Organizations and individual entrepreneurs can avoid going to the post office and government agencies, but send reports directly from their work computer. For some, the electronic format is just an additional convenience, but for others it is a duty. We will tell you what methods of submission there are and whether it is possible to submit reports via the Internet for free.

Who should report electronically?

How to submit electronic reports from the office

Top 5 services for submitting financial statements via the Internet

- Kontur.Extern - 3 months of free work

- BukhSoft - free access for two weeks

- VLSI - all reports with demo access

- Taxnet - Declaration.Online with demo access

- Astral Report 5.0 - reporting without trial period

One-time reporting via the Internet: submission methods

Electronic reporting via the World Wide Web has long become an integral part of an accountant’s activities. The Tax Code of the Russian Federation stipulates the obligation to send tax returns to the Federal Tax Service, including in electronic form, according to established deadlines.

There are several ways to submit electronic reports. Read more about this in the article “Electronic reporting via the Internet - which is better?”

You can send tax reports via the Internet only if you have an electronic signature. It is purchased on a paid basis from certification centers or upon concluding an agreement with an EDF operator.

One-time reporting can be submitted to the tax authorities in two ways: through the Federal Tax Service website and through electronic document management (EDF) operators. In turn, submission through the tax website is more often used for one-time filing of reports and can be done either with the payer’s own electronic signature or by proxy.

Submit reports in person

The least popular option. As a rule, individuals or individual entrepreneurs prefer to submit declarations to the inspectorate themselves. The heads of organizations take the opportunity to submit reports in person only if we are talking about zero (at the stage of liquidation or downtime). Zero declarations practically do not require filling out and it seems a pity to spend the finances of a dying business on them.

Pros:

- For free;

- Personal control;

- You can also make useful contacts while waiting in line.

Minuses:

- You will still have to visit the Federal Tax Service and other institutions - the Pension Fund of the Russian Federation, the Social Insurance Fund - as necessary;

- It’s good if the reports were prepared in a special program or service and were previously checked, otherwise - one mistake and you’ll have to redo everything. There is a worse option - the error will be discovered during a desk audit , most likely after the deadline for filing the declaration. If the error is critical, the report may be considered not submitted. Failure to submit a report = fine. Minimum - 1000 rubles.

- Not all reports can be submitted on paper by law, for example, VAT returns are submitted exclusively electronically, and from 2021 all organizations, without exception, are required to submit financial statements electronically. Now you also need to report to statistics through TCS (there is an exception for small businesses, they have the right to submit paper reports until the end of the year).

- Before submitting, reports still need to be prepared - find up-to-date forms, fill them out, understand the codes (they are in all forms).

Suitable for: individual entrepreneurs without employees, using a regime such as the simplified tax system “income”. The declaration is submitted only once a year and is relatively easy to complete.

Risks: the most important one is an outdated report form. A declaration drawn up according to an outdated form will not be accepted, and if your inspector nevertheless accepts it, then subsequently such a report will still be recognized as not submitted. There are also other errors - for example, incorrect reflection of indicators (in the wrong line, with kopecks, not in whole rubles, failure to fill in required fields, etc.). If there are significant errors, you will have to submit a corrective report, which means spending additional time and effort.

Submitting reports via the Federal Tax Service website

Sending one-time reports via telecommunications channels (TCS) can be carried out directly through the official Internet resource of the Federal Tax Service of the Russian Federation. For this purpose, a special service was developed. It can be used by any taxpayer who has an electronic signature and is able to meet certain technical requirements.

Read more about this option for submitting reports in the article “Procedure for submitting tax reports via the Internet.”

The disadvantage of this method of sending reports is the installation of software and the taxpayer’s independent study of the instructions. Document files generated in other programs must be reloaded into a special tax service program.

Sending reports through EDF operators

Submission of reports can be carried out with the help of electronic document management operators through TCS channels.

According to Art. 80 of the Tax Code of the Russian Federation, the taxpayer undertakes to provide reports in electronic form in the following cases:

- If over the past calendar year the number of company employees exceeded 100 people (according to paragraph 3, clause 3).

- If a reorganization of a company with more than 100 employees was carried out (according to paragraph 4, paragraph 3).

- If this obligation is applicable to a specific type of tax (according to paragraph 5, paragraph 3).

The list of EDF operators can be found on the official website of the Federal Tax Service.

Sending reports through EDF operators has the following advantages:

- no need to visit tax authorities;

- no need to create and certify paper versions of sent documents;

- the number of errors when preparing declarations is reduced;

- the taxpayer gets access to his individual data in the Federal Tax Service (for example, personal account information);

- the taxpayer gets the opportunity to electronically manage documents with the Federal Tax Service (for example, he can request certificates about the status of the debt to the budget or a reconciliation report of such debt).

“The economy must be economical - this is the demand of the time”

With this thesis, Brezhnev L.I. explained why there was such commodity “abundance” in the USSR. Today Brezhnev's statement is very relevant. The market for electronic reporting operators is crowded. Sellers of electronic reporting are forced to regularly organize promotions and provide discounts. Over the past couple of years, we have observed the following stocks on the market:

- software products for sending reports for a period of 3 to 6 months - free of charge;

- zero reporting - free;

- price reduction for the first year of service;

- 50% discount when changing a software product (switching from a competitor).

Price structure

Price lists for sending reports can be viewed on the websites of special communication operators. For example, you can look at the websites of the following companies:

- Accounting.Contour;

- Astral Report;

- Circuit. Extern ;

- My Business;

- Sky.

The price comparison is conditional, we considered one organization in the general mode, the minimum prices for a year of service are indicated.

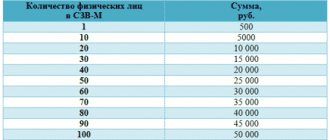

| 1C-Reporting | Astral Report | Accounting.Contour | Circuit. Extern | My Business | Sbis | Taxi | |

| Price per year (RUB) | 1500 | 3900 | 10,000 (for promotion 7000) | 3000 | 24 996 | 4500 | 5900 |

| Technology | Offline | Offline | Online | Online | Online | Offline | Offline |

| Technical support | 24 hours | 24 hours | 24 hours | 24 hours | 24 hours | 24 hours | 24 hours |

For comparison, the minimum capabilities of the program were selected: only sending reports to all government agencies. The price increases when choosing additional services.

For the comparative analysis, the price offer of the Nebo company is not taken into account, since its price is set for sending each report. The price in Moscow and the region is 170 rubles, in other regions - 100 rubles.

Conclusion: in terms of pricing policy, the leaders are:

- offline - 1C-Reporting;

- online - Contour. Extern.

The price range is very wide. As a rule, the high price hides additional services.

Submitting reports without involving EDF operators

Submitting reports on TCS without using the services of EDF operators is carried out in two main ways:

- Registration of personal digital signature. This method is most convenient for individual entrepreneurs, since it does not require the execution of a notarized, expensive power of attorney. Using this method involves sending reports on behalf of the individual entrepreneur through the Federal Tax Service website. The digital signature is issued within 1–3 days, after which the individual entrepreneur can begin sending reports.

- Execution of a power of attorney for a representative organization or an individual with an electronic signature. For such a shipment, in addition to signing an agreement for the provision of relevant services, it is necessary to issue a notarized power of attorney. An electronic copy of the power of attorney is attached to the submitted report, and then submitted to the Federal Tax Service in paper form.

How to monitor the status of report submission and receive confirmations?

All reports submitted through the personal account of the Federal Tax Service are displayed in the menu item “List of transferred files”:

You can view details for each report by clicking on the link in the “Status” column. All the details will be visible here, and you can also download confirmation documents or a certificate of refusal:

How to get an electronic signature

A certification center accredited by the Ministry of Telecom and Mass Media of the Russian Federation can issue an electronic signature. According to the terms of the order of the Federal Tax Service of the Russian Federation dated April 8, 2013 No. ММВ-7-4/142, for correct authorization in the system, a special key certificate is used, which verifies the electronic signature.

According to Art. 80 of the Tax Code of the Russian Federation, reporting on TKS is sent with a qualified electronic signature. According to the law of April 6, 2011 No. 63-FZ, the concept of a simple and qualified, or enhanced, electronic signature was introduced. Tax reporting submitted to the Federal Tax Service is signed only by a qualified digital signature.

Similar to paper documentation certified by a signature and seal, an electronic document acquires legal force and status after an electronic signature is affixed to it.

What do you need to send reports online?

When submitting reports via the Federal Tax Service website, the taxpayer must have:

- A certified electronic signature key issued by a special certification center and meeting the requirements of Order No. ММВ-7-4/142 of the Federal Tax Service of the Russian Federation dated 04/08/2013.

- Subscriber ID. You can receive it after registering on the Federal Tax Service website without contacting the EDF operator. You can register on the Federal Tax Service website using this link.

- Electronic information protection tool. Most often, encryption programs are used, or CIPF - means of cryptographic information protection. This name is given to programs that create private and public digital signature keys. The Crypto Pro program is mainly used.

- A computer connected to the Internet and an Internet Explorer browser (data encryption and transmission programs designed for filing tax reports work correctly in IE).

Is it possible to correspond with the tax office through your personal account?

The website nalog.ru says that through your personal account you can also:

- Make inquiries to the tax office regarding debts to the budget, overpayments, offset and refund of overpayments, etc.

- Receive an extract from the USRN regarding yourself.

- Check with the tax office regarding the status of payments for taxes, penalties, fines, etc.

- Send applications to the Federal Tax Service for clarification of an unclear payment, payment documents (if you found errors in them yourself), applications for offset/refund of overpayments.

- Submit documents for registration of a legal entity, making changes to the Unified State Register of Legal Entities, registering separate divisions and deregistering them, registering as UTII payers.

Go to Nalog.ru website

Results

You can send one-time reports via the Internet through the official website of the Federal Tax Service with the issuance of a personal digital signature or by proxy, without resorting to issuing a personal digital signature.

You can also use the services of EDF operators, the contract with which is concluded for a minimum period of one year. To send reports, you must obtain an electronic signature, subscriber ID and certificate from the certification authority. You should definitely pay attention to the security and reliability of the information specified in the electronic documentation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Additional modules

Reporting from 1C Preparation and sending of reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat from 1C

Zero reporting Preparation and submission of zero reporting to the Federal Tax Service, Pension Fund of Russia, Social Insurance Fund and Rosstat

VAT+ (Reconciliation) Reconciliation of invoices with counterparties

Alcohol reporting Generate, verify, sign and send declarations of forms 11 and 12 to FSRAR

Reporting to the RPN For organizations and individual entrepreneurs required to report to Rosprirodnadzor

Traffic light Automatic verification of counterparties and identification of material facts