The time that an employee spends on a business trip (work trip) in accordance with the issued order of the employer is recognized as working time. For these days, the posted worker is paid an average salary, and expenses related to the trip are also compensated.

The period of stay on a business trip (for daily allowances) is calculated by calendar days. It also includes: days of departure and arrival, travel. If these days fall on a weekend, then he can be considered a worker only at the initiative of the employer. Then the daily allowance (or travel allowance) is paid for that day as well. One of the following options may apply to the average daily earnings due:

- The business traveler receives an additional paid day off.

- Or he is paid double his average daily wage.

Both the first and second options are agreed upon with the employer. Expenses for business trips of an individual entrepreneur who works alone, without staff, are not compensated, since he himself is an employer.

For accounting purposes, expenses for business trips are documented in an advance report. At the same time, the accounting department takes into account all expenses that the employer decides to reimburse. Moreover, there may not be documentary evidence here.

Travel allowances are considered expenses for ordinary activities. They are accepted for accounting on the date of signing (approval) of the advance report by the employer.

Dates for excess daily allowance

To reflect the amount of excess daily allowance in form 6-NDFL, it is necessary to determine the dates that will be indicated in Section 2 of the Calculation.

The date of actual receipt of income for daily allowances subject to personal income tax is the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Thus, this date must be indicated on line 100 “Date of actual receipt of income” of form 6-NDFL.

The date of tax withholding (line 110) will be the date of actual payment of income from which personal income tax was withheld (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is important to keep in mind that this date cannot be earlier than the last day of the month, because personal income tax cannot be withheld if income is not received. And since the income was received on the last day of the month, then personal income tax can be withheld at the next payment of income made on the last day of the month or later (Letter of the Federal Tax Service dated April 29, 2016 No. BS-4-11/7893).

Accordingly, personal income tax on excess daily allowances must be transferred no later than the business day following the day when personal income tax was withheld from daily allowances.

Results

For some specific payments to employees, the Tax Code of the Russian Federation does not contain clarifying information regarding the deadlines for a particular transaction with personal income tax. However, logical conclusions can be reached using the explanations of the Federal Tax Service, which are becoming more and more numerous and which, we hope, will soon answer all the accumulated questions about filling out the calculation. Taking into account the norms of these clarifications and the Tax Code of the Russian Federation, the tax on daily allowance must be withheld from the first payment in the next month after the head of the organization approves the advance report.

Find all the latest information and news on filling out the calculation in the section of our website “Calculation of 6-NDFL” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Excess daily allowance in 6-NDFL: example

For July 2021, the employee received a salary (including average earnings during the business trip) in the amount of 76,000 rubles, incl. Personal income tax 13% - 9,880 rubles. The advance for July was paid on July 15, 2016 in the amount of 30,000 rubles. On July 27, 2016, the employee submitted an advance report for a business trip on the territory of the Russian Federation, which indicated the daily allowance for 4 days of the business trip in the amount of 4,000 rubles. (4 days * 1000 rub./day). On July 28, 2016, the advance report was approved by the General Director. On 08/05/2016, the employee was paid the balance of his salary for July 2021, taking into account the withholding of personal income tax from the salary of 9,880 rubles, as well as personal income tax from the excess daily allowance of 156 rubles. ((4,000 rub. – 4 days * 700 rub./day)*13%). The final payment was 35,964 rubles. (RUB 76,000 – RUB 30,000 – RUB 9,880 – RUB 156). Personal income tax was transferred to the budget on time (08/08/2016). There were no other payments in the reporting period.

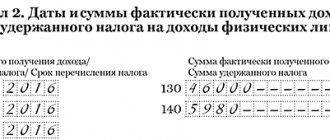

Section 2 of form 6-NDFL for 9 months of 2021 will be filled out as follows:

- line 100 “Date of actual receipt of income” - 07/31/2016;

- line 110 “Tax withholding date” - 08/05/2016;

- line 120 “Tax payment deadline” - 08/08/2016;

- line 130 “Amount of income actually received” - 77,200 (76,000 + (4,000 – 700*4));

- line 140 “Amount of tax withheld” - 10,036 (9,880 + 156).

Please note that the indicators for wages and excess daily allowance in Section 2 are collapsed, since all dates in lines 100-120 of Section 2 in relation to these payments coincided.

> How to correctly reflect daily allowances in excess of the norm in 6-NDFL?

We reflect daily allowances in 6-NDFL

Daily allowances above the norm in 6-NDFL: examples

Results

Tax

Excessive daily allowances are amounts that exceed the established personal income tax limit. So, on the territory of Russia they are equal to 700 rubles / day, and outside the country - 2500 rubles / day.

The employer has the right to give the employee a larger amount of money. But then you will need to deduct income tax from them. In addition, justification and documentary evidence of such increased expenses (expenses) is required.

Please note: for business trips abroad, daily allowances are paid as established by domestic legislation and internal company documents.

From 2021, daily allowances are subject to insurance contributions! Read more about this on our website here.

We reflect daily allowances in 6-NDFL

Clause 3 Art. 217 of the Tax Code of the Russian Federation states that there is a limit for daily allowances, from which personal income tax is not paid. This is 700 rubles. per day for business trips around the country and 2,500 rubles. per day for foreign business trips. If, according to internal regulations, the employer issues large amounts of daily allowance, then everything issued in excess of the limit is subject to personal income tax. Accordingly, taxable income must be reflected in 6-NDFL.

Read more about the rules for paying daily allowances.

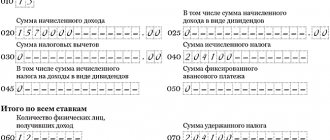

We show the amount of income on line 020 only to the extent of the excess. The option in which the full amount of income is shown on line 020 and a deduction for the amount of the limit on line 030 is not suitable, since in the letter of the Federal Tax Service dated 08/01/2016 No. BS-4-11/13984 (question 3) it is explained that in line 030 amounts fall in accordance with the codes of the types of deductions listed in the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/ [email protected]

The date of receipt of income (p. 100) in the form of daily allowance is recognized as the last day of the month when the manager approves the advance report (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation). This date cannot be the day the money is issued, since at that moment there is still no supporting document, the accomplished fact of the business trip, and the employee receives an advance, which can be returned in case of early arrival back or cancellation of the trip.

The employer must withhold tax (p. 110) when the next payment of funds to the employee occurs after the date of receipt of income (clause 4 of Article 226 of the Tax Code of the Russian Federation). The Federal Tax Service does not allow tax to be withheld before this date (letter from the Federal Tax Service dated July 25, 2014 No. BS-4-11/ [email protected] ).

As a rule, personal income tax on excess daily allowances is withheld on the day the salary is issued for the month in which the advance report is approved. The tax transfer (page 120) is made the next day after the withholding (clause 6 of Article 226 of the Tax Code of the Russian Federation).

See also “How is a one-day business trip paid?”

Daily allowances above the norm in 6-NDFL: examples

Let's consider various situations of drawing up calculations with excess daily allowances.

- Is it possible to withhold personal income tax after the advance report is approved, but until the end of the month?

Example

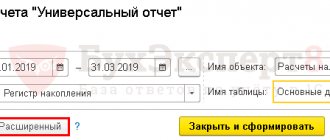

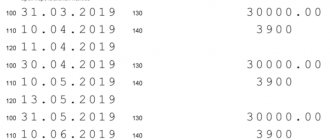

The employee was on a business trip within the country for 5 days, from March 1 to March 5, 2021. On February 28, he received an advance payment for the trip, including a daily allowance of 1,300 rubles. per day, total 6,500 rubles. The amount of daily allowance above the norm was (1,300 – 700) × 5 = 3,000 rubles. On March 7, the employee submitted the advance report for approval. On March 20, the company paid an advance on wages, the final payment of wages was made on April 5.

In the calculation for 6 months of 2021, daily allowances are included as follows:

| Line number | Meaning |

| 3 000 | |

| 08.04.2019* | |

| 3 000 |

* The tax payment deadline is the day following the date of payment of income, i.e. 04/06/2019. But since this is a weekend, the deadline is shifted to the next closest working date: 04/08/2019.

It is impossible to withhold tax on March 20, since this date precedes 03/31/2019.

- Is it possible to withhold personal income tax after the end of the month, but not when paying wages?

Example

The employee was on a business trip within the country for 5 days, from March 1 to March 5, 2021. On February 28, he received an advance payment for the trip, including a daily allowance of 1,300 rubles. per day, total 6,500 rubles. The amount of daily allowance above the norm was (1,300 – 700) × 5 = 3,000 rubles. On March 7, he submitted the advance report for approval. On March 20, the company paid an advance on wages, the final payment of wages was made on April 5. On April 1, this employee was paid vacation pay.

In the calculation for 6 months of 2021, daily allowances are included as follows:

| Line number | Meaning |

| 3 000 | |

| 3 000 |

Personal income tax can be withheld for any payment following the last day of the month of approval of the advance report.

- What to do if the daily allowance was paid after a business trip?

Example

The employee went on a business trip to another country without having time to take an advance payment. I stayed there for 5 days, from March 1 to March 5, 2021. On August 7, he submitted the advance report for approval. According to the report, in addition to compensation for other expenses, the employee is entitled to a daily allowance of 3,000 per day. The amount of daily allowance above the norm was (3,000 – 2,500) × 5 = 2,500 rubles. On March 11, the employee received full reimbursement for travel expenses. The final payment of wages was made on April 5.

In the calculation for 6 months of 2021, daily allowances are included as follows:

| Line number | Meaning |

| 2 500 | |

| 2 500 |

Despite the fact that the daily allowance was paid after the approval of the advance report, personal income tax cannot be withheld from this payment, since the income is considered received later - 03/31/2019.

The employee received average earnings and salary for the month

The employee went on a business trip. During the trip, the company calculated the average earnings, and for the remaining days of the month - the salary.

During the business trip, the company accrues to the employee not a salary, but an average salary (Article 167 of the Labor Code of the Russian Federation). During a business trip, an employee carries out instructions from the employer. This means that the average earnings for this time also relate to wages. In Section 2, reflect such payments in one block of lines 100–140.

The date of receipt of income for wages and average earnings is the last day of the month for which they are accrued. The company withholds personal income tax on the date of issue. Write down the payment day on line 110 of the calculation. The deadline for transfer is the next business day.

For example

In May, the employee was on a business trip for four days. The rest of the days he worked. During the business trip, the company accrued an average salary of 4,000 rubles. Salary for May - 23,000 rubles. The company issued salaries and average earnings on June 6. Total - 27,000 rubles. (4000 + 23,000). On this day, personal income tax was withheld - 3,510 rubles. (RUB 27,000 × 13%). The date of receipt of income based on salary and average earnings is 05/31/2016. The company reflected the salary and average earnings in one block of lines 100–140, as in sample 49.

Sample 49. How to fill out the salary and average earnings during a business trip:

Top

Reflection of daily allowances in the calculation of 6-NDFL in 2019

The time that an employee spends on a business trip (work trip) in accordance with the issued order of the employer is recognized as working time. For these days, the posted worker is paid an average salary, and expenses related to the trip are also compensated.

The period of stay on a business trip (for daily allowances) is calculated by calendar days. It also includes: days of departure and arrival, travel. If these days fall on a weekend, then he can be considered a worker only at the initiative of the employer. Then the daily allowance (or travel allowance) is paid for that day as well. One of the following options may apply to the average daily earnings due:

- The business traveler receives an additional paid day off.

- Or he is paid double his average daily wage.

Both the first and second options are agreed upon with the employer. Expenses for business trips of an individual entrepreneur who works alone, without staff, are not compensated, since he himself is an employer.

For accounting purposes, expenses for business trips are documented in an advance report. At the same time, the accounting department takes into account all expenses that the employer decides to reimburse. Moreover, there may not be documentary evidence here.

Travel allowances are considered expenses for ordinary activities. They are accepted for accounting on the date of signing (approval) of the advance report by the employer.

Above-limit travel allowances, personal income tax and general mandatory contributions for 2021.

The employer has the right to send an employee on a business trip in Russia or abroad. The business traveler is compensated daily for travel expenses. The date of payment of daily allowances is the day they are accrued. The day of approval of the business trip report is the date of receipt of income (in the form of daily allowance).

In 2021, a fixed limit on daily expenses has been determined, from which general mandatory insurance and personal income tax contributions are not calculated (Read also the article: → “Deadlines for submitting reports on 6-personal income tax in 2021”).

| Type of business trip | Legal limit on travel expenses for one day |

| Business trip to Russia | 700 rub. |

| Business trip abroad, outside the Russian Federation | 2,500 rub. |

The tax-free limit on contributions is established at a time; it cannot be determined on a cumulative basis. An organization has the right to prescribe in local regulations its daily allowance for business trips within the Russian Federation and beyond its borders. Moreover, it can exceed a fixed limit. Such daily allowances are called excess (i.e., above the established norm, limit). The amount exceeded by law will be subject to personal income tax and contributions for compulsory insurance (in addition to the injury tax) in the generally accepted manner.

This innovation has been in effect since 2021. Previously, travel expenses were not subject to general mandatory contributions if the limits were specified in the organization’s local acts.

So, from 2021, excess travel expenses are subject to personal income tax and mandatory insurance contributions, regardless of whether the excess amounts are fixed in the internal regulations of the organization or not.

Personal income tax is calculated on the final day of the month in which the business trip report was agreed upon. The tax is withheld after this date on the first payment, mainly from salary. It can be transferred to the budget on the day the income is paid or the day after that, but not later.

Main details of the description

To understand the taxation process, you first need to understand what a per diem is. Per diem is the cost that an employer has to incur to pay for an employee’s accommodation during a business trip.

Thus, it becomes clear that daily allowances are not remuneration for the employee’s work, but compensation for his living expenses. If an employee has the opportunity to return home every day during a business trip, then per diem is not provided for him. This follows from the fact that one-day business trips are not paid because the employee does not spend funds on paying for accommodation in a certain place.

If the payment of “one-day” daily allowances is prescribed in collective agreements and local regulations, then this is a direct violation of Russian legislation.

An exception is the situation when an employee is sent on a one-day business trip abroad. According to the regulations on business trips, payment in this case is made in the amount of fifty percent of the established daily allowance in foreign money.

What it is

Daily allowance is compensation for the material costs of employees sent on a business trip both in Russia and abroad, for accommodation. This compensation is expressed in monetary terms and is paid every day.

The head of the organization is obliged to pay daily allowances in the following situations:

- a company employee was sent on a business trip;

- the employee was sent on a business trip of a traveling nature;

- the employee carries out his activities in extreme conditions or participates in an expedition.

A business trip is usually called a business trip, and the employer himself determines its conditions and terms. An important feature is that business trips are usually carried out over long distances, that is, the employee does not have the opportunity to return home every day after work.

Payment refers to the calculation of funds for an employee. The payment may be in excess of the norm.

Expenses that are not per diem but paid by employers include the following:

- travel and transport costs, which are set by organizations independently;

- payment for accommodation in another city;

- any additional expenses that the employee had to incur due to the fact that he does not live at home.

The employee covers all other expenses from the amount that is paid to him daily in the established amount. The management of the organization, if necessary, can increase the daily allowance. It must be remembered that the additional amount is subject to taxation. If you do not know this, the manager may be held accountable in court.

Generally accepted standards

According to Article 210 of the Tax Code of the Russian Federation, when compiling the base for personal income tax, all monetary and in-kind profits of the taxpayer are taken into account. When determining personal income tax, material benefits are also taken into account, which are determined by a certain article in the Tax Code.

Article 217 lists income that is not subject to taxation. These primarily include compensation payments within the limits established by law. They rely on employees who perform their job duties. In addition, travel expenses may be included in compensation payments.

It is important to remember that the established amount of daily allowance is not subject to personal income tax, however, if we are talking about excess costs, then the additional amount of the fixed amount is subject to taxation. If the business trip takes place within Russia, then daily payments will be 700 rubles, if abroad, then 2,500 rubles. For other documented travel expenses, the tax is not paid in full.

To avoid taxation, per diem is most often called standardized income. Documentary evidence of what the employee spent them on is not required. Only daily allowances above the limit will be included in the tax base.

Position of the law

The Tax and Labor Codes regulate the payment of excess daily allowances.

According to the Labor Code:

- the employer is obliged to reimburse all employee expenses related to paying for housing at the place of business trip;

- The employer has the right to determine the amount of daily payments independently, and it must be specified in a special regulatory document;

- A business trip is not considered to be the departure of those employees whose work involves movement and field activities;

- While an employee is on a business trip, he cannot be fired and must be paid wages.

According to the Tax Code:

- the profit tax base is not reduced due to excess daily payments;

- the amount of daily payments, which is not subject to taxation, is limited;

- The procedure for withholding personal income tax is regulated by Article 226.

Article 226. Peculiarities of tax calculation by tax agents

Responsibility

Tax agents may be held liable if they:

- did not submit calculations in form 6-NDFL at all;

- submitted the report, but late;

- provided false information in the appropriate form.

If the first two situations described above occur, the taxpayer will have to pay a fine of 1,000 rubles for each overdue month, including incomplete ones.

For calculations that contain false information, you will have to pay 500 rubles each. But this can be avoided if the taxpayer found and corrected the error before the tax inspectors.

In addition to tax fines, there are also administrative fines, for example, for officials in organizations. Their size varies from three hundred to five hundred rubles.

If the taxpayer does not submit reports on time, the tax service may block the bank account. It is important to know that individual entrepreneurs, notaries, and lawyers are not held liable in the form of administrative fines.

Uniform requirements for registration of 6-NDFL

This is a standard reporting form according to which a tax agent (individual entrepreneur, organization) reports for the income of its personnel. The document has been introduced and applied since 2021. Its structure consists of a title page and 2 sections. This type of reporting is generated on an accrual basis for the first quarter, six months, 9 and 12 months.

Entries are made based on available information on income, deductions, and personal income tax. The tax agent must enter the information. He also submits the completed document to the Federal Tax Service.

The rules for filling out this form are determined and formalized by the Federal Tax Service of the Russian Federation. Amounts and details are required to be filled out. If there are not enough pages for the information that needs to be entered, then the required number of pages is taken to fill out. In familiar places that are not filled in, dashes are added.

The form can be filled out on a computer and printed. Then dashes are not placed in empty positions. The font used is Courier New 1 (6-18 points).

The date is written on each completed page and the signature of the head of the organization (individual entrepreneur, notary, lawyer, representative of the tax agent) is affixed.

The procedure for displaying above-limit travel expenses in 6-NDFL

In order to display excess amounts, Section 2 of 6-NDFL is drawn up. Here the dates and amounts of income and personal income tax are specified. The section includes 5 lines.

| Key points of section 2 line by line | Section 2 details (what does it include?) |

| Page “100” (Date of actual receipt of income) | This refers to income, the size of which is displayed at position “130”; the last day of the month is written (Article 223 of the Tax Code of the Russian Federation); sickness benefits and vacation pay are recorded on the actual date of receipt |

| Page “110” (Dating of withheld personal income tax) | Income tax is withheld on the day the actual income is received (displayed in position “130”), and it is from this that the tax is calculated |

| Page “120” (Date of income transfer) | The duration is influenced by the type of income: sickness benefits and vacation pay are issued before the end of the month; in some cases, the information is reflected the next day after receiving the money. Usually the date is recorded here, no later than which personal income tax is deducted |

| Page “130” (Amount of income received) | This includes: the exact amount of total actual income without deduction of withholding tax; amount of excess travel allowances |

| Page “140” (Value of withheld personal income tax) | The summed personal income tax that was withheld on the date recorded in position “110” |

If the beginning of an operation belongs to one reporting period, and the end to another, then section 2 of this form records information on the final period.

Example 1. Display and calculation of excess travel expenses, income tax, income in 6-NDFL

An employee of Proekt LLC, Tsarev N.M., was on a three-day business trip (July 2021) around the Russian Federation. His daily allowance for 3 days amounted to 3,000 rubles. (1,000 rubles for each business trip day). The advance report that the traveler submitted to the director was approved on July 28, 2017.

The accrued July salary of N. M. Tsarev amounted to 70,000 rubles. So, for July 2021 he was paid:

- 07.2017 - advance payment towards pay 35,000 rubles;

- 08.2017 - the balance of July earnings, taking into account the withheld income tax on it and on travel expenses.

The calculated tax was received by the budget on August 4, 2017. Daily travel allowances issued to an employee (1,000 rubles) exceed the fixed limit, i.e. 700 rubles. This means that personal income tax must be withheld from the difference, i.e., the amount exceeding the limit. Accordingly, this fact should be reflected in 6-NDFL (section 2, for 9 months).

| Calculation of amounts for pay, personal income tax and travel allowances | Line-by-line display of above-limit travel allowances issued to Tsarev N.M. (6-NDFL, section 2) |

| The total amount of travel allowances issued to N.M. Tsarev for 3 days of the business trip: 1,000 * 3 = 3,000 rubles. Amount of daily allowance for 3 days of a business trip, from which, by law, personal income tax does not need to be calculated: 700 rubles. per day * 3 days = 2,100 rub. The amount of daily allowance exceeding the limit is withheld from personal income tax (13%): 3,000 – 2,100 = 900 rubles. Personal income tax withheld from the excess amount of daily allowance: 900 rubles. * 13% = 117 Personal income tax on earnings: 70,000 * 13% = 9,100 rubles. Actual earnings received by N. M. Tsarev for July: 70,000 rubles. + 900 rub. = 70,900 rub. The summed personal income tax from pay and the excess amount of daily allowance: 117 + 9,100 = 9,217 rubles. | Page “100” (Date of receipt of income) - 07/31/2017 Page “110” (Dating of personal income tax withholding) - 08/3/2017 Page “120” (Dating of personal income tax enrollment) - 08/04/2017 Page “130” (Amount of actual salary of Tsarev N.M.) - 70,900 rubles. Page “140” (Total amount of personal income tax withheld) - 9,217 rubles. |

Answers to frequently asked questions

Question No. 1: During what time period is personal income tax withheld on travel expenses?

The tax is calculated from the initial payment in the month following the approval of the advance report.

Question No. 2: How to draw up section 2 if there is income in kind? Income is not calculated here.

Question No. 3: Is it possible to withhold tax on excess daily allowances until the end of the month (on the date of the advance payment)? The advance report has been agreed upon by this time.

If the estimated tax withholding date is before the last day of the month, then no. Even if there is an agreed expense report. Personal income tax is not withheld from an advance paid to a business traveler.

For example, a business trip lasted from October 9 to October 14, 2017, the advance report was approved on October 16, 2017. On the day the report is approved (October 16), personal income tax cannot be transferred. The tax must be transferred to the paycheck, which will be issued next month.

Personal income tax is withheld in accordance with the Tax Code of the Russian Federation on the date of payment of income. It can be withheld for any payment that is made after the final day of the month of approval of the report.

An employee sent on a business trip incurs additional inconvenience and costs of living in another city, the employer compensates for this by paying per diem. Are these amounts the income of the employee from whom tax must be withheld and does the accountant need to show the daily allowance in Form 6 of the personal income tax?