What are the income and deduction codes for personal income tax in 2021:? A table with codes and explanations is given in this article. In different tables with decoding codes of income and deductions for personal income tax for 2020.

Also see:

- Certificate form 2-NLFL in 2021

- New deadlines for submitting 2-NDFL in 2021

What do personal income tax codes mean?

The Tax Code obliges tax agents to keep records of income paid to individuals, not in any form, but using special codes.

Thus, paragraph 1 of Article 230 of the Tax Code of the Russian Federation states that each tax agent must compile tax accounting registers. They need to record income paid to individuals in accordance with the codes approved by the Federal Tax Service. The current codes are given in the Federal Tax Service order No. ММВ-7-11/ [email protected] (hereinafter referred to as order No. ММВ-7-11/ [email protected] ). They are used, including for filling out certificates in form 2-NDFL. This means that incorrectly assigning a digital code to income will result in an error in the 2-NDFL certificate. This, in turn, threatens the tax agent with a fine of 500 rubles. for each incorrectly completed income certificate (Article 126.1 of the Tax Code of the Russian Federation, clause 3 of the Federal Tax Service letter No. GD-4-11/14515 dated 08/09/16).

Fill out and submit 2-NDFL via the Internet with current codes

In addition, in many accounting programs, payment codes are tied to determining the date of actual receipt of income. And it is used when filling out line 100 of section 2 of the 6-NDFL calculation. Consequently, due to an error in income coding, the tax agent may incorrectly fill out the 6-NDFL calculation. For this violation, the fine is also 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation).

Finally, this same pay encoding is used in most accounting programs to calculate average earnings. Therefore, incorrect assignment of a code may cause incorrect calculations with employees for vacation pay, business trips, sick leave, etc. If the payment turns out to be underestimated, the organization may be fined in the amount of 30,000 to 50,000 rubles, an official - from 10,000 to 20,000 rubles, and an individual entrepreneur - from 1,000 to 5,000 rubles. (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the employee is transferred more than is due, there may be problems with the payment of various benefits compensated from the budget.

IMPORTANT. Errors in the application of codes can lead to underestimation or overestimation of vacation pay, travel allowance, sick leave and other payments “tied” to average earnings. Therefore, it is better to calculate these payments in web services, where current codes are installed and entered into reporting automatically.

Calculate your salary, vacation pay and benefits for free in the web service

Let's sum it up

Legislative changes in coding for various reporting forms occur quite often. Life does not stand still, and with it, control documentation. It is necessary to constantly monitor changes in this area, maintaining the established rhythm of life of the company. Falling out of it is fraught with problems with the inspection, unnecessary fines and headaches for the manager. We wish you to keep up with the times and good luck in your work!

It is important to closely monitor changes in legislation

Income code 4800 with decoding

Let's start with the most universal code - 4800 “Other income”. It corresponds to any income for which there is no more suitable code in Order No. ММВ-7-11/ [email protected] (letter of the Federal Tax Service dated 07/06/16 No. BS-4-11/12127). For example, this code indicates income in the form of a one-time additional payment for vacation (letter of the Federal Tax Service dated August 16, 2017 No. ZN-4-11 / [email protected] ).

In addition, code 4800 can be used, in particular, in relation to the following income: average earnings saved for the days of medical examination; payment for downtime caused by reasons beyond the control of the parties; compensation for the delay in issuing a work book to a dismissed employee; the average salary retained for donors on the days of blood donation and on the days of rest provided to them; the amount of forgiven debt on the advance report; excess daily allowance, etc.

This code is also used for settlements with individuals who are not employees of an organization or individual entrepreneur. For example, using this cipher it is necessary to reflect the amount of winnings that a buyer or client received when participating in a lottery that was not held for the purpose of advertising goods, works or services. Also, code 4800 is used when “requalifying” interim dividends if, at the end of the year, the amount of profit turned out to be lower than the calculated one.

Why do you need a certificate?

It would seem that who might need information about a citizen’s income and the taxes he pays. However, in reality, the document is in great demand, if only because credit institutions today require it every time they issue a serious loan. Since people cannot earn money in a few years to open a business, buy a home, a car and other important elements of life in the context of a protracted economic crisis in Russia, they have no choice but to borrow from banks.

The accounting department is obliged to issue a certificate to the employee not only upon personal application, but also upon dismissal of the latter, since when taking up a position at a new place of work, the personnel department sometimes requires the provision of this form from the previous place of work. Usually, when leaving a company, it is automatically implied that it will be issued, but otherwise, do not forget to fill out an application.

The use of the form is also mandatory in the procedure for obtaining state compensation in the form of a tax deduction, which is provided to some citizens in specific situations, for example:

- people who have spent a lot of money on treatment;

- parents paying for their children’s education in higher educational institutions;

- citizens who bought housing, etc.

Providing this form is necessary in many other situations:

- when calculating pensions for elderly people and pensioners due to health reasons;

- when preparing documents for the adoption of an orphanage child;

- to take part in court on disputes on various topics, such as labor proceedings;

- to determine the amount of alimony due to a child or ex-spouse, etc.

Sometimes foreign embassies require you to provide a form, but most often they are limited to only a certificate of employment and bank account information.

Income code 2000 with decoding

The next most common code is 2000. According to Order No. ММВ-7-11 / [email protected] , this code corresponds to “remuneration received by the taxpayer for the performance of labor or other duties.”

Typically, the use of this code does not cause difficulties - everything that is reflected in the employer’s accounting as a salary accrued under an employment contract for the daily performance of job duties “passes” under code 2000. The same value is assigned to the average earnings saved for the period of a business trip, since it also is a salary (letter of the Ministry of Finance dated November 12, 2007 No. 03-04-06-01/383).

Automatically calculate the salary of a posted worker according to current rules Calculate for free

Income codes 2002 and 2003 with decoding

But bonuses for the purpose of coding income as wages are not recognized, although they are named in Article 129 of the Labor Code of the Russian Federation as part of remuneration. Moreover, bonuses are reflected in tax registers and in 2-NDFL certificates in three different codes.

The main code is 2002. It is used for awards that simultaneously satisfy three conditions:

- the payment is not made at the expense of profits, earmarked proceeds or special-purpose funds;

- the payment is provided for by law, labor or collective agreement;

- the basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties). This circumstance must be confirmed by an order for payment of the bonus.

Code 2003 reflects bonuses (regardless of the criteria for their assignment) and other remunerations (including additional payments for complexity, intensity, secrecy, etc., which are not bonuses), which are paid from special-purpose funds, targeted revenues or profits organizations.

For other bonuses, code 4800 must be used.

Also see: “Taxes on premiums: we calculate personal income tax and contributions, take them into account in expenses, and reflect them in reporting.”

Income codes 2012 and 2013 with explanation

The 2012 code corresponds to the amount of vacation pay, that is, the average earnings retained by the employee during the vacation period. This code is used to make payments both for regular vacations and for additional ones, including educational ones.

Code 2012 can only be applied to vacation pay that is paid to existing employees. If the employer transfers compensation to the dismissed employee for unused vacation, this income must be assigned code 2013.

ATTENTION. The Labor Code allows for the provision of leave followed by dismissal (Part 2 of Article 127 of the Labor Code of the Russian Federation). In this case, the employee receives the final payment and work book before the vacation, and does not return to the previous employer after the vacation. However, from the point of view of labor legislation, the transferred amounts are vacation pay, and not compensation for unused vacation. Therefore, the code 2012 must be applied to such a payment.

Also see: “An employee is ill or recalled from vacation: what to do with personal income tax, contributions and reporting?”

Income code 2300 with decoding

Using code 2300 in personal income tax reporting, temporary disability benefits are indicated. This code must be assigned not only to the benefit that is paid in case of illness of the employee himself, but also to those amounts that are transferred in the case of caring for sick children or other family members.

REFERENCE. Formally, maternity benefits also fall under this code, since the basis for its accrual is sick leave. But since maternity benefits are not subject to personal income tax (clause 1 of article 217 of the Tax Code of the Russian Federation), this payment may not be recorded at all in the registers and certificate 2-NDFL (clause 1 of article 230 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated April 2, 2019 No. 03- 04-05/22860).

Create electronic registers and submit them to the Social Insurance Fund via the Internet

What income is not subject to personal income tax?

You need to understand: with regard to income tax, there are no so-called beneficiaries, that is, individuals who are completely exempt from paying it. Only certain types of income are subject to exemption:

- Benefits for women during pregnancy and childbirth.

- Insurance and funded pensions.

- Social supplements to pensions.

- All legally approved compensation related to: compensation for damage to health; with free provision of accommodation and utilities; with the dismissal of an employee, with the exception of payment for unused vacation.

- Payment for donated blood and breast milk to persons who are donors.

- Alimony received by the taxpayer.

- Financial assistance paid to employees within limits not exceeding four thousand rubles.

- Financial assistance paid to employees at the birth or adoption of a child within limits not exceeding 50 thousand rubles.

- Other income listed in the Tax Code of the Russian Federation, Article 217.

Various types of deductions are subtracted from the tax base when calculating personal income tax. This is an amount determined by law that is not subject to taxation. Deductions are provided to citizens with children, representatives of certain professions, veterans, persons affected by man-made disasters, and others listed in the Tax Code of the Russian Federation.

Revenue codes 2762 and 2760 with decoding

Using code 2762 in tax registers and 2-NDFL certificates, you must indicate the entire amount of financial assistance issued to the employee at the birth of a child. Let us remind you that such financial assistance is not subject to personal income tax up to 50 thousand rubles. for each child, provided that the payment is transferred no later than one year after his birth (clause 8 of article 217 of the Tax Code of the Russian Federation).

When paying employees of other types of financial assistance, the code 2760 is used. In this case, the basis for the transfer of money does not matter. So, if the company decides to issue financial aid for vacation, then this amount must be separated from the main “vacation pay” and reflected with code 2760. This code must also be assigned to financial aid paid to former retired employees. Let us remind you that such income is not subject to personal income tax up to 4,000 rubles. per year (clause 28 of article 217 of the Tax Code of the Russian Federation).

Income on which personal income tax is calculated

Personal income tax is charged on all types of income of individuals. They include:

- Salary based on the main position and part-time position.

- Premium payments.

- Payment of basic and additional vacations.

- Payment of sick leave.

- Gifts and winnings.

- Royalties received for intellectual activity.

- Insurance payments.

- Payment for work under civil contracts.

- Proceeds from the sale of property.

- Income of the lessor under the lease agreement.

- Other income of the taxpayer.

For the correct calculation of personal income tax, the citizenship of an individual does not matter, the only important thing is whether he is a resident or not. This is determined by how many days this person spends in a year (the calendar year is the tax period for personal income tax) within the borders of Russia. If a person stays in the country for more than 183 days, he is considered a resident; otherwise, he is considered a non-resident. A resident individual is subject to taxation on all income in accordance with the law. A non-resident pays only on the income he received from a Russian-based source.

The tax base for the income tax of an individual consists of all income issued to him in financial or in kind form, with the exception of amounts that, in accordance with the Tax Code of the Russian Federation, are free from taxation and various types of deductions.

Income code 2720 with explanation

Code 2720 is used in personal income tax reporting to include the cost of gifts for employees. In particular, it should be used for gifts for the New Year, birthday, etc.

ATTENTION. According to the rules of paragraph 28 of Article 217 of the Tax Code of the Russian Federation, gifts worth no more than 4,000 rubles are exempt from personal income tax. in a year. This income must be reflected in the tax registers, regardless of the amount of the gift. But in the 2-NDFL certificates the cost of gifts does not exceed 4,000 rubles. for a year, you don’t have to show it (letters from the Federal Tax Service dated 07/02/15 No. BS-4-11/ [email protected] and dated 01/19/17 No. BS-4-11/ [email protected] ).

Also see: “Tax accounting for gifts and bonuses, or what an accountant should do after February 23 and March 8.”

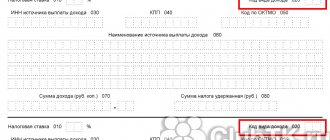

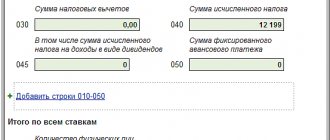

Appendix to the 2-NDFL certificate in 2021

The appendix to the 2-NDFL certificate must be filled out separately for each tax rate (clause 1.19 of the Procedure for filling out the 2-NDFL certificate). It states:

- income that you paid to an individual in cash and in kind, as well as in the form of material benefits;

- tax deductions from these incomes provided to individuals (except for standard, social and property ones).

The fields of the Appendix to the certificate are filled in as follows:

- in the “Month” field – the serial number of the month;

- in the “Income code” field – a code depending on the type of income of an individual (for example, the code for salary is 2000, the code for vacation pay is 2012);

- in the “Amount of Income” field – the entire amount of income accrued and actually received by an individual this month;

- in the “Deduction Code” field – the code corresponding to the deduction provided (for example, the code for deduction from the cost of a gift is 501);

- in the “Deduction Amount” field – the amount of the deduction provided. It cannot exceed the amount of the relevant income.

Here's an example:

Income codes 2400 and 1400 with decoding

To indicate rental income, you need to choose one of two codes (depending on the object that is transferred under the contract). Thus, income from the rental of any cars, as well as sea, river and aircraft, is reflected in personal income tax reporting using a special code 2400. It is necessary to show the fee for the rental of these types of transport, even if it is paid to the employee (including h. to the manager). The same code also covers income from other uses of vehicles. Therefore, it includes income from contracts for the provision of services for driving your own car, rental agreements with a crew, etc.

REFERENCE. Compensation for the use of a personal car, paid under an employment contract in the amount established by its parties, is not subject to personal income tax. There is no income code for this payment, and it does not need to be indicated in personal income tax reporting.

Also see: “How to more profitably register an employee’s use of his car (new edition).”

Draw up and print a vehicle rental agreement for free using a ready-made template

In addition, code 2400 applies to rental payments for fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks.

Income from the rental of any other property (including real estate, including residential) must be reflected using code 1400. It does not matter who exactly receives this income from an organization or individual entrepreneur: a manager, an ordinary employee or an outsider.

Deadlines for obtaining a certificate

As already mentioned, the employee receives this form independently, in the accounting department of the company where he is employed. You won't have to wait long to receive it, just three days. To start the paper preparation process, you need to appear in person at the accounting department and write an application addressed to the manager.

Time limits for obtaining a certificate from the accounting department

When receiving a document, check the following important elements, without which it has no real weight:

- The signature of the head of the organization is required;

- The company seal must be placed on the pages of the form.

Revenue code 2001 with decoding

Code 2001 is used for remuneration paid to directors on the board of directors and other members of the organization's collegial governing body.

ATTENTION. The salary of an executive under code 2001 is not “posted”, even if the corresponding position is called “director”. However, if the manager is a member of the board of directors (board, other collegial body) and receives additional remuneration for this, then this amount must be separated from the salary and reflected for personal income tax purposes using code 2001.

Income code 2014 with explanation

The amounts of severance pay, as well as the average monthly earnings saved for the period of employment, are reflected in personal income tax reporting with the code 2014. This code applies only to that part of the payments that is subject to personal income tax (in total, it exceeds three times the average salary, and for “northerners” - sixfold). The income tax-free amount of severance pay and average earnings for the period of employment for personal income tax purposes is not fixed or coded.

Also see: “Payments when laying off an employee in 2019‑2020.”

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free