It is mandatory to use the travel income code in the 2-NDFL certificate. Payments to employees whom management sends on business trips must be taxed. In the form, this data is written in special codes:

- the number 2000

is entered based on the employee’s average earnings; - 4800

- this is a number that indicates overtime, includes compensation for expenses and accommodation of the employee while on a business trip.

There is no individual code for registering and recording income from business trips in form 2-NDFL. Payments are divided into 2 codes - 4800 and 2000. Amounts that were exempt from tax are simply not indicated in the document.

Example of personal income tax payments from daily allowances

To reflect the amount of excess daily allowance in form 6-NDFL, it is necessary to determine the dates that will be indicated in Section 2 of the Calculation.

The date of actual receipt of income for daily allowances subject to personal income tax is the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Thus, this date must be indicated on line 100 “Date of actual receipt of income” of form 6-NDFL.

https://www.youtube.com/watch?v=ytdev

The date of tax withholding (line 110) will be the date of actual payment of income from which personal income tax was withheld (clause 4 of Article 226 of the Tax Code of the Russian Federation). It is important to keep in mind that this date cannot be earlier than the last day of the month, because personal income tax cannot be withheld if income is not received. And since the income was received on the last day of the month, then personal income tax can be withheld at the next payment of income made on the last day of the month or later (Letter of the Federal Tax Service dated April 29, 2016 No. BS-4-11/7893).

Accordingly, personal income tax on excess daily allowances must be transferred no later than the business day following the day when personal income tax was withheld from daily allowances.

For July 2021, the employee received a salary (including average earnings during the business trip) in the amount of 76,000 rubles, incl. Personal income tax 13% - 9,880 rubles. The advance for July was paid on July 15, 2016 in the amount of 30,000 rubles. On July 27, 2016, the employee submitted an advance report for a business trip on the territory of the Russian Federation, which indicated the daily allowance for 4 days of the business trip in the amount of 4,000 rubles.

(4 days * 1000 rub./day). On July 28, 2016, the advance report was approved by the General Director. On 08/05/2016, the employee was paid the balance of his salary for July 2021, taking into account the withholding of personal income tax from the salary of 9,880 rubles, as well as personal income tax from the excess daily allowance of 156 rubles. ((4,000 rub. – 4 days * 700 rub./day)*13%). The final payment was 35,964 rubles. (RUB 76,000 – RUB 30,000 – RUB 9,880 – RUB 156). Personal income tax was transferred to the budget on time (08/08/2016). There were no other payments in the reporting period.

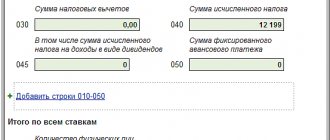

Section 2 of form 6-NDFL for 9 months of 2021 will be filled out as follows:

- line 100 “Date of actual receipt of income” - 07/31/2016;

- line 110 “Tax withholding date” - 08/05/2016;

- line 120 “Tax payment deadline” - 08/08/2016;

- line 130 “Amount of income actually received” - 77,200 (76,000 (4,000 – 700*4));

- line 140 “Amount of tax withheld” - 10,036 (9,880,156).

Please note that the indicators for wages and excess daily allowance in Section 2 are collapsed, since all dates in lines 100-120 of Section 2 in relation to these payments coincided.

Tax Code of the Russian Federation Art. 217 personal income tax on travel expenses.

Decree of the Government of the Russian Federation dated October 13, 2008 N 749 regulates the specifics of business trips.

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1 approves the form of documentation for business trips.

Local acts of the organization.

https://www.youtube.com/watch?v=ytpolicyandsafety

When sending an employee on a business trip, the organization makes the following payments to him:

- Salary based on average

- Travel allowances (payment for travel to and from the place of travel, accommodation at the place of business trip, other needs)

- Daily allowance (compensation)

Such payments represent travel expenses, which must be paid equally by both enterprises and individual entrepreneurs, and this does not depend on the taxation regime.

An employer who sends his employee on a business trip, in accordance with labor legislation, is obliged to compensate him for expenses associated with the business trip.

Experts from the legal consulting service GARANT O.N. Grafkin, E.V. Melnikova

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

If an employee travels for several days, the employer is obliged to reimburse travel expenses and daily allowances. And for a one-day business trip, only travel is reimbursed. Payments are regulated by Government Decree No. 749 dated October 13, 2008.

| Travel destination for 1 day | Daily allowance amount |

| Business trip abroad | 50% of the established limit |

| Business trip around the Russian Federation | Not paid |

But internal regulations may provide compensation for the trip, and their amount is also specified.

We invite you to familiarize yourself with: Personal Income Tax - Personal Income Tax

To correctly calculate daily allowance, you must take into account:

- days the employee is on a business trip, including weekends, holidays, days on the road and temporary stops

- payment of daily allowance in advance before the start of a business trip (if the employee is not given the money, he has the right not to go on a business trip)

- if the employee does not plan to return on the corresponding day after performing official duties, then the daily allowance is not paid

- daily allowances are paid if the employee receives a sick leave certificate while on a business trip (the average salary is not paid, but sick leave benefits are accrued)

| Travel within the Russian Federation | 700 rub. |

| Travel abroad | 2500 rub. |

The daily allowance is not reflected in the report on travel expenses, since there are no supporting documents. The fact of presence on a business trip is a business trip order and travel tickets.

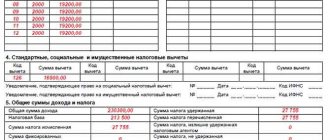

Local acts of the organization set the amount of daily allowance for trips within the Russian Federation in the amount of 1000 rubles. The employee was sent to Kazan for 5 working days (from September 3 to September 7, 2021). The employee left for his destination on September 2 and arrived back on September 8. What amount of daily allowance will be paid and the amount of personal income tax.

During a business trip, daily allowance will be paid for 7 days in the amount of 7,000 rubles.

Based on the legislation, 700 rubles are not subject to personal income tax. per day of stay on a business trip, which means 4900 rubles are not taxed, the amount in excess of these norms will be subject to personal income tax - 2100 rubles.

2100 rub. * 13% = 273 rub.

The date of receipt of income for excess daily allowance, as well as for the average salary during a business trip, is the last day of the month in which it was accrued.

For example, an employee was on a business trip from September 2 to September 8, 2019, and travel allowances were transferred on August 27. This means that on the last day of September - the 30th, he needs to calculate the salary based on the average for the time that the employee spent on a business trip and calculate personal income tax, and the excess daily allowance listed in August relates to the income of August, but it is treated as prepaid income , which is considered as such after approval of the business trip report, so personal income tax must be calculated with the next salary payment (for example, an advance for September). Personal income tax is withheld on the day the income is paid and transferred on the next business day.

Daily allowances above the limit amounted to 2,700 rubles, the amount of personal income tax on them was 351 rubles. The date of receipt of income will be the date of approval of the report, and payment of taxes will be the day following the day of payment of the next salary. The basis for writing off expenses to account 20 is an order for sending on a business trip and a report on travel expenses.

| Operation | Debit | Credit |

| Salary accrued | 20 | 70 |

| Personal income tax has been accrued and withheld from excess daily allowances | 70 | 68 subaccount “Personal Income Tax Payments” |

| Income paid to employees | 70 | 51 |

| Transferred to the personal income tax budget | 68 subaccount “Personal Income Tax Payments” | 51 |

Due to the fact that excess daily allowances for business trips will be classified as the employee’s income, they must be reflected in the reporting - in the 2-NDFL certificate, for which there is an income code: 4800 - and it is subject to personal income tax. The amount of daily allowance that is not subject to personal income tax and is not reflected in the certificate.

Due to the fact that excess daily allowances are considered income and are taxed, it also needs to be reflected in the 6-NDFL reporting. The date of receipt of income will be considered the date of approval of the advance report, and the date of calculation of personal income tax will be the date of the next salary payment (since the actual payment and report will not always be the day the salary is issued).

100 – report approval date

110 – next salary payment date

120 – date of transfer of tax from the next salary

130 – amount of excess daily allowance

https://www.youtube.com/watch?v=https:tv.youtube.com

140 – personal income tax withheld from these daily allowances.

00 – next day. Even if an employee leaves on a business trip at 23:55, then these 5 minutes will be counted as a whole day, for which the average salary and daily allowance must be calculated. At the same time, additional expenses for traveling to the place of departure of the main transport, for example, the airport, take into account the travel time to it and if it increases the duration of the business trip, it must also be paid.

We invite you to familiarize yourself with: Loss of income insurance

We must immediately draw your attention to the fact that today almost all calculations on certificate 2 of personal income tax are made solely on the basis of the use of special programs. In the program you just need to indicate the income code, after which, a certain amount of income, but the tax calculation will be done automatically.

Let us draw your attention to the existence of certain features when processing travel payments in personal income tax certificate 2:

- The certificate displays the amount of average earnings accrued to the traveling employee, exclusively with code 2000. This code, in principle, displays the amount of wages accrued to the employee under the employment contract;

- When paying daily allowances that are in excess of the specified amount, these parameters must be displayed in the certificate with code 4800. This code displays all types of income that fall under the concept of other income;

- Remember that daily allowances in the total amount are not subject to the personal income tax rate, and therefore they are not displayed in the certificate;

- Clear boundaries have been established for daily allowances, which are not taxed and are not indicated in the certificate. This is the amount of 700 rubles if the business trip takes place on the territory of Russia and the amount of 2500 rubles if the business trip is foreign;

- Also, these amounts are subject to insurance premiums, which are established exclusively by the organization’s local regulations.

What norms are provided by law?

The issue of excess daily allowances is regulated by two main legislative documents - the Labor and Tax Codes.

The Labor Code regulates the following aspects:

- Article 168 obliges the employer to reimburse expenses of employees associated with living outside their permanent place of residence;

- the amount of daily allowance can be determined by the employer independently, and it must be fixed in a local regulatory document or collective agreement;

- The trip of an employee whose work officially involves the implementation of field activities is not considered a business trip;

- when a person is on a business trip, his salary must be accrued to him in the established amount, and his job must also be retained.

Article 168. Amount of tax presented by the seller to the buyer

The Tax Code establishes the following standards:

- the fact that daily allowances higher than the norm established by the Russian Government do not reduce the income tax base (Article 264);

- Article 217 limits the amount of daily payments that are not subject to taxation;

- The procedure according to which personal income tax is withheld is determined by Article 226.

Article 264. Other expenses associated with production and (or) sales

Article 217. Income not subject to taxation (exempt from taxation)

Article 226 Peculiarities of calculation and payment of tax by tax agents when carrying out transactions with securities

Important regulatory documents are decrees of the Russian government, which address the problem of paying daily allowances to employees. In the first document, number 93, you can find information about the daily allowance standards that can be paid. The second, numbered 729, displays the amount of reimbursement for expenses incurred during a business trip, which should guide budget structures.

Insurance premiums based on daily allowance

Since 2021, the Federal Tax Service of Russia has been administering the procedure for calculating and paying insurance premiums to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund of Russia (with the exception of contributions for injuries). In this regard, the Tax Code has been supplemented with a new chapter 34 “Insurance premiums”. It sets out the rules for calculating and paying contributions.

Thus, it has been established that daily allowances in the amount of:

- no more than 700 rubles for each day of a business trip in the Russian Federation;

- no more than 2,500 rubles for each day of being on a business trip abroad (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

Until 2021, daily allowances were not subject to insurance premiums within the limits established by the company itself in its local regulations.

Thus, from 2021, daily allowances in excess of these standards should be subject to contributions, regardless of whether the excess amounts are prescribed in local regulations or not.

As a general rule, the date of payments is determined as the day they are accrued (clause 1 of Article 424 of the Tax Code of the Russian Federation). The date the employee receives income in the form of excess daily allowance is the day the advance report is approved.

This means that daily allowances that exceed the norm are included in the base for calculating insurance premiums in the calendar month in which the employee’s advance report is approved.

Let us remind you that upon returning from a business trip, the employee is obliged to submit an advance report on the amounts spent in connection with the business trip, including daily allowances, within three working days, and make a final payment on the cash advance issued to him before leaving for the business trip for travel expenses (clause 26 Regulations on business trips, approved by the Government of the Russian Federation of October 13, 2008 No. 749).

Please note that daily allowances are not subject to insurance premiums for injuries (Clause 2, Article 20.2 of Federal Law No. 125-FZ of July 24, 1998). In this case, the amount of daily allowance does not matter.

https://www.youtube.com/watch?v=ytabout

Insurance premiums are not charged on daily allowances if such daily allowances do not exceed the above limits (clause 2 of Article 422 of the Tax Code of the Russian Federation). Accordingly, daily allowances in excess of the norm are subject to insurance premiums in 2021.

In other words, when traveling within the Russian Federation for daily allowances over 700 rubles, insurance premiums will need to be calculated. And for business trips abroad, insurance premiums are calculated from daily allowances exceeding 2,500 rubles per day of business trip.

Please note that for one-day business trips, insurance premiums must be calculated from the entire amount. This is due to the fact that payments for one-day business trips cannot be recognized as daily allowances, and therefore they are not exempt from contributions (clause 11 of the Regulations, approved by Government Resolution No. 749 dated 13.10.2008, Letter of the Ministry of Finance dated 02.10.2017 No. 03- 15-06/63950).

We invite you to read: Insurance against loss of income

Although, if such payments for one-day business trips are formalized not as daily allowances, but as reimbursement of expenses associated with the business trip, they will not be subject to contributions. But the expenses incurred will need to be confirmed with primary documents.

Speaking about insurance premiums up to this point, we meant contributions for compulsory health insurance, compulsory medical insurance and VNIM, paid in accordance with the requirements of the Tax Code of the Russian Federation. As for insurance premiums for injuries, daily allowances are not fully subject to them. In this case, it does not matter whether the daily allowance threshold established by the employer exceeds 700 rubles or 2,500 rubles (Clause 2 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ, Letter of the Social Insurance Fund of November 17, 2011 No. 14-03-11/ 08-13985).

As already mentioned, excess daily allowances are subject to insurance premiums in 2021 in accordance with the requirements of the Tax Code of the Russian Federation. What are the features of reflecting daily allowances in the calculation of insurance premiums?

Despite the fact that only above-limit daily allowances are subject to insurance premiums for compulsory medical insurance, compulsory medical insurance and VNIM, the full amount of daily allowance must be shown in the DAM.

For the corresponding type of insurance, daily allowances paid to employees must first be included as part of the amounts of payments and other remunerations calculated in favor of individuals. And then the non-taxable part of the daily allowance must be indicated as part of the amounts not subject to insurance premiums (Procedure for filling out, approved by Order of the Federal Tax Service dated 10.10.2016 No. ММВ-7-11 / [email protected] , Letter of the Federal Tax Service dated 24.11.2017 No. GD-4 -11/ [email protected] ).

What it is

When an employee is sent on a business trip to another location in Russia or abroad, the organization must pay him a monetary remuneration calculated for each day. It's called "daily allowance".

The employer must pay them in the following situations:

- the employee is sent on a business trip;

- the employee is on a business trip, which is traveling in nature or the work within which takes place directly on the road;

- when working in the field or participating in an expedition.

The following definition is enshrined at the legislative level: a business trip is a business trip, the terms and conditions of which are determined by the employer. An important condition is that the place of work is remote from the location of the organization in which the seconded person works.

Payment of excess daily allowances involves the employee receiving an amount that exceeds the norm established by law. Special attention should be paid to expenses that do not qualify as daily allowance, but must be paid by the employer.

Among them:

- transportation costs (types of transport, the costs of which will be compensated, are determined by each employer independently);

- expenses associated with living in another city;

- additional expenses resulting from the fact that the employee lives away from home.

The remaining expenses are covered by the employee from the daily allowance paid by the employer. Their amount may be increased at the discretion of the organization’s management. In such a case, we must not forget that excess daily allowances are subject to taxation. If this rule is neglected, you can become a defendant in a lawsuit.

An example of reflecting daily amounts in excess of the standard (RUB 700) in section 2 of 6-NDFL

The employee reported on August 29, 2021. Will the salary for August 2019 be paid on April 5, 2021?

Personal income tax on the amount of daily allowance in excess of the limit must be withheld from the amount of wages paid (09/05/2019). Personal income tax must be transferred no later than 09/06/2019.

100 – 31.08.2019

110 – 05.09.2019

120 – 06.09.2019

https://www.youtube.com/watch?v=upload

130 – daily allowance over the limit

140 – withheld personal income tax from daily allowances above the limit

In form 4-FSS, daily allowance must be shown twice (Procedure for filling out, approved by FSS Order No. 381 dated September 26, 2016):

- as part of the amounts of payments in line 1 of table 1 “Calculation of the base for calculating insurance premiums” of form 4-FSS;

- as part of amounts not subject to insurance premiums, according to line 2 of table 1.

Income code “Travelling” in certificate 2-NDFL

You must understand that it is very important to correctly draw up the document taking into account all income and at the same time, you need to exclude the possibility of indicating those incomes that, in principle, cannot be taxed.

That is, the amount of 700 rubles, which is allocated to an employee for a business trip per day, in principle, is issued in full without withholding taxes. But, if you, for example, give an employee not 700, but 1000 rubles, then the amount of 300 rubles must go through certificate 2 of the personal income tax code 4800. Thus, from the amount of 300 rubles, a tax of 13% must be calculated. The posted employee receives a standard salary, which is also subject to tax at 13%.

Inclusion in RSV-1

All organizations, including individual entrepreneurs, need to send personal data and certificates in the RSV-1 form to the Pension Fund. It is a report that contains information regarding accrued or made insurance transfers. It contains a large amount of information; it must be sent to the FFOMS and the Pension Fund of the Russian Federation.

Line 201 in clause 2.1 reflects the amount of payments and compensations that do not require transfers for compulsory pension insurance.

All individual entrepreneurs and company managers should know the information from the RSV-1 form certificate.