What is advertising

Advertising is information that is addressed to an indefinite circle of people and is aimed at attracting attention to the object of advertising, maintaining interest in it and promoting it on the market (Clause 1, Article 3 of the Law of March 13, 2006 No. 38-FZ).

Situation: what does “an indefinite circle of persons” mean in the definition of advertising?

An indefinite circle of people are those recipients of advertising who are unknown in advance.

As a general requirement, advertising information is addressed to an indefinite number of persons (Clause 1, Article 3 of Law No. 38-FZ of March 13, 2006). This means that advertising:

- cannot be created for specific consumers of a particular product;

- should not mention specific citizens or organizations whose perception it is aimed at.

This interpretation of the concept of “an indefinite circle of persons” is set out in the letter of the Federal Antimonopoly Service of Russia dated April 5, 2007 No. ATs/4624 (brought to the attention of the tax inspectorates by the letter of the Federal Tax Service of Russia dated April 25, 2007 No. ШТ-6-03/348).

The object of advertising can be:

- product;

- a means of individualizing an organization or product;

- manufacturer or seller of goods;

- results of intellectual activity;

- event.

Such a list is established by paragraph 2 of Article 3 of the Law of March 13, 2006 No. 38-FZ.

At the same time, the results of intellectual activity and means of individualization of the organization include:

- trademarks;

- service marks;

- brand names;

- industrial designs;

- inventions;

- computer programs, databases.

This conclusion follows from Article 1225 of the Civil Code of the Russian Federation.

The method, form and means of advertising distribution can be any (Clause 1, Article 3 of the Law of March 13, 2006 No. 38-FZ).

Examples of advertising include:

- commercial on television or radio;

- advertising events for film and video services;

- information about the company posted on someone else’s website (banner);

- advertisements in the media;

- information on billboards, vehicles, and stop points;

- advertising on stands, billboards in the metro (letter of the Ministry of Finance of Russia dated October 16, 2008 No. 03-03-06/1/588);

- goods or finished products that are displayed in display cases, in sample rooms and showrooms, at exhibitions, expositions, fairs;

- addressless mailing of catalogs of goods by mail (letter of the Ministry of Finance of Russia dated November 3, 2010 No. 03-03-06/1/688);

- incentive lotteries not based on risk (letter of the Ministry of Economic Development of Russia dated April 7, 2014 No. D09i-451. Brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated April 21, 2014 No. ED-4-2/7598).

Situation: will the information on the sign be advertising?

Answer: no, it won't. Provided that the information on the sign is not related to a specific product.

The provisions of the law on advertising do not apply to information that must be communicated to the consumer by law (subparagraph 2, 5, paragraph 2, article 2 of the Law of March 13, 2006 No. 38-FZ).

For example, the seller of goods is required to indicate the following information on the sign:

- name of company;

- its location;

- operating mode.

This is stated in paragraph 1 of Article 9 of the Law of February 7, 1992 No. 2300-1.

In this case, the sign is not advertising, but informational in nature.

A similar point of view is reflected in the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 25, 1998 No. 37, letter of the FAS Russia dated March 16, 2006 No. AK/3512.

If the information on a sign is related to a specific product or causes buyers to associate it with it, then such a sign will be advertising (see, for example, paragraph 2 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 8, 2012 No. 58, resolution of the Federal Antimonopoly Service of the North-Western District dated April 23, 2013 No. A56-46534/2012).

Situation: will the information on the product packaging be advertising?

Answer: no, it won't.

The provisions of the law on advertising do not apply to information that must be communicated to the consumer by law (subparagraph 2, 5, paragraph 2, article 2 of the Law of March 13, 2006 No. 38-FZ).

Legislation obliges the seller (performer) to provide the consumer with reliable information that is necessary for the correct selection of goods, work, or services. Such information includes information about the product, its manufacturer, consumer properties, rules and conditions for the effective and safe use of the items sold. This information may be indicated on the label, marking or packaging of the product (Article 10 of the Law of February 7, 1992 No. 2300-1). Therefore, the mandatory information on the packaging will not constitute advertising.

Situation: can sending SMS messages with information about products be considered advertising? This service is provided by the telecom operator.

Answer: yes, you can. Sending SMS messages with information about products is nothing more than advertising.

After all, advertising is information that, in particular, is addressed to an indefinite number of people. Moreover, advertising can be distributed in any way, in any form and using any means. This is stated in paragraph 1 of Article 3 of the Law of March 13, 2006 No. 38-FZ.

In general, advertising can be distributed by telephone only with the prior consent of the subscriber. The advertiser, that is, the telecom operator, must obtain such consent. It turns out that he knows the specific addressee of the message.

But the advertising organization in this case cannot know in advance which of the potential clients the operator will send messages to. In addition, sending a message to a specific subscriber number does not mean that it is possible to recognize the person using this number. This means that the circle of people to whom the operator will send SMS will not be determined for the advertiser.

In this case, the sending of SMS messages through a telecom operator has the right to be recognized as advertising by the advertising organization.

Similar conclusions follow from Article 18 of the Law of March 13, 2006 No. 38-FZ and indirectly confirmed in the letter of the Ministry of Finance of Russia dated October 28, 2013 No. 03-03-06/1/45479.

How to Farm Facebook Ads Accounts

Pharming is the act of making a new account look like an average user. This is to increase Facebook's trust in this profile before running ads. As a result, your account will avoid manual verification and will work longer before being blocked.

If you plan to actively use Facebook Ads to make money on affiliate programs, then you need to farm continuously so that when a working profile is blocked, you have new advertiser accounts ready to replace them.

What you need for farming

This is a process in which you must simulate for each account the typical actions, use of FB and other sites by an ordinary user. To do this you will need:

- Unique photos for each profile. They will be needed if Facebook requires identity verification via selfie. These must be photographs that cannot be found on the Internet. For example, pictures of people from offline, old magazines and newspapers, from online sources that are not indexed by search engines and are not available on FB;

- A virtual machine with an operating system and a browser for creating a digital fingerprint. The OS language, browser language, time zone and other regional settings must correspond to the GEO from which the account was registered;

- High-quality individual proxies of the same country from which the Facebook account was registered.

How to Increase Facebook Account Trust

To make the social network trust your profile more, we recommend using the following techniques:

- Do not immediately log in to the Facebook website, especially if your account has been tracked. First, visit several online stores, news sites, entertainment portals and other resources that have Facebook widgets or pixels;

- Log in to your Facebook account on other sites using social network login plugins;

- Use more photos in your posts, add geolocation tags, use hashtags;

- Every day, perform five to ten actions related to communication: write your own messages, comment on other people’s posts, add friends, like, subscribe to public pages and other people’s accounts;

- Having invited one person to be your friend, then add 10-20 of his friends every day;

- Although it is not very ethical, you can gain Facebook's trust by complaining. For example, if someone has been added to you, delete the request as spam, and then complain on this user’s profile and request their verification.

How to prepare your FB account for publishing advertisements

Before creating an advertising campaign, create a Facebook page on the topic of the product you are offering and publish several neutral posts and surveys. After that, use the “Promote Post” button and advertise this page for a couple of days with a small budget and broad targeting.

After this, Facebook’s trust in your profile will increase and you can publish ads for regular CPA offers.

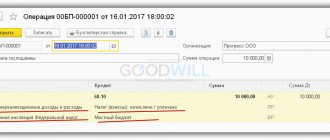

Accounting

Advertising expenses are included in expenses for ordinary activities. This follows from paragraphs 5 and 7 of PBU 10/99. Such expenses must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ). Since advertising is recognized as disseminated information, documentary confirmation requires not only the ordering of the advertisement itself, but also its actual distribution (Clause 1, Article 3 of Law No. 38-FZ of March 13, 2006).

Confirmation of advertising distribution, in particular, may be:

- reports from advertising distributors on the work done, for example, on the number of leaflets distributed;

- on-air certificates from television and radio stations;

- metro certificates regarding the provision of advertising services.

Similar conclusions are contained in letters of the Ministry of Finance of Russia dated September 6, 2012 No. 03-03-06/1/467, dated June 22, 2012 No. 03-03-06/2/71.

Advertising costs should be reflected in account 44 “Sales expenses” (Instructions for the chart of accounts). It is advisable to open a corresponding “Advertising Expenses” subaccount for this account.

Expenses and income tax: a brief educational program

For companies that pay income tax, the law establishes certain rules for accounting for such expenses.

Payers of income tax are all Russian legal entities, except for those who apply special tax regimes (simplified system, UTII, Unified Agricultural Tax), as well as payers of tax on gambling business and participants in the Skolkovo project. From 2021, participants in projects of innovative science and technology centers will also be exempt from income tax.

Article 264 of the Tax Code, which regulates the taxation of profits, classifies advertising costs as other expenses associated with production and sales (clause 28, clause 1, article 264). In the same article, paragraph 4 lists the types of expenses that are recognized as advertising. At the same time, the code divides costs according to the method of adoption.

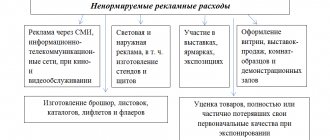

Some expenses are accepted in full (that is, the tax base is reduced by the entire amount of the expense). They are called non-standardized. This, according to the Tax Code:

- expenses for advertising events through the media,

- expenses for lighting and other outdoor advertising,

- expenses for participation in exhibitions, for window dressing, production of advertising brochures and catalogs containing information about goods, as well as for the markdown of goods that have lost their quality during exposure.

PSA: “Feeding the hungry is easier than you think”

Other types of expenses may be taken into account only in an amount not exceeding 1% of sales revenue for the reporting (tax) period. These are standard expenses. These include:

- expenses for the purchase or production of prizes awarded to the winners of drawings during mass advertising campaigns,

- expenses for other types of advertising not specified in Article 264 of the Tax Code.

Advertising placed by a third party

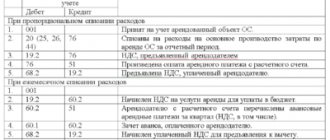

When placing advertisements through third-party organizations, reflect the cost of their services on account 44. To do this, make the following entry:

Debit 44 subaccount “Advertising expenses” Credit 60

– the cost of advertising services is reflected based on the report of the advertising distributor.

If the advertising placement is advanced several months in advance, then consider the prepayment as an advance payment:

Debit 60 subaccount “Settlements for advances issued” Credit 51 (50)

– paid for advertising placement.

Based on the advertising distributor's report, recognize advertising expenses as current expenses, and offset the advance:

Debit 44 subaccount “Advertising expenses” Credit 60

– the cost of advertising placement by a third party is reflected;

Debit 60 Credit 60 subaccount “Settlements for advances issued”

– the advance payment issued to pay for advertising placement services is credited.

What liability does tax violations entail?

The list of violations that are considered legally significant in relation to the advertising tax includes the following items:

- incorrect calculation of the tax amount, and, as a result, the occurrence of arrears;

- an accounting error resulting in an overpayment;

- late payment of taxes;

- failure to comply with reporting deadlines;

- failure to submit a declaration.

If errors are identified, the entrepreneur is given 10 days to correct and provide correct information. Otherwise, the overpayment will not be returned, and penalties will be charged on the arrears.

Article read: 177

The organization advertises independently

An organization can independently distribute advertising products. Purchased or manufactured promotional materials, for example, stationery with the organization’s logo, brochures, catalogs, should be reflected on account 10 at actual costs. Keep analytical records separately for each type of advertising product. To do this, open the “Advertising Materials” subaccount for account 10.

Reflect the receipt of promotional products as follows:

Debit 10 subaccount “Advertising materials” Credit 60;

– materials intended for distribution for advertising purposes have been taken into account.

After distributing the materials, charge their cost to account 44:

Debit 44 subaccount “Advertising expenses” Credit 10 subaccount “Advertising materials”

– the cost of advertising materials is written off based on the act of their expenditure.

When distributing (for example, at exhibitions, demonstrations) for advertising purposes goods that were originally intended to be sold, reflect their cost on account 41 subaccount “Goods handed over for advertising purposes.” And after distributing the samples, based on the report of the advertising distributor, write off the cost of the distributed goods as expenses - to the debit of account 44 of the “Advertising expenses” subaccount.

Similarly, reflect in accounting the finished products transferred for advertising purposes.

Accounting for advertising structures

The costs of creating or purchasing an advertising structure (for example, a stand, a billboard) form the initial cost of this structure. Depending on the period of use and the limit on the value of property recognized as an object of fixed assets established by the accounting policy, take into account the advertising design:

- on account 10 “Materials” as materials;

- on account 01 “Fixed assets” as an object of fixed assets (clause 5 of PBU 6/01).

Amounts recorded on account 10 can be written off at once at the time the advertising structure is put into operation:

Debit 44 subaccount “Advertising expenses” Credit 10 subaccount “Advertising materials”

– the costs of the advertising structure were written off.

Write off the cost of an advertising structure recognized as an object of fixed assets through depreciation:

Debit 44 subaccount “Advertising expenses” Credit 02

– depreciation has been accrued on the advertising structure.

Regardless of the type of advertising, write off the amounts accumulated per month on account 44 to the cost of sales as commercial expenses (clause 9 of PBU 10/99). To do this, make the following entry in accounting:

Debit 90-2 Credit 44 subaccount “Advertising expenses”

– advertising expenses are written off as cost of sales.

Payment methods in Facebook Ads for individuals

Individuals in Russia can use three payment methods:

- Bank card;

- PayPal account;

- Qiwi wallet.

If you select the first two, your account will be switched to automatic payments. If you choose Qiwi, the prepayment model will be set and in the future you will no longer be able to pay for advertising using PayPal, Qiwi only or a bank card.

If you pay for advertising with a bank card, the first and last name of the card owner must match the account information. If they are different, Facebook will decide that you used someone else's card and your advertising account may be blocked. After you enter your bank card number, expiration date and CVV code, $1 will be debited from the card for verification, which will later be transferred back.

Facebook is considered to have a lot of trust in PayPal; using this payment system means that your identity is verified. This reduces the likelihood of your Facebook Ads account getting banned.