If the founders of an LLC are individuals, then income in the form of dividends received from the business is subject to income tax (NDFL). The organization itself, performing the functions of a tax agent, is obliged to transfer personal income tax to the budget and report on time. In this article you will find an example of filling out dividends in 6-NDFL 2021.

Before January 1, 2015, the tax rate on dividends was 9%, and in 2021, a rate of 13% is applied to tax residents of the Russian Federation. If the LLC participant has been in Russia for less than 183 calendar days over the past 12 months, then the rate is already 15%.

What tax rate are dividends subject to?

At its core, dividends are income that is paid to individuals.

Personal income tax is withheld from him:

- for residents of the Russian Federation the rate is 13%;

- for non-residents – 15%.

Who is responsible for paying personal income tax?

If income is accrued to an employee of an enterprise, then all taxation issues are resolved by the accounting department of this enterprise. It is the chief accountant who is obliged to control the calculations with the budget.

The obligation passes to the recipient of funds if:

- the individual and the company that paid him the income are located in different states;

- the company did not make calculations and did not pay personal income tax.

The legislation regulates the terms of transfer:

- If the funds are paid by the JSC, the transfer must take place within a month after the payment.

- If the funds are paid by an LLC, then the tax must be transferred the next day after payment.

- Until July 15 of the following year after payment, if the tax is paid to the budget independently.

Does the legal form matter for recording dividends?

Art. 43 of the Tax Code of the Russian Federation defines a dividend as income received by its shareholders or founders from the net profit remaining after taxation.

The obligation to reflect dividend payments is provided for in Art. 230 of the Tax Code of the Russian Federation, it states that form 6-NDFL is submitted by tax agents.

All Russian organizations and individual entrepreneurs that pay dividend income are tax agents in accordance with Art. 226 of the Tax Code of the Russian Federation, i.e. Enterprises with any organizational and legal form are required to file 6-NDFL.

The company paid the founder interest on the loan

The founder issued a loan to the company at interest in 2015. In the second quarter, the company repaid the debt and paid interest for the entire period of the agreement.

Interest on the loan is the income of the founder. The rate on such income is 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 18, 2013 No. 03-04-06/38698). Article 214.2 of the Tax Code of the Russian Federation exempts interest on bank deposits from personal income tax if their amount does not exceed the Central Bank rate increased by five points. But if the company is not a bank, then interest in any amount is taxed.

The company accrues interest monthly, but only include it in the calculation during the payment period. It is on this date that the founder receives income (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). On lines 100 and 110, record the date the interest was paid. Line 120 shows the next business day.

For example

In 2015, the founder issued a loan to the company. On May 24, she repaid the loan and paid interest - 235,000 rubles. On this day, the company calculated and withheld personal income tax - 30,550 rubles. (RUB 235,000 × 13%). In addition to interest, the company paid salaries to 18 employees during the six months - 9,786,500 rubles, calculated and withheld personal income tax from this amount - 1,272,245 rubles. (RUB 9,786,500 × 13%).

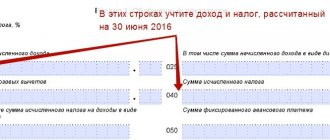

Section 1. The company increased income in line 020 by interest - RUB 10,021,500. (9,786,500,235,000). And also personal income tax in lines 040 and 070 - 1,302,795 rubles. (1,272,245 + 30,550). In line 060 (18 employees and 1 founder).

Section 2. The date of receipt of interest income is May 24. The company recorded this date on lines 100 and 110. On line 120 the company entered the next business day. The company filled out the calculation as in sample 75.

Sample 75. How to reflect interest paid in calculations:

Top

Example of filling out dividends in 6-NDFL

Questions often arise in calculating personal income tax. It is necessary to have a clear understanding of the recipients of dividends, the timing of their accrual and payments, as well as the timing of the transfer of personal income tax. The reliability of Form 6-NDFL depends on this, and any attempts to incorrectly reflect the original data will lead to fines from the tax office.

Recipients of dividends

The form must reflect all funds that are subject to personal income tax and paid to participants:

- founders of an LLC who have their own share in the authorized capital of the enterprise;

- JSC shareholders owning a block of shares.

At the same time, it takes into account employees and those who do not work at this enterprise. In other words, the fact of employment in the company is optional.

Tax agents for dividends

If a Russian organization pays dividends accrued from the net profit of any Russian organization or company registered abroad, then it is considered a tax agent. By law, this issuing organization is required to charge, withhold and remit taxes.

***

Before reflecting dividends in 6-NDFL in 2021 for 2021, it is first necessary to correctly classify the amounts paid as dividends. Then decide on the specific amount of dividends (it is indicated in the decision of the general meeting of founders/shareholders) and dates (payment of income, withholding and transfer of tax). The verified data is entered into 6-NDFL according to the Rules approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

Even more materials on the topic can be found in the “Personal Income Tax” section.

Reflection of dividends in the calculation of 6-NDFL

Only accrued and paid amounts should be reflected in the form. If dividends have been accrued but not yet paid in the period for which the calculation is being made, then they should not be reflected. If the accrual took place in June, and they were paid in parts - in June and July, then they must be reflected for different quarters.

In tax accounting, the withholding of personal income tax occurs at the time of payment of funds.

Completing section 1

I will give an example of calculating the form using the attached sample.

In the first section, all amounts should be reflected on an accrual basis.

Completing section 2

The second section should reflect data for 3 months - quarterly. The form is filled out line by line by date.

If the transfer day falls on a weekend, the transfer is postponed to Monday.

Features of reflecting dividend amounts in the calculation of 6-NDFL

If the founders are foreign citizens, then it is necessary to reflect the data with a tax rate of 15%. The first two sections with different tax rates are filled out separately.

Next, the data with rates of 13 and 15% are summed up. If a taxpayer's status changes during the year, it is clarified at the end of the year and transfers to the budget are recalculated.

Determining the payment date

To calculate the report, the day of payment of funds is considered to be the day these funds are accrued. If income was accrued on April 25, then in line 100 - April 25, and in line 130 - the amount of accruals. If accrued on December 31, the data must be reflected in the first quarter of the next year.

Recipients of dividends

Russian citizens and foreigners act as payers of personal income tax on dividends when receiving income within Russia. In addition, income can also be received from foreign sources. In such cases, income recipients must independently calculate taxes in relation to each amount of dividend income.

There are some nuances here. Citizens who have received dividends from foreign sources have the right to reduce the personal income tax payable by the amount of the transferred tax at the place of source of income. Thus, a double taxation situation does not arise. But these actions can only be performed in relation to income with which Russia has entered into a special agreement with the source countries. If the tax amounts paid at the source of income are greater than those accrued in accordance with the legislation of the Russian Federation, then it is impossible to return the difference from the budget.

Frequent errors that occur when reflecting dividends

Often, errors in reporting arise due to the inattention of both management and performers. For example, dividend payments are assigned to persons who, on the date of distribution of profit, were not yet founders or shareholders.

Other options:

- when they try to reflect in section 2 data relating to different reporting periods;

- when they try to reflect data on cash received on the last day of the quarter.

It is a mistake to show income in the current quarter if the tax payment date falls on Monday of the next quarter.

For example, the payment day is March 29, the tax is transferred the next day - March 30, and this is a day off. This means that the transfer must be made on April 1, but this is already the second quarter. Consequently, the payment of dividends should be reflected in the second quarter.

The company distributed but did not pay dividends

In the second quarter, the company held a meeting of participants and distributed dividends. She did not pay the money until the end of the six months.

For dividends, the date of receipt of income is considered the day when the company paid the money (subsection 1, clause 1, article 223 of the Tax Code of the Russian Federation). Do not show unpaid dividends in sections 1 and 2 of the half-year calculation. Reflect them in the calculation for the period in which the company will issue the money.

For example

On April 29, the company held a meeting of participants. As of this date, I distributed dividends to three participants - 870,000 rubles. The company did not pay the money by the end of the quarter, therefore it did not include dividends in sections 1 and 2 of the calculation for the half year. In addition to dividends for the half-year, the company accrued income to 14 “physicists” - 908,000 rubles, calculated and withheld personal income tax from January to June - 118,040 rubles. (RUB 908,000 × 13%). The company filled out Section 1 of the half-year calculation as in sample 72.

Sample 72. You do not need to fill out accrued dividends in the calculation:

Top

Sanctions for violation of reporting conditions

The Federal Tax Service provides for the imposition of penalties on organizations that perform their duties in bad faith.

| Violation | Amount of fine | Explanations |

| Submitting reports late | 1,000 rubles for each month in full or in part | Failure to comply with reporting requirements may result in the seizure of your current account. |

| Indication of data recognized as unreliable | 500 rubles | Any distortion of data, including details, is considered false information. |

Agents who independently discover inaccuracies in the tax information provided may be exempt from sanctions established by the Tax Code of the Russian Federation. Reliable data must be presented in the updated calculation. The penalty is lifted if the agent corrected the information before the Federal Tax Service Inspectorate discovered the unreliability of the reporting data.

Features of tax calculations

An enterprise in the form of an LLC must transfer the tax no later than the day following the settlement with the recipient. Amounts withheld for remuneration to JSC shareholders have a one-month deferment for transfer. If income is received by a person who is also an individual entrepreneur applying a special regime, tax is withheld in the usual manner.

When payments are made to non-residents and residents in the same period, amounts calculated at different rates are indicated separately in the reporting.

When setting the rate, the following conditions are taken into account:

- Possibility of changing a person’s status during the reporting year. Change can occur in both categories.

- Determination of the rate depending on the category of the recipient confirmed at the time of receipt of the amounts.

- The final determination of status is made at the end of the annual period. At the same time, the tax is recalculated from the beginning of the year based on the actual status data.

Information on dividends received must be reflected separately from information on other income. An important condition for income taxation is the inability to obtain a tax deduction if a person does not have other income.