Taxi waybill validity period

Some may say that one day is too little, that it is inconvenient to spend several hours traveling to a taxi depot, undergoing a medical examination of the driver and checking the technical condition of the car. Time is money, and lately taxi drivers already have too little of it.

This used to be the case, but now the validity period of the waybill is 10 hours.

Before going further, I advise you to read articles on the topic in which I expressed my opinion about the work:

- Renting a car for a taxi – How much can you earn?

- Working in a taxi with your own car.

- Working in a taxi is the whole truth without embellishment.

- Taxi on credit – Should I take it or not?

I completely agree with you about income, but the culprit for everything is not the requirements of the law, but the greed of aggregators and taxi companies. Some constantly reduce the price of services in the fight for the client. Others don't want to pay wages, just rent. That's why you don't have enough money. The voucher has absolutely nothing to do with it.

Medical examination before going on line

But let's look at this issue from the other side.

Do you want to be driven by a sleepy, sick, or worst of all, drunk driver? I'm sure not. This happens all the time. I can’t vouch for all cities, but in Moscow you encounter a driver who is strictly contraindicated from driving. How many commercials are there on TV: “A taxi driver rammed a bus stop full of people”; “A drunk taxi driver hit a child and disappeared,” and so on. These are not isolated cases. This is precisely why the requirement with a waybill was invented. They will never let you on the line if you are very tired or if you had a good time with friends the day before.

Medical examination at the end of the shift

A taxi driver does not sit under constant surveillance; if previously a dispatcher could call you, then with the arrival of aggregators no one calls you or hears your voice. What's stopping you from drinking another bottle of beer during your shift? Nothing. I won’t speak for everyone, but I personally knew several people who passed by a doctor and immediately ran to the store for a bottle of beer or something stronger. This is fine? No. Therefore, in order to avoid such cases, the requirement for a doctor to pass through at the end of the shift was invented.

Taxi technical check

If you were a customer, would you want to drive a faulty car? Having ordered a car, a complete wreck can easily come to you. Along the way there will definitely be something creaking, knocking, vibrating. It's better to walk.

Let's summarize this section. Will you feel safe if something is wrong with you or the driver? No. That’s why they introduced a requirement for a taxi voucher.

Filling rules

The procedure for issuing waybills is established by Order of the Ministry of Transport No. 152 dated September 18, 2008. Waybills are taken into account in a special journal. Let’s take a closer look at what changes occurred in waybills in 2020 and how to draw up this document so that the inspectors from the tax authorities and the traffic police, who most often look at this document, do not have any questions.

Filling out this form in motor transport organizations is carried out by dispatchers, and in other companies - by an employee authorized to release cars for a trip. Such responsibilities are established by order of the head of the organization, since the one who fills out the document is responsible for errors made in it. Sometimes the drivers themselves do the paperwork. But as a general rule, drivers are required to fill out only their part of the document - record data on the car’s mileage in accordance with the indicators of the instruments in the car.

A voucher is issued only for one flight, one working day or shift. The unified form provides the opportunity to extend the validity of this document, since various situations can happen to a car during a trip, and driving without a waybill is a violation.

The waybill has several different forms depending on the type of vehicle. These forms differ in content and requirements for completion. We have collected them in a table so that each organization can easily navigate and choose the one they need.

| Unified waybill form | Who fills it out and how? |

| Form No. 3 for passenger cars | It is allowed to be used for registration of passenger vehicle flights both in specialized organizations and in ordinary companies. Features of filling out this form are given in Rosstat letter No. ИУ-09-22/257 dated 02/03/2005. |

| Form No. 4-c for trucks with piecework wages for drivers | The form is intended for motor transport companies engaged in cargo transportation. It contains columns for marks by representatives of the customer of the cargo. A new document is issued only after the driver has submitted the previous one to the accounting department. The form contains a tear-off coupon on the basis of which the salary is calculated. In form No. 4-p it is mandatory to indicate the numbers of waybills for the transported cargo. Such waybills should be stored together with transport documents. This form is valid for two flights within one business day. The waybill contains tear-off counterfoils, which are filled out by the vehicle owner for each flight. They are needed for further presentation of the invoice to the flight customer. |

| Form No. 4-p for freight transport with time-based wages for drivers | |

| Form No. 3-special for special vehicles (truck cranes, cement trucks, garbage trucks, fuel tanks, concrete mixers, etc.) | |

| Form No. 4 for passenger taxi | The form has a field for recording taximeter readings. Such a waybill is issued for the driver for only one shift, after which he submits it to the dispatcher. |

| Form No. 6 - bus waybill | Form for carrying out bus routes on city routes. It contains a column about pre-trip medical monitoring of the driver’s condition. |

If such waybills are suitable for the organization, download the forms directly from the links in the table from the relevant resolutions. Each registration document must be stamped with the stamp of the organization that owns or rents the vehicle in order for it to have legal force. In addition, it is necessary to indicate the time of departure from the garage and the exact time of return of the car to its place. Please take into account other requirements for their design.

In particular, both when the vehicle leaves the garage and after it returns to the garage, the records are checked for compliance with the indicators of the instruments in the car, such as the fuel gauge, odometer, etc. The technical condition of the vehicle must be endorsed by an authorized employee, for example, an organization mechanic. The data on the pre-trip medical examination must be filled out by a health worker indicating the date. The record must indicate that the driver “passed a pre-trip medical examination and was cleared to perform work duties.” If necessary, a note about the medical examination after the flight is placed.

Sometimes a special program is used to fill out vouchers. It allows you to hide unnecessary areas of a document, determine exactly how long the journey took, and put an exact number on each document. The announcement of the use of the program must be made to all dispatchers so that vouchers are issued in the same way. In addition, this will make life easier for drivers, who will be able to take into account every ruble spent on the road and display the exact balances. The absence of such a program is not a violation, since new forms are not prohibited from being filled out manually.

What should be on the waybill?

- The first thing that should be in the header is the name of the organization and its form that issued the voucher (individual entrepreneur or LLC);

- Medical and mechanic data, as well as their seals;

- Vehicle data;

- The actual address of the organization where the inspection was carried out and the permit was issued;

- How are the labor relations with the driver formalized?

- Time to start shift;

- Shift end time;

- Equipment of the car when entering the line.

The voucher cannot be a photocopy, since it is available in a single copy. Each must have a unique number. Be sure to fill out all required fields.

Optional information

Usually the following additional information is indicated in waybills.

Standard fuel consumption is displayed in order to justify the costs of fuel and lubricants and classify them as costs that reduce the tax base when calculating income tax. Additionally, you can enter data on excess consumption or fuel savings, and indicate the volume and cost of refueling during the flight.

Also, in order to justify the costs of fuel and lubricants and confirm the reality of the trip for tax accounting purposes, it is advisable to indicate information about the route of transport . In this case, it is not enough to enter the addresses of the route checkpoints, travel time and distance traveled - you need a record confirming the fact of using the vehicle for production purposes (name of the cargo, information about the customer, etc.)

Note that the waybill is not the only document that can justify the cost of fuel and lubricants. It is also permissible to use, for example, acts of write-off and acts of completed work for these purposes.

Please note: officials do not always recognize that a waybill is a priori a document confirming fuel costs (letter of the Ministry of Finance dated 06.16.11 No. 03-03-06/1/354). Therefore, if your organization is not a motor transport enterprise, it is advisable to include in the accounting policy order a provision on the use of waybills as supporting documents when writing off production costs for fuels and lubricants. Otherwise, tax authorities may not take the DP into account.

Also see:

“Practical advice on accounting and write-off of fuel and lubricants”;

“Costs on fuel and lubricants: what amount can be taken into account when calculating income tax?”;

“Is it obligatory to indicate the route in the waybill: clarifications of the Ministry of Transport and judicial practice.”

Maintain accounting and tax records for free in the web service

Not only tax officials, but also inspectors from the labor inspectorate may show interest in waybills. Therefore, among other things, the DP must confirm that the driver (drivers during shift work) complied with the work and rest standards prescribed by law during the trip. To do this, in the “Route” section or in a separate appendix to the waybill, you need to indicate the time and duration of the stops . These indicators must comply with the standards for shift changes and breaks for meals and rest. Such standards are contained in the Order of the Ministry of Transport dated August 20, 2004 No. 15 (see “Carriers must review the work and rest schedule of their drivers”). The relevant provisions must be enshrined in a collective agreement or agreement drawn up in accordance with the rules of the Labor Code.

It should be remembered that the waybill is not a document that serves as confirmation of the driver’s real working time for the purposes of calculating wages and for settling other relations between the employee and the employer. This is indicated in the Appeal Ruling of the Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated January 30, 2018 in case No. 33-567/2018.

Also see: “From January 1, new work and rest standards will be introduced for truck and bus drivers.”

How to fill out a waybill correctly?

To avoid any troubles on the road, fill it out before leaving for your shift and all required fields.

- Name, number and period for which the waybill was issued. (By law, it can be issued for one month, but daily inspections and notes about them are required);

- Full legal data of the owner of the car, as well as the actual address, telephone number and its stamp;

- Car make and registration number;

- Date, time and speedometer reading at the time of entering the line;

- Date, time and speedometer reading at the time of return from the line;

- Driver's full name and signature;

- Medical examination notes;

- Mechanic's inspection notes.

Sample filling

Let us consider in detail how to fill out each field using the example of form No. 3 (for a passenger car) for an individual entrepreneur. The sample, taking into account the latest changes, was prepared using the commercial version of ConsultantPlus.

IMPORTANT!

Organizations and individual entrepreneurs have the right to change the sequence of filling out the waybill. The main thing is that the content of the columns complies with the requirements established by the Ministry of Transport.

Let's start by indicating the series, number and validity period of the document. The series is an optional element, so it is sometimes missing. As for numbers, they are assigned to waybills in accordance with the approved numbering.

The validity period is determined depending on the situation. In our example, the document was issued for one shift.

The next section is for information about the owner or lessee of the vehicle.

Legal entities enter:

- Name;

- organizational and legal form;

- location address;

- contact number;

- OGRN.

IP indicate:

- Full name (patronymic if available);

- mailing address;

- contact number;

- OGRIP.

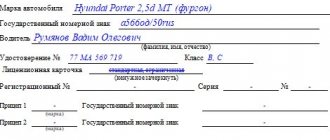

Information about the vehicle itself must be indicated as stated in the documentation. When filling out you must write:

- car make (can be in Latin or Cyrillic);

- number received during state registration;

- parking number, if available, if not, the field is skipped, this is not a violation.

The next large section is necessary to indicate who is driving the vehicle. The driver must be reported as follows:

- Full name (patronymic if available);

- Personnel Number;

- data from the driver's license (number, category or class).

Admission of a vehicle is not permitted without monitoring the technical condition of the vehicle and a medical examination. The corresponding marks are placed on the waybill indicating the specific travel time. The specified data is confirmed by authorized persons.

But there is one caveat: individual entrepreneurs operating exclusively passenger cars have the right not to conduct a pre-trip check of the technical condition of the vehicle. The rest are required to do this, so for most motor transport enterprises, technicians’ marks on waybills are mandatory.

Please note that the organization may not have its own medical worker and/or mechanic. In this case, to organize medical examinations and technical control, they either hire part-time workers or outsource this work.

Immediately before departure, the waybill must indicate the meter readings (integer numbers only) and the time they were taken. Next, you should enter data about what fuel was issued, in what quantity (if fuel is provided). All data is confirmed by the signature of the employee himself.

Many people have questions about what data to write down in the “Driver Tasks” section. If we are talking about a passenger car, then in the waybill issued for it they write at whose disposal the vehicle is being transferred. On forms for trucks it is allowed to write the person who ordered the transportation, and on forms for buses - the destination.

The driver is prohibited from changing the task. This can only be done by an authorized person of the owner or lessee of the vehicle, who acts as a representative of the employer. If the vehicle is used for special purposes, for example by law enforcement officers or road services, a note about this is placed on the waybill.

When the vehicle leaves the parking lot (garage), the dispatcher must record the time. In the future, this data is important for calculating time worked and, of course, wages.

Upon return, the travel voucher records the time of arrival, odometer readings, and information about the movement of fuel. Data on fuel consumption rates are taken from the Ministry of Transport order No. AM-23-r dated March 14, 2008, which approved fuel and lubricant consumption rates for road transport.

All data is confirmed by the signatures of authorized employees of the motor transport company.

If there were any delays along the way, the driver records this in a special section. Some people recommend indicating lunch time in this field.

The reverse side consists of a table and a few more lines. The table is filled out by the driver, entering the number of trips - one or several. He should write the destination and time of departure and arrival. If we are talking about a car that has been transferred to a private person, he is obliged to confirm the driver’s records.

The last section is the result of the vehicle's work per shift and payroll calculation. It is filled out to calculate wages. If the driver receives money based on the distance traveled, only 2 fields are filled in: “traveled, km” and “per kilometer, rub. cop." If the payment is time-based, fill out two other fields: “total in work order, hours” and “per hours, rub. cop." It is permissible to fill in all lines if necessary.

As a rule, this part is filled out in the accounting department, since only accountants are responsible for calculating and issuing wages to employees.

Taxi voucher for individual entrepreneurs

An individual entrepreneur is the same driver as anyone else who works in a taxi. He is also required to have a properly executed travel document with him. But you may have an advantage over someone who works for the company. You can take special courses, pass an exam and receive a mechanic’s certificate, which is issued for 5 years. And you won’t have to look for a place where you will undergo pre-flight inspection. You will stamp and sign yourself, thereby saving time for work.

Responsibility for errors

Responsibility for the correct execution of documents rests personally with the head of the organization and authorized persons who are responsible for the operation of the vehicle. Those who sign the form are responsible for the accuracy of the data they certified. If, during an inspection, representatives of the Federal Tax Service reveal violations in filling out the waybill, they have the right to exclude fuel and lubricants written off on it from expenses for profit tax purposes. Then the organization will have to pay additional tax, fines and penalties assigned by inspectors.

Changes in filling out the waybill for taxis from March 1, 2019

Our legislators gave us another surprise. And if you are used to filling out a ticket the old-fashioned way, you will have to relearn. Let's decide what has changed and how to fill out the waybill correctly. To do this, we need to turn to the new version of the law, and as many as 14 points have changed there. But is the devil as terrible as he is painted? For the most part, nothing new, everything is the same. Let's go point by point from beginning to end; if the changes are minor, we won't even stop.

The first thing that alerted me was the validity period of the waybill. Previously, I already recommended using it for no more than one day, but nothing has changed now. But it became more blurry. Look at the old and new editions, it will become clear to you that the wording is more vague and the employee, when checking, will be able to interpret it in his favor:

It happened before:

Became:

How's the wording? Obviously blurry and too hard to understand. Next we have the design of the header. Previously, the mandatory presence of the seal or stamp of the organization or individual entrepreneur that owns the car was required, but now this rule has been canceled. Since the new edition says nothing about this. My opinion was made because of the self-employed.

It happened before:

Became:

That's basically all that was affected by the changes on March 1. Not scary at all. Really?

What is the document for?

So-called travel vouchers are primary accounting documents, and maintaining travel vouchers at an enterprise is mandatory if organizations or individual entrepreneurs operate vehicles. At the same time, legal entities and individual entrepreneurs providing services for the transportation of goods or people are required to use unified forms of these documents.

Depending on the type of vehicle (VV) and the area of their application, different types of forms are used. Some of their types are designed for owners and tenants:

- passenger cars;

- trucks;

- special transport;

- passenger taxi;

- cargo taxi;

- public and non-public buses.

The forms necessary for entrepreneurs were approved more than twenty years ago by Decree of the State Statistics Committee No. 78 of November 28, 1997. They are still relevant, although over the years various changes have been made to the forms many times. In accordance with the order of the Ministry of Transport No. 476 dated November 7, 2017, additional information about the owner of the vehicle is indicated in the voucher: individual entrepreneurs - OGRIP, and organizations - OGRN.

Unified forms are not suitable for all organizations, and they are not required for everyone. Therefore, a legal entity (or individual entrepreneur) has the right to develop its own version, which takes into account all the mandatory details and necessary indicators. The use of your own modified form is indicated in the accounting policy of the organization, as defined in paragraph 4 of PBU 1/2008. Do not forget that the rules regulated by Article 9 of Federal Law No. 402-FZ of December 6, 2011 on accounting also apply to primary documents of strict reporting.

How we organize pre-trip inspections:

You enter into a 3-month contract with a licensed medical organization that has a certified mechanic on its staff.

The cost of the contract for 3 months is 6,000 rubles. This is only 2000 ₽ per month for legal actions.

Payment is made from the individual entrepreneur's current account and the payment order is attached to the agreement. This is necessary for proof at MADI in case the car is seized.

Inspection logs are also kept and stored, signed by officials. The logs are proof of the reality of passing medical and technical examinations. Therefore, in the matter of waybills and inspections, you are protected from all sides.

What are the consequences of this absence?

If you are stopped by a traffic police officer and you don’t have a ticket, you will get 500 rubles. Whether this is a lot or a little is up to you to decide for yourself. But according to the latest trends, even in Moscow this will equal approximately two hours of your work. Whether it's worth it or not is up to you to decide. Plus, don’t forget about the time you will lose at the traffic police post while they issue you a violation order.

Results

A passenger taxi waybill can be drawn up either according to a unified form or according to a form developed independently. Its main difference from other types of waybills is that when filling out it is necessary to indicate the readings of not only the odometer, but also the taximeter.

Sources: Order of the Ministry of Transport dated September 11, 2020 No. 368

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who has the right to conduct pre-trip (post-trip) inspection

Large transport organizations

, as a rule, have on staff both a personal physician with a certificate to conduct pre-trip and post-trip examinations of drivers, and a mechanic.

Small taxi companies and individual entrepreneurs

They can undergo pre-trip control with them or enter into an agreement with a licensed medical organization and a car mechanic who has a vehicle inspector certificate.

Attention: fake stamps that are used to evade mandatory pre-trip inspection will result in criminal penalties. Fraud occurs in any emergency situation: road accidents, special inspections, etc. All licensed medical institutions are included in the database. The authenticity of documents is easily verified.

Fuel consumption rates

The standards for fuel and lubricant consumption in road transport were introduced by Order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r “On the implementation of methodological recommendations “Standards for the consumption of fuels and lubricants in road transport”.

In accordance with paragraph 1 of these Methodological Recommendations, they are intended for motor transport enterprises, organizations involved in the management and control system, entrepreneurs, etc., regardless of their form of ownership, operating automotive equipment and special rolling stock on vehicle chassis on the territory of the Russian Federation.

Based on the Methodological Recommendations, organizations approve fuel and lubricant consumption standards for each model (make, modification) of vehicles in use.

The Tax Code of the Russian Federation does not contain provisions on rationing costs for fuels and lubricants. But if a company applies these standards, it can confirm the economic justification of expenses in case of disagreements with the tax authorities (Article 252 of the Tax Code of the Russian Federation).