Shipped products, which are part of the finished product and goods intended for resale, are accounted for as part of the organization's current assets. Data is generated in a separate account in accounting due to the fact that transaction operations may be accompanied by commission payments, special conditions relating to the transfer of ownership of the object of the agreement (before or after payment), and barter relations.

Question: How to reflect in the accounting of a manufacturing organization - supplier the provision of a bonus to the buyer in the form of a discount that reduces the cost of products shipped to the buyer (building materials), which is provided in the event of the purchase of a certain amount of building materials (in several batches) during the quarter? According to the supply agreement, upon reaching a certain volume of purchases of building materials during the quarter, the buyer is given a 10% bonus (discount), which reduces the price of building materials. During the quarter, two consignments of various building materials were supplied to the buyer: - in the amount of 480,000 rubles, including VAT of 80,000 rubles; — in the amount of RUB 1,200,000, including VAT of RUB 200,000. The actual cost was: - 280,000 rubles. - first batch; — 800,000 rub. - the second batch, which, according to tax accounting data, is equal to the amount of direct costs of the organization for the manufacture of these products. The delivered lots were fully paid for by the buyer. The amount of the premium (discount) provided to the buyer at the end of the quarter amounted to RUB 168,000. The premium is paid by transferring funds to the buyer's bank account. In tax accounting, an organization determines income and expenses using the accrual method. View answer

Moment of implementation

Consider the sale (sale) of finished products to be the transfer of ownership of them to the buyer.

As a rule, this happens at the moment the products are transferred to him. If the agreement between the seller and the buyer establishes a different procedure for the transfer of ownership (for example, after payment for the product), the buyer receives this right only after fulfilling all the stipulated requirements. In this case, the products transferred to the buyer will be considered not sold, but shipped. This conclusion follows from paragraph 1 of Article 223 of the Civil Code of the Russian Federation.

For more information about this, see How to determine the moment of transfer of ownership when selling purchased goods (your own products).

Accounting: ownership has passed to the buyer

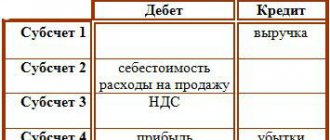

If the ownership of the product has been transferred to the buyer (i.e., a sale has occurred), income and expenses from such an operation are recorded in account 90 “Sales”. The basis for this is the primary accounting documents drawn up during the sale of products (Article 9 of the Law of December 6, 2011 No. 402-FZ).

Sales income will be revenue from the sale of finished products. Reflect it on the credit of account 90-1 at the time of transfer of ownership of the product to the buyer (subject to other conditions for recognizing revenue in accounting).

For more details, see How to determine the amount of revenue from the sale of finished products.

You can sell finished products both in cash and by bank transfer, as well as using plastic cards.

If the organization sold finished products for cash, make the following entry in accounting:

Debit 50 Credit 90-1 – revenue for finished products sold for cash is reflected.

If the organization sold finished products for cashless payment, make the following entry:

Debit 62 Credit 90-1 – revenue for finished products sold by bank transfer is reflected.

The procedure for recording sales of finished products in accounting when paying by credit card is similar to the procedure for recording such transactions when selling goods. For more information about this, see How to reflect retail sales of goods in accounting.

Such rules are established by the Instructions for the chart of accounts, subparagraph “d” of paragraph 12 of PBU 9/99 and paragraph 211 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

At the time of revenue recognition, reflect in accounting the costs associated with the production and sale of products (clause 18 of PBU 10/99). These will be:

- actual cost of production;

- selling expenses.

Reflect them in the debit of account 90-2.

This is stated in paragraphs 203, 206 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraphs 7 and 9 of PBU 10/99 and the Instructions for the chart of accounts.

Write off the actual cost of products sold as expenses in the order that depends on how the organization accounts for finished products: at actual cost or at standard cost.

If finished products are accounted for at actual cost, reflect them in expenses by posting:

Debit 90-2 Credit 43 – the actual cost of finished products sold is taken into account as expenses.

If finished products are accounted for at standard cost, reflect them by posting:

Debit 90-2 Credit 43 – the standard cost of finished products sold is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts.

To determine the cost of finished products that need to be written off as expenses (i.e., the cost that will be reflected in the credit of account 43), use one of the valuation methods:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of sold finished products is fixed in the accounting policy for accounting purposes. This is stated in paragraph 16 of PBU 5/01, paragraph 73 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and letter of the Ministry of Finance of Russia dated November 16, 2004 No. 07-05-14/298.

For information on how to reflect sales expenses as expenses, see How to reflect sales expenses of finished products (works, services) in accounting.

This procedure follows from paragraphs 203–206, 212 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, Instructions for the chart of accounts (accounts 40, 43, 90).

If the organization that sells the product is a VAT payer, charge this tax at the time of its transfer to the buyer. Reflect the accrual of VAT in the debit of account 90-3:

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on the sale of finished products.

This procedure follows from the Instructions for the chart of accounts (accounts 68, 90) and paragraph 212 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If the organization has received a partial (full) prepayment on account of a future delivery, make the following entries in accounting:

Debit 51 (50) Credit 62 subaccount “Settlements for advances received” - partial (full) prepayment was received from the buyer for the upcoming delivery of finished products;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” – VAT is charged on the amount of the advance received;

Debit 62 subaccount “Settlements for shipped finished products” Credit 90-1 – revenue from the sale of finished products is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on sales proceeds;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped finished products” - prepayment is credited;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” - the amount of VAT previously accrued and paid from the amount of the advance received is accepted for deduction.

This procedure is provided for in the Instructions for the chart of accounts (accounts 51, 50, 62, 90).

Finished products are usually sold in containers. For information on how to take it into account when selling products, see How to record transactions with containers when selling your own products.

Shipped goods in tax accounting

Tax authorities and officials of the Ministry of Finance have different positions regarding the recognition of revenue for tax accounting purposes. The first believe that, according to the Tax Code of the Russian Federation, the moment of revenue for such contracts is the receipt of funds as payment. According to the Ministry of Finance, revenue appears during the shipment of materials with the provision of accompanying documents.

The position of judicial practice on this issue is also ambiguous. Therefore, the taxpayer will have to decide for himself whether to recognize revenue from transactions performed. It would also be useful to provide documentary evidence that the buyer does not have the right to dispose of the received values until the funds are transferred. Typically, such evidence is provided by concluded contracts. All this will help prevent the tax inspectorate from trying to classify transactions as an understatement of the tax base for profits if the moment of shipment of goods and payment for it takes place in different reporting periods.

Accounting: ownership has not passed to the buyer

Record the shipped products on account 45 “Goods shipped”:

- at actual cost - if the organization accounts for finished products in account 43 “Finished products” at actual cost;

- at standard cost - if the products are accounted for in account 43 “Finished products” at standard cost, and the actual costs of their production are reflected in account 40 “Product Output”.

Keep accounting of shipped products on the basis of the primary accounting documents presented to the buyer (Article 9 of the Law of December 6, 2011 No. 402-FZ). When transferring (shipping) products, make the following entries:

Debit 45 Credit 43 – finished products were transferred to the buyer.

This procedure follows from the Instructions for the chart of accounts (accounts 43, 45).

To determine the cost of finished products that need to be reflected on the credit of account 43, use one of the valuation methods:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of sold finished products is fixed in the accounting policy for accounting purposes. This is stated in paragraph 16 of PBU 5/01, paragraph 73 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, and letter of the Ministry of Finance of Russia dated November 16, 2004 No. 07-05-14/298.

If the organization that ships the products is a VAT payer, at the time of shipment (transfer) of the products to the buyer, charge VAT (clause 3 of Article 38 of the Tax Code of the Russian Federation). Reflect the amount of accrued tax in accounting as follows:

Debit 76 subaccount “VAT on products, the ownership of which is transferred to the buyer in a special order” Credit 68 subaccount “Calculations for VAT” - VAT is charged, payable to the budget on shipped products, the ownership of which is transferred to the buyer in a special order.

For more information about this, see How to reflect in accounting the amount of VAT charged to the buyer when selling goods (own products), if the ownership of these goods (own products) has not transferred to the buyer.

After ownership of the shipped products passes to the buyer, record the proceeds from the sale in your accounting records. At the same moment, write off as expenses the cost of products sold and sales expenses (subparagraph “d”, paragraph 12 of PBU 9/99, paragraphs 211 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, p 7 and 9 PBU 10/99).

Record sales revenue as follows.

If the organization sold finished products for cash, make the following entry in accounting:

Debit 50 Credit 90-1 – revenue for finished products sold for cash is reflected.

If the organization sold finished products for cashless payment, make the following entry:

Debit 62 Credit 90-1 – revenue for finished products sold by bank transfer is reflected.

The procedure for recording sales of finished products in accounting when paying by credit card is similar to the procedure for recording such transactions when selling goods. For more information about this, see How to reflect retail sales of goods in accounting.

Write off the cost of products sold as expenses in an order that depends on how the organization accounts for finished products: at actual cost or at standard cost.

If finished products are accounted for at actual cost, reflect them in expenses using the following entry:

Debit 90-2 Credit 45 – the actual cost of finished products sold is taken into account as expenses.

If finished products are accounted for at standard cost, reflect them in expenses using the following entry:

Debit 90-2 Credit 45 – the standard cost of finished products sold is taken into account as expenses.

This procedure follows from the Instructions for the chart of accounts.

For information on how to reflect sales expenses as expenses, see How to reflect sales expenses of finished products (works, services) in accounting.

Simultaneously with the recognition of revenue and expenses, reflect the amount of VAT charged to the buyer as expenses:

Debit 90-3 Credit 76 subaccount “VAT on products, the ownership of which is transferred to the buyer in a special manner” - VAT is charged on shipped products.

This is stated in paragraphs 203, 206 and 212 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, paragraphs 7 and 9 of PBU 10/99 and the Instructions for the chart of accounts.

For more information about this, see How to reflect in accounting the amount of VAT charged to the buyer when selling goods (own products), if the ownership of these goods (own products) has not transferred to the buyer.

Finished products are usually sold in containers. For information on how to take it into account when selling products, see How to record transactions with containers when selling your own products.

What accounts are used when selling goods and services?

The chart of accounts for reflection in accounting provides for the use of the following accounts when reflecting the sale of services, works, and goods:

- — used to account for costs when selling services and performing work.

- 41 - is used when reflecting the cost of goods purchased for further resale.

- 42 - for writing off mark-ups on goods (when goods are reflected at sales prices).

- 43 - used to reflect finished products created at the enterprise.

- 44 - to account for sales expenses for goods sold.

- 45 – this account shows products that have been shipped to the seller, but have not yet been received or paid for by him.

- 46 - used when performing work step by step.

- 50 - when used in payments for sold services, works, goods, cash payments.

- 51 - when using non-cash payments in payments for sold services, works, goods.

- 52 - when the buyers are foreign persons transferring payment in foreign currency.

- 57 - when payment for sold services, works, goods is made by bank cards.

- — is used when making payments to suppliers and contractors for services, works, and goods sold to them.

- 68/VAT - used to calculate VAT on the sale of services, work, goods.

- — when carrying out sales of goods, works, services under one-time transactions.

- 90/1 - used when reflecting revenue from the sale of services, works, and goods in accounting.

- 90/2 - used to account for the cost of services, works, and goods sold.

- 90/3 - the account reflects information about VAT included in the price of sold services, works, goods (when the organization works with VAT).

- 90/4 - if the goods sold are subject to excise taxes.

BASIC

Income from the sale of manufactured products is revenue (clause 1 of Article 249 of the Tax Code of the Russian Federation). When calculating income tax, take it into account at the time of sale of products, regardless of when payment was received from buyers (customers). Do this if the organization uses the accrual method (clause 3 of Article 271 of the Tax Code of the Russian Federation).

If an organization has received an advance payment for the upcoming supply of products, then when calculating income tax using the accrual method, do not include the amount of the prepayment in income from sales (Articles 249, 271 and sub-clause 1, clause 1, Article 251 of the Tax Code of the Russian Federation).

When using the cash method, take into account revenue at the time you receive funds for sold products. The advance payment (advance payment) received from the buyer (customer) is also included in income at the time of receipt (clause 2 of Article 273, subclause 1 of clause 1 of Article 251 of the Tax Code of the Russian Federation). This rule applies despite the fact that the products have not yet actually been transferred to the buyer (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court dated December 22, 2005 No. 98).

Reduce sales revenue by expenses associated with the production and sale of products (subclause 1, clause 3, article 315 of the Tax Code of the Russian Federation):

- material costs;

- labor costs;

- the amount of accrued depreciation;

- other expenses.

For more information about accounting for income and expenses from the sale of products when calculating income tax, see How to take into account income and expenses from the sale of manufactured products (works, services) when taxing profits.

Sales of products are recognized as subject to VAT (subclause 1, clause 1, article 146 and clause 3, article 38 of the Tax Code of the Russian Federation). Therefore, if the seller is a VAT payer, at the time of shipment (transfer) of products or receipt of advance payment under the contract, accrue this tax (clause 1 of Article 167 of the Tax Code of the Russian Federation).

An example of how sales of finished products are reflected in accounting and taxation. Ownership of the product passes to the buyer at the time of its transfer

LLC "Proizvodstvennaya" is engaged in the manufacture of office cabinets. “Master” pays income tax monthly and uses the accrual method.

In March, the organization’s expenses amounted to 373,000 rubles, including: – direct expenses – 303,000 rubles; – indirect costs – 70,000 rubles.

In total, the organization produced 70 cabinets in March. Direct costs for their production amounted to 280,000 rubles.

The cost of work in progress balances at the end of March amounted to 23,000 rubles.

Thus, the cost of one cabinet was 5,000 rubles. ((280,000 rub. + 70,000 rub.) : 70 pcs.). The organization's accounting policy establishes that finished products are accounted for at actual cost.

In the same month, the organization sold 50 cabinets for the amount of 472,000 rubles. (including VAT – 72,000 rubles).

Master's accountant reflected the sale of finished products in March as follows:

Debit 62 Credit 90-1 – 472,000 rubles. – revenue from sales of finished products is reflected;

Debit 90-2 Credit 43 – 250,000 rub. (RUB 5,000 × 50 pcs.) – the actual cost of finished products sold is taken into account as expenses;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 72,000 rubles. – VAT is charged on the sale of finished products.

When calculating income tax for March, the accountant included in income the proceeds from the sale of cabinets - 400,000 rubles. (RUB 472,000 – RUB 72,000). As part of the expenses in full, he took into account indirect expenses - 70,000 rubles. The amount of direct expenses that will reduce the proceeds from the sale of cabinets will be 200,000 rubles. The accountant calculated it like this.

Cost of remaining finished products at the end of the month: 20 pcs. : 70 pcs. × (303,000 rub. – 23,000 rub.) = 80,000 rub.

Direct expenses that reduce revenue from the sale of cabinets for March: RUB 303,000. – 23,000 rub. – 80,000 rub. = 200,000 rub.

Results

To reflect the receipt of finished products at the warehouse and their sale in the month of production (i.e. until data on the actual cost is generated), prices are used that reflect the interim assessment of the created product. After the month is closed, the interim estimate is adjusted to the actual estimate, and the cost of both the products shipped in the month of production and the products remaining in the warehouse are subject to such adjustment.

The formation of intermediate and actual costs in accounting can be carried out in two ways: without using account 40 and with its use.

In the first case, the intermediate cost and deviations from it (both positive and negative) are reflected by the posting Dt 43 Kt 20; at the same time, for deviations arising from shipped products, an additional write-off is made to account 90 (Dt 90 Kt 43). In the second case, the intermediate cost is fixed by posting Dt 43 Kt 40, and the actual cost - by posting Dt 40 Kt 20, i.e. the amount of deviations appears on account 40 and is credited from it to the shipped (Dt 90 Kt 40) and remaining in the warehouse (Dt 43 Kt 40) products. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

simplified tax system

Regardless of which object of taxation the organization has chosen, take into account income from the sale of finished products when calculating the single tax (Articles 346.15 and 249 of the Tax Code of the Russian Federation). Income will be proceeds from sales. In the sales proceeds, also include advances received for the upcoming delivery of finished products (clause 1 of article 346.15 and clause 1 of article 249 of the Tax Code of the Russian Federation). How to calculate revenue, see On what income you need to pay a single tax under simplification.

If a simplified organization has chosen as an object of taxation income reduced by expenses, reduce sales revenue by expenses associated with the production and sale of products (clause 2 of Article 346.18 of the Tax Code of the Russian Federation). In this case, take into account only those expenses that are named in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Such expenses may include, in particular:

- expenses for the acquisition, construction and production of fixed assets;

- costs of acquiring or independently creating intangible assets;

- material costs, including costs for the purchase of raw materials and materials;

- labor costs;

- the amount of “input” VAT paid to suppliers, etc.

For more information on how to take into account expenses when calculating a single tax, see What expenses can be taken into account when calculating a single tax under simplification.

Postings for the release of finished products

The output of finished products can be accounted for by the accounting department at actual or standard cost. In the first case, the write-off goes directly to account 43. When using account 40, two entries are made:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20, , | Finished products of the main, auxiliary and service shops and divisions were capitalized at actual cost | 10000 | Certificate of calculation, certificate of release of finished products | |

| 20, , | The actual cost of finished products of the main, auxiliary and service departments and workshops is written off | 10000 | Certificate of calculation, certificate of release of finished products | |

| Standard cost of finished products written off (planned) | 10200 | Help-calculation |

OSNO and UTII

Income and expenses from the sale of products that relate to the general taxation system should be taken into account when calculating income tax. In cases where sales of products fall under UTII (for example, when providing catering services), do not take into account income and expenses when calculating the single tax. Calculate UTII based on imputed income (Article 346.29 of the Tax Code of the Russian Federation).

Moreover, if some expenses (for example, general business expenses) of the organization are associated with both types of activities, their amount must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation). This is due to the fact that when calculating income tax, expenses related to activities on UTII cannot be taken into account.

Income tax expenses include that part of the expenses that relates to the organization’s activities under the general taxation system (clause 9 of Article 274 of the Tax Code of the Russian Federation).

Posting - transferred from the current account to suppliers

Purchasing raw materials, materials, goods, fixed assets, intangible assets, works, services by transferring non-cash funds is a simple process. This usually happens in several stages:

- A supply agreement (performance of work, provision of services) is concluded between economic entities.

- The supplier issues an invoice for payment for materials (work, services).

- The buyer transfers in whole or in part - according to the terms of the contract - the amount indicated in the invoice.

- The shipment is made to the buyer's address.

The stages may vary: someone does without a contract, while all the conditions are written down in the invoice; valuables (work, services) can be paid after their shipment (fulfillment, provision).

The following entries appear in the accounting:

- Dt 60.2 Kt 51 - based on the payment order and bank statement, the transfer of funds to the supplier is reflected on account of the future supply of materials (works, services).

- Dt 08, 10, 20, 25, 41... Kt 60.1 - valuables, works, services are capitalized on the basis of transfer documents (invoices, acts, etc.) Valuables can be delivered directly by the supplier to the buyer, sent through a freight forwarding company, or the buyer picks them up by proxy.

- Dt 19 Kt 60.1 - VAT is reflected if it is highlighted in the supplier’s invoice.

- Dt 60.1 Kt 60.2 - the transferred advance payment is counted against received valuables, works, services.

If payment occurs after shipment, then the last entry in accounting is not made, and account 60.1 will correspond with account 51.