previous four quarters - in the situation under consideration, for the 2nd–4th quarters of last year and for the 1st quarter of the current year. And if sales revenues do not exceed an average of 15 million rubles. for each quarter, then you no longer need to pay monthly advances. That is, in the declaration for the first quarter there is no need to fill out lines 290–310.

In the half-year declaration, when determining the amount of tax to be paid additionally (lines 270–271) or reduced (lines 280–281), it is necessary to take into account the indicators of lines 180–200 of the declaration for the first quarter (paragraph 4 of clause 5.8 of the Procedure approved by the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600). At the same time, the amount of monthly advance payments accrued during the first quarter (lines 210–230) cannot be reflected in the half-year declaration. Even if there is an overpayment on your personal account card due to these payments based on the results of the first quarter, it can be compensated. To do this, at the end of the six months, it is enough to transfer to the budget not the entire amount reflected in lines 180–200, but the difference minus the overpayment resulting from the results of the first quarter.

Determine the balance of settlements with the budget in the half-year declaration using the formula:

| The amount of income tax to be paid additionally (reduced) based on the results of the six months | = | Tax base for half a year | × | Tax rate | – | The amount of the advance payment accrued for the 1st quarter (lines 180–200 of the declaration for the 1st quarter) |

If for some reason in the declaration for the first quarter the accountant declared monthly advance payments for the second quarter (filled out lines 290–310 of sheet 02 and subsection 1.2 in the declaration), then the tax inspectorate will expect the organization to pay them. In order for the inspector to reverse the accruals in the personal account card on time, inform him about the transition to quarterly payment of advances.

This follows from paragraphs 2–3 of Article 286 of the Tax Code of the Russian Federation and paragraph 5.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

See examples of filling out a half-year income tax return when switching from monthly advance payments based on the profit for the previous quarter to quarterly transfer of advance payments, if:

- based on the results of the first quarter, the organization made a profit;

- According to the results of the first quarter, the organization suffered a loss.

Organizations that pay tax monthly based on the actual profit received or quarterly indicate on lines 210–230 the amount of advance payments on the declaration for the previous reporting period (if it is included in the current tax period). That is, the data on these lines must correspond to the indicators on lines 180–200 of the previous declaration. In the declaration for the first reporting period, lines 210–230 are not filled in.

In addition, regardless of the frequency of tax payment, on lines 210–230, indicate the amount of advance payments additionally accrued (reduced) based on the results of a desk audit of the declaration for the previous reporting period. Provided that the results of this audit are taken into account by the organization in the current reporting (tax) period.

For organizations that have separate divisions, the amount of advance payments accrued to regional budgets for the organization as a whole should be equal to the sum of the indicators in lines 080 of Appendix 5 to Sheet 02 for each separate division (for a group of separate divisions located on the territory of one subject of the Russian Federation) , as well as at the head office of the organization.

This follows from the provisions of paragraph 5.8 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Situation: how to fill out lines 180–210 of sheet 2 in the annual income tax return? From the fourth quarter, the organization switched from quarterly to monthly tax payments.

On line 180, indicate the total amount of income tax accrued for the year. In line 210, enter the sum of lines 180 and 290 of sheet 02 of the declaration for nine months of this year.

The organization's transition to monthly payment of tax does not affect the completion of these lines. The fact is that the income tax return only needs to reflect the accrual of tax and advance payments. Actual settlements with the budget (in particular, the order of transfer and the amount of transferred advance payments) are not shown in the declaration.

Therefore, fill out lines 180–200 in the general order:

- on line 180, indicate the total amount of income tax;

- on line 190 (200) - income tax paid to the federal (regional) budget.

This procedure is provided for in clause 5.7 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

On lines 210–230, indicate the total amount of advance payments:

- accrued for nine months. In this case, these are the amounts indicated on lines 180–200 of the declaration for nine months;

- declared for payment in the fourth quarter. These are the amounts indicated on lines 290–310 of the declaration for nine months.

Important: since from the fourth quarter the organization switched from quarterly to monthly payment of tax, in the declaration for nine months it was necessary to declare the amount of monthly advance payments for the fourth quarter. If for some reason you did not do this, fill out and submit an updated declaration nine months in advance.

This procedure follows from the provisions of paragraph 5.8 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

If the amount of accrued advance payments exceeds the amount of tax calculated at the end of the next reporting (tax) period, the resulting overpayment of tax is reflected on lines 280–281 of sheet 02. These lines show the final balances for settlements with budgets in the form of amounts to be reduced (clause 5.10 of the procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600).

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated March 14, 2013 No. ED-4-3/4320.

See examples of how advance tax payments should be reflected in the income tax return if:

- The organization transfers advance payments monthly based on actual profits. During the year, the amount of taxable profit decreases;

- The organization transfers advance payments monthly based on the profit received in the previous quarter. During the year, the amount of taxable profit decreases:

- The organization makes advance payments quarterly. During the year, the amount of taxable profit decreases, but there is no loss.

Calculation of advance payments during reorganization and when changing the payment procedure

In the event of a reorganization of a taxpayer, during which another legal entity is merged with it, the amount of the monthly advance payment on the date of reorganization is calculated without taking into account the performance indicators of the merging organization (letter of the Ministry of Finance of Russia dated July 28, 2008 No. 03-03-06/1/431).

If a taxpayer changes the procedure for calculating advances, moving from monthly determination of them from actual profit to monthly payments calculated quarterly, then this can only be done from the beginning of the new year (paragraph 8, paragraph 2, article 286 of the Tax Code of the Russian Federation), notifying the Federal Tax Service no later than 31 December of the year preceding the change. The amount of the monthly payment that will have to be paid in the first quarter, in this case, will be determined as 1/3 of the difference between the amount of the advance calculated based on the results of 9 months and the amount of the advance payment received based on the results of the half-year in the previous year (paragraph 10 p. 2 Article 286 of the Tax Code of the Russian Federation).

To learn about the timing of advance payments, read the article “What is the procedure and deadlines for paying income tax (postings)?”.

Lines 240–260 Tax outside the Russian Federation

On lines 240–260, indicate the amounts of foreign tax paid (withheld) outside Russia in the reporting period according to the rules of foreign countries. These amounts are offset against tax payments in Russia in accordance with the procedure established by Article 311 of the Tax Code of the Russian Federation.

Separately reflect the amount included in the tax payment:

- to the federal budget - on line 250;

- to the budget of a constituent entity of the Russian Federation - on line 260.

On line 240, calculate the total amount of creditable tax using the formula:

| page 240 | = | page 250 | + | page 260 |

Lines 270–281 Tax to be paid additionally or reduced

Using lines 270–281, calculate the amount of tax to be paid additionally or reduced.

On line 270, calculate the amount of tax to be paid additionally to the federal budget:

| page 270 | = | page 190 | – | page 220 | – | page 250 |

On line 271 - additional payment to the regional budget:

| page 271 | = | page 200 | – | page 230 | – | page 260 |

If the results are zero, put zeros on lines 270 and 271.

If you get negative amounts, put dashes on these lines and calculate the amount of tax to be reduced.

On line 280, calculate the amount of tax to be reduced to the federal budget:

| page 280 | = | page 220 | + | page 250 | – | page 190 |

On line 281 - the amount to be reduced to the regional budget:

| page 281 | = | page 230 | + | page 260 | – | page 200 |

Lines 290–340 Monthly Advance Payments

Fill in lines 290–310 if the organization transfers income tax monthly based on the profit received in the previous quarter. However, do not fill out these lines in your annual declaration.

For organizations that do not have separate divisions, the advance payment to the federal budget (line 300) is calculated using the formula:

| page 300 | = | page 190 sheet 02 for the current reporting period | – | page 190 sheet 02 for the previous reporting period |

For information on the specifics of calculating tax and filling out declarations for organizations that have separate divisions, see How to pay income tax if an organization has separate divisions and How to draw up and submit an income tax return if an organization has separate divisions.

Calculate the advance payment to the regional budget on line 310 using the formula:

| page 310 | = | page 200 sheet 02 for the current reporting period | – | page 200 sheet 02 for the previous reporting period |

Calculate the total amount of monthly advance payments on line 290 using the formula:

| page 290 | = | page 300 | + | page 310 |

If the amounts are negative or equal to zero, there is no need to transfer advance payments.

Complete lines 320–340 if the organization:

- transfers income tax monthly based on the profit received in the previous quarter.

- Fill out these lines only in the declaration for nine months;

- transfers income tax monthly based on actual profit. Fill out these lines in the declaration for 11 months if the organization plans to pay tax monthly starting next year based on the profit received in the previous quarter.

For these lines, indicate the amounts of advance payments that will be paid in the first quarter of the next year:

- to the federal budget - on line 330;

- to the regional budget - on line 340.

Calculate the total amount of monthly advance payments on line 320 using the formula:

| page 320 | = | page 330 | + | page 340 |

Subsection 1.1

In Section 1, Subsection 1.1 is not filled in:

- non-profit organizations that do not have an obligation to pay income tax;

- organizations are tax agents that are not payers of income tax and submit declarations with location codes 231 or 235.

In the “OKTMO code” field, indicate the code of the territory in which the organization is registered. This code can be determined using the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st, or on the website of the Federal Tax Service of Russia (indicating the inspection code).

In the cells on the right that remain empty, put dashes.

On line 030, indicate the budget classification code (BCC), by which the organization must transfer tax to the federal budget, and on line 060, indicate BCC for transferring tax to the regional budget. It is convenient to determine these codes using a lookup table.

In line 040, transfer the amount of tax to be paid additionally to the federal budget from line 270 of sheet 02.

To line 050, transfer the amount of federal tax to be reduced from line 280 of sheet 02.

In line 070, transfer the amount of tax to be paid additionally to the regional budget from line 271 of sheet 02.

In line 080, transfer the amount of regional tax to be reduced to the regional budget from line 281 of sheet 02.

Declarations and calculations for other taxes

Let's talk about taxes that must be paid regardless of the taxation system used. If a business entity is recognized as a tax payer, it is obliged to pay it and report on it.

Some taxpayers (commission agents, agents, forwarders, developers) have an obligation to submit to the tax office a log of invoices received and issued.

Based on the results of the 4th quarter of 2021, the journal in the established form must be submitted by 01/21/2019.

Features of reflecting trade fees

The form, electronic format of the income tax declaration, as well as the Procedure for filling it out, approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, do not provide for the possibility of reflecting the paid trade tax. Before making changes to these documents, the tax service recommends doing the following.

Indicate the amount of the paid trade tax on lines 240 and 260 of sheet 02 of the declaration. Do this in the same way as when reporting tax paid (withheld) abroad that is offset against income taxes. In this case, the amount of trade duty and tax paid abroad reflected in the declaration cannot exceed the amount of tax (advance payment) that is subject to credit to the regional budget (line 200 of sheet 02). That is

| Page 260 sheets 02 | <= | Page 200 sheets 02 |

In addition, when filling out line 230 of sheet 02, reduce the amount of accrued advance payments by the amount of the trade fee reflected in the tax return for the previous reporting period. That is

| Page 230 sheets 02 of the declaration for the current reporting period | = | Amount of accrued advance payments for the current reporting period | – | Page 260 sheets 02 of the declaration for the previous reporting period |

Such clarifications are contained in the letter of the Federal Tax Service of Russia dated August 12, 2015 No. GD-4-3/14174. Appendixes 1 and 2 to this letter provide examples of how trade fees should be reflected in income tax returns.

For information on how trade taxes are reflected by organizations with separate divisions, see How to prepare and submit an income tax return if an organization has separate divisions.

What legislative innovations need to be taken into account when calculating income tax, and which not

Legislators regularly adjust tax laws. Thus, in 2021, due to the coronavirus epidemic, the rules for paying advance payments were temporarily changed:

- the income limit has been increased to switch to quarterly advances without monthly payments;

- It is allowed to switch to paying advances on actual profits within a year.

If you take advantage of these innovations, the procedure for filling out the declaration will also change.

We also recommend taking into account the following recent changes in legislation:

- Check the waybills when writing off fuel and lubricants. Documents must be prepared taking into account the latest clarifications of the Ministry of Transport.

- Check that all airfare costs are supported by your boarding pass. It is risky to include electronic forms in costs .

- You can take into account the costs of advertising on the Internet in full. They are not limited.

- Check the primary costs, because Only a cash receipt does not confirm expenses.

- Record the investment deduction in your declaration. The current declaration form provides a special annex for it.

ConsultantPlus experts provided instructions on how to reflect investment deductions in the declaration:

You can view it by getting free trial access to the system.

Our special section will help you keep track of current tax news.

Features in the Republic of Crimea and Sevastopol

Starting from the reporting periods of 2015, organizations in Crimea and Sevastopol fill out income tax returns in the same manner as Russian organizations.

Organizations in Crimea and Sevastopol can receive the status of participants in the free economic zone. If such status exists, in sheet 02 and in appendices 1–5 to sheet 02 of the tax return, in the “Taxpayer Identification” field, code “3” must be indicated (letter of the Federal Tax Service of Russia dated March 2, 2015 No. GD-4-3/3253).

Page 1 2 3 4 5

Income statement

In the financial statements in 2021, profit is displayed not only in the balance sheet, but also in another important document - the income statement. It should indicate the key financial indicators of business activities for a specific period. The deadline for submitting the profit report in 2021 is March 31.

The report consists of tables that display a set of indicators from the beginning of the reporting period: product cost, sales revenue, etc. These indicators in total make up the financial result of the enterprise: net profit or loss. To avoid problems with representatives of the Federal Tax Service in 2021, the profit report should be submitted to the tax office on time.

The document form approved by the Ministry of Finance is presented as a recommendation; business owners can add or remove lines at their discretion. In the 1C: Accounting 7.7 program, profit reporting for 2018 can be prepared automatically, this will save a lot of time for the chief accountant. Stakeholders (investors, creditors, banks) often demand reports on the financial performance of companies, as this helps them determine how efficiently the entity is functioning.