How to open an XML file - consider the simplest methods

As we understand, a certain number of programs are installed on the PC that can open this file.

Typically, in such cases, Windows offers a choice of special programs that can open this file. On the Internet, these files are usually opened by search engine robots automatically, and the average website reader does not notice this. But how can it be revealed to the common man? Let's click on this file with the mouse and try to open it.

When there is no printer

A common problem is when the “Declaration” program is installed on the PC to fill out 3-NDFL for 2021, but there is no printer. Is it possible to save the completed form for printing on another computer where this Federal Tax Service application is not installed?

There is no problem with this. Just in the “View” mode, click on the button with the image of a floppy disk. The print module will create a file with a TIF extension. It can be printed anywhere. Wherever it's convenient.

Also see “Who must submit 3-NDFL for 2021: list.”

Read also

09.01.2018

Uploading the declaration in xml format

You can download the declaration in xml format in 2 ways: 1st method (Appendix 11, Appendix 12):

- In the next window, select the path where you want to save the declaration file. Click Save.

- Go to the Declaration/Appendix 11 section. Click Save declaration.

Uploading the Form 12 declaration is carried out in the same way. Method 2 (Declaration Preparation Wizard): Upload the declaration in xml format using the Declaration Preparation Wizard.

For 2010:

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated November 25, 2010 No. ММВ-7-3/). You can download it by following this link (source: Federal Tax Service).

The tax return is filled out and printed according to certain rules. These rules are established by the Federal Tax Service (order of the Federal Tax Service of Russia dated November 25, 2010 No. ММВ-7-3/). You can download instructions for filling out form 3-NDFL by following this link.

How to restore a personal income tax return from an xml file?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program, can I convert the remaining xml into completed declaration forms?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program can I convert the remaining xml into completed declaration forms? Is there no Load from xml function in the Service?

No If you try to open it, it gives an error. A sign of a program's weakness. QuckPatent, but haven’t you tried it in the Taxpayer Legal Entity? documents-documents on personal income tax-2-personal income tax-download (red arrow) Not all, but many users of modern computer systems often encounter incomprehensible files in the XML format. Even fewer users know what kind of data this is and why it is needed.

Well, only a few understand which program to open an XML file.

Although everything in this matter is quite simple, nevertheless, sometimes problems arise. Let's see what's what.

Payment according to notifications

The next section “ Payment on notifications” is for filling out declarations for 2008, 2009, 2010. This section is missing in the declarations for 2011, 2012, 2013.

It is filled out by persons who have paid taxes (on winnings, entrepreneurs, dividends, etc.) based on tax notifications from the tax authority or independently. Fill out in the same way as previously described. Click “Plus”, the “Payment Details” window appears. We enter the amount of the payment made, select KBK by clicking the button next to the triangle. Click “Yes”.

This completes filling out the declaration.

Printout

Now about how to print the 3-NDFL declaration from the Federal Tax Service program.

Note that when installing the program, it will offer to separately install the so-called print module. And the printer can be either real or virtual. The first way is through the “Declaration” submenu (see the figure above).

Possibilities of the “Declaration” submenu. The option provides View/Preview of the generated declaration in the form and volume in which it will be printed if “Print” of the selected 3-NDFL is selected. Export Moves the data of the current declaration to a file in a format approved by the Federal Tax Service for sending to the inspectorate via electronic channels. Check the analysis of the generated declaration for completeness and compliance of the entered data. The second way to print 3-NDFL from the program is as follows. In the main application window on the toolbar, click “View”: Then you will see a series of sheets of the 3-NDFL declaration you generated for 2021: If in the main program window on the toolbar you select “Print”, then the 3-NDFL will be printed in its entirety.

And in the “View” mode, you can select the pages you need to print if you click on the button with the image of the printer without a checkmark.” As for the buttons with the image of floppy disks, they allow you to save printed pages into a file with the TIF extension: into one multi-page file or into each file one page at a time. Keep in mind: printed 3-NDFL forms contain a barcode and “+” symbols. This is normal for a so-called machine-oriented form. Simply put, these symbols are needed for the scanner to read information.

The inspectorate has no right to refuse to accept such a declaration.

Features of the Federal Tax Service program

The program for filling out 3-NDFL for 2021 on the official website of the Russian Tax Service can be downloaded from the link here (shown with the index for Moscow):

Those who, by force of law, are required to independently declare their income are naturally interested in the question: how to save the 3-NDFL declaration from the Federal Tax Service program and, in principle, not lose the entered data about themselves, their income, expenses (IP), as well as deductions.

So: its work is organized in such a way that when launched, the application automatically generates an empty declaration. And at any time you can:

- save the entered data to disk;

- load a previously saved declaration;

- form a new 3-NDFL.

Each time you open it next time, the title of the window will show the name you gave to the file with 3-NDFL for 2021.

Also see "".

How to open xml through browser

When you double-click on a file, in most cases it opens through a browser, and through the one that is designated as the default browser on a given computer (mostly Microsoft Edge for Windows 10).

But this setting is changeable:

- Confirm the action with the “OK” button.

- On the “General” tab, click “Edit” and select the desired browser or other application through which you want to open the file.

- Right-click on the file, calling up the context menu, find the “Properties” item (located at the bottom).

Example of information from invoices issued by persons specified in clause 5 of Article 173 of the Tax Code of the Russian Federation (Section 12)

Section 12 of the VAT return (also approved by order of the Federal Tax Service) is filled out only if an invoice is issued with the allocation of the tax amount by the following persons:

- persons who are not taxpayers of value added tax.

- taxpayers upon shipment of goods (work, services), sales operations of which are not subject to value added tax;

- taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of value added tax;

Example information in xml format

For 2011:

Tax return 3-NDFL is filled out by the taxpayer using the form approved by the Federal Tax Service (Order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/). You can download it by following this link (source: Federal Tax Service).

The tax return is filled out and printed according to certain rules. These rules are established by the Federal Tax Service (order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/). You can download instructions for filling out form 3-NDFL by following this link.

Transformations

As discussed above, XML also allows for efficient use and reuse of data. The mechanism for reusing data is called an XSLT transformation (or simply transformation).

You (or your IT department) can also use transformations to exchange data between back-end systems, such as databases. Let's assume that database A stores sales data in a table that is useful to the sales department.

Database B stores income and expense data in a table specifically designed for accounting.

Database B can use a transformation to take data from Database A and put it into the appropriate tables.

The combination of the data file, schema, and transformation forms the basic XML system.

The following figure shows the operation of such systems. The data file is checked against the schema rules and then passed in any suitable way for transformation. In this case, the transformation places the data in a table on a web page. The following example shows a transformation that loads data into a table on a web page.

The following example shows a transformation that loads data into a table on a web page.

The point of the example is not to explain how to create transforms, but to show one of the forms they can take. Name Breed Age Altered Declawed License Owner This example shows what the text of one type of transformation might look like, but remember that you may be limited to a clear description of what you need from the data, and that description can be done in your native language. For example, you might go to the IT department and say that they need to print sales data for specific regions for the last two years, and that the information should look like this and that.

The department can then write (or modify) a transformation to fulfill your request. Microsoft and a growing number of other companies are creating transforms for a variety of purposes, making XML even more convenient to use.

In the future, it will likely be possible to download a conversion that suits your needs with little or no additional customization. This means that over time, using XML will become less and less expensive.

Print documents with PDF417 2D barcode

To print a document with a PDF417 two-dimensional barcode, you must:

1. In document input mode, press the button

or the key combination [Ctrl]\[P].

2. In the print settings window that appears, check the box, click the button, and select a printer.

To print a document with a preview, you must select the checkbox in the Print Options window.

In the amount of documented expenses

If you sold a car (or other property) for less than you bought it, and this is confirmed by documents, select deduction 903 and indicate the deduction amount equal to the cost of your sale of the car. Thus, the deduction will fully cover the sale and income tax will be zero.

If you sold the car for more than you bought it, that is, you made a profit from resale, and you owned the car for less than three years, select deduction 906. The deduction should be indicated in the amount of the difference between the purchase and sale of the car, but not more than 250,000 rubles.

If the difference in the cost of selling a car exceeds 250,000 rubles, you will have to pay income tax at 13% of the income not covered by the deduction.

In our example, the car was purchased for 120,000, sold for 123,000, so deduction 906 should be indicated with a deduction amount of 3,000 rubles.

Having completed these steps, we will generate tax returns for printing (Figure 4).

Now I’ll tell you how to generate and print tax return forms without the PD417 barcode.

How to open an XML file sent by Rosreestr?

I can’t say exactly why the officials of this service are so clever, but the best way to open an XML file from Rosreestr, no matter how funny it sounds, is on the Rosreestr website itself.

The whole procedure is shown quite fully in the following video. You can go to the official website of Rosreestr using the link. You can also officially contact support for this organization on the website. In addition to these programs, other browsers can open XML, not just Internet Explorer.

Another Office program, Excel, opens this file. But, for files of this extension, there are special programs that include in-depth support for the syntax of this language. These are the programs: - XML Pad, EditiX Lite Version, XML Marker. Conclusion: - Opening an XML file is quite simple, just click on it with one mouse cursor, and it will open in one of the browsers.

But, in the mode of opening the file in the browser, we cannot edit it.

For editing, I recommend using Notepad++.

If you need to do more detailed editing of the file, I recommend using the programs from the previous paragraph, like XML Marker. Good luck! Best regards, Andrey Zimin 11/23/2018

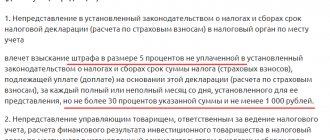

Other

If your tax service asks you to clarify the data after checking your declaration, you submit an updated tax return using the same file, making the necessary adjustments.

The program also has the ability to import general data from an old declaration into a new one without entering them again. In the old declaration, you need to save the file using “save as”, and in the new version of the program, click the “open” button, select “Declaration type” in the window below and then find the file saved for the previous year. Only information about the declarant will be transferred; the remaining data must be entered again.

How to submit a 3-NDFL declaration through the taxpayer’s personal account

Last updated December 2021 When your 3-NDFL declaration is ready, it needs to be sent to the tax office. Let's consider one of the submission methods: via We offer you video instructions and, below, step-by-step photo instructions.

Through your personal account you can send not only the declaration itself, but also a set of accompanying documents.

Entrust filling out and sending the 3-NDFL declaration to a personal tax expert of the online service NDFLka.ru!

Step one Log in to your Personal Taxpayer Account through the website. To do this, you need to know the TIN (this is your login) and password.

In addition, you can log in using a verified profile on the government services website.

After logging in, you need to select the “Life situations” tab: Step two Select the “Submit 3-NDFL declaration” tab: Don’t forget to register in the online service NDFLka.ru - we will help you return the maximum possible amount of tax deduction! Step three Select the method of filing the declaration and the year for which you are filing the declaration: Step four Attach the declaration file in xml format, received earlier in our service, as well as documents confirming the right to deduction: At this stage, be sure to attach documents confirming income and expenses stated in the declaration.

Note! The total volume of all sent files should not exceed 20 MB. If you do not have an electronic signature, then you need to verify your electronic signature. If the certificate has already been received, then proceed to the next step.

Step Five After you have uploaded all the supporting documents, you must enter the password for the electronic signature certificate. Your documents have been sent to the tax authority.

You can also find out about the results of a desk tax audit from your “Personal Account”, and there is no need to go to the tax office.

Don't forget to fill out the tax refund application. As soon as the desk verification of the documents is completed, the money, according to the application, will be transferred to your bank account. Step six As soon as the declaration is verified, you will receive information about the result of the desk audit: After completing the verification and confirming the amount of tax to be refunded, in the “MY TAXES” section you will see the amount of tax to be refunded.

The status of the refund application can be tracked in messages - the tax office will send you a notification.

Preservation

It is important to understand: the Federal Tax Service application works on such a principle that it will not allow information already entered into 3-NDFL to simply disappear. Even if you accidentally or on purpose:

- press Alt and F4 at the same time;

- click on the cross in the upper right corner of the window;

- Select File – Exit from the main menu.

In these cases - when there are unsaved changes in the completed 3-NDFL - the program will automatically prompt you to save it to a file. If the answer is yes, you will be asked for the name and location of the saved file (if a name has not already been selected).

When you select the “File” option in the main menu, a submenu with the following content will appear:

The following table shows how to save 3-NDFL from the Federal Tax Service program using these options.

| Possibilities of the “File” submenu | |

| Option | What gives |

| Create | Generates a new declaration. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. According to its internal structure, the program begins each start by creating a new declaration. That is, you can enter and change data in different 3-NDFL. |

| Open | Makes it possible to open a file with 3-NDFL, which was previously entered and saved. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. |

| Save | Allows you to save the active declaration to a file |

| Save as… | Will ask for the name and location of the file to save on your computer, laptop |

| Exit | Allows you to leave the program |

Please note: all these options are duplicated on the toolbar.

Here is another important instruction for filling out 3-NDFL in the application from the Federal Tax Service: if, after selecting the Create/Open/Save options, you confirmed the request to save changes, but did not enter the file name, the system will still display a dialog asking for the name and location a new file on your PC. That is, the information already entered will not disappear anywhere.

Not everyone knows that the “Declaration 2017” program allows you to generate a file with the 3-NDFL report for 2021 for the tax office in electronic form. To then send it via:

- Personal account of an individual on the official website of the Federal Tax Service of Russia.

- Government services portal – www.gosuslugi.ru.

You can receive such a file with an xml extension suitable for sending to the Federal Tax Service. To do this, on the toolbar you need to click on the “xml file” button:

The second way is to select “Declaration” – “Export to xml”:

Also see “Instructions for filling out 3-NDFL in 2021 in the “Declaration 2017” program.