Reconciliation of “Account Analysis” with the VAT return

Next, we will proceed to reconcile the “Account Analysis” with section 3 of the VAT return. Let us remind you that the “Credit” column displays the amount of calculated VAT, and the “Debit” column displays the amount of VAT that is subject to deduction and transfer to the budget.

In section 3 of the declaration, line 010, you can see the amount of the tax base and the tax that was calculated on the sale of goods and services at a rate of 18%. In the above example, the organization carried out sales only at this rate, therefore the amount in line 010, as a rule, coincides with the turnover of account 68.02 and account 90.03.

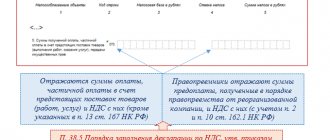

Please note that the “Credit” column in “Account Analysis” will show the turnover on account 76.AB - VAT, which was calculated from the amounts of advances from customers. You will see the same amount in the declaration on line 070.

Output VAT. Reflection of implementation. Sales book

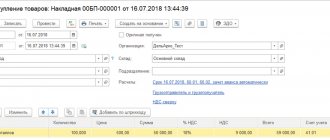

To further consider the issue, we will reflect the sale of the purchased goods and select VAT - the “Sales” menu item, and create a new document in the document log “Sales (acts, invoices)”.

Fig. 19 Menu item “Sales”

Having filled out the header of the document, we will select the sold product “Desk” in the tabular part. And for example, we will indicate the quantity that we purchased - 5 pieces, but our selling price will be 3,000 rubles, for a total amount of 15,000 rubles. The table highlights VAT - 2500 rubles.

Fig. 20 Filling out the document “Sales of goods (invoice)”

Let's see how it affected the accounting accounts when posting the document - the "Dt/Kt" button.

Fig. 21 Movements of the document “Implementation (act, invoice)”

During the process, transactions were generated reflecting:

- Write-off of the cost of our tables 6666.67 rubles on credit 41.01 “Goods in warehouses” and immediately reflected in the debit 90.02 “Cost of sales”;

- Proceeds from sales - 15,000 rubles on credit 90.01 “Revenue” and the buyer’s debt is immediately reflected in debit 62.01 “Settlements with buyers and customers”;

- Debt to pay VAT in the amount of 2,500 rubles to the budget under credit 68.02 “VAT”, in correspondence with debit 90.03 “VAT”.

On the second tab of “Document Movements” we see an entry in the “VAT Sales” register, which ensures that sales are included in the “Sales Book”.

Fig. 22 Entry in the “Sales VAT” register

Let’s create a “Sales Book” through the menu item “Reports” - “VAT”.

Fig. 23 Menu item “Sales” - “VAT”

By clicking the “Generate” button, we get our report.

Fig.24 “Sales Book” report

Tax deductions

Now let's start reconciling your tax deductions. You can see the VAT amount that was presented in the example on account 68.02 in correspondence from 19 accounts. And in the declaration you will see it in line 120.

As for the amount of VAT on offset advances from buyers, you will see it in the “Debit” column in correspondence with account 76.AB and in line 170 of section 3 of the VAT return.

1.Verified data

After completing all regulatory VAT operations, the VAT Declaration is completed with us as follows:

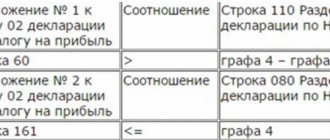

Lines 010-100:

Lines 120-210:

Let's start checking the Declaration.

A few nuances that you should pay attention to when checking your declaration:

- During the tax period, were advances refunded to customers? Then you will see these amounts in line 120 of section 3 of the declaration. At the same time, during the reconciliation of the declaration and analysis of account 68.02, you will see discrepancies of the same amount in turnover with accounts 19 and 76.AB.

- If you plan to compare the total turnover on the debit-credit of account 68.02 with the total amounts of calculated VAT and VAT deductible on the declaration, then please note that in the account analysis in the “Debit” column additionally displayed the amounts of paid VAT that are not displayed in the declaration (turnover with a score of 51).

- The final balance in account 68.02 will fully agree with the amount of tax payable according to the declaration only when there is no debt or overpayment for previous tax periods.

Based on materials from “Accounting in 1C without worries”

Today we will talk about a wonderful tool built into 1C programs - Express Accounting Check . I hope that this report will become your reliable assistant when checking the correctness of the reflection of transactions related to maintaining the sales book and purchase book, and you will be able to quickly identify the most common VAT accounting errors in the program.

As usual, we will work with you in the 1C: Accounting 8 edition 3.0 program. In the Reports the Express check report

In the window that opens, select the required period and open the report settings:

Since in this article we are talking about errors in VAT accounting, we leave only the last two checkboxes active. We're filming the rest.

You can expand each checking option and see what the program will check:

Click on the Run check and see, for example, this picture:

Why do I write “For example...”? Because, most likely, you will not have so many errors in the database. My colleagues and I tried very hard to come up with an example that will be of interest to you.

So, we have identified 11 errors in maintaining the sales book. Well. We'll figure out. Revealing our mistakes, wow! Errors for ALL possible verification parameters. That's how great we are.

Let's sort it out in order. We reveal the first error found by the program:

So, the first thing the program points out to us is the non-compliance with the chronological order of invoice numbering. Moreover, in the Recommendations to start processing the automatic renumbering of documents. That's how wonderful. Those. We worked with you for a whole quarter, issued invoices to our counterparties, and now we’ll redo everything. This is exactly what you don’t need to do. The law does not say anywhere that we are obliged to strictly observe the chronology in the numbering of invoices, so we will perceive this error as conditional and will not redo anything.

The next stage of verification is the completeness of the issuance of sales invoices. Expanding this stage, we see that the program points us to a specific implementation document for which, for some reason, we did not issue an invoice. Directly from this processing we can open the “problem” document. To do this, double-click on it with the left mouse button. By opening the document, we fix the error found:

After we have issued the invoice, we will check it again. The error is fixed and we move on to the next step. Timely issuance of sales invoices. Here the program detected an error associated with a discrepancy between the dates of the sales document and the invoice issued for it. Also, we can open either an implementation or an invoice directly from this processing and correct the document date:

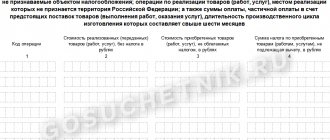

We fix this error and move on to the next one. Here is a more interesting case. The program checked the compliance of the amount of revenue in account 90.01.1 in the accounting system with the amount of accrued VAT from sales in account 90.03. In a detailed error report, the program points us to the “problematic” document, which most likely contains the error. And then we see the following situation: The amount of revenue, the VAT base and the VAT calculated according to this document are missing, but the accrued VAT is equal to 1525.42.

Before opening this document, let's look at the following error in Express Check:

We see that the same document was included in the analysis at the previous stage, only the detailed information about the error is exactly the opposite. Those. The amount of revenue, the VAT base and the VAT calculated according to this document are there, but the accrued VAT is missing. Obviously, by correcting the document, we will immediately get rid of two errors identified by the express check.

Open the problematic document and follow the hyperlink to the window for setting up accounting accounts. And in this particular case, the error lies in the VAT accounting account:

If you indicated income account 91.01 in the document, then the VAT account in this case should be 91.02.

This, of course, adds some difficulties when checking the VAT return, but you have to come to terms with it. We make corrections to the accounting accounts, repost the document and reformat the express check. There were immediately two fewer errors. Let's move on to the next line of our report:

Here the program also highlights for us a document in which a discrepancy between the VAT Base in the accounting system and the VAT Base in the “Sales VAT” register is found. Of course, there can be many reasons for this error, and the program offers us some of them. Very often problems arise due to manual entries and adjustments. In this particular case, we tried to “correct” the VAT amount in the document and were mistaken by 1 ruble. We need to discover the erroneous implementation:

And simply “re-score” the sales amount. And the program will calculate the correct VAT itself:

We carry out and close the document and perform the express check again. As you can see, the number of errors is decreasing. And the next one is related to the absence of the document “Creating Sales Book Entries” . Those users who have been working in 1C programs for a long time know that this document must be generated at the end of each quarter. I recommend that you always do this, even if you are sure that if you fill it out automatically, this document will be empty.

Directly from this report we can go to the VAT accounting assistant or in the Operations go to the list of regulatory VAT operations and generate the necessary document.

We fill out the document and perform the express check again. The next error is related to the discrepancy between the VAT amounts accrued on advances and the amounts in the “Sales VAT” register. But in this particular case, the program doesn't even give us a hint. In which document should we look for the error:

Here SALT in account 76AB can help us:

And in the balance sheet we immediately pay attention to the line with an empty subconto. We open this document and see that this posting was made using manually entered operations.

As a rule, users make most of the mistakes in manual entries. We will not understand the intricacies of this document now. Let's just mark it for deletion as erroneous. Our goal is to review the operation of express verification.

The next error is related to incomplete reflection of transactions under agency agreements in the sales book.

In the Recommendations , we can open the processing Registration of tax agent invoices , and first fill out the tabular part automatically and then click on the Execute .

And the last error in the section of checking the maintenance of the sales book is related to the incomplete reflection of VAT amounts for construction and installation work in the sales book. The program also offers us a solution to the problem by generating the document Accrual of VAT on construction and installation work in routine VAT operations:

The document can also be automatically filled in using information base data. And don’t forget to issue an invoice based on this document.

Now we run the check again and see that there is one error left in maintaining the sales book, which we do not accept as an error and will not correct.

Well, now let’s look at the correctness of maintaining a purchase ledger. By the way, it is in our best interests to correctly and as completely as possible reflect the information in the purchase book, so I will only briefly touch on this section, looking at three main errors.

The first - by analogy with the sales book, the program suggests that there are receipt documents for which there is no invoice. Either this is an error, or you really do not have the original document. We need to figure this out. In any case, the program tells us which documents need to be checked:

The next mistake is the lack of purchase ledger entries. This routine operation must also be done every quarter:

Well, one more mistake. Sometimes it occurs among users - the VAT account in the Receipts document is indicated incorrectly. The program compares data on account 19 and data on VAT registers and notifies us of an error.

We open the “problem” document and correct the VAT account.

Also, a similar error in express check often occurs when creating manual transactions on account 19. Let me remind you that the VAT return is filled out according to the accumulation registers of the VAT subsystem, so manual VAT entries should be avoided altogether.

Let's conduct an express check of accounting again and everything has been successfully corrected, except for the numbering of invoices.

Of course, to some readers, some of the errors discussed will seem far-fetched and far-fetched, but my task was to introduce you to a very useful processing and show the principle of its operation. Of course, there are different errors and they are not always as easy to find as I showed you, but basically, I hope, thanks to this article, you have found another assistant for checking VAT in the 1C Enterprise Accounting program.

Victoria Budanova was with you. Thank you for being with us. Successful reporting campaigns to you. I think that you will soon understand that 1C is simple.

| Head of care service Budanova Victoria |

Social buttons for Joomla